Transcription

Whitepaper SeriesBringing You a Better Way to Shop and Buy EquipmentLeasing 101by d.The 2012eLeaseCapitalFinance,LLC1

Table of ContentsLeasing OverviewWhy Lease? Better Value More Convenient Greater ControlUnderstandingLeasing Types of Leases Leasing Industry Links Buyout / Purchase OptionsComparingFinancingStrategies Leasing vs. Borrowing, Credit,and Cash 2012eLeaseCapitalFinance,LLC2

Leasing OverviewLeasing definedA lease is a contractual arrangement in which a leasing company (lessor) gives acustomer (lessee) the right to use its equipment for a specified length of time (leaseterm) and specified payment (usually monthly). Depending on the lease structure, atthe end of the lease term the customer can either purchase, return, or continue tolease the equipment.Leasing works for any type of businessEvery imaginable type of organization leases throughout the world includingproprietorships, partnerships, corporations, government agencies, religious and nonprofit organizations. Over 80% of American businesses lease at least one of theirequipment acquisitions and nearly 90% say they would choose to lease again.Almost limitless possibilitiesYou can lease anything associated with the operations of your business (includingall types of capital equipment, hardware, software, and soft costs such as installationand consultation).How leasing is done on Leasing CompaniesFill out a short online lease application. Leasing Companies will review yourapplication and contact you the moment you are approved to begin the leasingprocess. 2012eLeaseCapitalFinance,LLC3

Why Lease?Leasing has become the preferred method of acquiring equipment amongbusinesses. Currently, 35% of all equipment is leased. Leasing offers realadvantages including better value, more convenience and greater control.Better ValueMake better use of your money Conventional bank loans usually require more money upfront thanleasing and often have restrictive covenants.Conventional debt financing may require a 10-20% down payment.Leasing generally requires only one or two payments upfront, whichare applied to your future payments.Finance 100% of your costsIn most cases, the full amount of the equipment, as well as the service,shipping, installation costs and maintenance can be included in the lease.This spreads the cost out evenly over the term of the lease freeing up yourmoney to work harder for you.Realize significant tax savingsMonthly payments on operating leases are typically viewed as operatingexpenses offering significant tax benefits. You should always consult withyour financial advisor to determine the most tax-beneficial lease for yourcompany.More ConvenientSpeedy and easyWith Leasing Companies, most applications receive bids within twobusiness days. This means that you can acquire equipment now, so yourbusiness can focus on increasing revenues.You can tailor a solution that meets your requirementsLeasing is flexible so that you can tailor the length and amount of yourpayments to meet your business' needs. "step-up" leases allow you to start with low payments that increaseover time so you can concentrate on using the equipment togenerate revenue. "skip" leases restrict payments to given months of the year so youcan plan ahead to cover the slow times. "deferred payment" leases allow a significant grace period beforeyour first payment is due. "master" leases offer a more convenient way to add moreequipment to your existing lease. 2012eLeaseCapitalFinance,LLC4

Greater ControlAvoid the risk of your equipment becoming obsoleteWith ownership you run the risk that new technology will render yourequipment obsolete within a few years, leaving you with equipment that nolonger meets your needs and that is difficult to sell. Leasing allows you toreplace or upgrade equipment to keep your business competitive.Improve your cash flow forecastingThe fixed nature of a lease obligation eliminates uncertainty about thefuture cost of the equipment. Your lease payments facilitate more accurateforecasting and planning.No ownership dilutionLeasing allows you to increase the cash flow of your company withoutbringing in investors to finance capital expenditures. 2012eLeaseCapitalFinance,LLC5

Understanding LeasingTypes of LeasesBuyout / Purchase Options- True Lease or Operating Lease- Finance Lease or Capital Lease- Skip Lease- Sale Leaseback- 60 or 90-Day Deferred Lease- Master Lease- Municipal Lease- Step Up Lease- Fair Market Value (FMV) Purchase Option- Fair Market Value (FMV) Purchase- 10% Option- 10% Put- 1 Buyout- Comparing Purchase OptionsTypes of LeasesWhile leasing companies may use the same name to describe a lease, theterms and conditions written in their contracts often vary. Be certain to reviewyour documents carefully and ask your leasing company or Leasing Companiesto explain anything that is unclear.True Lease or Operating Lease What it is good for: Used with equipment that rapidly depreciates orbecomes obsolete in a short period of time.How it works: In a true or operating lease, the leasing company retainsownership of the equipment during the lease. True or operating leasestypically have no predetermined buyouts; customers usually classifythese payments as an operating expense.Benefits: Lower payments and typically the most tax-friendly form ofleasing, Additionally, true or operating leases offer three choices at theend of your lease:1. return the equipment to the leasing company,2. purchase the equipment at its fair market value or option amount,or3. extend your lease term.Finance Lease or Capital Lease What it is good for: If you plan on owning the equipment at the end of thelease.How it works: The full purchase price plus interest charges are spreadover the length of the lease.Benefits: You will own the equipment at the end of the lease for a minimalamount, such as a fixed percentage of the original cost or 1.00. 2012eLeaseCapitalFinance,LLC6

Skip Lease What it is good for: Organizations that need a flexible repaymentschedule such as seasonal businesses, agricultural companies,recreational services firms, and school systems.How it works: You specify months when no payments are made.Benefits: Flexibility to adjust to irregular cash flow.Sale Leaseback What it is good for: Customers who decide that leasing is more beneficialafter having purchased their equipment. Sale-leaseback also allowscompanies to raise cash for other investments or cash flow purposes.How it works: The business that has already purchased equipment sells itto a leasing company, which, in turn takes ownership of the equipmentand then leases it back to the business. Leasing Companies requires thatthe equipment be purchased within 90 days.Benefits: The sale-leaseback allows you to put money back into yourbusiness or into investments that appreciate rather than depreciate.60 or 90-Day Deferred Lease What it is good for: Businesses that need equipment for operation anddevelopment that will not immediately generate revenue.How it works: A 60 or 90-day deferred lease can be structured asa finance lease or a true lease. There is usually no advance paymentrequired, and the first payment is not due until 60 or 90 days after thelease begins.Benefits: The equipment you need can be acquired with little to no moneyup front and no payments for 2-3 months.Master Lease What it is good for: Leasing additional equipment over a certain period oftime.How it works: Separate lease schedules are created to accommodate theaddition of equipment over that period of time. The master lease governsthe basic terms and conditions. Each schedule may include different endof term options and different lease lengths but all will come under one"e;Master Lease."e;Benefits: Acquiring additional equipment is made more convenient. 2012eLeaseCapitalFinance,LLC7

Municipal Lease What it is good for: Local and state government organizations looking toacquire equipment.How it works: The tax structures and details of municipal leases varyconsiderably from standard business leases. Seek the advice of yourfinancial advisor to better understand your municipal lease options.Benefits: Municipal leases are designed specifically for local and stategovernment organizations.Step Up Lease What it is good for: Businesses whose financed equipment will becomemore profitable over time.How it works: Payments increase according to a regular schedule overthe life of the lease.Benefits: Payments can be differed to match cash flow.Leasing Industry Links Equipment Leasing Association. The Equipment Leasing Association(ELA) is a national organization comprised of member companies withinthe equipment leasing and finance industry.United Association of Equipment Leasing . The mission of the UnitedAssociation of Equipment Leasing (UAEL) is to further the welfare of itsmembers and to provide and promote a forum for interaction andprograms which enhance business opportunityNational Association of Equipment Leasing Brokers . The NationalAssociation of Equipment Leasing Brokers (NAELB) is an organizationformed to promote the interests of equipment leasing brokers througheducation, advocacy, improved communication with funders andprograms designed to upgrade the professionalism and profitability ofbrokers, funders and others engaged in the business of equipment leasefinancing.Equipment Leasing and Finance Foundation . The Equipment Leasingand Finance Foundation, the prime developer and disseminator of thebody of knowledge for the equipment lease financing industry, since1989. A non-profit, tax deductible organization.Equipment Leasing Association's (ELA) LeaseAssistant . An educationalportal for information on equipment financing and leasing.Monitor Daily . Every month the Monitor provides readers with in-depthinformation supplied by trusted sources in the leasing and financialcenters of the United States. 2012eLeaseCapitalFinance,LLC8

Buyout / Purchase OptionsBuyout/Purchase options are determined prior to the inception of the lease.They outline the customer's final financial obligations at the end of thelease. Leasing provides a number of options for purchasing yourequipment, including:Fair Market Value (FMV) Purchase OptionAt the end of term, you usually have the following options:1. Purchase the equipment for its then Fair Market Value,2. Extend the lease for a pre-determined length of time (this will bespecified in your lease contract), or3. Return the equipment at the end of term (please check your leasedocuments to see if this is one of the options). Please note thatsome leasing companies require you to enter into a new leaseagreement of equal or greater value if you choose this option.Fair Market Value (FMV) PurchaseAt the end of term you are obligated to purchase the equipment for its thenFair Market Value.10% OptionAt the end of term, you usually have the following options:1. Purchase the equipment for 10% of its original purchase price,2. Extend the lease for a pre-determined length of time (this will bespecified in your lease contract), or3. Return the equipment at end of term (please check your leasedocuments to see if this is one of the options). Please note thatsome leasing companies require you to enter into a new leaseagreement of equal or greater value if you choose this option.You are often required to give written notice of the option you wish to selectprior to the end of term. Please review your lease agreement to understandthe timing of this written notice10% PutAt the end of the lease term you are obligated to purchase the equipmentfor 10% of its original purchase price. 2012eLeaseCapitalFinance,LLC9

1 BuyoutThe customer purchases the equipment for 1 at the end of a capitallease and title to the equipment is transferred from the leasing company tothe customer.Comparing Purchase ValueEnd of term option isopen ended.Lower monthlypayments.Maximized taxbenefit.Great for rapidlydepreciatingequipment.Fair Market Valuecan be ambiguousand result in adisagreeably highvaluation.Fair Market Value allows you and yourleasing company to negotiate what thevalue of the equipment is at the end ofthe lease. There are normally 3options at the end of the term: buy theequipment for a mutually agreeableprice, continue leasing it, or return it.You should ask your leasing companywhat they normally expect to receive atthe of the lease term and if they cancap the amount.10%PurchaseOption /PutEnd of lease paymentis predetermined ateither a fixedpercentage of theequipment cost or aspecified dollaramount.You must pay theFixed Put. It isconsidered anadditionalpayment.The Fixed Put is beneficial if you wouldlike a lower monthly payment and arenot concerned about making anadditional payment at the end of lease. 1 Buyout End of lease payment Higher monthlyis 1.00.payments.Minimized taxbenefit.You can own the equipment for 1.00at the end of the lease.Please make sure to read your lease contract. Definitions may vary depending on the leasingcompany you choose. 2012eLeaseCapitalFinance,LLC10

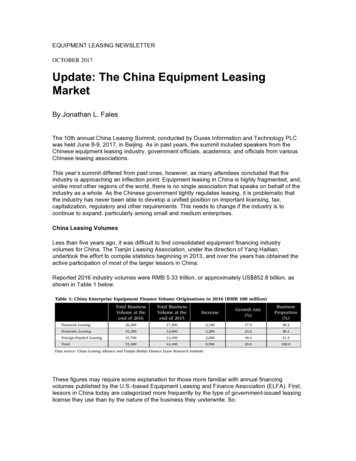

Comparing Financing StrategiesLeasing Companies vs. Borrowing, Credit, and CashLeasing CompaniesBorrowingCreditCashInterest RatesFixed rateCan fluctuatewith the marketFixed or floatingNoneSpeed ofApprovalWithin two businessdays after a bid hasbeen selected formost amountsDays to weeksDays to weeksInstantDown Payment Typically, only 1 or 2payments upfrontwhich are applied toyour balanceTypically, 1020% of the totalamountTypically, 1020% of the sary fortransactions under 150,000Generallyneededregardless ofamountrequestedGenerallyneededregardless ofamountrequestedNoneTax BenefitsOperating leasepayments can be100% tax deductiblewhen shown as anoperating expense.Depreciation canbe taken overthe useful life ofthe equipment.Depreciation canbe taken overthe useful life ofthe equipment.Depreciation canbe taken overthe useful life ofthe equipment.You own theequipment.You own theequipment.You own theequipment.EquipmentUsed as a hedgeObsolescence againstobsolescence. Whyown when you canlease? 2012eLeaseCapitalFinance,LLC11

! 2012!eLeaseCapital!Finance,!LLC! ! !!!6! Understanding Leasing Types of Leases - True Lease or Operating Lease -Finance Lease or Capital Lease -Skip Lease - Sale Leaseback -60 or 90-Day Deferred Lease -Master Lease -Municipal Lease -Step Up Lease Buyout / Purchase Options -Fair Market Value (FMV) Purchase Option -Fair Market Value (FMV) Purchase -10% Option