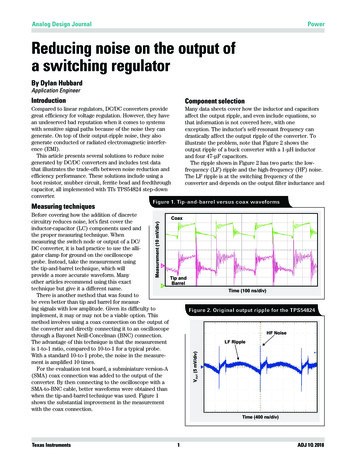

Transcription

The Economic Ripple Effects of COVID-19Francisco J. Buera1 Roberto N. Fattal-Jaef2Hugo Hopenhayn 4 P. Andrés Neumeyer 3 Yongseok Shin 11 Washington2 WorldUniversity in St. LouisBank 3 Universidad Torcuato Di Tella 4 UCLAUniversidad Torcuato Di TellaJune 3, 2020

Motivation COVID non-pharmaceutical interventions (NPIs):. largest (transitory ?) aggregate shock since. more permanent reshuffling of what/how we consume This paper:. Ripple effects of a LARGE transitory shock, e.g., Lockdown?. Ripple effects of a pure reallocation shock?. How effects depend on policies/institutions?

Motivation: How Bad, For How Long?

Motivation: How Bad, For How Long?

Motivation: Neoclassical Dynamics of Lockdown

Related Literature See NBER Working Papers 26867-27281

This Paper Heterogeneous Agents model. occupational choices. stochastic ability(zt zt 1z 1 z ηwith prob. ψtotherwise. credit friction: collateral constraints, kt λat. labor friction: matching friction w/ rest unemployment Deterministic dynamics following unanticipated shocks:. Lock-down: fraction φ of all firms becomes Non-Essential (shut-down). Reallocation shock: 10% of individuals redraw their productivity,0.87 ψ1 ψ 0.97 Buera, Fattal-Jaef & Shin (2015) (simple version of) Alvarez & Shimer (2011)

Roadmap Analyze macro and micro implicatons of:1. one-period lockdown shock, three cases:1.1 non-essential firms have no income, liable for rental/debt payments (baseline)1.2 also liable for wage payments, i.e., no wage subsidies/furloughs1.3 small open economy with tighter credit constraints.2. Pure reallocation shock.

Agent’s Optimization Problem: Essential(vt (z, a) maxa0 ,oc [ct ]1 σ βEvt 1 z 0 , a01 σ)ct at 1 max {wt , πt (z, at ; rt , wt )} (1 rt ) at Ttwhereπt (z, a; r , w ) max zk α l θ (rt δ) k wt lk,lsubject to k λa Full replacement unemployment insurance: wt Lump-sum taxes with budget balance, Tt wt Ut

Agent’s Optimization Problems: Non-Essential Businesses(v1NE(z, a) maxa0 [ct ]1 σ βEv2 z 0 , a01 σ)c1 a2 (r δ) k1 (1 r1 ) a1 T1 Workers(v1W (z, a) maxa0 [ ct ] 1 σ βEv2 z 0 , a01 σ)c1 a2 w1 (1 r1 ) a1 T1 Non-essential entrepreneurs only pay rental cost, (r δ) k1 . employment at will (US) or generous government wage subsidies (Europe) non-essential become essential for t 2

Labor Market Friction Mt unemployed workers matched to the hiring marketMt γ (Ut JDt ) Evolution of UnemploymentUt 1 Ut JDt Mt Job DestructionJDt Zhi[max {l 1 lt (a, z ) , 0}] dGtE dGtNE exiting entrep. Walrasian Hiring Market ClearingZhi[1 lt (a, z )] dGtE dGtNE 1 Ut 1 {z }l (a,z ) 0{z} labor supply tlabor demand

Labor Market Friction with Rest Unemployment non-essential workers are not reallocated in the first period but can be rehired frictionlessly by their previous employers in the secondperiod. only by surviving firms. if their net-worth constraint does not bind

Labor Market Friction with Rest Unemployment Mt unemployed workers matched to the hiring marketM1 γ (U1 JD1 R1 )M2 γ (U2 JD2 RH2 )whereR1 job destruction by surviving non-essential firms in t 1andRH2 ψZl0 0max {min {l2 (a, z ) , l0 } l1 , 0} dG2NE. i.e., job destruction by non-essential can be re-hired the following period Evolution of UnemploymentU2 U1 JD1 M1U3 U2 JD2 M2 RH2

Calibration Strategy Parameter values set to match. distribution and dynamics of U.S. establishments. unemployment rate in U.S. (γ). external finance to fixed capital in non-corporate sector in U.S. (λ)Ialso calibration to external finance in developing countries

Roadmap Analyze macro and micro implicatons of:1. one-period lockdown shock, three cases:1.1 non-essential firms have no income, liable for rental/debt payments (baseline)1.2 also liable for wage payments, i.e., no wage subsidies/furloughs1.3 small open economy with tighter credit constraints.2. Pure reallocation shock.

The Lock-Down Shock Start from stationary allocation Unexpected shock: fraction φ of businesses considered Non-Essential. magnitude and persistence of φ still open question. assume φ 0.3 , 1-period shock emphasize model’s propagation. shock realized after occupation and factor demand decisions, but beforeproduction two assumptions about labor costs in the first period:. are not paid by the firm, e.g., wage subsidies (Europe), furlough (US). firm must paid wage bill

Propagation Forces1. Burst of job destruction matching friction rise in Unemployment2. Imperfect insurance heterogeneous effect on net-worth3. Financial Frictions TFP, investment, rehiring dynamics

Roadmap Analyze macro and micro implicatons of:1. one-period lockdown shock, three cases:1.1 non-essential firms have no income, liable for rental/debt payments (baseline)1.2 also liable for wage payments, i.e., no wage subsidies/furloughs1.3 small open economy with tighter credit constraints.2. Pure reallocation shock.

Lockdown: Aggregate Variables I

Lockdown: Aggregate Variables II

Micro Implications I: Employment by AgeYoung: less than 5 year old

Micro Implications II: Consumption

Lockdown: Role of Rest Unemployment

Roadmap Analyze macro and micro implicatons of:1. one-period lockdown shock, three cases:1.1 non-essential firms have no income, liable for rental/debt payments (baseline)1.2 also liable for wage payments, i.e., no wage subsidies/furloughs1.3 small open economy with tighter credit constraints.2. Pure reallocation shock.

No Wage Subsidies: Aggregate Variables I

No Wage Subsidies: Aggregate Variables II

Micro Implications: Employment by AgeYoung: less than 5 year old

Roadmap Analyze macro and micro implicatons of:1. one-period lockdown shock, three cases:1.1 non-essential firms have no income, liable for rental/debt payments (baseline)1.2 also liable for wage payments, i.e., no wage subsidies/furloughs1.3 small open economy with tighter credit constraints.2. Pure reallocation shock.

Small Open Economy: Aggregate Variables I

Roadmap Analyze macro and micro implicatons of:1. one-period lockdown shock, three cases:1.1 non-essential firms have no income, liable for rental/debt payments (baseline)1.2 also liable for wage payments, i.e., no wage subsidies/furloughs1.3 small open economy with tighter credit constraints.2. Pure reallocation shock.

Pure Reallocation Shock Start from stationary allocation Unexpected shock: 10% of individuals redraw their productivity,0.87 ψ1 ψ 0.97. 10% of old businesses need to be replace by new ones. in a neoclassical world there are no aggregate consequences. process slow by financial and labor frictions It captures more permanent reshuffling of what/how we consume/produce. online person academic/business conference. changes in type of recreation and vacations

Pure Reallocation Shock: Aggregate Variables I

Pure Reallocation Shock: Aggregate Variables II

Summary of Results1. Fast aggregate recovery (with wage support/flexible employment & rest)2. but large, persistence effects for young firms3. fall of interest rate ( aggregate demand aggregate supply)4. large ripple effect without wage support/inflexible employment5. capital outflows from financially underdeveloped, small open economies

Work in Progress, Further Extensions Distribution of welfare costs. Who gain from wage subsidies, milder ripple effects? Lockdown of different duration. Are cost convex in the length? Capital irreversibility, Kt 1 (1 δ) Kt. Extension relevant for the case without wage subsidy, SOE with tighter creditconstraint. Initial drop in the price of capital, further tighten constraints, e.g., Kiyotaki &Moore (1997) Debt financed support policies. Further depress investment. Ameliorate initial fall in consumption of constrained agents

The Lock-Down Shock Start from stationary allocation Unexpected shock: fraction f of businesses consideredNon-Essential. magnitude and persistence of f still open question. assume f 0.3 ,1-period shock !emphasize model's propagation. shock realized after occupation and factor demand decisions, but before