Transcription

HIGH IMPACT:COVID-19 puts focus onmortality and tax for financialadvisers and their clientsJANUARY 2021

H I G H I M PA C T :COVID-19 puts focus on mortalityand tax for financial advisers andtheir clients2High Impact: IHT Outlook Survey

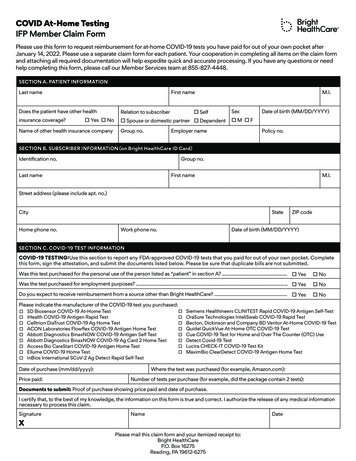

IntroductionIf the COVID-19 pandemic has made peoplethink more about their mortality then it may wellhave made many of them think about that othercertainty in life – taxes.The UK government will no doubt be looking to recoup the money it has spent counteringthe adverse impacts of the pandemic, so tax mitigation strategies could rise up the agendaof discussions between financial advisers and their clients too. One likely topic for suchdiscussions is Inheritance Tax (IHT).To understand more about the pandemic’s impact, we commissioned a study1 on IHTplanning, asking advisers for their thoughts on what has been a shocking experience formany thousands of people in the UK and how their relationships with their clients mightchange. Our findings are outlined below.COVID-19 has started the conversation about mortalityA majority of financial advisers (62%) do indeed believe COVID-19 will impact the IHTplanning market. Nearly two in five (38%) respondents in our survey believe clients will nowbe more open to IHT planning, another one in five (21%) say clients will start planning for IHTat a younger age and 17% say clients will choose more immediate solutions because of thepandemic (Q 16).Nearly two in five advisers (39%) intend to change their approach to IHT planning becauseof the pandemic. 17% plan to do more IHT planning and 16% say they will talk about itto clients at a younger age, while 7% plan to recommend faster-acting solutions morefrequently (Q 17).Advisers expect IHT cases to riseIHT represents a relatively insignificant proportion of the government’s overall revenue.Receipts from IHT totalled 5.2bn in the 2019/20 tax year, versus total forecast revenues of 635bn.2That said, most advisers (54%) expect the number of IHT cases they deal with to rise overthe next 12 months, including 4% who expect this rise to be ‘dramatic’. In contrast, only 2%expect a slight decrease (Q7). So the UK will see more IHT planning with new approachesover the next year.To provide some context to this expected increase in IHT cases, nearly a fifth of advisers(19%) made 11 or more IHT recommendations in the last year with only 7% saying they hadnot recommended any IHT solutions.The strongest reason for this increase appears to be the COVID-19 pandemic. More thana fifth (21%) of advisers attribute the anticipated rise to increased awareness of mortalityspurred by the crisis. Other reasons mentioned include the rising age profile of clients;concerns over changes to government policies on taxes and rising or stagnant asset values(all 12%) (Q8).Source: 112 financial advisers in the UK were interviewed between 15 and 31 May 2020 by PollRight1Source: HMRC23

H I G H I M PA C T :COVID-19 has prompted advisers to change their waysA significant majority offinancial advisers haveput in place measures tomitigate the challengespresented by COVID-19. For example,76% are now using video call softwarefor client meetings, while the sameproportion are using more telephonebased meetings. Seven in 10 (69%) areusing online application forms thatdo not require a wet signature, 26%have increased production of clientfacing content such as newsletters,blogs and articles and 14% haveincreased online marketing throughplatforms such as LinkedIn to attractnew clients (Q19).76%of advisersare now using video callsoftware for client meetingsThe majority (61%) of advisers expect tocontinue writing business as normal while 10% seethe COVID-19 crisis as an opportunity to write more.A substantial minority (31%) are wary though andexpect the pandemic will lead them to write lessbusiness and 3% have even put new businessefforts on hold.The Foresight propositionThe Foresight product rangeincludes the Foresight InheritanceTax Solution and the ForesightAccelerated Inheritance TaxSolution.Aims to deliver3%net returns per annumThe Foresight ITS provides investors with ashelter from IHT after two years from the date ofinvestment. It aims to deliver net returns of 3%4.5% per annum by owning and operating a highlydiversified range of infrastructure assets includingground mounted solar, onshore wind, reservepower plants, forestry and fibre broadband. Theseassets are ideal for estate planning solutions,typically providing returns derived from long-termcontracted revenue streams with low correlation toequity markets.The Foresight Accelerated ITS combines BusinessRelief ("BR") with a group life insurance policy,which will mitigate any IHT impact on theinvestment throughout the initial two-year period.Although the insurance element incurs a highercost, clients usually accept this because it solvesIHT liability problems from day one.Both products enable asset owners to retain fullcontrol of the assets.Often the largest BR cases follow the sale of abusiness, whereby the owner can reinvest theproceeds into a BR solution and benefit fromimmediate IHT mitigation via ReplacementProperty Provision.We expect the incidence of such sales may wellincrease post the pandemic.4High Impact: IHT Outlook Survey

H I G H I M PA C T :IHT thresholds for 2020/21Individuals can leave anestate valued at up to 325,000plus the new 'main residence'band of 175,000, giving atotal IHT-exempt allowanceof 500,000 per person. The tax thresholddoubles to 650,000 for married couples orcohabiting partners, or 1 million includingthe ‘main residence’ band, provided the firstperson to die leaves their entire estate totheir partner. Assets over these thresholdsare subject to a 40% tax bill.Such clients might include those who thinkthe Residents Nil Rate Band will exemptthem. When used by a couple, the allowancefor married couples of cohabiting partners ispushed up from 650m to 1m but for estateslarger than 2 million the RNRB exemptiontapers at a rate of 1 for every 2 above the 2m threshold.Companies that qualify include privately ownedcompanies that are not listed on the LondonStock Exchange or are quoted on the AlternativeInvestment Market. Companies must also carry outqualifying trades, which typically exclude mining,investment and property companies.A guide to Business ReliefBusiness Relief (BR) was introduced as part ofthe 1976 Finance Act to allow small businessesto be passed on through generations withoutincurring IHT. Its scope has evolved to becomeBR planning does not affect the Nil-Rate Band,thus complementing and legislatively diversifyingother trust and gift-based IHT planning wherethere is an impact.a method of investing for individuals lookingto reduce a potentially large IHT liability at thetime of their death.Clients who could benefit from BR include clients who: W ant to shelter their assets from IHT whileretaining access to their capital W ould like to put more than the Nil-Rate Bandinto a discretionary trust Feel they have left estate planning too late re a trustee looking to mitigate the impact Aof periodic or exit charges Have a power of attorney in place A re non-domiciled individuals looking tomeet capital requirements Have sold their business within the last three years re looking to set up a family investment Acompany with IHT efficiency Have IHT issues but do not feel ready to plan Have loan trusts and are concerned aboutthe IHT due on the initial capital5

H I G H I M PA C T :Challenges and opportunitiesBusiness Relief offers a solutionCOVID-19 presents anumber of challengesfor more traditional IHTplanning solutions likeinsurance, gifting and trusts.According to Foresight’s own researchinto the UK life insurance market,COVID-19 has caused delays ofbetween three and six months for lifeinsurance cases that require medicalunderwriting. This presents a realproblem for older clients interested inmitigating their IHT liability swiftly,as the maximum sum assured for76 year olds without requiringmedical examination is just 144,000 on average.Similarly, it’s intuitive that the pandemic makes gifting andtrust planning less attractive to investors concerned aboutneeding to survive for 7 years before the assets are fullyexempt from IHT.Consequently, it’s unsurprising that nearly half of advisers(47%) believe the COVID-19 crisis will increase the demandfor BR solutions, where the investor needs to survive for2 years for the IHT relief to apply (Q 18).BR is also attractive to investors who wish to keep accessand control of their assets, whilst mitigating IHT.Limiting the risk is a high priority for advisers: themost important feature when selecting a BR product isdiversification (28%). This was followed by the financialstrength of the provider (22%), the length of the trackrecord (17%), charges (12%) target return (10%) andtechnical support (2%) (Q12).6High Impact: IHT Outlook SurveyOther factors deterring advisers from recommending BRsolutions include product cost (29%); compliance challenges(27%); and product performance (15%). Client objectionswere the main stumbling block for just one in 20 cases (5%)(Q11).BR products are an important toolBR products are clearly not always the most suitablesolution when it comes to planning for IHT. But they are animportant tool for advisers.There are several attributes that make BR productsattractive to certain clients. Unlike with gifting and trusts,with BR, clients retain full access and control of the assets,which remain in their name. This is important should theclient’s circumstances change later in life.Speed is another benefit of BR, which can actually mitigatethe IHT bill from day one via a BR product that includesa life insurance element, or just two years for the uninsuredversion.Speed is particularly important for those concerned by thepandemic as well as older clients who believe they mighthave left it too late. It’s important to remember this doesn’tjust mean clients in their 80’s, as the access and controlbenefits of BR are usually attractive to younger clients intheir 60’s or 70’s too.Nor are such products the preserve of the super wealthy.Most advisers (56%) agree, including 12% who ‘stronglyagree’, that higher value estates make better use of BR thansmaller ones, even though the latter could be equally wellserved by it (Q14). The minimum investment on theForesight Inheritance Tax Solution and the ForesightAccelerated Inheritance Tax Solution, for example is 25,000, which means they can serve a wide range ofclients.

Given that it is older clients who are interested in IHT solutions itwould be no surprise if preservation of capital took precedenceover investment returns for most of them. Very often, anythingabove inflation is seen as a bonus. As such, the lower theinvestment risk advisers can source for their clients the better.This issue has been brought into focus by the investment volatilityintroduced by the pandemic. Products that invest in assets thatare less correlated to financial markets, like renewable energy andinfrastructure projects, should be all the more attractive to advisersin the current market environment.Whatever products advisers might select for their clients, raisingissues around mortality with clients is unlikely to be easy. It maybe that the discussions have been initiated following the recentdeath of a partner, that clients are incapacitated and need powersof attorney, or that several beneficiaries are involved. Whenadvising clients on inheritance, 50% of advisers say communicatingeffectively to gain understanding is the biggest challenge,followed by recommending suitable products (21%) and providingappropriate advice (15%) (Q 15).47%of advisersbelieve the COVID-19 crisiswill increase the demandfor BR solutions, where theinvestor needs to survivefor 2 years for the IHTrelief to applyAdvisers undoubtedly need to apply sensitive diplomacy. But byhelping families through difficult periods they can demonstratethe benefits of good advice and transition their services from onegeneration to the next.Product providers can help close the dealOn average, just over three in five clients (61%)proceed with advisers’ IHT recommendation(Q4). The most common reason for notproceeding is losing access to capital, which wascited by 59% of advisers. Other reasons includeclients not minding paying IHT (53%); the costsassociated with the proposed solution (50%) –although costs are modest relative to the 40%tax on unprotected assets; clients’ failing tounderstand proposed solutions (22%); and thelength of time solutions take to successfullymitigate IHT (21%) (Q5).Most of these objections must be addressed by advisers intheir negotiations with clients. But advisers believe thereare some things that could help them close more IHT cases.Top of their list is ‘handling support on common productobjections’, which was cited by 32%. Other factors mentionedinclude: more reasons to get back in front of clients (27%);more product training from providers (16%); and productproviders joining client meetings (15%). (Q6).Advisers believe that IHT product providers can best supportthem in writing new business through the provision ofspecialist knowledge, according to 65% of respondents. Thiswas followed by being available when required (53%), helpingattract new clients (25%) and finding planning opportunitieswithin advisers existing client bank (17%) (Q13).Foresight offers help in all these areas, including an automatedcalculator on its website (www.foresightgroup.eu) that showshow the Foresight Accelerated Inheritance Tax Solution canbe applied.7

APPENDICES:Foresight IHT Outlook surveyFinal resultsResearch Methodology1The survey was conductedby PollRight among 112financial advisers between15 and 31 May 2020.2The advisers managedan average of 174.4mof Assets on behalf oftheir clients.3Just under two thirds(62%) followed a prescribedin-house investment processand asset allocation policy.Foresight IHT Outlook SurveyQ1:What proportion of your client bank have an IHT liability?Answer 1%-80%25%81%-99%10%100%3%Average50%Q2:How many clients have you recommended IHT solutions to in the last 12 months?Answer choicesNone8Responses7%Between 1 and 545%Between 6 and 1029%11 or more19%Average6.2High Impact: IHT Outlook Survey

Q3:When planning for IHT, what solution do you most commonly recommend (rank from most common to least)?Answers1st2nd3rd4th5thTop ed BR3%10%7%31%49%20%Q4:What proportion of your clients usually proceed with IHT recommendations?Answer %-80%30%81%-99%13%100%10%Average61%Q5:What are the most common reasons your clients don’t proceed with an IHT planning recommendation?(Please select all that apply)Answer choicesResponsesLosing access to capital59%Client doesn’t mind paying IHT bill53%Costs associated with the proposed solution.50%A lack of client understanding of the proposed solution22%Length of time solution takes to successfully mitigate IHT21%Other (please specify)13%Q6:What would help you close more of these cases? (Please select all that apply)Answer choicesResponsesCommon product objection handling support32%More reasons to get back in front of a client27%More product training from providers16%Product providers joining for client meeting15%Other (please specify)13%None of the above33%No 2018 datafor this one?9

APPENDICES:Foresight IHT Outlook surveyFinal resultsQ 7:How do you expect the number of IHT cases to change in next 12 months?Answer choicesIncrease dramaticallyResponses4%Increase slightly50%Stay the same44%Decrease slightly2%Decease dramatically0%All increase54%All decrease2%Q8:What do you think will be the main reason for this?Increased number of casesResponsesIncreased awareness of mortality brought about byCovid-1921%Rising age profile of clients12%Concerns over changes to Government policy (taxes)12%Rising or stagnant asset value12%More people thinking about their estates2%People hate giving money to the Government1%Decreased number of casesResponsesStagnant or shrinking client base1%Inertia1%Q9:In what proportion of IHT cases do you recommend Business Relief (BR) as the best solution?Answer %81%-99%1%100%5%Average10ResponsesHigh Impact: IHT Outlook Survey42%

Q10:Over the last 12 months which one type of BR solution have you recommended the most?Answer choicesResponsesAIM47%Unlisted29%EIS7%None of the above (please specify)17%Q11:What holds you back from recommending BR as a solution more often? (Please select all that apply)Answer choicesResponsesProduct risk69%Product cost29%Compliance Challenges27%Product performance15%Client Objections (please provide more info)5%Other product Concerns (please provide more info)3%Other (please specify)24%Q12:What do you find most important when selecting a BR product?Answer choicesResponsesDiversification28%Financial strength of provider22%Length of track record17%Charges12%Target return10%Technical Support2%Size of the fund0%Other (please specify)9%Q13:How can an IHT product provider best support you in writing IHT business? (Please select all that apply)Answer choicesResponsesSpecialist knowledge65%Being available when required53%Helping attract new clients25%Finding planning opportunities within your existingclient bank17%11

APPENDICES:Foresight IHT Outlook surveyFinal resultsQ14:Do you find higher value estates are making better use of Business Relief compared to smaller estates thatcould be well-served by Business Relief advice?Answer choicesResponsesStrongly agree12%Somewhat agree44%Neither agree nor disagree38%Somewhat disagree6%Strongly disagree0%All agreeAll disagree56%6%Q15:The FCA aims to finalise “Guidance for firms on the fair treatment of vulnerable customers” later this year.What do you find most challenging when advising vulnerable clients on Inheritance Tax Planning?Answer choicesResponsesCommunicating effectively to gain understanding50%Recommending suitable products21%Providing appropriate advice15%Other (please specify)15%Q16:What impact do you think Covid-19 will have on the IHT planning market? (Please select all that apply)Answer choices12ResponsesClients will be more open to IHT planning38%Clients will plan for IHT at a younger age21%Clients will choose more immediate solutions17%It will have no impact38%All who expect Covid-19 to affect the IHT planning market62%High Impact: IHT Outlook Survey

Q 1 7:Do you think Covid-19 will affect your approach to IHT planning?Answer choicesResponsesI plan to do more IHT planning17%I plan to speak with clients at a younger age16%I plan to recommend faster acting solutions morefrequently7%It will have no impact61%All who believe Covid-19 will affect their IHT planning39%Q18:How do you expect Covid-19 to affect demand for BR solutions?Answer choicesResponsesIt will increase demand significantly1%It will increase demand moderately46%It will have no impact on demand47%It will decrease demand moderately5%It will decrease demand significantly1%All increase47%All decrease6%Q19:What measures have you put in place to mitigate the challenges presented by Covid-19?(Please select all that apply)Answer choicesResponsesUsing video call software for client meetings76%More telephone-based meetings76%Using online application forms that do not require a wetsignature69%Increased production of client facing content(Newsletters, blogs, articles etc.)26%Increased online marketing to attract new clients(LinkedIn etc.)14%None of the above (please specify)1%Q20:How has Covid-19 affected your approach to writing business?(Please select all that apply)Answer choicesResponsesI see Covid-19 as an opportunity to write more business10%I expect to continue writing business as normal61%I will write less business31%I have put a hold on all new business3%13

About ForesightWe are a leading independent infrastructureand private equity investment manager.Investing for a Smarter FutureInvesting for a smarter future is what we have been doingfor more than 35 years.We manage funds for institutional investors,family offices, private and high net-worthindividuals and have continued to expandrapidly in recent years with staff numbersnow exceeding 230.To us, a smarter future means thinking both about theway we invest our clients’ capital as well as the impactit has, be it diverting waste from landfill to convert intorenewable energy; managing solar plants and windturbines to power industry with up to 100% renewableenergy; acquiring utility scale battery storage assetsto balance the grid; supporting small businesses withgrowth capital and providing attractive investmentopportunities for some of the largest and most demandingof institutional investors.More than half of our assets undermanagement comes from institutions, withthe remainder made up from the traditionalretail structures, such as VCTs, EISs, BR(Business Relief) schemes and OEICs.Investing for a smarter future is a principle that guideseverything we do as we continuously search for ways tocreate a sustainable legacy for future generations.Foresight Group Sustainability Statistics270 renewable generationassets globally2.7GWof total generating capacityOffsetThat’s enough to powerover 1.6 milliontonnesof CO2emissionsmore than halfa millionUK householdsfor a yearin 2019Foresight’s infrastructure business is built on strong foundations which comefrom investing successfully at scale, on behalf of both institutions andretail investors, across the breadth of energy infrastructure for more than a decade.14High Impact: IHT Outlook Survey

15

Important Information This document has been issued andapproved as a financial promotion for the purpose of Section 21 ofthe Financial Services and Markets Act 2000 (“FSMA”) by ForesightGroup LLP, which is authorised and regulated by the FinancialConduct Authority (“FCA”), under reference number 198020.Foresight’s registered office is at The Shard, 32 London BridgeStreet, London, SE1 9SG.This document relates to the Foresight Inheritance Tax Fund. Theopportunities described in this document are NOT suitable for allinvestors. Key risks are explained in the Information Memoranda/Investor Guides and should be carefully considered beforesubmitting an application to invest. Your capital is at risk and youmay lose all the money you invest. Investments will be made insmall unquoted companies, which carry a higher risk that manyother forms of investment. The Fund’s investments are likely to beilliquid and difficult to realise. The value of shares and income fromthem may go down as well as up, and past performance is not areliable indicator of future performance and may not be repeated.Prospective investors should regard an investment in the Funds as along term investment. Tax reliefs are dependent upon an investor’sindividual circumstances and are subject to change. There can be noguarantee that the Funds’ investments will continue to qualify forBusiness Property Relief (“BPR”). A failure to meet the BPRqualifying requirements could result in the investments losing theirinheritance tax exempt status, resulting in adverse taxconsequences for investors.Foresight Group LLPThe Shard32 London Bridge StreetLondonSE1 9SGt: 44 (0)20 3667 8199e: sales@foresightgroup.euw: foresightgroup.eu

The Foresight proposition The Foresight product range includes the Foresight Inheritance Tax Solution and the Foresight Accelerated Inheritance Tax Solution. 76 contracted revenue streams with low correlation to of advisers are now using video call software for client meetings C net returns per annum The Foresight ITS provides investors with a