Transcription

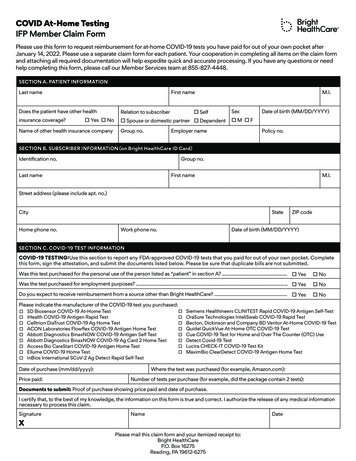

Conventional ConformingCOVID‐19 Interim Guidance8/12/2021TopicAge of DocumentsLast updated 08/11/2021Retired effective 08/11/2021.Refer back to the originalFNMA/FHLMC Age ofDocumentation guidelines, priorto COVID‐19 overlays.Underwriting SpecificationsThe age of documents requirement is being reduced from 120 days to 60 days for income and asset documentation, withthe following exceptions: Quarterly asset statements Military income documented on a Leave and Earnings Statement Social Security Income Retirement Income Long‐Term Disability Public Assistance Foster CareTPO's are required to follow all applicable Agency guidelines on this topic.Many student loans were placed into an automatic forbearance status and the other party may have missed paymentsFederal Student Loan in COVID‐due to the forbearance. Exclusion of the monthly student loan payment is permitted if:Related Forbearance, Paid By1) the missed payments are resolved by the responsible party (not the borrower) prior to closing of the new mortgageAnother Partyloan; 2) the responsible party had been making payments on the student loan for at least nine (9) months prior to theLast updated: 09/17/2020automatic forbearance; 3) the lender provides borrower documentation evidencing the student loan is in a COVID‐related automatic forbearance, and any missed payments have been paid (not by the borrower); and 4) evidence of 12Applicable to all applications untiltotal payments, either monthly or in aggregate, on the omitted debt.further notice.NOTE: Non‐Federal Student Loans or Student Loans paid by the borrower, payment must be included in the DTI.Assets for Closing and/orReservesLast updated: 08/11/2021Market‐based assets such as stocks, stock options, or mutual funds, when used for down payment or closing costs: Evidence of the borrower's actual receipt of the funds realized from the sale or liquidation must be documented in allcasesRetired effective 08/11/2021.Refer back to the originalFNMA/FHLMC guidelines, priorto COVID‐19 overlays.Market‐based assets such as stocks, stock options, or mutual funds, when used for reserves: Only 70% of the value of the asset may be considered. Liquidation is not required. TPO's are encouraged to review the location of the subject property. If there are any known local or State restrictionsthat could be impacting the borrower's ability to work, additional due‐diligence is recommended. TPO's are encouraged to evaluate the borrower's employment/occupation. If there are any known local or StateEmployment Stability Bestrestrictions for "non‐essential businesses" that could adversely impact the borrower's ability to work, the income mayPracticesnot be considered for qualifying.Last updated 08/28/2020 Non‐Self‐Employed Borrowers: If it is determined that there ARE orders in place, adversely impacting the borrower'sApplicable to all applications until ability to work, further documentation should be requested to validate the borrower is actively working and/or receivingfull pay during the impact. For example, if it is confirmed the business is closed but the employer is willing to confirm infurther notice.writing that the borrower's employment/pay is not affected during the closure, the income could be deemedstable/acceptable for qualifying.TPO'1‐Unit Purchasei d d thtidonly, nott allowedt b ond refinances)t d ithi Where30 d borrower(s)fli ti aredscheduledt (Fortransactionsto beginBorrowers Accepting Newemployment under the terms of a non‐contingent employment offer or contract, and the employment is scheduled toEmployment/Offer Letterbegin post‐closing, NexBank will require confirmation from the proposed/new employer that the borrower's non‐Last updated 08/28/2020contingent contract is still effective per the original terms and has not changed. This confirmation must be in writing orverbally, directly with the proposed/new employer and NexBank's funding department.Applicable to all applications until In the event the employer is experiencing closure due to COVID‐19, and cannot be reached, the loan will be unable tofurther notice.close/fund until employment can be verified directly with the new employer.Unemployment or FurloughedBorrowersLast updated 08/28/2020 Unemployment benefits are only allowed when associate with Seasonal Employment, per agency guidelines. Furloughed borrowers income is not eligible, even under agency "temporary leave" income policies.Applicable to all applications untilfurther notice.COVID-19 Interim Guidance - NDPage 1 of 5

TopicIncome TypeMarket‐Based Assets as IncomeLast updated: 08/11/2021Retired effective 08/11/2021.Refer back to the originalFNMA/FHLMC guidelines, priorto COVID‐19 overlays.Variable IncomeLast updated: 08/28/2020Applicable to all application untilfurther notice. Assets as Source of Income Employment‐Related/Assets as a Basisfor Mortgage Qualification Interest and Dividends Capital Gains DistributionUnderwriting SpecificationsTemporary GuidanceWhen market‐based assets are used for qualification purposes, the followingapplies: Employment Related Assets/Assets as a Basis for Qualification ‐ Assets mustbe reduced by 30% prior to applying the applicable income calculations. Distribution Income ‐ The value of the account must be reduced by 30% andthe reduced balance of the asset must be divided by the current monthlyamount of distribution income being received Interest and Dividends/Capital Gains ‐ Extreme caution must be exercisedwhen using historical earnings in qualifying. NexBank underwritingmanagement must second review the income type/calculations. A gap in employment or a reduction in income due to COVID‐19 cannot be excluded from the calculation, and the year‐to‐date income must continue to be calculated over the entire time period (YTD). If trending analysis indicates current YTD has declined, but borrower is actively employed with no indication thatemployment will not continue, the income may be considered for qualifying. If the trend of the YTD income calculation for variable wage earners is declining, it must be verified by the employerthat the income has since stabilized. If the employer cannot confirm stabilization, the income may not be used to qualify. If a variable hourly wage earner has returned back to the same employment (prior to COVID‐19 impact), there are nominimum amounts of time that must be documented for the income to be considered. If an variable hourly wage earner returns to work, working less than historical hours (prior to their gap of employmentdue to COVID‐19), the year‐to‐date income calculation will be utilized to account for the decline in income whendetermining the income for qualifying.TPO's must provide a written analysis of the self‐employed income amount and justification for thedetermination that the income used to qualify is stable.In addition to regular self‐employed tax return requirements, one of the below additionaldocumentation options must be obtained:Self‐Employed BorrowersLast updated 11/30/2020Applicable to all loans withapplication dates on or ion 1 An unaudited YTD P&L signed by the borrower that reports businessrevenue, expenses and net income. The information on the YTD P&L mustcover the most recent month preceding the application date and be dated nomore than 60 calendar days prior to the note date, AND For applications dated prior to December 14, 2020 ‐ Two (2) months'business account bank statements no older than the latest two (2) monthsrepresented on the YTD P&L. For example, if the YTD P&L is through10/31/2020, the business bank account statements can be no older thanSeptember and October. OR For applications dated on or after December 14, 2020 ‐ Three (3) months'business account bank statements no older than the latest three (3) monthsrepresented on the YTD P&L. For example, if the YTD P&L is through10/31/2020, the business bank account statements can be no older thanAugust, September and October.NOTE: Personal asset account statements evidencing business deposits andexpenses may be used when the borrower is the owner of a small businessand does not have a separate business account.Option 2 An audited YTD P&L, prepared in accordance with GAAP and audited by anindependent certified public account; reporting business revenue, expensesand net income. The information in the YTD P&L must cover the most recentmonth preceding the application received date and be dated no more than 60calendar days prior to the note date.Note: Additional documentation may be necessary to supplement the minimum requireddocumentation shown above to effectively assess the impact of the pandemic on the business.COVID-19 Interim Guidance - NDPage 2 of 5

TopicUnderwriting SpecificationsAll YTD P&L Statements: If the information on the YTD P&L is not reasonably consistent with the information on thebusiness account statements, additional documentation (such as month‐to‐month or quarterlytrending for YTD P&L, additional months and/or more recent bank statements) must be obtainedto support the information and resolve the discrepancy.ReviewingDocumentationUnaudited YTD P&L Statements: It must be determined if the business revenue, expenses and net income documented in theunaudited YTD P&L are reasonably consistent with the revenue and expense cash flowdocumented on the business account statements. If the unaudited YTD P&L statement cannot be supported by business account statementsand/or other documentation, the self‐employment income is not eligible for use in qualifying.If the unaudited YTD P&L is supported, or if an audited P&L is used, the TPO may proceed indetermining the current level of stable monthly income.Self‐Employed Borrowers(Continued)Last updated 06/02/2020Applicable to all loans withapplication dates on or after06/11/2020Establishing StableMonthly Income The YTD P&L (audited or unaudited), business account statements and other relevant factorsmust be reviewed to determine the extent to which the business has been impacted by COVID‐19. The current level of stable monthly SE income must be established using detailsfrom the YTD P & L, business account statements and supplementaldocumentation as applicable. It must be determined whether the income level has declined by comparing the information onthe YTD P & L to the business revenue and expenses reported on the most recent year’s business(schedule C or business) tax returns and the net monthly income as calculated by the TPO.Standard adjustments to the business cash flow can be made. When the TPO has determined thatthe net business income is impacted, but the P & L details are not sufficient to determine theincome is stable at the reduced level, additional documentation may be obtained to supplementthe P & L. (As an example: A month‐to‐month income trending analysis.) If stability cannot beconfirmed, the self‐employment income is not eligible for qualifying. For example: Historicalmonthly self‐employment income calculated 2,000 per month. The current level of stablemonthly self‐employment income determined by the TPO using the details from the P & L andother supplemental documentation 1,000/per month. The impact of the COVID‐19 pandemicresulted in a 50% decline from historical levels (see below) When the TPO has determined the current year net business income has been impacted by theCOVID‐19 pandemic and is less than the historical monthly calculated income, but is stable at thecurrent level, the amount of qualifying income historical income calculated must be reduced to nomore than the current level of stable month income determined by the TPO. More than thehistorical income calculated, the TPO must use no more than the current stable level of historicalincome calculated. A YTD P & L audited or unaudited cannot be used to support a higher level ofincome than the historical amount calculated. In all cases, qualifying income must be supported by documentation, including any supplementaldocumentation obtained.The TPO is responsible for establishing that the borrower’s income is stable and likely to continueat the same level used to qualify the borrower. It is expected that the TPO ensure they areGuidance for Reviewknowledgeable of the economic conditions related to the borrower’s business. In addition to theof Analysis ofbusiness review and analysis requirements, pandemic‐related factors must be considered. TPO areBusiness Impactsexpected to follow the guidance as published by Fannie Mae and Freddie Mac when analyzing theimpacts to the borrower’s business.Small BusinessAdministrationPPP/COVID‐19Related Loans orGrantsTax ReturnsLast updated: 03/27/2020Applicable for all loans untilfurther notice. Loan proceeds from SBA Payroll Protection Plan (PPP) and/or any other similar COVID‐19‐relatedprograms (federal, state or local level business loans and grants) are not considered businessassets for the purposes of eligible funds used to qualify the borrower for the transaction, including,but not limited to funds for the down payment, closing costs and reserves. Outstanding obligations of this nature do not need to be considered as a debt obligation forqualification purposes.Where tax returns are required for documenting income, the 2019 tax returns are due and required. If the borrower(s)have requested an extension for the 2019 tax returns all of the following are required: Copy of IRS form 4868 (Application for Extension). If taxes are owed per the 4868, provide evidence it has been paid or deduct from available assets. Provide processed IRS Form 4506T transcript for 2019 reflecting "no transcript available" Provide processed IRS Form 4506T transcripts matching the year(s) tax return(s) that will be used as qualifying income.COVID-19 Interim Guidance - NDPage 3 of 5

TopicUnderwriting SpecificationsThird‐Party Income VerificationsLast updated: 08/28/2020 The information from the electronic database must be dated no more than 60 days from the Note date.Applicable for all loans untilfurther notice.Verification of All MortgagesLast updated: 06/01/2020Applicable for all loans withapplication dates on or after06/02/2020.Extra due diligence for all mortgages on which the borrower is obligated or is being refinanced if the borrower is notobligated but is an owner, to determine whether the payments are current as of the Note date of the subject transaction.This includes co‐signed mortgages and mortgages on properties other than the subject property in which the borrower isobligated. It also applies when the borrower is not obligated on the subject mortgage being refinanced but is an owner. For a loan to be considered current, the borrower must have made all original, full mortgage payments due in themonth prior to the note date of the new loan by the last business day of that month. Acceptable due diligence documentation includes: 1) A payment history for the servicer or a third‐party verificationservice. 2) Payoff statement for the loan being refinanced. 3) The borrower's most recent mortgage statement. 4)Verification of Mortgage (VOM). NOTE: A credit supplement, to the original credit report, may be acceptable in thecontext with other available information if it documents a direct contact with the mortgage servicer and verifies the datethe last payment was made and the due date of the next payment.A borrower who is not current and has missed payments on ANY mortgage loan is eligible for a new mortgage if thosemissed payments were resolved in accordance of the following:If the borrower resolved missed payments through a reinstatement, they are eligible for a newmortgage loan. The TPO must document the source of funds, if the reinstatement was completedReinstatementafter the application date of the new transaction. Proceeds from a refinance may not be used toreinstate any mortgage loan.If outstanding payments will be or have been resolved through a loss mitigation solution, theborrower is eligible for a new mortgage loan if they have made at least three timely payments asof the note date of the new transaction as follows:Forbearance EligibilityLast updated 06/01/2020Applicable for all loans untilfurther notice.Loss MitigationSolution For a repayment plan, the borrower must have made either three payments under therepayment plan or completed the repayment plan, whichever occurs first. Note that there is norequirement that the repayment plan be completed. For a payment deferral, the borrower must have made three consecutive payments following theeffective date of the payment deferral agreement. For a modification, the borrower must have completed the three‐month trial payment period. For any other loss mitigation solution not listed above, the borrower must have successfullycompleted the program, or made three consecutive full payments in accordance with the program.Verification that the borrower has made the required three timely payments may include:‐ A loan payment history from the servicer or third‐party verification service,‐ The latest mortgage account statement from the borrower, or‐ A verification of MortgageNOTE: If these requirements are met on an existing mortgage loan being refinanced, the new loanamount can include the full amount required to satisfy the existing mortgage. Missed payments during the time of a COVID‐19 related forbearance that have been resolved, will not be considered inthe historical delinquencies for purposes of excessive mortgage delinquency policy.COVID-19 Interim Guidance - NDPage 4 of 5

FHA Standard & JumboCOVID‐19 Interim GuidanceTopicForbearanceLast updated: 09/10/2020Applicable to all loans with casenumbers assigned on or beforeJune 30, 2021Tax TranscriptsLast updated 03/30/2020Applicable for all loans untilfurther notice.Rental IncomeApplicable to all loans with casenumbers assigned on or beforeOctober 1, 2021Verbal Verification ofEmployment ‐ Self‐EmployedLast updated: 06/21/2021Applicable to all loans with casenumbers assigned on or beforeOctober 1, 2021ForbearanceLast updated: 09/10/2020Applicable to all loans with casenumbers assigned on or beforeJune 30, 20218/12/2021Underwriting SpecificationsFor all loans in which the borrower(s) are utilizing rental income to qualify, the following requirements apply: Once the income has been calculated per the standard requirements in Handbook 4000.1, the income must then bereduced by 25%, OR Verify 6 months PITIA reserves for the property associated with the rental income, OR Verify that the borrower has received the two month's previous rental payments evidenced by the borrower's bankstatements showing the deposits. This option is only applicable for borrowers with a history of rental income on theproperty.Tax transcripts are required for all loans. Transcripts may be provided in the following ways: Ordered and delivered by the TPO If the TPO is unable to obtain transcripts the borrower must contact the IRS directly. If the IRS is unable to deliver transcripts to the borrower, evidence of the attempt must be provided.In additional to the requirements in SF Handbook 4000.1: Reduce the effective income associated with the calculation of rental income by 25% or Verify 6 months PITI reserves (this option is applicable to Forward only), or Verify the borrower has received the previous 2 months rental payments as evidenced by borrower's bank statementsshowing the deposit. (This option is applicable only for borrowers with a history of rental income from the property).Within 20 business days of the Note date obtain one of the following: Evidence of current work (executed contracts or signed invoices that indicate the business is operating on the date ofverification of self‐employment. Evidence of current business receipts (payment for services performed) Certification completed by the NexBank to document the following: 1) Phone call directly to the business (documentthe details of the phone call), or 2) Visit to the business website that demonstrates activity supporting current businessoperations (timely appointments for estimates or services can be scheduled). Third‐party verification from a CPA, comptroller, or officer of the business.In the event that none of the above can be obtained, a certification from Schedule C Borrower(s) that the business isoperational may be accepted on a case‐by‐case basis at the discretion of the underwriter.Generally, a borrower who was granted Mortgage Payment Forbearance is eligible for a new FHA insured mortgageprovided: The borrower continued to make regularly scheduled payments and the Forbearance Plan is terminated, or For Cash‐Out refinances, the borrower has completed the Forbearance Plan and made at least twelve (12) consecutivemonthly payments post forbearance; or For Purchase and No Cash‐Out refinances, the borrower has completed the Forbearance Plan and made at least three(3) consecutive monthly payments post forbearance; or For Credit Qualifying Streamline refinance, the borrower has completed the Forbearance Plan and made less thanthree consecutive monthly payments post forbearance; and For all Streamline refinance transactions, the borrower has made at least six payments on the FHA‐insured mortgagebeing refinanced (where the FHA insurance Mortgage has been modified after forbearance, the Borrower must havemade at least six payments under the Modification).COVID-19 Interim Guidance - NDPage 5 of 5

FNMA/FHLMC Age of Documentation guidelines, prior to COVID‐19 overlays. Conventional Conforming COVID‐19 Interim Guidance 8/12/2021 Quarterly asset statements Military income documented on a Leave and Earnings Statement Social Security Income Retirement Income Long‐Term Disability Public Assistance