Transcription

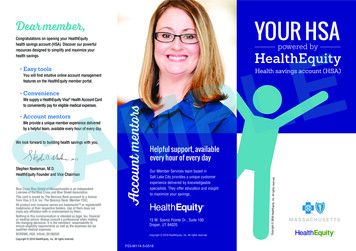

YOUR HSADear member,Congratulations on opening your HealthEquityhealth savings account (HSA). Discover our powerfulresources designed to simplify and maximize yourhealth savings.HealthEquity Easy toolsHealth savings account (HSA)You will find intuitive online account managementfeatures on the HealthEquity member portal.MASWe provide a unique member experience deliveredby a helpful team, available every hour of every day.We look forward to building health savings with you,Stephen Neeleman, M.D.HealthEquity Founder and Vice ChairmanBlue Cross Blue Shield of Massachusetts is an IndependentLicensee of the Blue Cross and Blue Shield Association.This card is issued by The Bancorp Bank pursuant to a licensefrom Visa U.S.A. Inc. The Bancorp Bank; Member FDIC.All product and company names are trademarks or registered trademarks of their respective holders. Use of them does notimply any affiliation with or endorsement by them.Nothing in this communication is intended as legal, tax, financialor medical advice. Always consult a professional when makinglife changing decisions. It is the members’ responsibility toensure eligibility requirements as well as the expenses are taxqualified medical expenses.BCBSMA HSA trifold 20180503Helpful support, availableevery hour of every dayOur Member Services team based inSalt Lake City provides a unique customerexperience delivered by knowledgeablespecialists. They offer education and insightto maximize your savings.15 W. Scenic Pointe Dr., Suite 100Draper, UT 84020Copyright 2018 HealthEquity, Inc. All rights reserved.Copyright 2018 HealthEquity, Inc. All rights reserved.F03-M114-5-0518Copyright 2018 HealthEquity, Inc. All rights reserved. Account mentorsAccount mentors ConvenienceWe supply a HealthEquity Visa Health Account Cardto conveniently pay for eligible medical expenses.ELPpowered by

GET STARTEDHOW YOU WINLearn moreHSA funds roll overyear after yearAdd a beneficiary for your HSA in the “BeneficiaryInformation” section of “Profile Details”.Activate your debit cardAccess your accountStart savingDecide how you will begin building yourhealth savings: Paycheck deductions Transfer from an existing HSA Direct contributions by EFTMASGo green On the HealthEquity portal, select “Profile” under“My Account”. Then select “Profile Details”. Confirm your email address in “Email Settings”.Then select your delivery method under“Communication Preferences”.BUILD SAVINGSPaycheck depositsIf your account is offered as a benefit from your employer,you may make regular pre-tax contributions from yourpaycheck. Talk to your HR department for assistance.Electronic FundTransfers (EFT)Using EFT, you can make a one-time contribution orschedule regular, automatic transfers from your personalbank account to your HSA. Log in to your HealthEquityaccount to set up an EFT.E}LPVisit www.HealthEquity.com/learn. You will finda list of Qualified Medical Expenses, rules foryour debit card, contribution tips, and more.Instructions are included with your card. Log in to MyBlue at www.bluecrossma.com/myblueafter your plan effective date. Type in your username and password (if you area first time user, you will be asked to register). Select “Review My Health Financial AccountsSummary” under “My Account”. Then, select“View My HealthEquity Account”.Add a beneficiary{Let’s go!1. REDUCES YOUR FEDERAL INCOME TAXES.When you contribute to your HSA directly from yourpaycheck, you reduce your taxable income by theamount you contribute.Your money earns interest while it is in the accountand you do not pay taxes on the interest earned. 3. WITHDRAWALS ARE TAX-FREE.**You never pay taxes on HSA withdrawals when themoney is used for qualified medical expenses.Do you already have an HSA with another administrator?Transfer your existing HSA balance to HealthEquity andconsolidate your savings. Download transfer requestforms at www.HealthEquity.com/form.*Watch your account balance grow as it earns interest orinvest in a variety of mutual funds.*Investments available to HSA holders are subject to risk, including the possibleloss of the principal invested and are not FDIC insured or guaranteed byHealthEquity. HSA holders making investments should review the applicablefund’s prospectus. HealthEquity doesn’t provide financial advice. Consult youradvisor or the IRS with any questions on filing your tax return.Copyright 2018 HealthEquity, Inc. All rights reserved.HSAs are tripletax-advantaged2. EARNS INTEREST TAX-FREE.Transfer an existing HSAInterest and investmentsUnlike older flexible spending accounts, whateveryou don’t spend from your HSA, stays in your account.The funds are yours to keep until you need them.** HSAs are never taxed at a federal income tax level when used appropriatelyfor qualified medical expenses. Also, most states recognize HSA funds astax-free with very few exceptions. Tax rates vary dependent upon individualcircumstances. Please consult a tax professional regarding your state’sspecific rules.INCREASE YOURHSA CONTRIBUTIONSMake the most of HSA tax advantagesby maximizing your contributions.HSA elections are flexible and you canchange the election amount at any time.You can adjust the amount of yourpaycheck deduction or recurring EFT asoften as you’d like. Speak to your HRrepresentative for more details.

Your HealthEquity VisaHealth Account Card is HERE CONVENIENTACCESS TOAt HomeOn the Go Pay providers by phone. Remember to keep all receipts. Pay for prescriptions at pointof purchase. To be eligible to contribute to ahealth savings account (HSA),you must:ELPyour HSAMAS Be enrolled in an HSA-qualifying health plan. Have no other health coverage, unless it is also HSA-qualified. Not be enrolled in Medicare. Not be claimed as a dependent on someone else’s tax return.Your HSA card will draw available funds directly from your HSA. Your card can be used everywhere Visa debit cards are accepted for qualified expenses. This card cannot be used at ATMs and youcannot get cash back, and cannot be used at gas stations, restaurants, or other establishments not health related. See Cardholder Agreement for complete usage restrictions. Choose the “credit”option when swiping your HSA card or enter a PIN to use as debit. To receive a personal identification number (PIN), call the number on the back of your card.Maximum Contribution Limits:Single-coverage limit for 2018: 3,450*Family-coverage limit for 2018: 6,900**An additional 1,000 is allowed as a catch-up contributionfor account holders age 55 .HealthEquity Visa Health Account Card is issued by The Bancorp Bank pursuant to a license from Visa U.S.A. Inc. The Bancorp Bank; Member FDIC.Access your account:Visit MyBlue to accessaccount information.All product and company names are trademarks or registered trademarks of their respective holders. Use of them does not imply anyaffiliation with or endorsement by them.Blue Cross Blue Shield of Massachusetts is an Independent Licensee ofthe Blue Cross and Blue Shield Association. Log in to MyBlue at www.bluecrossma.com/myblue after your planeffective date. Type in your username and password (if you are a first time user,you will be asked to register). Select “Review My Health Financial Accounts Summary” under“My Account”. Then, select “View My HealthEquity Account”. An expert team of specialists are standing by 24 hours a day,365 days a year to answer your questions about anything andeverything related to your HealthEquity accounts. If you haveany questions regarding how to best utilize your account, pleasecall 877.694.3938.

Health Savings Account Administration Fees Account Setup Below are the fees associated with the administration of your HealthEquity health savings account (HSA). With yourcurrent HSA-powered plan, you benefit from having your account setup and monthly fees paid for you by your healthplan or employer. In addition, you receive the discounted price associated with our other fees. If you choose to leaveyour current HSA-powered plan, you may be subject to additional fees.Account SetupMonthly Admin FeeReimbursement CheckPayment to ProviderReplacement CardReturn Deposited ItemOverdraftStop Payment RequestExcess Contribution Refund RequestAccount ClosingPaper StatementPaid by plan sponsor1Paid by plan sponsor 2.00 for paper check. No fee for electronic funds transfer.No fee3 free; 5.00 for each Card replaced if lost/stolen/damaged. 20.00 per item 20.00 per item 20.00 per item 20.002 25.003 1.00 per monthly statement (no fee for electronic statements)ELPMAS1Monthly admin fees are paid by your plan sponsor. If you change health plans or employers, your account may bedirectly charged up to 3.95 per month.2Charged only on funded accounts. See the Distributions section in the HealthEquity Custodial Agreement for moreinformation.3You are automatically set up to receive paper statements and will be charged 1.00 per monthly statement. To avoidthis fee, we recommend that you switch your account preference settings to electronic statements. You can do this bylogging into your Member Portal and updating your profile or by calling Member Services.HSA FDIC Insured Interest RatesBy default, your HSA cash balance is interest bearing and FDIC insured. Interest is calculated and compoundedmonthly. Interest is paid on the average daily collected balance according to the funds held within each tier and thattier’s associated interest rate (Federal Regulation DD Tiering Method B). Interest is credited to the HSA monthly as ofthe last business day of the statement cycle. HSAs closed prior to the end of their statement cycle will not be paid anyaccrued interest. Interest rates and balance tiers are subject to change at any time.Balance Tier1234Average Daily Account Balance 0.01 - 2,000.00 2,000.01 - 7,500.00 7,500.01 - 10,000.00Over 10,000.00Interest Rate*0.05%0.10%0.20%0.40%APY**0.05%0.05% to 0.09%0.09% to 0.12%0.12% to 0.37%If you elect to have your HSA cash balance placed in a non-FDIC insured option, the above rates do not apply to thatportion of your HSA balance. You can view your current HSA cash balance allocations on your monthly statements orby logging on to the Member Portal.* Rates in effect as of October 1, 2013.**APY means Annual Percentage Yield. Fees reduce earnings.

liable for your losses or damages. However, there are some exceptions.We will not be liable, for instance:(1) If through no fault of ours, you do not have enough funds availablein Benefit Plan to complete the transaction;(2) If a merchant refuses to accept the Card;(3) If an electronic terminal where you are making a transaction doesnot operate properly, and you knew about the problem when youinitiated the transaction;(4) If access to the Card has been blocked after you reported the Cardlost or stolen;(5) If there is a hold or your funds are subject to legal or administrativeprocess or other encumbrance restricting their use;(6) If we have reason to believe the requested transaction is unauthorized;(7) If circumstances beyond our control (such as fire, flood, or computeror communication failure) prevent the completion of the transaction,despite reasonable precautions that we have taken; or(8) Any other exception stated in our Agreement with you.The Custodian has the right to suspend or cancel the Card. The Cardmay be suspended or cancelled if you (or an individual authorized byyou) fail to use the Card in the manner it was intended. A suspendedCard can be reactivated after you take corrective action. You will receivenotification telling you why the Card is suspended and giving correctiveinstructions to reverse the suspension. The Card may be suspendedfor inappropriate and/ or abusive transactions including, or usagesinconsistent with IRS regulations or the HSA Documents, providingCard access to inappropriate individuals, and failure to maintain theminimum balance in the HSA. We may also cancel the Card at therequest of the Custodian if you (or an individual authorized by you)repeatedly fail to use the Card in the manner it was intended.Information about Your Right to Dispute TransactionsIn the case of a discrepancy or questions about Card transaction(s), callthe number listed on the back of the Card or the number listed in thesection captioned “Customer Service” at the end of this Agreement ifthe Card is not available, write to HealthEquity, Inc., 15 W Scenic PointeDrive, Suite 100, Draper, UT 84020, or email info@healthequity.com assoon as you can. You must contact us no later than sixty (60) calendardays after we posted the transaction(s) to the Custodian’s system. Youmay request a written history of your transactions at any time by callingor writing as instructed above.Telephone Monitoring/RecordingFrom time to time we may monitor and/or record telephone calls betweenyou and us to assure the quality of our customer service or as required byapplicable law.If the Card has been lost or stolen, we will cancel the Card to keeplosses down and will send a replacement Card. There is a fee forreplacing the Card. For information about the fee, see the sectionlabeled “Fee Schedule.”Other Miscellaneous TermsThe Card and your obligations under this Agreement may not beassigned. We may transfer our rights under this Agreement. Use of theCard is subject to all applicable rules and customs of any clearinghouseor other association involved in transactions. We do not waive our rightsby delaying or failing to exercise them at any time. If any provision ofthis Agreement shall be determined to be invalid or unenforceable underany rule, law, or regulation of any governmental agency, local, state,or federal, the validity or enforceability of any other provision of thisAgreement shall not be affected. This Agreement will be governed by thelaw of the State of Delaware except to the extent governed by federal law.Amendment and CancellationWe may amend or change the terms and conditions of this Agreementat any time. You will be notified of any change in the manner providedby applicable law prior to the effective date of the change. However,if the change is made for security purposes, we can implement suchchange without prior notice. We may cancel or suspend the Card orthis Agreement at any time. You may cancel this Agreement by callingthe number on the back of the Card and speaking to the Custodian’sMember Services to cancel the Card. Your cancellation of the Cardwill not affect any of our rights or your obligations arising under thisAgreement prior to termination.In case of a discrepancy or questions about Card transactions you willneed to tell us:1. Your name and HealthEquity Member ID.2. A description of the transaction(s) including the date and dollar amount.3. Why you believe there is a discrepancy.If you provide this information orally, we may require that you send thedetails listed above in writing within sixty (60) calendar days after weposted the transaction(s) you are questioning. You agree to cooperatefully with our investigation and to provide any additional informationor documentation we may need for the claim.Once we have the required details, information, and/or documents, wewill determine whether a discrepancy occurred. If we ask you to putdetails in writing and you do not provide them within sixty (60) calendardays of the date we posted the transaction(s) you are questioning, wemay not be able to resolve the claim in your favor.Terms and Conditions/Definitions for the Visa Health Account CardThis Cardholder Agreement (“Agreement”) outlines the terms andconditions under which the Visa Health Account Card (“Card”) isissued by The Bancorp Bank, Wilmington, Delaware. “HSA” refers toyour health savings account, which is an individual custodial accountestablished with HealthEquity, Inc. “Custodian” refers to HealthEquity,Inc., the custodian of your HSA. The “Card” is the device that is usedto access funds in your HSA and make distributions from the HSA inaccordance with applicable laws and regulations. “You” and “your”mean the person or persons who have received the Card and areauthorized to use the Card as provided for in this Agreement. “We”,“us”, and “our” mean the Issuer, our successors, affiliates or assignees.“Issuer” means The Bancorp Bank or its depository institution affiliate.The Issuer is an FDIC insured member institution.ELPNo Warranty Regarding Goods or Services as ApplicableNeither we nor the Custodian are responsible for the quality, safety, legality,or any other aspect of any goods or services you purchase with your Card.ArbitrationAny claim, dispute, or controversy (“Claim”) arising out of or relatingin any way to: i) this Agreement; ii) your Card; iii) the Cards of anyadditional cardholders designated by you; iv) your purchase of theCard; v) your usage of the Card; vi) the amount of available funds inthe Card Accounts; vii) advertisements, promotions or oral or writtenstatements related to the Cards, as well as goods or services purchasedwith the Card; viii) the benefits and services related to the Cards; or ix)transaction on the Card, no matter how described, pleaded or styled, shallbe FINALLY and EXCLUSIVELY resolved by binding individualarbitration conducted by the American Arbitration Association (“AAA”)under its Consumer Arbitration Rules. This arbitration agreement ismade pursuant to a transaction involving interstate commerce, and shallbe governed by the Federal Arbitration Act (9 U.S.C. 1-16).MASYour Liability for Unauthorized TransfersContact us at once if you believe the Card has been lost or stolen.Telephoning is the best way to minimize possible losses. If you believethe Card has been lost or stolen, or that someone has transferred ormay transfer money from the Card Account without your permission,call the number listed on the back of the Card or the number listed inthe section captioned “Customer Service” at the end of this Agreementif the Card is not available. Under Visa U.S.A. Inc. OperatingRegulations, your liability for unauthorized Visa debit transactionson the Card Account is 0.00 if you are not grossly negligent orfraudulent in the handling of the Card. This reduced liability doesnot apply to certain commercial card transactions, transactions notprocessed by Visa, or to ATM transactions outside the U.S. You mustnotify us immediately of any unauthorized use.Cardholder AgreementIMPORTANT – PLEASE READ CAREFULLYWe will pay the initial filing fee to commence arbitration and anyarbitration hearing that you attend shall take place in the federaljudicial district of your residence.ARBITRATION OF YOUR CLAIM IS MANDATORY ANDBINDING. NEITHER PARTY WILL HAVE THE RIGHTTO LITIGATE THAT CLAIM THROUGH A COURT. INARBITRATION, NEITHER PARTY WILL HAVE THE RIGHTTO A JURY TRIAL OR TO ENGAGE IN DISCOVERY, EXCEPTAS PROVIDED FOR IN THE AAA CODE OF PROCEDURE.For a copy of the procedures, to file a Claim or for other information aboutthese organizations, contact them as follows: AAA, at 335 Madison Avenue,New York, NY 10017 or at www.adr.org.All determinations as to the scope, interpretation, enforceability andvalidity of this Agreement shall be made final exclusively by the arbitrator,which award shall be binding and final. Judgment on the arbitration awardmay be entered in any court having jurisdiction.We will tell you the results in writing after completing our investigation.If we determine a discrepancy occurred we will correct the discrepancypromptly and credit the HSA. If we decide there was no discrepancy, wewill send you a written explanation.NO CLASS ACTION, OR OTHER REPRESENTATIVE ACTIONOR PRIVATE ATTORNEY GENERAL ACTION OR JOINDER ORCONSOLIDATION OF ANY CLAIM WITH A CLAIM OF ANOTHERPERSON OR CLASS OF CLAIMANTS SHALL BE ALLOWABLE.English Language ControlsAny translation of this Agreement is provided for your convenience.The meanings of terms, conditions and representations herein aresubject to definitions and interpretations in the English language. Anytranslation provided may not accurately represent the

specialists. They offer education and insight to maximize your savings. Dear member, Congratulations on opening your HealthEquity . health savings account (HSA). Discover our powerful resources designed to simplify and maximize your health savings. Easy tools. You will find intuitive online account mana