Transcription

[IN ACCORDANCE WITH CALIFORNIA INSURANCE CODE (CIC) SECTION 12938,THIS REPORT WILL BE MADE PUBLIC AND PUBLISHED ON THECALIFORNIA DEPARTMENT OF INSURANCE (CDI) WEBSITE]WEBSITE PUBLISHED REPORT OF THE MARKET CONDUCTEXAMINATION OF THE CLAIMS PRACTICES OFAMGUARD INSURANCE COMPANYNAIC # 42390 CDI # 4670-6NORGUARD INSURANCE COMPANYNAIC # 31470 CDI # 4671-4AS OF JUNE 30, 2018ADOPTED FEBRUARY 24, 2020STATE OF CALIFORNIACALIFORNIA DEPARTMENT OF INSURANCEMARKET CONDUCT DIVISIONFIELD CLAIMS BUREAU790.03 v5 02-16-16

NOTICEThe provisions of Section 735.5(a) (b) and (c) of the CaliforniaInsurance Code (CIC) describe the Commissioner’s authorityand exercise of discretion in the use and/or publication ofany final or preliminary examination report or otherassociated documents. The following examination report isa report that is made public pursuant to California InsuranceCode Section 12938(b)(1) which requires the publication ofevery adopted report on an examination of unfair ordeceptive practices in the business of insurance as definedin Section 790.03 that is adopted as filed, or as modified orcorrected, by the Commissioner pursuant to Section 734.1.790.03 v5 02-16-16

TABLE OF CONTENTSFOREWORD . 1SCOPE OF THE EXAMINATION . 2EXECUTIVE SUMMARY . 4DETAILS OF THE CURRENT EXAMINATION . 5TABLE OF TOTAL ALLEGED VIOLATIONS .7TABLE OF ALLEGED VIOLATIONS BY LINE OF BUSINESS 12SUMMARY OF EXAMINATION RESULTS . 15790.03 v5 02-16-16

FOREWORDThis report is written in a “report by exception” format. The report does notpresent a comprehensive overview of the subject insurers’ practices.The reportcontains a summary of pertinent information about the lines of business examined,details of the non-compliant or problematic activities that were discovered during thecourse of the examination and the insurers’ proposals for correcting the deficiencies.When a violation that reflects an underpayment to the claimant is discovered and theinsurer corrects the underpayment, the additional amount paid is identified as arecovery in this report.While this report contains violations of law that were cited by the examiners,additional violations of CIC § 790.03 or other laws not cited in this report may also applyto any or all of the non-compliant or problematic activities that are described herein.All unacceptable or non-compliant activities may not have been discovered.Failure to identify, comment upon or criticize non-compliant practices in this state orother jurisdictions does not constitute acceptance of such practices.Alleged violations identified in this report, any criticisms of practices and theCompanies’ responses, if any, have not undergone a formal administrative or judicialprocess.This report is made available for public inspection and is published on theCalifornia Department of Insurance website (www.insurance.ca.gov) pursuant toCalifornia Insurance Code section 12938(b)(1).1790.03 v5 02-16-16

SCOPE OF THE EXAMINATIONUnder the authority granted in Part 2, Chapter 1, Article 4, Sections 730, 733,and 736, and Article 6.5, Section 790.04 of the California Insurance Code; and Title 10,Chapter 5, Subchapter 7.5, Section 2695.3(a) of the California Code of Regulations, anexamination was made of the claim handling practices and procedures in California of:Amguard Insurance CompanyNAIC # 42390Norguard Insurance CompanyNAIC # 31470Group NAIC # 0031Hereinafter, the Companies listed above also will be referred to individually asAmguard, Norguard, or the Company, and collectively as the Companies.This examination covered the claim handling practices of the aforementionedCompanies on Commercial Automobile, Commercial Multiple Peril, and Workers’Compensation claims closed during the period from July 1, 2017 through June 30,2018, and Workers’ Compensation claims open as of June 30, 2018. The examinationwas made to discover, in general, if these and other operating procedures of theCompanies conform to the contractual obligations in the policy forms, the CaliforniaInsurance Code (CIC), the California Code of Regulations (CCR) and case law.To accomplish the foregoing, the examination included:1. A review of the guidelines, procedures, training plans and forms adopted bythe Companies for use in California including any documentation maintained by theCompanies in support of positions or interpretations of the California Insurance Code,Fair Claims Settlement Practices Regulations, and other related statutes, regulationsand case law used by the Companies to ensure fair claims settlement practices.2790.03 v5 02-16-16

2. A review of the application of such guidelines, procedures, and forms, bymeans of an examination of a sample of individual claim files and related records.3. A review of the California Department of Insurance’s (CDI) market analysisresults; and if any, a review of consumer complaints and inquiries about theseCompanies closed by the CDI during the period July 1, 2017 through June 30, 2018; areview of previous CDI market conduct claims examination reports on theseCompanies; and a review of prior CDI enforcement actions.The review of the sample of individual claim files was conducted at the offices ofthe Companies in Rancho Cordova, California.3790.03 v5 02-16-16

EXECUTIVE SUMMARYTheCommercial Automobile,Commercial MultiplePeril,and Workers’Compensation claims reviewed were closed from July 1, 2017 through June 30, 2018,referred to as the “review period”, and Workers’ Compensation claims that remainedopen as of June 30, 2018. The examiners randomly selected 137 Amguard claim filesand 19 Norguard claim files for a total of 156 claim files for examination. The examinerscited 339 alleged claims handling violations of the California Insurance Code and theCalifornia Code of Regulations and other specified codes from this sample file review.Findings of this examination included the failure to effectuate prompt, fair andequitable settlements of claims; failure to adopt and implement reasonable standardsfor the prompt investigation and processing of claims; and failure to conduct anddiligently pursue a thorough, fair, and objective investigation while persisting in seekinginformation not reasonably required for, or material to the resolution of a claims dispute.4790.03 v5 02-16-16

DETAILS OF THE CURRENT EXAMINATIONFurther details with respect to the examination and alleged violations areprovided in the following tables and summaries:AMGUARD SAMPLE FILES REVIEWCLAIMS INREVIEW PERIODSAMPLEFILESREVIEWEDNUMBER OFALLEGEDVIOLATIONSCommercial Automobile / Collision652662Commercial Automobile / Comprehensive361543Commercial Automobile / Property Damage472636Commercial Automobile / Bodily Injury744Commercial Automobile / General Finding001Commercial Multiple Peril / First Party Property6733642Commercial Multiple Peril / Third Party Liability252147Workers Compensation / Medical Only648719Workers Compensation / Indemnity205252Workers Compensation / Denied14826Workers Compensation / Open3285102409137282LINE OF BUSINESS / CATEGORYTOTALS5790.03 v5 02-16-16

NORGUARD SAMPLE FILES REVIEWCLAIMS INREVIEWPERIODSAMPLEFILESREVIEWEDNUMBER OFALLEGEDVIOLATIONSWorkers Compensation / Medical Only705710Workers Compensation / Indemnity347435Workers Compensation / Denied28533Workers Compensation / Open6305919671957LINE OF BUSINESS / CATEGORYTOTALS6790.03 v5 02-16-16

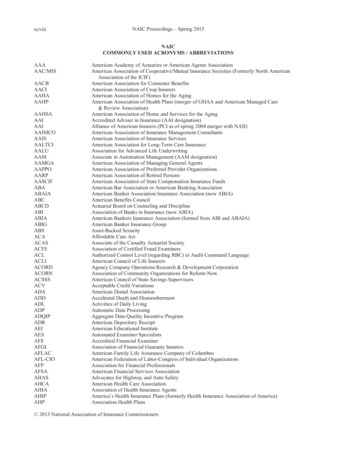

TABLE OF TOTAL ALLEGED VIOLATIONSDescription of AllegationAmguardNumber ofAllegedViolationsNorguardNumber ofAllegedViolationsCIC §790.03(h)(5)The Company failed to effectuate prompt,fair, and equitable settlements of claims inwhich liability has become reasonably clear.6635CIC §790.03(h)(3)The Company failed to adopt and implementreasonable standards for the promptinvestigation and processing of claims arisingunder insurance policies.2313CIC §790.03(h)(2)The Company failed to acknowledge and actreasonably promptly upon communicationswith respect to claims arising underinsurance policies.59The Company persisted in seekinginformation not reasonably required for ormaterial to the resolution of a claims dispute.220The Company failed to conduct and diligentlypursue a thorough, fair and objectiveinvestigation.150CIC §790.03(h)(1)The Company misrepresented to claimantspertinent facts or insurance policy provisionsrelating to any coverages at issue.180CCR §2695.4(a)*[CIC §790.03(h)(1)]The Company failed to disclose all benefits,coverage, time limits or other provisions ofthe insurance policy.180806040CitationCCR §2695.7(d)*[CIC §790.03(h)(3)]The Company failed to include, in thesettlement, the one-time fees incident totransfer of evidence of ownership of acomparable automobile.CCR §2695.8(b)(1)*[CIC §790.03(h)(5)]The Company failed to include, in thesettlement, the license fee and other annualfees computed based upon the remainingterm of the current registration.The Company failed to include, in thesettlement, all applicable taxes.7790.03 v5 02-16-16

Description of AllegationAmguardNumber ofAllegedViolationsNorguardNumber ofAllegedViolationsCIC §1879.2(a)*[CIC §790.03(h)(3)]The Company failed to include the Californiafraud warning on insurance forms related tofirst-party claimants.110CCR §2695.85(a)*[CIC §790.03(h)(3)]The Company failed to provide the insuredwith the Auto Body Repair Consumer Bill ofRights either at the time of application forautomobile insurance, at the time a policywas issued, or following an accident.110CCR §2695.5(b)*[CIC §790.03(h)(2)]The Company failed to respondcommunications within 15 calendar days.905020The Company failed to fully itemize in writingthe determination of the cost of a comparablevehicle at the time the settlement offer wasmade. Itemization of all components of thesettlement was not provided.20CIC §1861.05(a)*[CIC §790.03(h)(5)]The Company failed to amend the premiumcharged to the insured to reflect the currentexposure following the total loss of thevehicle that previously served as theexposure basis for rating purposes. No rateshall remain in effect which is wise in violation of Chapter 9, Article 10of the California Insurance Code.80CCR §2695.8(f)*[CIC §790.03(h)(3)]The Company failed to supply the claimantwith a copy of the estimate upon which thesettlement was based. (original estimate)70CitationtoThe Company failed to take reasonablesteps to verify that the determination of thecost of a comparable vehicle was accurateand representative of the market value in thelocal market area.CCR §2695.8(b)(4)*[CIC §790.03(h)(3)]The Company failed to explain in writing thedetermination of the cost of a comparablevehicle at the time the settlement offer wasmade. Determination of the actual cashvalue (ACV) was not explained.8790.03 v5 02-16-16

AmguardNumber ofAllegedViolationsNorguardNumber ofAllegedViolations20The Company failed to inform the claimant ofhis or her right to seek a refund of theunused license fees from the Department ofMotor Vehicles.20The Company failed to disclose in writing tothe claimant that notice of the salvageretention by the claimant must be provided tothe Department of Motor Vehicles and thatthis notice may affect the loss vehicle’s futureresale and/or insured value.20CCR §2695.7(g)*[CIC §790.03(h)(5)]The Company attempted to settle a claim bymaking a settlement offer that wasunreasonably low.50CIC §790.03(h)(3)The Company failed to adopt and implementreasonable standards for the promptinvestigation and processing of claims arisingunder insurance policies.40CCR §2695.7(b)(3)*[CIC §790.03(h)(3)]The Company failed to reference theCalifornia Department of Insurance in itsclaims denial.40CCR §2695.7(f)*[CIC §790.03(h)(3)]The Company failed to provide written noticeof any statute of limitation or other timeperiod requirement upon which the insurermay rely to deny a claim.40CIC §1871.3(a)*[CIC §790.03(h)(3)]The Company failed to secure a theftaffidavit from the insured prior to thesettlement of the claim.30CIC §1871.3(b)*[CIC §790.03(h)(3)]The Company failed to properly instruct theinsured regarding the signing of the theftaffidavit.30CCR §2695.5(e)(2)*[CIC §790.03(h)(3)]The Company failed to provide e within 15 calendar days.30CitationDescription of AllegationThe Company failed to include, in thesettlement, fees incident to the transfer of thevehicle to salvage status.CCR§2695.8(b)(1)(A)*[CIC §790.03(h)(5)]9790.03 v5 02-16-16

Description of AllegationAmguardNumber ofAllegedViolationsNorguardNumber ofAllegedViolationsCCR §2695.7(c)(1)*[CIC §790.03(h)(3)]The Company failed to provide written noticeof the need for additional time or informationevery 30 calendar days.30CVC §11515(a)(1)*[CIC §790.03(h)(3)]The Company failed to notify the Departmentof Motor Vehicles of a total loss settlementon a salvage vehicle within 10 days from thesettlement.30CIC §1871.3(a)(1)*[CIC §790.03(h)(3)]The Company failed to include the penalty ofperjury warning on its theft affidavit.20CCR §2695.7(p)*[CIC §790.03(h)(3)]The Company failed to provide writtennotification to a first party claimant as towhether the insurer intends to pursuesubrogation.20CCR §2695.7(b)*[CIC §790.03(h)(4)]The Company failed, upon receiving proof ofclaim, to accept or deny the claim within 40calendar days.10CCR §2695.7(q)*[CIC §790.03(h)(5)]The Company failed to share subrogationrecoveries on a proportionate basis with thefirst party claimant.10CCR §2695.8(i)(1)*[CIC §790.03(h)(5)]The Company failed to reflect a measurabledifference in market value attributable to thecondition and age of the vehicle in its basisfor any adjustment regarding betterment ordepreciation.10CCR §2695.3(a)*[CIC §790.03(h)(3)]The Company failed to maintain alldocuments, notes and work papers whichreasonably pertain to each claim in suchdetail that pertinent events and the dates ofthe events can be reconstructed.1028257CitationTotal Number of Alleged Violations10790.03 v5 02-16-16

*DESCRIPTIONS OF APPLICABLEUNFAIR CLAIMS SETTLEMENT PRACTICESCIC §790.03(h)(1)The Company misrepresented to claimants pertinent facts orinsurance policy provisions relating to any coverages at issue.CIC §790.03(h)(2)The Company failed to acknowledge and act reasonably promptlyupon communications with respect to claims arising under insurancepolicies.CIC §790.03(h)(3)The Company failed to adopt and implement reasonable standardsfor the prompt investigation and processing of claims arising underinsurance policies.CIC §790.03(h)(4)The Company failed to affirm or deny coverage of claims within areasonable time after proof of loss requirements had beencompleted and submitted by the insured.CIC §790.03(h)(5)The Company failed to effectuate prompt, fair, and equitablesettlements of claims in which liability had become reasonably clear.11790.03 v5 02-16-16

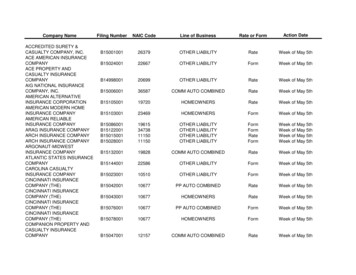

TABLE OF ALLEGED VIOLATIONS BY LINE OF BUSINESSCOMMERCIAL AUTOMOBILEAmguard 2017 Written Premium: 16,909,583Amguard 2018 Written Premium: 46,001,285AMOUNT OF RECOVERIESNUMBER OF ALLEGEDVIOLATIONS 323,924.87CCR §2695.7(d) [CIC §790.03(h)(3)]21CIC §790.03(h)(1)18CCR §2695.8(b)(1) [CIC §790.03(h)(5)]18CCR §2695.85(a) [CIC §790.03(h)(3)]11CCR §2695.8(b)(4) [CIC §790.03(h)(3)]9CIC §1861.05(a) [CIC §790.03(h)(5)]8CCR §2695.8(f) [CIC §790.03(h)(3)]7CCR§2695.8(b)(1)(A) [CIC §790.03(h)(5)]6CCR §2695.4(a) [CIC §790.03(h)(1)]5CIC §790.03(h)(3)4CCR §2695.5(b) [CIC §790.03(h)(2)]4CIC §1871.3(a) [CIC §790.03(h)(3)]3CIC §1871.3(b) [CIC §790.03(h)(3)]3CCR §2695.5(e)(2) [CIC §790.03(h)(3)]3CCR §2695.7(c)(1) [CIC §790.03(h)(3)]3CCR §2695.7(f) [CIC §790.03(h)(3)]3CCR §2695.7(g) [CIC §790.03(h)(5)]3CVC §11515(a)(1) [CIC §790.03(h)(3)]3CIC §790.03(h)(5)3CIC §1871.3(a)(1) [CIC §790.03(h)(3)]2CIC §1879.2(a) [CIC §790.03(h)(3)]2CCR §2695.7(b)(3) [CIC §790.03(h)(3)]212790.03 v5 02-16-16

CCR §2695.7(p) [CIC §790.03(h)(3)]2CCR §2695.7(b) [CIC §790.03(h)(4)]1CCR §2695.8(i)(1) [CIC §790.03(h)(5)]1CCR §2695.7(q) [CIC §790.03(h)(5)]1SUBTOTAL146COMMERCIAL MULTIPLE PERILAmguard 2017 Written Premium: 36,051,676Amguard 2018 Written Premium: 54,472,640AMOUNT OF RECOVERIESNUMBER OF ALLEGEDVIOLATIONS 11,500.00CCR §2695.7(d) [CIC §790.03(h)(3)]16CCR §2695.4(a) [CIC §790.03(h)(1)]13CIC §1879.2(a) [CIC §790.03(h)(3)]9CCR §2695.5(b) [CIC §790.03(h)(2)]5CCR §2695.7(b)(3) [CIC §790.03(h)(3)]2CCR §2695.7(g) [CIC §790.03(h)(5)]2CCR §2695.3(a) [CIC §790.03(h)(3)]1CCR §2695.7(f) [CIC §790.03(h)(3)]1SUBTOTAL4913790.03 v5 02-16-16

WORKERS’ COMPENSATIONAmguard 2017 Written Premium:Norguard 2017 Written Premium:Amguard 2018 Written Premium:Norguard 2018 Written Premium:AMOUNT OF RECOVERIES 63,654,278 152,712,457 63,658,376 158,185,808NUMBER OF ALLEGEDVIOLATIONS 239,047.05CIC §790.03(h)(5)98CIC §790.03(h)(3)32CIC §790.03(h)(2)14SUBTOTAL144TOTAL33914790.03 v5 02-16-16

SUMMARY OF EXAMINATION RESULTSThe following is a brief summary of the criticisms that were developed during thecourse of this examination related to the violations alleged in this report.In response to each criticism, the Companies are required to identify remedial orcorrective action that has been or will be taken to correct the deficiency.TheCompanies are obligated to ensure that compliance is achieved.Any noncompliant practices identified in this report may extend to otherjurisdictions. The Companies should address corrective action for other jurisdictionswhen applicable.Money recovered within the scope of this report was 45,686.45 as described insections 3, 8, 17, 23, 25, 33, and 36 below. Following the findings of the examinationas described in sections 3, 8, 27, 33 and 36 below, the Company Amguard conductedclosed claims surveys resulting in additional payments of 528,785.47. As a result ofthe examination, the total amount of money returned to claimants within the scope ofthis report was 574,471.92.COMMERCIAL AUTOMOBILE [Company Amguard only]1.In 21 instances, the Company failed to comply with the requirements ofCCR §2695.7(d) as noted below:a) In 19 instances, the Company persisted in seeking information notreasonably required for or material to the resolution of a claims dispute.In 13 instances, the Company requested the third party claimant have a PropertyDamage (PD) Release form notarized in order to process a property damageclaim payment, which was an additional cost and not material to the resolution ofthe claim.15790.03 v5 02-16-16

In six instances, the Company requested a claimant have a Power of Attorneyform notarized in order to process a transfer of ownership for a total loss claimpayment, which was an additional cost and not material to the resolution of theclaim.b) In two instances, the Company failed to conduct and diligently pursue athorough, fair and objective investigation. In these instances, the Companyaccepted liability; however, it prematurely closed the claims without paying forthe damages owed to the negligence-free third parties.The Department alleges these acts under (a) and (b) are in violation of CCR§2695.7(d) and are unfair practices under CIC §790.03(h)(3).Summary of the Company’s Response: The Company acknowledgesthe finding and has addressed finding with the following actions:a) In lieu of the required notarization in its PD release forms, the Company revisedits procedure and will request notarization in cases where a reasonable doubtexists pertaining to claimant identity. In such cases, the Company will refund therelated incidental costs. In all other cases, the Company will also acceptsignatures in the presence of others. Secondly, in lieu of its required Power ofAttorney

Norguard Insurance Company NAIC # 31470 Group NAIC # 0031 Hereinafter, the Companies listed above also will be referred to individually as Amguard, Norguard, or the Company, and collectively as the Companies. This examination covered the claim handling practices of the aforementioned Companies on Commercial Automobile, Commercial Multiple Peril .