Transcription

BEA (MPF) VALUE SCHEMEMPF SCHEME BROCHUREMandatory Provident FundSponsorTrusteeVersion dateBEA (MPF) HotlineFaxEmailWebsite address: The Bank of East Asia, Limited: Bank of East Asia (Trustees) Limited: March 2020: ( 852) 2211 1777 (operated by Bank of East Asia (Trustees) Limited): ( 852) 3608 6003: BEAMPF@hkbea.com: http://www.hkbea.com

IMPORTANT: Important — If you are in doubt about the meaning or effect of the contentsof this MPF Scheme Brochure, you should seek independent professionaladvice. The Master Trust offers different Constituent Funds (i) investing in one ormore APIFs and/or approved ITCISs which invest in equities or bonds; or (ii)making direct investments. Each Constituent Fund has a different risk profile. The BEA MPF Conservative Fund does not provide any guarantee of therepayment of capital. Investment involves risks. You should consider your own risk tolerance leveland financial circumstances before making any investment choices. In yourselection of Constituent Funds, if you are in doubt as to whether a certainConstituent Fund is suitable for you (including whether it is consistent withyour investment objectives), you should seek financial and/or professionaladvice and choose the Constituent Fund(s) most suitable for you taking intoaccount your circumstances. You should consider your own risk tolerance level and financial circumstancesbefore investing in the DIS. You should note that the BEA Core AccumulationFund and the BEA Age 65 Plus Fund may not be suitable for you, and theremay be a risk mismatch between the BEA Core Accumulation Fund andthe BEA Age 65 Plus Fund and your risk profile (the resulting portfolio riskmay be greater than your risk preference). You should seek financial and/or professional advice if you are in doubt as to whether the DIS is suitablefor you, and make the investment decision most suitable for you taking intoaccount your circumstances. You should note that the implementation of the DIS may have an impacton your MPF investments and accrued benefits. You should consult with theTrustee if you have doubts on how you are being affected.

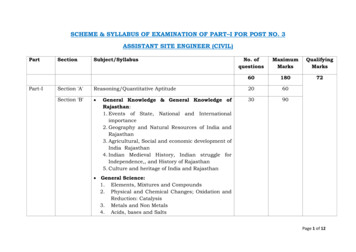

TABLE OF CONTENTSHeadingPage Number1. INTRODUCTION. 11.1About the BEA (MPF) Value Scheme.11.2Investment of contributions.12. DIRECTORY OF APPROVED TRUSTEE AND OTHER SERVICE PROVIDERS. 22.1Sponsor.22.2Trustee.22.3Investment Manager.23. FUND OPTIONS, INVESTMENT OBJECTIVES AND POLICIES. 33.1Scheme structure.33.2Table for Constituent Funds.43.3Investment objectives and policies.63.4Currency exposure.203.5Investment and borrowing restrictions.203.6Consequences of exceeding the investment limit.213.7Establishment, termination, merger and division of Constituent Funds.214. RISKS. 224.1Risk categories.224.2Risk factors.225. FEES AND CHARGES. 405.1Fee table.405.2Definitions.465.3No switching fee.495.4Change in Mandate fee.495.5Fees and out-of-pocket expenses related to the BEA MPF Conservative Fund.495.6Other charges and expenses.495.7Fees and out-of-pocket expenses of the DIS.505.8Cash rebates and soft commissions.505.9Explanatory notes.51

6. ADMINISTRATIVE PROCEDURES. 536.1How to join.536.2Contributions.546.3Investment in Constituent Funds.566.4Entitlement to accrued benefits.656.5Realisation of Units.676.6Payment of accrued benefits.676.7Other points to note.686.8Transfers.697. OTHER INFORMATION. 737.1Calculation.737.2Taxation.747.3Accounts, reports and statements.767.4Trust Deed.767.5Modification of Trust Deed and participation agreements.767.6Termination, merger or division of Master Trust.777.7Documents available.777.8Automatic exchange of financial account information.778. GLOSSARY. 79APPENDIX Further Information on the Indexes. 84

1. INTRODUCTIONThe Trustee and the Sponsor each accepts responsibility for the information contained in thisMPF Scheme Brochure as being accurate at the date of publication. However, neither thedelivery of this MPF Scheme Brochure nor the offer of or agreement to participate in the MasterTrust shall under any circumstances constitute a representation that the information containedin this MPF Scheme Brochure is correct as of any time subsequent to such date. This MPF SchemeBrochure may from time to time be updated. Intending participants in the Master Trust shouldask the Trustee or the Sponsor if any supplements to this MPF Scheme Brochure or any later MPFScheme Brochure have been issued.The Master Trust has been authorised by the SFC and approved by the MPFA in Hong Kong. Ingranting such authorisation and approval, neither the SFC nor the MPFA takes any responsibilityfor the financial soundness of the Master Trust or for the accuracy of any of the statementsmade or opinions expressed in this MPF Scheme Brochure. Such authorisation and approval doesnot imply that participation in the Master Trust is recommended by the SFC or the MPFA. SFCauthorisation is not a recommendation or endorsement of an MPF scheme or pooled investmentfund nor does it guarantee the commercial merits of an MPF scheme or pooled investment fundor its performance. It does not mean the MPF scheme or pooled investment fund is suitablefor all scheme participants or fund holders nor is it an endorsement of its suitability for anyparticular scheme participant or fund holder.No action has been taken to permit an offering of participation in the Master Trust or thedistribution of this MPF Scheme Brochure in any jurisdiction where action would be required forsuch purpose other than Hong Kong. Accordingly, this MPF Scheme Brochure may not be used inany jurisdiction where its distribution is not authorised.1.1About the BEA (MPF) Value SchemeThe BEA (MPF) Value Scheme is a master trust established by a trust deed dated as of 17thAugust, 2012 (as amended from time to time) between The Bank of East Asia, Limited asSponsor and Bank of East Asia (Trustees) Limited as Trustee. It is established under andgoverned by the laws of Hong Kong.1.2Investment of contributionsContributions are invested in one or more of the Constituent Funds established underthe Master Trust, in accordance with instructions given from time to time by Members.For details, please refer to the “6.2. CONTRIBUTIONS” sub-section under the “6.ADMINISTRATIVE PROCEDURES” section of this MPF Scheme Brochure.1

2. DIRECTORY OF APPROVED TRUSTEE AND OTHER SERVICE PROVIDERSSponsorThe Bank of East Asia, Limited10 Des Voeux Road Central, Hong KongTrustee,Custodian andAdministratorBank of East Asia (Trustees) Limited32nd Floor, BEA Tower, Millennium City5, 418 Kwun Tong Road, Kwun Tong,Kowloon, Hong KongInvestmentManagerBEA Union Investment Management 5 th Floor, 10 Des Voeux Road Central,LimitedHong KongLegal AdvisersBaker & McKenzie14th Floor, One Taikoo Place, 979 King’sRoad, Quarry Bay, Hong KongAuditorsKPMG8 th Floor, Prince’s Building, 10 ChaterRoad, Central, Hong Kong2.1SponsorThe Bank of East Asia, Limited (the “Bank”) was incorporated in Hong Kong in 1918 andis the sponsor of the Master Trust. The Bank is dedicated to providing comprehensiveretail banking, commercial banking, wealth management, and investment services to itscustomers in Hong Kong, Mainland China, and other major markets around the world. TheBank is the largest independent local bank in Hong Kong, with total consolidated assetsof HKD839.5 billion (USD107.2 billion) as of 31 st December, 2018. The Bank is listed onThe Stock Exchange of Hong Kong. The Sponsor is responsible for business development,marketing, and product development, as well as ancillary and support services to theTrustee as may be agreed between them from time to time.Where contributions and accrued benefits deriving from contributions to the Master Trustand other amounts are held in an interest bearing account with the Bank as described inthis MPF Scheme Brochure, the Bank will pay interest on such amounts at a rate no lowerthan the prevailing commercial rate for deposits of a similar size and duration.2.2TrusteeBank of East Asia (Trustees) Limited was incorporated in Hong Kong in 1975 and is thetrustee of the Master Trust. The Trustee is registered as a trust company in Hong Kong andhas been approved by the MPFA as an approved trustee for MPF purposes1 . The Trustee isalso a wholly owned subsidiary of the Bank.Under the Trust Deed, the Trustee is responsible for the administration of the Master Trustand the safekeeping of the assets of the Master Trust. The Trustee also acts as custodianof the assets of the Master Trust.2.3Investment ManagerBEA Union Investment Management Limited was incorporated in Hong Kong in 1988and is the investment manager of the Master Trust. Previously known as East Asia AssetManagement Company Limited, the Investment Manager is jointly owned by the Bank andUnion Asset Management Holding AG.1Such approval does not imply recommendation by the MPFA2

3. FUND OPTIONS, INVESTMENT OBJECTIVES AND POLICIES3.1Scheme structureBEA (MPF) VALUE SCHEME - CONSTITUENT FUNDSConstituentFundsBEA Growth BEAFundBalancedFundBEA Stable BEA Asian BEA Global BEA Greater BEA Greater BEA Hong BEA Global BEA MPF BEA Core BEA Age 65FundEquity Fund Equity Fund China Equity ChinaKong Tracker Bond Fund Conservative Accumulation Plus FundFundTracker Fund FundFundFundTwo or more APIFsBEA UnionInvestmentGlobal EquityFundBEA UnionInvestmentGreater ChinaGrowth Fund3SPDR Tracker FundFTSE of HongGreater KongChina ETFBEA UnionInvestmentGlobal BondFundBEA UnionDirectInvestments InvestmentCoreAccumulationFundBEA UnionInvestmentAge 65 PlusFund

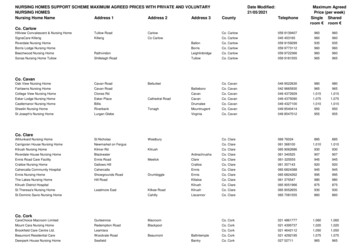

3.2Table for Constituent FundsUnder the Trust Deed, the Trustee is required to establish and maintain separateConstituent Funds in which contributions and accrued benefits may be invested. TheConstituent Funds are notional funds established within the Master Trust and are onlyavailable for investment by Members.The Master Trust currently offers the following Constituent Funds for investment:No.Name ofConstituentFundInvestmentManagerFund structureFunddescriptorInvestment focus1.BEA GrowthFundBEA tfundMixed AssetsFund – Global– Maximum90% inequities60% to 90% inequities, 10% to40% in cash, debtsecurities and/or money marketinstruments2.BEA BalancedFundBEA tfundMixed AssetsFund – Global– Maximum60% inequities40% to 60% inequities, 40% to60% in cash, debtsecurities and/or money marketinstruments3.BEA Stable Fund BEA tfundMixed AssetsFund – Global– Maximum40% inequities10% to 40% inequities, 60% to90% in cash, debtsecurities and/or money marketinstruments4.BEA GlobalEquity FundBEA UnionInvestmentManagementLimitedFeeder fundEquity Fund – Not less than 70%Globalin equities withthe remainder heldin money marketinstruments, cashor cash equivalents5.BEA AsianEquity FundBEA tfundEquity Fund – At least 70% inAsia ex-Japan equities, up to30% in cash, debtsecurities and/or money marketinstruments6.BEA GreaterChina EquityFundBEA UnionInvestmentManagementLimitedFeeder fundEquity Fund – Not less thanGreater China 70% in equities,up to 10% inother securities(as permittedunder the GeneralRegulation) withthe remainderheld in cash orcash equivalents4

No.Name ofConstituentFundInvestmentManagerFund structureFunddescriptor7.BEA GreaterChina TrackerFundBEA UnionInvestmentManagementLimitedFeeder fundEquity Fund – 100% in equitiesGreater China8.BEA Hong KongTracker FundBEA UnionInvestmentManagementLimitedFeeder fundEquity Fund – 100% in equitiesHong Kong9.BEA GlobalBond FundBEA UnionInvestmentManagementLimitedFeeder fundBond Fund –Global20% to 100%in short to longterm governmentbonds, 0% to 80%in short to longterm corporatebonds10.BEA MPFConservativeFundBEA neyMarket Fund– Hong Kong100% in shortterm deposits anddebt securities11.BEA CoreAccumulationFundBEA UnionInvestmentManagementLimitedFeeder fundMixed AssetsFund – Global– Maximum65% inHigher RiskAssets55% to 65% inHigher Risk Assetswith the remainderinvested in LowerRisk Assets12.BEA Age 65 Plus BEA UnionFundInvestmentManagementLimitedFeeder fundMixed AssetsFund – Global– Maximum25% inHigher RiskAssets15% to 25% inHigher Risk Assetswith the remainderinvested in LowerRisk Assets5Investment focus

3.3Investment objectives and policiesEach Constituent Fund has a separate and distinct investment objective and policy, asdescribed in more detail below.Investors should note that the statements of expected return for each ConstituentFund set out below represent the Investment Manager's expectations based on theInvestment Manager's past experience. However, there is no guarantee that suchreturns will be achieved. In addition, the return of a Constituent Fund over the shortterm may be greater than or less than the return of a Constituent Fund over the longterm, due to market fluctuations and other factors. The information in section (e)below is provided for reference only.3.3.1 BEA Growth Fund(a) ObjectiveTo achieve long-term capital appreciation within a controlled risk/return frameworkthrough investing mainly in global equities with some exposure in global debtsecurities/money market instruments.(b) Balance of investmentsThe BEA Growth Fund will invest primarily in global equity and bond markets. TheBEA Growth Fund will invest in a range of APIFs managed by the Investment Managerto obtain exposure to such markets, selected by the Investment Manager havingregard to the investment objective and investment policy. The underlying assets ofthe BEA Growth Fund are expected normally to be invested 60% to 90% in equitiesand 10% to 40% in cash, debt securities and/or money market instruments.(c) Security lending and repurchase agreementsThe BEA Growth Fund will not engage in security lending and will not enter intorepurchase agreements. The underlying APIFs may, however, engage in securitylending.(d) Futures and optionsBoth the BEA Growth Fund and the underlying APIFs will enter into financial futuresand options contracts for hedging purposes only.(e) RisksThe BEA Growth Fund is suitable for investors who are willing to assume a higherlevel of risk to achieve potentially higher long-term returns. The Investment Managerexpects the return of the BEA Growth Fund over the long term to reflect movementsin the global equity markets.The performance of the BEA Growth Fund is subject to a number of risks, includingthe following: China market riskconcentration riskcurrency riskemerging market riskcounterparty riskpolitical, economic and social riskvaluation and accounting riskhedging risk6 equity investment risk and volatilityriskcredit risk and credit rating riskinterest rates riskmarket/liquidity riskEurozone riskearly termination riskrisks in relation to futures and optionscontractsrisk of investment in Europe

Please refer to the “4. RISKS” section for a detailed description of each of the riskslisted above.3.3.2 BEA Balanced Fund(a) ObjectiveTo achieve a stable rate of return with an opportunity for capital appreciationthrough a balanced weighting of investments in global equities and debt securities.(b) Balance of investmentsThe BEA Balanced Fund will invest primarily in global equity and bond markets.The BEA Balanced Fund will invest in a range of APIFs managed by the InvestmentManager to obtain exposure to such markets, selected by the Investment Managerhaving regard to the investment objective and investment policy. The underlyingassets of the BEA Balanced Fund are expected normally to be invested 40% to 60% inequities and 40% to 60% in cash, debt securities and/or money market instruments.(c) Security lending and repurchase agreementsThe

The Bank of East Asia, Limited (the “Bank”) was incorporated in Hong Kong in 1918 and is the sponsor of the Master Trust. The Bank is dedicated to providing comprehensive retail banking, commercial banking, wealth management, and investment services to its customers in Hong Kong, Main