Transcription

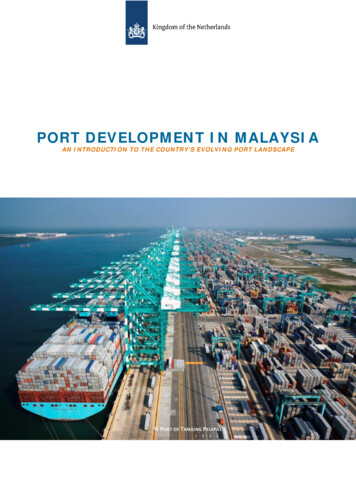

PORT DEVELOPMENT IN MALAYSIAAN INTRODUCTION TO THE COUNTRY’S EVOLVING PORT LANDSCAPE P ORT OF TANJUNG PELEPAS

CONTENTSMARKET OPPORTUNITIES . iiMARITIME GIANT MALAYSIA . 2GATEWAY TO SOUTHEAST ASIA . 3GLOBAL PORT ENVIRONMENT . 4PORTS OF MALAYSIA . 5MMC CORPORATION BERHAD. 7PORT POLICY . 7PORT KLANG . 8WESTPORTS . 9NORTHPORT . 10JOHOR PORT . 11PORT OF TANJUNG PELEPAS . 12JOHOR PORT AT PASIR GUDANG . 13PENANG PORT . 14BUTTERWORTH & PRAI WHARF . 15SWETTENHAM CRUISE PIER. 15BINTULU PORT . 16SABAH PORTS . 17OTHER PORTS . 19KUANTAN PORT . 19MALACCA PORT . 19KEMAMAN PORT . 19LABUAN PORT . 19SIPITANG . 19KUCHING . 20MIRI . 20RAJANG. 20PRIVATE PORTS . 20OFFSHORE SUPPLY . 20SHIPBUILDING . 20i

MARKET OPPORTUNITIESLarge, established port and maritime market.The vast size of the maritime and port industry generates a constant demand totap on to for Dutch port and maritime service providers and technology suppliers,including all on dock cargo handling related activities, tugging, ship supply,maintenance and repair, as well as manufacturers of port related and cargohandling transport equipment, warehousing and other support activities fortransportation.Expanding container transhipment hub.As a large and expanding transhipment hub, Malaysia can greatly benefit fromDutch innovators in the field of container handling and terminal design as toincrease efficiency and capacity both for existing and new terminals in a sustainableway.The prefered gateway to Southeast Asia.With affordable land available within free commercial zones around the majorports, Malaysia is an attractive location for Dutch companies to establish anregional distribution centre to serve the growing Southeast Asian market.Untapped market for smart port development.Malaysian ports need to innovate and modernize their operating facilities throughdigitalization and automation. There is much room for Dutch expertise to meetMalaysia’s prioritized demand for smart-port development, including integratedport community systems and related digital solutions.Huge scale port expansion and land development plans.With a broad range of port expansion and land development plans around the majorports and urban coastal centres, Malaysia is an interesting market for the Dutchport development industry with opportunities for dredgers, engineers, portoperators, constructers, project developers, architects, consultants and investors.ii

One of world’s main palm oil exporters.A solid cargo base is generated by the oil palm, timber and other agriculturalproduce industries. In this regard, specialized Dutch port developers, industrialengineers and project developers can find a promising market for the constructionand expansion of new small sized ports in Sabah and Sarawak.Oil & gas producing and trading hub.Demand for specialized (private) port facilities to serve the vast Malaysian oil & gasindustry remains high, leaving a market for Dutch producers and suppliers ofspecialized industrial equipment, machinery and services in this industry.Offshore supply & maintenance base.Malaysia serves the large offshore industry through its ports on the east coast.Dutch offshore equipment suppliers, constructors and transporters can remain animportant player in this market.Growing cruise destination.As a popular tourist destination surrounded by sea, global rise in cruise tourism willspark demand for extended cruise ports in Malaysia. Dutch cruise supportingbusinesses can help Malaysia to accommodate the increase in cruise calls.iii

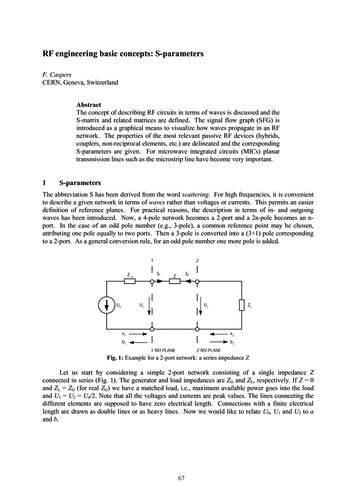

MARITIME GIANT MALAYSIAThe rapid growth and development of the Malaysian economy over the past decadescannot be seen a part from the country’s location alongside world’s most importanttrade routes. The Straits of Malacca have been a strategic waterway in global trade forcenturies. Today that is no different. Malaysia is a real maritime nation and home tosome of the world’s largest ports.According to the United Nations Conferenceon Trade and Development (UNCTAD),Malaysia is the world’s fifth best connectedcountry in terms of shipping line connectivity,ahead of the Netherlands and the UnitedStates. Malaysia is a container transhipmenthub in the region and a market leader inhandling and exporting oil and gas products.accounted for respectively 4.5 and 4.4 millionTEUs in throughput.Last but not least, as one of world’s largestliquefied natural gas (LNG) exporters,Malaysia is home to the first floating LNG portfacility and the largest palm oil terminal inthe world.Over the last ten years Malaysian ports haverecorded an average growth of 3% incompound cargo throughput. Following adrop in 2017 due to a change in the shippingline market and overall lows in globalseaborne trade, cargo throughput recoveredin 2018 totalling at 568 million tonnes.UNCTAD MARITIME CONNECTIVITY INDEXBestconnectedcountriesand/orterritories3. Korea, Rep.5. Malaysia6. Netherlands7. Germany8. United States9. United Kingdom10. BelgiumTREND IN CARGO THROUGHPUT BY MALAYSIAN PORTS(million tonnes)24.9 MILLION TEUS IN 2018export7006004002. Singapore4. Hong Kong (China)About 70% of the cargo is containerized.With a total throughput of 24.9 million TEUsin 2018, Malaysian ports handled almost asmany containers as the ports of Rotterdamand Antwerp combined. While the majority istranshipment, cargo that does not enter thecountry, Malaysian exports and imports5001. t56818%30017%65%2001000Cargo throughput2

GATEWAY TO SOUTHEAST ASIAThe strategic location and good connectivitymake Malaysia one of the preferred countriesto enter the Southeast Asian market. Overthe last decades Malaysia saw an impressiveincrease in container traffic through its ports,leaving behind other emerging economies inthe region. Since 2000 Malaysia recorded a400% growth in container throughput, nowtaking up almost a quarter of all containershandled in the region. Twenty years ago thiswas still 10%.TOTAL CONTAINER THROUGHPUT BY PORTS INSELECTED SOUTHEAST ASIAN COUNTRIES (millionTEUs)4035302520This is no surprise. Malaysia is right at theheart of the region where intercontinentaland intra-Asian sea trade routes meet eachother. Singapore remains the leading port inthe region, but has little space to expand andfewer connections over land. With plenty ofaffordable land available, well maintainedinfrastructure and a flourishing economy,Malaysia will only strengthen its alreadystrong position as the doorstep of the region,and benefit from rising container traffic inSoutheast siaVietnamThailandPhilippinesSOURCE :32008T HE W ORLD B A NK G ROUP

GLOBAL PORT ENVIRONMENTGlobal seaborne trade increased by 4% in2017, the fasted growth in five years. It isestimated that this trend has continued into2018 with UNCTAD forecasting a compoundannual growth of 3.8% until 2023.Shipping line alliancesFollowing the reshuffle of alliances in 2016,Malaysia saw a substantial drop in cargothroughput. Consolidation of shipping linesintomajoralliancesincreasestheirbargaining power when negotiation port callsand terminal operations. In combination withthe ever growing vessel size and thetendency to concentrate activities in severallarge ports along the main trading routes, itis a trend that is expected to continue andform a serious challenge for the fragmentedMalaysian port landscape. Decisions of theliner shipping alliances can make or break thefinancial year of a port. Yet, the same countsfor competing ports in the region. With theright investments and a strategy thatrecognizesthisdevelopments,theestablished ports of choice in the region canbe challenged as well.Globaleconomicandgeo-politicaldevelopments cause both challenges andopportunities for the Malaysian maritime andport sector. Yet it is expected that SoutheastAsia will remain a promising market withincreasinginterestsfrom(overseas)investors and manufactories, sparkinggrowth in flows of goods, expanding tradeand keeping up demand for port activity andexpansion.The role of ChinaA global rise in protectionism and reoccurringtrade disputes between China and the UnitedStated (US) might temper growth in Chineseexports to the West, which can have its effecton seaborne trade and the transhipmentfunction of Malaysia.Modernization & DigitalizationAs in any industry, ports are required toimplement advanced technologies, digitalizeprocesses and adopt innovative workingmethods to improve efficiency, reduce costsand therefore stay ahead of competitors. Thefuture port is a smart port, fully automatedwith a single integrated port communitysystem.Safetyand(cyber-)securityconcerns as well as the impact on the jobs ofport workers cause some reluctance inadopting full scale automation. Nevertheless,to keep up with the most advanced ports,Malaysiarecognizestheurgencyofmodernization, automating and digitalizingport operating activities in the country.However, now that labour costs in China arerising and Beijing is forced to focus more andmore on feeding and serving its domesticmarket, export manufactories are lookingelsewhere and often move activities toVietnam, Malaysia, Indonesia and Thailand.With its comprehensive and well maintainedinfrastructure, relatively low labour costs,English speaking workforce and affordableland available, Malaysia might well be thefirst choice in the region for foreignbusinesses to settle.Likewise, China itself has increased interestin Malaysia and is doing major investmentsin infrastructure projects through its globaldevelopment strategy known as the beltand-road initiative (BRI). On the east coastof Peninsular Malaysia, facing the SouthChina Sea, port development is mainlyincited by Chinese investment.Cruise tourismAs an already popular tourist destination,Malaysian ports will benefit from growth inthe cruise tourism market. Established cruiseports in Penang and Port Klang will have tokeep up with the growing size of cruise shipsand improve their connectivity with touristichotspots near the ports. New cruise portdevelopment is initiated around Port Dicksonand the historical city of Malacca.4

PORTS OF MALAYSIAThe Malaysian port landscape is fragmented into different specialized ports spread overthe country, coordinated by government assigned authorities and operated by privateparties. The main container handling ports are located at the west-coast of peninsularMalaysia, while the major bulk handling ports are on the east-coast and in Sabah andSarawak (Borneo).The fundaments for the current outlook of theport sector in Malaysia were laid in 1963when the Port Authorities Act was adopted,establishing most port authorities and theirfunction. Following the Port Privatization Actin 1990, the port authorities have beentransferring the operating activities to privateparties, hereby establishing their own role asfacilitator, regulator and owner of thedesignated port area. Today Malaysia counts8 federal administrated ports, which arerespectively: Port Klang, Port of TanjungPelepas, Johor Port, Penang Port, BintuluPort, Malacca Port, Kuantan Port andKemaman Port.Furthermore there are ports administrated bythe state governments in Sabah and Sarawakand several private owned port facilities andjetties across the country, including in PortDickson and Lumut, mainly for the benefit ofthe mining and oil and gas industries.PortAuthorityOperatorPort KlangPort Klang AuthorityWesports Sdn Bhd(Hutchison Ports)Northpost Sdn Bhd(MMC Group)Port of Tanjung PelepasJohor Port AuthorityPort of Tanjung Pelepas Sdn Bhd(MMC Group & Maersk Group)Johor PortJohor Port AuthorityJohor Port Sdn Bhd(MMC Group)Penang PortPenang Port Commission(established in 1955 by thePenang Port Commission Act)Penang Port Sdn Bhd(MMC Group)Bintulu PortBintulu Port Authority(established in 1981 by theBintulu Port Authority Act)Bintulu Port Sdn BhdMalacca PortMalacca Port AuthorityTanjung Bruas Port Sdn Bhd(MMC Group)Kuantan portKuantan Port AuthorityKuantan Port Consortium Sdn Bhd(IJM Corporation Bhd & Beibu Gulf Holding Co. Ltd)Kemaman PortKemaman Port AuthorityKonsortium Pelabuhan Kemaman Sdn Bhd(Eastern Pacific Industrial Corporation Bhd – EPIC)5

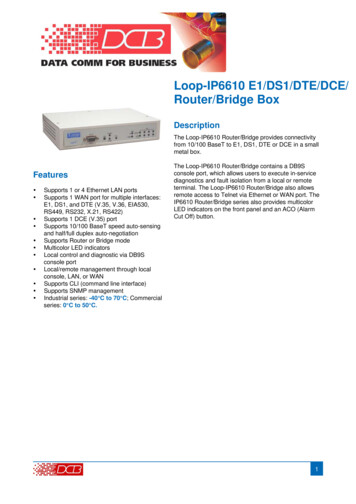

CONTAINERIZED CARGOTHROUGHPUT, 2018(million TEUs)2.352.39Port KlangPort of TanjungPelepasPenang PortMalaysia andoperators.Far ahead of the others, Port Klang and thePort of Tanjung Pelepas handle 64% of totalcargo throughput by Malaysian ports in 2018.As the two main container ports this can beattributed for a huge part to transhipments,yet Port Klang is a main entry and leavingport for goods as porta8.400.720.710.09Johor Portare7.57hubtranshipmentforoffshoreBintulu is the main port of entry for Sarawakand is among world’s largest LNG tradinghubs. Sapangar Bay port is the new vitalizedgateway to Sabah, and serves together withthe other ports in the state the trade of palmoil and related cargo.With little transhipment cargo, but a strongeconomic hinterland and good connections toSouthern Thailand, Penang Port is doing verywell as a regional import and export hub.Johor Port is an important port for the oil andgas industry and the deep-sea ports ofKuantan and Kemaman serve among othersthe mining industry in central and northThe relatively high cargo throughput in PortDickson can be attributed to Shell’s refinerythat operates the port. Lumut jetty isoperated by global mining leader Vale andused as a regional distribution andtranshipment hub.TOTAL CARGO THROUGHPUT BY PORT, 2018 (million tonnes)250.0220.7200.0139.8150.0100.043.950.0-Port KlangPort ofTanjungPelepasBintulu Port36.434.428.122.6Penang Port Johor Port Port .82.71.30.7KuchingKemamanMiriLangkawiRajangPort ofMalacca

MMC CORPORATION BERHADThe main player in Malaysia’s port sector isthe Malaysian Mining Corporation or MMCGroup;anutilityandinfrastructureconglomerate, with diversified businessunder three core divisions: Ports andLogistics,EnergyandUtilitiesandEngineering. Through its Ports & Logisticsdivision, MMC is a near monopolist in themarket, holding Northport (Port Klang), Portof Tanjug Pelepas, Johor Port, Penang Portand the port of Tanjung Bruas (Malacca). Assuch it is among the world’s 10 largest portoperators with an annual throughput ofalmost 16 million TEUs, more than 60% oftotal TUEs handles by Malaysian ports in2018. By holding one of the country’s largestintegrated logistics companies, KontenaNasional Bhd, and the main provider of cargotransport by rail, KTMB MMC Cargo Sdn Bhd,MMC has a large stake in the port-hinterlandconnectivity as well. With MYR 3 billionrevenue in 2018, the Ports and Logisticsdivision accounted for 60% of the totalrevenue of the group.Transport on it’s policy. The port relatedadvicory subommitees in this council are onincreasing Malaysia’s attractiveness toshipping businesses; promoting innovation inand sustainable growth of maritime ancillaryservices; and improving the competitivenessand productivity of Malaysian ports.PORT POLICYIn the Eleventh Malaysia Plan (a 2016-2020spanning economic development plan by theMalaysian government) the following portstrategy is formulated: ‘Expanding portcapacity, access, and operations through theNational Port Policy, a port communitysystem, and improving port accessibility andcapacity.’ In the 2018 mid-term review, thisstrategy is slightly downgraded, stating thatthe government will not consider proposalsfor the construction of new ports, as thecurrent ports are underutilized. Instead,focus will be on increasing efficiency ofconsisting ports, and expanding capacity byinnovation(i.e.digitalizationandautomation) and the construction of newwharfs.Free Commercial ZoneOne of the strategies of the Malaysiangovernment to generate more cargo for itsports is through establishing free commercialzones (FCZ) around the port areas. Thestatus of this areas are regulated through theCustoms Act 1967 and the Free Zone Act1990, allowing goods and services to bebrought into, produced, manufactured orprovided in a free zone without payment ofany customs duty, excise duty, sales tax orservice tax. The main objective of creatingthis FCZs is to attract (foreign) businesses tochoose Malaysia as their manufactoringand/or distribution base. This way the portsare guaranteed a flow of cargo. The mainFCZs inlcude the Port Klang Free Zone, Portof Tanjung Pelepas Free Zone, Pasir GudangFree Trade Zone and the Bayan Lepas FreeUndustrial Zone in Penang.It is indicated that the main challenges andopportunities for Malaysia includes increasingits cargo source and expanding bunker andother ship supply services. These are the twomain factors that shipping liners look at inchosing their port of call. There is anopportunity for Malaysia to benefit from theupcoming IMO fuel sulphur regulation, asstate owned PETRONAS is able to producefuel that meets the new requirements.In this regard, Port Klang is prioritized inMalaysia’s transport and logisitcs agenda anddesignated to become the country’s maritimecentre and bunkering hub. To reach this goalthegovernmenthasamongothersemphasized the urgency of improving lastmile connectivity to Port Klang throughinvestments in infrastructure around theport.This strategy is among others translated intothe National Shipping and Port Council(NSPC), that gathers all stakeholders in thesector to advize the Malaysian Ministry of7

Integrated Port Community SystemAs indicated before, Malaysian ports need toinnovate in order to keep up with itscompetitors.Especiallyintermsofdigitilization and automation there is spacefor imporvement. The Malaysian governmenthas set the creation of a single integratedport community system as a priority in itsport strategy. The main objective is tosimplifyandreducetheformalities,documentary requirements and procedureson the arrival, stay and departure of ships inMalaysian ports. This system shouldstreamline and integrate all the digitalservices of the terminal operators, g agents, the customs and otherservices present. In the fragmentedMalaysian port landscape this might well bethe sector’s biggest challenge and requiresmost expertise from outside.PORT KLANGPort Klang is the largest and most important port in Malaysia. It is situated on the westcoast of the peninsular where the river Klang debouches into the Straits of Malacca,hereby connecting the capital city Kuala Lumpur (38 km upstream) to the sea. PortKlang is a multipurpose port with a total cargo throughput of 221 million tonnes in2018, which is 39 per cent of all cargo handled by Malaysian Ports.The Klang Valley is the country’s economicand industrial heart. Centred in KualaLumpur, the urbanized area is home to over8 million people. To serve this vast urbanarea, Port Klang is designated the nationalloading centre of Malaysia.The port has its origins in the construction ofthe colonial Port Swettenham in 1901. ThePort Klang Authority (PKA) was established in1963, taking over the administration of PortKlangfromtheMalayanRailwayAdministration. In line with governmentpolicy, the port operating facilities havestarted to be privatized since 1986.With a total container throughput of 12.32million TEUs, Port Klang is ranked world’s13th busiest container port in 2018, justbehind Rotterdam (12th). More than half ofthe containers in Port Klang are handled astranshipment, yet, 55% (2.39 million TUEs)of Malaysian containerized seaborne importsenter the country through the port and 53%(2.35 million TEUs) of all its sea transportedcontainerized exports leave Malaysia throughit. Over the last 5 years average growth incontainer throughput has been 3.6%, with anexceptional drop of 9% in 2017 due to areshuffle in shipping line alliances thatcaused some major clients to move theiractivities to Singapore.Today the terminals are operated byNorthport Malaysia Bhd and WestportsHoldings Bhd. The free commercial zone isoperated by Port Klang Free Zone (PKFZ).CARGO THROUGHPUTPORT KLANG, 2018 (milliontonnes)CARGO THROUGHPUTPORT KLANG BY TYPE(%)7%2%4%300250245200217 220212 22120087%150100dry bulkliquid bulkgeneral cargocontainerized cargo850-2013 2014 2015 2016 2017 2018

WESTPORTSWest Port is the newest port area in PortKlang, located southwest of the town on theIndah Island (Pulau Indah). The port isoperated by Wesports Malaysia Sdn Bhd,member of Hong Kong based Hutchison Portsthat holds a 30% share.of 1.3 km. The dry bulk terminal has 4 berthswith a length of 850 meters, andaccommodates a 1 berth cement jetty with atotal length of 285 meters. The break bulkterminal handles steel and general cargoover 3 berths with an aggregate length of600 meters. In 2018 it handled 10.7 milliontonnes of conventional cargo.Westports accounts for 77% of all cargohandled in Port Klang. The port has 9container terminals spread over a quaylength of 5.8 km alongside a 15-17.5 metersdepth, allowing world’s largest containervessels to berth. With 20 berths and 67 shipto-shore cranes it handled about 9.5 millionTUEs in 2018 and welcomed a total of 8,550ships. With the current facilities this can growup to 14 million TUEs per annum. In 2018Westports booked a net profit of MYR 533million.Both the container and conventional cargoterminals provide ancillary services including,storage, on-dock depot, bunkering anddistribution facilities.Expansion & modernizationWestports plans to increase its capacity by 50per cent to 30 million TEUs per annum by2040. After it received an approval-inprinciple by the Malaysian government, afeasibility study on the development ofcontainer terminals 10 to 19 is expected tobe finished by the end of 2019. For the newBesides containers, Westports handlesconventional cargoes. The liquid bulkterminal counts 5 berths with a total length9

a 30-year extension of its port concessionand recorded a net profit of MYR 61 million in2018.CONTAINER THROUGHPUT PORT KLANG (millionTEUs)14.015%12.010%10.0Container services are spread over fourterminals with a combined quay length ofover 3 km and a depth alongside of 11.5 upto 17 meters, allowing vessels with adeadweight tonnage up to 200,000 to berth.In 2018 Northport handled 2.8 million TEU’s.5%8.00%6.0-5%4.02.0-In terms of conventional cargo, Northporthandles break bulk such as iron, steel,timber, plywood, machineries, roll-on-roll-off(RORO) and livestock, as well as dry bulkcargo such as grain, maize, coal, marine saltand fertilizer. In 2018 Northport handled atotal of 8.6 million tonnes conventionalcargo. Especially RORO cargo recordedgrowth in recent years with Northportbecoming a regional car distribution centrefollowing the lifting of government approvalpermits required to tranship .02.12.22.4YoY percentagechange3%5%9%11%-9%3%-15%terminals Westports is exploring new designsand automation options.Next to developing new terminals to grow itscapacity, Westports is looking into ways toincrease efficiency and lower handling coststhrough the (semi-)automation of its existingterminals, including transportation. Digitaland innovative solutions that increase cargohandling speed and improve overall terminalactivities are welcome.Northport is focused on intra-Asian trade,and is the main port of choice for small andmedium sized loads entering Malaysia. It hasextended downstream on-dock supportingfacilities such as re-packaging, warehousing,distribution and freight forwarding services,and is within Port Klang best connected to theMalaysian expressways network. In thisfunction it complements Westports as themain port of choice for huge scaleintercontinental cargo.Westports furthermore envisaged to be selfsufficient in its energy supply and is lookingfor ways to generate power within its portlimits. This offers opportunities for innovativeand experimental solutions.Expansion & Carey IslandThrough its Halal Silk Route initiative,Northport tries to bandwagon on the growinghalal market, by providing an integrated halalvalue chain within its port boundaries. Thefirst halal shipments to China have left theport, and, supported by the Malaysiangovernment, Northport is looking for newhalal trade links to Europe and the MiddleEast.NORTHPORTNorthport Malaysia Bhd operates Port Klang’soldest port areas and positions itself today asan intra-Asian transhipment and regionaltrading hub. It serves the domestic andcoastal trade routes, linking Port Klang toports in Sabah, Sarawak and Brunei as wellas short-sea port destinations in Indonesia,Thailand and Vietnam.Northport, furthermore, targets to generatean additional 2 million tonnes of cargothrough its new established biomassprocessing hub in the Southpoint area. Incollaboration with several industry partnersNorthport is a member of the MMC Group,and functions as a multi-purpose portequipped with facilities and services tohandle containers and conventional cargoes(liquid and dry bulk). Northport was granted10

and supported by the National BiomassStrategy 2020, the hub is set up to processwaste products from the oil palm and timberindustry.In addition, Northport envisages thedevelopment of a third port on the CareyIsland (Pulau Carey). In July 2018 TransportMinisterLokeannouncedthatthegovernment will conduct a study todetermine the feasibility of the proposed MYR200 billion port and maritime city project onCarey Island. As the study supervisor, thePort Klang Authority selects consultants toconduct the study in 2019.Sparked by a high demand for warehousingand distribution activities, Northport isseeking to expand its current terminals, portand free zone area.JOHOR PORTCompassing the most southern part of the Malaysian peninsular, the state of Johor isseparated from Singapore by just a narrow waterway, bridged by two highways and arailway connection. Two of Malaysian major ports are located in the state: Port ofTanjung Pelepas (PTP) and Johor Port at Pasir Gudang. Combined, these ports handled167.9 million tonnes of cargo in 2018. Over the last decades the region has proved tobe a serious competitor for Singapore with a very promising outlook.Johor’s economy is centred around its statecapital city Johor Bahru, which is justopposite of the Johor-Singapore causewaylinking Singapore to Malaysia. Home to 1.6million people, Johor Bahru is Malaysia’s thirdlargest and fastest growing metropolitanarea. Its proximity to Singapore has hadgreat impact on the development of theregionwithbothMalaysianworkerscommuting into Singapore during weekdays,and Singaporean tourists floating into Johorduring the weekends.In addition, in March 2019 Malaysian KAPetra and Hong Kong based Hutchison Portshave established a joint venture with theintention to develop world’s largest oil andgas ship-to-ship transhipment hub inMalaysian waters out of Johor’s coast.CARGO THROUGHPUT (million .0This

Following the reshuffle of alliances in 2016, Malaysia saw a substantial drop in cargo throughput. Consolidation of shipping lines into major alliances increases their bargaining power when nego tiation port calls and terminal operations. In combination with the ever growing vessel size and the tendency to concentrate activities in several