Transcription

STRATEGY SPOTLIGHT:The KeyDrivers to aSuccessfulLTOExamining the elements of2018’s most impactful LSR& FSR promotionsMARCH 2019www.sense360.com!1

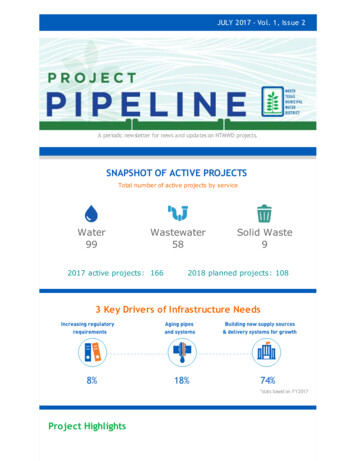

OverviewA key topic facing marketing leaders in the restaurantindustry is how to most effectively run limited time offers(LTOs) and promotions. Between development costs, advertisingspend, and the risk of lowering product margins without seeing the necessarylift in revenue, there is virtually no room for error. However, historically those same leaders have hadlittle concrete data to measure the true performance of their LTOs, and to benchmark thatperformance against the LTOs of industry competitors.Using Sense360's real-time behavioral insights, this article distills key findings from benchmarkingover 200 Limited Time Offers that ran in 2018. This includes a summary of the top features drivingsuccessful LTOs, as well as four case studies to highlight particular brands that found success in themarket running LTOs.MethodologySense360Based on a list of 210 restaurant LTOslaunched in 2018 (as identified by therestaurant publication Chew Boom), Sense360examined the year-over-year lift in Visit Shareduring the promotion window, compared toequivalent dates in the year prior. Visit Shareis a core Sense360 metric displaying the % oftotal market visits received by a particularbrand.Sense360 is a data and insights companythat empowers business leaders tocontinuously grow their business by makingconsistently great decisions, quickly and withconviction. Through bringing together all thedata that matters and creating accurate toolsthat are highly accessible and supported bya team of experts, Sense360 isrevolutionizing the current state of marketresearch -- which has been plagued by highcost, static products that are neither timelynor accurate. Sense360 was founded in 2014and is headquartered in Los Angeles. Formore information, please visit our website:www.sense360.com.Using logistic regression and analysis ofcorrelation factors, Sense360 identified theattributes of the LTO and brand running it thatbest explained year-over-year relative lift inVisit Share. These attributes included factorslike the kind of promotion run (e.g. new menuitem, discount, etc.), the recent performanceof the brand outside of the promotionwindow, and the size of the brand.!2

Key ThemesEmerge For TheTop PerformersOur intent was to understand the LTOenvironment of the restaurant industry andif certain factors have a consistent patternof driving LTO performance. Several keythemes stood out in our analysis.BY THE NUMBERSThe market in 2018 was saturatedwith limited time new menu items,making it hard to stand out.1New Menu items were incorporated in a whopping 85% of all the LTOs inthe sample. What makes this troubling is that our data showed anegative correlation with launching a new menu item LTO and achievingVisit Share lift. A bright spot was specifically for LTOs of value menu items,which saw a positive correlation with Visit Share lift.This offers unique insight into just how hard it is to stand out when the restof the market is also introducing new items. Unless the menu item isappealing to a different consumer or dining occasion (as is the case moreoften with the launch of value menu items), new menu item launches run ahigh risk of cannibalizing existing purchases and not creatingincremental Visit Share lift.2Discounts & Free Items made asplash.Among categories of LTOs, discounting and free items were mostcorrelated with lift in Visit Share. Many of the best performing LTOs of theyear fell into this category. Though perceived as good value byconsumers and likely to drive incremental traffic (as shown by the data),discount and free item LTOs shouldn’t necessarily be viewed as aguaranteed winning approach.Despite likely Visit Share gains, brands should be cautiousof eroded margins canceling out any net benefits ofincreased traffic, and the potential of poor retention ratesfrom consumers that responded just to this LTO may createlittle to no long-term value.!3209Limited TimeOffers catalogued& analyzed68DistinctBrands85%of LTOsIntroduced anew item30%Included aDiscount5%Included afree item

3Large brands with strong recent performance sawthe most growthThe momentum of the brand throughout 2018 (Visit Share gains the brand had in 2018 even outside of theLTO window) was the highest correlated factor with Lift. Among those with positive momentum, largerbrands did especially well.This shows Limited Time Offers have the ability to complement winning strategies. However, for brand’s thathave negative momentum, it could be indicative of bigger systemic problems that are beyond what an LTOcan solve. Additionally, sufficient customer awareness matters in LTO performance, and large brands havethe reach and advertising budgets capable of building the awareness needed to generate Visit Share lift.TOP PROMOTIONS OF 2018Burger King: 3 Pancakes for 89 cents .46% Visit Share Lift 10.2% Relative LiftBurger King introduced a 3 pancake entrée for 89 cents in mid-November of2018. In the month following, Burger King saw it’s National Visit Share duringbreakfast improve by 0.46% compared to the same period during breakfast in theyear prior (a 10.2% relative lift). While many of the new menu items introducedthroughout 2018 created little lift, if any, for their brands, value-focusedpromotions like these tended to have a greater impact. In this case, the newmenu addition created a lift in foot traffic for Burger King.Chipotle: Late Night Taco Happy Hour inMiami & Dallas .30% Visit Share Lift 25.1% Relative LiftChipotle introduced a Late Night Taco Happy Hour in Miami, FL and Dallas, TX inAugust of 2018. The brand offered 2 tacos if you made the purchase of anydrink after 8pm. The discount on their tacos resulted in a lift in their National VisitShare of 0.3% on an absolute basis, or 25.1% relative lift, from a year prior. WhileChipotle still required a purchase, the discounted entrée offerings appeal had atangible impact on foot traffic.!4

Taco Bell: Steal a Base, Steal a Taco .46% Visit Share Lift 10.2% Relative LiftTaco Bell brought back it’s “Steal a Base, Steal a Taco” promotion for its 7th year.When Mookie Betts stole a base in the 2018 World Series, he entitled Taco Bellguests to claim a free Doritos Locos Taco from 2pm to 6pm at Taco Bell’sNationwide on November 1st, 2018. Taco Bell saw a 1.1% lift in their National VisitShare on the day compared to the Year prior, a 23.3% relative lift. This promotionhas been a market favorite for the past few years and is an extreme example ofhow impactful discounting and give-away promotions can be in driving visits.Chick-fil-A: Lime Shake’s in Austin,TX 2.6% Visit Share Lift 45.2% Relative LiftChick-fil-A introduced a Key Lime Shake in Austin Texas in October of 2018.Chick-fil-A saw a large 2.6% lift in their Visit Share Year over Year during thepromotion (a 45.2% relative lift) without offering any special discounting. Chick-filA is a brand that saw strong growth in 2018, especially in markets like Austin, TX,and the strong growth during this promotion exemplifies the way strong growingbrands can use LTOs to further bolster their market position.LTOs: Key TakeawaysLimited Time Offerings usually play a bigpart for a QSR brand’s marketing strategy ,but only a few promos stand out and havethe ability to drive meaningful value. Thenew menu item LTO is the popular tactic ofthe moment, but brands are running themat the high risk of cannibalizing their sales.We recommend QSR operators considerthe following when launching an LTO:!5 Though popular, discount and free itemsLTOs shouldn’t shouldn’t be viewed as aguaranteed winning approach If the main goal is to drive visit share lift,a new menu item LTO will likely fallshort. If your brand has positive momentum,make sure to maximize it with an LTO.

Empoweringconsistentlygreat decisions3710 S. RobertsonSuite 213Culver City, CA 9000March 2019www.sense360.comMARCH 2019www.sense360.com

Chipotle introduced a Late Night Taco Happy Hour in Miami, FL and Dallas, TX in August of 2018. The brand offered 2 tacos if you made the purchase of any . part for a QSR brand’s marketing strategy , but only a few promos stand out and have the ability to drive meaning