Transcription

12/15/20201099-MISC, 1099-NEC, 1099-GIRS ReportingDOA – Daily Operations SectionStatewide Accounting Bureau20201Deadlines and datesImportant 1099-MISC/NEC informationGoods vs. servicesVerifying the W-9Reportable vs. non-reportable paymentsObjectivesReporting classification1099-GMarking voucher for reportingVerifying reporting using query resultsManual adjustments using adjust withholding screenTIN matching & CP2100Documentation221

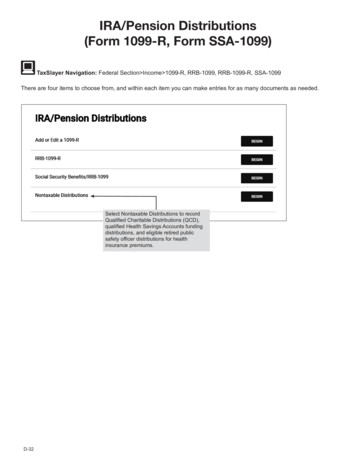

12/15/20201099MISC/NECDeadlines andDates January 11th 2021 January 13th 2021 January 25th 2021 January 29th 2021 February 1st 2021 March 1st 2021 Last day for payment cancellations/reissuesincluding ACH returns Interfacing agencies submit 1099 file Last day for agencies to make 1099adjustments using the adjust withholdingfunction 1099-MISC/NEC file sent to IRS 1099-MISC/NEC forms mailed to payees Cancellations/reissues and ACH returns toresume Adjust withholding screen re-opened33Important 1099 InformationState of Montana usessingle supplier systemAll payments made to asupplier will be combinedto create the total reportedon the 1099-MISC/NEC 600 combined minimum( 10 for royalties)It is important to mark allservices payments forwithholding as it isimpossible to know if theyhave completed work forother State agenciesIf your agency pays JohnDoe 10 for services andanother agency pays JohnDoe 591 for services, JohnDoe gets a 1099MISC/NEC442

12/15/20201099-MISC/NEC Reportable vs. nmentsConsultantsTax-exempt entitiesExpert witness testimonyCorporations – unless for medical, legalservices, or fish purchasesLegal servicesPurchases of goodsMedical servicesInsurance premiumsNon-employee compensationLegal damages – personal physical injury,medical expense reimbursement, propertydamage claimsRentStorage facilities, rent paid to a real-estateagentTrainingThese are examples – if you have any doubt, mark the payment for withholding55Good vs. ServiceThe IRS instructs that, when makinga payment for a combination of goodsand services (or parts and labor), thepayer should report the entireamount of the payments if supplyingthe parts or materials was incidentalto providing the serviceFor example, report the totalpayments to an auto repairshop under a repair contractWhen invoiced forlabor and parts, iffurnishing partswas incidental torepairing the auto663

12/15/2020Good vs. ServiceRepairing the officeprinter, including copierpartsReport the full amount iffurnishing the parts isincidental to providingthe serviceExamples of incidentalto providing theserviceThe IRS Instructions for Form1099-MISC/NEC providefurther explanation of whenthe full amount is reportableProviding maintenancefor the elevators,including replacementcontrol partsBuilding a partition wallin the second-floorconference room, includesmaterials for conferenceroom partition wallIn all three examples, the amount reportedis the total bottom-line invoice/paymentamount because you contracted for theservice and the goods (parts, materials)were necessary to perform the service77Good vs. ServiceExample ofpayment notincidental toproviding theservice A supplier sells you equipment, and itemizedfurther down on the bill of sale is a charge for“operator training on-site” In this case, you should separate the amount fortraining services and report that dollar amount inBox 1 of Form 1099-NECThe IRS Instructions for Form 1099-MISC/NEC provide further explanation ofwhen the full amount is reportable884

12/15/2020Good vs. Service12Your organization purchasesa dozen paintings from an artshow Treated as goods purchased Not reportableYour organization hires an artist tocreate a dozen paintings for youroffices Treated as a payment for a service Artwork is created specifically for youaccording to your specifications Reportable Form 1099-NEC Box 199Instructions for the Requester of Form W-9Form W-9 with Instructions for SupplierOnly accept current W-9 forms provided by the IRSVerifying a W-9Make sure the supplier has provided either an SSN orEIN, not bothThe supplier must choose one box on line 3The address provided on the W-9 should always bewhere tax information (1099-MISC/NEC) is sent toSign and date under penalty of perjury10105

12/15/2020Form W-91111Form1099MISC12126

12/15/2020Form1099NEC1313Reporting nd, buildings, offices, conference rooms, equipment, rentalassistance payments to property owners, surface royaltiesCapital lease payments for interestreported on 1099-INT, payments forstorageMISC-2Intellectual propertyMISC-3Services performed in course of business: punitive damages,non-physical injury, discrimination/defamation, prizes/awards,honorariums, medical researchMISC-4Any amount of money withheld from payment during the year*MISC-6Doctors, dentists, counselors, assisted living workers, clinics,hospitals, nursing homes, medical billingHealth insurance premiums,prescription drugs, medical goodsseparate from services, scientificresearch without illness treatmentMISC-10Proceeds paid to attorneys, fees, payment jointly payable toattorney and clientPersonal injury damages, physicalsickness, property claimsNEC-1Bonuses, commissions, professional services, expert witnessfees, legal fees to attorneys, purchases of fish for resale, repairsEmployee wages*The State of Montana rarely, if ever, uses this boxPersonal injury damages, physicalsickness, property claims14147

12/15/2020Reporting Classifications1099-MISC Box 1 – Rental Payments Examples include land, buildings, offices, conference rooms,equipment, rental assistance payments to property owners Operating lease – considered as “rent” by IRS the rental is generallyreturned to lessor at end of lease Capital lease – considered as “purchase of goods” by IRS the rentalis generally owned by lessee at the end of lease If capital lease payments include interest, the interest portion of thepayment should be reported on form 1099-INT if more than 600paid to a reportable entity Easements – more than 30 years is reported on 1099-S and less than30 years on 1099-MISC MOM Policy 335 – Capital Assets defines operating vs. capital lease1099-MISC issued if total is greater than 60015151099-MISC Box 2 – Gross RoyaltyPayments Examples include copyrighted items: photographs,novels/textbooks, performing a symphony or piece ofmusic, or the use of music in a commercial endeavor Generally, payments for use of intellectual propertyRoyalties not recorded in Box 2 Surface royalties (i.e. payments for the right to stripmine property owned by another) are reported in Box1 as rent Oil or gas payments for a working interest arereported in Box 1 of the 1099-NEC as non-employeecompensation Timber royalties made under a pay-as-cut contractare reported on the form 1099-S Proceeds from real estate transactions1099-MISC issued if total is greater than 10ReportingClassifications16168

12/15/2020Reporting Classifications1099-MISC Box 3 – Other Income Items not specifically reportable in other boxes Reportable legal damages; punitive, non-physical injury,discrimination/defamation Fair market value of awards/prizes not for services performed HonorariumsOther income not recorded in Box 3 Legal damages received due to personal physical injury or physicalsickness, damages that do not exceed the amount paid for medicalcare for emotional distress Property claims1099-MISC issued if total is greater than 6001717Reporting Classifications1099-MISC Box 4 –Backup WithholdingAny amount of federalincome tax that hasbeen withheld frompayments during theyear18Very rare due tostate’s internalprocesses1099-MISC issued if total is greater than 0189

12/15/2020Reporting Classifications1099-MISC Box 6 –Medical or Health CareServices Doctors/dentists Counselors Home health care workers Clinics/hospitals/nursinghomes Medical billing services Corporate exemptions doesnot applyMedical or health careservices not recorded inBox 6 Health insurancepremiums Prescription drugs Medical goods that areseparate from services For “pure” scientificresearch without providingany illness treatment1099-MISC issued if total is greater than 6001919Reporting Classifications11099-MISC Box 10 –Attorney GrossProceeds No corporate exemption Includes amount paid for fees,if cannot be separated fromsettlement If payment is jointly payableto attorney and client, reportfull amount to attorney inBox 102023ReportableNon-reportable Defamation Discrimination Emotional injuries notarising from physicalinjuries Payments for damagesreceived due to personalphysical injury orphysical sickness Property claims1099-MISC issued if total is greater than 6002010

12/15/20201099-MISC Box 3 and Box 10If attorney’s/law firm’sname is on the check,report the total amount ofthe check in Box 10If the legal damagespayment to the claimant istaxable, you must alsoreport this amount to theclaimant in Box 3 – even ifthe claimant’s name is noton the check (because ofthe assignment of incomedoctrine)This means you may beissuing two (or more)Form 1099-MISCs for asingle checkFor example, one to theattorney, reporting theamount in Box 10, andone to the claimant,reporting the amountin Box 3Must manually add thesecond total in theAdjust Withholdingscreen in SABHRS2121Legal Damages and Attorney Reporting1099-NEC Box 1 – Didthe attorney/law firmperform services for yourcompany/organization?1099-MISC Box 10 – Didthe attorney/lawfirmperform services for yourcompany/organization? If yes, report theamount in box 1 of the1099-NEC No corporate exemption If no, and the attorney’sname is on the check,report the gross amountof the check in Box 10 of1099-MISC No corporate exemption1099-MISC Box 3 – Legaldamages to claimant,report if taxable Punitive damages arealways taxable andreportable Reported in Box 3 of the1099-MISCAt times, more than one 1099 is required222211

12/15/20201099-NEC Box 1 – Nonemployee Compensation Payments for services to nonemployees Standard payee exemptions apply (Corps, tax-exempts,govt. payees), except no corporate exemption for legalservices paymentsExamplesReportingClassifications Attorneys/law firms providing legal services to yourorganization (no corporate exemption) Office cleaning Plant care Landscaping Independent contractors Consultants Training Printers and publishers Transportation Security services Translators and interpreters Auto repair1099-NEC issued if total is greater than 6002323 Used to report taxable grants inBox 6 Certain CARES Act grantpayments are subject to reporting SABHRS will have option toselect 1099-G, Box 6 reporting in2021 Process for 2020 is manual and acombined effort of SAB, SABHRS,and agencies1099-G IRSReporting Reporting is limited to certaingrant payments made with CARESAct funds2412

12/15/20201099-G2525Recording Reportable Payments for aSupplierThere are two ways to record a reportable payment for suppliers On the voucher at the time of payment (recommended) Through the adjust withholding screen Main Menu Suppliers 1099/Global Withholding Maintain Adjust WithholdingQueries for 1099 Information Main Menu Reporting Tools Query Query ViewerQuery name – MTAP PAYMENT DETAIL REPORT Run to Excel and sort by highlighting the column headings and pressing “alt,D,F,F”,or use a pivot table to refine your results Identify suppliers not marked and determine if they should have been Make the required adjustments using the adjust withholding screen in SABHRS262613

12/15/2020Recording a Reportable Payment in aVoucherWhen creating avoucher, find thewithholding link onthe InvoiceInformation tabClick the blue linkfor withholding2727Recording a Reportable Payment in aVoucher010203After clicking thewithholding link,the withholdinginformation willshowCheck the withWithholdingApplicable boxClick themagnifying glassto show thewithholdingoptions and selectthe correct one04Return to thevoucher byclicking Back toInvoice282814

12/15/2020Partial ReportingA voucher that needs partial reporting can have multiple invoice lines added This will allow you to select reporting information for each lineCreate two lines One for the amount not subject to reporting One for the amount to be reported on the corresponding 1099 form2929Partial Reporting1After creating two invoicelines in the voucher, clickwithholding link in thetop right2Select View All3Once withholdingselections are made, clickBack to Invoice303015

12/15/2020Verifying Reporting InformationThe queryMTAP PAYMENT DETAIL REPORT will show all paymentsmade by the business unitentered and between the daterange selectedThis will reducecorrections and helprealize the volume of youragency’s 1099-MISC/NECreportingWe suggest you run thisquery regardless of howthe suppliers get markedfor 1099 reportingDetermining how often torun the query will likely bedictated by the volume ofpayments made31Sort query results bysupplier name to make iteasy to see if all paymentsmade to a particularsupplier have been markedThis will quicklydetermine if all but one ora few payments have beenmarked for reporting31Verifying Reporting InformationIf Jim’s Tree Trimmingwas paid for the sametype of services for eachpayment, the withholdinginformation should beconsistentIn the query resultsshown, you will notice thevariation in thewithholding codeinformationBusiness VoucherUnitID32NameRemit VndrVendorVchrWithholdSetID Line Amt Line DescrCodeAmountPaymentReferenceIf you see a supplier witha business name thatclearly indicates a serviceprovided, but is notmarked, you may want toinvestigate furtherPaymentDateReconciledPymntSelectBankStatus Stat/Actn Account6101R00001234 Jim's Tree Trimming00001212 STATE500107500 CHK#5/5/20165/8/2016 PAIDCHK6101R00001235 Jim's Tree Trimming00001212 STATE100107100 CHK#5/30/20166/2/2016 PAIDCHK6101R00001236 Jim's Tree Trimming00001212 STATE200107200 CHK#6/12/20166/16/2016 PAIDCHK6101R00001237 Jim's Tree Trimming00001212 STATE7510775 CHK#6/30/20167/3/2016 PAIDCHK6101R00001238 Jim's Tree Trimming00001212 STATE300103300 CHK#7/1/20167/5/2016 PAIDCHK6101R00001239 Jim's Tree Trimming00001212 STATE25125 CHK#7/30/20168/5/2016 PAIDCHK6101R00001240 Jim's Tree Trimming00001212 STATE1251125 CHK#8/5/20168/15/2016 PAIDCHK073216

12/15/2020Manually Adjust Supplier InformationMain Menu Suppliers 1099/GlobalWithholding Maintain Adjust WithholdingEnter the Supplier ID and click searchIf more than one location is shown, check allto make sure you are not missing information3333Manually AdjustSupplier InformationClick themagnifyingglass next tothe Type fieldSelect theappropriate1099 form foryour search343417

12/15/2020Manually Adjust Supplier InformationEnter a date range and click searchSelect View All to see the results, as it only populates the first two lines3535Manually Adjust Supplier InformationAdding an amount If there are no entries yet, enter your information in the original line If there are existing entries, select the “ ” on the right side of the last line in the series This will create a blank line to make your entry Never use the “-” option Include the business unit that issued the payment, and it will auto-populate the full business unitwhich may need to be adjusted to match the voucher information Select the correct withholding classification in the “Class” column Enter the payment amount Select the original payment date Include relevant information in the description regarding the original payment; i.e. reference ID,the reason for the addition, initials, etc.363618

12/15/2020Manually Adjust Supplier ngclassificationWrongbusiness unitDate range must be entered; click search to view existing informationSelect “View All” to see all entries and expand window to see all fields including the descriptionSelect the “ ” on the line you wish to changeDo not use the “-” button as historical data must be preservedMirror the information from the previous line to reverse the original entry Description should contain original reference ID (warrant number), the reason for the change,and your initialsCreate a third line with the correct information Description should contain original reference ID (warrant number), the reason for the change,and your initialsIf you wish to only remove an amount, follow the first four steps only37Manually Adjust Supplier InformationExample – wrong amount Use the “ ” on the line you need to correct to create anadditional entry line Completely back off the original entry for a net zero Enter a third line with the correct information383819

12/15/2020Manually Adjust Supplier InformationExample – wrong reporting classification Use the “ ” on the line you need to correct to create anadditional entry line Completely back off the original entry for a net zero Enter a third line with the correct reporting classification3939Manually Adjust Supplier InformationExample – wrong business unit Use the “ ” on the line you need to correct to create an additionalentry line Completely back off the original entry for net zero Enter a third line with the correct business unit404020

12/15/2020Manually Adjust Supplier InformationWrong TIN –reportinginformation hasbeen recorded forthe wrong supplier411. Reverse the incorrect payment informationin the adjust withholding screen2. If there are multiple lines, you can sumthem and make one total entry to back offthe entire amount3. Add comments; the original supplieraccount should reference the Supplier IDthe amount was moved to The corrected adjustment shouldreference the Supplier ID that the totalwas originally reported under4. Add the amount to the correct supplier It’s best to break each of the entriesout by payment (individual lines) topreserve the information trail Use your best judgement; this willhelp you later if an issue arises41Used by agencies to requesta duplicate copy of a 1099or correction of a prior yearafter the deadlineCorrection/DuplicateRequestUpon completion,corrected form will besubmitted to the IRS andmailed to the payeeReporting deadline forcalendar year 2020 isJanuary 13th, 2021Navigate to ServiceNowand complete the 1099Correction/Duplicaterequest form424221

12/15/2020Correction/Duplicate RequestImportant to verify information before submitting requestNavigate to MT Payment Inquiry in SABHRS Main Menu Accounts Payable Review Accounts Payable Info Payments MT Payment Inquiry Remit SetID STATE Remit Supplier Supplier ID Payment Date between 01/01/2020-12/31/2020 (or the year you are requesting theadjustment for) Click Search Compare the results to the information in the adjust withholding screen Main Menu Suppliers 1099/Global Withholding Maintain Adjust Withholding The simplest way to sum a larger number of payments is to copy and paste into Excel43Failure to report 1099-MISC/NEC to IRS 280 penalty per 109943New suppliers’ name and TIN informationsubmitted to IRS to verify accuracyQuarterlyTINMatchingMismatches are communicated with thepaying agenciesAgencies work with suppliers to get updatedW-9, which is then sent to DOSSupplier is TIN matched again with new W9 informationMismatches are inactivated in SABHRSuntil a positive TIN match can be completed444422

12/15/2020CP2100 & B-NoticesIRS SENDS CP2100REPORT IN THEFALL ANDSOMETIMES INTHE SPRINGLISTS TINMISMATCHESFROM PREVIOUSYEAR’S 1099FILINGDOS IS REQUIREDTO SEND BNOTICES TOSUPPLIERS TOGATHER UPDATEDW-9SUPPLIERS HAVE30 BUSINESS DAYSTO RESPOND TO BNOTICESNO RESPONSERESULTS ININACTIVATION OFSUPPLIER INSABHRS4545B-NoticeExample464623

12/15/2020Review QuestionsWhen do all 1099-MISC forms get uploaded to theIRS?4747Review QuestionsIn the following example, which amounts would bereportable?An interior design company constructs severalcubicles for your office area. Do you report the amountof the service/labor, the amount of the materials andparts, or both?484824

12/15/2020Review QuestionsYour office purchases several photographs to hangaround the building. Reportable or not?4949Review QuestionsAre the following items reportable or nonreportable? Consultants Medicalservices Governments Non-employee Storage Insurancecompensationfacilitiespremiums505025

12/15/2020Review QuestionsWhich SABHRS screen is used to make corrections toreportable amounts, business units, and reportingclassifications?5151Review QuestionsWhat is the penalty for failure to report a 1099MISC/NEC to the IRS?525226

12/15/2020Review QuestionsWhat is the only box that will be used for 1099-Greporting?5353Thank you forattending!Direct additional questions to ServiceNow or call 406-444-30925427

State of Montana uses single supplier system All payments made to a supplier will be combined to create the total reported on the 1099-MISC/NEC 600 combined minimum ( 10 for royalties) If your agency pays John Doe 10 for services and another agency pays John Doe 591 for services, John Doe gets a 1099-MISC/NEC It is important to mark all