Transcription

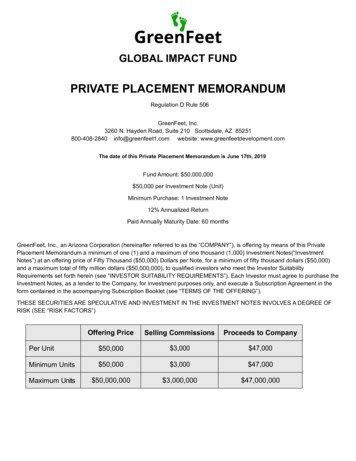

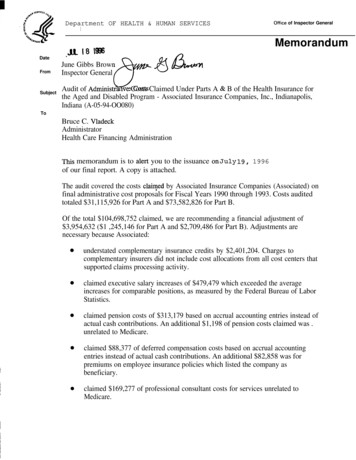

,Department OF HEALTH & HUMAN SERVICESofficeof Inspector General{DateFromSubject. Memorandum18 [9%June Gibbs BrownInspector General&L@Audit of Adrninistrawe Costs Claimed Under Parts A & B of the Health Insurance forthe Aged and Disabled Program - Associated Insurance Companies, Inc., Indianapolis,Indiana (A-05-94-OO080)ToBruce C. VladeckAdministratorHealth Care Financing AdministrationThis memorandum is to alert you to the issuance on JUly 19, 1996of our final report. A copy is attached.The audit covered the costs cla ed by Associated Insurance Companies (Associated) onfinal administrative cost proposals for Fiscal Years 1990 through 1993. Costs auditedtotaled 31,115,926 for Part A and 73,582,826 for Part B.Of the total 104,698,752 claimed, we are recommending a financial adjustment of 3,954,632 ( 1 ,245,146 for Part A and 2,709,486 for Part B). Adjustments arenecessary because Associated:understated complementary insurance credits by 2,401,204. Charges tocomplementary insurers did not include cost allocations from all cost centers thatsupported claims processing activity.claimed executive salary increases of 479,479 which exceeded the averageincreases for comparable positions, as measured by the Federal Bureau of LaborStatistics.claimed pension costs of 313,179 based on accrual accounting entries instead ofactual cash contributions. An additional 1,198 of pension costs claimed was .unrelated to Medicare.claimed 88,377 of deferred compensation costs based on accrual accountingentries instead of actual cash contributions. An additional 82,858 was forpremiums on employee insurance policies which listed the company asbeneficiary.claimed 169,277 of professional consultant costs for services unrelated toMedicare.

Page 2- Bruce C. Vladeckclaimed 162,151 of indirect cost allocations that were for non-Medicare relatedcosts .overstated return of investment by 67,230 because amounts were inconsistentlycalculated between fiscal years.claimed 56,958 of post-retirement benefit costs based on accrual accountingentries instead of actual cash contributions.claimed 45,070 of executive car allowances that were unsupported and 10,885for other employees’ mileage reimbursements that exceeded amounts permittedunder Federal Travel Regulations.claimed 49,480 of interest costs that are not allowable under Federal regulations.claimed 26,240 for adve ising, entertainment, dues, and contributions that werefor non-Medicare related activities.claimed 1,046 for a late payment of property tax penalty that is not allowableunder Federal regulations.In response to our draft report, Associated agreed to 516,314 of our recommendedfinancial adjustments (pension costs - 288,388; indirect cost allocation - 562;automobile costs - 10,236; interest costs - 49,480; professional consultants - 166,602;and property taxes - 1,046) and disagreed with the remaining amounts questioned.,For fimther information, contact:Paul P. SwansonRegional Inspector Generalfor Audit ServicesRegion V(312) 353-2618Attachments

Department of Health and Human ServicesOFFICE OFINSPECTOR GENERALAUDIT OF ADMINISTRATIVE COSTS CLAIMEDUNDER PARTS A & B OF THEHEALTH INSURANCE FOR THE AGED ANDDISABLED PROGRAMASSOCIATED INSURANCE COMPANIES, INC.,INDIANAPOLIS, INDIANA #SERVICE q GIBBS BROWNInspector GeneralJUNE W 2‘5%?-#JULY 1996A-05-94-OO080%d .

DEPARTMENT OF HEALTH AND HUMAN SERVICESREGION V105 W ADAMS STCHICAGO. ILLINOIS 60603.620IOFFICE OFINSPECTOR GENERALCommon Identification No. A-05-94-00080Mr. Dennis Brinker, CPAChief Financial Officer and Vice PresidentAdminaStar Federal, Inc.P.O. Box 50454Indianapolis, Indiana 46250-0454Dear Mr. Brinker:Enclosed for your information and use are two copies of an Officeof Inspector General (OIG) audit report entitled, “Audit ofAdministrative Costs Claimed Under Parts A & B of the HealthInsurance for the Aged and Disabled Program. ” The audit coveredthe period October 1, 1989 ,through September 30, 1993. A’copy ofthis report will be forwarded to the HHS action official namedbelow, for her review and any action deemed necessary.Final determination as to actions taken on all matters reportedwill be made by the action official. We request that you respondto this official within 30 days from the date of this letter.Your response should present any comments or additionalinformation that you believe may have a bearing on the finaldetermination.In accordance with the principles of the Freedom of InformationAct (Public Law 90-23), Office of Inspector General audit reportsissued to the Department’s grantees and contractors are madeavailable, if requested, to members of the press and generalpublic to the extent information contained therein is not subjectto exemptions in the Act which the Department chooses toexercise.(See 45 CFR Part 5).To facilitate identification, please refer to the above CommonIdentification Number in all correspondence relating to thisreport .Sincerely,Paul SwansonInspector Generalfor Audit Services/@RegionalEnclosuresDirect Reply to:Ms . Daly VargasAssociate Regional Administrator

ISUMMARYAssociated Insurance Companies, Inc. (AIC) receives, reviews,audits, and pays both Medicare Part A and Part B claims underagreements with Blue Cross and Blue Shield Association and theHealth Care Financing Administration. The AIC is entitled toreimbursement for its allowable administrative costs incurred.For the period October 1, 1989 through September 30, 1993, AICclaimed administrative costs, for Medicare Parts A and B, asfollows:FiscalYear1990199119921993Part A 7,155,0417,349,1057,972,0778,639,703Part B 15,181,11817,116,97418,504,80022,779,934Total 22,336,15924,466,07926,476,87731,419,637Total 31,115,926 73,582,826 104,698,752Of the 104,698,752 in administrative costs claimed, we arerecommending financial adjustments of 1,245,146 (Part A) and 2,709,486 (Part B). .These amounts are detailed in the Exhibitsand the Findings and Recommendations section of the report.We found that Medicare costs were overstated because: Complementary insurance credits were understated by 2,401,204because AIC’S charges to complementary insurers did notinclude cost allocations from all cost centers that supportclaims processing activity. Salary increases for some of AIC’S executives exceeded averageincreases for comparable positions, as measured by the FederalBureau of Labor Statistics, by 479,479. Pension costs of 313,179 were charged to Medicare basedsolely on accrual accounting entries instead of actual cashcontributions.Additional pension costs claimed of 1,198were unrelated to Medicare. Deferred compensation costs of 88,377 were based on accrualaccounting e tries instead of actual cash contributions.Additional deferred compensation costs claimed of 82,858 werefor premiums on employee life insurance policies. AIC is thebeneficiary on the policies and insurance proceeds are notrestricted for use as deferred compensation. Professional consultant costs claimed of 169,277 were forservices unrelated to Medicare. Indirect cost allocations to Medicare of 162,151 were fornon-Medicare related costs.i

Return on investment costs were inconsistently calculatedfrom one fiscal year to the next, causing both overstatementsand understatements in charges to Medicare. The net resultwas a cumulative overstatement of 67,230. Post-retirement health benefits costs of 56,958 were basedsolely on accrual accounting entries instead of actual cashcontributions. Executive car allowances of 45,070 were unsupported, andother employees’ mileage reimbursement costs exceededamounts permitted under Federal Travel Regulations by 10,885. Interest costs of 49,480 were charged to Medicare.Federalregulations do not allow interest costs on borrowing. Advertising, entertainment, dues, and contributions totaling 26,240 were charged to Medicare although the costs wereapplicable to non-Medicare activities. Costs of a penalty of 1,046 for late payment of propertytaxes are unallowable.?AUDITEE COMMENTSAIC concurred in 516,314 of our recommended financialadjustments (pension costs - 288,388; professional consultants 166,602; indirect cost allocations - 562; automobile costs 10,236; interest costs - 49,480; property taxes - 1,046) anddisagreed or did not respond to the remaining amounts questioned.In some instances, AIC provided additional information, regardingitems questioned in our draft report, not available to us duringour field work, This final report has been adjusted to reflectthis additional information. AIC’S written comments aresummarized at the end of each finding and are attached as anAppendix to this report.ii.

TABLE OF CONTENTSPAGESUMMARYiINTRODUCTION1BackgroundScope of Audit11FINDINGS AND RECOMMENDATIONSComplementary CreditsExecutive Salary IncreasesPension CostsDeferred CompensationProfessional ConsultantsIndirect Cost AllocationsReturn on InvestmentPost-Retirement Health InsuranceAutomobileCosts ,,InterestAdvertising, Entertainment, Dues & ContributionsProperty TaxesOTHER MATTERSEXHIBITSA Final Administrative Cost Proposal (Part A)October 1, 1989 through September 30, 1993B- Final Administrative Cost Proposal (Part B)October 1, 1989 through September 30, 1993c- Final Administrative Cost Proposal (Part A)October 1, 1989 through September 30, 1990D Final Administrative Cost Proposal (Part B)October 1, 1989 through September 30, 1990E Final Administrative Cost Proposal (Part A)October 1, 1990 through September 30, 1991F Final Administrative Cost Proposal (Part B)October 1, 1990 through September 30, 1991G Final Administrative Cost Proposal (Part A)October 1, 1991 through September 30, 1992H- Final Administrative Cost Proposal (Part B)October 1, 1991 through September 30, 1992I Final Administrative Cost Proposal (Part A)October 1, 1992 through September 30, 1993J- Final Administrative Cost Proposal (Part B)October 1, 1992 through September 30, 1993ItAPPENDIX - Associated Insurance Companies, Inc. Comments.23457811121314151616

INTRODUCTIONBACKGROUNDHealth Insurance for the Aged and Disabled (Medicare) wasestablished by Title XVIII of the Social Security Act. HospitalInsurance (Part A) provides protection against the cost ofhospital and related care. Supplemental Medical Insurance(Part B) is a voluntary program that covers physician services,hospital outpatient services and certain other health services.The Health Care Financing Administration (HCFA) administers theMedicare program. Under an agreement with HCFA, the Blue Crossand Blue Shield Association (BCBSA) participates as a Medicareintermediary to assist in program administration. Under asubcontract with BCBSA, Associated Insurance Companies, Inc.(AIC) receives, reviews, audits, and pays Medicare Part A claims.Under a separate agreement with HCFA, AIC participates as aMedicare carrier and performs the same functions for MedicareSubject to limitations specified in thePart B claims.agreements, AIC is entitled to reimbursement for reasonableadministrative costs incqrred.From October 1, 1989, through September 30, 1993, AIC claimed 104,698,752 in administrative costs.SCOPE OF AUDITOur audit was conducted in accordance with generally acceptedgovernment auditing standards. The audit objective was todetermine whether Medicare Part A and B administrative costsclaimed by AIC on its “Final Administrative Cost Proposals”(FACP) were reasonable, allocable and allowable. We examined theadministrative costs claimed by AIC to determine whether theamounts were in accordance with (i) Federal AcquisitionRegulation (FAR) Part 31, (ii) the Carrier/Intermediary Manual,and (iii) the Medicare Agreements. We also reviewed salaryincreases given to AIC’S executives and the reasonableness ofresultant cost allocations to Medicare.Our examination included audit procedures designed to achieve ourobjective and a review of accounting records and supportingThe audit covered the period October 1, 1989documentation.through September 30, 1993. Audit fieldwork was performed atAIC’S offices in Indianapolis, Indiana from August 1994 throughMarch 1995.Otir audit did not cover pension segmentation. A separate auditof the AIC pension plan for compliance with segmentationrequirements will be performed at a later date.

FINDINGS AND RECOMMENDATIONSCOMPLEMENTARY INS CE CREDITSThe AIC understated complementary insurance credits, which are arequired offset to amounts claimed as Medicare administrativeThecosts, causing the FACPS to be overstated by 2,401,204.AIC’S cost allocations to complementary insurers included onlycost centers directly involved in complementary insuranceOther cost centers which benefitted claims processingactivity.activity, such as Medicare secondary payer and hearings andinquiries, were excluded from the cost allocations.The Medicare Intermediary Manual (section 1601.c) states thatcharges to complementary insurers should include cost allocationsfrom all cost centers that support the intermediary’s claimsprocessing activity. HCFA Program Memorandum, AB-95-1,illustrates the application of section 1601 by stating that thecost allocations should include costs from areas such as Medicaresecondary payer and hearings and inquiries.Because AIC did not adher to provisions of the Manual sectionand supplemental memorandum cited above, Medicare was overchargedby 2,401,204.RECOMMENDAT IONWe recommend that AIC make a financial adjustment of 2,401,204,as follows:FYFYFYFY1990:1991:1992:1993:Part B537,975437,898457,608476,460 1,909,941Part A 149,341125,604111,440104,878 491,263 Total687,316563,502569,048581,338 2,401,204 Auditee ResponseAIC disagreed with our financial adjustment recommendation. AICbelieves that the HCFA program memorandum AB-95-1 was used onlyas a guide to determine the fixed rates that were implemented inJanuary, 1995 and that this guide was not intended to be appliedAIC believes that allocations from cost centersretroactively.such as Medicare secondary payor, recons and hearings, inquiries,and medical review should not be included in the complementaryinsurance rate.Auditors ResponseThe HCFA program memorandum AB-95-1 was based on criteriacontained in the Medicare Intermediary Manual throughout theaudit period. The memorandum only illustrated, with examples,Our finding merelythe existing provisions of the Manual.2

t,reiterates the long standing principle that all costs whichbenefit an activity should be allocated to that activity.EXECUTIVE SALARY INCREASESSalary increases for AIC executives significantly exceededaverage increases for comparable positions as measured by theEmployment Cost Index established by the Bureau of LaborStatistics (BLS) .The resulting charges to Medicare were 479,479 higher than if ECI statistics had been used as a guidefor executive salary increases.The ECI represents dozens of indices that are calculated forvarious occupational and industry groups to measure the rate ofchange in employee compensation.It is a fixed weight index atthe occupational level and eliminates the effects of employmentshifts among occupations. The ECI is distinguished from othersurveys in that it covers all establishments and occupations inboth the private nonfarm and public sectors. We used the indexfor executive compensation because we considered it to be themost equitable and relevant.Regulations containedat 8 CFR 31.201-3(a) state that a cost isreasonable if it does not exceed what a prudent person wouldIn addition, 48incur in the conduct of competitive business.CFR 21.205-6(b) states “. .Compensation is reasonable if each ofthe allowable elements making up the employee’s compensationpackage is reasonable. . .Relevant factors include generalconformity with compensation practices of other firms of the samesize, industry and the geographical location. . . . “ Salaryincreases received by AIC executives did not meet this standardfor reasonableness.The ECI for executives in managerial/administrative areasdisclosed that average salary increases during the period coveredby our audit were, as follows:FY 1990FY 1991FY 1992FY 19935.4%4.1%1.7%3.3%Salary increases exceeding the above rates resulted in 479,479of unreasonable charges to the Medicare program.RECOMMENDATIONWe recommend that AIC make a financial adjustment of 479,479, asfollows:FYFYFYFY1990:1991:1992:1993Part B 27,61251,382110, 13283,115 272,241Part A 21,76638,27285, 97261i228 207,2383Total 49,37889,654196,104144,343 479,479‘

Audi.tee ResponseAIC disagreed with our financial adjustment recommendation. AICbelieves that the regulations cited in the report do not requireconformance to prescribed percentages for salary increases. Inaddition, AIC states that there were many changes in itsorganization during the audit period which affected compensationlevels and that many of the executives included in our analysishad changes in levels of responsibility that affectedcompensation. AIC further stated that our analysis includedincentive payments, and they doubted that the BLS informationincluded incentive payments.Auditor ResponseOur analysis did consider changes within AIC’S organization suchas retirements, new-hires, and management incentive payments.Regarding changes in job responsibilities, our review includedthe six executives that AIC’S response maintained had significantincreases in responsibility. We found that these six executiveshad cumulative increases in their compensation package over theaudit period ranging from 87 to 116 per cent. The related Bureauof Labor Statistic’s cumulative increase was only 14.5 per cent.These executives did have changes in job titles during the auditperiod, but, while titles changed, the level of responsibilityThese individuals were always essentially the CEOs/VPsdid not.within their respective division and subsidiary company.Therefore, we do not believe charging Medicare for compensationincreases exceeding the BLS averages was justified.The statistics from the BLS “Employment Cost Index” includedsalaries, bonuses, incentive payments, commissions, retirement,and cost-of-living adjustments.PENSION COSTSThe AIC overstated pension costs on the FACPS by 314,377 becausepension costs were not funded by cash contributions ( 313,179)and non-Medicare costs were included in amounts claimed ( 1,198) .Regulations at 48 CFR 31.205-6(j) (2) (i) state that pension costsmust be funded before an organization’s Federal income tax returnPension costs assigned to the current year, but notis due.funded by the due date, are not allowable in a subsequent year.The AIC did not fund its pension plan with cash contributions.Charges to the FACPS totaling 313,179 were based on accrualentries only.The AIC did not make required contributionsbecause its actuary determined that cash contributions were notIn addition,necessary to cover the fund’s current liabilities.AIC claimed 1,198 for pension costs that were not related toMedicare.4

RECOMMENDAT IONSWe recommend that AIC:1. Make a financial adjustment of 314,377, as follows:FYFYFYFY1990:1991:1992:1993:Part B 5,57440,90441,67876,255 164,411Part A 5,14237,67938,17168,974 149,966Total 10,71678,58379,849145,229S314,3772. Establish procedures to ensure that unfunded andnon-Medicare pension costs are not charged to Medicare.Auditee ResponseAIC concurred with 287,190 of our recommended financialadjustment on pension costs not funded by cash contributions andPart of AIC’Sthe 1,198 which was unrelated to Medicare.response concerned 1,136* relating to duplicate accruals that wehad questioned in our draft report. After examining AIC’Sadditional supporting documentation for the 1,136, we removedthe questioned amount from this final report.This amountAIC disagrees with the remaining 25,989 questioned.represents the cost of AIC’S Supplemental Executive RetirementPlan (SERP ) for highly compensated executives. AIC states thatSERP is a deferred compensation plan which is not subject to thecited pension plan regulations and that AIC is not required tofun

Insurance (Part A) provides protection against the cost of hospital and related care. Supplemental Medical Insurance (Part B) is a voluntary program that covers physician services, hospital outpatient services and certain other health services. The Health Care Financin