Transcription

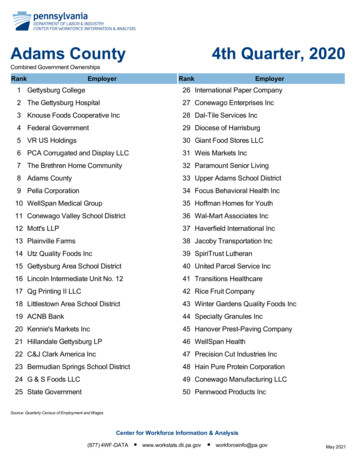

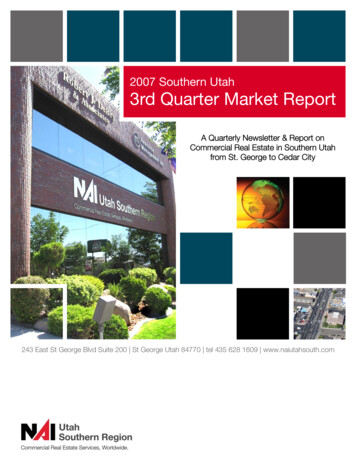

2007 Southern Utah3rd Quarter Market ReportA Quarterly Newsletter & Report onCommercial Real Estate in Southern Utahfrom St. George to Cedar City243 East St George Blvd Suite 200 St George Utah 84770 tel 435 628 1609 www.naiutahsouth.com

Impact of Construction &Growth on TrafficThere is more to commercialreal estate than just squarefootage & lease rates.We understand the elementsthat impact your business.NAI Utah Southern Region is the premiercommercial real estate brokerage inSouthern Utah providing expert services toboth local & global clientele.NAI's services include Acquisitions & Dispositions Leasing Tenant Representation Investment Services Due Diligence Related Consulting & Advisory ServicesOur Southern Utah Commercial Brokersspecialize in Industrial, Office, Retail,Investment, & Multifamily properties. Wealso offer Property Management &Corporate Services that help to save yourbusiness time & money.Whether you're looking for Utah officespace, industrial warehouses, retail outlets,or investment opportunities, we can help!With over 350 offices worldwide & Utahoffices located in Cache County,Davis/Weber Counties, Salt Lake City, UtahCounty, & St. George, NAI is everywhere toassist with your real estate needs.Where canwe help you next?22007 3rd Quarter Market Report Copyright 2007 NAI Utah Southern Region All Rights Reserved

Current State ofThe MarketIn spite of national trends, Southern Utah is weathering the battered real estate markets verywell. There is significant discussion in the national press & in our local press about nationalreal estate trends. These trends are almost exclusively focused on the residential markets &they can seem quite foreboding. Nationwide, building permits are at decade lows,transaction volumes have dropped a lot, foreclosures are up, inventories are up, & assetvalues are dropping by double digits. More recently, the unraveling of the sub primesecurities markets created instability that seems to have mostly stabilized.Can One Site Really HaveSo Many Answers? Market ResearchNews & InformationProperty ListingsAgents with Local KnowledgeLandlord RepresentationTenant RepresentationInvestment SalesRetail ConsultingView over 130 listings atlistings.naiutahsouth.comAlthough it can seem scary in the trenches, Washington County is faring significantly betterthan the national press suggests. In Southern Utah, transaction volumes are off by 50%compared with the peak, but volumes are consistent with 2003 & 2004. Transactionalbusiness such as title companies, mortgage brokers, contractors, & real estate brokers arehit particularly hard by lower volumes. That said, we believe we are in a stablemarket. According to the Southern Utah Home Buying Facts guide, Washington Countyaverage sale prices have dropped by approximately 5.9% from July 2006 to July2007. Numbers indicate that from the highest quarterly average sales price to the lowest,Washington County is off by about 7%. Considering that we just went through a period of100% appreciation in a period of two or three years, this isn't much of a pricecorrection. When you look at price per SF on existing homes, (this adjusts for variations inthe size of homes) it looks as though we are only off 2.5 to 3%.What about August & September? We are a little early for anything but preliminary numbersfor September, but MLS residential units closed for August were higher than forJuly.Prices were 2% lower in August, but September appears to show pricesholding. We are also showing average time on the market at between 110 & 130days. This is a more than a month less than in 2002 & 2003. Many ask how we explainthese numbers. It is generally a matter of pricing. The homes that have been on themarket, for a considerable amount of time, are overpriced. It is like placing a limit order for astock that will never be filled. Many of these homes go through multiple realtors. Not untilthe home is priced appropriately (or the owner gets lucky) does the home sell. Similarly, themarket is clearing relatively less expensive homes. As a result, we end up with a significantnumber of homes that are not priced to sell & a significant number of expensive (over 350,000) homes that artificially inflate our inventory numbers.So, where is the market heading? Currently, Utah has the lowest foreclosure rate in thecountry. This is an indication of a market that is healthier than average. Other economicindicators also show that we are performing very well. Our workforce is growing faster thanboth the State & the Nation at 3.5% since July 2006, & our wages rose 3.3% over the pastyear. Increases in the cost of living are now lower than the Nation on average.Unemployment remains low at 2.9% compared with over 4% for the Nation. All of theseindicate economic strength. This doesn't mean prices have hit bottom, but it does meanthere is a floor.The local commercial market is in very good shape. We are seeing significant constructionactivity this year, validating the law of supply & demand. In 2005 & 2006 we were shortsupply & lease rates moved up. In 2007, inventory has become available & lease rateshave stabilized. If you are looking for commercial real estate, or even a home, now is a verygood time to buy. In the world of stocks, Washington & Iron Counties are growthstocks. Investors have to endure a little volatility but, in the end, the capital gains shouldmake it worth the ride.Neil Walternwalter@naiutahsouth.comMark Waltermwalter@naiutahsouth.comManaging DirectorPrincipal BrokerAll Rights Reserved - 2007 3rd Quarter Market Report NAI Utah Southern Region3

A Sample of Our3rd Quarter TransactionsLeasesIndustrial350 North Industrial CenterCoal Creek Industrial ParkFort Pierce Office/WarehouseR&R Industrial Center, Suite 4R&R Industrial Center, Suite 10Riverside CommercialRiverside Drive Office/WarehouseSouthwick Office/WarehouseSunchase Business ParkOfficeBoulevard Office ParkCrossroads Center, Building EEnce Executive TowerMetcalf Office SpaceMorningside Office PlazaRed Cliffs Professional ParkRio PlazaVentana Office ParkRetailDixie Sunset PlazaFestival Plaza, Suite A-2Festival Plaza, Suite B-2Festival Plaza, Suite B-4Festival Plaza, Suite B-5Old China King BuildingPier 49 Pizza BuildingSt. George Boulevard Mini-MartRio PlazaSouthland Retail Building, Suite A180Southland Retail Building, Suite A1703,627 SF3,2005,2601,5002,5001,8452,2804,10320,000Jason Griffith & Meeja McAllisterJason Griffith, Meeja McAllister, & Eric ChristensenWes DavisJason Griffith & Meeja McAllisterJason Griffith & Meeja McAllisterJason Griffith & Meeja McAllisterJason Griffith, Meeja McAllister, & Eric ChristensenJason Griffith & Meeja McAllisterWes DavisOffice WarehouseOffice WarehouseOffice WarehouseWarehouseWarehouseOffice WarehouseOffice WarehouseOffice WarehouseOffice Warehouse1,131 SF3,0002,4069002,5251,00010,1822,310The Walter GroupWes DavisJason Griffith & Meeja McAllisterRyan Garrett & Brandon VandermydeJason Griffith, Meeja McAllister, & The Chappell TeamJason Griffith & Meeja McAllisterJason Griffith & Meeja McAllisterJason Griffith & Meeja sionalJason Griffith & Meeja McAllisterWes DavisWes DavisWes DavisWes DavisWes Davis & Eric ChristensenJason Griffith & Meeja McAllisterJoseph Iwanski & Brandon VandermydeJason Griffith & Meeja McAllisterThe Walter GroupThe Walter GroupUnanchored StripAnchored StripAnchored StripAnchored StripAnchored StripFree StandingUnanchored StripFree StandingUnanchored StripUnanchored StripUnanchored Strip1,090 50SalesInvestmentGrandma's AtticSinclair Station & Mexican RestaurantSuper 8 Motel, Salina UTLand1.2 Acres of Industrial Land2.02 Commercial Acres in Virgin1.9 Acres East of Stock Building Supply14.13 Acres in Fremont20.59 Acres in Fremont7.05 Acres in LeedsFt. Pierce Industrial Park, Lot 154Garfield County AcreagePine View Commercial CenterRetailSunland Commercial5,000 SF The Walter Group4,270The Chappell Team40,900The Chappell Team1.20 AC2.021.9014.1320.597.051.816.310.69Wes DavisThe Walter GroupJason Griffith, Meeja McAllister, & The Chappell TeamThe Chappell TeamThe Chappell Team & Brandon VandermydeThe Walter GroupThe Walter GroupThe Walter GroupRyan Garrett & Brandon Vandermyde1,600 SF Wes DavisRetail StoreFree lMulti-Family/ResidentialRetail/OfficeUnanchored StripVisit www.naiutahsouth.com to read press releases of our latest transactions.42007 3rd Quarter Market Report Copyright 2007 NAI Utah Southern Region All Rights Reserved

3rd Quarter.Happenings Around Town Barnes & Noble announced a new storeat Red Cliffs Mall. The store will stockclose to 200,000 book, music, DVD &magazine titles, & include a café servingStarbucks coffee, according to a pressrelease from Red Cliffs Mall. Festival Plaza, the newest retail center toSt. George, located next to Sportsman’sWarehouse & Costco, held its GrandOpening on July 10th, 2007. The centerhas filled up quickly, with many new &existing retailers. LaneBryant,thenation’slargestwomen’s plus-size specialty apparel, willopen a new location at Red Cliffs Mall.Lane Bryant is the most recognizedOther Notable Happeningsname in plus-size clothing, with an em- Coldwater Creek, a National retailer ofwomen’s apparel, jewelry, gift, &accessories, announced a new locationin Red Cliffs Mall.phasis on fashion. new location in St. George, its third in Instacare opened a new facility onUtah. Tai-Pan Trading Wholesale HomeSunset.Decor has been an importer/wholesaler FAA grants 7 million for airport landsupplying the home décor markets alongpurchase.the Rocky Mountain region since 1979. Tonaquint Data Center broke ground onSept. 10. Pizza Factory Pineview opened forbusiness. hair. A Paul Mitchell Partner School hasopened in Washington.Tai Pan Trading Company is building a Chico's opened at Red Cliffs Mall.Chico’s is the leading specialty retailer ofprivate branded sophisticated, casual-todressy women’s clothing & accessories. Noble Roman’s held its grand openingat the Shoppes at Telegraph.All Rights Reserved - 2007 3rd Quarter Market Report NAI Utah Southern Region5

Commercial Market OverviewSt. George AreaIndustrial MarketLease Rates (NNN)LowAverageHighTotal Vacancy2006 InventoryBuilt in '07 YTDYTD InventoryUnder ConstructionLease Rates (NNN) Class ALow 1.20Average 1.36High 1.506.63%VacancyTotal Vacancy2006 InventoryBuilt in '07 YTDYTD InventoryUnder Construction 0.54 0.59 0.756.91%6,692,000648,0007,340,000196,000ReviewThe number of projects completed during the first six months of theyear resulted in an anti-climatic third quarter for industrial. The RedHills Commercial building, in the old St. George Industrial Park, & theDixie Metal Recycling building were the notable completions for thequarter. With all of the new space available, the once super-hotindustrial market finally has enough supply for the market tostabilize. Vacancy rates edged slightly higher, & lease ratesdropped slightly, signaling a peak in the 2004-2007 industrial fervor.For tenants, the number of spaces at less than 5,000 SF can still bedifficult to find — if the tenant isn’t flexible with location. For spaceslarger than 5,000 SF & even up to over 100,000 SF, there are manymore options than our market has seen in recent history.OutlookThe industrial market has stabilized with the recent surge in supply.For landlords, rising lease rates & abnormally low vacancy rates area thing of the past. As an economic development zone, Fort PierceIndustrial Park will continue to see relatively suppressed supplybecause of restrictions on the development of investment properties. On the other hand, Gateway has seen significant spec buildingin anticipation of strong tenant demand in Washington County. If atenant or a user can be flexible with their location, there should beplenty of opportunities to find space to lease—particularly largerspace—through this quarter & into 2008.Class B 1.05 1.17 1.303.24%Class C 0.91 0.96 ewThe office market saw 100,000 SF of space built over the pastquarter, in addition to the 110,000 SF built during the first half of theyear. There is just under 200,000 SF under construction & another183,000 announced. We have been cautioning property ownersabout the impending correction in the office market since the end of2006. At just under 5%, Class A vacancies have risen primarily dueto new construction. Beginning in 2002, Class A office lease rateswere at 1.25 per SF NNN compared, with 1.36 today. This represents a mere 8% increase over five years, in contrast with nationaltrends that have risen more sharply. New additions to the marketplace include the S&S Office Building & Rim Rock Commercial Center near Olive Garden, Workers’ Compensation Fund of Utah’s building in Tonaquint, the Bloomington Executive Suites building, & twosmaller buildings—one on Sunset Boulevard & one in Ventana.OutlookWith long-run absorption rates around 170,000 SF per year, 2007 isalready over that mark with additional properties anticipated to finishconstruction in the fourth quarter. The pipeline for new constructioninto 2008 is also filling up. As with many of the recently constructedbuildings, absorption will be primarily from owner/users & excessspace will be coming on the market. As a result, property ownerscan expect to see continued pressure on lease rates & risingvacancies through the end of the year & into 2008. Some of thenew projects coming online in the 4th quarter include Boulevard Center Building C, the Chiniquy Center, South Main Plaza #2, & the Legacy Professional Building.Industrial Vacancy by Quarter12%St. George AreaOffice Market25%10%Office Vacancy by s-B5%2%0%Q4 '02 6Q4 '03Q4 '04Q4 '05Q4 '06Q1 '07Q2 '070%Q3 '07Sample includes 817,531 SF. Inventory includes only buildings over 6,000 SF; excludes storage locations.Q4 '02 Q4 '03Q4 '04Q4 '05Q4 '06Q1 '07Q2 '07Q3 '07Sample includes 1,170,946 SF. Inventory includes only buildings over 4,000 SF; excludes government &hospital locations.2007 3rd Quarter Market Report Copyright 2007 NAI Utah Southern Region All Rights Reserved

Commercial Market OverviewSt. George AreaRetail MarketLease Rates (NNN) Class ALow 1.50High 2.25Average 1.825.92%VacancyTotal Vacancy2006 InventoryBuilt in '07 YTDYTD InventoryUnder ConstructionLease Rates (NNN)Ind.Low 0.50Average 0.59High 0.807.20%VacancyTotal Vacancy2006 InventoryBuilt in '07 YTDYTD InventoryUnder ConstructionClass B 1.20 1.75 1.514.03%Class C 1.00 1.35 ewWe continue to see strong retail expansion, lease rate stability, &more national tenants. Over the past two years, retail has been avery good market. Lease rates nudged up to 1.82 per SF foranchored space. Year-to-date, 310,000 SF of new retail space hascome online, with another 360,000 under construction, & more than380,000 announced. With all of the new construction, we haveseen vacancy rates move higher. National, regional, & local tenantsare expanding into more than one location, such as the opening ofthe new Staples, which provides stability to growth & drives traffic tonew commercial centers. Projects with good accessibility & visibilityare still attracting tenants quickly, & higher vacancy rates are not acause for concern, for desirable properties, at this point.Cedar CityIron CountyOffice Retail 0.90 1.09 1.09 1.29 1.35 1.3517.10% 21.00%IndustrialAt 0.59 per SF, industrial lease asking rates are slightly lower thanlast quarter & vacancy rates have dipped slightly. There is newoffice warehouse space available on Industrial Road & just off ofHighway 56. More is coming on Highway 56 & in Port 15 &construction at the Charlotte Pipe facility is also moving along nicely.For large users, there are still existing facilities for lease & there isample ground for developers of warehouse, flex, or manufacturingspace. Industrial is a bright spot in the area.OfficeThe office market is still quite soft, particularly in the medical officesegment. Office space has remained available near the hospital, onSouth Main Street, & on Royal Hunt Drive for more than a year.Lease rates are about the same as last quarter & vacancy rates areOutlookAbsorption in the retail sector has been very strong & will continue similar to the first quarter vacancy rates. New office construction isas long as the county continues to see strong growth. With long- nearly at a stand-still right now, although we should start seeingrun absorption at around 380,000 SF per year, we are not seeing absorption over the next couple of quarters.enough development to risk becoming overbuilt, yet. The nationalheadlines our community has seen have spurred expansion, & it will Retailbe important to watch expansion patterns of national tenants & retail Retail vacancy rates remain high, although there is absorption in thesales growth in our community to make sure development doesn’t market. Average asking lease rates appear to be stable, althoughget ahead of demand. Even with our rapid growth, there are a num- the high end of the market has dropped 0.13 reflecting landlord'sber of national & regional retailers who haven’t entered our market. willingness to make concessions. Construction continues at a briskOver the coming months, look for a new Robert’s Crafts location pace. At the Providence Center, two multi-tenant building & a Walnext to Kohls, the completion of buildings around Texas Roadhouse greens are under construction or nearly completed. Jimmy John’s &Grill, completion of improvements at the Red Cliffs Mall, grand open- the Comfort Inn should be finished in the next quarter & Bealls isings for tenants at Festival Plaza, continued expansion at Sunset renovating a space next to Staples.Corner, & announcements of new tenants at Red Cliffs Square.Retail Vacancy by cancy 3rdby l4%2%5%Class-C0%Q4 '02 Q4 '03Q4 '04Q4 '05Q4 '06Q1 '07Q2 '070%Q3 '07Sample includes 1,124,138 SF. Inventory includes only buildings over 5,000 SF; excludes vehicle related &financial locations. Q1 Q2 Q3Q1 Q2 Q3Q1 Q2 Q3IndustrialOfficeRetailIndustrial sample includes 104,569 SF. Office sample includes 171,926 SF. Retail sample includes306,676 SF.All Rights Reserved - 2007 3rd Quarter Market Report NAI Utah Southern Region7

NAI professionals are virtually everywhere – from Los Angeles to London, Memphis to Mexico City – in over 350 offices worldwide.Experienced local professionals in primary, secondary & tertiary markets are fluent in the local languages & customs, have deep roots intheir communities & can guide your way in real estate decision-making as your company operates in new & existing markets.We know our markets intimately, & are on familiar terms with majorproperty owners, tenants (occupiers) & government agencies.NAI Global is the world's leading managed network of more than 350commercial real estate firms spanning the globe. Since 1978, ourclients have built their businesses on the power of our expandingnetwork. NAI Global’s extensive services include multi-siteacquisitions & dispositions, sublease, tenant representation, leaseadministration & audit, investment services, due diligence &related consulting & advisory services.Landlord Representation Tenant Representation Investment Sales Corporate Services Retail ConsultingOver 100 Years Combined Real Estate ExperienceMark WalterJason GriffithJoseph IwanskiMary IwanskiAllene EnglandSandy WhiteWes DavisNeil WalterJon WalterJohn GriffithMathew Chappell17 Local Agents3 Agents with CCIM Designation3 Agents with Masters Degrees inManagementPatriciaChappellPatricia Chap

Tonaquint Data Center broke ground on Sept. 10. Pizza Factory Pineview opened for business. hair. A Paul Mitchell Partner School has opened in Washington. Noble Roman’s held its grand opening at the Shoppes at Telegraph. Barnes & Noble annou