Transcription

VEHICLETELEMATICS:POISED TO DELIVERBY BOB CHABOTTelematics is poised to affect us all,sooner rather than later. As with allnew automotive technologies,independent shops must be preparedto adapt to the change to continueoperating successful businesses.Images: Delphi Product & Service Solutions & ThinkstockTechnology doesn’t justhappen. It takes years todevelop, implement andperfect. My first lesson inthis was a decade ago,when I visited with LarryBurns, then General Motors vice president for research and development, at aSequel hydrogen vehicle media event atNorthwestern University near Chicago.Ironically, it wasn’t hydrogen that captured my attention.During my test drive with Burns, Iasked him what other technologieswere on his radar screen. “Telematics,”he responded casually. “Bob, suppose32January 2014you owned a Corvette. Now suppose Itold you GM had developed a softwarepatch that could provide your Corvettewith 20 more horsepower that could besent directly to your vehicle overnight.Would you be interested in that?”After I replied affirmatively, headded, “Well, we can do that now in ourresearch facilities. All we need to do isbuild the infrastructure to deliver itwidely, and the means to monetize it.”That day, 10 years ago, my interestwas sparked. Today, telematics is on thecusp of disrupting traditional vehicleservice and repair, particularly in thearea of remote vehicle diagnostics.Modern street automobiles are nolonger mere mechanical devices with adriver. They’re also an array of data andcommunications technology that permits telematics-enabled decision-making. Vehicles are pervasively monitoredand controlled by dozens of electroniccomputers, sensors and controllers, coordinated via internal networks.As with other vehicle technologies,OEMs also want to turn telematicsproducts and services into a revenuestream. Modern telematics productsand services generally fall into one oftwo broad categories: Customer Relationship Manage-

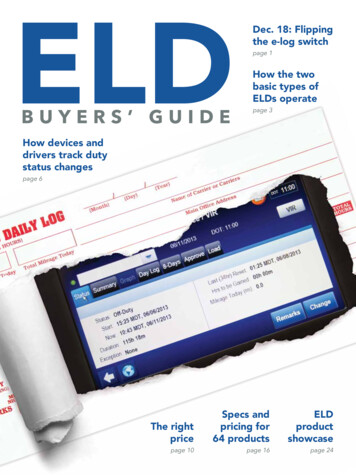

ment (CRM) telematics, such as infotainment, navigation, location and otherconveniences. Vehicle Relationship Management(VRM) telematics, such as remote vehicle diagnostics, preventive maintenancescheduling, driver behavior modification and more.The recent boom in consumer electronics demand provided a timely doorway for OEMs to market telematics. Thetransition began first with CRM embedded products and services that targeted“top-of-mind” consumer demands.These focused on growing the bond between vehicle owners and the automakerby delivering telematics-based applications that provided positive in-vehicle experiences. In addition, it was determinedthat consumers would willingly pay forCRM products and services.The annual International ConsumerElectronics Show (ICES) provides agood barometer for the growth of vehicletelematics systems over time. OEMs firstbegan demonstrating CRM telematics inthe early 2000s—typically infotainmentand navigation products deliveredthrough center stack consoles. It was during this time that General Motors pioneered its OnStar suite of telematics services, which was the first, albeit limited,implementation of remote vehicle diagnostics, safety and other VRM telematics.Other automakers began to followsuit. The automobile industry is now asignificant participant in exhibitor,speaking, panel and planning roles atICES events. At the recent 2013 event,more than a dozen OEMs participated,each with embedded telematics products that featured a mix of proprietaryembedded CRM and VRM features.Consumers have been more or lessconditioned to see automakers as theproviders of infotainment, navigation andother high-value CRM solutions. Persuading them to use vehicle diagnostics andJanuary 201433

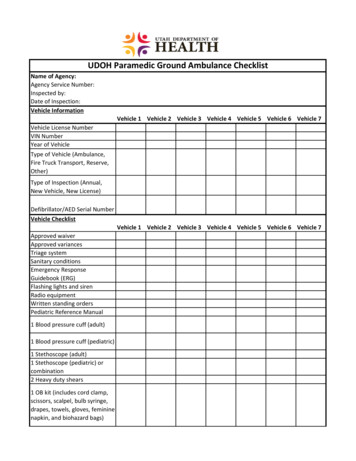

VEHICLE TELEMATICS: POISED TO DELIVERother VRM services is the nextstep, as OEMs try to broadentheir customer relationships bypersuading motorists to alsoview dealers as their go-toguardian and service provider.Images courtesy Strategy AnalyticsImages courtesy AAIABut OEMs also knowtelematics plays a key role inimproving customer retention. “Everything an automaker does after a car issold is aimed at customer retention,” explained MarkHuge RevenueSeng, vice president of GlobPotentialal Aftermarket Practice“The automotive aftermarLeader at IHS Automotive.ket is one of the few indus“From a service perspective,tries where we know whatToyota’s practice has a posiwe’re going to have to sertive impact on customer revice approximately seventention, but there’s more to ityears in advance,” shared Automakers have been trying to cash in on telematics since than this. OEMs know thatFrank Ordoñez a few years it was first introduced. Initially, consumer-related man- keeping vehicle service atago, while he was the presi- agement products created positive consumer experiences dealerships results in a betterthat positioned OEMs as top-of-mind providers. Automakdent of Delphi Product & ers have more recently introduced embedded proprietary customer retention rate thanService Solutions. That holds vehicle-related management telematics products to im- can be realized when vehitrue for telematics.cles are serviced at indepenprove customer retention and brand loyalty.Polk (recently acquired bydent shops. Telematics is aIHS Automotive), Strategytool that can help achieveAnalytics ABI Research, J.D.this.Power and Associates and“The results of a recentother market research firmsPolk/IHS Automotive studyproject that telematics willconfirm this,” Seng added.grow exponentially between“Brand loyalty was measurednow and 2018. In the next fiveamong customers with vehiyears, these research firms say,cles that were just outsidetelematics installations will inthe traditional warranty pecrease by more than 600%riod. OEM brand loyaltyand revenues will more thanamongst customers who conquadruple. They also say thattinued getting service donemost of the sales growth willat the OEM’s dealer networkbe concentrated in the U.S.was at 45.1%. That measureHere’s the rub: Telematicsis considerably higher thanallows direct communication Many aftermarket telematics devices have been introduced the 28.4% loyalty ratingwith vehicles, so it can be in recent years, ranging in purpose from remote diagnos- amongst customers who hadused to refer motorists to fa- tics to insurance-led driver behavior modification units. their vehicles serviced by ancilities for service and repair. AAIA and the Aftermarket Telematics Task Force are seeking independent aftermarket faThe ability for the OEMs to a collaborative, open-platform, standardized approach.cility.”lead and control the dialogueMake no mistake. Vehiclewith the vehicle owner via embedded A Customer Retention Aid designers are combining sensors,proprietary systems, remotely diagnose From a service information and proce- probes and two-way communication deand repair vehicles and suggest mainte- dures standpoint, Toyota Motor Sales vices that gather data, create informanance could negatively impact the after- USA has led automakers in making in- tion for vehicle owners and refer afterformation and diagnostic services af- market service and repairs to their dealmarket, notably independent shops.However, telematics technology also fordable and readily available to inde- er organizations. Proprietary codes arecreates the opportunity for the after- pendent shops. Toyota has repeatedly being used to limit access to the vehimarket and service and repair shops to stated that it wants those who purchase cles databases. Are car-buying cuscompete by developing the means to its vehicles to be able to have them tomers really being served?communicate with their customers and properly serviced and repaired at anytheir vehicles in the same manner. The facility, dealer or independent. Toyota It’s All About the Dataaftermarket, its shops and technicians knows positive service experiences in To date, there has been little collaboramust recognize this and act collectively the aftermarket improve the chances of tion between automakers and the afterto respond to telematics’ inherent chal- a repeat customer. Some other, but not market to ensure that telematics data,all, automakers have followed suit.like service information, is equally availlenges and opportunities.34January 2014

Images courtesy Delphi Product & Service Solutionsable at dealer and independent shops. cept an aftermarket telematics upgrade. ics) won the 2013 challenge with its InInstead, OEM-embedded proprietary“AAIA and like-minded aftermarket Drive system, which offers consumers atelematics solutions are being leveraged organizations have begun raising aware- choice of telematics services, includingto encourage customers to keep having ness and addressing concerns regarding safety and security, vehicle operationvehicle service performed at dealerships telematics. We believe that consumers data, navigation, roadside assistance, dibeyond the warranty period.have a right to choose where their agnostics and service reminders.“Automakers are building a closed telematics data goes and that telematics In mid-2013, AAIA formed the Afecosystem of embedded telematics, communications should be across stan- termarket Telematics Task Force, to diswhich puts them first in line to get re- dards-based, open platforms that do not cuss the future of telematics and deterpair and maintenance data,” notes Fred compromise consumers.”mine what the independent aftermarketBlumer, CEO of Vehcon Inc., who alsoLuckett cited several key initiatives:strategy should be. Current sponsoringco-founded Hughes Telematics. “Clear In 2009, AAIA introduced the Shop associations of the Aftermarket Telematly the independent aftermarket cannot of Tomorrow (iSHOP), an aftermarket ics Task Force are: AAIA, the Automosit by and do nothing while OEMs de- proof-of-concept at AAPEX, which tive Aftermarket Suppliers Associationploy this strategy.”demonstrated the integration of remote (AASA), the Automotive InternationalTo be competitive and caAssociation (AIA) of Canadapable of meeting the needsand the Equipment and Toolof vehicle owners, the afterInstitute (ETI). It has alreadymarket, especially indepenformed three subcommitdent shops and their associatees—policy, technical andtions, must work to ensuremarketing—to capture thethat consumers who buy verange of possibilities, identifyhicles with embedded telepossible barriers or risks assomatics systems have theciated with telematics and desame choice they have todaytermine a path forward.as to where their vehicle gets“The Telematics Taskserviced. Bottom line? ShopsForce exists to serve the longcannot afford to be hogtiedterm needs of independentor inactive when it comes toand national service retailers,”accessing and using telematLuckett stated. “All of theics data to preserve and growparticipants on the Telematicscustomer bases.Task Force are either highly“OEMs also need to stoptechnical and can help designtrying to figure out how to Delphi’s connected car telematics solution employs an OBD a technical solution, or theyget consumers to pay for II plug-in device that connects consumers, their vehicles are associations that representand traditional independent shops with the same remotetelematics subscriptions and diagnostic capabilities to compete with the dealer networks the interests of all of theirjust turn the modems on,” that use OEM proprietary embedded telematics technolo- members, including shopsays Roger Lanctot, associate gies. The solution can be integrated with AAIA’s iSHOP.owners through AAIA’s Cardirector for global automoCare Professionals Networktive practices at Strategy Analytics. “The diagnostic telematics, wireless commu- (CCPN), an advisory body of independata about the vehicle’s use is worth nication and shop management and in- dent shop owners whose purpose is tomore than any [consumer] revenue formation systems. Visit www.aftermar represent their needs and interests withstream they might create.” Examples in- ket.org/Tomorrow for more information. the rest of the association.”clude monetizing telematics by charging In 2011, AAIA began to formulateother commercial users of the data, such its annual Aftermarket Telematics Chal- What Can anas insurance companies who are trying to lenge to spur the development of after- Independent Shop Do?modify driver behavior, service and re- market telematics solutions, then identi- While the automakers are actively enpair facilities and professionals or third fy and recognize the best examples of gaged in deploying telematics for realparty service information providers.connected-vehicle technology that can time connectivity with their customers,“Consumers crave connectivity in be fitted to vehicles in the aftermarket. the bulk of independent aftermarkettheir lives, including their time behind Delphi Product & Service Solutions shops are offline, hoping customers willthe wheel,” explained Scott Luckett, won the 2012 challenge with an OBD II remember them. Aside from thechief information officer for the Auto- plug-in telematics module that enabled CCPN, the majority of aftermarketmotive Aftermarket Industry Associa- car owners to monitor vehicle health shops that fix the vehicles consumerstion (AAIA). “Nearly 160 million vehi- and send diagnostic trouble codes to the buy are not involved in the Telematicscles, 1996 and newer, are equipped with service facility of their choice. Verizon Task Force dialogue.“In the aftermarket, telematics needsan OBD II diagnostic port that can ac- Telematics (formerly Hughes Telemat-January 201435

VEHICLE TELEMATICS: POISED TO DELIVERImage courtesy IHS Automotiveto be deployed by thousands of shops at data requests or information gathering regulators are concerned that OBD IIa time in order to be cost-effective,” may cause a variety of hard-to-diagnose ports and underhood connections proLuckett added. “National retailers, pro- conditions,” cautioned Bernard Lackey, vide hackers, thieves and others withgram groups and banner programs are a brand quality manager at GM Service easy access to data and communicationalso going to have to deploy solutions en Operations.networks, including telematics systems,masse in order to have the scale to keepAsk customers if they’ve had af- to gain control of vehicles, or set themcosts low and to create visibility among termarket devices connected to up, for theft.consumers.”their vehicle since their last visit toAt a recent industry event, MOTOR“Telematics is still in its earliest you. Before you begin service, you asked the automakers present whatstages,” Lanctot emphasized. “The pow- need to know this or you could end up measures were being considered. Sever of telematics is not what it is today, but chasing ghosts.eral said they were considering elimiwhat it could become. Product cycles for“Because OBD II regulations require nating the OBD II port and replacing ittelematics systems are typically in the OnStar [in GM vehicles] not to inter- with wireless connectivity. This wouldthree- to six-month range, much shorter fere with aftermarket devices when allow data and communications to bethan vehicle product cycles. The after- connected and making a data request better safeguarded and made availablemarket is also better positioned than au- through the OBD II port, OnStar can to vetted, bona fide service and repairtomakers are to react to this faster pace be prevented from gathering critical di- professionals. If OBD II ports disapof change.”agnostic data,” Lackey advised. “Certain pear, will you and the aftermarket beHere are five strategies independent aftermarket devices that remain con- ready?Let me share one more of Larryshops and technicians can consider act- nected to the vehicle (underhood, forBurns’ insights from that testing on now:drive ten years ago. “DownGet informed. IndepenRepeat Buying Among Those Whothe road, vehicles will alsodent shops and techniciansmore intelligent. Admust become and remainHave Vehicles Serviced By Dealerships becomevanced sensor systems, comaware of the current state ofmunication networks, teletelematics, as well as emergmatics and other new teching trends, products, threatsnologies will enable OEMs toand opportunities. Automakoffer more advanced infoers are investing huge dollarstainment options, improvedin developing embedded syscollision and passenger safetytems and marketing them toprotection, smarter trafficconsumers, insurance comrouting, enhanced remote dipanies and others. That’s critagnostics and management ofical mass that must be reckvehicles, [and] allow vehiclesoned with.In an IHS Automotive study, brand loyalty wasto be connected and evenGet engaged. Frankly,measured among customers whose vehicles wereopen [them] to autonomoustelematics is too important ajust outside of the traditional warranty period.technology for independentdriving—putting new levelsshops to stand idly by while Automakers view telematics as a marketing tool that can of safety, convenience andothers shape their future. If extend service at dealerships beyond warranty periods, vehicle maintenance withinnothing else, ask your associ- increase customer retention rates and improve brand loy- technological reach.”The emergence and evoations why they aren’t part of alty when customers make their next vehicle purchase.lution of telematics is poisedthe Telematics Task Forcedialogue, and what they’re doing in- instance) during service can also cause to affect us all—from automakers tostead to help you remain competitive problems. If a device makes connection the aftermarket to consumers—soonerand top-of-mind with motorists.with only one CAN bus [between ser- rather than later. As with any new techLearn what you don’t know that vice intervals], it can cause bus errors nology, we must understand telematicscould hurt your service readiness. and strange control module behavior. In and be willing to accept that we mayThe proliferation of certain aftermarket addition, should the device still be oper- have to use new technologies, tools,devices that plug into the underdash ating, it can interfere with diagnostic training and procedures and integrateOBD II communications port, under- communications, such as reprogram- innovations into our business models inhood or elsewhere, can complicate your ming control modules, since the device order to maintain it. That’s just the waychange rolls.ability to service vehicles, according to won’t allow the bus to power down.”ACDelco and GM.Understand that telematics is be“An unauthorized [by the automaker] ing seen as vehicle security informaThis article can be found online ataftermarket device connected that uses tion. Automakers, insurance compawww.motormagazine.com.the vehicle’s serial data bus to perform nies, law enforcement organizations and36January 2014

connected-vehicle technology that can be fitted to vehicles in the aftermarket. Delphi Product & Service Solutions won the 2012 challenge with an OBD II plug-in telematics module that enabled car owners to monitor vehicle health and send diagnostic trouble codes to the service facility of their choice. Verizon Telematics (formerly Hughes Telemat-