Transcription

Part 2A of Form ADV: Firm BrochureItem 1Cover PageP.O. Box 59165Nashville, Tennessee 37205rpearce@prosperfm.com615-200-7779 (phone)615-691-7082 (facsimile)www.prosperfm.comThis brochure (the “Brochure”) provides information about the qualifications and business practices of ProsperFinancial Management, LLC (“Prosper Financial”). If you have any questions about the contents of this Brochure,please contact us at 615-200-7779 or rpearce@prosperfm.com. The information in this Brochure has not beenapproved or verified by the United States Securities and Exchange Commission or by any state securities authority.Additional information about Prosper Financial may also be available on the SEC’s website atwww.adviserinfo.sec.gov. You can search for Prosper Financial on this site by using CRD number 155100.Any statements regarding Prosper Financial as a registered investment adviser or regarding Richard G. Pearce, Jr.,Esq. as an investment adviser representative are not intended to imply any particular level of skill or training.This brochure is dated May 20, 2013

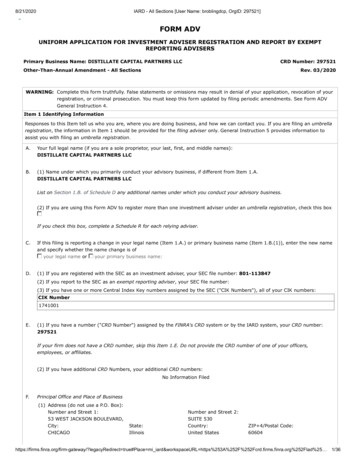

Item 2Material ChangesThe material changes since the last update of the Brochure, on January 10, 2013, are as follows:Item 1 has been updated to provide the new phone number, mailing address and a facsimile number.Item 5 has been updated to identify “Executive Level” services, which are the services most commonly provided toits clients and consistent with the prior ADV Part II, and distinguish them from “Value Investment Plans”, which isa new fee structure and service.Item 8 has been amended to distinguish Executive Level services from Value Investment Plans.Item 12 has been amended to describe Prosper Financial’s use of Scottrade to custody assets that the client desiresProsper Financial to exercise discretionary authority over.Item 14 has been amended to describe Prosper Financial’s intent to enter into referral arrangements with one ormore accounting firms.2

Item 3Table of ContentsItemDescriptionPageItem 1Cover Page1Item 2Material Changes2Item 3Table of Contents3Item 4Advisory Business4Item 5Fees and Compensation5Item 6Performance-Based Fees and Side-by-Side Management7Item 7Types of Clients8Item 8Methods of Analysis, Investment Strategies and Risk of Loss9Item 9Disciplinary Information10Item 10 Other Financial Industry Activities and Affiliations11Item 11 Code of Ethics, Participation or Interest in Client Transactionsand personal Trading12Item 12 Brokerage Practices13Item 13 Review of Accounts14Item 14 Client Referrals and Other Compensation15Item 15 Custody16Item 16 Investment Discretion17Item 17 Voting Client Securities18Item 18 Financial Information19Item 19 Requirements for State-Registered Advisers20Item 20 Privacy Policy213

Item 4Advisory BusinessProsper Financial is a registered investment adviser based in Nashville, Tennessee. It has been in business for twoyears. The sole owner of Prosper Financial is Richard G. Pearce, Jr. Esq.Prosper Financial provides the full range of advisory services, which can be broken down into financial planningand investment advice. Financial planning involves reviewing a client’s income and expenses, anticipated changesto his or her income and expenses, and future needs, including retirement, and advising the client as to the 1) properinvestment vehicles; 2) the amount that needs to be saved; 3) whether the client’s goals and needs can be met orwhether changes need to be made to reach those goals and needs; and 4) whether the client has the proper amountand types of life, disability and other types of insurance. Investment advice involves making appropriate investmentchoices and adjustments to the client’s investments given the client’s risk tolerance, retirement goals, and the currentstate of the securities markets. Prosper Financial uses fundamental and technical analysis to determine appropriateinvestments and has access to a significant amount of research and reports in furtherance of its analysis. ProsperFinancial evaluates mutual funds, exchange traded funds, common stocks, preferred stocks, bonds, convertiblebonds, options, real estate investment trusts (REITs), master limited partnerships (MLPs) and other types ofinvestments in advising its clients.All of Prosper Financial’s services are individually suited to fit each client’s present financial situation, futurefinancial needs and goals, and risk tolerance. With regard to financial planning, Prosper Financial’s services will beadjusted based upon how close the client is to achieving his or her financial goals, in terms of suggesting, forexample, increasing savings, moving savings into different investment vehicles, increasing or decreasing lifeinsurance, and/or changing retirement expectations and anticipated retirement date. With regard to investmentadvice, the client’s risk tolerance, investing comfort, and status towards reaching his or her investment goals allweigh heavily in determining what types of investments are appropriate for that client. In some cases, the client’sportfolio will need to be focused on income, whereas in other cases on capital appreciation or often a combination ofthe two. Prosper Financial now offers a passive investment management option, whereby Prosper Financial willexercise discretionary authority over a portion of a client’s assets and, based upon the client’s risk tolerance,objectives and preferences, make an initial investment allocation into low cost exchange traded funds and mutualfunds that is rebalanced annually.Prosper Financial does not engage in a wrap fee program. It has approximately 2,300,000 of assets underdiscretionary authority as of April 1, 2013. Prosper Financial has approximately 700,000 of assets underadvisement on a non-discretionary basis as of April 1, 2013.Prosper Financial may also provide financial consulting services separate from the above-described advisoryservices. Financial consulting services would be performed for clients who do not want to engage Prosper Financialon a continuing basis, or in situations in which the client desires financial services that do not clearly fall under thecategories of financial planning and investment advice. These services include, but are not limited to, business andindividual financial consulting, such as performed by a chief financial officer (CFO), portfolio reviews, and relatedfinancial consulting services. Prosper Financial may also give lectures or seminars on financial matters in exchangefor a fee.4

Item 5Fees and CompensationFor clients enrolled in the “Executive Level” investment management and financial planning services, which entailsservices being provided throughout the contract term with the client as opposed to one-time or annual services, thefees for Prosper Financial’s services may consist of an initial and/or a periodic fee. Both fees are fixed in advanceand are based upon Prosper Financial's estimate of the time required to provide the services times its hourly rate aswell as upon the amount of assets under advisement. Both fees are negotiable. Hourly fees will be charged forservices outside of scope of the initial fee and periodic fee."Initial Fee"The "Initial Fee" compensates Prosper Financial for its time reviewing the client's financial information, analyzingthe information, performing any necessary research, possibly preparing a written report containing ProsperFinancial's recommendations, and meeting with the client to discuss the recommendations. The Initial Fee includesall of Prosper Financial's costs and expenses, half of which is payable upon execution of a contract with the clientand the other half of which is due upon delivery of Prosper Financial's written recommendations. Services will notbe performed by Prosper Financial until the first half of the Initial Fee is received. The Initial Fee is based upon theexpected time that it will take to perform the above-described services times an hourly rate of 200.00. If the Clientterminates its Agreement with Prosper Financial prior to completion and delivery of the written report, ProsperFinancial will retain a pro-rata portion of the pre-paid Initial Fee, which will be based upon an hourly rate of 200.00 times the amount of time spent working for Client until notification by Client of termination of theAgreement. Any excess amount will be promptly refunded to Client."Periodic Fee"The "Periodic Fee" compensates Prosper Financial for its time performing periodic reviews of the client'sinvestments, research pertaining to the client's investments and general economic developments, and allcommunications with the client regarding these services. A Periodic Fee is only charged if such services arerequested by Client. Prosper Financial will cease to provide any services on the client's behalf during any time inwhich the Periodic Fee has not been paid. The Periodic Fee includes all of Prosper Financial's costs and expenses,and is payable on a quarterly basis within thirty (30) days of invoice. The Periodic Fee will be payable every three(3) months and is based upon the expected time that it will take to perform the periodic review, any necessaryresearch and communicate the recommendations with the client. If the Client terminates its Agreement with ProsperFinancial after the payment of a quarterly Periodic Fee but prior to completion of the work by Prosper Financialrelated thereto, Prosper Financial will retain a pro-rata portion of the pre-paid Periodic Fee, which will be basedupon an hourly rate of 200.00 times the amount of time spent working for Client until notification by Client oftermination of the Agreement. Any excess amount will be promptly refunded to Client.To the extent that the Periodic Fee is based upon the assets under advisement, which is different from and broaderthan assets under management, then the general fee schedule is as follows:Assets under Advisement 1- 1,000,000 1,000,001- 2,000,000 2,000,001- 5,000,000 5,000,001 Fee Percent of AUA1.00%0.75%0.50%0.40%Separate Services/ProgramsProsper Financial may agree to a one-time fixed fee for limited financial planning work, such as preparing a budgetand/or a retirement plan. The charges for these services typically range from 500- 1,500, and the plans may beupdated annually at a discounted rate.5

Prosper Financial now offers a discounted investment management option for assets that it has discretionaryauthority over (hereinafter “Value Investment Plan” or “VIP”). The fee for these services is based upon the assetsunder management (“AUM”), and is negotiable; however, the general fee schedule is as follows:Asset under Management 100,000- 500,000 500,001- 1,000,000 1,000,001 Fee Percent of AUM0.60%0.50%0.40%Currently, Prosper Financial has a minimum fee for these services of 600, and requires 100,000 of assets undermanagement to accept a client under this Value Investment Plan. Prosper Financial may waive one or both of theserequirements under certain circumstances.Clients are billed for fees incurred. If fees are charged at a rate other than a flat fee, Prosper Financial will provideclients with itemized fee invoices to disclose the fee calculations. Clients are urged to review all fee invoices foraccuracy.Separately from fees paid to Prosper Financial, clients will incur custodian fees and transaction costs, including butnot limited to mutual fund fees and brokerage fees for purchasing and selling securities.Prosper Financial may offer its services at reduced rates to certain friends, family and business associates. Thoseindividuals may or may not make referrals to Prosper Financial, but there is no arrangement or agreement to do so.Financial Consulting ServicesProsper Financial may provide financial consulting services at an hourly rate, on a fixed fee, or based upon acontingency or success fee. Prosper Financial may use a combination of these fee structures in order to meet theclient’s needs.6

Item 6Performance-Based Fees and Side-By-Side ManagementNot applicable.7

Item 7Types of ClientsProsper Financial’s clients are primarily individuals; however, Prosper Financial is currently performing consultingservices for a business.8

Item 8Methods of Analysis, Investment Strategies and Risk of LossProsper Financial does not have a fixed investment strategy. Instead, Prosper Financial will tailor the investmentstrategy of each client to his or her present situation, future goals and risk tolerance in light of the current state of theeconomy and markets. Prosper Financial engages in both fundamental and technical analysis and has access to awide range of research to use in supporting its own research. Financial analysis involves reviewing a company’sfinancial statements, competitive advantages, competitors and economic factors to determine whether a security’svalue and risk. Technical analysis involves reviewing a company’s past prices and volume to determine a security’svalue and risk.It is common for Prosper Financial to seek to maximize the benefits of three investment strategies: 1) dollar-costaveraging; 2) periodic rebalancing; and 3) cost efficiency. Dollar-cost averaging is the principle of makingconsistent periodic investments into the stock and/or bond market such that the client is, without intentionally timingthe market, purchasing more securities when prices are low and fewer when prices are higher. Rebalancinginvolves, either once or twice a year, moving funds between securities to meet the client’s target investmentallocation. Securities that have appreciated more rapidly will be sold in part (thereby selling high) and the proceedsused to purchase securities that have lagged the market (thereby buying low). Rebalancing combines with dollarcost averaging to create a rational, disciplined investment approach that does not rely upon frequently inaccuratemarket timing or other gimmicks. Finally, by recommending low cost mutual funds and exchange traded funds inmost circumstances, Prosper Financial is able to achieve an appropriate level of diversity within the client’s risktolerance with a minimal amount of investment expenses.Of course, investing in securities involves the risk of loss, which clients should be prepared to bear before investingin securities. Further, since Prosper Financial does not engage in frequent trading strategies or attempt to “time themarket”, clients may hold, and be advised to continue to hold, securities that decline in value and in some cases,Prosper Financial may encourage its clients to buy more of those securities after they have declined in value.Further, it is possible that an economic downturn or other factors will cause most or all of a client’s securities todecline in value, potentially significantly.In addition, certain investments, including but not limited to options, real estate investment trusts and master limitedpartnerships, carry additional risks relative to 1) unique tax consequences from holding the securities, 2) potentialilliquidity of the investment, and 3) significant differences in volatility compared to the general stock or bondmarket.Prosper Financial’s Value Investment Plan involves a one-time analysis of the client’s other investments, risktolerance and objectives. Prosper Financial will then create an investment allocation for the securities under isdiscretionary authority and use 6-10 exchange traded funds and/or mutual funds to achieve its goals. Once a year,Prosper Financial will engage in tax-loss harvesting, if appropriate, and rebalance the investments. ProsperFinancial will also annually revise the plan in accordance with changes in the client’s other investments, risktolerance and objectives. The primary differences between the Executive Level services and the Value InvestmentPlan are 1) that the Value Investment Plan does not involve any financial planning services; and 2) Prosper Financialwill not engage in periodic reviews of the client’s investments or make changes to the investment plan until the nextannual review. Clients who desire to obtain such additional services will either be charged an additional fee or beconverted to Executive Level clients for an additional fee.9

Item 9Disciplinary InformationNone.10

Item 10Other Financial Industry Activities and AffiliationsRichard G. Pearce, Jr., Esq., Managing Member and President of Prosper Financial, is a practicing attorney inTennessee and Kentucky. Richard G. Pearce, Jr., Esq., practices at the law firm of Grant, Konvalinka & Harrison,P.C., in Chattanooga, Tennessee. There is no contractual relationship or other agreement between Prosper Financialand Grant, Konvalinka & Harrison, P.C.11

Item 11Code of Ethics, Participation or Interest in Client Transactions and Personal TradingProsper Financial will not purchase securities other than that it may hold, for its own account, certificates of depositand/or money market accounts. Prosper Financial’s owner, Richard G. Pearce, Jr., owns securities for his ownaccount, and Prosper Financial may recommend that clients to purchase securities that Richard G. Pearce, Jr. alsoowns, but the transactions will in no event be between Mr. Pearce and the client. Mr. Pearce will not "front run" orotherwise engage in trading of securities recommended to a client in an effort to obtain a better price for Mr. Pearceof such securities or otherwise gain an advantage. Prosper Financial will disclose to clients if Mr. Pearce owns anysecurities that Prosper Financial recommends a client purchase in the market. Prosper Financial's client advisorycontract also notifies the client that Mr. Pearce may hold securities that Prosper Financial recommends the clientpurchase in the market.Prosper Financial 's code of ethics states that Prosper Financial and its employees will a) comply with all applicablestate and federal securities laws; b) will not defraud client in any manner; c) will at all times act in the client's bestinterest with a duty of loyalty, honesty and good faith to the client; d) will avoid, and, if unavoidable, disclose anypotential or actual conflicts of interest to the client and will, as appropriate, cease providing services to the client.Prosper Financial’s code of ethics will be provided upon request.12

Item 12Brokerage PracticesProsper Financial may recommend that a client use a discount broker-dealer to take custody of their investments.The primary factors in determining a broker-dealer for a client are: 1) commission fees charged by the broker-dealermust be minimal; 2) the broker-dealer should have an office near the client's home or office; 3) the broker-dealermust be reputable and have an easy-to-use investment platform; 4) whether the broker-dealer offers advisor-levelservices to Prosper Financial. Clients desiring to use the Value Investment Plan will be required to place the assetsto be managed in custody with Scottrade.Soft Dollar Benefits: Prosper Financial has entered into a relationship with Scottrade and is currently contemplatingentering into relationships TD Ameritrade and/or Fidelity, all broker-dealers, as part of Prosper Financial providingdiscretionary authority services to its clients. It is likely that these broker-dealers will offer “soft-dollar” benefits toProsper Financial, including but not limited to access to research generated by the broker-dealer as well as researchprovided by third-parties and made available to Prosper Financial. Specifically, Scottrade offers Prosper Financialaccess to investment research, education seminars, and discounts on certain financial planning software, investmentmanagement software and insurance. It is not expected that Prosper Financial will receive brokerage commissionsbased upon transactions made by Prosper Financial’s clients with broker-dealers, and it currently receives no suchcommissions. Prosper Financial expects to only use free research and discounted software offered by the brokerdealers. There is a potential conflict of interest in that clients se

Item 12 has been amended to describe Prosper Financial’s use of Scottrade to custody assets that the client desires Prosper Financial to exercise discretionary authority over. Item 14 has been amended to describe Prosper Financial’s intent to enter into referral