Transcription

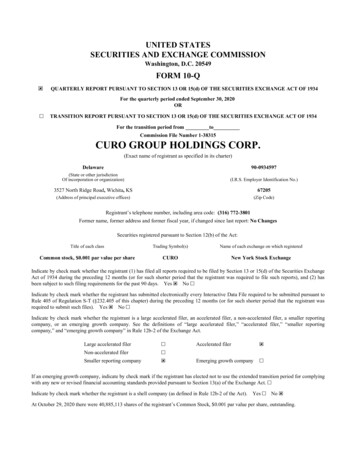

UNITED STATESSECURITIES AND EXCHANGE COMMISSIONWashington, D.C. 20549FORM 10-Q QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934For the quarterly period ended September 30, 2020OR TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934For the transition period from toCommission File Number 1-38315CURO GROUP HOLDINGS CORP.(Exact name of registrant as specified in its charter)Delaware90-0934597(State or other jurisdictionOf incorporation or organization)(I.R.S. Employer Identification No.)3527 North Ridge Road, Wichita, KS67205(Address of principal executive offices)(Zip Code)Registrant’s telephone number, including area code: (316) 772-3801Former name, former address and former fiscal year, if changed since last report: No ChangesSecurities registered pursuant to Section 12(b) of the Act:Title of each classTrading Symbol(s)Name of each exchange on which registeredCommon stock, 0.001 par value per shareCURONew York Stock ExchangeIndicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities ExchangeAct of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) hasbeen subject to such filing requirements for the past 90 days. Yes No Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant toRule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant wasrequired to submit such files). Yes No Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reportingcompany, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reportingcompany,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.Large accelerated filer Non-accelerated filer Smaller reporting company Accelerated filer Emerging growth company If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complyingwith any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).Yes No At October 29, 2020 there were 40,885,113 shares of the registrant’s Common Stock, 0.001 par value per share, outstanding.

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIESFORM 10-QTHIRD QUARTER ENDED SEPTEMBER 30, 2020INDEXPagePART I – FINANCIAL INFORMATIONItem 1.Financial Statements (unaudited)Condensed Consolidated Balance Sheets –September 30, 2020 and December 31, 20195Condensed Consolidated Statements of Operations –Three and nine months ended September 30, 2020 and 20196Condensed Consolidated Statements of Comprehensive Income –Three and nine months ended September 30, 2020 and 20197Condensed Consolidated Statements of Cash Flows –Nine months ended September 30, 2020 and 20198Notes to Condensed Consolidated Financial Statements10Item 2.Management’s Discussion and Analysis of Financial Condition and Results of Operations39Item 3.Quantitative and Qualitative Disclosures about Market Risk75Item 4.Controls and Procedures75PART 2 – OTHER INFORMATIONItem 1.Legal Proceedings76Item 1A. Risk Factors76Item 2.Unregistered Sales of Equity Securities and Use of Proceeds76Item 3.Defaults Upon Senior Securities76Item 4.Mine Safety Disclosures76Item 5.Other Information77Item 6.Exhibits78SIGNATURES792

GLOSSARYTerms and abbreviations used throughout this report are defined below.Term or abbreviationDefinition12.00% Senior Secured Notes12.00% Senior Secured Notes, issued in February and November 2017 for a total of 470.0 milliondue March 1, 2022, fully extinguished September 20182017 Final CFPB RuleThe final rule issued by the CFPB in 2017 in Payday, Vehicle Title and Certain high Cost Installmentloans.2019 Proposed RuleThe subsequent CFPB rulemaking process which proposed to rescind the mandatory underwritingprovisions of the 2017 Final CFPB Rule.2019 Form 10-KAnnual Report on Form 10-K for the year ended December 31, 2019, filed with the SEC on March 9,2020.8.25% Senior Secured Notes8.25% Senior Secured Notes, issued in August 2018 for 690.0 million, which mature on September1, 2025Ad AstraAd Astra Recovery Services, Inc., our former exclusive provider of third-party collection services forthe U.S. business that we acquired in January 2020Adjusted EBITDAEBITDA plus or minus certain non-cash and other adjusting items; Refer to "Supplemental NonGAAP Financial Information" for additional details.Allowance coverageAllowance for loan losses as a percentage of gross loans receivableAOCIAccumulated Other Comprehensive Income (Loss)ASCAccounting Standards CodificationASUAccounting Standards UpdateAverage gross loans receivableUtilized to calculate product yield and NCO rates; calculated as average of beginning of quarter andend of quarter gross loans receivablebpsBasis pointsCABCredit access bureauCARES ActCoronavirus Aid, Relief, and Economic Security ActCash MoneyCash Money Cheque Cashing Inc., a Canadian subsidiaryCash Money Revolving Credit FacilityC 10.0 million revolving credit facility with Royal Bank of CanadaCDORCanadian Dollar Offered RateCFPBConsumer Financial Protection BureauCFTCCURO Financial Technologies Corp., a wholly-owned subsidiary of the CompanyCODMChief Operating Decision MakerCondensed Consolidated FinancialStatementsThe condensed consolidated financial statements presented in this Form 10-QCOVID-19An infectious disease caused by the 2019 novel coronavirusCSOCredit services organizationEBITDAEarnings Before Interest, Taxes, Depreciation and AmortizationExchange ActSecurities Exchange Act of 1934, as amendedFASBFinancial Accounting Standards BoardFFLFriedman Fleischer & Lowe Capital Partners II, L.P. and its affiliated investment funds, a relatedparty to the CompanyForm 10-QQuarterly Report on Form 10-Q for the three and nine months period ended September 30, 2020Gross Combined Loans ReceivableGross loans receivable plus loans originated by third-party lenders which are Guaranteed by theCompanyGuaranteed by the CompanyLoans originated by third-party lenders through CSO program which we guarantee but are notincluded in the Condensed Consolidated Financial StatementsKatapultKatapult Holdings, Inc. (formerly known as Zibby), a private lease-to-own platform for online, brickand mortar and omni-channel retailersNCONet charge-off; total charge-offs less total recoveriesNOLNet operating lossNon-Recourse Canada SPV FacilityA four-year revolving credit facility with Waterfall Asset Management, LLC with capacity up toC 250.0 millionNon-Recourse U.S. SPV FacilityA four-year, asset-backed revolving credit facility with Atalaya Capital Management with capacity upto 200.0 million if certain conditions are metOCCCTexas Office of Consumer Credit Commissioner3

Term or abbreviationDefinitionROURight of useRSURestricted Stock UnitSECSecurities and Exchange CommissionSenior RevolverSenior Secured Revolving Loan Facility with borrowing capacity of 50.0 millionSequentialThe change from the second quarter of 2020 to the third quarter of 2020SRCSmaller Reporting Company as defined by the SECStride BankIn 2019, we partnered with Stride Bank, N.A. to launch a bank-sponsored Unsecured Installmentloan originated by Stride Bank. We market and service loans on behalf of Stride Bank and the banklicenses our proprietary credit decisioning for Stride Bank's scoring and approval.TDRTroubled Debt Restructuring. Debt restructuring in which a concession is granted to the borrower asa result of economic or legal reasons related to the borrower's financial difficulties.U.K. SubsidiariesCollectively, Curo Transatlantic Limited and SRC Transatlantic LimitedU.S.United States of AmericaU.S. GAAPGenerally accepted accounting principles in the United StatesVIEVariable Interest Entity; our wholly-owned, bankruptcy-remote special purpose subsidiaries4

PART I.FINANCIAL INFORMATIONITEM 1.FINANCIAL STATEMENTSCURO GROUP HOLDINGS CORP. AND SUBSIDIARIESCONDENSED CONSOLIDATED BALANCE SHEETS(in thousands, except share data)(unaudited)September 30,2020December 31,2019ASSETSCash and cash equivalents 207,071 75,242Restricted cash (includes restricted cash of consolidated VIEs of 33,696 and 17,427 as of September 30,2020 and December 31, 2019, respectively)62,52734,779Gross loans receivable (includes loans of consolidated VIEs of 327,242 and 244,492 as of September 30,2020 and December 31, 2019, respectively)497,442665,828Less: allowance for loan losses (includes allowance for losses of consolidated VIEs of 53,183 and 24,425as of September 30, 2020 and December 31, 2019, respectively)(80,582)(106,835)Loans receivable, net416,860558,993Income taxes receivable35,21411,426Prepaid expenses and other (includes prepaid expenses and other of consolidated VIEs of 1,165 as ofSeptember 30, 2020)28,25935,890Property and equipment, 53Right of use asset - operating leasesDeferred tax assetsGoodwillOther intangibles, netOther assets—5,055134,589120,60937,21933,9278,151Total Assets7,642 1,126,534 Accounts payable and accrued liabilities (includes accounts payable and accrued liabilities of consolidatedVIEs of 26,665 and 13,462 as of September 30, 2020 and December 31, 2019, respectively) 51,747 1,081,895LIABILITIES AND STOCKHOLDERS' EQUITYLiabilitiesDeferred revenue60,0835,22010,170118,831124,999Accrued interest (includes accrued interest of consolidated VIEs of 983 and 871 as of September 30, 2020and December 31, 2019, respectively)5,72819,847Liability for losses on CSO lender-owned consumer loans6,19810,623799,460790,54413,37610,664Lease liability - operating leasesDebt (includes debt and issuance costs of consolidated VIEs of 128,302 and 8,408 as of September 30,2020 and 115,243 and 3,022 as of December 31, 2019, respectively)Other long-term liabilitiesDeferred tax liabilitiesTotal itments and contingencies (Note 13)Stockholders' EquityPreferred stock - 0.001 par value, 25,000,000 shares authorized; no shares were issuedCommon stock - 0.001 par value; 225,000,000 shares authorized; 47,040,416 and 46,770,765 sharesissued; and 40,885,113 and 41,156,224 shares outstanding at the respective period ends9Treasury stock, at cost - 6,155,303 and 5,614,541 shares at the respective period endsPaid-in capital9(77,852)(72,343)77,46868,087Retained earnings157,93293,423Accumulated other comprehensive loss(45,004)(38,663)112,55350,513Total Stockholders' EquityTotal Liabilities and Stockholders' Equity 1,126,534See accompanying Notes to unaudited Condensed Consolidated Financial Statements.5 1,081,895

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS(in thousands, except per share data)(unaudited)Three Months EndedSeptember 30,2020Revenue Nine Months EndedSeptember 30,2019182,003 2020297,264 2019645,318 839,503Provision for losses54,750123,867218,979338,262Net revenue127,253173,397426,339501,241Salaries and 03640,93742,205Office5,0585,99314,53216,563Other costs of providing 6,990Total cost of providing services63,68376,758186,571217,924Gross margin63,57096,639239,768283,317Corporate, district and other expenses36,65838,665116,246123,043Interest expense18,38317,36454,01852,077(Income) loss from equity method 98769,97474,327Cost of providing servicesAdvertisingOperating expense (income)Total operating expenseIncome from continuing operations before income taxes(Benefit) provision for income taxes(822)Net income from continuing operations12,8815,132Net income (loss) from discontinued operations, before incometax——1,714(39,048)Income tax expense (benefit) related to disposition—598429(45,991)Net (loss) income from discontinued operations—(598)Net income 12,881 0.32 1,28527,389 0.63 6,94371,259 1.71 81,270Basic earnings (loss) per share:Continuing operationsDiscontinued operationsBasic earnings per share—(0.01) 0.32 0.31 0.030.62 0.61 1.630.151.74 1.68 1.78Diluted earnings (loss) per share:Continuing operationsDiscontinued operationsDiluted earnings per share— 0.31(0.01) 0.600.03 1.711.590.15 1.74Weighted average common shares ,77546,01041,66046,887See accompanying Notes to unaudited Condensed Consolidated Financial Statements.6

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME(in thousands)(unaudited)Three Months EndedSeptember 30,2020Net income 12,881Nine Months EndedSeptember 30,2019 27,3892020 71,2592019 81,270Other comprehensive income (loss):Foreign currency translation adjustment, net of 0 tax in allperiodsOther comprehensive income (loss)Comprehensive income 18,472 25,435 64,918See accompanying Notes to unaudited Condensed Consolidated Financial Statements.7 99,646

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS(dollars in thousands, unaudited)Nine Months Ended September 30,20202019Cash flows from operating activitiesNet income from continuing operations 69,974 74,327Adjustments to reconcile net income to net cash provided by continuing operating activities:Depreciation and amortizationProvision for loan lossesAmortization of debt issuance costs and bond discountDeferred income tax (benefit) expenseLoss on disposal of property and 7(3,147)145(Income) loss from equity method investment47(2,653)Increase in cash surrender value of life insurance5,132(418)Share-based compensation—9,8967,587Accrued interest on loans receivable26,566(11,446)Prepaid expenses and other assets7,36214,275Changes in operating assets and liabilities:Other assets79Accounts payable and accrued liabilities(8,439)(10,439)Deferred revenue13,596(4,843)Income taxes payable(533)—25,117Income taxes receivable(23,790)5,598Accrued interest(14,092)(15,303)Other long-term liabilitiesNet cash provided by continuing operating activitiesNet cash provided by (used in) discontinued operating activities2,7252,767309,746464,2931,714Net cash provided by operating activities(504)311,460463,789Cash flows from investing activitiesPurchase of property and equipmentLoans receivable originated or acquired(7,401)(8,667)(951,803)(1,369,644)Loans receivable repaid836,915Investments in Katapult(11,187)Acquisition of Ad Astra, net of acquiree's cash received(14,418)Net cash used in continuing investing activities(147,894)Net cash used in discontinued investing activities995,291(8,168)—(391,188)—Net cash used in investing activities(14,213)(147,894)(405,401)Cash flows from financing activitiesProceeds from Non-Recourse U.S. SPV facility35,206—Proceeds from Non-Recourse Canada SPV facility23,35715,992(42,131)(24,835)Payments on Non-Recourse Canada SPV facilityDebt issuance costs paid(6,991)Proceeds from credit facilities69,853179,811(69,853)(174,811)Payments on credit facilitiesPayments on subordinated stockholder debt(198)—Proceeds from exercise of stock options(2,252)12687(641)(110)Repurchase of common stock(5,908)(52,172)Dividends paid to stockholders(6,750)Payments to net share settle restricted stock units vestingNet cash used in financing activities (1)—(3,732)Effect of exchange rate changes on cash, cash equivalents and restricted cash(58,488)(257)1,204Net increase in cash, cash equivalents and restricted cash159,5771,104Cash, cash equivalents and restricted cash at beginning of period110,02199,857Cash, cash equivalents and restricted cash at end of period (1) Financing activities were not impacted by discontinued operations8269,598 100,961

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS(dollars in thousands, unaudited)The following table provides a reconciliation of cash, cash equivalents and restricted cash reported within the unauditedCondensed Consolidated Balance Sheets as of September 30, 2020 and 2019 to the cash, cash equivalents and restrictedcash used in the Statement of Cash Flows:September 30,2020Cash and cash equivalents 207,071 269,598Restricted cash (includes restricted cash of consolidated VIEs of 33,696 and 21,897 as ofSeptember 30, 2020 and September 30, 2019, respectively)Total cash, cash equivalents and restricted cash used in the Statement of Cash Flows62,207 100,96162,527See accompanying Notes to unaudited Condensed Consolidated Financial Statements.92019 38,754

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIESNOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTSNOTE 1 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND NATURE OF OPERATIONSNature of Operations and Basis of PresentationThe terms “CURO" and the “Company” refer to CURO Group Holdings Corp. and its wholly-owned subsidiaries as aconsolidated entity, except where otherwise stated.CURO is a growth-oriented, technology-enabled, highly-diversified consumer finance company serving a wide range of nonprime consumers in the U.S., Canada and, through February 25, 2019, the United Kingdom.The Company has prepared the accompanying unaudited Condensed Consolidated Financial Statements in accordance withU.S. GAAP, and with the accounting policies described in its 2019 Form 10-K. Interim results of operations are not necessarilyindicative of results that might be expected for future interim periods or for the year ending December 31, 2020.Certain information and note disclosures normally included in annual financial statements prepared in accordance with U.S.GAAP have been condensed or omitted, although the Company believes that the disclosures are adequate to enable areasonable understanding of the information presented. Additionally, the Company qualifies as an SRC, which allows it toreport information under reduced SEC disclosure requirements. SRC status is determined on an annual basis as of the lastbusiness day of the most recently completed second fiscal quarter. Under these rules, the Company met the definition of anSRC as of June 30, 2020, and it will reevaluate its status as of June 30, 2021.The unaudited Condensed Consolidated Financial Statements and the accompanying notes reflect all adjustments (consistingonly of adjustments of a normal and recurring nature) which are, in the opinion of management, necessary to present fairly theCompany's results of operations, financial position and cash flows for the periods presented.COVID-19The COVID-19 pandemic, which surfaced in late 2019 and spread worldwide, including to the U.S. and Canada, continues tocause global uncertainty. Macroeconomic conditions, in general, and the Company's operations have been significantlyaffected by COVID-19 and there continues to be no reliable estimates of how long the pandemic will last or the scope ormagnitude of its near-term or long-term impacts. Resurgences of the pandemic in various states and provinces in which theCompany operates also adds uncertainty as jurisdictions establish or re-institute protocols to lessen the burden of these cases,as described further below. In recent months, efforts to produce a vaccine and more effective treatments for those that havebeen infected by COVID-19 have progressed rapidly. However, it is not possible to predict if a viable vaccine will in fact bedeveloped, the timing of any such vaccine, and the timing and ability to scale such a vaccine for the general population.Federal, state/provincial, and local governments

Mine Safety Disclosures 76 Item 5. Other Information 77 Item 6. Exhibits 78 SIGNATURES 79 2. . a private lease-to-own platform for online, brick and mortar and omni-channel retailers NCO Net charge-off; total charge-offs less total recoveries NOL Net operating loss . OCCC Texas Office of Consumer Credit Commissioner 3. Term or abbreviation .