Transcription

Transcript-Enhanced GuidebookA continuing education activity for pharmacy techniciansOTC Products inPatient Self-CareAnd the Role ofPharmacy Technicians

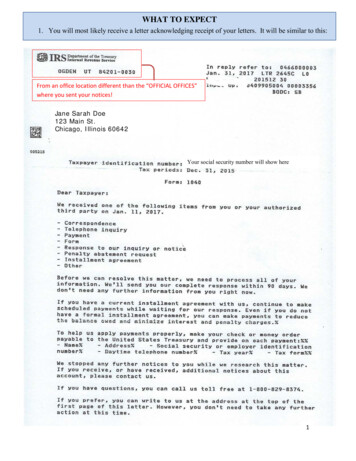

OTC Products in Patient Self-CareAnd the Role of Pharmacy TechniciansThis activity has been developed for pharmacy technicians who encounter patients who have questions orconcerns about using over the counter (OTC) medications. This program will assist technicians in determiningwhen to engage the pharmacist with specific patient concerns. The role of generic OTC and store-brand productsare reviewed, as well as their economic benefits to the patient and pharmacy. Despite their perceived safety,OTC products can be associated with adverse effects. Important updates on the safe use of OTC products forpeptic ulcer disease, allergies, birth control, and pain management are also discussed.Learning ObjectivesThe target audience for this activity is pharmacy technicians.At the completion of this activity, the participant will be able to:Describe the evolving patient attitudes toward self-care and wellness, specifically in the context of OTCproductsList important considerations for educating patients who may benefit from pharmacist counseling on theattributes and efficacy of OTC productsIdentify specific situations in which a pharmacy technician should engage the pharmacist with a patientwho is asking about OTC drug productsSummarize the emergence of pharmacist-dispensed OTC products and the technician’s role in assistingpatients and pharmacists with these productsFacultyMary Lynn Moody BSPharmDirector, Business DevelopmentDrug Information GroupUniversity of Illinois at ChicagoCollege of PharmacyChicago, IllinoisJames H. Wisner, BBA, MBAPresidentWisner Marketing Group, Inc.Libertyville, IllinoisAccreditationProCE, Inc. is accredited by the accreditation Council for Pharmacy Education as a provider of continuing pharmacyeducation. ACPE Universal Activity Number 0221-9999-14-185-H01-T has been assigned to this knowledge-based,home-study activity (initial release date 08-08-14). This CE activity is approved for 1.0 contact hour (0.10 CEU) instates that recognize ACPE providers. The activity is provided at no cost to participants. Completion of an evaluationand post-test with a score of 70% or higher is required to receive CE credit. CE credit will be uploaded automaticallyto NABP/CPE Monitor within 3 to 4 weeks after completion of the evaluation. No partial credit will be given.Release date: August 8, 2014ProCE, Inc.848 W. Bartlett RoadSuite 3EBartlett, IL 60103www.ProCE.comExpiration date: August 8, 2017FundingThis activity is supported by aneducational grant from Perrigo.2

About the FacultyMary Lynn Moody, BSPharmMary Lynn Moody, BSPharm, is a Clinical Associate Professor in the Departmentof Pharmacy Practice at the University of Illinois at Chicago College of Pharmacy.She is also the Director of Business Development for the Drug Information Group.In this role, she is responsible for development and coordination of businessrelationships with clients of the Drug Information Group. Mary Lynn completedher pharmacy degree at the University of Illinois at Chicago and a PGY1 residencyat Northwestern Memorial Hospital in Chicago.James H. Wisner, BBA, MBAJim Wisner is President of the Wisner Marketing Group in Libertyville, IL. Helaunched his company in 1999 after accruing over 30 years of senior managementexperience in the food and drug industry at Jewel Food Stores, Shaw's Supermarkets, and Topco Associates, where he was responsible for the OTC productarea and launched the Topco Pharmacy Program. He has developed severalindustry-wide research and education programs in consumer healthcare and othertopics. Jim has contributed to many pharmacy education activities, focusing onself-care and patient behavior in the community pharmacy setting. He received hisBBA in Marketing from the University of Notre Dame and his MBA from theKellogg Graduate School of Management at Northwestern University. Hepreviously held a visiting position at the University of Illinois at Chicago Collegeof Pharmacy.DisclosuresIt is the policy of ProCE to require the disclosure of the existence of any significant financial interest or any otherrelationship a faculty member or a sponsor has with the manufacturer of any commercial product(s) discussed in aneducational presentation. Mary Lynn Moody has disclosed that she has served as a consultant and/or speaker for thePerrigo Company. Jim Wisner has disclosed that he has served as a consultant and/or speaker for the Perrigo Company. Aportion of grant funds received by ProCE from Perrigo will be used to compensate the faculty for this activity.The opinions expressed in this program should not be construed as those of the CE provider or Perrigo. The informationand views are those of the faculty through clinical practice and knowledge of the professional literature. Portions of thisprogram may include the use of drugs for unlabeled indications. Use of drugs outside of labeling should be consideredexperimental and participants are advised to consult prescribing information and professional literature.3

This CE activity is a little different from manyothers in that it deals with front of the counterissues and patient self-care motivations.The patient’s perspective on the pharmacy andinteraction with the pharmacist will be discussedalong with the economic impact of OTC and storebrands on both the patient and your pharmacyoperation.This CE focuses as much on the practiceenvironment as it does on the pharmacy itself.Pharmacy technicians are often the first point ofcontact for patients with questions about OTC.This learning activity provides an update on selfcare trends and OTC. It is very important tounderstand these trends in order to have a properperspective regarding how patient behavior isevolving. The role of OTC will be reviewed – andwhy the pharmacy will have greater involvementthan ever before. Store brand medications will bespecifically discussed. Store brands are equivalentto generic pharmaceuticals and you may besurprised to find out just how important a role theyplay in your patients’ lives. Finally your role – andhow you should interact with patients and thepharmacist regarding OTC products and storebrands – will be addressed.4

So, what is this CE activity really all about? Whydo we want to focus on OTC products and storebrands?Why are we discussing store brands? The role ofthe pharmacy is to offer patients the best care at theleast possible cost and to ensure that the entirepharmacy operation – including OTC – providesenough revenue to maximize its value to the patientas well as your employer.Just how important are store brands? If we add upall of the doses of pharmaceuticals and OTCproducts that are taken by patients throughout theUnited States, what percentage are accounted forby store brand OTC medications?In unit sales, OTC accounts for over 60% of alldrugs purchased, and store brands account for 46%of all of the OTC products. This means that morethan 1 in every 4 medications purchased in theUnited States is a store brand or generic OTCproduct.5

Let’s take a look at some store-brand trends, andhow they impact individuals.The last of the baby boomers turn 50 years old in2014. It is important to understand that “over 50” isreally not “over the hill” – it is the hill that isdriving healthcare today.Individuals over 50 account for 70% of allprescription drug purchases and more than half ofall OTC purchases. One-third of all OTC purchasesare made by those over the age of 65. That groupwill continue to grow in the future as well. Equallyimportant, personal healthcare expenditures beginto increase dramatically at age 45, nearly triplingbefore most individuals reach retirement age.6

In recent years, direct-to-consumer advertising ofprescription drugs has increased. And with themany Rx-to-OTC launches, more healthcarecommunications and advertising have been targetedto consumers than ever before. Many otherchannels, such as ongoing media coverage andpopular literature, provide even more information.Just take a look at how many magazines – and noweven mobile apps – are dedicated to or directed athealth and wellness topics.Over 80% of Internet users today look for healthand medical information online. Most everyonelooks for that information before making a visit tothe doctor, and in many cases they feel that theymay be as well – or perhaps even better – informedthan the doctor when they arrive.And it is not only information on ailments andprescription drugs; it is also OTC products thatconsumers are researching. In one survey, 57% ofInternet users had researched OTC productssometime within the last 2 months. Significantly,73% of that group did so at least once a month.There are many new tools and information availabletoday that weren’t available a few years ago. Thereare mobile apps that a shopper can take to the storeand a variety of touchscreen-enabled devices inmany stores. There are fitness and diet apps to trackevery step you take and every bite you eat. The listgoes on and will only continue to get bigger.7

Rx-to-OTC switches are estimated to be 44 billionduring the 5-year period between 2010 and 2015.Nearly two-thirds of all Americans wish that atleast some of the prescription medications theycurrently take would be made available over thecounter. OTC is accessible, convenient, and canoften preclude the need to see a doctor.Switch activity is likely to increase. The FDA isbecoming proactive in moving more drugs to OTCstatus.One of the reasons is that many other countrieshave a much greater focus and reliance on selfcare. They also have a longer life expectancy thancitizens of the U.S. These countries havehistorically been more aggressive in movingproducts to OTC status. The FDA believes thatdrugs that can be safely taken and managed bypatients should be made available as OTCproducts.The FDA is looking to revamp the current systemfor regulating OTC drugs. The decades-old processthat is currently in place is not flexible enough tokeep pace with modern medical developments. Theplan is to overhaul the Over-the-Counter DrugMonograph, a system that was put into place in1972. It was designed to set the dosing, labeling,and other standards for nonprescription drugingredients – everything from aspirin toantibacterial hand scrubs. The regulators at theFDA have acknowledged that the process isextremely time-consuming, requiring multiplerounds of scientific review followed by publichearings and comments, before a final monographcan be published. We will continue to see changesin OTC regulations in the future.8

The FDA has several very specific requirements tobe met before a drug can be switched to OTC status.First, the benefits must outweigh the risks when it isused as an OTC as opposed to a prescriptionproduct. Second, there must be little potential formisuse and a low likelihood of abuse. Next,consumers should be able to recognize the medicalconditions for which the product is used and shouldalso be capable of self-treating and using the drugscorrectly. Finally, the drug must be adequatelylabeled for use in a way that is clear andunderstandable. Rx-to-OTC conversions take time –they can be very costly. Generally, both use andlabel comprehension studies are required before thedrugs are approved. Product safety issues arehandled on a case-by-case basis.This list includes some of the drugs currently beingreviewed for future switches. The list is fluid andchanges as the FDA assesses new information.A renewed interest in bringing statins to OTCstatus will have a major impact. Mevacor is alreadyOTC in the United Kingdom.Pharmacy Technicians are cautioned that patientsmay need just as much pharmacist counselingregarding usage of a drug that has gone Rx-to-OTCas some may wrongly presume that there is lessrisk of interaction or depletion because it OTC.Patients who have questions or appear unsureshould be referred to the pharmacist for addtitionalcounseling.9

How does OTC impact patient care?OTC is important. 35% of all adults in the UnitedStates use OTC medications on a regular basis.U.S. consumers make an average of 26 trips peryear to purchase OTC products, but only 3 trips peryear to the doctor’s office.Nearly all consumers believe that OTC medicinesmake it easy to treat minor medical ailments andprefer to treat themselves before seekingprofessional care. 86% of OTC users believe theseproducts make doctor visits unnecessary. 85% ofparents even prefer to treat their children with anOTC product first – before visiting the doctor.10

OTC products are cost-effective. They save 102billion annually relative to alternatives such asdoctor visits and prescription drugs. On average,every dollar spent by consumers on OTCmedications saves the U.S. healthcare system 6 to 7. In an age where the cost of health care isconstantly under discussion, OTC medications areprobably one of the most immediate and effectiveways to rein in healthcare costs.This is an example of what happens when a drug isswitched from prescription status to OTC, and theneventually makes its way to store brand or genericalternative. When Prilosec was originally aprescription drug, it cost patients nearly 1,500 peryear to maintain their regimen. When the genericprescription form was introduced, the cost was cutby more than half. Moving to OTC, the brandedproduct again cut the price in half. And, since itcould be purchased on sale or at a discounted price,most individuals were able to buy it at about onethird the cost of the generic prescription drug. WhenOmeprazole became a store brand, the cost againwas nearly halved. Ultimately, the patient movedfrom a medication regimen that cost nearly 1,500per year to maintaining the same drug regimen for alittle over 100 a year.The federal government’s multiple changes inflexible spending accounts have been veryconfusing for many people. Until 2002, patientspaid the full cost of OTC products. In 2003, theseproducts were made reimbursable through flexiblehealth spending accounts. These accounts enablepatients to pay for some of their healthcareexpenses with pre-tax dollars. In 2011, as part of thePatient Protection and Affordable Care Act, OTCproducts were not reimbursable without a writtenprescription. This change has had far-reachingrepercussions for patients and the healthcaresystem.11

Under the ACA, requiring a prescription will addabout 4.5 billion to healthcare costs if only 10%of patients seek a prescription for an OTC productwhich they could otherwise purchase off the shelf.In one study, more than half the people were usingflexible spending accounts to purchase OTCproducts, and 46% indicated that with the changein the law, they would now seek a prescription.Additionally, 76% of physicians said they weresomewhat or very likely to write an OTCprescription for patients seeking reimbursement.There is some discussion about reverting to theprevious flexible-spending law, but it has not yetbeen changed. Meantime, technicians may seemany patients bringing prescriptions for OTCproducts because for them it may be less costlythan purchasing off the shelf.Many more products today are available without aprescription, but must be dispensed by apharmacist. Examples include children’smedications, pseudoephedrine products, and untilrecently, emergency contraceptives. Drugs that areoften dispensed with a prescription – even thoughavailable on the shelf – include omeprazole andsimilar drugs. When a patient approaches with aprescription for an OTC product, considersuggesting the patient talk with the pharmacist tosee if there is a cost-effective store brandequivalent available – the same as you would dofor generic prescription drugs.What exactly is store brand OTC? Is the quality thesame as national brand drugs? What are theeconomics of these products, and how doconsumers feel about them?12

Store brands are the OTC equivalent to generic Rxdrugs. Their ingredients compare with those of thetop-selling national brands, and the packaging oftenhelps patients identify the national brandequivalent. Store brands are most often sold under aparticular store’s name or label (or a name or labelthat they control) and sometimes are referred to bypharmacists as generic OTC.The use of the term “generic” makes sense whentalking about prescription pharmaceuticals. Mostpeople understand that generic pharmaceuticalshave the same efficacy, mechanism of action, andother characteristics as their branded counterparts.They simply cost less. However, for products otherthan prescription drugs, the term “generic” oftenhas a different connotation.Patients understand that when being offered a“generic” prescription they are receiving anequivalent product at a lower price. But allpharmacy personnel are cautioned that referring toan OTC product as a “generic” may suggest to thecustomer that it is an inferior product. The word“generic” takes on a different context in store aisleswhere prior consumer experience with genericproducts is typically with lower-quality,inexpensive items. Therefore, when speaking ofstore brand OTC products, it is important thatpharmacists and other staff use a term such as “ourbrand” or reference the specific brand name usedby the store or chain.13

Store brands, also referred to as “private label” –dominate most OTC categories in which they aresold. Store brand analgesics far outsell the leadingbrands, and collectively outsell the next 9 brandscombined. A recent University of Chicago studyalso found that pharmacists choose store brands forthemselves 90% of the time.In unit sales, the store brand share is even higher.Across the board, these products have become theleading choice for most consumers, and they nowcollectively represent over 46% of total unit salesacross all channels. When reassessed on a volumebasis (the same as equivalent doses), store brandsrepresent 59% of all OTCs taken.Let’s move on to store brand economics.14

Everyone benefits with store brands. Thiscomparison (costs are representative) indicates thatthe store brand product is significantly lessexpensive when compared with the national brand.The retail price to the consumer is also far lower,but the gross margin dollar return to your store’soperation is significantly higher.It is important to note that everyone comes outahead. The consumer typically saves around 30%or more, and the increase in the retail margin isdramatically higher.This helps the pharmacy maintain staffing levels toprovide better care.The cumulative impact from customers switchingto less costly but equally effective alternatives issubstantial.For example, if just 10 patients per week switchedto a store brand alternative in a pharmacy operationthat has 100 stores, the savings to patients totalsmore than 100,000 per year. At the same time,additional return to the store is almost as much.The savings across all OTC categories aresignificant. The patient can redirect these savingsto other healthcare needs and greatly extend theirhealthcare budget. For less affluent patients, this isespecially important.15

Why do advertised brands cost more? For the top20 brands alone, conventional media spendingaccounts for more than 22% of the product cost.Add to this other marketing expenses, and itbecomes clear why these brands cost so muchmore.The net result is a significant difference in cost ofproduct that is unrelated to the product itself.In terms of quality, are store brands different fromtheir advertised brand counterparts? Let’s take alook at store brand quality.The most important thing to understand about storebrands is that they must adhere to the exact samestandards as advertised brands.Both store brand and advertised brandmanufacturers are held to the same FDA standardsand requirements for safety and common goodmanufacturing practices (cGMPs). Pharmacists andtechnicians can be confident that

James H. Wisner, BBA, MBA Jim Wisner is President of the Wisner Marketing Group in Libertyville, IL. He launched his company in 1999 after accruing over 30 years of senior management experience in the food and drug industry at Jewel Food Stores, Shaw's Super-markets, and Topco Associates, where he was responsible for the OTC product