Transcription

Foreign Source Income Exemption (FSIE) Regimefor Passive Income7 July 2022

Our SpeakersAnthony LauPolly WanRegional LeaderPartnerInternational Tax and M&A ServicesGlobal Business Tax ServicesSouthern ChinaTel: 852 2852 6704Tel: 852 2852 1082Email: pwan@deloitte.com.hkEmail: antlau@deloitte.com.hkYiu Hong ChungJackie WongDirectorDirectorInternational Tax ServicesGlobal Business Tax ServicesTel: 852 2531 1455Tel: 852 2238 7421Email: yhchung@deloitte.com.hkEmail: jackiewong@deloitte.com.hk 2022. For information, contact Deloitte China.3

Agenda1Background6Nexus approach2Overview of the FSIE regime7Unilateral tax credit3Scope8Compliance requirements4Economic substance requirement9Way forward5Participation exemption 2022. For information, contact Deloitte China.10Summary4

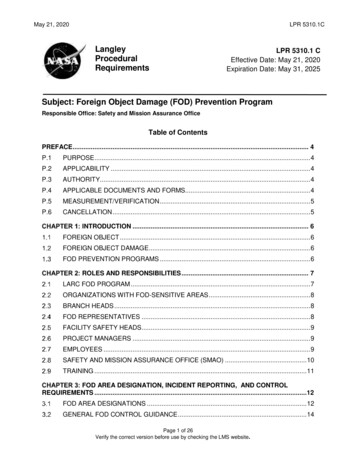

Background5 Oct 2021 EU completed the review of Hong Kong’sterritorial source tax regimeEU included Hong Kong in its “watchlist”June 2022 A consultation paper on the proposedrefinement to the FSIE regime for passiveincome was issued by HK government tostakeholdersOct 2021Hong Kong responded that it wouldamend its tax law by 31 Dec 2022with the revised rules taking effecton 1 Jan 2023 territorial source principle of taxationwill continue limited target (no substantial economicactivity in HK that receive passiveincome not chargeable to tax in HK)Oct 2022 (target)Introducedraft legislation1 Jan 2023 (target)Effective In-scope offshore passive incomewould be deemed taxable if certainconditions are not met 2022. For information, contact Deloitte China.5

Overview of the FSIE regimeCovered offshore ‘passive’ income Interest Dividends Disposal gains in relation toshares or equity interests Income from intellectualproperties (IP)Received in HKEconomicsubstancerequirementfor dividends /disposal gains mesecond chance fordividends / disposalgainsMNE groupNexus RuleThe proposedrefinements to FSIEregime will only affectmultinationalenterprise (MNE)groups as defined bythe GloBE Rules. 2022. For information, contact Deloitte China.Dividends / disposal gains Dividends / disposal gains that areremitted and do not qualify forsubstance based exemption may qualifyfor participation exemptionfor IP IncomeIntellectual property income Specific rule for income from IPreceived in HK Exemption based direct IP expensesin HK over total IP expensesUnilateral taxcreditApplies where FSIE does not apply applicable to passive incomefrom non-CDTA jurisdictions6

Scope 2022. For information, contact Deloitte China.7

ScopeOffshore passive incomeDividendsDisposal gainson shares / equity interest InterestIP incomeReceived in Hong Kongby a constituent entity of an MNE group irrespective of revenue or asset size GloBE definition – a group that includes at least one entity or permanent establishment (PE) that is notlocated in the jurisdiction of the ultimate parent entity 2022. For information, contact Deloitte China.8

“Received in” No clear definition of "received in Hong Kong" in the consultation paperFor Singapore, under Section 10(25) of the Income Tax Act 1947, income from outside Singapore is considered “received inSingapore” when it is:Remitted to, transmitted or brought into Singapore;Used to satisfy any debt incurred in respect of a trade or business carried on in Singapore; orUsed to purchase any movable property (such as equipment, raw material, etc.) brought into Singapore. 2022. For information, contact Deloitte China.9

Economic substance requirement 2022. For information, contact Deloitte China.10

Economic substance requirementFor non-IP incomeSubstantial economic activities Relevant activities for the passive incomeE.g. making necessary strategic decision,managing and assuming principal risksAdequacy testIn relation to the relevant activities: Adequate no. of qualified employees in HK Adequate operating expenditures in HK 2022. For information, contact Deloitte China.Outsourcing Permitted with adequate monitoringOutsourced activities conducted in HK11

Economic substance requirementExample: Outsourcing to employment entity Company A serves as the group employment entity and employsall front office and back office staff.Company Aremuneration Company A enters into transactions on behalf of Company B andtherefore books to Company B’s accounts.Company BEmploymentcontacts Company A is remunerated through appropriate transfer pricingarrangements.Equity trading transactions Company B has no, or few, direct employees.Substance has been effectively outsourced. Adequate monitoring? 2022. For information, contact Deloitte China.12

Economic substance requirementPure equity holding companyPure equity holdingcompany Primary function: acquires and holdsshares or equitable interests incompanies Only earns dividends and disposalgainsReduced substantialactivities testRelevant activities Holding and managing its equityparticipation Complying with the corporate lawfiling requirement in Hong KongCategory 2022. For information, contact Deloitte China.13

Economic substance requirementInterest incomeSimple loanFinancing business Offshore: provision of credit test Offshore: operation test FSIE: economic activities in HK FSIE: economic activities in HKWhat substance is required fora one-off simple loan? 2022. For information, contact Deloitte China.Source of profits?14

Participation exemption 2022. For information, contact Deloitte China.15

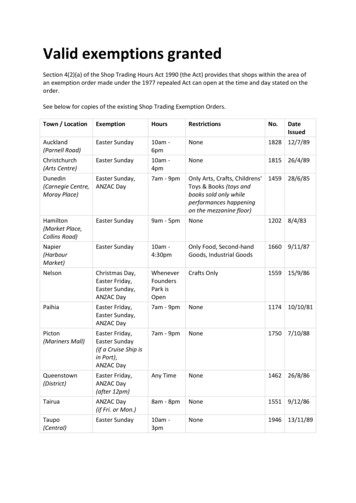

Participation exemptionFor dividends and disposal gainsCo. A(Investor Co.)DividendShareholding 5%Co. B(Investee Co.)HK resident person/PE in HKHK incorporated; orNon-HK incorporated withmanagement or control in HKShareholding5%Hold at leastof shares ininvestee companyPassive incomeInvestee company’s income: notmore than50% passive income 50% passive income 2022. For information, contact Deloitte China.16

Participation exemptionAnti-abuse rulesSwitch-over ruleIf the income or the profitsof the investee companyare subject to tax in aforeign jurisdiction wherethe headline tax rate isbelow 15%, the tax reliefavailable to the investorcompany will switch overfrom the participationexemption to foreign taxcredit relief.Main purpose ruleAnti-hybrid mismatch ruleRobust anti-abuse rules #No participation exemptionis available if the mainpurpose or one of the mainpurposes of thearrangement or a series ofarrangements is obtaining atax advantage that defeatsthe object or purpose ofthe exemption.Where the incomeconcerned is dividends, theparticipation exemption willnot apply to the extent thatthe dividend payment isdeductible for the investeecompany.If a covered taxpayer entersinto an artificialarrangement with an intentto avoid the proposeddeeming provisions and inturn the profits tax chargeon any in-scope offshorepassive income, the IRDmay seek to apply s61 and /or s61A.# apply to FSIE regime 2022. For information, contact Deloitte China.17

Participation exemptionMulti-layer holding structureHK Co100%DividendüHK Co: HK resident personüHK Co holds at least 5% of shares in BVI Co BVI Co receives 50% passive incomeBVI Co100%Op Co 2022. For information, contact Deloitte China.DividendThe dividends received by HK Co. may not be qualified for participationexemption because 50% of BVI Co.'s income is passive income.18

Disposal gainsCapital gain on disposal ofoverseas co.Securities trading Current: offshore & capital arguments Offshore: Overseas listed securities FSIE: in-scope regardless of revenue orcapital nature Likely no participation exemption (cannot fulfillthe 5% shareholding requirement) Economic substance requirement In-scope FSIE? Economic substance requirementCapitalargument? 2022. For information, contact Deloitte China.Active income?19

Nexus approach 2022. For information, contact Deloitte China.20

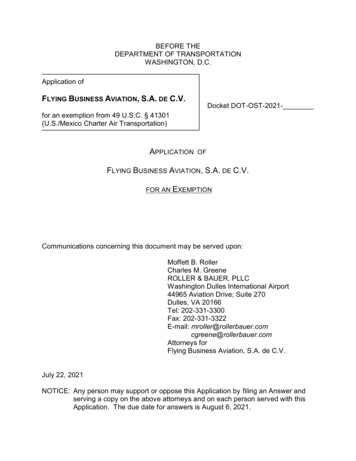

Nexus approachFor IP income2Taxexemptionbased onnexus ratio14- domestic R&Dactivities 2022. For information, contact Deloitte China.30% upliftNexus ratio3JurisdictionalapproachIncomefromqualifying IPü Patentsü IP functionally equivalent to patents (legally protected / approved/ registered)û Marketing-related IP (e.g. trademark, copyright)Exempt income QualifyingexpendituresQualifying expenditures to develop IPIncome fromxqualifying IPOverall expenditures to develop IPü R&D expenditures directly connected to the IPû Acquisition cost of IPü R&D conducted by taxpayer in HKü R&D outsourced to a resident related party in HKü R&D outsourced to an unrelated party in or outside HK21

Unilateral tax credit 2022. For information, contact Deloitte China.22

Unilateral tax creditDouble taxation reliefChargeable to profits taxFail to get exemptionbut has paid tax in a non-CDTA jurisdictionUnilateral Tax Credit 2022. For information, contact Deloitte China.In-scope offshorepassive incomeExempt from profits taxAble to get exemption andhas paid tax in a non-CDTA jurisdictionNo Tax Credit23

Compliance requirements 2022. For information, contact Deloitte China.24

Compliance requirementsNon-IP incomei.ii.General information tobe provided to IRDa) the type(s) of in-scope offshorepassive income received by thetaxpayerb) where and how the incomeconcerned has been receivedc) the types and location of businessactivities undertaken by thetaxpayerwhether the relevant activities have been conducted in Hong Kong; andif the relevant activities have been conducted in Hong Kong,A. the number of qualified employees employed, and the amount ofoperating expenditures incurred, by the taxpayer in Hong Kong toundertake the relevant activities; andB. where the relevant activities have been outsourced, the details of theoutsourced entity and how the taxpayer has exercised monitoring ofthe outsourced activities conducted in Hong Kong.IP incomeHow the nexus approach has been complied with.Participation exemptionFor taxpayer who intends to claim participation exemption,i.the jurisdiction in which the taxpayer is resident for tax purposes;ii. if the taxpayer is not resident for tax purposes in Hong Kong, whether it has a PEin Hong Kong;iii. the details of the shares or equity interest in the investee company held and/ordisposed of by the taxpayer;iv. the details of the investee company’s income;v. (for dividends) the deductibility of the dividend payment by the investeecompany;vi. if the taxpayer intends to claim tax credit, whether and if so how the incomeconcerned and (for dividends) the investee company’s profits are subject to taxin another jurisdiction.The IRD will determine whether:(1) the economic substancerequirement has been met;(2) the nexus approach has beencomplied with;(3) the participation exemption isapplicable;(4) tax credit should be granted,on a case-by-case basis.Tax creditHow the income and the investee company’s profits (for dividends) are subject to taxin another jurisdiction. 2022. For information, contact Deloitte China.25

Way forward 2022. For information, contact Deloitte China.26

Way forward15 July 20224 July 2022Consult LegCo Panel onFinancial Affairs 2022. For information, contact Deloitte China.End of stakeholdersconsultationOctober 2022Introduce theamendment bill into theLegislative CouncilDecember 2022Passage of theamendment bill (target)1 January 2023Legislative amendmentsto take effect (target)IRD’s AdministrativeGuidance27

Summary 2022. For information, contact Deloitte China.28

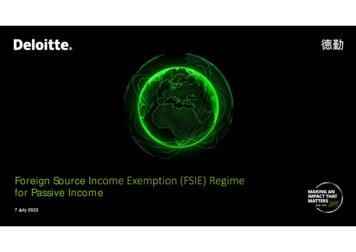

SummaryIn-scope offshorepassive income?NoYesIncome receivedin HK?NoYesBy a CE of anMNE group?NoYesDividends/disposal gainsPure equityholding ancerequirement met?YesYesNoNoYesYesReducedsubstantialactivities testmet?YesEconomicsubstancerequirementmet?Tax exemptNoIncurredqualifying R&Dexpenditure*?YesTax exemptDeemedtaxable#IP income frompatent orequivalent?Interest incomeNoYesDeemedtaxable #Tax exempt(based onnexus ratio)Deemedtaxable #Not impactedby FSIE regime# with foreign tax credit or unilateral tax credit* Qualifying expenditures cover R&D activities undertaken by taxpayer or related 2022. For information, contact Deloitte China.parties in HK or outsourced to unrelated parties in or outside HK29

Q&A 2022. For information, contact Deloitte China.30

EXTERNALAbout DeloitteDeloitte refers to one or more of Deloitte Touche Tohmatsu Limited (“DTTL”), its global network of member firms, and their related entities (collectively, the “Deloitte organization”). DTTL (alsoreferred to as “Deloitte Global”) and each of its member firms and related entities are legally separate and independent entities, which cannot obligate or bind each other in respect of thirdparties. DTTL and each DTTL member firm and related entity is liable only for its own acts and omissions, and not those of each other. DTTL does not provide services to clients. Please seewww.deloitte.com/about to learn more.Deloitte is a leading global provider of audit and assurance, consulting, financial advisory, risk advisory, tax and related services. Our global network of member firms and related entities in morethan 150 countries and territories (collectively, the “Deloitte organization”) serves four out of five Fortune Global 500 companies. Learn how Deloitte’s approximately 345,000 people make animpact that matters at www.deloitte.com.Deloitte Asia Pacific Limited is a company limited by guarantee and a member firm of DTTL. Members of Deloitte Asia Pacific Limited and their related entities, each of which are separate andindependent legal entities, provide services from more than 100 cities across the region, including Auckland, Bangkok, Beijing, Hanoi, Hong Kong, Jakarta, Kuala Lumpur, Manila, Melbourne,Osaka, Seoul, Shanghai, Singapore, Sydney, Taipei and Tokyo.The Deloitte brand entered the China market in 1917 with the opening of an office in Shanghai. Today, Deloitte China delivers a comprehensive range of audit & assurance, consulting, financialadvisory, risk advisory and tax services to local, multinational and growth enterprise clients in China. Deloitte China has also made—and continues to make—substantial contributions to thedevelopment of China's accounting standards, taxation system and professional expertise. Deloitte China is a locally incorporated professional services organization, owned by its partners inChina. To learn more about how Deloitte makes an Impact that Matters in China, please connect with our social media platforms at www2.deloitte.com\cn\en\social-media.This communication contains general information only, and none of Deloitte Touche Tohmatsu Limited (“DTTL”), its global network of member firms or their related entities (collectively, the“Deloitte organization”) is, by means of this communication, rendering professional advice or services. Before making any decision or taking any action that may affect your finances or yourbusiness, you should consult a qualified professional adviser.No representations, warranties or undertakings (express or implied) are given as to the accuracy or completeness of the information in this communication, and none of DTTL, its member firms,related entities, employees or agents shall be liable or responsible for any loss or damage whatsoever arising directly or indirectly in connection with any person relying on this communication.DTTL and each of its member firms, and their related entities, are legally separate and independent entities. 2022. For information, contact Deloitte China.

Intellectual property income Specific rule for income from IP received in HK Exemption based direct IP expenses in HK over total IP expenses Covered offshore 'passive' income Interest Dividends Disposal gains in relation to shares or equity interests Income from intellectual properties (IP) Received in HK