Transcription

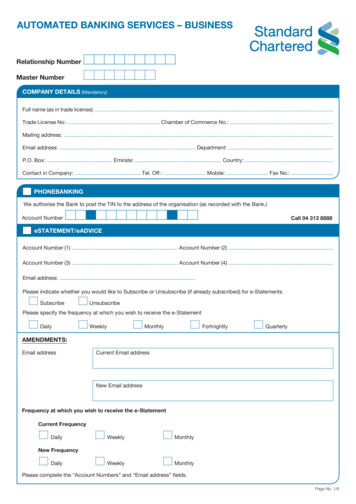

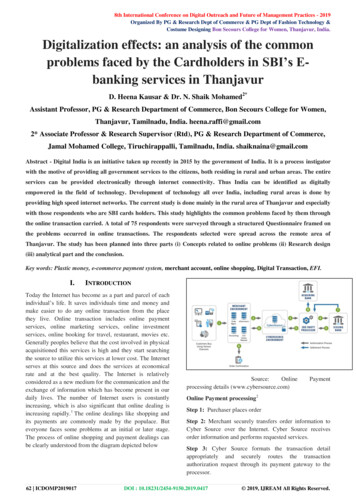

8th International Conference on Digital Outreach and Future of Management Practices - 2019Organized By PG & Research Dept of Commerce & PG Dept of Fashion Technology &Costume Designing Bon Secours College for Women, Thanjavur, India.Digitalization effects: an analysis of the commonproblems faced by the Cardholders in SBI’s Ebanking services in ThanjavurD. Heena Kausar & Dr. N. Shaik Mohamed2*Assistant Professor, PG & Research Department of Commerce, Bon Secours College for Women,Thanjavur, Tamilnadu, India. heena.raffi@gmail.com2* Associate Professor & Research Supervisor (Rtd), PG & Research Department of Commerce,Jamal Mohamed College, Tiruchirappalli, Tamilnadu, India. shaiknaina@gmail.comAbstract - Digital India is an initiative taken up recently in 2015 by the government of India. It is a process instigatorwith the motive of providing all government services to the citizens, both residing in rural and urban areas. The entireservices can be provided electronically through internet connectivity. Thus India can be identified as digitallyempowered in the field of technology. Development of technology all over India, including rural areas is done byproviding high speed internet networks. The current study is done mainly in the rural area of Thanjavur and especiallywith those respondents who are SBI cards holders. This study highlights the common problems faced by them throughthe online transaction carried. A total of 75 respondents were surveyed through a structured Questionnaire framed onthe problems occurred in online transactions. The respondents selected were spread across the remote area ofThanjavur. The study has been planned into three parts (i) Concepts related to online problems (ii) Research design(iii) analytical part and the conclusion.Key words: Plastic money, e-commerce payment system, merchant account, online shopping, Digital Transaction, EFI.I.INTRODUCTIONToday the Internet has become as a part and parcel of eachindividual’s life. It saves individuals time and money andmake easier to do any online transaction from the placethey live. Online transaction includes online paymentservices, online marketing services, online investmentservices, online booking for travel, restaurant, movies etc.Generally peoples believe that the cost involved in physicalacquisitioned this services is high and they start searchingthe source to utilize this services at lower cost. The Internetserves at this source and does the services at economicalrate and at the best quality. The Internet is relativelyconsidered as a new medium for the communication and theexchange of information which has become present in ourdaily lives. The number of Internet users is constantlyincreasing, which is also significant that online dealing isincreasing rapidly.1 The online dealings like shopping andits payments are commonly made by the populace. Buteveryone faces some problems at an initial or later stage.The process of online shopping and payment dealings canbe clearly understood from the diagram depicted below62 ICDOMP2019017Source:Onlineprocessing details (www.cybersource.com)PaymentOnline Payment processing2Step 1: Purchaser places orderStep 2: Merchant securely transfers order information toCyber Source over the Internet. Cyber Source receivesorder information and performs requested services.Step 3: Cyber Source formats the transaction detailappropriately and securely routes the transactionauthorization request through its payment gateway to theprocessor.DOI : 10.18231/2454-9150.2019.0417 2019, IJREAM All Rights Reserved.

International Journal for Research in Engineering Application & Management (IJREAM)ISSN : 2454-9150 Special Issue - ICDOMP’19Step 4: The transaction is then routed to the issuing bank(purchaser's bank) to request transaction authorization.Step 5: The transaction is authorized or declined by theissuing bank or card (Discover, American Express).Step 6: Cyber Source returns the message to the merchant.Step 7: Issuing bank approves transfer of money toacquiring bank.Step 8: The acquiring bank credits the merchant's account.II.CONCEPTS RELATED TO ONLINETRANSACTIONPLASTIC MONEY: It is an electronic module where allthe information about the client or the card holder and thebank are stored and can be executed by putting it in theATM and at the Point of Sales terminal. It may be in theform of Debit card, credit card, ATM card, store card,Precash card etc.E-COMMERCE PAYMENT SYSTEM: it facilitates theacceptance of electronic payment for online transactions. Itis also known as a Electronic Data Interchange (EDI). Thissystem is introduced to use green transaction ie., Paper lessmoney Transaction.MERCHANT ACCOUNT: It is a type of bank account orbusiness account of a trader or merchant with bank whereall the funds paid through plastic money are deposited inthis business account. It accepts Visa, MasterCard,American Express or any other debit or credit card forpayments.ONLINE SHOPPING: It is a form of e-commerce, whereconsumers can directly buy goods or services from a sellerover the Internet by referring the online shopping zone.There are multiple zone which displays the differentproduct's availability and pricing at different e-retailers.The consumer can select the product and can use online oroffline option of payment option for such product andrequest for delivery to their convenient location.DIGITAL TRANSACTION: A digital transaction is aseamless system involving one or more participants, wheretransactions are effected without the need for cash. Digitaltransaction involves a constantly evolving way of doingthings where financial technology companies collaboratewith various sectors of the economy for the purpose ofmeeting the increasingly sophisticated demands of thegrowing tech-savvy users.3ELECTRONIC FUND TRANSFER: It is a popularelectronic payment method to transfer money from onebank account to another bank account. It can be operatedself by the customer in online and can also use NEFT,RTGS to transfer money but in this case the customer has todepend upon the bank to transfer the fund.63 ICDOMP2019017III.REVIEW OF RELATED LITERATUREGoyal and Goyal (2012)4 studied that an analysis of thedifferences in risk perceptions between bank customersusing i-banking and those not using internet banking wasdone and the study showed that risk perceptions in terms offinancial, psychological and safety risks among customernot using the internet was more meaningful than thoseusing internet banking. Customers not preferring to use ibanking thought that they would be swindled when usingthis service and therefore, are particularly careful abouthigh risk expectation during money transfers from andbetween accounts. Private and foreign banks are trying toturn more and more customer towards the usage of internetfor the banking transaction.Smith and Rupp (2003)5 have examined and identify thefactors in their work that affects the behaviour ofconsumers. These issues have been identified as for themarketing effort, socio-cultural influence, emotional factor,the psychological factors and privacy factors, to theexperience, the purchase and post -purchase decisions.They also show that consumers are affected by variouspsychological factors, such as perception, motivation,personality, attitudes and emotions.Kaufman-Scarbrough, Carol; Linquist, Jay D (2002) 6This study finds more differences between the behaviour offrequent and occasional online shoppers, and greatersimilarities between occasional shoppers and non-onlineshoppers. Those consumers who shop online frequently aremore confident, spend more money when they shop onlinein their home country, and also shop more cross-border.While they do worry about issues such as delivery andreturning goods, they also tend to be savvier on how tosolve problems when they do occur. Therefore encouragingand developing online shopping at national level is likely toincrease cross-border shopping as well.Rachel & Caterina, (2012)7 According to the study of trustin e-commerce what might makes consumers worry islosing money while not getting products in online shopping.In another word, they get defrauded by Internet frauds.Based on most the shared information about those frauds(Web Of Trust), two most common Internet frauds is:Phishing and malwareObjectives of the study To study the problems faced by SBI card holdersin E- services. To give appropriate suggestion to the customer toovercome this problems.Statement of the problemIt was once upon a time in India that most of theconsumers are heavily dependent only on the casheconomy; they have been using cash in hand for purchaseof products and service. As continuation of demonetizationprocess, now the consumers have to switch from cash toDOI : 10.18231/2454-9150.2019.0417 2019, IJREAM All Rights Reserved.

8th International Conference on Digital Outreach and Future of Management Practices - 2019Organized By PG & Research Dept of Commerce & PG Dept of Fashion Technology &Costume Designing Bon Secours College for Women, Thanjavur, India.cashless electronic transactions. Currently the governmenthas restricted the traditional cash transaction and offers forelectronic transfer. The consumers are push to adopt andimplement cashless transaction for their needs. ThoughIndia is marching towards cashless economy, still there arecomplications and lack of awareness in using the plasticmoney and especially in E-transaction. Therefore this studymakes an attempt to analyze the problems faced by the SBIcard holders in online services.Scope of the studyThe present study has wide scope. This studyhighlights the problems arouse in Internet transfers,Telephone banking, Mobile Banking problems etc. It coversthe opinion of the SBI card holders who have experiencedthe problem in online dealings. It also covers the stepsinvolved in online purchase and payment processing.IV.RESEARCH DESIGNRESEARCH METHODOLOGY: This is the surveymethod of research based on Primary data. An attemptwas made to analysis of the common problems faced by theSBI Cardholders in E- Services in Thanjavur.SOURCES OF DATA: The research works with bothprimary and secondary data’s. The information required forthe study was collected from the respondents usingstructured questionnaire as a primary source. Secondarydata’s’ are referred from books, reports, journals, internetand like.STATISTICAL TOOLS: The collected data has beenrepresented in the form of Table. The data has been furthersimplified into percentage for easy understanding. Simplestatistical analysis such as descriptive statistical analysis,frequency distribution, cross tabulation, Chi square test, andcorrelation test is also applied to test the independence ofthe variables.Sampling designThe sampling design describes the sample size, samplingmethod and Universe of the current research studied.SAMPLE SIZE: The study is mainly based on the primarydata collected by the researcher. Questionnaire method ofdata collection has been exclusively used for this purpose.The data has been collected from 75 respondents. Eachrespondent fills separate questionnaire. The questionnaire isfarmed in such a way that could help to find out solution forthe objective of the study.SAMPLING METHOD:Since the population isindefinite, convenience method of sampling is used in orderto collect data from the respondents. The data was collectedin person using a structured questionnaire from therespondent regularly opt E- services and experienced theproblems faced in online dealing from Thanjavur areselected.UNIVERSE OF THE STUDY: The universe for the studyto analyze the problems faced by the SBI card holders inonline dealings is Thanjavur city.64 ICDOMP2019017PERIOD OF THE STUDYPeriod of the study is four months from the month ofDecember 2017 to March 2018.Limitations of the study The findings of the study are purely an outcome ofthe responses given by the sample respondents. Due to time availability, the sample size was takenas up to 75 respondents The findings of the study may be relevant only tothe study area viz., Thanjavur. The cardholder’s responses are subject to personalbias.V.ANALYSIS AND DISCUSSION1. Personal Back ground 77 % of respondents studied were female.65 % of the respondents were in 18-25 age group41% of the respondentsundergraduate degree.havecompleted64 % of the respondents studied were unmarried.40 % respondents of card holders were self employed43 % of the SBI customers opined their incomeranges between Rs.10,000- Rs. 20000 63 % of the respondents used the card for a periodof 1-5 years.2. SBI’s Service Quality 41 % of the respondents opined quality of serviceas the best attribute of SBI. 41% of the respondents have referred the qualityof service insisted to use new techniques.3. Customers awareness on Net services 43 % of respondents have average knowledge incomputer usage level. 40 % of the respondents have knowledge in theoperating ATM/Debit card in net.4. Customer perception on SBI’s level of Technologya) INTERNET SERVICES 27 % of respondents are highly satisfied withbalance inquiry through internet 59 % of respondent are satisfied in account toaccount transfer made through internet51 % of the respondents opined neutrally to thedues verification through internet.60% of the respondents are satisfied with theobligation of statement request using internet.b) BANKING SERVICESDOI : 10.18231/2454-9150.2019.0417 2019, IJREAM All Rights Reserved.

International Journal for Research in Engineering Application & Management (IJREAM)ISSN : 2454-9150 Special Issue - ICDOMP’19 VI.69 % of respondent belongs to satisfied on up-todate technology.59% of the respondents are satisfied with easelocation of the bank.60% of the respondents have felt satisfied with thesufficient number of ATM machines available.41% of the respondents have felt satisfied andopined that number of cash counting machines areavailable in the bank and it saves their time.PROBLEMS FACED BY THE RESPONDENTSa) Problems in E – Banking services 56 % of the respondents felt rarely feel thatinternet banking doesn’t give fast response.47%of the respondents have felt that the internetoperation has been felt unfinished.45 % of the respondents felt internet bankingtransactions can be tampered by others.b) Telebanking Problem 41 % of the respondents have rarely felt toimmediate connection to access the service is notavailable. Basedon NofItems14Source:Primary data (Output generated from SPSS 21)A reliability analysis was carried out on the task ofmeasuring the problems faced by the SBI card holders in EBanking transactions comprising 14 items. Cronbach’salpha showed the questionnaire to reach acceptablereliability, α 0.768. The alpha coefficient for the fourteenitems is 0.768, suggesting that the items have relativelyhigh internal consistency. Most items appeared to beworthy of retention, resulting in a decrease in the alpha ifdeleted. The one exception to this was online statementinquiry, which would increase the alpha to α 0.774. Assuch, removal of this item should be considered.Factor AnalysisKMO and Bartlett's y.Bartlett'sTestof Approx. Chi-Square369.498Sphericitydf171Sig.000Source: Primary data(Output generated from SPSS 21)44 % of the respondents have rarely experienced tothe lack of guidelines through Telebanking.c) M-banking Problems Reliability StatisticsCronbach'sCronbach's AlphaAlphaStandardized Items.768.77043 percent of respondents are never felt login/signoff as easy through mobile banking.63 % of the respondents have never felt insecure inbanking transaction.VII.Kaiser – Meyer – Olkin measure of sampling adequacyindex is 0.569, which indicates that factor analysis isappropriate for the given data set. KMO measure ofsampling adequacy is an index to examine theappropriateness of factor analysis. Bartlett’s test ofSphericity Chi-square statistics is 369.498, which wouldmean the 14 statements are correlated and hence asconcluded in KMO, factor analysis is appropriate for thegiven data set.STATISTICAL ANALYSISReliability TestANOVA test between Profession and problems in internet banking transactionsE-Banking Transaction FamiliarityCustomer Technology levelAccounting details InquiryE-Payment services65 ICDOMP2019017Between GroupsWithin GroupsTotalBetween GroupsWithin GroupsTotalBetween GroupsWithin GroupsTotalBetween GroupsWithin GroupsTotalSum of .99722.0008.46931.31739.787DOI : Mean Square1.8500.578FSig.3. 43.732.005 2019, IJREAM All Rights Reserved.

8th International Conference on Digital Outreach and Future of Management Practices - 2019Organized By PG & Research Dept of Commerce & PG Dept of Fashion Technology &Costume Designing Bon Secours College for Women, Thanjavur, India.A/c to A/c TransferDue inquiry in netRequisition for Statement through netBank Updating knowledgeTelecommunication clarificationLack of internet operating GuidelinesLogin is uneasyFelt unsecuredBanking with new technologyLeaving operation unfinishedBetween GroupsWithin GroupsTotalBetween GroupsWithin GroupsTotalBetween GroupsWithin GroupsTotalBetween GroupsWithin GroupsTotalBetween GroupsWithin GroupsTotalBetween GroupsWithin GroupsTotalBetween GroupsWithin GroupsTotalBetween GroupsWithin GroupsTotalBetween GroupsWithin GroupsTotalBetween GroupsWithin 1Source: Primary data (Output generated from SPSS 21) The differences in the mean of samples based onthe E-Banking Transaction Familiarity and thedifferences in the mean of samples based on theprofession of respondents are Significant. The differences in the mean of samples based onthe Customer Technology level and thedifferences in the mean of samples based on theprofession of respondents are Insignificant The differences in the mean of samples based onthe Accounting details Inquiry and thedifferences in the mean of samples based on theprofession of respondents are Significant. The differences in the mean of samples based onthe E-Payment services used for onlineshopping and the differences in the mean ofsamples based on the profession of respondents areSignificant. The differences in the mean of samples based onthe A/c to A/c Transfer using NEFT & RTGSthrough internet and the differences in the meanof samples based on the profession of respondentsare Significant.66 ICDOMP2019017 The differences in the mean of samples based onthe Due inquiry through internet and thedifferences in the mean of samples based on theprofession of respondents are Significant. The differences in the mean of samples based onthe Requisition for Statement for reference andthe differences in the mean of samples based onthe profession of respondents are insignificant. The differences in the mean of samples based onthe Bank updating awareness information andthe differences in the mean of samples based onthe profession of respondents are insignificant. The differences in the mean of samples based onthe Tele communication clarification and thedifferences in the mean of samples based on theprofession of respondents are insignificant. The differences in the mean of samples based onthe clarity of internet language and thedifferences in the mean of samples based on theprofession of respondents are Significant. The differences in the mean of samples based onthe Login and the differences in the mean ofDOI : 10.18231/2454-9150.2019.0417 2019, IJREAM All Rights Reserved.

Internationa

Precash card etc. E-COMMERCE PAYMENT SYSTEM: it facilitates the acceptance of electronic payment for online transactions. It is also known as a Electronic Data Interchange (EDI). This system is introduced to use green transaction ie., Paper less money Transaction. M