Transcription

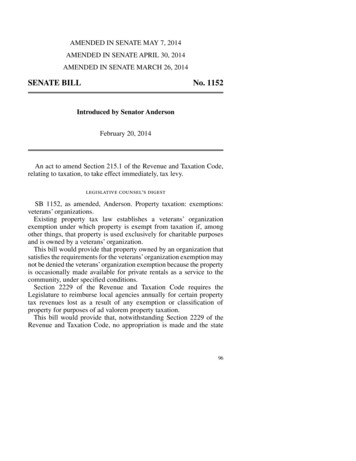

AMENDED IN SENATE MAY 7, 2014AMENDED IN SENATE APRIL 30, 2014AMENDED IN SENATE MARCH 26, 2014SENATE BILLNo. 1152Introduced by Senator AndersonFebruary 20, 2014An act to amend Section 215.1 of the Revenue and Taxation Code,relating to taxation, to take effect immediately, tax levy.legislative counsel’s digestSB 1152, as amended, Anderson. Property taxation: exemptions:veterans’ organizations.Existing property tax law establishes a veterans’ organizationexemption under which property is exempt from taxation if, amongother things, that property is used exclusively for charitable purposesand is owned by a veterans’ organization.This bill would provide that property owned by an organization thatsatisfies the requirements for the veterans’ organization exemption maynot be denied the veterans’ organization exemption because the propertyis occasionally made available for private rentals as a service to thecommunity, under specified conditions.Section 2229 of the Revenue and Taxation Code requires theLegislature to reimburse local agencies annually for certain propertytax revenues lost as a result of any exemption or classification ofproperty for purposes of ad valorem property taxation.This bill would provide that, notwithstanding Section 2229 of theRevenue and Taxation Code, no appropriation is made and the state96

SB 1152—2—shall not reimburse local agencies for property tax revenues lost bythem pursuant to the bill.This bill would take effect immediately as a tax levy.Vote: majority. Appropriation: no. Fiscal committee: yes.State-mandated local program: no.The people of the State of California do enact as follows:line 1line 2line 3line 4line 5line 6line 7line 8line 9line 10line 11line 12line 13line 14line 15line 16line 17line 18line 19line 20line 21line 22line 23line 24line 25line 26line 27line 28line 29line 30line 31SECTION 1. The Legislature finds and declares all of thefollowing:(a) Section 501(c)(19) of the United States Internal RevenueCode and related federal regulations provide for the exemption forposts or organizations of war veterans, or an auxiliary unit orsociety of, or a trust or foundation for, any such post ororganization that, among other attributes, carries on programs toperpetuate the memory of deceased veterans and members of theArmed Forces and to comfort their survivors, conducts programsfor religious, charitable, scientific, literary, or educational purposes,sponsors or participates in activities of a patriotic nature, andprovides social and recreational activities for their members.(b) Section 215.1 of the Revenue and Taxation Code stipulatesthat all buildings, and so much of the real property on which thebuildings are situated as may be required for the convenient useand occupation of the buildings, used exclusively for charitablepurposes, owned by a veterans’ organization that has been charteredby the Congress of the United States, organized and operated forcharitable purposes, when the same are used solely and exclusivelyfor the purpose of the organization, if not conducted for profit andno part of the net earnings of which ensures to the benefit of anyprivate individual or member thereof, are exempt from taxation.(c) The Chief Counsel of the State Board of Equalizationconcluded, based on a 1979 appellate court decision, that onlyparts of American Legion halls are exempt from property taxationand that other parts, such as billiard rooms, card rooms, and similarareas, are not exempt.(d) In a 1994 memorandum, the State Board of Equalization’slegal division further concluded that the areas normally consideredeligible for exemptions are the office areas used to counsel veteransand the area used to store veterans’ records, but that the meeting96

—3—line 1line 2line 3line 4line 5line 6line 7line 8line 9line 10line 11line 12line 13line 14line 15line 16line 17line 18line 19line 20line 21line 22line 23line 24line 25line 26line 27line 28line 29line 30line 31line 32line 33line 34line 35line 36line 37line 38line 39line 40SB 1152hall and bar found in most of the facilities are not considered usedfor charitable purposes.(e) Tax-exempt status is intended to provide economic incentiveand support to veterans’ organizations to provide for the socialwelfare of the community of current and former military personnel.(f) The State Board of Equalization’s constriction of the taxexemption has resulted in an onerous tax burden on Californiaveteran service organizations posts or halls, hinders the posts’ability to provide facilities for veterans, and threatens the economicviability of many local organizations.(g) The charitable activities of a veteran service organizationspost or hall are much more than the counseling of veterans. Therequirements listed for qualification for the federal tax exemptionclearly dictate a need for more than just an office.(h) Programs to perpetuate the memory of deceased veteransand members of the Armed Forces and to comfort their survivorsrequire the use of facilities for funerals and receptions.(i) Programs for religious, charitable, scientific, literary, oreducational purposes require space for more than 50 attendees.(j) Activities of a patriotic nature need facilities to accommodatehundreds of people.(k) Social and recreational activities for members requireprecisely those areas considered “not used for charitable purposes”by the State Board of Equalization.(l) The State Board of Equalization’s interpretation of theRevenue and Taxation Code reflects a lack of understanding ofthe purpose and programs of the veteran service organizationsposts or halls and is detrimental to the good works performed insupport of our veteran community.SEC. 2.SECTION 1. Section 215.1 of the Revenue and Taxation Codeis amended to read:215.1. (a) All buildings, and so much of the real property onwhich the buildings are situated as may be required for theconvenient use and occupation of the buildings, used exclusivelyfor charitable purposes, owned by a veterans’ organization thathas been chartered by the Congress of the United States, organizedand operated for charitable purposes, when the same are used solelyand exclusively for the purpose of the organization, if notconducted for profit and no part of the net earnings of which inures96

SB 1152line 1line 2line 3line 4line 5line 6line 7line 8line 9line 10line 11line 12line 13line 14line 15line 16line 17line 18line 19line 20line 21line 22line 23line 24line 25line 26line 27line 28line 29line 30line 31line 32line 33line 34line 35line 36line 37line 38line 39—4—to the benefit of any private individual or member thereof, shallbe exempt from taxation.(b) The exemption provided for in this section shall apply tothe property of all organizations meeting the requirements of thissection and subdivision (b) of Section 4 of Article XIII of theCalifornia Constitution and paragraphs (1) to (7), (4), inclusive,(6), and (7) of subdivision (a) of Section 214.(c) (1) The exemption specified by subdivision (a) shall not bedenied to a property on the basis that the property is used forfraternal, lodge, or social club purposes.(2) With regard to this subdivision, the Legislature finds anddeclares all of the following:(A) The exempt activities of a veterans’ organization asdescribed in subdivision (a) qualitatively differ from the exemptactivities of other nonprofit entities that use property for fraternal,lodge, or social club purposes in that the exempt purpose of theveterans’ organization is to conduct programs to perpetuate thememory of deceased veterans and members of the Armed Forcesand to comfort their survivors, to conduct programs for religious,charitable, scientific, literary, or educational purposes, to sponsoror participate in activities of a patriotic nature, and to providesocial and recreational activities for their members.(B) In light of this distinction, the use of real property by aveterans’ organization as described in subdivision (a), forfraternal, lodge, or social club purposes is central to thatorganization’s exempt purposes and activities.(C) In light of the factors set forth in subparagraphs (A) and(B), the use of real property by a veterans’ organization asdescribed in subdivision (a) for fraternal, lodge, or social clubpurposes, constitutes the exclusive use of that property for acharitable purpose within the meaning of subdivision (b) of Section4 of Article XIII of the California Constitution.(d) Property owned by an organization that satisfies therequirements of Section 215 or this section shall not be denied theveterans’ organization exemption because the property isoccasionally made available for private rentals as a service to thecommunity, provided that the amount of rental fee charged islimited to that amount necessary to reimburse the veterans’organization for its costs in making the rental available, and any96

—5—line 1line 2line 3line 4line 5line 6line 7line 8line 9line 10line 11line 12line 13line 14line 15line 16line 17line 18line 19line 20line 21line 22line 23line 24line 25line 26SB 1152proceeds from the rentals are used exclusively for the charitablepurposes of the organization.(c)(e) An organization that files a claim for the exemption providedfor in this section shall file with the assessor a valid organizationalclearance certificate issued pursuant to Section 254.6.(d) (1)(f) This exemption shall be known as the “veterans’ organizationexemption.”(2) Property owned by an organization that satisfies therequirements of Section 215 or this section shall not be denied theveterans’ organization exemption because the property isoccasionally made available for private rentals as a service to thecommunity, provided that the amount of rental fee charged islimited to that amount necessary to reimburse the veterans’organization for its costs in making the rental available, and anyproceeds from the rentals are used exclusively for the charitablepurposes of the organization.SEC. 3.SEC. 2. Notwithstanding Section 2229 of the Revenue andTaxation Code, no appropriation is made by this act and the stateshall not reimburse any local agency for any property tax revenueslost by it pursuant to this act.SEC. 4.SEC. 3. This act provides for a tax levy within the meaning ofArticle IV of the Constitution and shall go into immediate effect.O96

SENATE BILL No. 1152 Introduced by Senator Anderson February 20, 2014 An act to amend Section 215.1 of the Revenue and Taxation Code, relating to taxation, to take effect immediately, tax levy. legislative counsel's digest SB 1152, as amended, Anderson. Property taxation: exemptions: veterans' organizations.