Transcription

Aetna Student HealthPlan Design and Benefits SummaryPreferred Provider Organization (PPO)Rice UniversityPolicy Year: 2022–2023Policy Number: 890436www.aetnastudenthealth.com(877) 375‐7908Disclosure: These rates and benefits are pending approval by the Texas Department of Insurance and can change.If they change, we will update this information.

This is a brief description of the Student Health Plan. The Plan is available to Rice University students and theireligible dependents. The Plan is underwritten by Aetna Life Insurance Company (Aetna). The exact provisions,including definitions, governing this insurance are contained in the Certificate issued to you and may be viewedonline at www.aetnastudenthealth.com. If there is a difference between this Benefit Summary and the Certificate,the Certificate will control. If you would like to obtain information about coverage under the Plan, please contact usat 877-375-7908, or call the Member Services number on the back of your ID card, or write to us at:Aetna, Student Health151 Farmington AvenueHartford, CT 06156RICE UNIVERSITY HEALTH SERVICESThe Rice Student Health Services is the University's on-campus health facility, which provides preventative andoutpatient clinical care for students. Staffed by nurse practitioners and registered nurses, it is open weekdays from8:00 a.m. to 5:00 p.m., during the Fall and Spring semesters and Monday – Wednesday from 9:00 a.m. to 3:00 p.m.,during the summer. A Physician and nurse practitioner are on call at all times and conduct clinics during the week.The Student Health Services does not file or bill insurance. However, students that are enrolled in the Aetna StudentHealth Insurance plan will be able to submit a claim for reimbursement for specific services. To see the services thatare eligible for reimbursement, please visit health.rice.edu or studenthealthinsurance.rice.edu.For more information, call the Student Health Services at (713) 348-4966. In the event of an emergency, call 911 orthe Campus Police at (713) 348-6000.Coverage PeriodsStudents: Coverage for all insured students enrolled in the Plan for the following Coverage Periods. Coverage willbecome effective at 12:01 AM on the Coverage Start Date indicated below and will terminate at 11:59 PM on theCoverage End Date indicated.Coverage PeriodCoverage Start DateCoverage End pring01/01/202307/31/202301/13/2023Eligible Dependents: Coverage for dependents eligible under the Plan for the following Coverage Periods.Coverage will become effective at 12:01 AM on the Coverage Start Date indicated below and will terminate at 11:59PM on the Coverage End Date indicated. Coverage for insured dependents terminates in accordance with theTermination Provisions described in the Certificate of Coverage.Coverage Start DateCoverage End pring01/01/202307/31/202301/13/2023Coverage PeriodRice University 2022-2023Page 2

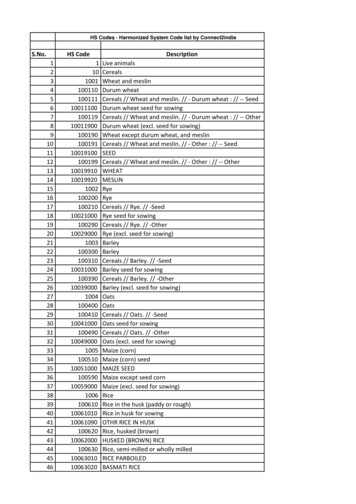

RatesThe rates below include both premiums for the Plan underwritten by Aetna Life Insurance Company (Aetna), as wellas Rice University administrative fee.RatesUndergraduates and Graduate StudentsAnnualFall SemesterSpring/Summer SemesterStudent 2,809 1,178 1,631Spouse 2,809 1,178 1,6311 Child 2,809 1,178 1,6312 or more Children 5,618 2,356 3,262Student CoverageWho is eligible?All registered, degree-seeking students are required to have health insurance through the Aetna Student HealthPlan or through another qualifying medical plan. Students must actively attend classes for at least the first 31 days,after the date when coverage becomes effective. If we find out that you do not meet this eligibility requirement, weare only required to refund any premium contribution minus any claims that we have paid.If a student withdraws from Rice University on or prior to 08/31/2022 for fall, or 01/31/2023 for spring, the studentwill be dropped from the insurance plan. Previously covered students must re-enroll in coverage for the new policyyear, including dependent coverage, prior to the enrollment deadline date.All registered students are required to maintain health insurance coverage while enrolled at Rice University with theexception of visiting students, auditors, students enrolled in the Glasscock School of Continuing Studies (excludingthe Masters of Arts in Teaching for New Teachers) and all students enrolled in traditional online programs.EnrollmentAll students are required to maintain health insurance through the school or provide proof of comparable coverage.To ensure compliance with this University policy all students are required to either enroll in the Aetna StudentHealth Plan or request a waiver of insurance indicating that other coverage is active.Students that do not complete an online enrollment or waiver request by 08/26/2022 for Fall or 1/13/2023 forSpring will be automatically enrolled into coverage and responsible for the full premium amount.Eligible students will have the insurance premium placed on their student account. Students that submit and havean approved waiver of coverage prior to the deadline will have the insurance premium credited to their studentaccount. Students that do not enroll in or waive the insurance coverage prior to the deadline will be automaticallyenrolled in the annual student insurance plan and charged the full premium. An approved waiver applies to theentire 2022-2023 academic year during which it is filed. Anyone enrolled in the Aetna Student Health Plan cannotcancel coverage for any reason.To enroll online or request a waiver of coverage, log onto https://www.aetnastudenthealth.com, enter RiceUniversity in the search tool, then follow the link to make your insurance selection. You can also access the link byvisiting the Student Health Insurance website: https://studenthealthinsurance.rice.edu.Rice University 2022-2023Page 3

Exception: A Covered Person entering the armed forces of any country will not be covered under the Policy as ofthe date of such entry. A pro rata refund of premium will be made for such person, and any covered dependents,upon written request received by Aetna within 90 days of withdrawal from school.Certain qualifying life events allow special enrollment in coverage outside of the open enrollment period. You have30 days from the date of the qualifying life events to enroll in coverage. The following are examples of qualifying lifeevents: Loss of current coverage Marriage/Divorce Birth of a Child/Adoption Spouse/Child arrival from another countryIf you experience a qualifying life event and need to enroll in coverage, please email: StudentInsurance@rice.edu.Documentation to support the qualifying life event is required. Premiums are pro-rated according to the remainderof the semester and/or plan year.Dependent CoverageEligibilityCovered students may also enroll their lawful spouse/domestic partner (same or opposite sex) and the coveredstudent’s child who is under 26 years of age.The term "child" includes: Your biological children Your adopted children Your stepchildren For health expense coverage, your grandchild whom you support on the date of his or her initial application forcoverageEnrollmentTo enroll the eligible dependent(s), a covered student may enroll them at the same time enrolling themselves whenvisiting www.aetnastudenthealth.com and selecting the school name. Dependent enrollment will not be acceptedafter 8/27/2021 (or 1/14/2022 for Spring) unless there is a qualifying life change that directly affects their insurancecoverage. (An example of a qualifying life change would be the birth of a child).Important note regarding coverage for a newborn child, or adopted child: A newborn child - Your newborn child is covered on your health plan for the first 31 days from the moment ofbirth.- To keep your newborn covered, you must notify us (or our agent) of the birth and pay any required premiumcontribution during that 31-day period.- You must still enroll the child within 31 days of birth even when coverage does not require payment of anadditional premium contribution for the newborn.- If you miss this deadline, your newborn will not have health benefits after the first 31 days.- If your coverage ends during this 31-day period, then your newborn‘s coverage will end on the same date asyour coverage. This applies even if the 31-day period has not ended. An adopted child or a child legally placed with you for adoption - A child that you, or that you and your spouse ordomestic partner adopts or is placed with you for adoption is covered on your plan for the first 31 days after youbecome party in a suit to adopt the child or the adoption or the placement is complete.- To keep your child covered, we must receive your completed enrollment information within 31 days after theadoption, after you become party in a suit to adopt the child, or after placement for adoption.Rice University 2022-2023Page 4

- You must still enroll the child within 31 days of the adoption, you become party in a suit to adopt the child orplacement for adoption even when coverage does not require payment of an additional premium contributionfor the child.- If you miss this deadline, your adopted child, the child for whom you became a party in a suit to adopt, or thechild placed with you for adoption will not have health benefits after the first 31 days.- If your coverage ends during this 31-day period, then coverage for your adopted child the child for whom youbecame a party in a suit to adopt, or the child placed with you for adoption will end on the same date as yourcoverage. This applies even if the 31-day period has not ended. A stepchild - You may put a child of your spouse or domestic partner on your plan.- You must complete your enrollment information and send it to us within 31 days after the date of your marriageor your Declaration of Domestic Partnership with your stepchild’s parent.- Ask the policyholder when benefits for your stepchild will begin. It is either on the date of your marriage or thedate your Declaration of Domestic Partnership is filed or the first day of the month following the date we receiveyour completed enrollment information.- To keep your stepchild covered, we must receive your completed enrollment information within 31 days afterthe date of your marriage or your Declaration of Domestic Partnership.- You must still enroll the stepchild within 31 days after the date of your marriage or your Declaration of DomesticPartnership even when coverage does not require payment of an additional premium contribution for thestepchild.- If you miss this deadline, your stepchild will not have health benefits after the first 31 days.- If your coverage ends during this 31-day period, then your stepchild‘s coverage will end on the same date asyour coverage. This applies even if the 31-day period has not ended. Dependent coverage due to a court order: If you must provide coverage to a dependent because of a court order,your dependent is covered on your health plan for the first 31 days from the court order.- To keep your dependent covered, we must receive your completed enrollment information within 31 days of thecourt order.- You must still enroll the dependent within 31 days of the court order even when coverage does not requirepayment of an additional premium contribution for the dependent.- If you miss this deadline, your dependent will not have health benefits after the first 31 days.- If your coverage ends during this 31-day period, then your dependent’s coverage will end on the same date asyour coverage. This applies even if the 31-day period has not ended.If you need information or have general questions on dependent enrollment, call Member Services at 877-375-7908.Termination and RefundsWithdrawal from Classes – Leave of AbsenceIf you withdraw from classes under a school-approved leave of absence, your coverage will remain in force throughthe end of the period for which payment has been received and no premiums will be refunded.Withdrawal from Classes – Other than Leave of AbsenceIf you withdraw from classes other than under a school-approved leave of absence within 31 days after the policyeffective date, you will be considered ineligible for coverage, your coverage will be terminated retroactively and anypremiums collected will be refunded.If the withdrawal is more than 31 days after the policy effective date, your coverage will remain in force through theend of the period for which payment has been received and no premiums will be refunded.Rice University 2022-2023Page 5

If you withdraw from classes to enter the armed forces of any country, coverage will terminate as of the effectivedate of such entry and a pro rata refund of premiums will be made if you submit a written request within 90 days ofwithdrawal from classes.Medicare Eligibility NoticeYou are not eligible to enroll in the student health plan if you have Medicare at the time of enrollment in thisstudent plan. The plan does not provide coverage for people who have Medicare.Coordination of Benefits (COB)The Coordination of Benefits (“COB”) provision applies when a person has health care coverage under more thanone plan. If you do, we will work together with your other plan(s) to decide how much each plan pays. This is calledcoordination of benefits (COB).The order of benefit determination rules tell you the order in which each plan will pay a claim for benefits. The planthat pays first is called the primary plan. The primary plan must pay benefits in accordance with its policy terms.Payment is made without regard to the possibility that another plan may cover some expenses. The plan that paysafter the primary plan is the secondary plan. The secondary plan may reduce the benefits it pays so that paymentsfrom all plans do not exceed 100% of the total allowable expense.For more information about the Coordination of Benefits provision, including determining which plan is primaryand which is secondary, you may call the Member Services telephone number shown on your ID card. A completedescription of the Coordination of Benefits provision is contained in the Policy issued to Rice University and may beviewed online at www.aetnastudenthealth.com.In-network Provider NetworkAetna Student Health offers Aetna’s broad network of In-network Providers. You can save money by seeing Innetwork Providers because Aetna has negotiated special rates with them, and because the Plan’s benefits arebetter.If you need care that is covered under the Plan but not available from an In-network Provider, contact MemberServices for assistance at the toll-free number on the back of your ID card. In this situation, Aetna may issue a pre approval for you to receive the care from an Out-of-network Provider. When a pre-approval is issued by Aetna, thebenefit level is the same as for In-network Providers.PreauthorizationYou need pre-approval from us for some eligible health services. Pre-approval is also called preauthorization. Yourin-network physician is responsible for obtaining any necessary preauthorization before you get the care. When yougo to an out-of-network provider, it is your responsibility to obtain preauthorization from us for any services andsupplies on the preauthorization list. If you do not preauthorize when required, there is a 500 penalty for eachtype of eligible health service that was not preauthorized. For a current listing of the health services or prescriptiondrugs that require preauthorization, contact Member Services or go to www.aetnastudenthealth.com.Rice University 2022-2023Page 6

Preauthorization callPreauthorization should be secured within the timeframes specified below. To obtain preauthorization, call MemberServices at the toll-free number on your ID card. This call must be made:Non-emergency admissions:You, your physician or the facility will need to call and requestpreauthorization at least 3 days before the date you are scheduled tobe admitted.An emergency admission:You, your physician or the facility must call within 48 hours or as soonas reasonably possible after you have been admitted.An urgent admission:You, your physician or the facility will need to call before you arescheduled to be admitted. An urgent admission is a hospital admissionby a physician due to the onset of or change in an illness, the diagnosisof an illness, or an injury.Outpatient non-emergency servicesrequiring preauthorization:You or your physician must call at least 3 days before the outpatientcare is provided, or the treatment or procedure is scheduled.We will provide a written notification to you and your physician of the preauthorization decision, where required bystate law. If your preauthorized services are approved, the approval is valid for 30 days as long as you remainenrolled in the plan.Description of BenefitsThe Plan excludes coverage for certain services and has limitations on the amounts it will pay. While this PlanSummary document will tell you about some of the important features of the Plan, other features that may beimportant to you are defined in the Certificate. To look at the full Plan description, which is contained in theCertificate issued to you, go to www.aetnastudenthealth.com.This Plan will pay benefits in accordance with any applicable Texas Insurance Law(s).Policy year deductibleIn-network coverageOut-of-network coverageYou have to meet your policy year deductible before this plan pays for benefits.Student 250 per policy year 1,000 per policy yearSpouse 250 per policy year 1,000 per policy yearEach child 250 per policy year 1,000 per policy yearPolicy Year Deductible ProvisionsEligible health services applied to the out-of-network policy year deductibles will not be applied to satisfy the innetwork policy year deductibles. Eligible health services applied to the in-network policy year deductibles will notbe applied to satisfy the out-of-network policy year deductibles.This is the amount you owe for in-network and out-of-network eligible health services each policy year beforethe plan begins to pay for eligible health services. See the Policy year deductibles provision at the beginning of thisschedule for any exceptions to this general rule. This policy year deductible applies separately to you and each ofyour covered dependents. After the amount you pay for eligible health services reaches the policy yeardeductible, this plan will begin to pay for eligible health services for the rest of the policy year.Policy year deductible waiverThe policy year deductible is waived for all of the following eligible health services: In-network care for Preventive care and wellness In-network care and out-of-network care for Pediatric Dental Services, Voluntary sterilizationfor males, Well newborn nursery care, Pediatric Vision Care Services, and Outpatient prescription drugsRice University 2022-2023Page 7

Maximum out-of-pocket limitsIn-network coverageOut-of-network coverageStudent 6,000 per policy year 12,000 per policy yearSpouse 6,000 per policy year 12,000 per policy yearEach child 6,000 per policy year 12,000 per policy yearFamily 12,000 per policy year 24,000 per policy yearEligible health servicesIn-network coverageOut-of-network coverageRoutine physical examsPerformed at a physician’s office100% (of the negotiated charge)per visit70% (of the recognized charge)per visitNo copayment or policy yeardeductible appliesCovered persons age 22 and over:Maximum visits per policy yearCovered persons through age 21: maximumage and visit limits per policy year1 visitSubject to any age and visit limits provided for in thecomprehensive guidelines supported by the American Academy ofPediatrics/Bright Futures/Health Resources and ServicesAdministration guidelines for children and adolescents. Fordetails, contact your physician or Member Services by logging in toyour Aetna website at www.aetnastudenthealth.com or callingthe toll-free number on your ID card.Preventive care immunizationsPerformed in a facility or at a physician'sofficeMaximums100% (of the negotiated charge)per visit70% (of the recognized charge)per visitNo copayment or policy yeardeductible appliesNo policy year deductible,copayment or copayment appliesfor children from birth throughage 6Subject to any age and visit limits provided for in thecomprehensive guidelines supported by the American Academy ofPediatrics/Bright Futures/Health Resources and ServicesAdministration guidelines for children and adolescents.For details, contact your physician or Member Services by loggingonto your Aetna member website atwww.aetnastudenthealth.com or calling the number on the backof your ID card.The following is not covered under this benefit: Any immunization that is not considered to be preventive care or recommended as preventive care, such asthose required due to employment or travelRice University 2022-2023Page 8

Eligible health servicesIn-network coverageOut-of-network coverageRoutine gynecological exams (including Pap smears and cytology tests)Performed at a physician’s, obstetrician(OB), gynecologist (GYN) or OB/GYN office100% (of the negotiated charge)per visit70% (of the recognized charge)per visitNo copayment or policy yeardeductible appliesAdditional Well women exam maximumsSubject to any age limits provided for in the comprehensiveguidelines supported by the Health Resources and ServicesAdministration. Pap smear or screening using liquid based cytology methods: 1Pap smear every 12 months for women age 18 and older Gynecological exam that includes a rectovaginal pelvic exam:1exam every 12 months for women over age 25 who are at riskfor ovarian cancer Diagnostic exam for the early detection of ovarian cancer,cervical cancer, and the CA 125 blood test: 1 exam every 12months for women age 18 and older. For women over age 60depending on risk factors.Maximum visits per policy year1 visitPreventive screening and counseling servicesPreventive screening and counselingservices for Obesity and/or healthy dietcounseling, Misuse of alcohol & drugs, Useof Tobacco Products, Depression Screening,Sexually transmitted infection counseling &Genetic risk counseling for breast andovarian cancerObesity and/or healthy diet counseling Maximum visits100% (of the negotiated charge)per visit70% (of the recognized charge)per visitNo copayment or policy yeardeductible appliesAge 0-22: unlimited visits.Age 22 and older: 26 visits per 12 months, of which up to 10 visitsmay be used for healthy diet counseling.Misuse of alcohol and/or drugs counseling Maximum visits per policy year5 visitsUse of tobacco products counseling Maximum visits per policy year8 visitsDepression screening counseling Maximum visits per policy year1 visitSexually transmitted infection counseling Maximum visits per policy year2 visitsGenetic risk counseling for breast andovarian cancer limitationsRice University 2022-2023Not subject to any age or frequency limitationsPage 9

Eligible health servicesIn-network coverageOut-of-network coveragePreventive screening and counseling services (continued)Routine cancer screenings100% (of the negotiated charge)per visit70% (of the recognized charge)per visitNo copayment or policy yeardeductible appliesMammogram MaximumsMammogram: 1 mammogram every 12 months for coveredpersons age 35 and older. When diagnostic imaging is used toevaluate a breast abnormality or where there is a personal historyof breast cancer or dense breast tissue it is not subject to any ageor frequency limitations.Prostate specific antigen (PSA) testmaximumsProstate specific antigen (PSA) test maximums: 1 Prostate SpecificAntigen (PSA) test every 12 months for covered persons age 50 andolder. 1 PSA test every 12 months for covered persons age 40 andolder with a family history of prostate cancer, or other risk factorAdditional MaximumsLung cancer screening maximumPrenatal care services (Preventive careservices only)Subject to any age, family history, and frequency guidelines as setforth in the most current: Evidence-based items that have in effect a rating of A or B in thecurrent recommendations of the United States PreventiveServices Task Force; and The comprehensive guidelines supported by the HealthResources and Services Administration1 screening every 12 months100% (of the negotiated charge)per visit70% (of the recognized charge)per visitNo copayment or policy yeardeductible appliesLactation support and counseling services100% (of the negotiated charge)per visit70% (of the recognized charge)per visitNo copayment or policy yeardeductible appliesLactation counseling services maximumvisits per policy year either in a group orindividual settingBreast pump supplies and accessories6 visits100% (of the negotiated charge)per item70% (of the recognized charge)per itemNo copayment or policy yeardeductible appliesRice University 2022-2023Page 10

Eligible health servicesIn-network coverageOut-of-network coverageFamily planning services – contraceptives - Counseling servicesContraceptive counseling servicesoffice visit100% (of the negotiated charge)per visit70% (of the recognized charge)per visitNo copayment or policy yeardeductible appliesContraceptive counseling servicesmaximum visits per policy year either in agroup or individual settingFemale contraceptive prescription drugsand devices provided, administered, orremoved, by a provider during an office visit2 visits100% (of the negotiated charge)per item70% (of the recognized charge)per itemNo copayment or policy yeardeductible appliesFemale Voluntary sterilization - Inpatientprovider services100% (of the negotiated charge)70% (of the recognized charge)No copayment or policy yeardeductible appliesFemale Voluntary sterilization - Outpatientprovider services100% (of the negotiated charge)per visit70% (of the recognized charge)per visitNo copayment or policy yeardeductible appliesThe following are not covered under this benefit: Services provided as a result of complications resulting from a female voluntary sterilization procedure andrelated follow-up care Any contraceptive methods that are only "reviewed" by the FDA and not "approved" by the FDA Male contraceptive methods, sterilization procedures or devicesPhysicians and other health professionalsPhysician, specialist including ConsultantsOffice visits (non-surgical/non-preventivecare by a physician and specialist, includestelemedicine, teledentistry or telehealthconsultations) 20 copayment then the planpays 75% (of the balance of thenegotiated charge) per visit 20 copayment then the planpays 50% (of the balance of therecognized charge) per visitAllergy testing performed at a physician’s orspecialist’s officeCovered according to the typeof benefit and the place wherethe service is receivedCovered according to the typeof benefit and the place wherethe service is receivedAllergy injections treatment performed at aphysician’s or specialist’s officeCovered according to the typeof benefit and the place wherethe service is receivedCovered according to the typeof benefit and the place wherethe service is receivedAllergy testing and treatmentThe following are not covered under this benefit: Allergy sera and extracts administered via injectionRice University 2022-2023Page 11

Eligible health servicesIn-network coverageOut-of-network coveragePhysician and specialist surgical servicesInpatient surgery performed during yourstay in a hospital or birthing center by asurgeon (includes anesthetist and surgicalassistant expenses)75% (of the negotiated charge)50% (of the recognized charge)The following are not covered under this benefit: The services of any other physician who helps the operating physician A stay in a hospital (Hospital stays are covered in the Eligible health services and exclusions – Hospital and otherfacility care section) Services of another physician for the administration of a local anestheticOutpatient surgery performed at aphysician’s or specialist’s office oroutpatient department of a hospital orsurgery center by a surgeon (includesanesthetist and surgical assistant expenses)75% (of the negotiated charge)per visit50% (of the recognized charge)per visitThe following are not covered under this benefit: The services of any other physician who helps the operating physician A stay in a hospital (Hospital stays are covered in the Eligible health services and exclusions – Hospital and otherfacility care section) A separate facility charge for surgery performed in a physician’s office Services of another physician for the administration of a local anestheticAlternatives to physician office visitsWalk-in clinic visits (non-emergency visit) 20 copayment then the planpays 75% (of the balance of thenegotiated charge) per visit 20 copayment then the planpays 50% (of the balance of therecognized charge) per visit75% (of the negotiated charge)per admission50% (of the recognized charge)per admissionPreadmission testingCovered according to the typeof benefit and the place wherethe service is receivedCovered according to the typeof benefit and the place wherethe service is receivedIn-hospital non-surgical physician services75% (of the negotiated charge)per visit50% (of the recognized charge)per visit75% (of the negotiated charge)50% (of the recognized charge)Hospital and other facility careInpatient hospital (room and board,including intensive care) and othermiscellaneous services and supplies)Includes birthing center facility chargesAlternatives to hospital staysOutpatient surgery (facility charges)performed in the outpatient department ofa hospital or surgery centerThe following are not covered under this benefit: The services of any other physician who helps the operating physician A stay in a hospital (See the Hospital care – facility charges benefit in this section) A separate facility charge for surgery performed in a phys

The Rice Student Health Ser vices is the University's on-campus health facility, which provides preventative and . However, students that are enrolled in the Aetna Student Health Insurance plan will be able to submit a claim for reimbursement for specific services. To see the services that are eligible for .