Transcription

Presenting a MassMutualCareChoice Select IllustrationSMFOR FINANCIAL PROFESSIONAL USE ONLY. NOT FOR USE WITH THE PUBLIC.

MassMutualCareChoiceSM SelectSM SelectMassMutual CareChoiceLife InsuranceIllustrationLTC Riders SummaryLife Insurance Illustrationand LTCRidersandSummaryWe understand that clients may find illustrations difficult to understand.NarrativeSummaryNarrativeSummaryThis sales tool will highlighteachofthe sectionsof the CareChoiceCareChoiceSelectwholeis a levelpremium wholelifeinsurancepolicywithtwoLTClifeRiders.whole life policy e LTC Ridersa guaranteed death benefit (equal to the base policy face amount) and a guaranteed cash value. The LTC Ridersprovidea poolof longtermbenefits thatcanforbecertainaccessedto pay forqualifiedlong term care servicesprovide a pool of longterm carebenefitsthatcancarebe accessedto payqualifiedlongcertainterm careservicesreceivedbytheinsured.received by the insured.Client Information Client InformationWhere to start?Prepared forValuedPrepared forValued Client, Male, Age45 Client, Male, Age 45Non-TobaccoUnderwriting Class Underwriting ClassNon-TobaccoFirst, make sure you provideall thepremiumsimportantdatato runclassesthe itingaresubjecttoHomeOfficeapproval.All coverages, premiums and underwriting classes are subject to Home Office approval.will bemedicalrequiredtoprovide medicalinformation,andanageexam45,maynon-tobaccobe necessary.status, age,premiumIn thisinformation,example,weanareusingYou andwill berequired Youtoamount.provideandexammay onclient, 12,000 annual premium for10 years,and thedividendoption of Paid-Up Additions.IssuingCompanyMassachusettsMutualLife Insurance CompanyIssuing CompanyMassachusettsMutualLife InsuranceCompanyNon-guaranteedvalues include dividends which are not dPaymentWholeLifewithPremiumsPolicyLimited Payment Whole Life with Premiums Payable for 10 Years Payable for 10 YearsexampleisrunusingalltheBasicReportsincluded, as well as the optional reportsavailable: InternalGenericPolicyNameWhole Life PolicyGeneric Policy NameWhole Life iledValuesPolicy Form NumberICC19-MMCCWLRider NameAcceleratedDeathLongBenefitfor CareQualifiedLongRiderTerm Care Insurance RiderGenericandRiderMonthlyName GenericAcceleratedDeath nalAcceleratedICC19-LTCR1-MMCCWLAccelerated Rider FormNumber Rider Form Number ICC19-LTCR1-MMCCWLManager or contact the MassMutual Sales Desk at 1-855-464-3436.ExtendedGeneric Rider Name Generic Rider NameExtended LTC BenefitsRider LTC Benefits RiderExtendedLTCNumberBenefits Rider Form NumberExtended LTC BenefitsRider FormMECStatusMEC StatusInitial Dividend OptionInitial Dividend OptionIllustration Section: NarativeSummaryPremiumInformationPremium oPaid-UpAdditionsPaid-Up AdditionsPremium Payment ModeAnnualPremium Payment ModeAnnualWholeLifePolicyPremium 10,428.50Whole Life Policy Premium 10,428.50page 2 theclientwill find a summary of important information, such as thepremium and dPremium 247.63ExtendedLTC BenefitsRider Premiuminitialcoverageinformation.Additionally, you will see the Death Benefit andLTC benefit 1,323.81Extended2LTC BenefitsRiderPremium 1,323.81AcceleratedDeathIllnessBenefitRiderfor TerminalIllnessCharge)Rider (No Premium Charge)Accelerated DeathavailableBenefitfor onTerminal(NoPremiumDay 1 of the policy. You will also see the Initial Maximum Monthly LTC Benefit 11,999.94Total Initial Premium Total Initial Premium 11,999.94and minimum benefit period (48 months).Initial Coverage InformationInitial Coverage InformationInitialPolicyDeathFaceBenefit(Base Policy Face Amount)Initial Death Benefit (BaseAmount) 186,190.00Inflation Protection SelectedInflation Protection SelectedInitial DeathBenefit AvailableforBaseAcceleration(Initial Base Benefit Amount)Initial Death Benefit Availablefor Acceleration(InitialBenefit Amount)InitialExtendedLTCBenefitAmountInitial Extended LTC Benefit AmountInitial LTC Benefit PoolInitial LTC Benefit PoolInitialMaximum Monthly BenefitInitial Maximum MonthlyBenefitMinimum Benefit PeriodMinimum Benefit PeriodNo 186,190.00 186,190.16 372,380.16 7,757.9248 MonthsTerm Care (LTC) CoverageLong Term Care (LTC)LongCoverage 186,190.00NoDeathBenefit 186,190.00day1 186,190.16 372,380.16LTCBenefitday 7,757.92148 MonthsInitial MaximumMonthlyLTC BenefitDividendsguaranteedand arefluctuationssubject to significantfluctuationstheChangeslifetime inof dividendsthe policy.willChanges in dividends willDividends are not guaranteedandarearenotsubjectto significantover the lifetimeof the overpolicy.changeall Non-Guaranteedvalues shown in this illustration.change all Non-Guaranteedvaluesshown in this illustration.Preparedfor:Client (Male, 45, Non-Tobacco)Prepared for: Valued d by: MassMutualAgent by: MassMutual AgentMEC Limit: 10,483.04MEC Limit: 10,483.04Version: MMD Web2021-11-01(AL)Prepared on: NovemberPrepared2, 2021 on: November 2, 2021Version: MMD Web2021-11-01(AL)Illustration Section: How CareChoice Select WorksPAGE32 age 3 has explanatory text and a graph that may be helpful to demonstrate the LTCPage 2 of 42PPage 2 of 42benefits to your clients.FOR FINANCIAL PROFESSIONAL USE ONLY. NOT FOR USE WITH THE PUBLIC.

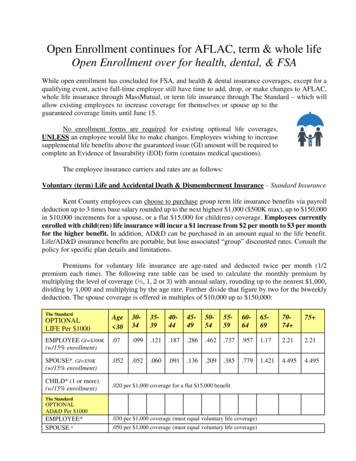

Illustration Section: Narrative Summary and Numeric Summaryand Signature PagePAGES4-12 he Narrative Summary section includes important information about the policy and LTC Riders,Thow dividends work, an explanation of premiums and charges and LTC benefits, tax qualification ofthe LTC Riders, eligibility for benefits and covered services and other important information aboutthe benefits of the LTC Riders as well as other important information such as limitations andexclusions, and the effects of benefit payments on the policy. This section also provides an exampleof the costs of a policy with and without inflation protection, as well as definitions of the termsused throughout the illustration. It should be noted that clients should read the explanations anddefinitions outlined in the Narrative Summary and Numeric Summary sections of the illustrationbefore making any purchase. The Numeric Summary also includes the required signature sectionfor both the applicant/owner and agent.MassMutual CareChoiceSM SelectIllustration Section: Illustrated ValuesSummaryLife Insurance Illustration and LTC Riders SummaryPAGE13Illustrated Values Summary he chart on page 13 summarizes the guaranteed and non-guaranteed values at issue age, age 85TThe followingtables and chartssummarizethethe guaranteedand non-guaranteed illustrated policy values at select ages, whichand theage halfwaybetweentwo ages.include: the age once all Contract Premiums have been paid (Year 10),age 85, and the age halfway between the two. Thesevalues assume that no benefit payments are made under the LTC Riders.GUARANTEED VALUESCumulative Contract Premium: 119,999Age 45Age 65Age 85 372,380 372,380 372,380 7,758 7,758 7,758484848Policy Surrender Value End Year 3,827 120,997 159,239Death Benefit Payable End Year 186,190 186,190 186,190Age Beg YearLTC Benefit Pool Beg YearMaximum Monthly Benefit Beg YearMinimum Benefit Period (in months) Beg YearNON-GUARANTEED VALUES*Cumulative Contract Premium: 119,999Age Beg YearLTC Benefit Pool Beg YearMaximum Monthly Benefit Beg YearMinimum Benefit Period (in months) Beg YearAge 45Age 65Age 85 372,380 477,348 682,101 7,758 7,758 7,758486187Policy Surrender Value End Year 4,177 188,576 435,699Death Benefit Payable End Year 187,142 298,967 509,441IRR* of 4.86%IRR* of 3.58%IRR* of 4.02%LTC BenefitPool Beg YearPolicy SurrenderEnd YearDeath BenefitPayable End YearThis illustration reflects the dividend option of Paid-Up Additions. *Non-guaranteed values include dividends which are neitherestimates nor guarantees, but are based on the 2022 dividend schedule. The dividend schedule is reviewed annually and it is likelythat dividends in future years will be lower or higher depending on the company’s actual experience. For this reason, we stronglyrecommend that you look at a hypothetical lower schedule illustration available upon request.Refer to the Narrative Summary for assumptions, explanations and additional information.* The Internal Rate of Return is a measure that can be used to evaluate performance and is based on the current dividendschedule. For Policy Surrender Value and Death Benefit, the internal rate of return (IRR) is the level interest rate at whichValuedNon-Tobacco)outlays (out-of-pocketPreparedcosts)for:upto Clientthat(Male,year45,mustbe compounded at each year to generate the value shown. For the LTCPresented by: MassMutual AgentMEC Limit: 10,483.04Benefit Pool, it is the levelinterestrateneededto generate the Maximum Monthly Benefit(MMB)each month until the poolPrepared on: November 2, 2021Version: MMDWeb2021-11-01(AL)is exhausted. For example, the annual premium of 12,000 for 10 years would have to earn 4.02%eachyear for 40 years toPage 13 of 42equal the Death Benefit Payable of 509,441 at age 85.FOR FINANCIAL PROFESSIONAL USE ONLY. NOT FOR USE WITH THE PUBLIC.3

Illustration Section: Tabular Values: Guaranteed and Non-GuaranteedPAGES14-19 hese pages in the illustration show the LTC Benefit Pool, Policy Surrender Value, and theTDeath Benefit values over the years of the policy (Shows both guaranteed values andnon-guarantee values).Illustration Section: The impact of LTC benefit payments on policy valuesPAGE20 his page illustrates the impact that LTC claim payments will have on the guaranteedTpolicy values.Illustration Section: Detailed ValuesPAGES21-26 s described on page 11 above, the dividends can be a key competitive advantage forACareChoice products. When electing paid-up additions, pages 21-26 demonstrate the potentialcumulative cash value of the additions over the lifetime of the policy. Also demonstrates thePolicy Surrender Value, which is the combination of the cash value of additions, the cashsurrender value of the guaranteed face amount, and the partial return of LTC rider premium.MassMutual CareChoiceSM SelectLifeInsuranceIllustrationand LTC Riders SummaryCumulative cash value ofPolicy SurrenderPaid Up Dividend additionsValueDetailed Values (Part I)AgeBegYear 0012,00012,000Annual Cash ValueDividend of AdditionsEnd YearEnd rrenderValue(life policy)End Year3,6279,98619,51429,63240,374PartialReturnof LTCPremiumsEnd Year5501,2572,1213,1434,321PolicySurrenderValueEnd efitBeg in months)Beg Year4848484849LTCBenefitPoolBeg AmountBeg CoverageBeg 0186,190186,190186,190186,190186,190186,190FOR FINANCIAL PROFESSIONAL USE ONLY. NOT FOR USE WITH THE PUBLIC.These values assume that no benefit payments are made under the LTC Riders.This illustration reflects the dividend option of Paid-Up Additions. Non-guaranteed values include dividends which are neither4

MassMutual CareChoice SelectIllustration Section: Detailed LTC LifeBenefitPaymentsInsurance Illustration and LTC Riders SummarySMDetailed LTC Benefit PaymentsPAGES27-28Mostclients will want to know what happens to the policy values of the CareChoiceThe following example represents the impact that LTC claim payments will have on both guaranteed and non-guaranteed policyvalues.assumes thatthe insuredeligibleto receiveLTC benefitsCoveredPagesServices beginningat age 85.theIt furtherSelectItpolicywhentheybecomessubmita LongTermCareforclaim.27-28 showclient whatassumes that the insured qualifies for and receives the Maximum Monthly Benefit amount each month until the LTC benefits arewill happen during a claim period and how it affects their policy values.exhausted.Initial Death Benefit: 186,190Initial Contract Premium: 12,000Initial Maximum Monthly Benefit: 7,758Guaranteed Values*Non-Guaranteed Values**YearAgeBegYearLTCBenefitPoolBeg YearAnnualLTCBenefitsPaidPolicySurrenderValueEnd YearDeathBenefitPayableEnd YearLTCBenefitPoolBeg YearAnnualLTCBenefitsPaidPolicySurrenderValueEnd YearDeathBenefitPayableEnd At year 2 ofclaims for anLTC eventAt year 4 ofclaims for anLTC eventIllustration Section: Policy Benefits and Monthly Life Income Option —(Guaranteed and non-guaranteed)PAGES29-34 ages 29-34 illustrate the Monthly Life Income Option available and the impact this has onPthe values of the policy. If the policy is surrendered, the policyowner has the option to apply60104000000331,596331,59661105000381,673the CashSurrenderValue0 of the lifepolicy0 portion0 of the 78434,378the purchaseof a monthly0 life incomeannuity.The0 amount0 shown isequal monthly63107000 the489,850489,85064108000000548,234548,234payment that would be payable based upon the minimum life only income rates of the*These valuesassumethat no dividendsare paid.policy.Thesevaluesappearas both guaranteed and non-guaranteed values.**This illustration reflects the dividend option of Paid-Up Additions. Non-guaranteed values include dividends which are neitherestimates nor guarantees, but are based on the 2022 dividend schedule. The dividend schedule is reviewed annually and it is likelythat dividends in future years will be lower or higher depending on the company's actual experience. For this reason, we stronglyrecommend that you look at a hypothetical lower schedule illustration available upon request.Illustration Section: Internal Rate of Return on Cash Value andRefer to the Narrative Summary for assumptions, explanations and additional information. This illustration is not valid unless accompanied byor preceded by a Basic Illustration dated 11/02/2021. Refer to the Basic Illustration for guaranteed elements and other important information.Death BenefitPrepared for: Valued Client (Male, 45, Non-Tobacco)Presented by: MassMutual AgentMEC Limit: 10,483.04 hisTsectionillustratesfor theSurrenderPreparedon: November2, 2021 the Internal Rate of Return Value and the Death Benefit (non-guaranteed values). The Internal Rate ofReturnis aPage27 of 4235-40measure that can be used to evaluate performance and is based on the current dividendschedule. For Policy Surrender Value and Death Benefit, the internal rate of return (IRR)is the level interest rate at which outlays (out-of-pocket costs) up to that year must becompounded at each year to generate the value shown.Illustration Section: MassMutual DividendsPAGES41-425This section explains the potential dividend with the policy and the options the client has toreceive these dividends.FOR FINANCIAL PROFESSIONAL USE ONLY. NOT FOR USE WITH THE PUBLIC.

FOR FINANCIAL PROFESSIONAL USE ONLY. NOT FOR USE WITH THE PUBLIC.Limited Payment Whole Life insurance (MMCCWL-2019, and ICC19-MMCCWL in certain states, including North Carolina)is a participating, permanent, level-premium life insurance policy issued by Massachusetts Mutual Life Insurance Company,Springfield, MA 01111-0001. 2021 Massachusetts Mutual Life Insurance Company (MassMutual ), Springfield, MA 01111-0001.All rights reserved. www.MassMutual.com.LI7431 1221MM202211-300026

CareChoice Select is a level premium whole life insurance policy with two LTC Riders. The whole life policy provides a guaranteed death benefit (equal to the base policy face amount) and a guaranteed cash value. The LTC Riders provide a pool of long term care benefits that can be accessed to pay for certain qualified long term care services