Transcription

NÁRODNÁ BANKA SLOVENSKAANALYSIS OF THE SLOVAK FINANCIAL SECTOR FOR THE YEAR 2011ANALYSISOF THE SLOVAK FINANCIAL SECTORFOR THE YEAR 2011

Analysisof the Slovak Financial Sectorfor the Year 2011

Published by: Národná banka Slovenska 2012Address:Národná banka SlovenskaImricha Karvaša 1813 25 BratislavaSlovakiaTelephone: 421 2 5787 2141 421 2 5787 2146Fax: 421 2 5787 1128http://www.nbs.skAll rights reserved.Reproduction for educational and non-commercialpurposes is permitted provided that the source isacknowledged.ISSN 1338-5542 (online)

ContentsForeword 4Analysis summary 61Macroeconomic developmentsas they affect financialsector stability 112 Developments in the Slovakfinancial sector 202.1 The banking sector 262.1.1 Trends in the banking sector balancesheet 262.1.2 Financial position of the banking sector 372.2 The insurance sector 412.3 The pension sector 472.3.1 Retirement pension saving 472.3.2 Supplementary pension saving 512.4 Collective investment 542.5 Investment firms 593 Risks in the Slovak financialsector 603.1 Credit risk in the banking sector 3.1.1 Credit risk in the household sector 3.1.2 Credit risk in the non-financialcorporations sector 3.2 Market risks and liquidity risk 626264673.2.1 Market risks in banks 3.2.2 Market risks of other non-banksegments of the Slovak financialmarket from a systemic view 3.2.3 The most significant market risks inindividual non-bank sectors of thefinancial market 3.2.4 Measuring market risks using Valueat Risk (VaR) 3.2.5 Liquidity risk in the banking sector 67687073744 Macro stress testing of theSlovak financial sector 764.14.27779Description of scenarios used Scenario impacts Macroprudential indicatorsof the financial sector 85glossary and abbreviations 100LIST OF CHARTS AND TABLES 106List of boxesBox 1Recommendation of NBS concerningbanking sector stability 39NBSAnalysis of the Slovak Financial Sector20113

Foreword

ForewordNárodná banka Slovenska produces the Analysisof the Slovak Financial Sector for the purposes ofthe NBS Banking Board as well as for professionals and the wider public. The aim of this reportis to analyse the current situation and developments in the domestic financial market, to warnof potential risks and threats to its stability, andthus to help avoid potential crisis situations.This analysis evaluates the overall condition ofthe financial sector as at 31 December 2011, although in several parts it uses later data, whereavailable. The main aim is to assess the financialsystem’s resilience to possible negative developments, looking at both individual institutionsand the sector as a whole. The analysis providesa more detailed view of the links between financial sector developments, on the one hand, andmacroeconomic and microeconomic indicators,on the other hand. The macro-prudential natureof the analysis is reflected mainly in the use ofstress testing, which may be used to guage thefinancial sector’s sensitivity under various scenarios. In the Annex there are charts of selectedmacroprudential indicators for the main risk areas in the financial sector.As in previous analyses, financial information onparticular institutions is primarily obtained fromNBS information systems and from documentsproduced by various departments of the NBSFinancial Market Supervision Unit. Additionalsources include the Statistical Office of the Slovak Republic (SO SR), Eurostat, the EuropeanCentral Bank (ECB), and other external sourcesand commercial information systems. The analysis does not cover the exercise of supervisionover particular institutions.NBSAnalysis of the Slovak Financial Sector20115

Analysissummary

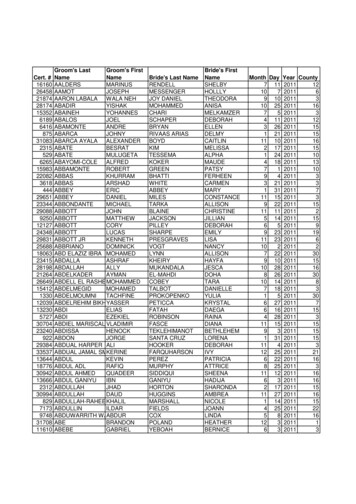

Analysis summaryExternal developments significantly affected thedomestic financial sector in 2011The stability of the domestic financial sector in2011 was affected by many factors, includinga number of relatively new and specific trends.These originated mainly from the external environment and were largely related to the euroarea sovereign debt crisis. Most segments of thedomestic financial market recorded a declinein assets or marked slowdown in their growth,particularly in the second half of 2011. Annualprofitability growth also decelerated in the second half of the year. On balance, the effects ofexternal developments on financial sector stability were more adverse than positive.Positive trends in the banking sector were mostapparent in the first half of 2011The banking sector in Slovakia went through twodistinct phases in 2011. The first half of the yearsaw the continuation of several positive trendsthat began in 2010. Particularly during the firstquarter there were improvements in the economic situation in both Slovakia and abroad, aswell as a certain degree of stabilisation in globalfinancial markets. In Slovakia, bank lending tohouseholds rose markedly, and by the end of thefirst half of 2011 the stock of housing loans wasalready approaching pre-crisis levels. Lendingto firms also began to pick up significantly during this period, after several years of stagnation.In addition, bank profits surged in the first sixmonths and the sector‘s total profit at the end ofJune 2011 was almost 90% higher year-on-year.The sovereign debt crisis in the second half of2011 affected the Slovak financial sectorFor the domestic financial sector, includingbanks, the situation began to change appreciably in the second half of 2011. Several euroarea countries were affected by a combinationof three major risks – the sovereign debt crisis,a slowdown or decline in economic growth, andthe state of banking sector stability in certaincountries. These risks also affected the Slovak financial sector to varying degrees.The principal risk was the sovereign debt crisis,which gained momentum towards the end of2011 when its repercussions spread to almostall euro area countries. For the Slovak financialsector, the main impact of this phase of the crisis was on investments in Slovak governmentbonds, especially given the substantial exposure to this group of assets. The revaluation ofgovernment securities adversely affected theprofitability and capital adequacy ratio of certain banks.The insurance sector, too, was quite heavily exposed to the risk of a decline in governmentbond prices, due to both the relatively largeholdings of these securities and also the relatively long duration of the portfolios. The situationin financial markets also had an adverse effecton supplementary pension funds and collectiveinvestment funds, which were exposed not onlyto market developments for bonds issued bySlovakia and other central European countries,but also to a large degree by stock market turbulences. As a result, the performance of several ofthese funds declined relatively sharply in the second half of the year. On the other hand, investments of pension fund management companiesremained largely conservative in 2011 and theirvalue was not affected to any significant extenteven by the bond market developments in thelast quarter of the year.Credit risk in the banking sector increasedThe second external risk that affected domesticbanks was a slowdown in euro area economicgrowth, which gradually passed through to theSlovak economy. The Slovak growth forecast for2012 was repeatedly revised down during thesecond half of 2011.Certain indicators for the household and nonfinancial institution sectors also began to deteriorate during this period, which affected theability of households and enterprises to repaytheir bank loans. The labour market situationworsened, and several segments of the nonfinancial institution sector reported a decline insentiment indicators and performance.Credit risk in banks was heightened by inflation,with the inflation rate in Slovakia being amongNBSAnalysis of the Slovak Financial Sector20117

a n a ly s i sthe highest in the euro area throughout 2011. Atthe same time, however, households and enterprises benefited from the persisting low level oflending rates.Although the amount of non-performing loansin the banking sector did not increase significantly, the NPL ratio stopped declining, which isanother sign of mounting credit risk. Overall, weexpect credit risk in the banking sector to increase in 2012 on the back of developments in theexternal environment.Lending and profit growth slowed in the secondhalf of 2011The activities of domestic banks reflected theworsening outlooks for economic growth andseveral other economic indicators. Growth inlending to households began to decelerate inthe second half of the year. According to severalbanks, one of the key reasons for this slowdownwas declining household demand for housingloans amid weakening household confidence.This period also saw declining growth in loans toenterprises.In addition, profitability growth in the bankingsector moderated in the second half of 2011,since, as mentioned earlier, it was adversely affected by the revaluation of bond portfolios. Incomparison with 2010, however, costs of nonperforming loans were lower and interest income from the non-financial institution sectorwas higher. Interest income from loans to households recorded lower growth than in the previous year.Negative perception of euro area banks affecteddomestic banks only indirectlyThe specific external risks that banks faced during 2011 were related to the generally negative perception of the euro area banking sectorand hence of the parent undertakings of Slovakbanks. Banks in Slovakia were not exposed tothis risk directly. No domestic bank reported significant adverse effects on its profitability, capitalor liquidity position.Risk was closely monitored by rating agencies.Deteriorating position of parent institutions wasunderstood as a risk for subsidiaries given thelower probability that parent institutions willsupport their subsidiaries in case of need. Thes u m m a r yrisk was generally applied to all banks in Centraland Eastern Europe.Competition for household business remained highThe financial position of banks was affected bythe ongoing strong competition in householdsector, and particularly in banks‘ interest-ratepolicies. Interest rates on longer-term time deposits and on housing loans with longer initialrate fixation periods did not closely follow underlying fundamentals, but instead were at levels favourable for bank customers. Profitabilitywas affected mainly by the decline in interestrate spreads for the household sector and thelower annual growth in interest income from thissector.The banking sector remained stable in 2011Despite facing certain adverse trends during theyear, the banking sector in Slovakia remained ina sound and stable position in 2011. The risksto which the sector was exposed were coveredby its very strong financial position. Althoughthe sector‘s profitability growth slowed in thesecond half of the year, its total profit for 2011was around a third higher than the profit for theprevious year. At the same time, domestic banksplan to retain a large proportion of their profitsin their capital.The banking sector‘s capital adequacy ratio increased in 2011 and stood at 13.4% by the end ofDecember, higher than the average for EU banking sectors. Most of that ratio was for core Tier 1capital.In 2011 the banking sector did not abandon itstraditional model where the focus is on the domestic economy and risks.Banking sector has a stable liquidity positionThe banking sector in Slovakia, unlike manyother countries, has a relatively robust liquidityposition. Bank lending is financed primarily outof retail deposits, which means the sector is lesssensitive to relatively unstable funding from financial markets. Most banks, in regard to liquidity, report minimal dependence on financingfrom parent undertakings. In view of the regulatory requirement laid down by Národná bankaSlovenska, domestic banks maintain a significantamount of liquid assets, which means they areresilient to any sizeable decline of funds.NBSAnalysis of the Slovak Financial Sector20118

a n a ly s i sNBS issued recommendations on strengthening thes u m m a r ystability of the domestic banking sectorweighed the worsening of financial results dueto the ongoing crisis.The Slovak banking sector was also supportedby the NBS decision to issue recommendationsfor the banking sector mainly in regard to itscapital and liquidity positions. The recommendations were a response to an expected deterioration in the environment in which banksoperate and their main purpose was the maintenance of adequate capital buffers. Given thestrong position of the banking sector, the recommendations were largely a precautionarymeasure.The amount of technical provisions fell moderately, with the most pronounced declines in theprovision for claims and the provision established on the basis of a provisions adequacy test.The asset coverage of technical provisions wassufficient, and these assets continued to be invested in a conservative and largely unchangedmanner. The main change in 2011 was caused bya redemption of government bonds and theirpartial replacement by corporate bonds.Stress testing results indicate banking sectorstabilityThe banking sector‘s resilience to substantialadverse developments was confirmed by stresstesting. The stress tests were designed to reflecton risks that the sector may face in the future.The scenario „Economic Downturn“ simulateda slump in the domestic economy. The scenario“Sovereign Crisis” combined a downturn in thedomestic economy with a worsening of adversetrends in the euro area sovereign debt market. Inboth scenarios, the banking sector as a whole reported strong resilience based largely on soundcapital ratios.Insurance sector showed relatively positive trendsin 2011Life insurance premiums continued to recordmoderate growth in 2011, as they had in previous year, driven mainly by unit-linked and supplementary insurance products. Non-life insurance premiums rebounded moderately in 2011with growth in almost all insurance lines and thestrongest growth in property insurance premiums.The overall loss ratio reached its lowest levelsince 2006, largely due to a decline in the lossratio in property insurance. By contrast, the expense ratio increased slightly. The reinsuranceratio increased modestly. At the same time, reinsurance appears to be efficient since the reinsurance of claim costs and premiums have verysimilar ratios.The profitability of the insurance sector in 2011increased substantially in year-on-year terms.Profitability was driven mainly by the technicalresults in life and non-life insurance, which out-Supplementary pension funds performed poorlyIn the area of pensions, the number of peopleenrolled in Pillar II (retirement pension funds)and Pillar III (supplementary pension funds)increased modestly in both cases. There was,however, a relatively marked difference in theincrease in assets under management in thetwo sectors. Whereas the net asset value ofPillar II funds maintained its linear growth ofprevious periods, the NAV growth of supplementary pension funds was only one-third ofthe level of the previous year. This disparitywas largely explained by the weak performance of Pillar III funds, which on average madea negative return of 2.6%. This was related tothe difference in risk policies of the portfolios,the main difference being in their exposure toequity instruments.The asset structure of Pillar II funds did notchange significantly in 2011 and remained largely conservative.The financial result of management companiesin both the Pillar II and Pillar III sectors improvedin 2011. Indeed, supplementary pension management companies (Pillar III) made their firstever aggregate annual profit.Assets in collective investment funds declinedTrends in the collective investment sectorwere predominantly negative during 2011. Theamount of assets under management in the sector declined by 15%. The household sector‘s netsales of common fund shares amounted to almosthalf a billion euro, with money market funds recording the highest volume of redemptions. Redemptions were concentrated in the second halfof the year and peaked in August. The decline inNBSAnalysis of the Slovak Financial Sector20119

a n a ly s i sthe sector‘s net asset value was further exacerbated by the average negative performance ofcommon funds. Their returns, especially those ofequity funds and funds of funds, were deeply innegative territory.s u m m a r yThe actual asset structure of common funds remained largely unchanged. On the positive side,management companies in the collective investment sector managed to increase their profitability in 2011.NBSAnalysis of the Slovak Financial Sector201110

C h a p t e rMACROECONOMICDEVELOPMENTSAS THEY AFFECTFINANCIAL SECTORSTABILITY11

c h a p t e r11 Macroeconomic developments as theyaffect financial sector stabilityEconomic slowdown in advanced countriesThe year 2011 was difficult in terms of economicgrowth, with the negative developments undoubtedly outweighing the positive ones. RealGDP growth undershot original estimates and,to an even greater degree, was lower than in theprevious year. This was true not only for the global economy as a whole, but also for the majorityof regions and individual countries.Hence there was a further widening of thealready considerable gap between growth inthe still fast-growing emerging countries andgrowth in stagnating advanced economies.Outlooks for 2012 are even gloomier. According to Consensus Forecast1 medium-term projections, economic growth is expected to continue decelerating and several countries mayeven experience a contraction. More seriousstill is the escalating vulnerability and sensitivity to additional shocks and the overall unpredictability of developments. The downsideChart 1 GDP forecasts for selected economiesin 2012 (%)risks to GDP growth forecasts are at presentunusually high.The mounting sovereign debt crisis in the euroarea had major repercussions on global economicdevelopmentsBy far the most prominent of the many economicissues in 2011 was the euro area sovereign debtcrisis. As a result of this crisis, it was the euro areathat experienced the greatest difficulties duringthe period under review and its future outlooksappear to be the least favourable. It should beadded that the stress situation in Europe affected the whole world to a greater or lesser degree.The unsustainability of public finances in Europehad not been entirely new phenomenon; however its systemic dimension significantly intensified during 2011, not only for Europe, but for theentire world. During the year the euro area crisiswent through several phases, which appearedto affect first financial markets and later also thereal economy. Periods of elevated stress wereChart 2 Standard deviation of forecasts forGDP growth in the euro area and the UnitedStates (p. p.)50.840.730.620.510.400.3-1Euro areaFranceUnited StatesJan. 2012Feb. 2012Dec. 2011Oct. 2011Nov. 2011Sep. 2011July 2011Aug. 2011June 2011Apr. 2011May 2011Mar. 2011Jan. 2011Feb. 2011-20.2ItalyGermanySlovakiaSource: Consensus Forecasts; London, Consensus Economics.Note: The vertical scale shows consensus forecasts for GDPgrowth (median of values given by forecasting institutions),made in the respective month.0.1020062007Euro area2008200920102011United StatesSource: Consensus Forecasts; London, Consensus Economics.Note: The vertical scale shows the standard deviations of GDPgrowth forecasts in the sample of forecasting institutions.1 Consensus Forecasts; London,Consensus Economics.NBSAnalysis of the Slovak Financial Sector201112

c h a p t e rinterspersed with calmer periods, but the general trend clearly indicated a mounting range ofproblems.Due to this fear, and accompanying circumstancessuch as decelerating economic growth, marketsturned their attention to Spain and Italy. Giventhe size of these economies, the spread of contagion to them represented a substantial qualitativeshift. The following period saw the escalation ofa dangerous cycle of three mutually reinforcingnegative trends – a deteriorating macroeconomicoutlook, banking sector instability, and rising riskpremia on new and outstanding sovereign debt.Despite intensive efforts by European leadersto adopt measures that would definitively endthis cycle, the pessimism in financial marketsbecame more entrenched, except during someshort calmer periods. The sovereign debt crisisreached its peak, to date, in November and at thebeginning of December when European bondmarkets were gripped by panic and even thosecountries that had hitherto been considered themost creditworthy saw investor flight from theirgovernment bonds. Not only market participants,but also credit rating agencies judged the situation to be critical. The credit ratings of most euroarea countries were downgraded, often by severalnotches. These moves also contributed to mounting nervousness.Credit rating at the beginning of 2010Credit rating in mid-March 2012Source: Bloomberg, www.standardandpoors.comNote: The table shows S&P long-term credit kiaJan. 2012Dec. 2011Oct. 2011Nov. 2011Sep. 2011July 2011Aug. 2011June 2011Apr. 2011May 2011Mar. 2011Jan. 20110Feb. 20110Dec. nBelgiumAustriaChart 4 Yields to maturity of 10-year governmentbonds of selected euro area countries (% p.a.)FranceChart 3 Credit ratings of selected euro areacountriesNetherlandsTurbulence in financial markets, particularly in thesecond half of 2011High volatility and nervousness characterisedfinancial markets for the most part of 2011; thisGermanyLooking at the chronology of the sovereign debtcrisis in 2011, the first key event was the requestand subsequent approval of financial assistancefor Portugal, which became the third countrydependent on assistance of EU/IMF. Soon afterwards, towards the end of the first half ofthe year, the focus of attention turned again toGreece. It was becoming clear that the first rescue package for Greece would not be sufficient,since the implementation of the state budgetwas going less well than planned. As investorsin Greek government bonds began to have serious doubts about the country’s ability to putits public finances back on a sustainable footing, the yields on Greek debt hit record highs.As part of a proposed recovery programmeaimed at preventing a disorderly Greek default,the private sector was asked to bear part ofthe cost of restructuring the country’s debt. Toa large extent because of this request, the crisissubsequently gathered momentum. Despite official assurances that such debt write-down atthe expense of private creditors would be anexceptional measure applying only to Greece,financial markets became increasingly concerned that a similar approach may in time betaken with other countries.AAAAA AAAAA AABBB BBBBBBBB BBBBB BBCCCSD1Greece(right-hand scale)Source: Bloomberg.NBSAnalysis of the Slovak Financial Sector201113

c h a p t e rFor most of the year financial asset trading wasconducted in the form of “risk-on / risk-off” trades, meaning that investors, depending on theprevailing nature of incoming macroeconomicnews, either sold off more risky assets and bought low risk assets, or did the opposite. The price movements of specific assets were to a largeextent determined by the class to which theywere assigned, with less than usual attentionpaid to the properties of individual assets. Asa result there was an above-average correlationof prices both within and between classes. Thedownturns in sentiment were accompanied bysell-offs of equities, government bonds issuedby higher-risk countries, and speculative-gradebonds, and by increased demand for selectedsovereign debt of low-risk countries, dollars,and gold. In a climate of uncertainty, investorsgravitated towards the least risky assets primarily so as to ensure a return of principal. As thegroup of risk-free assets shrank, demand forthem increased. This phenomenon was bestexemplified by US and German governmentbonds, which were traded at record low yieldsto maturity.The subdued risk appetite in 2011 translated intorelatively weak demand for equities, which lostvalue on average. Global equity index ended theyear 10% lower than its level at the start of theyear. Among the worst performing equities werethose from emerging countries and bank shares.Bank share prices were affected not only by negative sentiment, but also by a downward revisionof the profitability outlook.Chart 5 Indicators of uncertainty in theEuropean banking 050200Jan. 2012July 2011Oct. 2011Jan. 2011Apr. 2011July 2010Oct. 2010Jan. 2010Apr. 2010July 2009Oct. 2009Jan. 2009Apr. 2009July 2008Oct. 2008Jan. 20080Apr. 2008was by no means confined to the European bondmarket. These strains had a number of directsources in addition to the prevailing sovereigndebt crisis. Investor nervousness was heightened at the beginning of the year by the civil unrest in several North African countries, which wasprimarily reflected in rising oil prices. At aroundthe same time markets were further shaken bythe repercussions of the Great East Japan Earthquake. Tensions were exacerbated in July by thedispute in the United States over the raising ofthe country’s debt ceiling. With an agreement onthis issue not reached until the last possible moment, fears were raised that the amount of debtwould hit the existing ceiling and subsequentlyresult in the United States defaulting on its nearest debt payment obligations.1iTraxx Senior FinancialsEuribor-OIS spread (right-hand scale)Source: Bloomberg, www.euribor.orgFunctioning of the euro area interbank market wassubstantially disruptedThe euro area interbank market was among thespheres hardest hit by the sovereign debt crisis.Confidence among banks was undermined byuncertainty about the size and actual distribution of risks, with an adverse impact on the effective distribution of liquidity in the sector.Banks from the countries worst affected by thecrisis and banks with substantial exposures tosuch countries found themselves all but shutout of wholesale funding markets, particularlyin the second half of the year. Even when relatively strong banks did lend to each other, theyextended mainly shorter-maturity loans. Theproportion of secured transactions increased.While a rising number of banks remained reliant on ECB liquidity-supplying operations, it wasalso the case that banks with surplus liquiditypreferred to deposit their funds with the centralbank than to seek higher returns in the interbankmarket. The stress in the sector was evident fromthe rising trend of indicators such as the Euribor/OIS spread and the iTraxx Senior Financials index,which reached record levels.The range of measures taken to stabilise the crisishave so far had limited effectAs outlined above, for most of last year European governments and other competent institutions were making various attempts to stabiliseNBSAnalysis of the Slovak Financial Sector201114

c h a p t e rthe crisis situation. a strategy for safeguardingthe euro area and euro was gradually formulated around four core pillars. The most pressingtask was to prevent a disorderly Greek default.To this end, a 130-billion financial assistanceprogramme was approved for Greece, involving, on the one hand, funding from the EU andIMF, and, on the other hand, the nominal valueof privately-held Greek sovereign debt beingwritten down by around 50% through swap arrangements. The real loss for investors stood ataround 77% of the nominal amount. This privatesector participation, a condition for the assignment of the remaining funds from the rescuepackage, was a source of great uncertainty in financial markets since it was not clear in advancewhether the private sector bondholders wouldvoluntarily participate to a sufficient extent. Inthe end, however, the Greek debt was successfully restructured in mid-March 2012 and thewhole programme was given the green light.On the positive side, Greece thus gained somemanoeuvring room in which to continue with reforms. There is, however, already strong speculation that sooner or later the financial assistancewill have to be raised again and that, as mattersstand, the only genuine solution for the countryis a complete default.Another mean of tackling the crisis is by bolstering the financial capacity of European FinancialStability Facility (EFSF), which is primarily intended to prevent the crisis spreading to othercountries. The EFSF currently has an outstanding capacity of around quarter of billion euro.From 2012 the EFSF is due to be replaced bythe European Stability Mechanism (ESM), whosefinancial strength will be twice that of its predecessor. There is, however, considerable pressure to have both facilities running concurrentlyfrom the middle of the year in order to ensuregreater effectiveness. This question will probablybe considered in the near future. The markets arehighly sceptical about any such prospect, sinceeven the combined capacity of the two facilitieswould not suffice in the event that Spain or Italyremained reliant on financial assistance.Any lasting solution to the sovereign debtcrisis will require strengthening bank capital,given that the repercussions from the troubled countries are channelled to the bankingsector in several ways and are impairing its1balance sheet with consequent negative feedback loop. Following an agreement reachedat the EU Summit in October 2011, the largestEuropean banks will have until 30 June 2012to increase their core Tier 1 capital ratio to9%. For the financing of their recapitalisation,banks are expected to first use private sourcesof capital. If necessary, national governmentsshould provide support.The last of the core pillars is the repair of publicfinances of euro area countries. For this purpose,the so-called fiscal compact was proposed in2011 and received final approval at the beginning of 2012. The fiscal compact is an agreem

2.1 The banking sector 26 2.1.1 Trends in the banking sector balance sheet 26 2.1.2 Financial position of the banking sector 37 2.2 The insurance sector 41 2.3 The pension sector 47 2.3.1 Retirement pension saving 47 2.3.2 Supplementary pension saving 51 2.4 Collective investment 54 2.5 glossInvestment firms 59