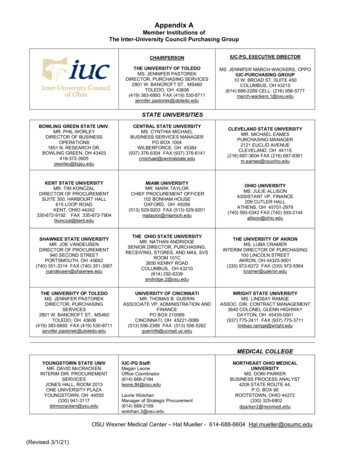

Transcription

Episys Core Conversion SuccessMember CommunicationsC O N N E C TIntelligent solutions to connect with members,all under one roof.

SYNERGENT CAN HELPCongratulations on your upcoming conversion to Episys!We have over 65 credit unionS T R E A M L I N E D C O M M U N I C AT I O N S F O R C O N V E R S I O N S U C C E S Susers and we have craftedYou are about to undergo a transition that will impact staff and members. Communicatingmany different conversionchange and managing a conversion are two significant undertakings that Synergent can assistcommunications. We realizewith. We have over 65 credit union users and know from experience the importancehow important members are inof communicating with members during the conversion process.this process and know the keyThe service and support offered by Synergent, paired with the unparalleled performance ofmessages to share.the Episys Core Processing Platform, will contribute to a successful conversion. During thisSynergent has createdcomprehensive membertransition, Synergent is here to help communicate the process to staff and members witha comprehensive set of materials designed to inform, excite, and educate.communication materials toP R E PA R E Y O U R S TA F Fhelp get the word outYour staff is essential in ensuring a smooth transition for your membership. Our Directquickly and efficiently.Marketing Services team can provide your credit union with a sample timeline for staff to useWe have produced customizedas a tool to guide timing and frequency of the varied conversion communications to membersnewsletters, banner ads,as the live date approaches.statement inserts, postcardsTraining for staff is a vital tool in promoting awareness and familiarity of a new service. Beand in-branch advertising thatsure to provide enough time for staff to get comfortable with Episys before going live, alongincludes the credit union brand,with the opportunity to test drive remote services – such as online banking, audio response,name and logo.mobile banking and remote deposit capture. Performing a variety of transactions, such asbalance inquiries, transferring funds, and changing passwords are a few exercises to train staffto be ready to answer member questions.Conversion week is an important time to make sure employees do not become too stressedor overwhelmed. Make it exciting with a conversion countdown, performance awards, games,competitions, and a celebration when conversion is complete.C O M M U N I C AT E T H E A D VA N TA G E S T O Y O U R M E M B E R SMembers are the reason behind a conversion. Focus on the benefits they will gain fromenhanced services. Ensuring they understand why the change is occurring will help them bemore accepting of it. Be consistent with your message and communicate through multiplechannels to reach as many members as possible.Synergent can customize newsletters, banner ads, statement inserts, postcards, and in-branchadvertising with your credit union’s name and logo. Our team can share comprehensiveconversion materials with membership directly, both via email and in print.T O O L S F O R C O M P R E H E N S I V E C O M M U N I C AT I O NUtilize all the communication tools, such as newsletters, statement inserts, email, in-branchadvertising, and your website. Prepare both internal and external technical supportcommunications for when you go live. Members may have questions about the new services.Having a checklist of talking points available to member service representatives and branchpersonnel, along with a list of Frequently Asked Questions on your website, also will ensuremembers can easily find the answers they need.

C O N V E R S I O N C O M M U N I C AT I O N S : H R C UHRCU worked with Synergent Direct Marketing Services to develop a member“Synergent did not forgetcommunication campaign that addressed conversion with a fun theme. Postcards, statementabout us after conversion.inserts, posters, and a newsletter were used to effectively communicate the new changesThis is more than a businessthat would benefit members. HRCU’s newsletter was a vehicle to keep members up to datepartnership; it’s about sharingthroughout the conversion process, highlighting key dates as they approached.a common goal. Synergent hasthe credit union mentality. Weare a credit union for a reason.” Brian HughesPresident/CEOHRCU“From the start, the Synergentteam was all about getting itdone and getting it done right.They went above and beyond,thinking outside of the box tocreate workflows that werecustomized to us.” Rosemary ShieldsChief Operating OfficerHRCU“HRCU truly takes great careof their staff. For conversion,they had an action-packedemployee kickoff meetingthemed as a funeral for theirold system, complete withmatching coffin party favors,and a visit from the GrimReaper (President/CEO BrianHughes). The training of staffand conversion were madea priority. The staff wasencouraged to practice onthe new system, and HRCUdedicated after hourscomputer labs for employeesto stay late and practice.” Aimee DohertyAccount Relationship ManagerSynergent

C O N V E R S I O N C O M M U N I C AT I O N S : S T. M A RY ’ S B A N KDIRECT MARKETINGSERVICES CONVERSIONCOMMUNICATIONS Q & AQ: Does Synergent DirectMarketing Services recommendcreating a cohesive theme orbrand for all memberconversion/upgradecommunications?A. YES. Conversion/upgradebranding allows a credit unionto have fun with what could bea stressful situation for theirmembers. A cohesive themepromotes the credit union’scommitment to membercommunications and makes iteasy for members to recognizeimportant information about howtheir accounts will be affected.Q: How early in theconversion/upgrade processdo you recommend creditunions start communicatingto their members about theupcoming changes?A: We recommend promotinggeneral awareness at least threemonths in advance.

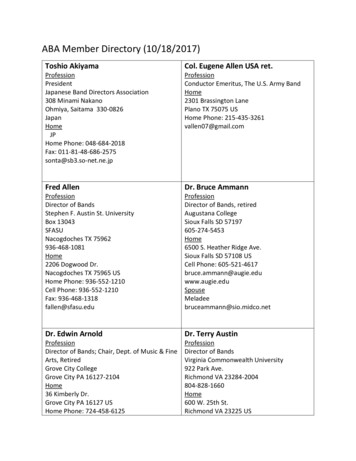

C O N V E R S I O N C O M M U N I C AT I O N S : R E C E N T C A M PA I G N SDIRECT MARKETINGSERVICES CONVERSIONCOMMUNICATIONS Q & ANo matter how you wish to communicate a conversion to members, Synergent DirectMarketing Services has a variety of material that makes the process simple and effective.Whatever you choose, we can customize each piece to fit your credit union’s brand, orQ: How does Direct MarketingServices help credit unionscreate a unique campaign to help celebrate your technology upgrade.create a positive messageabout conversion/upgrade toMiddletown (Main Office)“Early member notification was atPortsmouththe top of Bayer Heritage FCU’sBristol2537 East Main RoadPortsmouth, RI 02871401.683.316650 Gooding AvenueBristol, RI 02809401.253.6500NewportNorth Kingstown7490 Post RoadPLEASE READ!North Kingstown, RI 02852401.885.9660Important AccountInformation.858 West Main RoadMiddletown, RI 02842401.846.8930800.498.8930TechnologyUpgrade Newswish list when creating theirWakefield43 Memorial BoulevardNewport, RI 02840401.846.1965150 Old Tower Hill RoadWakefield, RI 02879401.789.5551Member Focused. Service DrivenFind out how our upcoming software upgrades will affectyou and your accounts.Dates to RememberFriday, May 1 - All branches and ourMember Contact Center will closeat 4:30 p.m. EST and re-open at10:00 a.m. EST on Monday, May 4.(All branches and our Member ContactCenter will be closed on Saturday,May 2)Online BankingOur upgraded system provides enhanced security and exciting new features.What you need to do: Register for our new Online Banking after 10:00 a.m. EST on Monday, May 4. All current Online Banking users must re-register for Online Banking. Go to www.bayerhfcu.com and click on CU@Home Login. Follow the easy step-by-step instructions. For enhanced security, the Birthday and last 4 digits of the Primary Accountholder’s SSN will be required. When prompted, create a Username and Password.The following services will beunavailable from Friday, May 1, at4:30 p.m. EST through Monday, May 4,at 10:00 a.m. EST.––––Details insideOnline BankingBill PayMobile BankingShared BranchingThe following services will remain openand accessible during this time period.– Debit cards– Credit cards– ATMsNOTE: Member Contact Center will be unavailable on Saturday, May 2. Phonesupport will resume on Monday, May 4 at 10:00 a.m. EST.technology upgrade newsletterimportant to promote the benefitsthat was sent to all membersof improved service, technologyAn email notification and statement insert also was sent to theOnline Banking Registration Screen858 West Main RoadMiddleton, RI 02842and for details on our new services.Bangor, MEPermit No. 112NOTE: Member Contact Center willbe unavailable on Saturday, May 2.Phone support will resume on Monday,May 4 at 10:00 a.m. EST.and member benefits. It iswould gain through the upgrade. After your initial registration, you will no longer enter your Account # to accessyour account. You will use your new Username. To make a loan payment, use the new Loans tab on the Online Banking menu.New onlineservices ahead,strategy. They began with apositive and exciting benefits theyOur technology upgrade is gettingcloser: September 2, 2014.Our Member Contact Center willYouwill needfromto re-enrollin Onlinebeavailable7:30 a.m.–Banking.checkour website5:30p.m.PleaseMonday– FridayandonSaturday8:00 a.m.- 12:00andyour mailfromfor importantinformationp.m.2, tofrom atus 800-272-6003on how to access Optionyour accounts,assist our members.messaging that promises staffconversion and outlined theWhat you need to know: Your email address must be valid and on file with BHFCU by Friday, May 1. As you register, a passcode will be emailed to you. Do not close the OnlineBanking screen. NOTE: If you do not receive your passcode, please check yourjunk/spam mail. Questions? Call our Member Contact Center at 800-272-6003 Option 2.just for you!A: Member communicationconsultation, messaging,ness campaign played a key partprint, mailing services, and more!growingmediums important whentogetherreaching members?A: Not all members like to beSimple-to-use online banking · Enhanced mobile bankingMobile check deposit · New financial management toolsAll this and more coming in MarchPAIDPresortStandardU.S. Postagehighlighted growth and benefitsof conversion to membership,aiding in a smooth transition.” Erica VachonSenior Direct MarketingService Representativereached in the same way.It takes many communicationNEWSValley FCU to build an effectivewith a unified graphic themedevelopment, creative design,online/email communications,collaborated with Geneseeconcise messaging coupledtimeline, and branding/themeQ: Why is using a variety ofMarketing Services teamwith their vision. The simple,does Synergent Directpurposes. The cohesive aware-to their membership. Our Directconversion campaign that alignedQ: What products and servicessame look and feel for branding“From our first strategy conferenceto communicate their conversionexperience in every area.Marketing Services offer? Shannan HeacockSenior Direct MarketingService Representativea clear vision of how they wantedand the overall staff/membermembership, incorporating thein the success of the conversion.”call, Genesee Valley FCU broughtA: Focus on clear, conciseconversion communicationnotifying them of the upcomingExciting changescoming soon!At the close of business on Thursday,April 30, our current 24-hour PhoneTeller will be disabled. Our new iTalksystem will be available at 10:00 a.m.EST on Monday, May 4.both staff and members?NGE!CHAOODIS GImportant AccountInformation EnclosedrWINInside this IssueThreePhaseService Availabilitymethods to get your messageANNOUNCINGAN EXCITINGTECHNOLOGYUPGRADE!We are upgrading our software and delivery systems.Our system upgrade will belaunched on August 1st.Please take a few minutes to read this special edition newsletterthe Game ofto find out how this software upgrade will affect you and youraccounts.FinancialTechnology UpgradeDates to Remember . . . . . . . . . 2President’s MessageOnline Banking . . . . . . . . . . . . . 2I am excited to inform you that St. Lawrence Federal Credit UnionKeep in mind:24-Hour Audio Response Features:.2will be upgrading to new, state-of-the-art technologies on Enhanced Online Banking Make sure you have your new memberBill Pay . . . . . . . . . . . . . . . .Convenient. . . . 3 Mobile BankingDecember1, 2014.newsletterisAugustfilled1stwith informationnumberbefore Saturday,with Mobile CheckDeposit This AccountInformationwill AlwaysE-Statements . . . . . . . . . . .and. . so. .much3 more! affecting your accounts.It alsodetailssome exciting enhancementsRemain Safe and Intactthis upgrade will bring. The enhancements include powerful OnlineNew FeaturesSoon you’llBankingbe winningall ofMobileour greatservices.tools,withdynamicBankingand comingsoon, improved888-599-2265 www.sbgecu.orgOnline Banking . . . . . . . . . . . For. . more3 informationonlineandprocesses, which willon theseaccountnew features openingand to obtain yournewloanmemberapplicationnumber,one of ourbankingconveniently locatedor signconvenientin to online bankingwith branchesus morethan ever before.Bill Pay . . . . . . . . . . . . . . . . . . please. . 4 call or visitmaketo contact us via secured email.Mobile Banking . . . . . . . . . . . . . 4In preparation for this upgrade, all credit union locations will be24-Hour Audio Response . . . . . 5closed on Monday, December 1 to ensure all member services arefully available to you at 12:00 p.m. on Tuesday, December 2.Over the next few weeks, our staff will be working “double duty.”As they continue to serve you on our current system, they will betraining on the new platforms as well.across. Each method is important.

S A M P L E C O M M U N I C AT I O N S T I M E L I N EThree Months Prior to Conversion Finalize member communication strategy and timing Newsletter article or statement insert on upcoming conversion emphasizing benefitsfor members Provide staff with the communication plan, article, and/or insert for reference asmember questions ariseTwo Months Prior to Conversion Signage goes up (counter, door, lobby) Staff receives copies of all communications being sent to members as they becomeavailable Weekly updates to staff on conversion activities Brief announcements to members in online banking, mobile banking, statementmessages, estatement messages, inserts, website, and phone system highlightingconversion activitiesOne Month Prior to Conversion Weekly updates to staff on conversion activities, including copies of all communicationsto keep them informed Staff training begins Weekly communications (newsletter articles, emails, banner ads, direct mail, lobbyhandouts, etc.) to members regarding: Changes to remote services such as online banking, bill pay, mobile banking(new login/registration process, if applicable); new features and benefits Changes at the credit union Changes to credit/debit cardsFirst Week After Conversion Announcement of successful conversion to members Frequent encouragement and meetings to monitor progress Thank staff for their contributions and provide an update on the success of the conversionOne Month After Conversion “Thanks for a smooth and successful conversion” communication to members

AFTER CONVERSIONPartnering for SuccessEvery Direct Marketing Services partner credit union is assigned a dedicated Marketing“Being a direct marketingServices Representative (MSR) as a single point of contact. Your MSR will collaborate with yourepresentative for credit unionson messaging, creative design strategy and targeting data to determine specific audiences.is very rewarding. I love theBecause you work one-on-one with your MSR, your partnership with Synergent is personal,relationship building that keepswith access just an email or a phone call away.Targeted Marketing with Data MiningPartnering with Synergent Direct Marketing Services enables your credit union to use datamining to target the most appropriate audience for your marketing materials. Analyzing thetransactional information allows members to receive personalized communications from yourcredit union, highlighting only the products and services of relevance to them. Adding datamining to any campaign strategy increases the relevancy of the message you are sending.Data mining can significantly increase your return on investment due to targeting themembers most likely to adopt the promoted product or service.growing. It’s great to see ourcredit unions continue to useour products and services aftera conversion has wrapped up.We just want to see the creditunions we work with be successful.” Erica VachonSenior Direct MarketingService RepresentativeThe Value of OnboardingYour best chance of cross-selling an additional product or service to a new member is highestwithin their first 90-120 days of membership. Onboarding is proven to increase memberretention and aids in a feeling of member connectedness. With growth and membersatisfaction top priorities for credit unions, onboarding is the most valuable way to reach newmembers and ensure they are informed of your credit union’s offerings while fostering thecredit union experience.Onboarding is a targeted, 90-120 day campaign during which new members receive tailored,omni-channel communication (phone calls, emails, direct mail, and/or social media) that notonly provides a welcome message, but also educates new members on targeted productsand services that are offered by your credit union.Enhanced Email MarketingIn today’s busy and increasingly mobile-centric world, email marketing remains a topchannel to engage members. Mobile responsive design is essential and all of Synergent’scustom graphic designs have a clean, modern appearance, whether the email is viewedon a traditional computer screen, or more and more prevalently, on mobile devices.After an email campaign is sent to members, the benefits of Enhanced Email Marketingcontinue. With real-time reporting, integrated analytics, and calculation of return oninvestment, marketing campaign metrics can be easily accessed and reviewed. Whethermessaging is a cross-promotional notification or a seasonal lending incentive, an emailmarketing campaign provides valuable product and service information to your membership,while increasing credit union profits.FOR MOREINFORMATIONDirect MarketingServicesDoug MacDonaldVice President800-341-0180 ext 204dmacdonald@synergentcorp.comTechnology ServicesFred BarberAccount Executive800-341-0180 ext 593fbarber@synergentcorp.com2 Ledgeview DriveWestbrook, ME 04092synergentcorp.com

www.synergentcorp.com800.341.0180PO Box 1236, Portland, Maine 04104WE ARE COMMITTED TO PROMOTING THE GROWTH OF CREDIT UNIONS THROUGH SERVICE EXCELLENCE IN THE DELIVERY OF QUALITY PRODUCTS AND SERVICES.

online account opening and loan application pocesses which will make banking with us moe conenient than ee beoe n pepaation o this upgade all cedit union locations will be closed on Monda ecemer to ensue all membe seices ae ull aailable to ou at 2 : P.M. on Tesda eceme