Transcription

COLLEGE SUCCESSTHROUGHFINANCIAL LITERACYTim Hagan and Gretchen HolthausOffice of Student SuccessFinancial Literacy ProjectWichita State University

Who Are We?u The Financial Literacy Project at Wichita StateUniversity has been funded by a College AccessChallenge Grant since 2011.u We are not allowed to charge money for anyservices.u No Trial Memberships, Bank Account Numbers,Credit Cards, etc.We’re FREE.

Let’s Chatu Is “College” worth the price?u Do Enough Students Graduate?u Do Students know how to find aCollege they can Afford?u Do Students know how to ManageMoney?u Can they Learn more?u Can You Help?

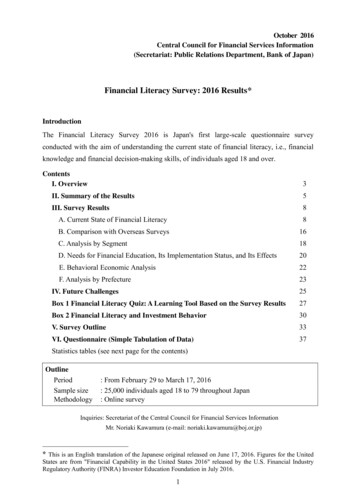

THE VALUE OF EDUCATIONDidn’t Graduate

While nearly 70% ofhigh school studentsenroll for college

just 59% ofthem willgraduate collegein 6 years

WHAT BARRIERSARE IN THEIR WAY?

WHEN YOU ASK CHIEF ACADEMICOFFICERS, THEY CITE:1. LACK OF ACADEMICPREPAREDNESS2. ADEQUACY OF PERSONALFINANCIAL RESOURCESHabley, W., Valiga, M., McClanahan, R., & Burkum, K. (2010). What works in studentretention 2010 Study: Public Four-Year Colleges and Universities. Iowa City: ACT.

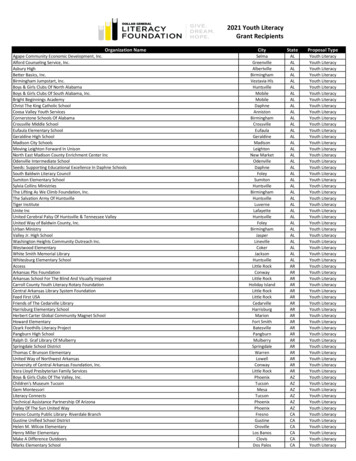

RETENTION INITIATIVESAcademicPreparednessFinancial Resourcesu 97% of colleges offertutoring servicesu 83% have pre-enrollmentfinancial aid advisingu 90% have a writingcenter/labu 63% give short-termloansu 84% have a libraryorientationu 53% of universitiesreport providing moneymanagement workshopsto their studentsHabley, W., Valiga, M., McClanahan, R., & Burkum, K. (2010). What works in studentretention 2010 Study: Public Four-Year Colleges and Universities. Iowa City: ACT.

WHAT’S THESOLUTION? Academic Advisers help developyour Academic Plan A Financial Plan helps youachieve your Academic Plan

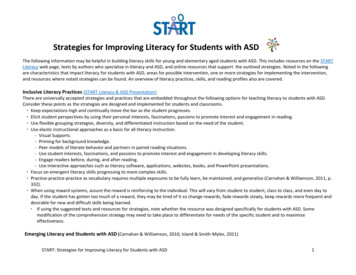

FREE ONLINE ticoNo advertisementsoFree to everyone anddeveloped for current orcollege-bound students

Stafford Loans are 4.66% APRfor the 2014-15 school yearMonthly Paymentfor 10 Years 233.34 298.11 313.37Minimum Salary Needed 28,000 35,773 37,604 516.28 61,954

PART 1 OF THE ONLINE COURSEISN’T JUST ABOUT THE MONEYu Touches on other success factors Getting involved Picking a major Time management And more

Part IIu Financial Goalsu Importance of Checking/Savings Accountsu Measuring and Tracking Income andExpenseu Getting More for Your Moneyu Loans, Debtu Credit Reports and Scoresu Identity Theft

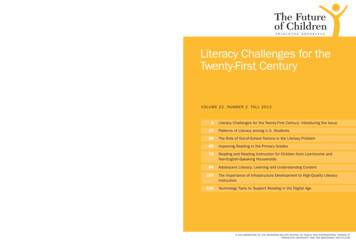

INTEREST RATE/FEE COMPARISONTotalInterestPaidin1Yearona 1000LoanBalance 4,500 4,000 3,500 3,000 2,500 2,000 1,500 1,000 500 0 3,900DebtthatmaybenecessaryDebttoAvoid 2,640 3,000 1,400 50 69 oan

TEACHING RESOURCESu Lesson Plansu Assign Modulesu Track Student Progressu Quiz QuestionsAvailable via Email

STUDENT MONEY MANAGEMENTu Ways to implement financial educationinto existing programsu Introduction to the University coursesu Orientationu Money Management Workshopsu Career Fairsu Office for Student Money Management

QUESTIONS?COMMENTS?

FURTHER INFORMATIONu u Email - info@mycollegemoneyplan.orgTwitter - @CollegeCostTips

CONTACT US316-978-3254OSMM@wichita.eduTwitter: @WSU OSMMFacebook: Office for Student Money ManagementSkype: WSUOSMM

Financial Literacy Project Wichita State University COLLEGE SUCCESS THROUGH FINANCIAL LITERACY . . ADEQUACY OF PERSONAL FINANCIAL RESOURCES Habley, W., Valiga, M., McClanahan, R., & Burkum, K. (2010). . Lesson Plans ! Assign Modules ! Track Student Progress ! Quiz Questions Available via Email .