Transcription

HALF YEARLYDecember 31, 20213Ghani Global GroupISO 9000 & ISO 14000 CERTIFIED COMPANYGhani Global Holdings Limited

CORPORATE INFORMATIONBOARD OF DIRECTORSAtique Ahmad KhanMasroor Ahmad KhanHa z Farooq AhmadRabia AtiqueHafsa MasroorMahmood AhmedChaudhry Umair WaqarChief Executive Of cerChairmanAUDIT COMMITTEEMahmood Ahmed - ChairmanHa z Farooq AhmadRabia AtiqueHafsa MasroorHUMAN RESOURCE & REMUNERATION ANDCOMPENSATION COMMITTEEChaudhry Umair Waqar - ChairmanAtique Ahmad KhanHa z Farooq AhmadHafsa MasroorPRESIDENTM. Ashraf BawanyCOMPANY SECRETARYFarzand Ali, FCSCHIEF FINANCIAL OFFICERAsim Mahmud, FCALEGAL ADVISORBarrister Ahmed Pervaiz, Ahmed & PansotaLahoreGhani Global Holdings Limited01BANKSAl Baraka Bank Pakistan LtdAskari Bank LimitedBank Alfalah LimitedFaysal Bank LimitedHabib Metropolitan Bank LtdThe Bank of Punjab LimitedAUDITORSShineWing Hameed Chaudhri & Co.Chartered AccountantsH.M. House, 7-Bank Square, Lahore.SHARE REGISTRARVision Consulting Limited1st Floor, 3-C, LDA Flats, Lawrence Road, LahoreTel: 042-36375531, 36375339, Fax: 042-36312550REGIONAL MARKETING OFFICEC-7/A, Block F, Gulshan-e-JamalRashid Minhas Road, Karachi.Ph: (021) 34572150E-mail: shahidayub@ghaniglobal.comREGISTERED/CORPORATE OFFICE10-N, Model Town Ext, Lahore 54000, PakistanUAN: 111 GHANI 1 (442-641)Fax: (092) 42 35160393E-mail: info.gases@ghaniglobal.comWebsite: www.ghaniglobal.com / www.ghanigases.com

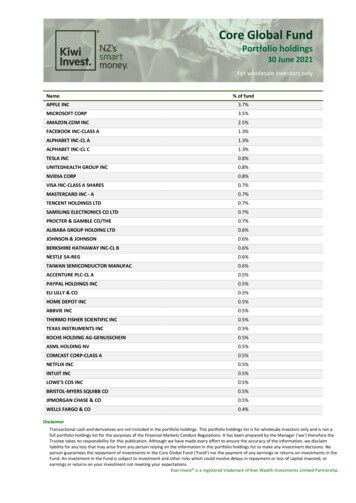

DIRECTORS’ REPORTDear ShareholdersAssalam-o-Alaikum Wa RehmatUllah Wa BarakatohThe Directors of your Company (Ghani Global Holdings Limited) are pleased to present the condensed interim nancialstatements of the Company for the half year ended December 31, 2021, along with review report of the auditors thereon, incompliance with the requirements of Companies Act, 2017. The consolidated condensed interim nancial statement of theCompany for the half year ended December 31, 2021 are also annexed.FINANCIAL PERFORMANCEStandalone PerformanceFor the half year ended December, 2021, your company has conducted some trading business resulting in sales of Rs. 35.3million and Gross pro t of Rs.10.09 million. Administrative expenses incurred by the company are normal as well operatingexpenses of the Company. Other income are commission on corporate guarantee issued by the Company and pro t from bankson saving accounts.CONSOLIDATED PERFORMANCEFinancial Performance including subsidiaries for the period ended December 31, 2021 in comparison with the same period inlast year is as under:ParticularsSalesNet SalesGross Pro tDistribution costAdministrative expensesOperating pro tFinancial costNet pro t attributable toOwnersEarnings per share- restatedRupees in ‘000’ Except 62,936256,6371.441.46VarianceRs. 7,260206,29941434816481-2980(0.02)-1Ghani Chemical Industries Limited (subsidiary company)Ghani Chemical Industries Limited (GCIL) is engaged in manufacturing and sale of industrial and medical gases and chemicals.Alhamdulillah sales and end result performance of this subsidiary has considerably increased as compared with the sameperiod of last year.For the period ended December 2021, subsidiary company sales have increased from Rs. 1,810 million to Rs. 2,705 million ascompared with the same period of last year, depicting increase of 49%. Gross Pro t increased from Rs. 661 million to Rs. 1,047million, depicting increase of 59%. Alhamdulillah, during this period this subsidiary posted Net Pro t of Rs. 553 million incomparison with Net pro t of Rs. 236 million in the same period of last year.A comparison of the key nancial results of your Company for the period ended December 31, 2021 with the same period lastyear is as under:Ghani Global Holdings Limited02

ParticularsSalesNet SalesGross ProfitDistribution costAdministrativeexpensesOperating pro tFinancial costNet profitEarnings per share RestatedRupees in ‘000’ Except 51,047,613660,638(149,849)(127,480)VarianceRs. 0.96Ghani Global Glass Limited (subsidiary company)Ghani Global Glass Limited is engaged in manufacturing and sale of import substitute Glass Tubing, Glass Ampoules and GlassVials since 2015. During the period subsidiary succeeded to get approval of its products in multinational companies (MNCs),middle, and large scale national companies where it is working closely with these companies and getting a sizeable businesseven the presence of numerous converters in market.Alhamdulillah your Company's sales are improving day by day by acceptance of company products in the market. For the periodended December 2021, your company's sales have increased to Rs. 918 million from Rs. 773 million as compared with thesame period of last year, depicting increase of 19%. Gross pro t of the company has increased to Rs.258 million from Rs. 230million as compared to the same period of last year. Distribution cost and administrative cost incurred during period is Rs. 19million and 40 million whereas for the last period it was Rs. 18 million and Rs. 38 million, respectively showing normal increasein distribution & admin expenses. This period end company is showing operating pro t of Rs. 193 million compared to last periodpro t of Rs. 164 million. Finance cost for the period incurred on the long term nance and working capital lines decreased to Rs.28 million compared to Rs. 57 million for the last period. Alhamdulillah company's net pro t for this period increased to Rs. 138million compared to pro t of Rs. 93 million in the corresponding period.A comparison of the key nancial results of your Company for the period ended December 31, 2021 with the same period lastyear is as under:ParticularsSalesNet SalesGross ProfitDistribution costAdministrative expensesOperating pro tFinancial costNet profitEarnings per share - RestatedRupees in ‘000’ Except . 231829,575-5144,93149(0.18)-24Half Yealy December 31, 202103

FUTURE PROSPECTSGhani Chemical Industries Limited (subsidiary company)The subsidiary has setup its 4th ASU (Air Separation Unit) plant at Port Qasim, Karachi for exclusively supply of Liquid Oxygenand Liquid Nitrogen (the products) to Engro Polymer & Chemicals Limited, Port Qasim for a period of 15 years. Formal supply ofthe products are expected to be commenced during 1st week of March 2022.Further, the subsidiary has also commenced the construction work for setup of its 5th ASU plant for 275MTPD capacity formedical and industrials gases at Hattar Economic Zone, District Haripur, Khyber Pakhtunkhwa (KP). This decision has beenmade to respond to the national cause of overcoming the growing shortage of Oxygen in hospitals, and especially as a result ofthe recent EOI published by the Khyber Pakhtunkhwa Economic Zones Development & Management Company. The addedcapacity shall ensure not only consistent supply of fast growing demand of Oxygen to the hospitals in KP and Northern regions ofthe country but also meeting the increasing demand of gases for development projects by Government and for industrialrequirements of CPEC projects.Further, this subsidiary has decided for setting-up of two state-of-the-art chemical plants for manufacturing of Citric Acid(import substitute) and Sulphuric Acid in Allama Iqbal Industrial City, Faisalabad with an approximate cost of PKR 8.5 Billion.The company (Ghani Chemical Industries Limited) has led listing application at Pakistan Stock Exchange (PSX) through InitialPublic Offering (IPO) at the Strike Price to be determined through Book Building Process in accordance with the Public OfferingRegulations, 2017 and applicable regulations of the Rule Book of the PSX.Ghani Global Glass Limited (subsidiary company)Work on expansion plan, BMR to enhance capacity, the subsidiary is in the phase of setting up new furnace, to tap the increasingdemands of market and to diversify into new products and markets, is actively in process. Machinery against the LCs is in arrivalprocess and accordingly work on erection of furnace is also in process in accordance with the plan. With commissioning of newfurnace having additional production line, tube manufacturing capacity of this subsidiary will be enhanced by about 50% and thisfurnace is expected to be ready by end of March 2022 IN SHAA ALLAH.ACKNOWLEDGEMENTSThe board of directors wishes to express their gratitude to valued shareholders, banks/ nancial Institutions, customers andsuppliers for their continuous support, cooperation and patronage. We also wish to place on record the dedication, hard workand diligence of executives, staff and workers of the company. Needless to mention, all growth in the business of the company isnot possible without will and blessings of ALMIGHTY ALLAH.For and behalf of Board of DirectorsLahoreDated: February 28, 2022Ghani Global Holdings Limited04ATIQUE AHMAD KHANChief Executive Of cerMASROOR AHMAD KHANDirector

l Ê]†jÂ]5ZŠ Z ÅøZ Û : Zgz&Å}i ëX D gŠÐ wŠµ»yZ HŠ OZ6väVMig ƒ idLZiËJZ eX g‡¹ÌÆyz ÆVzg ZŠ Z gÍÔi,gzZ D gŠÐwŠµ6ÞZ u 6ZyÎ 0 Ô8 Ï ZöZë b§kZÔ HŠ OZ6ðOZ ÅväVM D ZŠ Zt]»ig ƒ LZëÑÆkZgzZ]â ZÆ\ vZgzZ ñƒD ZŠ Z]» \ vZëX D ZŠ Zt]Ì»y)g »x ÓÆ gÍgzZX T eðÉgОg I è Å ( )·] Half Yealy December 31, 202105

žì µÂXì Hì‡.ö ( .-.2 *Z ) ASU åa CZaÆbZ GçFÛ Å ( ] ¡) Xz * ù â gzZ xWX ÏñYƒqzÑyZgzŠÆ‹ Æ2022ag â bZ Û ‚Ÿ!Å] ¡275MTPD aÆVu QgzZ ? ( 8 Æ) { Z éJ6Ôg7 CÙ IÔyziî ) Zg éŒ8ä}g ZŠ Z â Ôh' ÅxW Vß hêtXì c Š qzÑÌx » CZyaÆ\ZÃÆ.ö ASU,z5LZaÆ &ù á Ð s§Å v[hZ Cze 4zi î ) Z Z éJ66 gîm{gzZÑò Æä0 1‡6 ºðƒ f(Xì Š H ËÆEOIDq{Š DÃbZ Û ÚÅÔðƒf(Ð !ÅxWÃVß hÆV à ÑÆogzZ 8 ÆsÜ: & ŸZZg7 ÌÃÔðƒ f( Å’aÆ ]c gz QÅV1µ CPEC gzZ V1µ CªFÆ #Ö ÓÉ Ïñ X Ï} Æ g » Å Z ugËgzZ ( wŠ æWgŠ ) Z u ‚ Š !Wß; 7&Z wD Z) ä}g ZŠ Z f kZžt h' X ÏñW†Ñ9zg[g Z 8.5ã½6Tì Hê»äÎÛö¡ Fh]zŠa& Z7Z)g fÆ ( IPO) 8 Û Wê ðZ’Z ( PSX) ÞZ u 6Z yÎ 0 ä ( m7&Z ¡") vYHÅ4Écg8 .nIG54h6 õZ6. Æ*ZçÍÑ, wzg Å PSXgzZ 2017 ÔçEEÛ Wê ç»Tì Å]ZŠ „ZpgŠ Å ëEX ÇñYH)g fÆ¿Æ8 ,( v f ) ;9nÛÖ Œ¡ Øeç oßÆf( ÅLg â Ôì µ%Æ ä ì‡ Û 5{g ZŠ Z â ÔBMR aÆ äJ ( à &Ôx »6 "µVzÅ s ÜÆ sZXì ¿6gîwdÔaÆäÑqà V g â gzZ] ¡5gzZä Zg7ÃÔðƒÆ Û 5à ZzíÑ g ZzZa ŸZXì g Y. ÆyöÌx » »ä Z9Ãz. ÆkZgzZì ¿ÆæW Û tžì yZgzZ Ç ñYƒ†ŸZ‚ 50 ã½ &Å8à [k Å}g ZŠ Z f kZ ÔÐ äƒ qzÑX ÏñYƒg »vZY á yZJy WÆ2022ag âGhani Global Holdings Limited06

ÏZÆ w‚ žŽ ˆƒ9zg 918 ( Ð 9zg 773 Å vkZ yZgzŠÆ ]æ Å 2021 cŠÐ 230 ÅZ6 kZ » v « Æ ]æ ÏZ Åw‚ÔX Zƒ eg g†ŸZ‚19 kZ yZgzŠÆž² ]æ버g9zg 40gzZ 19†Ñò OZgzZ†ÑÅ„yZgzŠ kZXì Šƒ9zg 258 (&t 7 Ð 9zg 104 «o 6W » v f kZ yZgzŠÆ ]æ kZ X ¶9zg 38 gzZ 18 KçG.ÔE4 H4F5GÆ]æ †ÑC1â nÆ]æ à Zz äƒ ay6VÅÑ ÿ5GågzgzZ Cæ sî X Šƒ9zg 193;g9zg 138 «oØ{ » v „â uzŠvZ:ZX ˆƒ9zg 28 ƒ Á « Æ9zg 57X å9zg 93«ot}]æë²ø:i ZñB‚Æ]æÏZÅw‚ » ò C1â ãÆvÅ\WaÆ]æà Zz䃻à 2021cŠ 31:ì 3,004- .18)0.750.57l Þ ÓÚ] 1Ò ØfÏjŠÚ( v f ) ;9nÛÖ ˆm†9‰;Þ] ØÓnÛnÒ oßÆ-Ê7 zEZ cZ Ô̇ g7 ä }g ZŠ Z fù â 6 gîàSaÆ ]æ Åw‚ 15 Ã̇ g7 Ô Ø hZ ç,GHalf Yealy December 31, 202107

( v f ) - ;9nÛÖ ˆm†9‰;Þ] ØÓnÛnÒ oßÆ-²1.GÏZ Åw‚ÔXì sz z Û gzZ g »ÅV ðÒ¹GgzZVu?gzZ Q( sZ ðWÏY) m7& Z ¡"Xì Zƒ†ŸZ { Zp§{ ÏŠ g »Å³îgzZ û¾6WÅ{g ZŠ Z f kZ « Æ]æÐ9zg 1810 « Æá²ÏZÆw‚ * z Û Åv â Ô ]æà Zz䃻à 2021cŠ9zg 1,047 (Ð9zg 661 «o ùX Zƒ†ŸZ‚49 Tì ˆƒ9zg 2705 (553 vZ:ZÔ «o » v ]æ Å„â uzŠ à Zz äƒ »Ã 2021cŠ 31Š c 3Š†ŸZ »‚59Ô Š (JX å9zg 236«ot ]æÏZw‚Ô²;g9zg ø:i ZñB‚Æ]æÏZÅw‚ » ò C1â ãÆvÅ\WaÆ]æà Zz䃻à 2021cŠ 31:ì 49)(92,183)857,267(93,204)553,1421.64( v f ) - ;9nÛÖ Œ¡ Øeç oßÆ4 Z k†Ô[kk†wŠ æWgŠÐ2015 k†.ÔXì sz z Û gzZ g »Å}Zzk†gzZ²ðG3FÞ ‰"gàÃ] ¡KZ Vµò 6 äe } ( gzZ äxgŠ Ô ( MNCs) Vµ ÁZM v ft yZgzŠÆ w‚ëZ qZŠŽz ! Æ iRg.Š¼ Lg â gzZì „g x »ïB‚Æ VµyZ vt V X ˆƒ [x» ä Ghani Global Holdings Limited08Xì „g Ýqg !zg »

ig ƒ m³]»'zvZ Gî*9gzix?ZÆ{ Y WÐñe WgzZ Š)Æv zÅ 2017ÔZgyZI]Z eÆ( g ƒ.Þ ‰") vÅ\W]!ˆ„ŽŠgzZ {”fÆvX D kCÙp6 ä 7 2021 ÔcŠ 31 "! ]!ˆ„ŽB‚X ÝB‚Ì2021cŠ 31"!o †Ò Ò oi nÖ Úo † Ò 1‰ å‚vn ÂÅ9zg 35.3 ËÆTì Hg !zg » Cg ˆ¼ ävÅ\WÔaÆ„ŽáZz䃻à 2021 cŠÆ ]YZyZ x ]YZyZ ò OZáZz äY ñVZÐ s§Å vX Zƒ «o ù »9zg 10.09 gzZ z Û6 VÂ3YgzZ z6 g Çfg7g » {Š g YÐ s§Å vãæW Š X ]YZyZ 6WÆvB‚B‚Xì «oÐVËo † Ò rÓmø:i ZñB‚Æ]æÏZÅw‚ » ò C1â ãÆvÅ\WaÆ]æà Zz䃻à 2021cŠ 31:ì 0)(5,369)470,08347,260206,299(0.02)2020 cŠ2021 f Yealy December 31, 202109

Ghani Global Holdings Limited10

Ghani Global Holdings LimitedUnconsolidated Condensed Interim Statement Of Financial Position as at December 31, 2021NoteASSETSNon-current assetsIntangible asset (goodwill)Long term investments5Un-auditedAuditedDec. 31,June 30,20212021--- Rupees in thousand --703,581,141703,481,1413,581,2113,481,211Current assetsStock-in-tradeTrade debts - unsecured, considered goodAdvances and other receivablesTrade deposits and prepaymentsSales tax refundableAdvance income taxCash and bank balances6Total 3,776,466EQUITY AND LIABILITIESShare capital and reservesAuthorised capital74,000,0003,000,000Issued, subscribed and paid-up share capital83,219,2702,799,365Capital reserve - share premium0Unappropriated pro ilitiesCurrent liabilitiesTrade and other payables9Unclaimed dividendT axation10Total liabilitiesContingencies and commitments11Total Equity and LiabilitiesThe annexed notes form an integral part of these unconsolidated condensed interimfinancial statements.Atique Ahmad KhanAsim MahmudMasroor Ahmad KhanChief Executive Of cerChief Financial Of cerDirectorHalf Yealy December 31, 202111

Ghani Global Holdings LimitedUnconsolidated Condensed Interim Statement of Pro t or Loss & OtherComprehensive Income (Un-audited)For the Quarter and Six Months Period Ended December 31, 2021NoteSix months period endedQuarter endedDec. 31,Dec. 31,Dec. 31,Dec. 31,2021202020212020--------------------- Rupees in thousand ---------------------Gross sales35,327032,9270Less: sales tax(5,219)0(4,870)0Net sales30,108028,0570Direct cost(20,014)0(18,465)0Gross pro t10,09409,5920Administrative (112)(796)Other expensesOther income12Pro t / (loss) before taxationT axation10Pro t / (loss) after taxationOther comprehensive incomeTotal comprehensive income/ (loss) for the periodEarnings / (loss) per share - )RestatedRestated----------------------------- Rupee 6)The annexed notes form an integral part of these unconsolidated condensed interim financialstatements.Atique Ahmad KhanAsim MahmudMasroor Ahmad KhanChief Executive Of cerChief Financial Of cerDirectorGhani Global Holdings Limited12

Ghani Global Holdings LimitedUnconsolidated Condensed Interim Statement of Cash Flows (Un-audited)For the Six Months Period Ended December 31, 2021Six months period endedDec. 31,Dec.31,20212020--- Rupees in thousand --Cash Flows From Operating ActivitiesProfit / (loss) for the period - before 618)0(2,062)Effect on cash ows due to working capital changes(Increase) / decrease in current assets:Stock-in-tradeTrade debtsAdvances and other receivablesTrade deposits and prepaymentsSales tax refundableIncrease in current liabilities:Trade and other payables803Cash (used in) / generated from operationsIncome tax paidNet cash (used in) / generated from operating 2)0(46,325)(1,161)(100,000)0Cash Flows From Investing ActivitiesLong term investments madeCash Flows From Financing ActivitiesShares deposit money received0517,546Net (decrease) / increase in cash and cash equivalents(146,325)516,385Cash and cash equivalents at beginning of the period151,6632,0485,338518,433Cash and cash equivalents at end of the periodThe annexed notes form an integral part of these unconsolidated condensed interim financialstatements.Atique Ahmad KhanAsim MahmudMasroor Ahmad KhanChief Executive Of cerChief Financial Of cerDirectorHalf Yealy December 31, 202113

Ghani Global Holdings LimitedUnconsolidated condensed Interim Statement of Changes in Equity (Un-audited)For the Six Months Period Ended December 31, 2021Capitalreserve SharepremiumSharecapitalRevenuereserve Unappr opriatedpro tTotal- - - - - - -Rupees in thousand - - - - - - Balance as at June 30, 2021 (audited)2,799,365Total comprehensive income forthe period of six monthsended December 31, 20210Bonus shares issued267,6490419,905(267,649)Balance as at December 31, 2021(un-audited)3,219,2700Balance as at June 30, 2020 (audited)1,533,059T otal comprehensive loss forthe period of six monthsended December 31, 2020Balance as at December 31, ,780,152(24,333)700,623(24,333)2,755,819The annexed notes form an integral part of these unconsolidated condensed interim financialstatements.Atique Ahmad KhanAsim MahmudMasroor Ahmad KhanChief Executive Of cerChief Financial Of cerDirectorGhani Global Holdings Limited14

Ghani Global Holdings LimitedNotes to the Unconsolidated Condensed Interim Financial Statements (Un-audited)For the Six Months Period Ended December 31, 20211.Legal Status And OperationsGhani Gases (Private) Limited (GGL) was incorporated in Pakistan on November 19, 2007as a company limited by shares under the Companies Ordinance, 1984 and was convertedinto a public company on February 12, 2008. GGL was listed on Pakistan Stock Exchangeon January 05, 2010; GGL's name has been changed to Ghani Global Holdings Limited(the Company) under the provisions of section 13 of the Companies Act, 2017 on August28, 2019. The registered of ce of the Company is situated at 10-N Model T own Extension,Lahore. The principal activity of the Company, subsequent to the separation ofmanufacturing undertaking, is to manage investments in its Subsidiary / AssociatedCompanies and trading activities.During the financial year ended June 30, 2020, under a Scheme of Compromises,Arrangement and Reconstruction as sanctioned by the Lahore High Court, Lahore onFebruary 06, 2019, the Company transferred its manufacturing undertaking to GhaniChemical Industries Ltd. (Subsidiary Company) on July 08, 2019.2.Basis of preparation2.1Statement of complianceThese condensed interim financial statements have been prepared in accordance with theaccounting and reporting standards as applicable in Pakistan for interim financial reporting.The accounting and reporting standards as applicable in Pakistan for interim financialreporting comprise of:-International Accounting Standard (IAS) 34, ‘Interim Financial Reporting’, issuedby the International Accounting Standards Board (IASB) as noti ed under theCompanies Act, 2017 and-Provisions of and directives issued under the Companies Act, 2017.Where provisions of and directives issued under the Companies Act, 2017 differ with therequirements of IAS 34, the provisions of and directives issued under the Companies Act,2017 have been followed.2.2These condensed interim financial statements do not include all of the information requiredfor full annual financial statements and should be read in conjunction with the annualaudited financial statements of the Company as at and for the year ended June 30, 2021.Selected explanatory notes are included to explain events and transactions that aresigni cant to the understanding of the changes in the Company's financial position andperformance since the last annual audited nancial statements.2.3These condensed interim financial statements are un-audited and are being submittedto the members as required by section 237 of the Companies Act, 2017. The figures for thesix months period ended December 31, 2021 have, however, been subjected to limitedscope review by the external Auditors.2.4Basis of measurementThese condensed interim financial statements have been prepared under the historicalcost convention.2.5Functional and presentation currencyThese condensed interim financial statements are presented in Pak Rupees, which isalso the Company’s functional currency. All amounts have been rounded to the nearestthousand, unless otherwise stated.Half Yealy December 31, 202115

Signi cant accounting policies3.The accounting policies adopted for the preparation of these condensed interim financialstatements are the same as those applied in the preparation of audited annual financialstatements of the Company as at and for the year ended June 30, 2021.3.1Initial application of standards, amendments or an interpretation to existingstandardsThe following amendments to existing standards have been published that are applicableto the Company's financial statements covering annual periods, beginning on or after thefollowing dates:a)Standards, amendments and interpretations to accounting standards that areeffective in the current periodCertain standards, amendments and interpretations to accounting standards are effectivefor accounting periods beginning on July 01, 2021 but are considered not to be relevant orto have any signi cant effect on the Company's operations (although they may affect theaccounting for future transactions and events) and are, therefore, not detailed in thesecondensed interim nancial statements.b)Standards, amendments and interpretations to existing standards that are not yeteffective and have not been early adopted by the CompanyThere are certain standards, amendments to the accounting standards and interpretationsthat are mandatory for the Company's accounting periods beginning on or after July 01,2022 but are considered not to be relevant or to have any signi cant effect on theCompany's operations and are, therefore, not detailed in these condensed interim financialstatements.4.Accounting estimates and judgmentsThe preparation of these condensed interim financial statements requires management tomake judgements, estimates and assumptions that affect the application of the accountingpolicies and the reported amounts of assets and liabilities, income and expenses. Actualresults may differ from these estimates.In preparing these condensed interim financial statements, the signi cant judgments madeby management in applying the Company's accounting policies and the key sources ofestimation uncertainty were the same as those applied to the financial statements for theyear ended June 30, 2021.5.Long term investments - At costService Fabrics Limited (SERF)The Company's shareholders, in their extra ordinary general meeting held on August 28,2021 through a special resolution, have accorded their approval in terms of section 199 ofthe Companies Act, 2017 for aggregate investment upto Rs.250 million in Service FabricsLimited (SERF - an Associated Company). The investment is in the form of equityinvestment in the share capital of SERF . The Company, during the period, has madeinvestment of Rs.100 million under this head.The name of SERF has been changed to G3 T echnologies Ltd. (GTECH) vide SECP'scertificate No.B048334 dated November 17, 2021. GTECH will be engaged in the businessof trading, production, marketing of Calcium Carbide and investment in technologycompany.5.1The Company has assessed and evaluated the recoverable amounts of investments in theSubsidiary Companies and an Associated Company at the reporting date. Based on theseassessments, no material adjustment is required to the carrying values stated in theseunconsolidated interim nancial statements.Ghani Global Holdings Limited16

AuditedUn-auditedJune 30,Dec. 31,20212021--- Rupees in thousand --6.Advances and other receivablesAdvances to suppliers - considered goodLetters of credit marginsDue from Subsidiary Company6468637,4957,2216208,2037.8,084Authorised capitalThe Company, during the period, has increased its authorised capital fromRs.3,000,000,000 divided into 300,000,000 ordinary shares of Rs.10 each toRs.4,000,000,000 divided into 400,000,000 ordinary shares of Rs.10 each. This increasehas been made to cater for future increase in paid-up share capital.8.Issued, subscribed and paid-up capitalThe Company, during the period by capitalising out of capital (share premium) and revenuereserves, has allotted 41,990,465 ordinary shares of Rs.10 each as fully paid bonus sharesin the proportion of fifteen (15) ordinary shares for every hundred (100) ordinary sharesheld by the members of the Company at the closure of the business on October 14, 2021.This bonus issue rank pari passu in all respects with the existing ordinary shares of theCompany.9.Trade and other payables8,3862,559Accrued liabilities3862,051Due to Subsidiary Company304Trade creditorsWithholding tax payableAdvances from customers - contract liabilities97543214,0279,49410.08,691Taxation10.1 Income tax assessments of the Company have been completed upto the tax year 2021 i.e.accounting year ended June 30, 2021.10.2 Provision for the current period represents tax payable under section 148 (Minimum tax onimports) of the Income Tax Ordinance, 2001.10.3 Income tax expense is recognised in each interim period based on best estimate. Amountsaccrued for income tax expense in one interim period may have to be adjusted in asubsequent interim period of that nancial year if the estimate changes.11.Contingencies and commitments11.1 ContingenciesThe Company has provided corporate guarantees aggregating Rs.671,900 thousand (June30, 2021: Rs.1,194,900 thousand) to banks against finance facilities availed by itsSubsidiary Companies.11.2 CommitmentsNo commitment was outstanding as at December 31, 2021; (commitments againstirrevocable letters of credit for import of finished good stocks outstanding as at June 30,2021 were for Rs.32.927 million).Half Yealy December 31, 202117

12.13.CumulativeJul. - Dec.,Jul. - Dec.,20212020--- Rupees in thousand ---Other incomeProfit on bank saving accounts3,036Commission on corporate guarantees2,2422,39205,2782,392Transactions with related partiesSigni cant transactions made during the period with related parties were as follows:Commission chargedSales madeLoans / advances receivedShares deposit money received14.Financial risk management14.1Financial risk factors2,24214,46102,392026,8260511,587The Company’s activities expose it to a variety of financial risks: market risk (includingcurrency risk, fair value interest rate risk, cash flow interest rate risk and price risk), creditrisk and liquidity risk.The condensed interim financial statements do not include all financial risk managementinformation and disclosures required in the annual financial statements, and should beread in conjunction with the Company's annual financial statements as at and for the yearended June 30, 2021.There have been no changes in the risk management department or in any riskmanagement policies since the year ended June 30, 2021.14.2Fair value estimationDuring the period, there were no signi cant changes in the business or economiccircumstances that affect the fair value of the Company's financial assets and financialliabilities. Further, there were no reclassi cations of nancial assets.15.Corresponding guresThe comparative unconsolidated condensed interim statement of financial positionpresented in these unconsolidated condensed interim financial statements has beenextracted from the audited unconsolidated financial statements of the Company for theyear ended June 30, 2021, whereas the comparative unconsolidated condensed interimstatement of pro t or loss & other comprehensive income, unconsolidated condensedinterim statement of changes in equity and unconsolidated condensed interim statement ofcash flows have been extracted from the un-audited unconsolidated condensed interimfinancial statements for the period ended December 31, 2020.16.Date of authorisation for issueThese unconsolidated condensed interim financial statements were approved andauthorised for issue by the Board of Directors of the Company on February 28, 2022.Atique Ahmad KhanAsim MahmudMasroor Ahmad KhanChief Executive Of cerChief Financial Of cerDirectorGhani Global Holdings Limited18

GHANI GLOBAL HOLDINGS LIMITEDCONSOLIDATED CONDENSED INTERIM STATEMENT OF FINANCIAL POSITIONAS AT DECEMBER 31, 2021NoteASSETSNon-current assetsProperty, plant and equipmentRight of use assetIntangible assetsLong term investmentsLong term deposits5Current assetsStores, spares and loose toolsStock in tradeTrade debtsLoans and advancesDeposits, prepayments and other receivablesT ax refunds due from governmentAdvance income tax - netCash and bank balancesTOTAL ASSETSEQUITY AND LIABILITIESShare capital and reservesAuthorized share capital400,000,000 (June 30, 2021: 300,000,000) ordinary shares of Rs. 10 eachIssued, subscribed and paid up share capitalCapital reserve - share premiumUnappropriated pro tLoans from sponsorsAttributable to the equity holders of the Holding Company6Non - Con

The consolidated condensed interim nancial statement of the Company for the half year ended December 31, 2021 are also annexed. . Ghani Chemical Industries Limited (subsidiary company) Ghani Chemical Industries Limited (GCIL) is engaged in manufacturing and sale of industrial and medical gases and chemicals. . furnace having additional .