Transcription

Fiscal Resilience Improvement Program (RRP SAM 50210-001-2)SECTOR ASSESSMENT (SUMMARY): PUBLIC SECTOR MANAGEMENT (PUBLICEXPENDITURE AND FISCAL MANAGEMENT)Sector Road Map1.Sector Performance, Problems, and Opportunities1.The public sector accounts for a substantial portion of overall expenditure in Samoa, withgovernment spending equal to 34% of gross domestic product (GDP) in fiscal year (FY) 2016.The state plays a substantial role in the economy through state-owned enterprises (SOEs),which include a range of commercial businesses that employ 10% of the workforce. Thegovernment supplies most infrastructure services, has a substantial role in agriculture, and runsa number of businesses. Maintaining macroeconomic stability and strengthening the country’sresilience to external shocks through improved public financial management (PFM) is vital toSamoa’s long-term economic growth prospects.2.Samoa has made considerable progress in reforming its PFM systems during FY2008and FY2015. The budget is credible, fiscal information is generally comprehensive andtransparent, the orderliness of and participation in the annual budget process is strong, manyaspects of budget execution (in terms of predictability and control) are carried out well, as aremost aspects of external scrutiny and audit. An independent evaluation1 of progress of thesecond phase of the government’s Public Financial Management (PFM) Reform Plan,implemented during 2011– 2013, assessed that 22 of the 25 reform targets had been either fullyor partially achieved. The most recent Public Expenditure and Financial Accountabilityassessment (carried out in 2013) confirmed these PFM improvements relative to the 2010 PEFA,with notable improvements between the two assessments including arrears monitoring andbroader budget credibility, tax assessments, bank reconciliations, payroll controls, procurement,expenditure controls, internal audit, annual financial statements, and legislative scrutiny of thebudget and audit reports.2 The budget is published each year on the Ministry of Finance website.3.PFM reforms will help reduce public debt to sustainable levels through reduced fiscaldrain and improved efficiencies. Samoa has a generally well managed budget in the face of large12EU. Annual Monitoring Report Public Finance Management Eligibility Assessment: Samoa 2015-2016. Brussels.PEFA. Samoa 2014. ments/WS-Dec14-PFMPR-Public.pdf; PEFA.Samoa 2010. ments/WS-Apr10-PFMPR-Public.pdf

2external shocks. The high levels of debt during FY2009 and FY2016 has reconfirmed the needfor more prudent debt management, particularly for higher-quality investments that contribute toeconomic growth. Economic recovery, and tsunami and cyclone-related recovery efforts havecontributed to rising public debt; however, a large proportion of the new debt is attributable tolarge scale non-economic infrastructure projects such as government buildings. Although Samoasuccessfully reduced debt levels from over 100% of GDP in 1993 to about 30% of GDP inFY2008 through responsible fiscal management and grant financing from development partners,its current debt situation could worsen if fiscal consolidation does not occur. Exogenous shocksand fiscal policy responses have led to debt rising to an estimated 53% of GDP in FY2016.According to the 2015 International Monetary Fund and World Bank Debt Sustainability Analysis,Samoa is currently classified as being at moderate risk of debt distress.34.Budget deficits have been above the government’s long-term target of 3.5% of GDP sinceFY2009 as a result of (i) Samoa’s recovery and reconstruction needs following natural disastersin 2009 and 2012, which are estimated to have cost around 40% of GDP; and efforts to maintainaggregate demand in a subdued domestic economy. Rapid fiscal expansion and borrowing sinceFY2009 has left Samoa with a large debt stock and higher operating costs. Continued efforts willnow be necessary to bring public finances back onto a sustainable footing. Samoa’s fiscal trendsuntil FY2015 have reflected high expenditure levels and modest revenue growth, with high levelsof financing through aid inflows. The fiscal deficit remained above the targeted 3.5% of GDP untilFY2015. Deficits were largely financed by external borrowings, with debt reaching 57.8% of GDPin FY2015. Budget deficits need to be kept low, as was the case in FY2016, when lowerexpenditure levels resulted in a deficit of 0.4% of GDP, and public debt declined to 52.6% ofGDP.5.Improving PFM will also help build the country’s resilience to natural disasters.Agriculture and tourism are the mainstays of the Samoan economy. Agriculture comprisesaround 10% of the economy and employs roughly two-thirds of the largely rural-basedpopulation. Agricultural produce makes up the bulk of the country’s exports, making the Samoan3International Monetary Fund. 2015. Samoa: Staff Report for the 2015 Article IV Consultation—Debt Sustainability Analysis. dsacr15191.pdf

3economy particularly vulnerable to natural disasters. Tourism accounts for approximately 25% ofGDP. Growth and demand in both industries weakened significantly as a result of the 2009tsunami and 2012 cyclone. The government intends to mainstream climate resilience in policydecisions and public investments in order to reduce disruptions to public expenditure programsand public service delivery.2.Government’s Sector Strategy6.Maintaining macroeconomic stability is a core strategy of the Strategy for theDevelopment of Samoa (SDS) 2012–2016. 4 According to the International Monetary Fund(footnote 2), Samoa’s fiscal and monetary policies are consistent with the prevailing economicconditions, and Samoa has begun to consolidate its fiscal position to return its public debt tomore sustainable levels over the medium to long term. The outlook is, however, subject to anumber of important risks. The envisaged positive economic contributions from tourism andagriculture may fail to materialize, particularly if natural disasters such as tropical cyclones (towhich Samoa is highly susceptible) continue to increase in frequency and intensity. These willcause growth to fall short of the already modest medium-term projections and make reductions inthe debt-to-GDP ratio more difficult.7.Weak institutional capacity in Samoa could also hinder the implementation of coreeconomic reforms, and divert administrative and policy attention to reforms that are politicallyappealing but are not accompanied by significant productivity gains. Another key risk to reform isposed by Samoa’s high degree of vulnerability to external shocks, including from naturaldisasters. Experiencing another major natural disaster over the medium term will threatenSamoa’s macroeconomic stability and require that many government staff shift their attention todisaster recovery and reconstruction. Samoa’s Public Finance Management Reform Strategy(PFMRP) will focus on improving policy coordination and the link between planning andbudgeting during its third implementation phase (2015-2017).8.Samoa has established a comprehensive framework for climate change adaptation at thenational and sectoral level. Samoa has signed and ratified the United Nations FrameworkConvention on Climate Change and the associated Kyoto Protocol. The national policy tocombat climate change (NPC) was approved by Cabinet in 2008.5 Most activities identified in thepolicy are at an advanced stage of preparation or in the process of implementation. Work iscurrently underway to update the National Adaptation Programme of Action of 20056, whichidentified priority activities by consensus. Furthermore, the SDS has introduced environmentalsustainability and disaster risk reduction as a specific goal, with targets, since 2008. Severalsectoral strategies and action plans also include climate change adaptation aspects, includinginfrastructure, forestry, land use, waste management, biodiversity, housing and water.456Ministry of Finance, Government of Samoa. 2012. Strategy for the Development of Samoa, 2012–2016. Apia.Government of Samoa, Ministry of Natural Resources and Environment. 2007. National Policy of Combating ClimateChange. Apia.UNDP. 2005. National Adaptation Programme of Action. Washington D.C.

49.In terms of institutional responsibilities, the Ministry of Finance (MOF) is responsible forformulating, implementing, and evaluating fiscal and financial policies; developing nationaleconomic strategies and plans; and coordinating development assistance. While the MOF is wellmanaged and working to improve its structure, procedures, and systems, it suffers fromlong-standing capacity constraints with regard to national planning. Given the central role of theMOF in overseeing public finance, continued capacity development in these areas is warranted.A series of institutional mechanisms have been established to coordinate climate and disasterresilience projects, including the Climate Resilience Implementation and Coordination Unit withinthe Ministry of Finance, the National Disaster Council, the National Climate Change CountryTeam, the Climate Change Unit within the Ministry of Natural Resources and Environment, andan ongoing climate change Projects Steering Committee. Emphasis is also placed on involvingthe private sector and communities, and on raising public awareness.10.MOF has responsibility for most financial management matters under the Public FinancialManagement Act of 2001 (revised) and leads and coordinates the PFMRP through a task forceof assistant chief executive officers from all MOF divisions. The task force, which is chaired bythe chief executive of MOF, meets at least once per month. The Finance Sector AdvisoryCommittee provides higher-level direction to the design and implementation of the PFMRP. Itsmembers are the chief executives of the ministries of finance, revenue, and statistics, thegovernor of the Central Bank, and the controller and chief auditor. An important feature is thesignificant responsibility and accountability placed on MOF division heads for delivering PFMRPactions that fall under their functional responsibilities.11.Each new phase of the PFMRP is endorsed by the Cabinet. The Cabinet and the CabinetDevelopment Committee receive regular reports on progress in implementing public financialmanagement reforms. While many early elements of the current PFMRP phase were focused onMOF, the Ministry of Public Enterprises, the Ministry of Revenue, and the Audit Office, there hasbeen growing attention to strengthening PFM systems in line ministries and sector agencies.This is likely to increase as further phases of the PFMRP are designed and implemented.3.ADB Sector Experience and Assistance Program12.The Economic Recovery Support Program7 and Public Sector Financial ManagementProgram8 of the Asian Development Bank (ADB) helped Samoa recover from the combinedimpact of the global financial crisis, the 2009 tsunami and the 2012 tropical cyclone. Policyactions undertaken by the government include improved PFM and continued significant andpolitically sensitive SOE reforms.78ADB. 2010. Report and Recommendation of the President to the Board of Directors: Proposed Program Cluster andLoan to the Independent State of Samoa for Subprogram 1 of the Economic Recovery Support Program. Manila;and ADB. 2011. Report and Recommendation of the President to the Board of Directors: Proposed Loan to theIndependent State of Samoa for Subprogram 2 of the Economic Recovery Support Program. Manila.ADB. 2013. Report and Recommendation of the President to the Board of Directors: Proposed Policy-Based GrantIndependent State of Samoa: Public Sector Financial Management Program. Manila.

513.Use of the budget support modality remains a high priority for the government,particularly in terms of increasing expenditures to maintain delivery of essential public services.Ongoing sources of budget-support funding include: the European Union for water supply andsanitation; the Governments of Australia and New Zealand for performance-based budgetsupport for PFM; and ADB and the World Bank for general budget support. A large part of thefunding for capacity building has been provided by Australia and New Zealand through the PublicSector Improvement Facility. Technical assistance for public finance reform has also come fromthe ADB, the European Union (mainly through the Technical Cooperation Facility), the PacificFinancial Technical Assistance Centre, and the World Bank.14.In March 2013, ADB, Australia, New Zealand and the World Bank developed a joint policyaction matrix (JPAM) with the Government of Samoa, which provides the framework forpolicy-based financing. The JPAM has five key themes—strengthening of planning systems,stronger contributions by SOEs, better public financial management systems, maintenance ofoverall fiscal discipline, and consultation and engagement of stakeholders. The strategic focus ison PFM reform and good governance, with 17 actions designed to trigger budget support fundingfrom the various development partners. There is broad agreement among the JPAM partnersthat the matrix should focus on economy-wide PFM and structural reforms, and thatsector-specific matters should be handled through sector-based budget support.

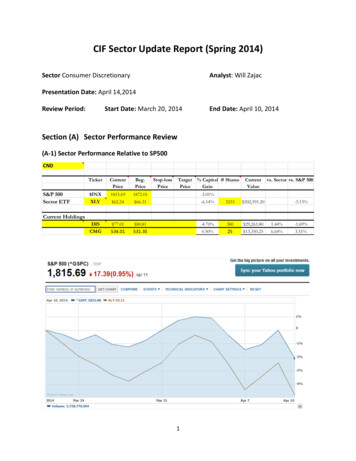

6Problem Tree for Public Sector Fiscal ManagementLimited fiscal room todeliver basic public servicesand respond to shocksEFFECTSRising public expenditureand debt levelsReconstructiondominates publicspending and debtHigh vulnerability toclimatic shocksLink betweenplanning andbudgeting is weakState-owned enterpriselosses drain the budget andhinder service deliveryWeak budgetmanagement andprogram budgetingPoorly performingstate-ownedenterprisesCORE PROBLEMInadequate value-for-moneyin public procurementsLarge, non-competitivepublic procurementsPublic debt levels areunsustainableFiscal deficitswideningCAUSESUB-CAUSE

7Sector Results Framework (Public Sector Fiscal Management, 2016–2018)Country Sector OutcomesOutcomes withIndicators withADBTargets andContributionBaselinesLong-term fiscalGovernmentstabilityachievesits medium-termtarget ratio of publicdebt to GDP of 50%by FY2020(FY2016 baseline:55.7% of GDP)Sustainable fiscalbalance achievedand maintained, withfiscal deficit at orbelow 3.5% of GDPduring FY2017–FY2019 (Baseline:average fiscaldeficit of 4.2%during FY2009–FY2016)Country Sector OutputsIndicators withOutputs with ADBIncrementalContributionTargetsImprovements in the PEFA ratings of C for (i) compositionPEFA ratings forof expenditure;Samoa, particularlyfor publicclassification of thebudget; timeliness,procurementvalue for money,and controls inRationalization ofSOEs reduces drain procurement;regularity ofon governmentbudgetaccountsreconciliation; andoversight ofNational monitoringaggregate fiscal riskand reportingframework forfrom otherclimate changepublic-sector entities(2012 baseline: C)establishedand (ii) multiyearperspectives infiscal planning,effectiveness ofinternal audit,quality andtimeliness of annualfinancial statements(2012 baseline: C)ADB Sector OperationsPlanned andMain OutputsOngoing ADBExpected fromInterventionsADB Interventions2016Main outputs includeFiscal Resilienceimproved (i) SOEImprovementperformance, (ii)Program;public procurementSubprogram 1systems,(iii) public debt2017management, andFiscal Resilience(iv) resilience toImprovementclimate change.Program;Subprogram 22018NoneADB Asian Development Bank, CDTA capacity development technical assistance, FY fiscal year, GDP gross domesticproduct, PEFA Public Expenditure and Financial Accountability, SOE state-owned enterprise.Source: Asian Development Bank.

Development of Samoa (SDS) 2012-2016.4 According to the International Monetary Fund (footnote 2), Samoa's fiscal and monetary policies are consistent with the prevailing economic conditions, and Samoa has begun to consolidate its fiscal position to return its public debt to more sustainable levels over the medium to long term.