Transcription

Item 1 - Cover PagePart 2A & B of Form ADV: Firm BrochureDated: March 26, 2014742 Ann StreetStroudsburg, PA 18360Contact Information:Erin A Baehr, CFP , EAPhone: 570.223.1550Email: ebaehr@BaehrFinancial.comWebsite: www.baehrfinancial.comThis Brochure, dated March 26, 2014, provides information about the qualifications and businesspractices of Baehr Family Financial LLC. If you have any questions about the contents of thisBrochure, please contact us at: 570-223-1550 and/or ebaehr@baehrfinancial.com The informationin this Brochure has not been approved or verified by the United States Securities and ExchangeCommission or by any state securities authority.Erin Baehr is a Commonwealth of Pennsylvania registered investment advisor. Registration of aninvestment advisor does not imply any level of skill or training. The oral and writtencommunications of an advisor provide you with information about which you determine to hire orretain an advisor.Additional information about Erin Baehr is available on the SEC’s website atwww.Adviserinfo.sec.gov.1

Item 2 - Material ChangesOn July 28, 2010, the United State Securities and Exchange Commission published “Amendmentsto Form ADV” which amends the disclosure document that all registered investment advisorsprovide to clients. This Brochure, dated March 26, 2014, provides you with a summary of ourservices and fees, professionals, certain business practices and policies, disclosures, and more. Eachyear this brochure will also be used to provide you with a summary of new and/or updatedinformation.This Item will summarize material changes that are made in this Brochure. We will ensure that youreceive a summary of any materials changes to this and subsequent Brochures within 120 days of theclose of our business’ fiscal year. We may further provide other ongoing disclosure informationabout material changes as necessary. We will further provide you with a new Brochure as necessarybased on changes or new information, at any time, without charge.Currently, our Brochure may be requested by contacting Erin Baehr at 570-223-1550 orebaehr@baehrfinancial.com. Our Brochure is also available on our web sitewww.BaehrFinancial.com, free of charge.Additional information about Erin Baehr is available via the SEC’s web sitewww.adviserinfo.sec.gov. The SEC’s web site also provides information about any persons affiliatedwith Baehr Family Financial, LLC who are registered, or are required to be registered, as investmentadviser representatives of Baehr Family Financial, LLC.The following summarizes material changes or disclosures to items previously provided in our lastannual Brochure, dated March 28, 2013:Item 5:Open Retainer fees- combined initial year and renewal year fee line itemsItem 10:Removed affiliation with the Alliance of Cambridge Advisors and added membership in KingdomAdvisorsItem 11:Changed code of ethics to reflect pledge to abide by both NAPFA’s code of ethics and that ofQualified Kingdom Advisors.Item 19:Added Qualified Kingdom Advisor professional designation and description2

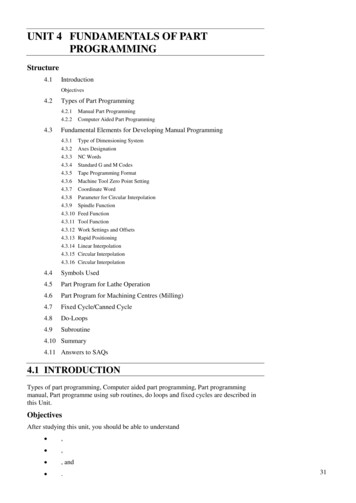

Table of ContentsItem 1 - Cover Page . 1Item 2 - Material Changes .2Item 4 – Advisory Business .4Item 5 – Fees and Compensation .6Item 6 – Performance-Based Fees and Side-By-Side Management .8Item 7 – Types of Clients .8Item 8 – Methods of Analysis, Investment Strategies and Risk of Loss .8Item 9 – Disciplinary Information . 10Item 10 – Other Financial Industry Activities and Affiliations . 10Item 11 – Code of Ethics, Participation or Interest in Client Transactions and Personal Trading. 11Item 12 – Brokerage Practices . 14Item 13 - Review of Accounts . 15Item 14 - Client Referrals and Other Compensation . 152Item 15 - Custody . 16Item 16 - Investment Discretion . 16Item 17 – Voting Client Securities . 17Item 18 – Financial Information . 17Item 19 – Requirements for State-Registered Advisors . 17Appendix A: Supplemental Brochure3

Item 4 – Advisory BusinessFirm DescriptionBaehr Family Financial, LLC (BFF), was established in 2007.We are a fee-only holistic financial planning firm specializing in providing personalized,confidential financial planning and investment management to individuals and families.We serve as the trusted guide for providing means to identify your personal financialobjectives; find solutions to your financial problem areas; design and simplify your cashflow, perform tax planning as well as individual tax preparation, advising on financial riskand investment allocations, retirement planning, insurance, estate planning, and wealthtransfer. All services are tailored to your unique objectives. We do not sell insurance orinvestment products, nor do we accept commission as a result of any productrecommendations. We do not pay referral or finder’s fees, nor do we accept such feesfrom other firms.Principal OwnersBFF is solely owned and operated by Erin A Baehr, CFP , EA.Types of Advisory ServicesAt Baehr Family Financial, LLC, we provide the following types of services:1. Open Retainer Agreement: an Open Retainer Agreement provides broad basedfinancial planning for a fixed annual fee. This means that we work alongside youthroughout our engagement period to organize and optimize the various areas ofyour financial life. We begin by identifying what is important to you and your family,and coordinating tax, insurance, and estate planning, as well as walking through otherfinancial decisions and choices as they arise, to make sure your finances are workingfor you, not against you. This is an ongoing relationship, to work with you toaddress additional financial issues in your life as they occur, at your request.Our recommendations are unique to you and your current situation. We provide youwith detailed investment advice and specific recommendations as part of thisprocess. Implementation of the recommendations is always at your discretion.During the Initial Year we develop your financial plan through a series of meetingsdesigned to explore your goals, and educate and empower you to make gooddecisions about your financial life. We cover a variety of topics (examples listedbelow), according to importance to you, through a series of four to six scheduledmeetings, plus any additional meetings as needed. Meetings may held be face to faceor virtually via online meetings or telephone if more convenient. Assistance withimplementation of recommendations is provided as needed, and always at yourdiscretion.4

- Tax preparation- Budgeting and cash flow- Tax planning- Record-keeping- Net worth assessment- Retirement planning- Portfolio analysis- Goal setting- Develop asset allocation strategies- Estate planning review- Investment Selection- Small business planning- Insurance analysis- Education planning review- Wealth transfer planning- Selection and analysis of employeebenefits1

In Subsequent Years we may schedule three or four regular meetings (plusothers as needed). Appointment topics will depend on what is appropriatefor you, but typically include:-Tax planning & Tax preparationUpdating goalsInvestment review/updateRebalancing of assetsFinancial planning services as requested or needed2. Financial Review: A Financial Review consists of a limited analysis offinancial planning questions selected in advance by the client. Reviews arenarrower in scope than the Open Retainer and do not constitutecomprehensive financial planning, nor do they include ongoing advice orimplementation assistance. Rather, a financial review is appropriate forsomeone with questions in limited areas. With a financial review, we analyzethe documents and information you provide, and then we review ourfindings and written recommendations at an interactive meeting. We provideemail and telephone follow up on questions arising from theserecommendations for 30 days after the review meeting. Our two types offinancial reviews are the Financial Checkup, which is a high level overview ofyour financial situation with recommendations for improvement; and theRetirement Readiness Review, which is an assessment of your financialpicture at retirement, and typically is appropriate for those planning to retirein the next few years.3. Other Services:All services below are also defined in scope and do not constitute ongoingadvice, comprehensive financial planning, or implementation assistanceunless otherwise agreed upon.a. Custom Project: A custom project is built based on the needs andwishes of the client. It is designed to cover specific issues or topics,and the fee, which is determined and agreed to in advance, variesaccording to complexity and scope of services. Topics typically focuson one or more of the following areas: asset/liability analysis, taxplanning, business financial planning, cash flow management,investment review, or retirement planning.b. Limited Retainer: Intended for those with basic financial situationsand limited investment assets, a limited retainer offers investmentadvice with reviews quarterly or semi-annually, with other topicsaddressed on an hourly or project basis. It does not constitute acomprehensive financial planning engagement, and is offered at ourdiscretion.5

c. Tax Preparation: Tax preparation work in some cases may beincluded in the Open Retainer Agreement. It is also available as astand-alone service.d. Hourly Planning: Hourly planning services consist of “workingsessions,” in which clients and planner spend time working onfinancial issues during meetings that are billed by the hour, in fifteenminute increments. Additional work done by planner outside of themeeting is also billable.4. Portfolio Management Services:Offered within the Open Retainer program or the Limited Retainer, portfoliomanagement services include investment selection recommendations and trading ona non-discretionary basis. Investments are recommended based on your risk profileand stage in life, and are discussed with you for your input and approval. Foraccounts that are held at Scottrade or Shareholders Service Group where we havelimited trading authority, we may execute trades necessary to implement investmentpurchases, sales, or exchanges, with your prior approval. Accounts are reviewedperiodically, in most cases no less than annually, and rebalance recommendationsmade when necessary.4CYou may impose restrictions on investing in certain securities or types of securities. Ourinvestment recommendations take your wishes into account.Assets are invested primarily in no-load mutual funds and exchange-traded funds, through adiscount broker. Discount brokerages may charge a transaction fee for the purchase of somefunds.Stocks and bonds may be purchased or sold through a brokerage account when appropriate.The brokerage firm charges a fee for stock and bond trades. Baehr Family Financial LLCdoes not receive any compensation, in any form, from fund companies.4DWe do not participate in wrap fee programs.4EAs of March 26, 2014 BFF advises Open Retainer clients on an ongoing basis with respectto 17,300,000 in marketable assets including cash, securities portfolios, and retirementaccounts.Item 5 – Fees and CompensationOpen RetainerOpen Retainer: 1,800 to 20,000Fees are calculated annually and payable quarterly or monthly, in advance. Fees are calculatedbased on the overall complexity of your financial situation.6

Add-ons, credits, and miscellaneous adjustments: A charge of up to 200 may be assessed for eachamended tax return prepared, if applicable. A charge of up to 100 per return may beassessed for additional tax returns prepared for dependents of the client. Credits andmiscellaneous adjustments may be applied at Advisor’s sole discretion, as appropriate.Project RetainerServices under the custom Project Retainer are provided on a flat-fee basis, and the fee isdetermined by the complexity of the project and depth of analysis needed, with a minimumfor very basic projects of 500. Fees for Project Retainers are payable one- half at time ofengagement with the balance due in full at completion of the engagement.Limited RetainerMinimum fee for the limited retainer range is 800 and up, and is billed quarterly ormonthly, in advance.Financial ReviewThe minimum fee for a financial review is 750 for the Financial Checkup and 950 for theRetirement Readiness Review, with one-half payable upon engagement and the balance dueat completion.Hourly PlanningServices billed under hourly planning are billed at hourly fees up to 150 to 250 per hour.Fees are payable at time of service. In the event of multiple client meetings within a month,advisor may bill monthly instead.For all engagements, we retain the right to offer reduced fees in certain circumstances;such as extenuating circumstances of client, or for family and friends.Payment TermsUnder no circumstances do we require or solicit payment of fees in excess of 500 per clientmore than six months in advance of services rendered. Therefore, we are not required toinclude a financial statement. Fees are negotiable, and advisor reserves right to work on probono or reduced fee basis under certain circumstances.Fees for project retainers and financial reviews may be credited toward an initial year openretainer fee if client signs open retainer agreement within sixty days.Fees may be paid by check, credit/debit card, or by debiting investment accounts.Regarding fees debited from client accounts: In those cases where Baehr Family Financialdebits fees, BFF possesses written authorization from the client to deduct advisory fees froman account held by a qualified custodian; BFF sends the qualified custodian written notice ofthe amount of the fee to be deducted from the clients account; and BFF sends the client a7

written invoice itemizing the fee, including any formulae used to calculate the fee, the timeperiod covered by the fee and the amount of assets under management on which the fee wasbased. BFF will not deduct fee until client returns the invoice granting signed permission todeduct fee. Fee is not based on amount of assets under management, but is strictly a flatretainer fee, as that is how BFF calculates client fees.We are a fee-only financial advisory firm and do not sell investment or insurance products.Unless specifically requested and authorized (with such request accepted by us), we do notexecute recommendations on your behalf. You are responsible, but under no obligation, toimplement any of our recommendations, unless we have agreed to implement for you orassist in implementation.In addition to our fee, you may incur certain other fees and charges to implement ourrecommendations. Additional charges and fees may be imposed by custodians, brokers,third party investment and other third parties, such as fees charged by managers, custodialfees, deferred sales charges, odd-lot differentials, transfer taxes, wire transfer and electronicfund fees, and other fees and taxes. Mutual funds and exchange traded funds also chargeinternal management fees, which are disclosed in a fund’s prospectus. Such charges, fees andcommissions are exclusive of and in addition to our fee.You may terminate an engagement by providing written notice within five days of signing anagreement. Additionally, either party may terminate an agreement, without penalty, at anytime upon 30 days written notice. Any prepaid but unearned fees will be promptly refunded.Any fees that have been earned but not yet paid will be due and payable. Earned andunearned fees in the Open Retainer agreement are determined by the time passed. Forinstance, should you terminate the agreement one month into one quarter’s payment, youwill be refunded two months’ fees. In arrangements that are instead defined by the numberof meetings, earned and unearned fees are determined by the number of meetings held vs.promised.Item 6 – Performance-Based Fees and Side-By-Side ManagementWe do not charge any performance-based fees (fees based on a share of capital gains on orcapital appreciation of the assets of a client).Item 7 – Types of ClientsWe provide broad-based financial planning and investment advisory services primarily toindividuals and families. We strive to work with people from all different walks of life. Assuch, we maintain no minimum net-worth or asset requirements. As discussed above, yourchosen relationship agreement and fee will be based upon your individual circumstances.Item 8 – Methods of Analysis, Investment Strategies and Risk of LossThe main sources of information we may rely upon when researching and analyzing securities willinclude traditional research materials such as financial newspapers and magazines, annual reports,prospectuses, filings with the SEC, as well as research materials prepared by others, company pressreleases and corporate rating services. We also subscribe to various professional publicationsdeemed to be consistent and supportive of our investment philosophy.8

Moreover, we approach investment portfolio analysis and implementation based on internalfactors such as your tax situation, overall risk tolerance, current financial situation, and yourpersonal goals and aspirations. After identifying these items, your portfolio will be structuredaround your individual needs, while minimizing negative effects of external factors, such asinterest rates, market performance, and the economy as a whole.In general, we recommend no-load mutual funds (i.e., mutual funds that have no sales fees),exchange traded funds, U.S. government securities, money market accounts, certificates ofdeposit, and individual bonds (corporate, agency and municipal). However, in the course ofproviding investment advice, we may address issues related to other types of assets that youmay already own. Any other products that may be deemed appropriate for you will bediscussed, based upon your goals, needs and objectives.The primary investment strategy used on client accounts is strategic asset allocation utilizingboth passively-managed index funds and actively-managed no-load mutual funds. Portfoliosare globally diversified to control the risk associated with traditional markets.Your investment strategy is based on the objectives discussed during our consultations. Youmay change these objectives at any time.Risk of LossAll investments have certain risks associated with them that are borne by the investor. Ourinvestment approach constantly keeps the risk of loss in mind. Investors face the followinginvestmen

1 Item 1 - Cover Page Part 2A & B of Form ADV: Firm Brochure Dated: March 26, 2014 742 Ann Street Stroudsburg, PA 18360 Contac