Transcription

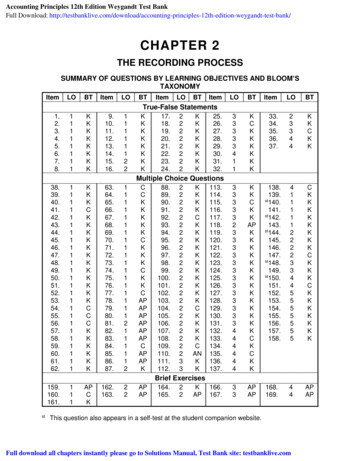

Financial Accounting 3rd Edition Weygandt Solutions ManualFull Download: ER 2The Recording ProcessASSIGNMENT CLASSIFICATION TABLELearning ObjectivesQuestionsBriefExercisesDo It!ExercisesAProblems1.Describe how accounts,debits, and credits areused to record businesstransactions.1, 2, 3, 4, 5, 6,7, 8, 9, 14, 211, 2, , 511, 2, 4, 6, 72.Indicate how a journal isused in the recordingprocess.10, 11, 12, 13,14, 16, 193, 4, 623, 5, 6, 7, 8, 9, 1A, 2A, 3A,11, 12, 13, 14 5A3.Explain how a ledger andposting help in therecording process.15, 177, 8310, 11, 144.Prepare a trial balance.18, 209, 10411, 12, 13, 15, 2A, 3A, 4A,16, 175ACopyright 2018 WILEY. Weygandt, Financial and Managerial Accounting, 3/e, Solutions Manual (For Instructor Use Only)This sample only, Download all chapters at: AlibabaDownload.com2A, 3A, 5A2-1

ASSIGNMENT CHARACTERISTICS e Allotted(min.)1AJournalize a series of transactions.Easy20–302AJournalize transactions, post, and prepare a trial balance.Easy30–403AJournalize and post transactions and prepare a trial balance.Moderate40–504APrepare a correct trial balance.Moderate30–405AJournalize transactions, post, and prepare a trial balance.Moderate40–50Copyright 2018 WILEY Weygandt, Financial and Managerial Accounting, 3/e, Solutions Manual (For Instructor Use Only)

WEYGANDT FINANCIAL AND MANAGERIAL ACCOUNTING 3ECHAPTER 2THE RECORDING PROCESSNumberLOBTDifficultyTime EX32APEasy8–10EX41CEasy6–8EX52APEasy6–8EX61, 2APEasy6–8EX71, 2APEasy8–10EX103CEasy2–4EX113, 4APEasy10–12EX122, 4APModerate10–12EX132, 4APModerate12–15EX142, 0-15EX172–4APHard20–25Copyright 2018 WILEY. Weygandt, Financial and Managerial Accounting, 3/e, Solutions Manual (For Instructor Use Only)2-3

THE RECORDING PROCESS (Continued)NumberLOBTDifficultyTime Moderate40–50CT11CEasy8–10CT21, 2ANEasy8–10CT31, 2ANEasy15–20CT4—AP, SModerate20–30CT5—AP, SModerate10–15CT62, —SModerate40–452-4Copyright 2018 WILEY Weygandt, Financial and Managerial Accounting, 3/e, Solutions Manual (For Instructor Use Only)

Correlation Chart between Bloom’s Taxonomy, Learning Objectives and End-of-Chapter Exercises and ProblemsKnowledgeComprehensionWeygandt, Financial and Managerial Accounting, 3/e, Solutions Manual (For Instructor Use Only)1.Describe how accounts,Q2–1debits, and credits are used to Q2-21record business e how a journal is used Q2-10in the recording process.Q2-12Q2-11Q2-13Q2-14Q2-194.Explain how a ledger andposting help in the recordingQ2-15process.Prepare a trial balance.Expand Your Critical -5 E2-7DI2-1E2-2BE2-1 4P2-1AP2-2AP2-3ABE2-9 E2-13 P2-3A Q2-20DI2-4 E2-16BE2-10P2-5AE2-11 E2-17E2-15E2-12P2-4AP2-2AFinancial ReportingReal–World FocusCommunicationComparative Analysis Communication All About YouEthics CaseDecision-Making Ethics CaseDecision–MakingAcross theOrganizationAcross , Planet,and ProfitBLOOM’S TAXONOMY TABLECopyright 2018 WILEYLearning Objective

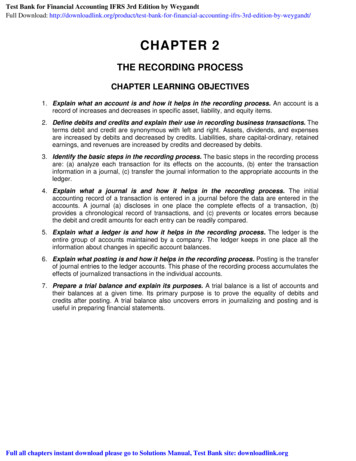

ANSWERS TO QUESTIONS1.A T-account has the following parts: (a) the title, (b) the left or debit side, and (c) the right or creditside.LO 1 BT: K Difficulty: Easy TOT: 1 min. AACSB: None AICPA FC: Reporting IMA: Reporting2.Disagree. The terms debit and credit mean left and right respectively.LO 1 BT: C Difficulty: Easy TOT: 1 min. AACSB: None AICPA FC: Reporting IMA: Reporting3.Tom is incorrect. The double-entry system merely records the dual effect (at least two accountsare affected) of a transaction on the accounting equation. A transaction is not recorded twice; it isrecorded once, with a dual effect.LO 1 BT: C Difficulty: Easy TOT: 1 min. AACSB: None AICPA FC: Reporting IMA: Reporting4.Olga is incorrect. A debit balance only means that debit amounts exceed credit amounts in anaccount. Conversely, a credit balance only means that credit amounts are greater than debitamounts in an account. Thus, a debit or credit balance is neither favorable nor unfavorable.LO 1 BT: C Difficulty: Easy TOT: 2 min. AACSB: None AICPA FC: Reporting IMA: Reporting5.(a) Asset accounts are increased by debits and decreased by credits.(b) Liability accounts are decreased by debits and increased by credits.(c) Revenues, common stock, and retained earnings are increased by credits and decreased bydebits. Expenses and dividends are increased by debits and decreased by credits.LO 1 BT: C Difficulty: Easy TOT: 2 min. AACSB: None AICPA FC: Reporting IMA: Reporting6.(a)(b)(c)(d)(e)(f)(g)Accounts Receivable—debit balance.Cash—debit balance.Dividends—debit balance.Accounts Payable—credit balance.Service Revenue—credit balance.Salaries and Wages Expense—debit balance.Common Stock—credit balance.LO 1 BT: C Difficulty: Easy TOT: 2 min. AACSB: None AICPA FC: Reporting IMA: Reporting7.(a)(b)(c)(d)(e)Accounts Receivable—asset—debit balance.Accounts Payable—liability—credit balanceEquipment—asset—debit balance.Dividends—stockholders’ equity—debit balance.Supplies—asset—debit balance.LO 1 BT: C Difficulty: Easy TOT: 2 min. AACSB: None AICPA FC: Reporting IMA: Reporting8.(a) Debit Supplies and credit Accounts Payable.(b) Debit Cash and credit Notes Payable.(c) Debit Salaries and Wages Expense and credit Cash.LO 1 BT: C Difficulty: Easy TOT: 2 min. AACSB: None AICPA FC: Reporting IMA: Reporting2-6Copyright 2018 WILEY Weygandt, Financial and Managerial Accounting, 3/e, Solutions Manual (For Instructor Use Only)

Questions Chapter 2 (Continued)9.(1)(2)(3)(4)(5)(6)Cash—both debit and credit entries.Accounts Receivable—both debit and credit entries.Dividends—debit entries only.Accounts Payable—both debit and credit entries.Salaries and Wages Expense—debit entries only.Service Revenue—credit entries only.LO 1 BT: C Difficulty: Easy TOT: 2 min. AACSB: None AICPA FC: Reporting IMA: Reporting10.The basic steps in the recording process are:1. Analyze each transaction for its effect on the accounts.2. Enter the transaction information in a journal.3. Transfer the journal information to the appropriate accounts in the ledger.LO 2 BT: K Difficulty: Easy TOT: 1 min. AACSB: None AICPA FC: Reporting IMA: Reporting11.The advantages of using the journal in the recording process are:(a) It discloses in one place the complete effects of a transaction.(b) It provides a chronological record of all transactions.(c) It helps to prevent or locate errors because the debit and credit amounts for each entry canbe easily compared.LO 2 BT: C Difficulty: Easy TOT: 2 min. AACSB: None AICPA FC: Reporting IMA: Reporting12.(a) The debit should be entered first.(b) The credit should be indented.LO 2 BT: K Difficulty: Easy TOT: 1 min. AACSB: None AICPA FC: Reporting IMA: Reporting13.When three or more accounts are required in one journal entry, the entry is referred to as acompound entry. An example of a compound entry is the purchase of equipment, part of which ispaid for with cash and the remainder is on account.LO 2 BT: C Difficulty: Easy TOT: 2 min. AACSB: None AICPA FC: Reporting IMA: Reporting14.(a) No, business transaction debits and credits should not be recorded directly in the ledger.(b) The advantages of using the journal are:1. It discloses in one place the complete effects of a transaction.2. It provides a chronological record of all transactions.3. It helps to prevent or locate errors because the debit and credit amounts for each entrycan be easily compared.LO 2 BT: C Difficulty: Easy TOT: 2 min. AACSB: None AICPA FC: Reporting IMA: Reporting15.The advantage of the last step in the posting process is to indicate that the item has been posted.LO 3 BT: K Difficulty: Easy TOT: 1 min. AACSB: None AICPA FC: Reporting IMA: Reporting16.(a) Cash .Common Stock.(Issued shares of stock for cash)9,000(b) Prepaid Insurance .Cash .(Paid one-year insurance policy)8009,000Copyright 2018 WILEY. Weygandt, Financial and Managerial Accounting, 3/e, Solutions Manual (For Instructor Use Only)8002-7

Questions Chapter 2 (Continued)(c)Supplies .Accounts Payable.(Purchased supplies on account)2,000(d) Cash .Service Revenue .(Received cash for services rendered)7,8002,0007,800LO 2 BT: AP Difficulty: Easy TOT: 4 min. AACSB: Analytic AICPA FC: Reporting IMA: Reporting17.(a) The entire group of accounts maintained by a company, including all the asset, liability, andstockholders’ equity accounts, is referred to collectively as the ledger.(b) A chart of accounts is a list of accounts and the account numbers that identify their locationin the ledger. The chart of accounts is important, particularly for a company that has a largenumber of accounts, because it helps organize the accounts and define the level of detail thata company desires in its accounting system.LO 3 BT: C Difficulty: Easy TOT: 3 min. AACSB: None AICPA FC: Reporting IMA: Reporting18.A trial balance is a list of accounts and their balances at a given time. The primary purpose of atrial balance is to prove (check) that the debits equal the credits after posting. A trial balance alsofacilitates the discovery of errors in journalizing and posting. In addition, it is useful in preparingfinancial statements.LO 4 BT: C Difficulty: Easy TOT: 2 min. AACSB: None AICPA FC: Reporting IMA: Reporting19.No, Juan is not correct. The proper sequence is as follows:(b) Business transaction occurs.(c) Information entered in the journal.(a) Debits and credits posted to the ledger.(e) Trial balance is prepared.(d) Financial statements are prepared.LO 2 BT: K Difficulty: Easy TOT: 2 min. AACSB: None AICPA FC: Reporting IMA: Reporting20.(a) The trial balance would balance.(b) The trial balance would not balance.LO 4 BT: AN Difficulty: Easy TOT: 4 min. AACSB: Analytic AICPA FC: Reporting IMA: Reporting21.The normal balances are Cash debit, Accounts Payable credit, and Interest Expense debit.LO 1 BT: K Difficulty: Easy TOT: 2 min. AACSB: None AICPA FC: Reporting IMA: Reporting2-8Copyright 2018 WILEY Weygandt, Financial and Managerial Accounting, 3/e, Solutions Manual (For Instructor Use Only)

SOLUTIONS TO BRIEF EXERCISESBRIEF EXERCISE 2-11.2.3.4.5.6.Accounts PayableAdvertising ExpenseService RevenueAccounts ReceivableCommon lanceCreditDebitCreditDebitCreditDebitLO 1 BT: C Difficulty: Easy TOT: 6 min. AACSB: None AICPA FC: Reporting IMA: ReportingBRIEF EXERCISE 2-2June 12312Account DebitedCashEquipmentRent ExpenseAccounts ReceivableAccount CreditedCommon StockAccounts PayableCashService RevenueLO 1 BT: C Difficulty: Easy TOT: 4 min. AACSB: None AICPA FC: Reporting IMA: ReportingBRIEF EXERCISE 2-3June 12312Cash .Common Stock .4,000Equipment .Accounts Payable.1,200Rent Expense .Cash .800Accounts Receivable .Service Revenue .3004,0001,200800300LO 2 BT: AP Difficulty: Easy TOT: 4 min. AACSB: Analytic AICPA FC: Reporting IMA: ReportingCopyright 2018 WILEY. Weygandt, Financial and Managerial Accounting, 3/e, Solutions Manual (For Instructor Use Only)2-9

BRIEF EXERCISE 2-4The basic steps in the recording process are:1.Analyze each transaction. In this step, business documents are examinedto determine the effects of the transaction on the accounts.2.Enter each transaction in a journal. This step is called journalizing andit results in making a chronological record of the transactions.3.Transfer journal information to ledger accounts. This step is calledposting. Posting makes it possible to accumulate the effects ofjournalized transactions on individual accounts.LO 2 BT: C Difficulty: Moderate TOT: 5 min. AACSB: None AICPA FC: Reporting IMA: ReportingBRIEF EXERCISE 2-5(a)Aug.Effect on Accounting Equation(b)Debit-Credit Analysis1 The asset Cash is increased; thestockholders’ equity accountCommon Stock is increased.Debits increase assets:debit Cash 5,000.Credits increase stockholders’ equity:credit Common Stock 5,000.4 The asset Prepaid Insurance isincreased; the asset Cash isdecreased.Debits increase assets:debit Prepaid Insurance 1,800.Credits decrease assets:credit Cash 1,800.16 The asset Cash is increased; therevenue Service Revenue isincreased.Debits increase assets:debit Cash 1,900.Credits increase revenues:credit Service Revenue 1,900.27 The expense Salaries and WagesExpense is increased; the assetCash is decreased.Debits increase expenses:debit Salaries and Wages Expense 1,000.Credits decrease assets:credit Cash 1,000.LO 1 BT: C Difficulty: Moderate TOT: 6 min. AACSB: None AICPA FC: Reporting IMA: Reporting2-10Copyright 2018 WILEY Weygandt, Financial and Managerial Accounting, 3/e, Solutions Manual (For Instructor Use Only)

BRIEF EXERCISE 2-6Aug. 141627Cash.Common Stock .5,000Prepaid Insurance.Cash .1,800Cash.Service Revenue .1,900Salaries and Wages Expense.Cash .1,0005,0001,8001,9001,000LO 2 BT: AP Difficulty: Easy TOT: 5 min. AACSB: Analytic AICPA FC: Reporting IMA: ReportingBRIEF EXERCISE 2-7Cash2,1003,2005,3005/125/15Bal.5/5Accounts Receivable5,000 5/12Bal.Service Revenue5/55/15Bal.5,0003,2008,2002,1002,900LO 3 BT: AP Difficulty: Easy TOT: 5 min. AACSB: None AICPA FC: Reporting IMA: ReportingBRIEF EXERCISE 2-8CashDateMay ght 2018 WILEY. Weygandt, Financial and Managerial Accounting, 3/e, Solutions Manual (For Instructor Use Only)Balance2,1005,3002-11

BRIEF EXERCISE 2-8 (Continued)Accounts ReceivableDateExplanationMay 512Ref.J1J1Debit5,000Service RevenueDateExplanationMay 5,0003,200Balance5,0008,200LO 3 BT: AP Difficulty: Easy TOT: 5 min. AACSB: None AICPA FC: Reporting IMA: ReportingBRIEF EXERCISE 2-9FAVRE COMPANYTrial BalanceJune 30, 2020Cash .Accounts Receivable .Equipment .Accounts Payable.Common Stock .Dividends .Service Revenue .Salaries and Wages Expense .Rent Expense.Debit 5,2003,00017,000Credit 7,00020,0008006,0006,0001,000 33,000 33,000(Credit tot. Accts. pay. Com. stk. Serv. rev.)LO 4 BT: AP Difficulty: Easy TOT: 5 min. AACSB: None AICPA FC: Reporting IMA: Reporting2-12Copyright 2018 WILEY Weygandt, Financial and Managerial Accounting, 3/e, Solutions Manual (For Instructor Use Only)

BRIEF EXERCISE 2-10ERIKA COMPANYTrial BalanceDecember 31, 2020Cash .Prepaid Insurance .Accounts Payable .Unearned Service Revenue .Common Stock .Dividends .Service Revenue .Salaries and Wages Expense .Rent Expense .Debit 16,8003,500Credit 3,0004,20013,0004,50025,60018,6002,400 45,800 45,800(Credit tot. Accts. pay. Unearn. serv. rev. Com. stk. Serv. rev.)LO 4 BT: AN Difficulty: Moderate TOT: 6 min. AACSB: Analytic AICPA FC: Reporting IMA: ReportingCopyright 2018 WILEY. Weygandt, Financial and Managerial Accounting, 3/e, Solutions Manual (For Instructor Use Only)2-13

SOLUTIONS FOR DO IT! REVIEW EXERCISESDO IT! 2-1James would likely need the following accounts in which to record thetransactions necessary to ready his photography studio for opening day:Cash (debit balance)Supplies(debit balance)Equipment(debit balance)Notes Payable (credit balance)Accounts Payable(credit balance)Common Stock (credit balance)Rent Expense (debit balance)LO 1 BT: C Difficulty: Easy TOT: 4 min. AACSB: None AICPA FC: Reporting IMA: ReportingDO IT! 2-2Each transaction that is recorded is entered in the general journal. Thethree activities would be recorded as follows:1.2.3.Cash .Common Stock.8,000Supplies .Cash .Accounts Payable .1,6008,0003001,300No entry because no transaction has occurred.LO 2 BT: AP Difficulty: Easy TOT: 4 min. AACSB: Analytic AICPA FC: Reporting IMA: ReportingDO IT! 2-3Cash4/1 1,600 4/16 6004/3 3,900 4/20 5004/30 4,400LO 3 BT: AP Difficulty: Easy TOT: 3 min. AACSB: Analytic AICPA FC: Reporting IMA: Reporting2-14Copyright 2018 WILEY Weygandt, Financial and Managerial Accounting, 3/e, Solutions Manual (For Instructor Use Only)

DO IT! 2-4CHILLIN’ COMPANYTrial BalanceDecember 31, 2020DebitCash . 6,000Accounts Receivable .8,000Supplies .5,000Equipment.76,000Notes Payable .Accounts Payable .Salaries and Wages Payable .Common Stock .Dividends .8,000Service Revenue .Rent Expense .2,000Salaries and Wages Expense .38,000 143,000Credit 20,0009,0003,00025,00086,000 143,000LO 4 BT: AP Difficulty: Moderate TOT: 6 min. AACSB: Analytic AICPA FC: Reporting IMA: ReportingCopyright 2018 WILEY. Weygandt, Financial and Managerial Accounting, 3/e, Solutions Manual (For Instructor Use Only)2-15

SOLUTIONS TO EXERCISESEXERCISE 2-11.False. An account is an accounting record of a specific asset, liability,or stockholders’ equity item.2.False. An account shows increases and decreases in the item it relates to.3.False. Each asset, liability, and stockholders’ equity item has aseparate account.4.False. An account has a left, or debit side, and a right, or credit side.5.True.LO 1 BT: K Difficulty: Easy TOT: 3 min. AACSB: None AICPA FC: Reporting IMA: Reporting2-16Copyright 2018 WILEY Weygandt, Financial and Managerial Accounting, 3/e, Solutions Manual (For Instructor Use Only)

Copyright 2018 WILEY Weygandt, Financial and Managerial Accounting, 3/e, Solutions Manual (For Instructor Use 2Asset3Account hDecreaseDebitLO 1 BT: C Difficulty: Easy TOT: 10 min. AACSB: None AICPA FC: Reporting IMA: Reporting(c)EXERCISE 2-22-17Account Debited

EXERCISE 2-3General JournalAccount Titles and ExplanationDateJan. 2391116202328Ref.DebitCash .Common Stock .15,000Equipment .Cash .8,200Supplies .Accounts Payable .500Accounts Receivable .Service Revenue .1,800Advertising Expense .Cash .200Cash .Accounts Receivable.780Accounts Payable .Cash .300Dividends .Cash .500J1Credit15,0008,2005001,800200780300500LO 2 BT: AP Difficulty: Easy TOT: 10 min. AACSB: Analytic AICPA FC: Reporting IMA: Reporting2-18Copyright 2018 W ILEY. Weygandt, Financial and Managerial Accounting, 3/e, Solutions Manual (For Instructor Use Only)

EXERCISE 2-4Oct. 1Debits increase assets: debit Cash 20,000.Credits increase stockholders’ equity: credit Common Stock 20,000.2No transaction.3Debits increase assets: debit Equipment 2,300.Credits increase liabilities: credit Accounts Payable 2,300.Oct. 6Debits increase assets: debit Accounts Receivable 3,600.Credits increase revenues: credit Service Revenue 3,600.27Debits decrease liabilities: debit Accounts Payable 850.Credits decrease assets: credit Cash 850.30Debits increase expenses: debit Salaries and Wages Expense 2,500.Credits decrease assets: credit Cash 2,500.LO 1 BT: C Difficulty: Easy TOT: 6 min. AACSB: None AICPA FC: Reporting IMA: ReportingEXERCISE 2-5DateOct. 1General JournalAccount Titles and ExplanationCash .Common Stock .Ref.Debits20,00020,0002No entry.3Equipment .Accounts Payable .2,300Accounts Receivable .Service Revenue .3,600Accounts Payable .Cash .850Salaries and Wages Expense .Cash .2,50062730Credit2,3003,6008502,500LO 2 BT: AP Difficulty: Easy TOT: 6 min. AACSB: Analytic AICPA FC: Reporting IMA: ReportingCopyright 2018 WILEY Weygandt, Financial and Managerial Accounting, 3/e, Solutions Manual (For Instructor Use Only)2-19

EXERCISE 2-6(a)1.2.3.Increase the asset Cash, increase the liability Notes Payable.Increase the asset Equipment, decrease the asset Cash.Increase the asset Supplies, increase the liability Accounts Payable.(b)1.Cash .Notes Payable .Equipment .Cash.Supplies .Accounts Payable .2.3.5,0005,0002,5002,500450450LO 1, 2 BT: AP Difficulty: Easy TOT: 6 min. AACSB: Analytic AICPA FC: Reporting IMA: ReportingEXERCISE 2-7(a)Assets Liabilities Stockholders’ Equity1. (Issue stock)2. ––(Expense)3. (Revenue)4. ––(Dividends)(b)1.2.3.4.Cash .Common Stock .Rent Expense .Cash.Accounts Receivable .Service Revenue .Dividends .Cash.5,0005,0009509504,7004,700600600LO 1, 2 BT: AP Difficulty: Easy TOT: 8min. AACSB: Analytic AICPA FC: Reporting IMA: Reporting2-20Copyright 2018 W ILEY. Weygandt, Financial and Managerial Accounting, 3/e, Solutions Manual (For Instructor Use Only)

EXERCISE 2-8General JournalDateMarch 135812142224272830Account TitlesRent Expense .Cash .Debit1,200Accounts Receivable.Service Revenue .140Cash .Service Revenue .75Equipment .Cash .Accounts Payable .600Cash .Accounts Receivable .140Salaries and Wages Expense .Cash .525Utilities Expense .Cash .72Cash .Notes Payable .1,500Repairs Expense .Cash .220Accounts Payable .Cash .520Prepaid Insurance .Cash 0LO 2 BT: AP Difficulty: Moderate TOT: 10 min. AACSB: Analytic AICPA FC: Reporting IMA: ReportingCopyright 2018 WILEY Weygandt, Financial and Managerial Accounting, 3/e, Solutions Manual (For Instructor Use Only)2-21

EXERCISE 2-9Trans.1.2.3.4.5.6.7.8.9.10.11.12.13.Account TitlesCash .Common Stock .Debit24,000Cash .Notes Payable .7,000Equipment .Cash .11,000Rent Expense .Cash .1,200Supplies .Cash .1,450Advertising Expense.Accounts Payable .600Cash .Accounts Receivable .Service Revenue .2,00016,000Dividends.Cash .400Utilities Expense .Cash .2,000Accounts Payable .Cash .600Interest Expense .Cash .40Salaries and Wages Expense .Cash .6,400Cash .Accounts Receivable 002,000600406,40012,000LO 2 BT: AP Difficulty: Moderate TOT: 10 min. AACSB: Analyt

Weygandt, Financial and Managerial Accounting, 3/e, Solutions Manual (For Instructor Use Only) 2-7 Questions Chapter 2 (Continued) 9. (1) Cash—both debit and credit entries. (2) Accounts Receivable—both debit and credit entries. (3) Dividends—debit entries only. (4) Accounts Payable—both debit and credit entries.