Transcription

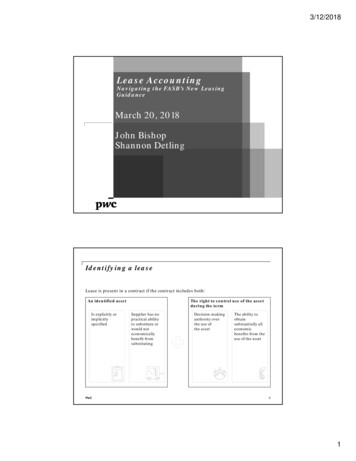

3/12/2018Lease AccountingNavigating the FASB’s New LeasingGuidanceMarch 20, 2018John BishopShannon DetlingIdentifying a leaseLease is present in a contract if the contract includes both:An identified assetIs explicitly orimplicitlyspecifiedPwCThe right to control use of the assetduring the termSupplier has nopractical abilityto substitute orwould noteconomicallybenefit fromsubstitutingDecision-makingauthority overthe use ofthe assetThe ability toobtainsubstantially alleconomicbenefits from theuse of the asset21

3/12/2018Embedded leasesIdentifyinga leaseDoes this contain a lease?Determining whether to apply lease accounting under the newleasing guidance is likely to be much more important sincevirtually all leases will be on the lessee’s balance sheet.3PwC3Leases with related partiesLease is classified based on legally enforceable terms and conditionsof the leaseNo adjustments for off-market terms in sale and leasebacktransactionsClassification and accounting should be the same asleases between unrelated parties in the separatefinancial statements of the related partiesLessors and lessees should apply related partydisclosure requirements in ASC 850 RelatedParty DisclosuresPwC42

3/12/2018Separating lease and nonlease components A contract may contain lease and nonlease components Components within an arrangement are those items or activities that transfer a good orservice to the customer Lease components provide the customer with rights to use an identified asset Only lease components are classifiedLand is a separate lease component unless the accounting effect of treating it as aseparate component would be insignificantExamples of items that are notcomponentsExamples of nonlease components: Property taxes Consumables Maintenance InsurancePwC5If a lessee pays for property taxes on behalfof the lessor, should the lessor gross up theincome statement for those payments?YesPwC63

3/12/2018Allocating contract considerationLesseeLessor Allocate consideration to eachcomponent based on relativestandalone selling price Allocate consideration to thecomponents based on transactionprice allocation guidance inthe new revenue recognition standard Lessee may elect, by class of underlyingasset, to not separate nonleasecomponents from the associated leasecomponent, but treat them as a leasecomponent FASB proposal to not separatenonlease component from relatedlease component in certaincircumstancesPwC7Lease classification – LesseeIf a lease meets any of the following 5 conditions, it is a finance leaseTransfer of ownershipOption to purchase is reasonably certainLease term is a “major part” of the economic life*Present value of lease payments is “substantially all” of the fair valueSpecialized nature*Not applicable if commencement date falls at or near end of asset’s economic lifePwC84

3/12/2018Lessee modelBalance sheet*Right-of-use assetLease liabilityIncome statementInterest expenseAmortization expenseLease expenseStatement of cash flows (operating,investing, financing)Interest portion of liabilityPrincipal portion of liabilityLease expensePwCOperating leaseFinance leaseYYYYNot applicableNot applicableYYYNot applicableNot applicableNot applicableOperatingOperatingFinancingNot applicable*Policy election to not recognize short-term leases on balance sheet, short-term lease: Lease term of 12 months or less from commencement No purchase option that the lessee is reasonably certain to exercise9Income statement comparisonTotal ExpenseASC842 Operating lease(Type B)Annual ExpenseTotalExpenseASC 842Finance lease(Type A)Lease YearPwC105

3/12/2018Measurement of the lease liabilityOverviewLease liabilityWhat is thelease term?Lease paymentsDiscount rateWhich variablelease paymentsare included?Which discountrate is used?PwC11Lease termLease commencement The date a lessor makes an underlying asset available for use to a lessee The date for classification and initial measurementLease term Start with non-cancellable period of the lease Consider all relevant factors that create an economic incentive for lessee to exercisean option to continue using the asset or terminate the lease Is the lessee reasonably certain to exercise its option?PwC126

3/12/2018Which variablepayments areincluded?Variable lease paymentsVariable lease paymentsdependent on .rate/indexe.g. inflation/interest rate ormarket rental ratesPart of leaseliabilityother variablese.g. performance basedlease payments, % of salesNot part of leaseliabilityPwC13Discount rate to measure lease liability (lessee)Has thischanged?Interest rate implicit in the leaseif rate cannot be readilydeterminedIncremental borrowing rate at commencement date*Matters more because almost all leasesrecognized on balance sheetPwC*Non-Public Business Entities: Accounting policy election to use a risk-free discount rate for allleases; risk-free discount rate needs to match the lease term of each lease147

3/12/2018Incremental borrowing rate New guidance: The rate of interest that a lessee would have to pay to borrow on acollateralized basis over a similar term an amount equal to the lease payments in asimilar economic environment Old guidance: The rate that the lessee would have incurred to borrow over a similarterm the funds necessary to purchase the leased assetPwC15Initial direct costs (IDC)Incremental costs that would not have been incurred if the lease had notbeen obtainedExamples of initial direct costs Commissions Payments made to an existing tenant toincentivize tenant to terminate it’s leaseExamples of costs that are not initialdirect costs Fixed employee salaries General overheads e.g., depreciation,equipment costs, unsuccessfulorigination efforts Costs for advertising, soliciting potentiallessees, servicing existing leases Costs related to activities that occurbefore the lease is obtained, e.g., costs ofobtaining tax or legal advice, negotiatinglease terms, due diligence related costssuch as evaluating a prospective lessee’sfinancial conditionDefinition is more narrow than direct loan origination costsPwC168

3/12/2018Reassessment requirements – LesseesEffectCauseUnder ASC 842, different triggering events could causedifferent consequences Changes in the assessment oflessee renewal, termination,or purchase options basedon triggering events withinlessee’s controlChange in amounts probableof being owed under a lesseeprovided residual valueguarantee Reassess leaseclassification Remeasure liability usingupdated discount rate* Do not reassess lease classification Remeasure liability using original discount rate &revised paymentsContingency resolved suchthat some or all variablepayments, which are notbased on an index or rate,become fixed Reallocate consideration between lease & non-lease components Adjust the right-of-use asset (potential P&L impact)*unless already reflected in existing discount ratePwC17What are the main changes for lessors?“The accounting applied by a lessor will largely be unchanged.”Changes in classificationtest and accounting forsales-type and directfinancing leases (someSTL - DFL)Up front profit will bedeferred if control is nottransferred to the lessee(DFL)Application of sale andleaseback and build-tosuit accountingLeveraged leaseaccounting discontinuedNo differentiation ofleases of real estate andleases of other assets(e.g. long-term landleases)Conformance withcertain glossary terms inlessee guidanceInitial direct costsinclude only costs thatwould not have beenincurred had the leasenot been obtainedEnhanced qualitative &quantitative disclosuresrequiredAlignment of lessoraccounting model withthe revenue recognitionprinciple in Topic 606PwC189

3/12/2018Sale and leaseback transactionsDetermine whether a sale has occurred Seller-lessee and buyer-lessor accounting is symmetrical Transaction must qualify as a sale under new revenue guidance No sale is recognized when the leaseback is classified as a finance lease or a sales-type lease(use 842 definition of initial direct costs for classification) A repurchase option may prevent sale accountingAccount for the transaction when a sale is recognized Gains are recognized in full upon sale The seller and buyer classify the lease in the same manner as any other leaseAccount for ‘off-market’ terms If the terms of a transaction are off-market, adjustment is required (e.g., recognition of a rentprepayment or a borrowing from the buyer)PwC19Asset impairmentLessee Apply long-lived assets guidance (ASC 360) Appropriately write down the right-of-use asset Following the impairment, amortize the right-of-use asset on a straight-line basis- For operating leases, expense will continue to be reflected as a single lease expense in theincome statement, but lease expense will no longer be recognized on a straight-line basisLessor Sales-type and direct financing leases: Apply guidance for receivables (ASC 310 impairment,ASC 326 credit losses when adopted) to the entire net investment in lease, treating anyunguaranteed residual as a terminal cash flow- How to consider changes in residual value under CECL? Operating leases: apply long-lived asset guidance (ASC 360)- Does CECL apply to straightline operating lease receivables?PwC2010

3/12/2018Effective dateEffectivedateEarlyadoptionpermitted?Public BusinessEntity*Fiscal years and interimperiods after Dec 15,2018(2019 calendar year)YesNon-public EntityFiscal years after Dec 15,2019(2020 calendar year)Interim periods after Dec15, 2020(2021 calendar yearYes*Also applicable to certain non-profit entities and certain employee benefit plans.PwCOn July 20, 2017 the SEC Observer to the EITF meeting said SEC staff would not object ifentities that are considered public business entities, only because their financialstatements or financial information is required to be included in another entity’s SECfiling, use the effective dates for private companies when they adopt ASC 84221Practical ExpedientsIndividual expedients May apply hindsight to existing leases to determine lease term and assetimpairment Existing land easements not accounted for under ASC 840Package At adoption do not reassess:- Whether an arrangement is, or contains, a lease- Lease classification- Whether initial direct costs would qualify for capitalization under thenew standardPwC2211

3/12/2018Proposed optional transition method for leasesExample using calendar year-end public company*Cumulative-effect adjustment to retained earningsPwC23Transition if package of practical expedients iselected and hindsight is notLesseeLessorCapital LeasesOperating LeasesAll LeasesCarry overcurrent balancesRoU asset & lease liabilityat PV of remaining“minimum rentalpayments” under ASC840* probable RVGCarry overcurrentbalancesPwC*Diversity in whether executory costs (maintenance, insurance,taxes) included in minimum lease payments under ASC 8402412

Leveraged lease accounting discontinued. 3/12/2018 10 PwC Sale and leaseback transactions 19 Seller-lessee and buyer-lessor accounting is symmetrical Transaction must qualify as a sale under new revenue guidance No sale is recognized when the leaseback is classified as a finance lease or a sales-type lease