Transcription

GOLDMAN SACHS EUROPEAN FINANCIALSCONFERENCEMadrid12 June 2014George Culmer, Chief Financial OfficerAlison Brittain, Group Director, Retail

AGENDAOUR BUSINESS MODELQ1 2014 PERFORMANCERETAIL BANKING UPDATESUMMARY1

STRATEGYBest bank for customersBANK OF SCOTLANDLLOYDS BANKSIMPLE, LOW RISK, UK FOCUSED RETAILAND COMMERCIAL BANKICONIC AND DISTINCTIVE BRANDSHALIFAXMULTI CHANNEL DISTRIBUTIONSCOTTISH WIDOWSEFFICIENT SYSTEMS AND PROCESSESHIGH QUALITY, COMMITTED COLLEAGUESHELPING BRITAIN PROSPER THROUGH OUR UNIQUE COMPETITIVE POSITION2

STRATEGYBest bank for shareholders2011 STRATEGIC OBJECTIVESEFFICIENT, LOW RISK BUSINESSMODELOBJECTIVESLEADING COST POSITIONRESHAPESTRENGTHENour business portfolioour balance sheet andto fit our assets,liquidity positioncapabilities and riskappetiteLOWER RISK APPETITESIMPLIFYINVESTthe Group to improveto grow our coreagility, service andcustomer businessesefficiencyLOWER FINANCIAL LEVERAGEUNIQUE COMPETITIVE POSITIONLOWER COST OF EQUITYLOWER COST OF DEBTCONFIDENT OF DELIVERING STRONG AND SUSTAINABLE ECONOMIC RETURNS3

STRATEGYAccelerated delivery of strategic objectivesASSETREDUCTIONINTERNATIONALPRESENCECOST SAVINGS Over 200bn of non-core asset reduction to end 2013 Achieved EU commitment target 2 years ahead of plan International presence significantly reduced Exited or announced exit from 21 countries, target of 10 or fewer in 2014already achieved Strategic Review cost target of 10bn delivered 2 years ahead of plan 2014 FY costs of 9bn TSB Wholesale funding requirement reduced by more than 150bn since H1FUNDING2011 Loan to deposit ratio now 111% from 135% at the end of 2011CAPITALRATIOS Significant increase to capital ratios, ahead of market expectations Pro forma fully loaded common equity tier 1 ratio 10.7% Q1 20144

STRATEGYA strong improvement to underlying and statutory profitUNDERLYING PROFITSTATUTORY PROFIT BEFORE TAX 6.2bn 1.4bn 0.4bn (0.6)bn 2.6bn 1.8bn 0.2bn2011 (3.8)bn 1.5bn 0.4bn 0.5bn2012Profit in Q12013Q1 2014201120122013Q1 2014Profit for full year5

AGENDAOUR BUSINESS MODELQ1 2014 PERFORMANCERETAIL BANKING UPDATESUMMARY6

HIGHLIGHTS FOR THE FIRST THREE MONTHS OF 2014 Continue to successfully execute on our strategy Underlying profit increased 22% to 1.8bn and statutory PBT of 1.4bn Lending and deposit growth in our key customer segments Customers at the heart of our business; launched Helping Britain Prosper plan Simplification driving further reduction in our market-leading cost:income ratio Capital position further strengthened and AT1 requirement now satisfied UK Government stake now reduced to 24.9% Supporting and benefiting from the UK economic recovery7

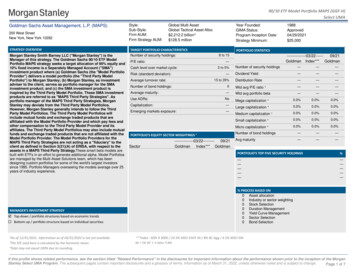

FINANCIAL PERFORMANCEProfit and returns substantially improved and balance sheetstrengthenedUNDERLYINGPROFIT 1.8bn22%RETURN ONRWAs2.71%75bp Group underlying profit increased to 1.8bn– Net interest margin up 36bp to 2.32%– Simplification delivering further efficiencies; costs down 5%– Substantial 57% reduction in impairment charge Statutory profit before tax of 1.4bn Strong loan growth in key customer segmentsFL CET1RATIO(1)10.7%0.4pp Run-off portfolio reduced by 3.6bn to 29.7bn Deposits increased 5.3bn; loan to deposit ratio improvedto 111%FL LEVERAGERATIO(2)4.5%0.7pp Fully loaded CET1 and leverage positions improved fromunderlying profit and management actions(1)Pro forma.(2)Pro forma Basel III leverage ratio estimated in accordance with Jan 2014 revised Basel III leverage ratio framework.8

SUPPORTING OUR CUSTOMERS AND THE UK ECONOMYContinued loan growth in key customer segmentsNET LENDING BALANCES (%) Stronger UK economic growth– Improving housing market– Unemployment falling– Strengthening consumer and business confidence– Disposable income growingMortgages(1)SME Mortgages(1) continue to grow, in line withstronger market– Gross mortgage lending 9.8bn– Lent 2.6bn to more than 20,000 first-time buyersYoYQoQ2% 0.3%5%Mid Markets1%Global Corporates &other Commercial Continued strong performance in SME lending– SME lending up 5%– Supported c.29,000 start-ups in Q1 1.5%(0.3)%8%Consumer Finance(3)9%(5.5)% 4.4% Mid Markets is gaining share in a contractingmarket(2)Other(4)(7)%(1.4)% Global Corporates impacted by loan repaymentsin first quarterTotal Groupexcl run-off Substantial growth in UK Asset Finance1%(0.4)%LOAN GROWTH SUPPORTING UK ECONOMIC RECOVERYExcludes specialist book and Intelligent Finance. (2) BoE Market Data – turnover 25m.Intelligent Finance, Dutch mortgages and other Retail lending.(1)(3)UK Consumer Finance growth.(4)Other includes specialist book,9

GOOD DEPOSIT GROWTHRelationship strategy continues to deliverDEPOSIT GROWTH (YoY) Deposit growth reflects strength of ourcustomer franchise 7.1bn Retail relationship brands driving depositgrowth in a low base rate environment 8.9bn12% 15.4bn4%4% Growth in high quality Transaction Bankingdeposits(13)% Tactical brands de-emphasised, down 13% inRetail onBankingRetailtacticalbrandsGroup Greater flexibility in deposit gatheringbenefiting Group cost of fundsDELIVERING THROUGH MULTI-BRAND STRATEGY10

FINANCIAL PERFORMANCEMaintaining the reducing cost trendTOTAL COSTS TREND ( bn) 5% cost reduction(13)%11.110.8 Simplification run-rate savings of10.19.6c.9.0 (E)(1) 1.6bn; continue to target exitrun-rate of 2bn by end 2014 Continue to expect 2014 costs ofaround 9bn (excluding TSB costs)20102011201220132014 Impairment charge down 57% withIMPAIRMENT ( m)0.80%reductions in all divisions Impairment driven by prudent credit(57)%1,002(17)%risk appetite, provision releases andreductions in run-off 3ImpairmentTotal costs 2010 – 2012 restated for impacts of IAS 19R.Q42013AQR(1)Excluding TSB costs.4310.35%Q12014 Impaired loans as a percentage oftotal advances of 5.7% (Dec 2013:6.3%) Coverage ratio of 51.1% (Dec 2013:50.1%)11

FURTHER STRENGTHENING THE BALANCE SHEETCommon equity tier 1 and leverage positions furtherstrengthenedFULLY LOADED COMMON EQUITY TIER 1 RATIO9.6%7.1%7.7%10.7%10.3%8.1% Stronger capital positionprincipally driven by underlyingprofit– 400m insurance dividend paidto Group in Q1H22011H12012H22012H12013H22013(1)Q12014(1)– Pro forma ECN exchange effectpartly offset by benefit ofpension scheme changeFULLY LOADED LEVERAGE RATIO4.1%3.1%3.5% Estimated pro forma fullyloaded CET1 ratio improved to10.7%3.4%4.5%3.8% Pro forma leverage ratioH22012H12013Basel lllH22013(1) (2)CRD lVQ12014substantially improved throughAT1 issuance(1)A STRONGLY CAPITAL GENERATIVE BUSINESS(1)Pro forma.(2)Estimated in accordance with January 2014 revised Basel III leverage ratio framework.12

AGENDAOUR BUSINESS MODELQ1 2014 PERFORMANCERETAIL BANKING UPDATESUMMARY13

OUR RETAIL STRATEGYAligned with our Group Strategy to be the Best Bank for CustomersHelping Britain ProsperPURPOSEVISIONVALUESTo be the Best Bank for CustomersPutting customers firstKeeping it simpleMaking a differencetogetherPeople with a Passion to Serve CustomersIconic Brands appealing to a wide range of CustomersCAPABILITIESSimple & Transparent Products & Services driven by Customer NeedSeamless Multi-channel Customer ExperiencePrudent Risk Appetite14

OUR MULTI-BRAND STRATEGYProviding a comprehensive range of choices for ourcustomersEstablished LeaderEstablished Leader inScotlandNo. 1 ChallengerLocal ChampionThe bank that goesfurther to better serve itscustomersThe bank that goesfurther to better serveScotlandThe bank that gives youextra when it matters themostA high street bank thatcreates value for localpeople and usiasticBalancedSimpleLocal15

STRENGTHENING OUR BALANCE SHEET AND FRANCHISECURRENT ACCOUNT SWITCHERSCUSTOMER LENDINGTotal External Switchers (2013)2.8315,953(1.9)(2.9)(2.9)H2 2012H1 2013H2 2013Switchers In-171,713GROSS NEW MORTGAGE LENDINGNet growth of144,240 CurrentAccount Switchersin 2013Switchers OutRETAIL DEPOSITS2012201360%10%8%5%10%8%6%4%4%3%2%2%22.3UK LBG(3)Market(1)13.9H2 2012H2 2013LTSBHXBOSRelationshipbrands 5.0%OtherUK LBG(3) LTSBLBG(2) Market(1)HXOtherLBG(2)BOSRelationshipbrands 6.4%(11)%16

MULTI-CHANNEL CAPABILITYServicing our customers how and when they wantCOMMUNITY BANKSINTERNET BANKINGTELEPHONE BANKINGMOBILE BANKING17

INTERNET AND MOBILE BANKING GROWTHMOBILE USER GROWTH (ACTIVE USERS (m))DIGITAL GROWTH (ACTIVE USERS 12Lloyds TSB(1)Excluding TSB.H22012HalifaxH12013BOSH2201320082009Lloyds TSB20102011Lloyds Bank20122013BOS and Halifax18

MULTI-SEGMENT CAPABILITYRecognising the different needs of our customer segmentsMASS AFFLUENTBUSINESS BANKINGWEALTH19

INTEGRATION OF WEALTH & RETAIL BUSINESS BANKINGImproved propositions and leveraging Retail infrastructure for alower cost modelDevelopment to propositionsRBBBranchTelephone Increase Local Business Managers from 27 to 217 FTELeverage Bank Managers to build customer relationshipsMulti-brand, multi-skilled colleaguesCall Routing and case managementLoans and overdrafts online No card reader to access Mobile Banking App Online and MobileWealthRM manages portfolio Licensed for all products Branch based Target Operating ModelUK Wealth Location StrategyPrivate Banking Service CentreWealth colleagues based in premises with Group partners Top 100 branches will have in house adviser Leverage existing Group infrastructure Improving client experience 20

FINANCIAL PERFORMANCEFurther improvement in impairmentIMPAIRMENT ( m)(44)%1,970 Impairment charge down 44% since(13)%20111,2700.55%1,101 Year on year impairment chargedecreased by 13%0.36%0.32% Impairment reduction driven by2011Impairmentstable unsecured book anddecreasing secured charges largelydue to lower impaired loan balances20132012AQRGROSS IMPAIRED LOANS ( m)2.5%2.4%8,8226 Secured impaired loans have fallenfor 4 consecutive years Impaired loans as a percentage of8,3202,3706,4522.1%% ofbook1,9997,1871,5466,3215,64120122013total advances of 2.1% (Dec 2012:2.4%; Dec 2011: 2.5% ) Secured Coverage ratio of 26.1%(Dec 2012: 25.6%; Dec 2011: 25.6%)2011SecuredUnsecured21

BEST BANK FOR CUSTOMERSInvestment has delivered improved customer satisfaction and lowercomplaintsFCA BANKING COMPLAINTSPER 1,000 ACCOUNTS (excluding PPI)7065Lloyds ow at1.0 perNationwide 1,00010CUSTOMER SATISFACTIONNET PROMOTER 2H113H213ORIGINAL 2014 TARGET OF 1.0 COMPLAINT PER 1,000 ACCOUNTS ACHIEVED22

CORE RETAIL FINANCIAL PERFORMANCEFurther increase in core Retail profit and returns in 2013CORE RETAIL PROFIT ( m)17%3,7743,224 Underlying profit improvementdriven by 5% growth in NII and11% reduction in impairment20122013 NII growth driven by 15bpsCORE RETURN ON RISK WEIGHTED ASSETS95bp4.55%margin expansion and return togrowth in core loans andadvances3.60% Asset quality further improvedin both secured and unsecured2012201323

RETAIL SUMMARYAligned with Group strategy, strong position with our distinctiveassets and capabilitiesStrongCustomerRelationships Over 30 million customersMulti-brandstrategy Iconic retail brands on the high street in the UKBroadMulti-channelDistribution Over 10.5m Retail Online Users across LloydsBanking Group (including TSB) and over 4mmobile usersCustomerFocusedPeople Customer service scores increasing across allbrandsIntegrated &SimplifiedPlatform Integrated platforms to deliver savings andsimplify customer processes24

AGENDAOUR BUSINESS MODELQ1 2014 PERFORMANCERETAIL BANKING UPDATESUMMARY25

LOOKING AHEADGuidance for 2014 Loan growth in all key customer segments Full year 2014 net interest margin now expected to increase to around 2.40%(1) Other income will remain challenging Further benefits from Simplification; guidance for full year costs of 9bn excludingTSB unchanged Continued risk reduction; full year AQR now expected to reduce to around 45bp Run-off portfolio to reduce to around 23bn by end of year Expect to launch TSB IPO in summer, subject to regulatory approval and marketconditionsWELL POSITIONED FOR FURTHER PROGRESS IN 2014(1)Excluding the effect of TSB disposal.26

HIGHLIGHTS FOR THE FIRST THREE MONTHS OF 2014 Continue to successfully execute on our strategy Underlying profit increased 22% to 1.8bn and statutory PBT of 1.4bn Lending and deposit growth in our key customer segments Customers at the heart of our business; launched Helping Britain Prosper plan Simplification driving further reduction in our market-leading cost:income ratio Capital position further strengthened and AT1 requirement now satisfied UK Government stake now reduced to 24.9% Supporting and benefiting from the UK economic recovery27

FORWARD LOOKING STATEMENTS ANDBASIS OF PRESENTATIONFORWARD LOOKING STATEMENTSThis announcement contains forward looking statements with respect to the business, strategy and plans of the Lloyds Banking Group and itscurrent goals and expectations relating to its future financial condition and performance. Statements that are not historical facts, includingstatements about the Group or the Group’s management’s beliefs and expectations, are forward looking statements. By their nature, forwardlooking statements involve risk and uncertainty because they relate to future events and circumstances that will or may occur. The Group’sactual future business, strategy, plans and/or results may differ materially from those expressed or implied in these forward looking statementsas a result of a variety of factors, including, but not limited to, UK domestic and global economic and business conditions; the ability to derivecost savings and other benefits, including as a result of the Group’s Simplification programme; the ability to access sufficient funding to meetthe Group’s liquidity needs; changes to the Group’s credit ratings; risks concerning borrower or counterparty credit quality; instability in theglobal financial markets, including Eurozone instability and the impact of any sovereign credit rating downgrade or other sovereign financialissues; market-related risks including changes in interest rates and exchange rates; changing demographic and market-related trends;changes in customer preferences; changes to laws, regulation, accounting standards or taxation, including as a possible result of thereferendum on Scottish independence and also including changes to regulatory capital or liquidity requirements; the policies and actions ofgovernmental or regulatory authorities in the UK and other jurisdictions in which the Group operates; the implementation of the Bank Recoveryand Resolution Directive and Banking Reform Act; the ability to attract and retain senior management and other employees; requirements orlimitations imposed on the Group as a result of HM Treasury’s investment in the Group; the ability to satisfactorily dispose of certain assets orotherwise meet the Group’s EC State aid obligations; the extent of any future impairment charges or write-downs caused by depressed assetvaluations, market disruptions and illiquid markets; the effects of competition and the actions of competitors, including non-bank financialservices and lending companies; exposure to regulatory scrutiny, legal proceedings, regulatory and competition investigations or complaints,and other factors. Please refer to the latest Annual Report on Form 20-F filed with the US Securities and Exchange Commission for adiscussion of certain factors together with examples of forward looking statements. The forward looking statements contained in thisannouncement are made as at the date of this announcement, and the Group undertakes no obligation to update any of its forward lookingstatements.BASIS OF PRESENTATIONThe results of the Group and its business are presented in this presentation on a underlying basis. Please refer to the Basis of Presentation inthe Q1 2014 Interim Management Statement which sets out the principles adopted in the preparation of the underlying basis of reporting.

(1) Pro forma. (2) Pro forma Basel III leverage ratio estimated in accordance with Jan 2014 revised Basel III leverage ratio framework. Group underlying profit increased to 1.8bn -Net interest margin up 36bp to 2.32% -Simplification delivering further efficiencies; costs down 5% -Substantial 57% reduction in impairment charge