Transcription

TELECOM DATA MONETIZATION VIABIG DATA ANALYTICSMona FahmyBusiness Systems Analyst, EnterpriseAnalytics - Global ITDell EMCmona.hassan@dell.comNashwa AbolFettouhSenior IT Business Partner, Global ITDell EMCnashwa.abolfettouh@dell.comMohamed AlaaSenior IT Business Partner, Global ITDell EMCmohamed.alaa@dell.com

Table of ContentsThe Analytical ‘Wisdom’ . 3Monetization Opportunities in Different industry Verticals . 4Amazon . 4Two Stories: The German Football Association (DBF) . 5Story Time! Deep Dive into Telecom. 6Monetization Opportunities . 12Big Data Analytics in Practice! . 15The Ethical Dimension. 16Conclusion . 17References . 18Disclaimer: The views, processes or methodologies published in this article are those of the author. Theydo not necessarily reflect Dell EMC’s views, processes or methodologies.2016 EMC Proven Professional Knowledge Sharing2

“By three methods we may learn wisdom: First, by reflection,which is noblest; second, by imitation, which is easiest; andthird by experience, which is the bitterest.” ConfuciusThe Analytical ‘Wisdom’For Confucius wisdom is a precious, sought quality that builds on our repositories of knowledge andexperience to enlighten our future. That belief would still be valid if we replaced Confucius's quest forwisdom with that of data scientists to unlock data worth and insights for businesses by means of “ValueAnalytics”. In the business world, learning by experience would be the most costly, especially whenlearning through imitation and reflection are viable options. That’s where we need analytics.Coupled with the technology advancement that’s slashing the costs of data acquisition, processing andstorage, opportunities are growing to leverage unprecedented value through analytics. This value is nolonger considered a luxury; it’s a key success factor for many organizations across different industriesand an enabler for competitiveness through unconventional methodologies.This value can be realized by linking previously latent datasets with other diverse business and personaldata content for a 360 degree view of the analysis space and even broader. Data science and analyticalskills, therefore, became the key to expose hidden treasures that can uncover any untackled revenuestreams. That’s where we get the wisdom of learning from the past, predicting the future andconnecting the dots for the next competitive strategy steps.Looks promising? Would love to try it? Would it be costly to evaluate the effectiveness of a dataanalytics project on your business?A lot of very reasonable questions can come in here and a lot of arguments and reverse-arguments canbe made on the cost structure and estimates for analytics solutions; it won’t be a cut-throat cost nor willit be a free meal! But at least we can claim that entire Proof of Concepts (POCs) can be built nowadaysbased on open source tools and technologies running on commodity hardware before jumping intoexploratory lump-sum investments and complex Total Cost of Ownership (TCO) calculations forcommercial solutions.2016 EMC Proven Professional Knowledge Sharing3

Monetization Opportunities in Different industry VerticalsAmazonIndustry gurus have already accomplished a lot through analytics and big data. In e-commerce andonline retail, Amazon, for instance has been doing it very innovatively and efficiently for years; usingdata analytics algorithms to build recommender systems for products based on customer profiles,purchase behavior history and click stream analysis creating very well-informed opportunities for upselling and cross-selling.Amazon also capitalizes on this perfect understanding for the customer to provide very unique andinsightful customer service. Today, it uses item-to-item collaborative filtering on many data points suchas what users have bought before, what they have in their virtualshopping cart or wish list, the items they have rated and reviewed,as well as what other similar users have bought, to heavilycustomize the customer browsing experience 1. On multiple levels,Amazon’s Patent: ‘Anticipatorythey have mastered the art of service personalization!Shipping’Further, this is even going largely commercial with Amazon jumpinginto the Business to Business (B2B) Big Data players’ arena throughadding big data services to Amazon Web Services (AWS). This iscreating Platform as a Service (PaaS) for data collection, processingand sharing as well as readiness to combine with existing open datasets that Amazon already hosts.In all the cases above, whether it’s enhancing the chances to upsell/cross-sell, providing a superior customer experience or jumpinginto the B2B data services space this translates directly into dollarvalue saved or additional revenue earned and a gratified P&Lstatement.In 2014, Amazon patented apredictive analytics solution thatuses customer activity onAmazon to predict what theymay order. Amazon is soconfident in the results of itssolution that it starts packagingand shipping potential orders tointermediary destination hubswaiting for the customer order tocome in!With that, Amazon seeks g time relying on thepower of data!1Amazon: Using Big Data Analytics to Read Your Mind, Bernard Marr, 20142016 EMC Proven Professional Knowledge Sharing4

The German Football Association (DBF)Competition: World CupPlace: GermanyYear: 2006When Germany hosted the World Cup in 2006, the German FootballAssociation (DBF) has just started collaboration with SAP to develop ananalytics application called ‘Match Insights’ with the purpose of analyzing vastamounts of data about members of the German team and their opponents.This data was then used to measure key performance indicators, such as passaccuracy, distance run, speed and shooting accuracy etc.Despite the team’s dedication to training and this developedinsights application Germany didn t manage to win the World Cup.Italy won the tournament by defeating France 5–3 in a penaltyshootout in the final, whereas, Germany defeated Portugal 3–1 tofinish in third place. But this was only the start!Eight years later, DBF and German players could achieve more with theapplication and they were 2014’s World Cup Champions. SAP helped todevelop more advanced analytical and mobile features so they can usemobile phones or tablets to get more information about any opponent.Competition: World CupPlace: BrazilYear: 2014One of the main targets after World Cup 2006 was to enhance thepassing speed which the application’s analysis spotted as aweakness. By working on this, the team was able to reduceaverage possession time from 3.4 seconds in 2006 to 1.1 secondsin 2014.Analytics involvement had a transformational role on the footballexperience for coaches, players, fans, and the media. Imagine this:In just 10 minutes, 10 players with three balls can produce over seven million data points that the teamcan analyze to customize training and prepare for the next match.The journey to World Cup wasn t that easy for the German team but with the help of big data analyticsthey did manage to win the title 8 years later. Analytics played important role in their journey and it isreally a success story to tell!22Germany’s World Cup Tactics: shaped by data, Sophie Cutis, The Telegraph, 20142016 EMC Proven Professional Knowledge Sharing5

Story Time: Deep Dive Into TelecomWe’ll understand the opportunities in Telecom nowadays through three phases: First, understanding theindustry trends. Second, understanding the data power. Third, through exploring what analyticalchallenges are there and how they present monetization opportunities.Telecom DataMonetizationOpportunitiesIndustryAnalysis &Trends2016 EMC Proven Professional Knowledge Sharing6

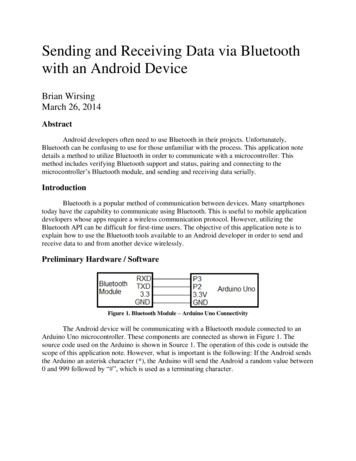

More and more industries are starting to realize the value proposition that analytics can bring to thetable contributing to both enhanced operational efficiencies as well as corporate and competitivestrategies. With this realization, analytics-oriented projects are getting more advocacies withinorganizations and executive teams are more open to adopt and sponsor data-centric strategic initiativeswith more confidence on Return on Investment (ROI).One good industry manifestation of this is in telecommunications service; an industry of US 1.5 trillionin revenue and over 7 billion mobile users. This is a highly competitive industry with multiple providersin each country and a high pace of change.Let’s look at this industry’s competitive analysis withfocus on the most remarkable highlights. Porter’s 5forces’ Model establishes a framework to guide thisanalysis in the light of five driving forces.1.Threat of new entry: Low/medium threat dueto difficulty of entering this capital-intensivemarket with very high fixed costs. Access to atelecom license could be very complex,represnting another entry barrier. (Low).2.Supplier power: For most markets, the largenumber of Telecom equipment providersdilutes the effect of supplier bargaining powerwhich is good for Telecom Operators.(Medium).3.Buyer power: With the many providers andproduct/service offering and the inconsiderableswitching costs, Buyers have high bargainingpower in many customer segments. (Rising).4.Threat of substitution: Subsititues from nonTelecom providers inroduce a big risk. Internetbased messaging and voice services providedfrom Over the Top (OTT) suppliers (WhatsApp,Skype, etc.) are decreasing Average Revenueper User (ARPU) of Telecom operators . (High).5.Competitive Rivalry: Rivalry is very high withmultiple operators pushed to provide highquality services at low prices to reatincustomers. Non-Telecom competiton is alsodriving the ARPU down putting great pressureon sustaining profitability. (High).Figure 1: Porter's Model for Competitive Analysis2016 EMC Proven Professional Knowledge Sharing7

1Profit margins erosion in voice and text services2Telecom TRENDSIncreased customer appetite for data services345Strong Competition from (OTT) providersInternet of Things ConnectivityNetwork Function Vitualization (NFV)A few trends are reshaping today’s Telecom provider market and challenging the traditional model ofdoing business. These trends will drive the next tide of stratgic decisions jumping into the Big Data realmand Internet of Things (IoT) connectivity world.Profit margins from typical telecom services like voice and text are declining due to emergence ofalterantive services from non-telecorm internet-based OTT platforms. It is estimated that between 2013and 2017 data revenue for the telecommunications sector is set to grow by US 128 billion, compared toa US 38 billion decline in voice revenue over the same period 3.Also, customers’ appetite for data services is increasing as a result of streaming services. Data andcontent generation and consumption is growing at exponential rates. This data growth is a doubleedged sword for Telecom providers. On one side, it broadens the scope for analytics data services thatTelecom providers should have an instrumental role in. On the other side, it’s exhausting the networkinfrastructure and calling for more capital investments to continue to provide a reliable quality service.Another very relevant and significant trend is the growing interest and expectation from the Internet ofThings. According to Gartner’s analysis in 2015, IoT is at the peak of the Hype Cycle for EmergingTechnologies with 5-10 years anticipated before reaching a plateau (Figure 2). With the expectation tolive in a smarter, more connected world the role of Telecom Providers comes into play in IoTdelpoyments. Much due diligence is still required here to understand the mandates of Telecomproviders in the IoT world and the nature,usability and value of the data created.3Vodafone Group Plc, Annual Report, 20142016 EMC Proven Professional Knowledge Sharing8

Figure 2: Gartner Hype Cycle for Emerging TechnologiesAdditionally, another trend that’s recieving much attention in the Telecom world is Network FunctionVirtualization (NFV). This concept aims at providing alterantive software-based implementations tomany of the existing hardware-based network functions. This is anticipated to have a huge businessimpact on reducing captial expenditures and operational expenses that used to be a major pain point inthe industry. The good thing is that this presents a large opportunity to collborate with IT storage,virtualization and cloud services vendors to accomplish.In essence, the typical model of doing Telecom services business is no longer sufficient for sustainabilityand growth. In addition to the fierce rivalry within the industry, platforms are emerging to providesimilar services at no cost and regulations aren’t in a sound position to ban this trend. Therefore, there’sa pressing need for providers to innovate relying on the power of their data and the wave of IoT servicesto control their expenditures and secure new revenue streams.2016 EMC Proven Professional Knowledge Sharing9

Telecom data is a valuable asset and operators are unique in the sense that they play a triple role in thedata world: data generators, data aggregators and data consumers.Data Generators: Telecom business operations generate vast amounts of data with different structuresthat can be processed to provide significant insights. Call Detail Records (CDRs) and CustomerRelationship Management (CRM) data generated from daily customer interactions are a few.Data Aggregators: An integral part of the IT infrastructure for telecom operators is a data warehousingand business intelligence (DW/BI) solution infrastructure. This is the basis for most of their reporting andanalytics efforts integrating data from multiple transactional sources through the typical Extract,Transform and Load (ETL) operations with any needed preprocessing and cleansing.Data Consumers: Within this framework, telecom operators consume aggregated data and datagenerated through their mining operations from descriptive and predictive data mining models feedingit back into their systems. In addition, they can be considered a consumer for any readily available openor public data sets that can leverage more dimensions to their analytics space. Publicly shared socialmedia data is one example.Let’s walk through a few examples to grasp the essence of telecom-specific data. One major data sourcein telecom is CDR data. This source has a wealth of metadata fields that can be mined. It has detailedrecords for voice and text transactions in telecom interactions like transaction parties phone numbers(caller and receiver), routing path, duration, start and end times and the ID of the equipment producingthe record as well as many other network details.From an analytics perspective these are used to build association and community models, predictivemodels of residency, work and frequently visited locations to a KMs degree of accuracy.One other key data source is CRM data compiling data from multiple channels of interaction withcustomers: company website, email, live chat, telephone and others and analyzing it to supportcustomer relationship management. It has very worthy data sets that can provide effective customerinsights to support customer acquisition, retention and enhancement of the overall customerexperience.2016 EMC Proven Professional Knowledge Sharing10

Both data sources are ready to partner with web-based data sources, social media sources and more.One good representation of the data sources, volumes and types in today’s digital universe is shown inFigure 3, sourced from Teradata Inc.Figure 3: Data Growth and Variety, Teradata Inc.This reflects the reality of today’s diverse data sources and the inferences and insights that can be builtupon. It’s the smarter digital universe with the immense content generation tools and engines calling foruntraditional approaches, technologies and skills to act upon. It’s Big Data wealth as defined!The first step always remains to formulate the business opportunity into an analytical challenge.2016 EMC Proven Professional Knowledge Sharing11

Monetization OpportunitiesBeing insightful of the aforementioned industry trends and with our deep understanding of the data inhand along with other potential data sets, we can start providing clues to resolve the conventional andemerging industry challenges as well as spotting favorable opportunities.With value analytics, the opportunities are limitless. For instance, let’s see what In-house efficiencies canbe accomplished: Multi-faceted customer segmentation, Churn Analytics, Insights for new productdevelopment with higher hitting rates, Network analytics and optimization just to name a few.A variety of commercial opportunities are there too that will be further enriched with IoT connectivitydata and metrics. As a marketing and advertising agency, wouldn’t you be interested in the results offootfall analytics; the patterns and timings of flow of customer clusters throughout days of theweek/hours of the day? Would this Analytics-as-a-Service (AaaS) – coming from a trusted source –impact your decisions on where, when and how to place outdoor advertising? What about real-timeadvertising; what are the hit chances for a retail store sending you an offer on a product of interestwhile you’re only a few steps away? What if we add to this a social media analytics dimension? Howabout customers' profile and demographics? Infinite opportunities!No more old-fashioned, costly above the line commercial techniques, a smart way of advertising isemerging; targeting the right customer with much higher certainty of gaining customers'attention/wallet.It’s not a blink of an eye though to get this done, so, let’s walk in the shoes of industry leaders of variousroles for a while as we impose some questions that value analytics can guide through; Think of it as athree-level challenge with the last portion having the highest commercial value proposition, yet, thetoughest analytical encounters!Conventional: What signals can alert us for a possible customer churn?Why do my customers leave my company for the competitor?What customer value segment has the highest churn rate? What drivers explain that for thissegment?What type of retention plan can work for each customer value segment? Do we need to gofor more personalized retention plans? Is it cost effective to do?What network parameters need to be altered for best performance?2016 EMC Proven Professional Knowledge Sharing12

Emerging: What portion of my customer-base is a dual line user? Can we measure, infer or predict whatthey prefer about the other provider?What are the demographical dimensions (known/inferred) that compose the profile of myhighest value segment customers? How can we better target customers with similar profile?Are the members of my high-value customers

2016 EMC Proven Professional Knowledge Sharing 7 M ore and more industries are starting to realize the value proposition that analytics can bring to the table contributing to both enhanced operational efficiencies as well as corporate and competitive strategies.