Transcription

Completed acquisition by GXS of InovisThe OFT’s decision on reference under section 22(1) given on 25 June2010. Full text of decision published 14 July 2010.Please note that the square brackets indicate figures or text which havebeen deleted or replaced in ranges at the request of the parties or thirdparties for reasons of commercial confidentiality.PARTIES1.GXS and Inovis are global providers of business-to-business (B2B) ecommerce services and software solutions, which enable businessdocuments, such as purchase orders, delivery information andinvoices, to be processed and exchanged electronically betweenparties.2.In the UK, GXS operates through GXS Limited (GXS UK) and Inovisthrough its wholly-owned subsidiary Inovis UK Limited (Inovis UK,formerly Harbinger Commerce Limited) and Freeway CommerceLimited (acquired in August 2007).TRANSACTION3.The parties entered into an Agreement and Merger Plan on 7December 2009 (the Transaction). Pursuant to this agreement, anew holding company, incorporated in the US (NewCo), became theindirect 100 per cent parent of GXS and Inovis. The current GXSshareholders collectively hold 71.7 per cent of the equity in Newco,with the current Inovis shareholders collectively holding theremaining 28.3 per cent. The Transaction completed on 3 June2010.4.The Transaction is predominantly US-led, with the UK element of theTransaction comprising a relatively small part of the overall deal (lessthan 10 per cent of the total value of the deal). The OFT received a1

satisfactory submission by the parties on 6 April 2010 and theadministrative deadline was 24 June 2010.JURISDICTION5.As a result of the Transaction, GXS and Inovis will cease to bedistinct enterprises within the meaning of section 26 of theEnterprise Act (the Act). Inovis's 2009 UK turnover wasapproximately [ ] so that the turnover threshold under section23(1)(b) is not met.6.The parties' share of supply of Electronic Data Interchange (EDI)messaging services in the UK exceeds 25 per cent, so that theTransaction qualifies for review under the Act.BACKGROUND7.The Competition Commission (CC) has previously considered EDI inFrancisco Partners/G international, which was cleared in 2005.18.On that occasion the CC found that 'EDI is one of a number ofelectronic tools which were developed in the 1980s to provide amore efficient exchange of business information between tradingpartners using a specific means of formatting (a message contentstandard), and various ways of transmitting data.'2 The businessinformation exchanged between trading partners includes purchaseorders, delivery/shipping information, invoices, and order statusinquiries.9.At its inception, EDI was carried out using direct point-to-pointtelecommunications lines. This method of exchanging data is suitablewhen the number of trading partners involved in the exchange issmall. In the 1980s, however, as the number of businesses usingEDI started growing intermediaries introduced private proprietarynetworks (called value-added networks, or VANs) to facilitate EDImessaging.1A report on the acquisition by Francisco Partners LP of G International, Inc, September2005 ('CC report'). In particular, the section in the text above draws from section 2 ofthe CC report, and the parties' submission.2paragraph 2.4 CC report2

10. VANs allowed users to connect to a single access point for the VANusing an appropriate message content and communications protocol,rather than support independent direct connections to each of theirtrading partners.11. In other words, VANs can be thought of as a form of 'electronic postoffice' which allows multiple trading partners that use different EDIstandards to communicate with each other without the need fordirect point-to-point connections. EDI VANs act as a post office,routing the documents and data to the recipient. EDI VANs alsoprovide a number of additional services, for example, retransmittingdocuments, auditing and validating the information, acting as agateway for different transmission methods, and handlingtelecommunications support.12. An EDI VAN combines two elements: a) a physical communicationsand computing infrastructure, and b) data management processesthat enable the handling and transmitting of messages that representbusiness transactions.13. The role of 'traditional' EDI messaging (point-to-point EDI and EDIVANs) remained broadly unchanged until the late 1990s, when theemerging use of Internet technologies for the transmission of EDImessages started to transform this industry. In particular, theInternet made possible the introduction of several newer approaches,namely: traditional EDI VANs accessed via the Internet (rather than vialeased lines or dial-up connections) internet EDI VANs (which rely on the Internet not only for thetransmission of electronic documents to and from the VAN, butalso for operating the VAN itself) web EDI, which allows smaller trading partners to exchangeelectronic documents through a web site (usually set up by alarger trading partner) point-to-point Internet EDI (including technologies such as AS2),where trading partners are connected directly to each other via3

the Internet, and hence there is no need for direct leased lines andVAN infrastructure at all.314. As explained in detail below, the CC found that all these newInternet-based approaches were part of the same relevant market as'traditional' EDI VANs.15. In this case the parties also note the significant growth experiencedby the provision of managed EDI services, whereby customersoutsource their EDI messaging needs to service providers as opposedto the traditional approach of renting VAN infrastructure fromintermediaries such as GXS. The OFT understands that EDI VANsusually remain an underlying component of managed EDI services(that is, unless direct, point-to-point solutions, such as AS2, areimplemented). The main difference between managed and nonmanaged EDI services is that in the former case the service providertakes care of all aspects of the EDI service, for example, there is noneed for the customer to retain dedicated staff in-house. In the caseof non-managed EDI services, instead, the customer usually retainssome dedicated staff in-house that are responsible for the day-to-dayfunctioning of EDI. While it is possible that providers of managed EDIservices to provide additional functionalities, for example, in terms ofsoftware customisation and usage data analysis, when referring tothe term 'managed EDI services' the OFT is using it to describe theoutsourcing of EDI messaging services. The parties note that [ ]estimates a compound annual growth rate of 17.9 per cent between2007 and 2012 for managed services and that managed services areforecast to overtake traditional EDI messaging (in terms of revenues)by 2012. According to the parties, this growth has been driven by,amongst other factors, a desire by users for more functionality fromtheir B2B provider than simply message transportation, as well asreducing the complexity of provisioning for hundreds or thousands ofexternal business partner connections.3It is often said that point-to-point Internet EDI (such as AS2) 'cuts the VAN out of EDI',to highlight that with these methods there is no need for an intermediary (that is, theVAN) to act as a post office and facilitate data interchange between trading partners.4

PRODUCT MARKETIntroduction16. In the UK, GXS and Inovis are both active at all different levels ofthe supply chain of EDI messaging services, namely: at the upstream level, they are active in the supply of themessaging infrastructure used in the provision of EDI messagingservices (also known as the 'VAN') at an intermediate level, GXS and Inovis supply software for EDImessaging at the downstream level, GXS and Inovis provide EDI messagingservices and managed EDI services to final customers (forexample, insurance brokers, large retailers, automotive industry,manufacturers and their trading partners).17. The OFT's distinction above between upstream, intermediate anddownstream levels is for convenience and ease of exposition only.The OFT understands that both infrastructure and software arecomplementary inputs into EDI messaging services, and therefore itwould be incorrect to view infrastructure as an input into software(as the categorisation into upstream and intermediate levels abovecould imply). However, as EDI messaging infrastructure is alsosupplied on a merchant basis (that is, software providers or finalcustomers can rent it), it makes sense in this case to considertheories of harm arising from market power in EDI messaginginfrastructure (that is, at the 'upstream level' in the diagram below);hence, we consider the distinction above useful.18. The chart below provides a graphical representation of this supplychain:5

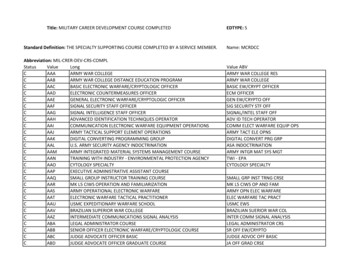

Figure 1: Supply chain for EDI messaging servicesUpstream level:EDI messaging infrastructureIntermediate level:Software for EDI messagingDownstream level:EDI messaging services(possibly including managed EDI services)Final customersSource: OFT19. Each of the parties is also a monopolistic provider of interconnectionto its own EDI messaging infrastructure.420. The parties' sales in the different EDI messaging segments for 2009are shown in the Table below.4Furthermore, the parties also have some minimal overlap in data synchronisation andmanaged file transfer. Given the very small turnover of both parties in these twosegments in the UK, the OFT does not consider them in any further detail.6

Table 1: Parties' sales in the UK in 2009 – by segmentManagedEDIservicesEDImessaging managed EDIservices(a)(b)(c) (a) (b)(d)(e)GXS[][][][][][]Inovis[][][][][][]GXS Inovis[][][][][][]EDI es(f) (a) (b) (d) (e)Source: the parties21. As the demand for infrastructure and software is largely derived fromthe demand for EDI messaging services, a sensible approach tomarket definition in this case is to look at the 'downstream' levelfirst.Product scope: EDI messaging services (the downstream market)The CC's findings in 200522. In its report of 2005 the CC defined the relevant product market as'the market for the transmission of EDI messages from one businessto another' (paragraph 4.25). The CC described the market as 'EDIcommunication services' (paragraph 4.26).23. According to the CC, this market included point-to-point EDI (alsocalled direct-connect EDI) as well as 'traditional' EDI VANs. Bothdirect-connect EDI and traditional EDI VANs are accessed throughtelecommunications lines (that is, either leased lines or dial-upconnections). In addition, the CC considered that the relevant marketincluded the newer approaches that had been developed since the5It was not possible for the OFT to separate revenues for EDI messaging services andEDI messaging infrastructure.7

late 1990s exploiting Internet technology, referred to above inparagraph 13, namely traditional EDI VANS accessed via theInternet, Internet EDI VANs, web EDI and point-to-point Internet EDI(including technologies such as AS2). The CC found that thesenewer services were technically feasible and economically viablesubstitute for traditional EDI VANs.24. As noted below (see the subsection on software for EDI messagingbelow), the CC included communication software (but not translationnor application interface software) in the same relevant market asEDI communication services. In addition, the CC did not considermanaged EDI services, since this type of service had a marginalpresence in 2005.The parties' view25. In this case the parties distinguish a market for EDI messaging and amarket for managed EDI services. They agree with the CC'sconclusion that the relevant product market for EDI messaging iswider than 'traditional' EDI VANs and should include all Internetbased solutions listed at paragraph 23 above. In fact, they arguethat, given significant technological developments since 2005, therelevant product market should be even wider and also includemanaged EDI services on the basis that customers outsource theirEDI messaging needs to external service providers (as opposed tothe traditional approach of buying a complete EDI VAN solution fromintegrated players such as GXS and Inovis or from resellers).26. Ultimately, however, the parties submit that it is not necessary forthe OFT to conclude on product market definition because, even ifmanaged EDI services are not included in the same market for EDImessaging, the proposed transaction will not give rise to asubstantial lessening of competition.The OFT's assessment in this case27. The OFT is of the view that the appropriate market to consider at thedownstream level is 'EDI messaging services'.28. We have seen no evidence which would justify excluding Internetbased solutions for EDI messaging from the relevant market in this8

case. These solutions appear to be well-established in the marketand fully compete with 'traditional' EDI VANs.629. As to whether managed EDI services should also be included in therelevant market, the OFT notes the fact that revenues for managedEDI services are growing and are also forecast by industry sources tosurpass the revenues associated with 'traditional' EDI messaging(which are reportedly stagnant) by 2012. However, this is not initself evidence that managed services exert a competitive constrainton EDI messaging and therefore should be considered as part of thesame market.30. Similarly, the fact that managed EDI services fulfil the same basicfunction as the other types of EDI messaging included in the CC'smarket definition is not sufficient for the OFT to conclude that theyare both in the same market (although it is, admittedly, consistentwith them being in the same market).31. On the other hand, the parties reported several examples ofcompanies switching part or all of their EDI messaging traffic toproviders of managed EDI services in recent years.7 During itsinvestigation the OFT also received a few responses from companieswho had switched (or were considering switching) to managed EDIservices. Third parties also told us that outsourcing of part or thewhole of EDI messaging needs by firms is a growing trend. While itis therefore plausible that managed services do constrain EDImessaging services, the OFT does not have evidence that switchingto managed EDI services from EDI messaging is related to changes inrelative prices of EDI messaging, for example, so as to be able todefinitively conclude that customers would switch to managed EDIservices. The OFT cannot therefore draw definitive conclusions onmarket definition from this movement towards managed EDIservices.32. Ultimately, however, the OFT considers that in this case it is notnecessary to conclude on whether managed EDI services are in the6While point-to-point Internet EDI may not have grown rapidly over the last years (seebelow), it is still an alternative option to EDI messaging.7The parties mention that [ ] are examples of GXS customers who recently switchedfrom traditional EDI messaging to managed EDI services. Examples of customers whorecently outsourced their EDI requirements to Inovis include [ ] and [ ].9

same relevant market as the other EDI messaging solutions identifiedby the CC in 2005. This is because the competitive assessment islargely unaffected by this issue, since at the downstream level thesame competitors who provide EDI messaging services are also ableto provide managed EDI services (and indeed they do), and theseinclude the merging parties as well as their main competitors (forexample, Sterling Commerce, Easylink, Descartes, Crossgate, DiNet)and resellers (for example, [ ], [ ], [ ]). In addition, evidence providedby the parties does not suggest that there is stronger competitionbetween the parties in respect of EDI managed services. In addition,other providers of managed EDI services (for example, B2B / ecommerce vendors) can be treated in a similar way as resellers (inthat they also need to procure EDI messaging infrastructure fromthird parties), and any competitive constraint which they exert onthe parties is appropriately considered in the competitive assessmentbelow.33. In addition, the inclusion of managed EDI services in the relevantmarket (which the OFT understands is smaller, although growing)does not significantly change the competitive assessment.Product scope: Software for EDI messaging (the intermediate market)The CC's findings in 200534. In its report of 2005 the CC said (at paragraph 4.21) that EDIsoftware can be classified in three categories: communication software, which permits communication, includingdata transmission, with the VAN translation software, which converts data from the in-houseformat into the agreed EDI standard before transmission (or thereverse for incoming messages), and application interface software, which imports and exports databetween customers' in-house applications and the translationsoftware.35. The CC noted that communication software is usually provided aspart of the EDI service, whereas application interface software andtranslation software are often provided by specialist software10

providers. On this basis, the CC concluded that communicationsoftware is part of the same market as EDI messaging, but thattranslation and application interface software are in a separate (butrelated) market.The parties' view36. In this case the parties submit that the boundaries between thesedifferent types of software are blurring. They note that 'today, amore common classification of EDI software includes 'stand-aloneEDI translators' (equivalent to translation software in the [CC]Report), which interprets incoming EDI information and converts itinto the format used by the company's internal systems; and'gateway software' (comprising both application interface softwareand communication software as defined in the [CC] Report), which isused to consolidate and centralise a company's data and tointeroperate with external business partners.'37. Accordingly, the parties submit that the distinction betweencommunication software and other types of EDI software is nolonger appropriate since most software packages have bothtranslation and communications capabilities, and therefore all threetypes of software should be included in an EDI software marketwhich is separate from EDI messaging services.The OFT's assessment in this case38. The OFT's market investigation confirms that the boundariesbetween these different types of software have blurred since 2005.This suggests that there is an EDI software market (possiblycomprising communication, translation and application interfacesoftware) at the 'intermediate' level of the supply chain that isdistinct from EDI messaging services.39. In any event, the parties' overlap in this market is limited asconfirmed by third parties (given the weak position of GXS insoftware). There are also several other software suppliers in thismarket. As such, the OFT does not need to conclude on the precisescope of the EDI software market. In addition, because of the lack ofhorizontal concerns, the OFT does not consider the EDI softwaremarket further in the competitive assessment described below.11

Product scope: EDI messaging infrastructure (the upstream market)40. The CC did not explicitly consider the market for EDI messaginginfrastructure in its report of 2005. However, given the OFT'smarket investigation, that has revealed the market structureidentified in paragraph 18 above, the OFT has considered itappropriate to define the upstream market which third partiestypically refer to as 'infrastructure', 'the VAN', 'backbone services'or 'the network component of EDI messaging'. This includes Internetconnections or telecommunications lines, servers, mainframes, datacentres, and all the infrastructure components that are needed forthe exchange of electronic data. Historically, 'traditional' EDI VANswere proprietary but the advent of newer Internet-ba

at an intermediate level, GXS and Inovis supply software for EDI messaging at the downstream level, GXS and Inovis provide EDI messaging services and managed EDI services to final customers (for example, insurance brokers,