Transcription

APS Government Program Management OfficeAPS Vendor GuideStatus: FinalVersion: 1.0Date Created: 8/16/2010Date Last Modified: 8/31/2010APS Vendor GuideApproved May 28, 2010Page 1 of 19

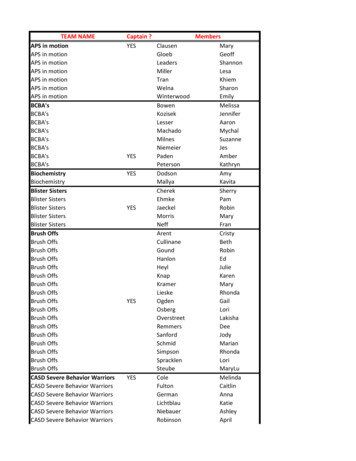

APS Government Program Management OfficeTABLE OF CONTENTSGENERAL INFORMATION . 4COMMUNICATIONS . 4COST MANAGEMENT . 5TRAVEL AND BUSINESS EXPENSE POLICY . 5DIRECT VS. INDIRECT EXPENSES . 8ALLOWABLE/UNALLOWABLE EXPENSES. 9PROGRAM INCOME . 9LABOR ACCOUNTING. 9PAYROLL . 9DAVIS-BACON AND RELATED ACTS . 12PROCUREMENT. 13ACQUISITION THRESHOLDS . 13CONTRACTS . 13BILLING . 13INVOICES . 14INVOICE SUPPORTING DOCUMENTATION . 14SALES TAX EXEMPTION . 15PROJECT MANAGEMENT. 15REPORTING . 15ARRA . 15BUDGET TO ACTUAL REPORTING . 15TECHNICAL REPORTING . 15SPECIAL STATUS REPORTS. 16AUDITS . 17MONITORING . 17ETHICS . 17RECORD RETENTION . 18CLOSEOUT PROCEDURES . 18REFERENCES. 18APS Vendor GuidePage 2 of 19

APS Government Program Management OfficeATTACHMENTS . 19A. VENDOR CONTACT SHEET. 19B. SAMPLE TRAVEL EXPENSE STATEMENT AND RELATED INSTRUCTIONS . 19C. EXPENSE ALLOWABILITY/ALLOCABILITY MATRIX . 19D. SAMPLE TIMESHEET AND RELATED INSTRUCTIONS . 19E. SAMPLE INVOICE . 19F. INVOICE SUPPORTING DOCUMENTATION . 19APS Vendor GuidePage 3 of 19

APS Government Program Management OfficeThis handbook provides vendors participating in APS’s government-funded projects withguidelines and templates for meeting a variety of reporting requirements. It is intended to complywith the Code of Federal Regulations (CFR) for federal assistance awards, the AmericanRecovery and Reinvestment Act (ARRA), and APS corporate policies.This handbook should be used to supplement information provided in the APS Contract andcontractual flow downs (“APS Contract”). This is a living document and will periodically beupdated to provide additional guidance. The APS Contract and the applicable regulationssupersede and have control over any conflicting or ambiguous information contained in thishandbook.General InformationVendors should read the APS Contract in its entirety before reading this supplemental handbook.Vendor means a dealer, distributor, merchant, or other seller providing goods or services that arerequired for the conduct of a federal program. These goods or services may be for anorganization's own use or for the use of beneficiaries of the federal program.Amendments may be issued to update the vendor requirements in response to any additionalrequirements or guidance from the U.S. Office of Management and Budget, the applicablefunding agency or APS.CommunicationsPOINTS OF CONTACTAPS requires vendors to maintain an updated point of contact list with the APS GovernmentProgram Management Office (GPMO). The following should be provided: Reporting Contact – all regulation and reporting updates will be sent to this contact.o Nameo Phone Numbero Email Address Project Manager Accounting ContactSee Attachment A - Vendor Contact Sheet.CONFERENCE PAPERS/PRESENTATIONS/JOURNAL ARTICLES/PRESSRELEASESAPS is obliged to protect and preserve its rights and the rights of its partners, affiliates,subrecipients and vendors as well as to meet all government requirements. This includesproviding accurate project information and encouraging the exchange of ideas while meetingdisclosure requirements and guidelines for a regulated and publicly traded entity. Therefore, it isrequired that all press releases, conference papers, presentations, proceedings, and journalarticles that intend to communicate scientific or technical work supported under the project scopebe submitted for review and approval prior to publication, announcement or presentation, even ifAPS Vendor GuidePage 4 of 19

APS Government Program Management Officesuch publication or dissemination is not specifically identified in the scope of work or APSContract.Submissions for approval must disclose the content to be shared in its entirety. The cover sheetshould list: Name of Conference/Publication/Proceeding Location of Conference (City, State, and Country) Date of Conference (Month/Day/Year) Conference SponsorSubmissions should be sent to the GPMO and Project Team at least ten business days beforepublication, announcement or presentation.Cost ManagementAPS is obligated to manage, monitor and control all project activities within project budget,scope, and schedule.Travel and Business Expense PolicyTravel and business expenses must be included in the vendor’s scope of work and beaccompanied by an advanced approval from the APS Project Manager or Principal Investigator.Only reasonable expenses will be approved.APS’ travel policy does not allow for per diem expenses. All expenses must be substantiatedwith actual receipts to meet any governmental scrutiny that may be assessed.Signed expense reports are required with scanned itemized receipts for all charges. Receiptsmust be legible and have the following minimum information: Amount Date Place Essential character of the expense.APS Vendor GuidePage 5 of 19

APS Government Program Management OfficeITEMIZED RECEIPTNON-ITEMIZED RECEIPTNOTE: Airfare must show all travel dates, to and from location, and airline traveled. Hotelreceipts must include the dates of stay and show itemized listings for all expenses, includingdetailed restaurant charges.Ticketing change fees will only be reimbursed by APS when accompanied with a writtenapproval authorization from the APS Project Manager or Principal Investigator that details: Official business need for ticket changeChange fee amountCharges not covered by APS: Expenses over the GSA Domestic Per Diem rates (Visit the GSA website for additionaldetails) Alcohol charges. Entertainment expenses. Personal expenses such as personal hygiene items, laundry charges, magazines, groundtransportation for personal travel, etc. Items specifically excluded from program award documentation.APS Vendor GuidePage 6 of 19

APS Government Program Management OfficeSee Attachment B for a sample travel expense statement and related instructions.TIPPING GUIDELINESQUESTIONWhat are the government guidelines on tipping?ANSWERThe tip amount is up to each person; however, the full amount of the meal and tip must notexceed the established total per diem amount.For Example:Tommy has lunch in Phoenix, AZ and the per diem rate is 71 for the day ( 18 is allowed forlunch). Tommy’s pre-tip lunch bill is 12.30. Tommy can leave any tip amount he wants to aslong as the combined meal and tip amount does not exceed the 18 per diem maximum for thatmeal.APS Vendor GuidePage 7 of 19

Maximum PerDiem RateAPS Government Program Management OfficeBased onmaximumper diemrateestablisheThe per diem rate for Meals & Incidentals Expenses (M&IE) is then furtherbroken down by meal guidelines:Meals. Expenses for breakfast, lunch, dinner and related tips and taxes(specifically excluded are alcoholic beverage and entertainmentexpenses, and any expenses incurred for other persons).Incidental Expenses. Fees and tips given to porters, baggage carriers,bellhops, hotel maids, stewards, or stewardesses and others on ships, andhotel servants in foreign countries.Federal Travel Regulation, Chapter 300, Part 300-3(http://www.gsa.gov/ftr)Direct vs. Indirect ExpensesDirect costs are charges incurred for activities or services that benefit a specific project. Indirectcosts are charges incurred for activities that benefit more than one project.Refer to the APS Contract to determine if indirect costs are allowed for reimbursement.See Attachment C - Expense Allowability/Allocability Matrix for additional guidance.APS Vendor GuidePage 8 of 19

APS Government Program Management OfficeAllowable/Unallowable ExpensesAn allowable expense is designated by government regulations, contract documentation, or APSpolicy state as an acceptable project expense eligible for potential reimbursement or cost sharingobligations.An unallowable expense is an expense that is prohibited and is found to be an unacceptableproject expense to be applied towards potential reimbursement or cost sharing obligations.See Attachment C - Expense Allowability - Allocability Matrix for additional guidance.Program IncomeIf income is earned during the project period as a result of the award by any tier, that income isconsidered program income. This income must be added to the funds committed to the awardand used to further the project’s objectives.Examples of program income include: Coal waste produced during and/or after the hydro-gasification process was sellable tomakers of asphalt, tires, and other such products. Any income produced from the selleither must be used to benefit the program as a cost-share contribution or must bededucted from the total project or program allowable costs on which the federal share isbased. Any license fees or royalties generated from patents, patent applications, materials,inventions, etc. created under an award would need to be used to further that award untilthe close of the program.Labor AccountingPayrollAll hours will need to be recorded, regardless of the individual’s pay status as non-exempt,exempt, hourly, or salaried. All timesheets must be signed by the employee.See Attachment D - Sample Weekly Timesheet for sample weekly timesheets and relatedinstructions. (Completion of timesheet template is optional if the level of detail requested can beprovided on internal timesheet forms.)All overtime must be approved in advance by an immediate supervisor; failure to receiveadvance approval may result in overtime claims being rejected for reimbursement. When anemployee incurs billable time on both grant and non-grant projects, overtime will be split on aweighted average basis. (See examples below). Overtime premium needs to be calculated per29 CFR §778.115 regulations. Failure to calculate overtime correctly will result in a penalty of 10 per day per person for every miscalculated rate, no matter how small.APS Vendor GuidePage 9 of 19

APS Government Program Management OfficeUncompensated overtime will need to be tracked and reported as well.The following examples illustrate the preferred methods of calculating payroll and allocating toproject budgets:Straight Pay Rate: 20.00Task CodeGV1022APS456Monday Tuesday WednesdayThursday Friday Total87988402211171091099471. Calculate the total straight time pay:(hours multiplied by rate equals total straight time pay)47 * 20.00 940.002. Calculate the number of overtime hours:(total hours minus 40 work week hours equals overtime hours)47 – 40 73. Compute overtime pay rate:(straight pay rate multiplied by 1.5) 20.00 * 1.5 30.00 (Or 10.00 additional per overtime hour)4. Calculate total overtime pay:(overtime hours multiplied by overtime pay rate equals total overtime pay)7 * 10.00 70.005. Figure total pay:(total straight time pay plus overtime pay equals total pay) 940.00 70.00 1010.00Allocate pay to the appropriate project budgets based on hours worked per project:Task CodeGV1022APS456Project hours dividedby total hours40 / 47 0.857 / 47 0.15Computation 1010.00 * 0.85 858.50 1010.00 * 0.15 151.50The above example assumed that the pay rate was the same for each project; however, the nextexample takes into account different pay rates.APS Vendor GuidePage 10 of 19

APS Government Program Management OfficeScenario:Joe worked the following hours:Mon. Tue Wed Thur. Fri Total Hrs. Pay RateProject A5343520 10.00Project B4323416 12.50Project C3242314 15.001281081250 200.00 200.00 210.00 610.001. Calculate the total straight time pay:(hours multiplied by rate equals total straight time pay)2. Calculate the number of overtime hours:(total hours minus 40 work week hours equals overtime hours)3. Compute blended straight pay rate:(total straight time pay divided by total number of overtime hours equals blendedstraight time pay rate) 610.00 / 50 12.20 (Or 6.10 additional per overtime hour)4. Compute blended overtime pay rate:(total blended straight time pay multiplied by 1.5 equals overtime pay rate) 12.20 * 1.5 18.30 (Or 6.10 additional per overtime hour)5. Calculate the total overtime pay:(overtime hours multiplied by overtime pay rate equals total overtime pay)10 * 6.10 61.006. Figure total pay:(total straight time pay plus overtime pay equals total pay) 610.00 61.00 671.007. Compute pay allocation to the appropriate project budgets based on hours workedper project:Task CodeABCAPS Vendor GuideProject hoursdivided by totalhours20 / 50 0.4016 / 50 0.3214 / 50 0.28Computation 671 * 0.40 268.40 671 * 0.32 214.72 671 * 0.28 187.88Page 11 of 19

APS Government Program Management OfficeDavis-Bacon and Related ActsAPS will notify vendors if they will be working on a Task Code where the Davis-Bacon Actapplies. Vendors are expected to maintain compliance.All vendors subject to Davis-Bacon compliance are also subject to on-site monitoring reviews.See Monitoring section in this handbook for additional guidance.To whom does the Davis-Bacon Act apply?All laborers and mechanics employed by contractors or subcontractors, including journeyman,apprentices and trainees, on the project shall be paid wages at rates not less than those prevailingon similar construction in the locality as determined by the U.S. Secretary of Labor, regardless ofcontractual relationship.The minimum statutory threshold for development work on federally funded or assistedconstruction projects is 2,000.What must I do to stay compliant?The wages for every mechanic and laborer employed on the job shall be computed on the basisof a standard work week of forty hours. Employees shall be compensated at a rate of not lessthan one and one-half times the basic hourly rate of pay for all hours worked in excess of fortyhours in the work week (base rate x 1.5 overtime rate). Wages must be paid weekly. Onlypermissible payroll deductions are allowed; otherwise, approval must be obtained from theSecretary of Labor.Davis-Bacon poster (WH-1321) must be posted at all times by the contractor and subcontractorsat the work site of the work in a prominent and accessible place where it can be easily seen.File a weekly certification of payrolls to the APS GPMO no later than one week following payday.Vendors must also comply with the Copeland Act (Anti-Kickback Law): Whoever by force,intimidation, or threat of procuring dismissal from employment or by any other mannerwhatsoever, induces any person employed in the construction, prosecution, completion or repairof any public building, public work or building or work financed in whole or in part by loans orgrants from the United States, to give up any part of the compensation to which he is entitledunder his contract or employment, could face a fine of up to 5,000 and/or up to five years ofimprisonment.Additional Reference Material can be found OE Training - “Impact of Davis-Bacon Requirements of the 2009 Recovery Act”:http://www1.eere.energy.gov/wip/davis-bacon act.htmlAPS Vendor GuidePage 12 of 19

APS Government Program Management OfficeProcurementVendors are allowed to acquire only the equipment and materials approved in the scope of work.Any other procurement may be rejected for reimbursement.Acquisition ThresholdsPer the APS Contract, vendors may not delegate tasks to other subawardees or subcontractorswithout prior written approval from APS.ContractsVendors must ensure that termination language is included in all vendor contracts. Per 10 CFR600.25 “Suspension and Termination,” new obligations will not be reimbursed after the effectivedate of the termination of an award.Debarment and Suspension VerificationVendors are required to verify that no vendors and suppliers utilized are on the governmentdebarment and suspension list located at https://www.epls.gov/.Federally Owned PropertyUnless otherwise noted, all equipment and supplies obtained with government funding is theproperty of APS and must be returned upon project completion or termination, whichever occursfirst.BillingAPS vendors are required to submit at least a monthly invoice. Each invoice must beaccompanied by a reconciled statement approved by the vendor Project Manager as well as thework authorization signed by the APS Project Manager or APS Principal Invest

Vendors should read the APS Contract in its entirety before reading this supplemental handbook. Vendor means a dealer, distributor, merchant, or other seller providing goods or services that are required for the conduct of a federal program. These goods or services may be for anFile Size: 794KB