Transcription

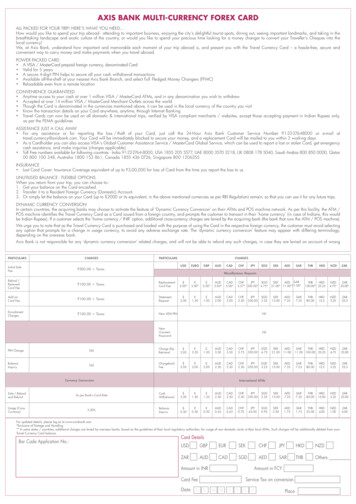

AXIS BANK MULTI-CURRENCY FOREX CARDALL PACKED FOR YOUR TRIP! HERE'S WHAT YOU NEED.How would you like to spend your trip abroad - attending to important business, enjoying the city's delightful tourist spots, dining out, seeing important landmarks, and taking in thebreathtaking landscape and exotic culture of the country, or would you like to spend your precious time looking for a money changer to convert your Traveller's Cheques into thelocal currency!We, at Axis Bank, understand how important and memorable each moment of your trip abroad is, and present you with the Travel Currency Card – a hassle-free, secure andconvenient way to carry money and make payments when you travel abroad.POWER PACKED CARD A VISA / MasterCard prepaid foreign currency, denominated Card Valid for 5 years A secure 4-digit PIN helps to secure all your cash withdrawal transactions Available off-the-shelf at your nearest Axis Bank Branch, and select Full Fledged Money Changers (FFMC) Reloadable even from a remote locationCONVENIENCE GUARANTEED Anytime access to your cash at over 1 million VISA / MasterCard ATMs, and in any denomination you wish to withdraw Accepted at over 14 million VISA / MasterCard Merchant Outlets across the world Though the Card is denominated in the currencies mentioned above, it can be used in the local currency of the country you visit Know the transaction details on your Card anywhere, anytime, through Internet Banking Travel Cards can now be used on all domestic & international trips, verified by VISA compliant merchants / websites, except those accepting payment in Indian Rupees only,as per the FEMA guidelinesASSISTANCE JUST A CALL AWAY For any assistance or for reporting the loss / theft of your Card, just call the 24-Hour Axis Bank Customer Service Number 91-22-27648000 or e-mail attravel.currency@axisbank.com. Your Card will be immediately blocked to secure your money, and a replacement Card will be mailed to you within 2 working days As a Cardholder you can also access VISA's Global Customer Assistance Service / MasterCard Global Service, which can be used to report a lost or stolen Card, get emergencycash assistance, and make inquiries (charges applicable) Toll Free numbers available for following countries - India 91-22-2764-8000, USA 1855 205 5577, UAE 8000 3570 3218, UK 0808 178 5040, Saudi Arabia 800 850 0000, Qatar00 800 100 348, Australia 1800 153 861, Canada 1855 436 0726, Singapore 800 1206355INSURANCE Lost Card Cover: Insurance Coverage equivalent of up to 3,00,000 for loss of Card from the time you report the loss to usUNUTILISED BALANCE - FLEXIBLE OPTIONSWhen you return from your trip, you can choose to:1. Get your balance on the Card encashed.2. Transfer it to a Resident Foreign Currency (Domestic) Account.3. Or simply let the balance on your Card (up to 2000 or its equivalent, in the above mentioned currencies as per RBI Regulation) remain, so that you can use it for any future trips.DYNAMIC CURRENCY CONVERSIONIn certain countries, the acquiring banks may choose to activate the feature of ‘Dynamic Currency Conversion’ on their ATMs and POS machine network. As per this facility, the ATM /POS machine identifies the Travel Currency Card as a Card issued from a foreign country, and prompts the customer to transact in their ‘home currency’ (in case of Indians, this wouldbe Indian Rupees). If a customer selects the ‘home currency / INR’ option, additional cross-currency charges are levied by the acquiring bank (the bank that runs the ATM / POS machine).We urge you to note that as the Travel Currency Card is purchased and loaded with the purpose of using the Card in the respective foreign currency, the customer must avoid selectingany option that prompts for a change in usage currency, to avoid any adverse exchange rate. The ‘dynamic currency conversion’ feature may appear with differing terminology,depending on the overseas bank.Axis Bank is not responsible for any ‘dynamic currency conversion’ related charges, and will not be able to refund any such charges, in case they are levied on account of PAUDCADCHFJPYSGDSEKAEDSARInitial SaleFee 300.00 TaxesReload /RenewedCard Fee 100.00 TaxesReplacementCard Fee 3.00* 3.00* 2.00*AUD5.00*CAD5.00*CHFJPYSGD3.57* 350.00* 4.75*SEKAED SAR21.00* 11.00*11.00*Add-onCard Fee 100.00 TaxesStatementRequest 2.00 1.50 ashmentCharges 100.00 TaxesNew ATM 00* aneous RequestsAxis Bank ATMsJPY250.00SGD3.25THB80.00PIN ChangeNilCharge SlipRetrieval 3.00 2.50 ED11.00SARTHBHKD11.00 100.00 23.25NZD4.75ZAR35.00BalanceInquiryNilChargebackFee 2.00 2.00 ED7.25SAR7.25THB80.00HKD15.5NZD3.25ZAR23.5Currency ConversionSale / Reloadand RefundAs per Bank's Card RateUsage (CrossCurrency)3.50%International ATMsCashWithdrawal 2.00 1.50 eInquiry 0.50 0.50 1.75SAR1.75THB25.00HKD4.00NZD1.00ZAR6.00For updated details, please log on to www.axisbank.com*Exclusive of Postage and Handling** In some states / countries, additional charges are levied by overseas banks, based on the guidelines of their local regulatory authorities, for usage of non-domestic cards at their local ATMs. Such charges will be additionally debited from yourTravel Currency Card balance.Bar Code Application No.:Card HBOthersAmount in INRAmount in FCYCard FeeDateDService Tax on conversionDM MYYYYPlace

TRAVEL CURRENCY CARD APPLICATION FORMForm TypePersonal Details*Mr.Ms.First NameDr.Middle NameDate of Birth D DPAN No.:M MMother’s Maiden Name:Last NameYYYYGender:* MMarital Status: SingleMiddle NameFTMarriedFather's Name:Passport No.*Date of Issue*DDExpiry Date*M MYYYYDDPlace of Issue*M MYYYYE-mail ID:*Your Axis Bank Travel Currency Card Statement will be sent on the above e-mail idNationalityCity of BirthCountry of BirthAre you an existing Axis Bank Customer:* YCustomer IDNResidential Address (Current / Permanent):*LandmarkPin Code*City*Landline No.STD CodeState*Mobile No.*Office Name & Address:LandmarkPin CodeCityLandline No.STD CodeStateMobile No.Customer Information#Please mention occupation codes as applicable for Non-individuals in case of HUFOccupation* Private SectorPublic SectorOccupation Code*#StudentAnnual Salary Income ( lakhs)*Salaried* YGovt. Sector 1Business 1-5 5-10Professional 10-15Self-Employed 15-25 25-50RetiredHousewife 50If Yes*, Employer Name Job Role DesignationNDetails of Travel*Country of Travel:Purpose of Travel:Date of Travel: D DBusinessEducationMedicalM MYYYNo. of Days of Travel:YHoliday / LeisureOthersChoose your Travel Currency Card1. Choose your Carda. Multi-Currency Cardb. Single Currency Card2. Choose your ZAROTHERSDocuments SubmittedAir TicketCopy of PassportForm 60 / PAN Copy(Mandatory for cash amount over 20,000)Payment ModeCash AmountAxis Bank Account(Up to 50,000)AmountCheque / DD AmountCustomer ID:SB / CA Account No.:Details of Foreign Exchange requiredFCY Currency FCY Amount (in words & figures)

Source of FundSalaryBusiness IncomeRent IncomeOther*Relation with person funding the Card: SelfSpouseParentOther*For list of close relatives as per Section VI of Companies Act, please refer to Section on Page 5.Fields marked * (star) are mandatory.Please sign this authorisationI hereby apply for the issuance of an Axis Travel Currency Card to me, and declare that the information included in the application is true and correct, and that I am an Indian citizen, and that Iam eligible to apply for an internationally valid Card. I accept that Axis Bank is entitled in its absolute discretion to accept or reject this application, without assigning any reason whatsoever.I hereby confirm that I have received the Terms and Conditions as applicable to the Axis Bank Travel Currency Card, and have read and understand the same. If this application is accepted, Ishall be bound by the Terms and Conditions governing the Axis Bank Travel Currency Card, as may be in force from time to time, and the use of the Card shall be deemed to be acceptance ofthose Terms and Conditions. I am aware that by agreeing to this, I am estopped from taking a plea subsequently, that I have not been aware of the Terms and Conditions. I authorise Axis Bankand / or its associates to verify any information or otherwise at my office / residence, or to contact me, my Employer / Banker / Credit Bureau / RBI or any other source, to obtain or provide anyinformation that may be required for confirming membership requirements, or maintaining my account in good standing. I agree to an ongoing confirmation for use of my name, address, e-mailand mobile number for marketing / merchandising offers between Axis Bank and other companies. I understand and acknowledge that local laws and Reserve Bank of India Rules and Regulationslay down norms and limits for the purchase and use of foreign exchange. I undertake that the usage of the Axis Bank Travel Currency Card by me will be in accordance with the Exchange ControlRegulation of the Reserve Bank of India, and the applicable laws in force from time to time, in particular and without information, the Foreign Exchange Management Act, 1999 (“FEMA”). In theevent of any failure on my part to comply with the Rules and Regulations or in the event of any information supplied by me being incorrect and inaccurate, I agree that I will be solely liable forany / all penalties and / or action under the local laws and / or regulations as may be in force, governing the purchase and use of the Axis Bank Travel Currency Card, and shall indemnify AxisBank for any losses or damages caused to the Bank. I also understand that a Service Tax is applicable on all fees, interest and other charges as per the Government of India regulations, andagree to pay the same. In case I have applied for an Additional Card (Add-on Card) available for a resident Indian - parent, spouse, brother, sister, or child over 12 years of age or for myself, Iwill receive the details of transactions done using Add-on Card along with the Primary Card. The facility of an Additional Card being a facility, continuation of the membership of the AdditionalCard member will be dependent on the continuation of my membership. I agree and acknowledge that Axis Bank will act on requests made by any person(s) other than me, claiming to representme for reload of the Axis Bank Travel Currency Card issued to me. In such an event I shall not contest the said reloading. I, hereby request and authorise agree and acknowledge that, Axis Bankto act and rely on any instructions or communications given by me or any person(s) other than me, directly or indirectly, via telephone, cellphone, facsimile, untested telexes and faxes, telegraph,cable, e-mail or any other form of electronic communication, for any purpose, related to Axis Bank Travel Currency Card or Add-on Card. I / We, understand and acknowledge that there areinherent risks involved in giving or sending the instructions or communications via telephone, cellphone, facsimile, untested telexes and faxes, telegraph, cable, e-mail or any other form of electroniccommunication, and at times the said instructions or communication may not be clear, complete, visible, readable and as such I hereby agree and confirm that Axis Bank shall not be held liablefor and shall be indemnified from, any losses or damages including legal fees, arising upon acting on, or failure to act on such instructions, or communications, wholly or in part in accordancewith the said instructions or communications so received. In case of Axis Bank Travel Currency Card issued to me at the requests of my Employer, I hereby authorise Axis Bank to act on the requestsmade by my employer for reload, cancellation and refund of the Axis Bank Travel Currency Card. I understand that ATMs / EDC terminals are machines, and errors could occur while in operation.I agree to indemnify the Bank for any such machine / mechanical errors / failures, and shall not hold the Bank liable for any failure and / or errors in operation of the Cards at the ATMs / EDCterminals. I hereby agree that the Axis Bank Travel Currency Card will not be funded by the Bank in the event there is any breach of the limits as prescribed under FEMA, and as applicable tome, or if there is any discrepancy / breach of the KYC requirements, and I shall not hold the Bank liable for non-funding due to the reasons mentioned aforesaid.Signature of CardholderDateNomination (DA1 Form)*I wish to nominateDDM MYYYPlaceY(Only one individual nominee permitted and to be signed also in case of no nomination)I do not wish to nominateNomination under Section 45 ZA of the Banking Regulation Act, 1949 and Rule 2 (1) of the Banking Companies (Nomination) Rules 1985 in respect of Bank DepositsI / We (Name)(Address)Nominate the following person to whom in the event of my / our / minor's death the amount of deposit in the above account may be returned by Axis Bank Ltd.NameAddressSame as Primary ApplicantIf different from Primary ApplicantAgeRelationship with depositor, if anyIf nominee is Minor, Date of Birth D DYearsSame as Primary ApplicantYYYYRelationship with Minor**As nominee is Minor I / We appoint (Name)AddressM MIf differentto receive the amount of deposit on behalf of the nominee in the event of my / our / minor's death during the minority of the nominee.Signature of Witness***Signature of Primary Applicant**NameNameAddressAddressDate, Place*Strike out if nominee is not a Minor.Signature of the Joint Applicant(s)**Where deposit is made in the name of a Minor, the nomination should be signed by a person lawfully entitled to act on behalf of the Minor.*** In case of thumb impression, nomination to be filled in as an annexure.For Branch / FFMC use onlyThis is to certify that the remittance is not being made by / to ineligible entities and that the remittance is in conformity with the instructions issued by the Reserve Bank from time totime under the Scheme.Travel Currency Card #Account Reference #Branch / FFMC CodeName of Issuing AuthoritySignatureStamp and SealDate:Place:Fields marked * (star) are mandatory.Branch / FFMC NameEmployee ID

Declaration for purchase of foreign exchange under theLiberalised Remittance Scheme of USD 250,000Details of the remittances made / transactions effected under the Scheme in the current financial year (April - March )Sr. No.DateAmountName and address of AD branch / FFMC through which the transaction has been effectedDeclarationI, (Name), hereby declare that the total amount of foreign exchange purchased from or remittedthrough, all sources in India during the financial year as per Item No. of the application, is within the overall limit of USD 250,000 (US Dollar Two Hundred and FiftyThousand only), which is the limit prescribed by the Reserve Bank of India for the purpose and certify that the source of funds for making the said remittance belongs to me and theforeign exchange will not be used for prohibited purposes.Declaration under FEMA 1999 as per Form A2(1) I / We hereby declare that the total amount of foreign exchange purchased from or remitted through all sourcesin India during this financial year, including this application, is within USD Limit as prescribed by RBI for the said purpose under FEMA, 1999.(2) Foreign exchange purchased from you is for the purpose indicated above.**(Strike out whichever is not applicable)DECLARATION-cum-UNDERTAKING[Under Section10 (5), Chapter III of The Foreign Exchange Management Act, 1999]I / We hereby declare that the transaction details of which are specifically mentioned in the Schedule hereunder does not involve, and is not designed for the purposeof any contravention or evasion of the provisions of the aforesaid act or of any rule, regulation, notification, direction or order made thereunder.I / We also hereby agree and undertake to give such information / documents as will reasonably satisfy you about this transaction in terms of the above declaration.I / We also understand that if I / We refuse to comply with any such requirement or make only unsatisfactory compliance therewith, the Bank shall refuse in writing toundertake the transaction and shall if it has reason to believe that any contravention / evasion is contemplated by me / us report the matter to Reserve Bank of India.*I / We further declare that the undersigned has / have the authority to give this declaration and undertaking on behalf of the firm / company.*Applicable when the declaration / undertaking is signed on behalf of the firm / company.DateDDM MYYYYPlaceSignatureDebit AuthorityI / We authorise you to debit my / our account number and effect the Travel Card funding, as detailed above, along with yourapplicable charges i.e. Foreign Conversion Tax, Commission & Service Tax.Signature of the Account HolderNameSection 1A person shall be deemed to be a relative of another if, and only if,- (a) they are members of a Hindu undivided family; or (b) they are husband and wife; or (c) theone is related to the other in the manner indicated below:Father (including stepfather)DaugtherMother (including stepmother)Daughter's husbandSon (including stepson)Brother (including stepbrother)Son's wifeSister (including stepsister)

Form No. 60Form of Declaration to be filled by a person who does not have a Permanent Account Number, and who enters into any transaction specified in Rule 114B.1. Full Name and Address of the Declarant:2. Particulars of transaction: Application of Travel Currency Card3. Amount of the transaction:4. Are you assessed to tax?YesNo5. If yes,(I) Details of Ward / Circle / Range where the last return of income was filed?(II) Reasons for not having Permanent Account Number:6. Details of the document being produced in support of address in Column (1)VerificationI, , do hereby declare, that what is stated above is true to the best of my knowledge and belief.Verified today, the day ofSignature of the declarantDateDDM MYYYYPlaceFATCA-CRS DeclarationDetails under FATCA and CRS(Please consult your professional Tax Advisor for further guidance on your tax residency, if required) Identification Type and Identification Number (Documents 1 submitted as proof of identity of the individual) Name of the document submittedIdentification Number Please tick the applicable tax resident declaration: (Any one)*I am a tax resident of India and not resident of any other countryI am a tax resident of the country/ies mentioned in the table belowCountry##Tax Identification Number%Identification Type (TIN or Other%, please specify)To also include USA, where the individual is a citizen / green cardholder of USA.%In case Tax Identification No. is not available, kindly provide functional equivalent .1permissible documents are Passport, Election ID Card, PAN Card, ID Card, Driving Licence, UIDAI Card, NREGA Job Card and Others.FATCA-CRS CertificationI have understood the information requirement of this Form (and Terms & Conditions) and hereby confirm that the information provided by me on this Form is true, correctand complete and hereby accept the same.Signature:Date:Place:*Mandatory FieldsFATCA-CRS Terms and ConditionsThe Central Board of Direct Taxes has notified on 7th August, 2015 Rules 114F to 114H, as part of the Income Tax Rules, 1962, which Rules require Indian financialinstitutions such as the Bank to seek additional personal, tax and beneficial owner information and certain certifications and documentation from all our account holders.In relevant cases, information will have to be reported to tax authorities / appointed agencies / withholding agents for the purpose of ensuring appropriate withholdingfrom the account or any proceeds in relation thereto.Should there be any change in any information provided by you, please ensure you advise us promptly, i.e., within 30 days.If you have any questions about your tax residency, please contact your Tax Advisor. If you are a US citizen or resident or Green Card Holder, please include UnitedStates in the foreign country information field along with your US Tax Identification Number. It is mandatory to supply a TIN or functional equivalent of the country inwhich you are tax resident issues such identifiers. If no TIN is yet available or has not yet been issued, please provide an explanation and attach this to the Form.

The 'dynamic currency conversion' feature may appear with differing terminology, depending on the overseas bank. Axis Bank is not responsible for any 'dynamic currency conversion' related charges, and will not be able to refund any such charges, in case they are levied on account of wrong . AXIS BANK MULTI-CURRENCY FOREX CARD ALL .