Transcription

MARCH 2013Vol. 2 - No. 2OPPORTUNITYenterpriseA NEWSLETTER FROMBUSINESS BANKINGEvents and - ‐Oct- ‐125- ‐Nov- ‐125- ‐Dec- ‐125- ‐Jan- ‐13Expand your businessreach with banking inChinese Yuan5- ‐Feb- ‐135- ‐Mar- ‐13Currency conundrum:Handling forex risk inyour businessBuilding on a firmfoundation: GCC cementand steelGlobal equity shrugs offthe sequesterLike global real estate,Dubai property returnsto formMishal Kanoo: “Yourbrain is your biggestweapon” Read more Read more Read more Read more Read morePresenting Islamic Bankingproducts from Business BankingNews update UAE annual inflation drops to 0.43% in Jan on lower housing prices Dubai airport starts 2013 with new passenger record Expo 2020: Infrastructure produces rich returns for businesses GCC private education sector represents 14% of USD36bn market Number of new firms up in Dubai Dubai’s property market set to witness USD1bn influx Dubai Chamber seeks to revise franchising law Is the sun setting on gold? Foreigners spend over AED2.16bn during DSF Saudi spending poised to touch SAR1trn this year

enterpriseVol. 2- No. 2FEATUREDCurrency conundrum:Handling forex risk in yourbusinessDubai being the re-export hub of not justthe region but also the world, it hostsseveral small and medium-sized businessesfor which currency is a large concern. Theentrepreneur has little time available fromgrowing the business, forcing them toemploy forex geeks who spend their daysand nights tracking the currency “pairs”relevant to their geographical businessspread.Small businesses and high net worthindividuals find that currency trading islucrative, but look for ways to minimize risk.By Dirk Flahertysaid a trader at a Dubai-based currencyhouse.“My margins on re-export are already prettythin. When I add the cost of employingpeople solely to track currency trends, theybecome even thinner,” Younes added.A currency pair is a means of determiningthe value of a particular currency againstanother. The first currency of a currencypair is called the “base currency”, andthe second is the “quote currency”. Thecurrency pair shows how much of the quotecurrency is needed to purchase one unit ofthe base currency.For instance, if the USD/EUR currency pairis quoted as being USD/EUR 1.5 andyou purchase the pair, this means that forevery 1.5 euros that you sell, you purchase(receive) USD 1. If you sold the currency pair,you would receive EUR 1.5 euros for everyUSD you sell. The inverse of the currencyquote is EUR/USD, and the correspondingprice would be EUR/USD 0.667, meaningthat USD 0.667 would buy EUR 1.Dubai-based Aruba Forwarding LLC, with anannual turnover of USD 12 million, importsfast-moving consumer goods from morethan 10 countries worldwide, and re-exportsthem to another three or four nations. Itslargest revenue risk comes from foreignexchange fluctuations.“We pay in multiple currencies and earnin multiple currencies,” Aruba generalmanager Faris Younes said. “We have twopeople dedicated to tracking currency trendsand making currency purchases and salesat just the right time so as to ensure we donot lose money between the buying of thegoods and selling them.”QUICK LINKSHOME FEATURED“Not only is the learning curve prettysteep, if a company want to stay aheadof the currency market, but it is alsopretty expensive to hire effective andknowledgeable people to do this for you,” OPPORTUNITY MARKETS UPDATEAruba’s two forex geeks often usealgorithms to track pairs, handle margins,effect rollovers and bet on spreads, futuresand options. Currency trading being a highlydynamic market, sometimes they come outahead of the curve and at other times theycrash and burn.“Clearly, there is an element of risk in thetrillion-dollar global forex trading market,”the trader said. “If currency trading is notyour primary business, where risk is factoredinto your activity, it can create situationswhere it actually has a negative impact onyour balance sheet.”But affordable alternatives to doing yourown currency management are few and farbetween.“Affordability is a secondary concern,” thetrader said. “The primary concern is whetheryou want to add currency risk to yourexisting core business risk. My advice wouldbe to let the professionals handle it.”Sanjay Haldar, a finance professionalemployed at an investment bank, says hetrades foreign exchange but refuses to do ithimself. Haldar, who has been designated as REALTY CHECK NEWS UPDATE a “high net worth individual” by his bank,believes that there is money to be made intrading currency, to supplement his alreadyconsiderable salary income.“But currency is not my core strength. Ioutsource it to professionals, to whom I giveclear parameters concerning my risk appetiteand purpose of trading, and let them handleit,” he said, adding that his consultants usea mix of long and short positions as well ascross trades.Haldar believes currency and equity tradeson his account are best left to professionalmarket watchers, because that leaves himfree to focus on his core strengths, which heis quick to add “do not include staring at ascreen all day and sometimes at night just totrack my trades”.Currency trading can be used in multipleways. You can be a Haldar and supplementyour income. You can be a Younes andreduce currency exposure in your business.Or you can use it as a hedge for otherinvestments. The bottom line for most noncore forex traders is simple: it is not an easymarket to become acquainted with, thelearning curve is steep, and the risk of lossesincreases if you do not devote significanttime and attention to it. ZawyaEVENTS & PROMOTIONS

enterpriseVol. 2- No. 2OPPORTUNITYBuilding on a firmfoundation: GCC cementand steelmanaging director, the Links Group, said.“So, there are a number of initiativesthat we have seen, where start-ups andentrepreneurs can be involved in that sector.We have seen everything from people whoare doing specialist tiles, to floor coveringprotection and a number of those have beenvery successful,” he said.By Jude HardyOverall, the construction pipeline across theGCC is valued at USD 1.8 trillion, accordingto Alpen Capital’s 2012 ‘GCC ConstructionIndustry’ report. The sector also contributed5.4% of the overall GDP for the entire GCCregion. As a percentage of GDP for the UAE,the sector increased from 8.9% in 2006 to11.5% in 2010.Key drivers for this sector include thewillingness of GCC governments to developnon-oil sectors – including constructionand real estate. An expanding populationand increased urbanization will also keepresidential demand high, as well as theneed for commercial office properties. Theregion’s 16 million expatriates, who wishto own their own homes, will likely drivehousing demand as well.A slew of upcoming mega-scale projectshas breathed new life into the GCC’sconstruction sector, according to industrydata compiled by Zawya. Five years after thereal estate bubble burst, the region appearsto be entering a new phase of developmentboom, spurred by hydrocarbon giants SaudiArabia, Qatar and the UAE.So why are these projects good news forsmall and medium-sized businesses?“What drives the industry right now is notwhat drove the industry three years ago.It was very much a market that was soldoff-plan three or four years ago. Now thedemand is for something that people cantouch and feel. They want something that“First of all, when people look at cementand steel in terms of construction, in thetypical building 33% of the building costis in the materials,” Stuart Curtis, groupQUICK LINKSHOME FEATURED OPPORTUNITY MARKETS UPDATEis quality that they can pay for, that theycan afford. So the demand here right now– not just in the UAE but across the GCC– is for quality affordable housing,” Curtiscontinued.competition within the sector is likely toresult in competitive bidding by the playerswhich is expected to drive down the marginsof construction companies further’, thereport states.“The opportunities for SMEs in that areaare from building material supply to actualconstruction companies themselves. Weas an organization are continually settingup construction companies; in fact 40% ofour base is construction or constructionrelated companies. And we are not seeingany slowdown in that sector, in fact we areseeing more joint sectors in that area,” hesaid.The labor-intensive nature of the sectoralso means high attrition rates amongstexpatriate labor workforce ‘remains ahurdle, as the skilled expatriate workers aredrawn towards their home countries dueto better job opportunities. This is likely toact as a major barrier for the labor-intensiveconstruction sector’, the report reads.However, there are some negative aspectsrelated to the sector, which smallerbusinesses need to watch out for.According to the Alpen Capital report,oversupply is still an issue facing the GCCconstruction and real estate sector – whichin the past has led to a number of projectcancellations. Weak investor sentiment willalso affect the sector, the report states:‘Investor sentiment is expected to be weakin the near-term due to tightening creditconditions. Numerous large projects werecancelled across the GCC in 2010 and 2011due to weak investor sentiment and lack offunds’.For Curtis, however, another aspect thatsmaller companies need to watch out foris when they’re paid for the work they’vecompleted.“You are in a very difficult part of the foodchain. So you are going; developer, subcontractor, contractor and down, so theSME space goes further and further downfrom there. So, in that sector, you need tobe very, very careful how you get paid that is the most important thing there,” heconcluded. ZawyaIncreased competition and fragmentationis also a factor to consider: ‘The increased REALTY CHECK NEWS UPDATE EVENTS & PROMOTIONS

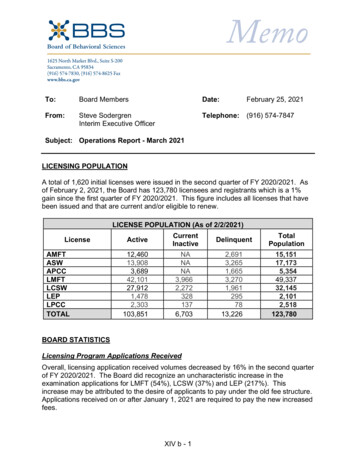

enterpriseVol. 2- No. 2MARKETS UPDATEGlobal equity shrugs off e euters,asatMarch6,2013Global markets shrugged off the USsequester fight, close elections in Italy andeven China’s signal that it is pulling backinfrastructure spending, leaving manyanalysts to wonder whether financialmarkets’ rally is coming to an end.An improved US job market, a fast-growingservices sector and the US Federal Reserve’scontinued support of the economy haslargely offset the embarrassing political fightbetween the White House and Congresson sequester, or automatic cuts that kickedin as the two parties failed to agree onspending cuts.The drop in Chinese activity could also loweroil prices, which would hurt Gulf marketsentiment, but for now the momentum is“While the recent crisis is vivid testament to FEATURED OPPORTUNITY MARKETS UPDATEOil5- ‐Nov- ‐125- ‐Dec- ‐125- ‐Jan- ‐135- ‐Feb- ‐135- ‐Mar- ‐13largely positive.Still, it is unclear whether China’s decisionto cool off on infrastructure spending willstart weighing on global markets. Domesticspending on affordable housing is set todecline from a 2012 high as Beijing scalesback construction targets. Certain transportprojects will see growth, but moderationsets the overall tone, analysts note.Meanwhile, Fed chairman Ben Bernanke hasargued that the benefits of keeping interestrates low outweigh the risks.HOME5805705605505405305205105005- ‐Oct- ‐12“In light of the moderate pace ofthe recovery and the continued highlevel of economic slack, dialing backaccommodation with the goal of deterringexcessive risk-taking in some areas poses itsown risks to growth. Indeed a prematureremoval of accommodation could, byslowing the economy, perversely serve toextend the period of low long-term rates.”Despite concerns of overheating, the S&P500 Index is trading at 13.6 times estimated12-month earnings, compared to 14.9 timesin October 2007 when the index reached anall-time high, according to Reuters data.yen and was at the 94.10 level. The Britishsterling has fallen nearly 7.5% this yearagainst the dollar and stood at USD 1.5032on March 6 as the American greenbackemerged as the strongest currency this 6.812.5the costs of ill-judged risk-taking, we mustalso be aware of constraints posed by thepresent state of the economy,” Bernankesaid in a speech on March 1.The Dow Jones Index hit record levels, whilethe Standard & Poor’s index inched closerto its own record on March 6, as investorsploughed funds into the rally and tradersrepeated the newly-popular investmentphilosophy – TINA: There Is No Alternative.QUICK LINKSD/Yld(%)12A43.883.382.233.53.23.3 The Dubai market has retreated after rising18.5% year-to-date. It currently stands15.5% higher than the start of the yearand remains the best performing market inthe region. Abu Dhabi (14.1%) and Kuwait(10.5%) have also posted double-digitgrowth year-to-date, suggesting a regionwide rally that continues to take root.Kuwait’s price-to-earning ratio is the highestin the region at 16.9 times earnings, but theUAE markets stand at 10.6, still lower thanmost other regional markets, suggestingmore headroom for growth.Brent crude is down a mere 0.7% for theyear, at USD 111.18 per barrel, even afterthe death of Venezuela’s Hugo Chavez,president of OPEC’s sixth-largest crudeproducer. Most analysts predict thatinstability in the Latin American countrywould only serve to raise crude prices andcall upon Saudi spare capacity, benefitingthe Gulf region.GoldGold has fallen 6% year-to-date andcurrently languishes at USD 1,576.8 perounce. Market observers believe the sunmay have set on the yellow metal fornow. ZawyaCurrencyThe euro fell against the dollar as theEuropean Central Bank was widely expectedto maintain interest rates. In fact, someanalysts believe the ECB could cut interestrates in the future to recharge the lacklusterEurozone. The euro has consistently fallenbelow USD 1.30 this year.The dollar also gained against the JapaneseREALTY CHECK NEWS UPDATE EVENTS & PROMOTIONS

enterpriseVol. 2- No. 2REALTY CHECKLike global real estate,Dubai property returns i302%0.00%8.30%na0.00%Frankfurt- ‐1%0.00%4.80%3500.00%HongKong2%2.00%3.00%232- ‐11.10%London- ‐1%0.00%4.00%2190.00%Moscow- ‐7%- ‐4.20%9.00%215- ‐4.20%Mumbai70%2.70%10.10%2051.90%NewYork11%- ‐6.00%4.70%2952.80%Paris- ‐8%- ‐2.10%4.50%251- ‐7.20%SaoPaulo- ‐36%26.40%9.50%na20.10%Shanghai- ‐26%0.40%6.00%2382.20%Singapore- ‐8%0.80%3.40%214- ‐9.80%Sydney6%2.50%6.90%359- aSalle,realestatedataasatendofQ4,2012.After being in the doldrums for a few years,the real estate sector in most emerging anddeveloped markets is showing signs of arecovery.Much of the leveraged investments that hadpumped up real estate prices prior to theglobal financial crisis have been cleansed fromthe system and an environment of low interestrates is bringing investors back to the propertymarkets.Currency 2012% 2011%Real estate consultant Jones Lang LaSalleexpects investments of up to USD 500 billionin real estate globally in 2013 – the highestinvestment level since 2007.FEATUREDDubai–BeachAED2Dubai–CityAED8384- ‐1Dubai–OverallAED83.683.30.31,433 1,364 5.10% 1,194 1,109 7.70%7726.30%6856495.60%1,048 9858206.40%8768206.80% 9.90%- .70%31.90%38.10%7.00%1.60%15.50%Buoyed by the business optimism, EmaarProperties – the emirate’s flagship real estatecompany – announced it will launch newprojects such as the Dubai Modern ArtMuseum and Opera House District.Closer to home, Dubai’s real estate market isalso coming in from the cold after a few yearsof hibernation.The company delivered 31,230 residentialunits apart from two million square feet ofcommercial space, as the real estate marketpicked up last year.The emirate’s real estate market continues toexperience higher levels of residential sales andthe prime market is now well into an upturn,notes JLL.Emaar says its business strategy includes“taking advantage of the recent buoyancy inDubai’s real estate market by developing newiconic projects.”“The recovery in prices is most pronounced inthe villa sector (where prices increased 24%in 2012, compared to 12% in the apartmentsector). Rents have also started to recover (7%for villas and 6% for apartments in 2012).However, the improvement in prices is largelyconfined to prime established locations, with“Investment volumes in Asia Pacific areforecast to increase by around 15%, withAsian sovereign wealth funds and pensionfunds deploying more capital in their home 81Changein2012 2011 Change 2012 2011 Change%pointsregion.”“In Europe, we anticipate that this year will seea similar level of investor activity to last yearbut with upside potential, particularly fromthe secondary markets, which are starting tosee greater investor interest given their moreattractive yields,” said JLL.HOME83RoomYieldSource:Ernst&YoungFor high net-worth individuals in the Gulf,which are shrewd real estate investors, the UScommercial property sector offers the strongestupside potential, especially as it is expected togrow 15%-20% during the year.QUICK LINKSAverageRoomRatesNetAbsorptionless established locations seeing little or nogrowth in teOccupierMarketsOPPORTUNITY MARKETS UPDATE Still, it needs to be put in perspective, asvacancies in Dubai’s prime central businessdistrict (CBD) remain high at around 31%.continues to be tenant-favorable, demandis still concentrated on just a few buildings/locations, and the range of prime buildings insingle-ownership is more restricted than theoverall vacancy figures would suggest.”Meanwhile, the emirate’s hospitality propertymarket is also picking up, primarily asinstability in other lodging markets in theMiddle East and Africa (MENA) flare up, saidErnst & Young in a report on the global travelmarket.“Continued unrest in countries such asEgypt, Libya and Syria has enabled leisuredestinations, such as Dubai, to benefit fromthe redirected lodging demand . An increasein tourism from Chinese leisure travelers isanticipated to boost room rates in populartourist destinations, such as Dubai, in 2013.”The emirate ended 2012 with an overalloccupancy rate at 83.3%. In addition, RevPARincreased by 6.4% and average room rate alsoincreased by 6.3%, said E&Y.Analysts expect the global real estate marketto pick up even further in the second halfof the year as the clouds of economic doomdisappear and businesses are more confidentof the future. And Dubai is poised to get a liftas the high tide comes in. Zawya“Non-CBD locations have even higher vacancylevels, as much as 80% in some sub-markets,”said JLL. “While the overall office marketREALTY CHECK NEWS UPDATE EVENTS & PROMOTIONS

enterpriseVol. 2- No. 2NEWS UPDATESUAE annual inflation dropsto 0.43% in Jan on lowerhousing pricesExpo 2020: Infrastructureproduces rich returns forbusinessesAnnual inflation in the United Arab Emiratesfell slightly to 0.43% in January, from 0.66%in December, driven by mainly by a decreasein the housing component, the country’snational bureau of statistics said in an emailedstatement.Dubai’s focus on competitiveness andsustained investment in infrastructure hasproduced rich returns for the businesses.Various business setups, growing links tonew markets and growth options in theemirate are attracting more investors toleverage these advantages.A rise in the food, beverages and tobacco,and transportation prices were mitigated byhousing prices, which dropped a 1.64% onyear. The housing category makes up nearly40% of the U.A.E.’s overall Consumer PriceIndex. – Zawya Dow JonesQUICK LINKSHOME FEATUREDWith buoyant and growing sectors of theglobal economy, a resilient economy and aninfrastructure that is second to none, theUAE is arguably the most competitive nationbidding for Expo 2020. – Gulf News OPPORTUNITY MARKETS UPDATE Number of new firms up inDubaiDubai Chamber seeks torevise franchising lawThe Department of Economic Development(DED) witnessed a 9% increase in licensesissued in January 2013 compared to thesame month of 2012 as economic activity inDubai remained on an upward curve. While1,310 licenses were issued in January 2012,1,428 were issued in January 2013 reflectingincreasing investor confidence in Dubai.Dubai Chamber of Commerce and Industryattempts several endeavors to revise thefranchising law with the aim of easingbusiness and protecting brands andinvestors in the UAE market.The commercial sector saw a 69% increasein the number of licenses, the highestamong all sectors in January 2013, whilethe professional sector accounted for a 28%rise, followed by the tourism and industrialsectors at 2% and 1% respectively. –Emirates 247REALTY CHECK NEWS UPDATE With the participation of leading legal firms,a workshop reviewed and discussed UAEfranchising laws, setting up a franchise andthe challenges and risks associated withfranchising and how to mitigate them.The Dubai Chamber felt that modifyingcertain aspects in the franchising law willenhance the business of the local andinternational brands in the market as wellas give more flexibility to organize businessperspectives under proper legislativeumbrella. – Gulf NewsEVENTS & PROMOTIONS

enterpriseVol. 2- No. 2NEWS UPDATESForeigners spend overAED2.16bn during DSFDubai airport starts 2013with new passenger recordInternational visitors to the UAE spentover USD 589 million (AED 2.16 billion) ontheir Visa cards during the Dubai ShoppingFestival (DSF) 2013, registering a 19% yearon-year growth over DSF 2012, accordingto data issued by Visa Inc., the world’slargest retail electronic payments networksand a lead sponsor of the region’s premiershopping event.Dubai International saw more than 5.5 millionpassengers throughput in January 2013,setting a record for the maximum passengersin a single month, Dubai Airports said in astatement.The airports body said the boost came on theback of holiday traffic in January, which is alsothe month Dubai Shopping Festival was held.Passenger traffic rose 14.6% to 5,559,760 inJanuary 2013, up from 4,852,139 in the samemonth in 2012, according to Dubai Airport’straffic report. Whereas, aircraft movementstotaled 31,332 in January 2013, climbing5.6% from the 29,680 movements recordedin January 2012. – Gulf News.The results collected by the company’sVisaVue Travel data service indicatedthe month-long retail and shoppingextravaganza got off to an excellent start,with spending on overseas-issued Visacards in the first week of DSF touchingUSD 153.35 million. The Friday of the firstweekend of the sale also witnessed recordspending, with over USD 25 million spent onoverseas Visa cards. – Emirates 247QUICK LINKSHOME FEATURED OPPORTUNITY MARKETS UPDATE GCC private educationsector represents 14% ofUSD36bn marketEducation sector is one of the focus areasfor the GCC governments with a growingshare spending being channeled to build newschools, colleges, and universities, KuwaitFinance House report said.According to the report, sector data showsthat the total students in GCC region isexpected to grow by 1.8% to reach 11.3million in 2020 from 9.5 million in 2010. –Saudi GazetteREALTY CHECK NEWS UPDATE Dubai’s property market setto witness USD1bn influxDubai’s real estate market, which iswitnessing a resurgence this year, will getanother major shot in the arm when theUSD 1 billion Investment Corporation ofDubai (ICD)-Brookfield Dubai Real EstateFund gets underway.A move to start the fund was made withICD and Brookfield Asset Management,the co-promoters of the fund, namedDouglas Kirkman, Senior Vice-Presidentof the Brookfield Property Group, asChief Executive Officer of ICD-BrookfieldManagement Limited, the firm that willmanage the fund. – Emirates 247EVENTS & PROMOTIONS

enterpriseVol. 2- No. 2NEWS UPDATESIs the sun setting on gold?Saudi spending poised totouch SAR1trn this yearAfter climbing 500% in a decade, perhaps itis time for gold investors to accept that theyellow metal is a spent force.Investment in infrastructure projects couldprovide a significant opportunity for investorsin Saudi Arabia, as government spending isset to touch SAR 1 trillion (USD 266.6 billion)in 2013, according to Emirates NBD WealthManagement, a part of the Middle East’sleading bank.The secular bull cycle that thrust gold intothe limelight as the world’s most rewardinginvestment is finally waning and the metal isfinally taking a well-deserved breather, someanalysts believe.Speaking at an investor road show in Riyadh,Mark McFarland, chief investment strategist,Emirates NBD Wealth Management, said:“Across the GCC, government spending willbe a key driver of GDP growth in 2013, asregional economies focus on upgrading theirphysical infrastructure and social facilitiesin line with world-class standards. This isparticularly true of Saudi Arabia, where publicspending is set to increase by 15% in 2013 totouch SAR 1 trillion.”Gold is down 6.5% year to date and thereis a good chance this could be the year itrecords its first annual decline in more thana decade. –alifarabia.comTruth: He dreams of his business going placesReality: Business Financing Solutions toempower his dreamsSMS ‘BLP’ to 4453. ZawyaQUICK LINKSHOME FEATURED OPPORTUNITY MARKETS UPDATE REALTY CHECK NEWS UPDATE EVENTS & PROMOTIONS

enterpriseVol. 2- No. 2Mishal Kanoo: “Your brainis your biggest weapon”better off than they are today. So, that wasone of the best lessons I had growing up.credit others for doing something or thinking,facilitating their growth.On educationOn family businessAs I was growing up I was a spoilt brat. Ibelieved that the world revolved around myown little stupid head. I discovered quicklyfrom my mother that it did not. I rememberone specific moment: I was seven years oldwhere my mother taught me one of thebest lessons I’ve ever learnt. Our cook hadput a bit more spice than I could tolerate,so I threw a tantrum. I called the cook andsaid a lot of things; my mother observedquietly and allowed me to say what Iwanted to say.Well, you know, it’s simple: we trainmonkeys. When people are trained, they aretaught to do a repetitive action. Let asidebeing cognitive or creative, they are justdoing a repetitive action and if we can dothat with a monkey we can do that with aperson. On the other hand if we educatea person, we are telling that person ‘don’trepeat what I am doing but understandwhat I’m doing; then if you build on it anddo something better than me so much thebetter.’ Today it’s become more a norm toengage people in repetitive things; we donot want to engage their minds.There are many issues you will encounter in afamily business. I think the biggest problem issuccession planning and most likely it’s a planto fail; there is no succession planning. Mostfamilies fail to plan. Within the Islamic societywe go by the Sharia law in which God hastalked about ownership and not management.I can’t force my son to have a football club justbecause I want that for him. When it comes tosuccession planning I shouldn’t plan to havesomeone succeed me who fits ‘my mindset’but rather what they will need in the future.Then later she took me to this place behindthe Jumeirah mosque, where there used tobe old houses occupied by less well-to-dopeople who battled economic conditionsand you could see how poor they were. Mymother, before we went there, took me toSatwa where we bought crates of orangesand apples.Your brain is your biggest weapon, forit’s the moment when you think – that’swhen you threaten people. People who getthreatened by your thoughts and ideas arethose people who deserve to go. I wantmore people to challenge me and arguewith me and to vest me because at the endof the day you raise my bar.She made me give bags of apples andorange myself to those people. Themoment they opened the door I could seestraight inside the house and the type ofpeople living there. It struck me at thattender age of seven that I was a spoilt bratand I understood clearly that there arepeople who were underprivileged. And If Idon’t do something in my life then I am noOn managingOn growing upQUICK LINKSHOME FEATUREDThe only thing I will credit myself with doing isempowering people who are smart, intelligent,able and capable to reach their full potentialrather than me taking credit for it. I have seenin this part of the world, people are more thanhappy to take credit for other peoples’ workand I find this despicable. The idea to helppeople must resonate in our heads. We must OPPORTUNITY MARKETS UPDATE Then there is conflict management. As long asthere are humans, there will always be fights.On greedIf I give you charity, I pity you, I’m sayingyou’re not good enough. I give you thefacilities and say use your internal drive anddo something with them – you don’t oweme after that. You will feel good becauseyou have achieved something. Hence, I wantyou to have that greed and want more; notin a malicious way but in a productive way. Iwant people to have that internal heat anddrive. Get up, do something.On SMEsMost people have the impression that whatSMEs need is finance – that’s a factor. Whilemoney can be obtained from your friendsor family, the need of the hour is education,REALTY CHECK NEWS UPDATE support mentoring and people to help youmove. The worst part is we talk a beautifulgame – ‘we support SMEs’ – really? Showme. A big company looks at an SME doingwell and says I will set up a competitor inthat segment and milk that SME to death.Firstly, we need to protect the SMEs. Thewhole purpose of creating these SMEs is sothat they can breathe and the more theybreathe

growing the business, forcing them to and nights tracking the currency "pairs" relevant to their geographical business spread. A currency pair is a means of determining the value of a particular currency against another. The first currency of a currency pair is called the "base currency", and the second is the "quote currency". The