Transcription

The Relative Importance of Trust and Usable Website Design inBuilding E-Loyalty Intention on Internet Banking101The Relative Importance of Trust and Usable Website Design inBuilding E-Loyalty Intention on Internet BankingNor Aziati Abdul Hamid, Department of Technology Management, Faculty of Technology Management, UniversityTun Hussein Onn Malaysia, aziati@uthm.edu.mybanks) out of a total of 25 in Malaysia currentlyoffering Internet banking services [87].AbstractThe high cost of attracting new customers on theInternet and the relative difficulty in retaining themmake customers’ loyalty an essential asset formany banks. Since online transactions involvemany uncertainties for the customer and most ofthe Internet banking offers the same product as theother competitor, it is crucial for banks torecognize the key factor that can tie their existingcustomer become a loyal customer an change theweb surfers into purchaser. Despite of increasingusage of Internet banking in Malaysia, theliterature only portray little effort of empiricalresearch has addressed the role of quality Internetwebsites design and customer online trust informing consumers’ intentions to revisits orrepurchase particular products or at particularbanks within the context of customer relationshipmanagement. This empirical study was performedto measure relative importance of two differentfactor that is most cited as a critical success factorfor e-commerce environment; usable websitedesign and trust elements on the website. The studyspecifically focuses on Internet banking users andsample for the study was drawn amongacademician, post-graduate and out campusstudents of three different faculties in University ofMara Technology Shah Alam. The results of theempirical analysis confirmed that the trust of theuser increases when the user perceived that thewebsite was usable and that there was aconsequent increase in the degree of websiteloyalty.1. BackgroundCustomer loyalty has a direct impact on therevenue and profitability of a company. Thewebsite interface plays an imperative role incustomer e-loyalty. An interactive and content fullwebsite creates added value and highly motivatecustomer repeated visits [79]. The increasingpopularity of the Internet has created greatchallenges for companies in various businesssectors to promote and sell their products andservices using this new distribution channel. Onevery responsive business sector to this change isthe banking sector. Internet banking services havebeen operational in Malaysia since 1st June 2000[2]. Presently, only banking institutions licensedunder the Banking and Financial Institution Act1989 (BAFIA) and Islamic Banking Act 1983 areallowed to offer Internet banking services. Thereare 12 commercial banks (inclusive of IslamicWith the potential of Internet to reach millions ofcustomers and the opportunities to save transactioncosts, banks in Malaysia are now urged to provideonline banking services and to develop onlinerelationships with potential customers in order toremain competitiveness in a turbulent market.According to the 11th Malaysia Internet Surveyconducted by ACNielsen [1], Internet banking is oneof the most popular services utilized by Malaysiansurfers. As end of December 2005, total number ofuser was estimated at 10.4 million people—with 67% (6,968,000) using it for banking purposes. Theamount is estimated to reach 11.4 by the end of 2006.Although Internet banking is expanding positively inmost Asean countries and elsewhere [27], sectoranalysts have observed that only a very smallminority of web site visitors (1.3–3.2 percent) returnto make purchases [67]. In Malaysia, commercialbanks have been quick to realize the importance of eloyalty factor to competitive advantage. Althoughmillions of dollars have been spent on buildingInternet banking systems in Malaysia, reports haveshown that potential users may not use the systems orleave the systems after certain period of time [69].A bad first experience on website can kill themillions they spent on e-loyalty [71]This researchpointed out the need for research to identify thefactors that determine loyalty among Internetbanking users. There are several reasons why thisstudy has to be drawn up: Research concerning the antecedents of Internetbanking loyalty is scarce and focused on moregeneral issues [51]. Nevertheless, a number ofmostly practitioner-oriented studies examine howInternet companies can retain their customer’sstickiness, but if stickiness does not involve arelationship, it does not mean e-loyalty [71]. Banks struggle mightily with customer loyalty.Indeed, there is little agreement among bankers asto what behaviors constitute customer loyalty andhow best to encourage these behaviors [35] Most bank product developments are easy toduplicate [9]. 83% of respondents would move their business toa bank that rewards loyalty [81]. 50% of customers are satisfied with their banks,only 10% consider themselves to be loyal [81].Banks need therefore to maximize the impact andeffectiveness of their online off ering to not onlyCommunications of the IBIMAVolume 3, 2008

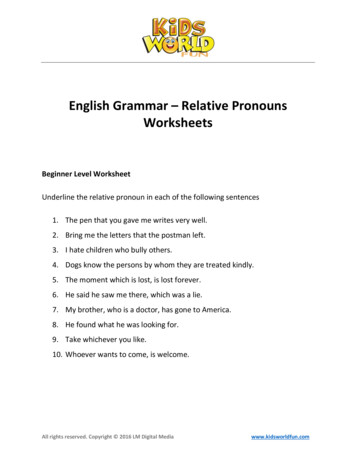

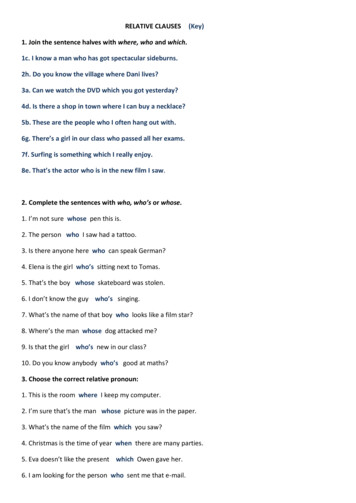

102Nor Aziati Abdul Hamidretain existing customers but grow share ofwallet [44].As a website loyalty seems to depend on consumerskills in managing and controlling the website andcognitive lock-in [30], suppose that the consumer’sconvenient and positive prior experience whenusing the website, lessens the likehood of theconsumer changing to another website [30]. Butthere is little empirical evidence to support theimportance of usability factors on Internet bankswebsites. Most of the scholars only address theimportance of trust as the main barrier of consumerparticitipation in e-commerce [7], [29], [39], [56].This study is designed to contribute insights intothese issues in three main ways;i) To determine what are the major websitedesign factors that drive customerloyalty in cyberspaceii) To measure the association between trustand usable website design factor withcustomer’s e-loyaltyiii) To measure the relative importancebetween trust and usable website designfactor in building e-loyalty in Internetbanking environment2. E-LoyaltyThe concept of e-loyalty enlarges the traditionalconcept of loyal to online consumer behavior. Eventhough the core theoretical foundations oftraditional loyalty and the newly classified conceptof e-loyalty are generally similar; there aredistinctive aspects of it in the area of Internet basedmarketing and buyer behavior [21]. More specificdefinition is provided by Anderson and Srinivasan[3], who define e-loyalty as “the customer’sfavorable attitude toward an electronic business,resulting in repeat purchasing behavior”. E-loyaltyhas several parallels to the brand loyalty and estore loyalty concept [10], [21]. For example, byrecommending products based on customers’previous purchases an e-store (e.g., Amazon.com)is likely to increase customer loyalty, as it wouldwhen providing facilities that allow the user toselect the elements of their personal interface witha website. Schultz [64] describes customer or brandloyalty in cyberspace as an evolution from thetraditional product driven, marketer controlledconcept towards a distribution driven, consumercontrolled, and technology-facilitated concept.Sohn and Lee [72] noted “e-loyalty indicatescustomers' behavior to visit and revisit the specificwebsite and make transactions comfortably”. Thereare different determinats identified by the scholarsthat can generate e-loyalty. Table 1.0 summarizedthe determinats.Usable Website Design and E-loyaltySince the Internet Banking represents the onlinepresence of the bank, a low-usability websitereflects a poor image of the company, eventuallyresulting in a lower customer’s intention to return tothe website [46].Table 1.0: Determinants of e-loyaltyDeterminantsTrustNet perceived valueValueCostsEmotional elements (confidence,integrity, pride and passion)Website QualityService QualityTrustCustomizationContact erWebsite TechnologyValue PropositionTrust and SecurityCustomer ServiceBrand BuildingQuality customer support,On-time delivery,Compelling product presentations,ConvenientReasonably priced shipping and handling,Trustworthy privacy policies.Author[55][17][73][21][59]Findings from a recent large-scale study suggest thatconsumers use “surface” elements, such as web sitedesign [18] in judging security and trust. Schlosser etal. [63] found that investments in web site design canboost trusting beliefs and online purchase intentions.Other web site design elements can aid inrelationship building. Thus creating websites withhigh usability features that encourage plannedpurchasing and repeat visits is an important objectivefor e-commerce websites [56]. According to Rourke,C. [60], typical online banking usability problemsare: Inconsistent navigation and page layouts On-site search engines that don not find,even when it is available Bank-oriented jargon that is not explained Poor feedback using interactive tools andforms Inability to save an application andcomplete it later Too many steps in transactions and novisibility of progress Unhelpful error messages Pages that are inaccessible to customerswho are blind or disabledTheoretical ConsiderationsCommunications of the IBIMAVolume 3, 2008

The Relative Importance of Trust and Usable Website Design inBuilding E-Loyalty Intention on Internet BankingThe theoretical framework of this research wasdeveloped based on various theories have beenexplicitly or implicitly applied in research onconsumers’ e-shopping behavior, including theTheory of Reasoned Action (TRA) and the Theoryof Planned Behavior (TPB). Besides that, thisresearch grounded in well-known reformulatedinformation system success model DeLone andMcLean [12], for mapping with usability attributeswhile commitment-trust of relationship marketingtheory [43] is a grounded theory for onlinerelationship banking.In order to provide a parsimonious and unifiedview on usability, Kuan et al. [37] has adopted themost prominent IS success model by DeLone andMcLean’s [12]. As a web storefront is essentiallythe information system for the user’s onlinepurchase needs, Kuan et al. [37] argue that theintention to purchase corresponds to IS success andwebsite usability attributes can be classifiedaccording to three quality dimensions in DeLoneand McLean’s model. Quality dimensions areoccasionally considered to be causing e-loyaltydirectly [73], a majority of studies view them asantecedents of e-satisfaction [77], i.e. satisfactionis conceptualized as a mediator of the relationshipbetween quality and loyalty.System quality can include the characteristics of ane-commerce system such as ease of navigation anddownload delay. Information quality captures thecontent provided by the website. Service quality isthe overall support provided by the website forusers and customers. Kuan et al. [37] researchmapped usability attributes experienced by users ofwebsites from past research to the usabilitydimensions obtained from DeLone and McLean’sreformulated model of IS success. As DeLone andMcLean argue that the system quality, informationquality and service quality will affect the intentionof IS use, this study examines the impact of theseusability dimensions on the intention of plannedand future purchase in the context of Internetbanking.The modeling of loyalty has a long tradition inacademic literature research. The majority of earlystudies define loyalty as the repeat purchasing of aparticular service or product [28]. This approachhas been long criticized by numerous scholars forthe missing differentiation between true andspurious loyalty [17]. In order to avoid the pitfall ofequating repeat purchasing with loyalty, thecombination of attitudinal and behavioral attributesis recommended [23]. This paper therefore appliesa two-dimensional conceptualization of loyaltyconsisting of both attitudinal and behavioralelements proposed by [52]. Oliver [52] forwards adetailed framework of loyalty that presents loyaltyas comprising four distinct, sequential phases. First,103cognitive loyalty refers to the existence of beliefs that(typically) a brand is preferable to others. Second,affective loyalty reflects a favorable attitude or likingbased on satisfied usage. Third, conative loyaltyconstitutes the development of behavioral intentionscharacterized by a deeper level of commitment [86].Finally, action loyalty relates to the conversion ofintentions to action, accompanied by a willingness toovercome impediments to such action.3. Research MethodsThe aim of this research is to test hypothesescompromise the elements of trust and usability ofwebsite design that are theoretically derivedcustomer loyalty in cyberspace (e-loyalty), theresearch approach is quantitative. Whether thehypotheses are supported or refuted, the researcherreports the result objectively [6].In this study, single case was chosen due to the factthat this research attempted to collect detailedinformation and knowledge about customer loyaltyin online banking. Due to shortage time andconvenience factor, Maybank2u.com which has beenawarded as the most comprehensive and advancedInternet Banking systems in Malaysia was selected asthe sample for this study. Maybank is doing onlinebusiness and along with the traditional business. Thisresearch only touched its personal online bankingrather than other Internet banking option offeredthrough Maybank2u.com.Research Framework and HypothesesUtilizing the reorganized usability dimensions basedon DeLone and McLean’s [12] reformulated Modelof IS success, Morgan and Hunt [43] precursor oftrust model and Oliver [52] brand loyalty model forconstructing proposed research model of e-loyalty,the differing impact of usability and trust factor oncustomer e-loyalty was analyzed. E-loyalty is asurrogate measure of customer retention and likewisedefined as the likelihood an online customer willrepatronize and repurchase from the same website inthe future [21].The backbone of the models is the relationshipsbetween usability and precursors of trust with thecustomer’s retention rate and intention of repeatpurchase which are consistent with the classicalbehavioral intention theories [37].Therefore, basedupon the above review of studies, four alternativehypotheses were built which will lead to increasedcustomer online loyalty (H1, H2, H3 and H4respectively) in Internet Banking. Figure 1.0 depictsthe research framework to be compared in this study.The figure shows the research model for ‘Usabilityof website’, ‘Trust’ and ‘E-Loyalty’ with causallinkages indicated by the arrows.The model assumes that ‘Trust’ is determined byshared value, communication and opportunisticCommunications of the IBIMAVolume 3, 2008

Nor Aziati Abdul Hamid104behavior control adapted from Morgan and Hunt[43] model while ‘Usability of website’ isdetermined by System Quality, Information Qualityand Service Quality adapted from D&Mreformulated model [12]. ‘E-Loyalty’ wasdetermined by Action Loyalty, Affective Loyalty,Cognition Loyalty and Conativeunimportant, 5 very unimportant) on most of thequestions. Nevertheless, questions measuring onlineloyalty (e-loyalty) used a 5-point Likert scale, ratingthe performance by (1 excellent, 2 very good, 3 good, 4 fair, 5 poor), multiple selection and closenominal measurement (1 Yes, 2 No).Sampling TechniqueFigure 1.0: Proposed research Model andHypothesesLoyalty adapted from Oliver [52] brand loyaltymodel.The potential influences of usable website designtowards customer trust are also included in themodel. The hypotheses are as follows:Hypotheses 1:Usabilityofwebsiteissignificantly associated withcustomer online loyalty (eloyalty)Hypothesis 2:Trust is significantly associatedwith customer online loyalty (eloyalty)Hypothesis 3:Usabilityofwebsitesignificantly associated withcustomer trustHypothesis 4:Usability of website is relativelymore important than customertrust in building customer onlineloyalty (e-loyalty)Measurements and ConstructsExisting literature were utilized and existinginstruments were adapted to measure the variablesof this study to support the specification of a set ofpotentially strong metrics. Respondents were askedto rate their opinion using 5-point Likert scale (1 very important, 2 important, 3 neutral, 4 The unit of analysis for this study is individualsselected through convenience sampling among raduate (out-campus) and post-graduatestudents in various faculties in University of MaraTechnology(UiTM)sincetheuserofMaybank2u.com among the academician andadministrative staff in Information Technology andScience Quantitative Faculty itself is limited. Thejustification of using this sampling method is twopronged, one it is impossible to get a list of bakingcustomers from the banks since it is against theBanking and Financial Institution Act [78] to obtaina list of cardholders' contact numbers and addressesfrom financial institutions Respondents comprise ofindividuals from Shah Alam area. The number ofquestionnaire distributed was 337. The method ofdistributing the questionnaire was through personaladministration.The reason for choosing various faculties in UiTM isto consider different knowledge domain instead ofonly looking at non-technical and technical educationbackground since the gap of Internet usage amongnon-technical and technical background become slimbecause the nature of working environment itselfwhere knowledge in information technology is amust. Another condition was that the user of theonline banking services must be sophisticated ornovice user in order to have an experience users forevaluating the existing services provided by theMaybank2u.com.4. Data AnalysisThe results are presented and discussed andconclusions are drawn using the following sequence:(a) return rate for the survey; (b) reliability ofmeasurement; (c) normality test; (d) demographicCommunications of the IBIMAVolume 3, 2008

The Relative Importance of Trust and Usable Website Design inBuilding E-Loyalty Intention on Internet Bankingprofile of the respondents and Internet bankingusage; (e) data analysis of measured variables; and(f) results and discussion of the hypothesis testing.Return Rate for the SurveyA self-administered questionnaire was distributedto three faculties in UiTM, Shah Alam. Thequestionnaire was sent conveniently among thestudents, academic staff and administrative stafffrom those faculties. The chosen faculties areFaculty of Science Quantitative and InformationTechnology, Faculty of Architecture, Planning andSurveying and Faculty of Business Management.Since the research focuses on Maybank2u.comusers only, those who did not meet the samplecriteria, and those who completed it incorrectly willbe eliminated. After eliminating, 151 responseswere retained for the study, yielding an overallresponse rate of 45 percent of total distributedquestionnaire.Reliability and Validity of MeasurementThe reliability of an instrument is most oftenmeasured by the Cronbach-alpha statistic whilefactor analysis was used to ensure the constructvalidity [33]. The Cronbach alpha value for trustconstructs is 0.903 while usability constructs is0.921. Construct validity was evaluated byconvergent and discriminant validity. Convergentvalidity can be assessed by factor loading and theaverage variance extracted. Factor loading greaterthan 0.70 was considered significant and asevidence of convergent validity.Sampling AdequacySampling adequacy was measured using KaiserMeyer-Olkin (KMO) and Bartlett’s test ofsphericity. KMO statistics varies from 0 to 1. Avalue of 0 indicates that the sum of partialcorrelation is large relative to the sum ofcorrelations, indicating the diffusion in the patternof correlation (hence, factor analysis is likely to beinappropriate). According to Hair et al. [25] andGuadagnoli et al.[24], a value of 0.50

information system success model DeLone and McLean [12], for mapping with usability attributes while commitment-trust of relationship marketing theory [43] is a grounded theory for online relationship banking