Transcription

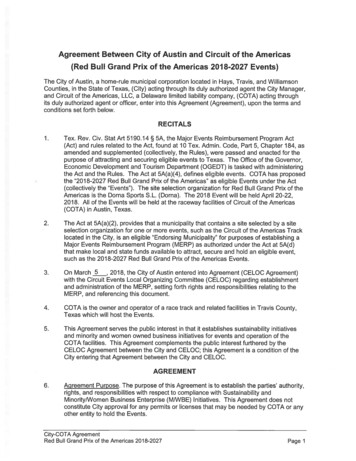

February 23, 2011Americas: Medical Technology: Life ScienceTools & DiagnosticsEquity ResearchExpanding coverage to include DiagnosticsExpanding coverage to include DiagnosticsWe are initiating coverage of Diagnostics companies ALR, CPHD, GPRO,HOLX, MYGN and QGEN within our existing universe of Life Science Toolsand Diagnostics (Neutral coverage view). The group benefits from strongdemand drivers and healthy innovation. However, operating costs arerising and the regulatory environment is mixed. Against this context, wefavor high growth product cycle stories with acquisition potential (CPHD,Buy) or expanding franchises with valuation support (HOLX, Buy) whileavoiding names with single product risk (MYGN, Sell) and increasingcompetitive pressures (QGEN, Sell).M&A and innovation should support premium multiplesAfter several years of consolidation, just 25% of the industry’s revenues aredriven by independent publicly traded companies as M&A in Diagnosticshas occurred via a wide range of constituents across pharma, industrialsand lab companies. As new molecular platforms and content aredeveloped, we expect M&A activity will remain an active theme. Longterm, we are optimistic about the opportunity for Companion Diagnosticsand emerging markets although we do not see these themes as near-termdrivers of share outperformance.Life Science Tools & Diagnostics coverage ic Research SuppliesSIALNeutralTMONeutral 63.83 57.68 71 6011%4%Analytical InstrumentsBRKRNeutralPKINeutralWATBuy 18.92 26.98 83.38 18 27 93(5%)0%12%GenomicsAFFXILMNLIFESellBuyNeutral 5.21 72.27 54.41 4.50 81 60(14%)12%10%Test & MeasurementANeutralMTDNeutral 43.92 169.28 45 1692%(0%)Traditional DiagnosticsALRNeutralHOLXBuy 37.99 20.61 41 258%21%Molecular DiagnosticsCPHDBuyGPRONeutralMYGNSellQGENSell 25.39 63.23 19.07 20.42 30 72 17 1818%14%(11%)(12%)CompanyRatingLife Science Tools price targets are 12-month (SIAL, TMO,BRKR, PKI, WAT, ILMN, LIFE, A, MTD) except AFFX which is6-monthDiagnostics price targets are 6-month(ALR, HOLX, CPHD, GPRO, MYGN, QGEN).Source: Goldman Sachs Research estimatesTop Buys: CPHD ( 30 PT, 18% upside), HOLX ( 25 PT, 21% upside)CPHD is well positioned to deliver upside to current Street estimates asrecent product launches ramp. We see continued R&D productivity andview CPHD as an attractive potential acquisition candidate. For HOLX, wesee the beginnings of a renewed product cycle in tomosynthesis coupledwith attractive free cash flow to support valuation upside.RELATED RESEARCHAmericas: Medical Technology: Life Science Tools &Diagnostics: Pay for product cycles as domestic growthslows; Neutral viewPerkinElmer, Inc. (PKI): Awaiting margin and cash usevisibility; initiate with Neutral ratingTop Sells: MYGN ( 17 PT, 11% downside), QGEN ( 18 PT, 12%downside)We believe MYGN’s mature BRCAnalysis franchise faces deceleratinggrowth and see long-term risk to the company’s pricing structure. Our Sellrating on QGEN is based on our view that the company’s HPV franchisefaces competitive pressure and that the emerging franchise in CompanionDiagnostics will be a multi-year build out process.We also initiate coverage of ALR ( 41 PT, 8% upside) and GPRO( 72 PT, 14% upside) with Neutral ratingsIsaac Ro(212) 902-6393 isaac.ro@gs.com Goldman Sachs & Co.Jeff Ares(212) 902-5166 jeff.ares@gs.com Goldman Sachs & Co.Anesu Nyamuda(917) 343-0571 anesu.nyamuda@gs.com Goldman Sachs & Co.The Goldman Sachs Group, Inc.The Goldman Sachs Group, Inc. does and seeks to do business withcompanies covered in its research reports. As a result, investors shouldbe aware that the firm may have a conflict of interest that could affectthe objectivity of this report. Investors should consider this report asonly a single factor in making their investment decision. For Reg ACcertification, see the end of the text. Other important disclosures followthe Reg AC certification, or go to www.gs.com/research/hedge.html.Analysts employed by non-US affiliates are not registered/qualified asresearch analysts with FINRA in the U.S.Global Investment Research

February 23, 2011Americas: Medical Technology: Life Science Tools & DiagnosticsContentsPortfolio Manager Summary: Focus on product cycles3Key recommendations: Buy CPHD and HOLX, Sell MYGN and QGEN3How to make money in Diagnostics4Key issues and how we are different6Key tailwinds6Key headwinds8What is Diagnostics?10Background10Our stock picking framework emphasizes product cycles and M&A12Product cycles create opportunities for divergence13Strategic appeal a key factor16Higher valuation justified by strong organic growth19Capital allocation21End market exposure21Key tailwinds23Favorable demographics23Diagnostics as a cost containment tool25The conversion to molecular drives multiple benefits26Companion Diagnostics a long-term opportunity33Key headwinds36Increasing competition from adjacent Healthcare sectors36Regulatory environment is a mixed bag39Personalized medicine and the education gap44Cepheid (CPHD; Buy)49Hologic (HOLX; Buy)53Myriad Genetics (MYGN; Sell)57Qiagen N.V. (QGEN; Sell)62Alere, Inc. (ALR; Neutral)67Gen-Probe, Inc. (GPRO; Neutral)71Appendix75Big pharma a major force in diagnostics75Life Science Tools companies are expanding into diagnostics79Lab companies are expanding into genetic testing81Emerging markets are promising but still undeveloped85Prices in this report are as of the close on February 18, 2011.Goldman Sachs Global Investment Research2

February 23, 2011Americas: Medical Technology: Life Science Tools & DiagnosticsPortfolio Manager Summary: Focus on product cyclesWe are expanding our universe of coverage to include the following Diagnosticscompanies: ALR, CPHD, GPRO, HOLX, MYGN and QGEN.In Diagnostics, we prefer names that offer product cycles and acquisitionpotential against an uncertain backdrop for patient volumes and regulatoryreform. Today, diagnostic testing drives 80% of healthcare decision making but accountsfor just 2% of healthcare spending. Over the next few years, we believe Diagnosticscompanies can achieve a larger percentage of the aggregate healthcare spend as futuretests offer increased clinical utility and appeal to a more cost-conscious healthcare system.However, our near-term outlook on the group is tempered by depressed test volumes,hospital spending constraints, and pending regulatory reform. For these reasons, wemaintain a Neutral coverage view for our expanded universe of Life Science Tools andDiagnostics companies. We prefer names whose franchises offer new product cyclescoupled with strategic value to potential acquirers and steer away from single productstories and names with increased competition/pricing pressure.Key recommendations: Buy CPHD and HOLX, Sell MYGN and QGENBuy Cepheid (CPHD) 6-month price target of 30, 18% upsideCPHD is well positioned to deliver revenue/EPS upside due to expanding use of itsmolecular diagnostic system known as GeneXpert. The company’s portfolio of high marginmolecular tests target attractive growth areas such as hospital acquired infections (HAI’s)and infectious disease. We also see continued R&D productivity that should drive upside toout-year estimates. Lastly, we view CPHD as an attractive acquisition target given itsposition as a pure play molecular diagnostic company with a unique technology,expanding menu and growing installed base.Buy Hologic (HOLX) 6-month price target of 25, 21% upsideHOLX has the No. 1 share in digital mammography and cervical cancer testing. Thecompany has a nascent product cycle in next-generation mammography (tomosynthesis)that is buttressed by the highest free cash flow yield in the group. We would view astabilizing test volume environment as a positive although we continue to model zero longterm growth in the ThinPrep franchise and view increased traction for Cervista HPV as afree call option in the stock. Although capital allocation has been mixed in recent years, wenote that recent acquisitions have been smaller and more logical fits.Sell Myriad Genetics (MYGN) 6-month price target of 17, 11% downsideMYGN’s BRCAnalysis franchise for assessing breast cancer risk drives 88% of total sales.We see slowing growth that will require increased sales and marketing, patent uncertainty,a limited portfolio of new products, and long-term pricing risk as DNA sequencingtechnology advances. We could take a more constructive view if we see stronger-thanexpected test volumes, better-than-expected pricing power, and development ofcompelling new tests.Sell Qiagen (QGEN) 6-month price target of 18, 12% downsideQGEN is a hybrid Diagnostics/Life Science Tools company that faces near-term pressure inits core growth driver (HPV testing) and is unlikely to see material upside in its core sampleprep franchise, in our view. We could take a more constructive view upon evidence ofbetter-than-expected pricing power, market share retention in HPV, and faster-thanexpected traction in the Companion Diagnostics franchise.Goldman Sachs Global Investment Research3

February 23, 2011Americas: Medical Technology: Life Science Tools & DiagnosticsHow to make money in DiagnosticsGiven the secular drivers of demand and innovation that we outline later in this report, wepoint investors to five guidelines to consider when seeking alpha in the Diagnostics group:(1) Pay for growth: Diagnostics stocks are driven by revenue growthInvestors should seek out names in Diagnostics that have the most potential for upwardrevisions to revenue growth. Given favorable demographic trends, continuous technologyadvances and a fertile landscape in the overall healthcare system, we see aggregate marketgrowth of 5-6% in Diagnostics. As a result, we believe investors should focus on namesachieving double digit revenue growth. This revenue growth is primarily achieved via theintroduction of new instrumentation platforms and subsequent expansion of test menus. Asecondary consideration should be EPS growth, as mix typically shifts to higher marginconsumables and companies benefit from better operating leverage. Most exposednames: CPHD (Buy), GPRO (Neutral), and HOLX (Buy).(2) Pay for M&A: Valuation analysis should incorporate M&A potentialSince 2006, therehave been over 60announcedacquisitions inDiagnostics for anaggregate 51bnGiven the disruptive nature of many novel diagnostic technologies, we see ample interestfrom a wide range of parties in the healthcare system. Since 2006, there have been over 60announced acquisitions in Diagnostics for an aggregate consideration of 51bn. Over thelast twelve months, we have observed consistent M&A activity in diagnostics across a widerange of industries that include Pharma, Labs, Industrials and Life Science Tools.Additionally, we see a steady pace of acquisitions and partnerships with novel privatediagnostics companies. We favor stocks that have M&A potential and whose technologyand footprint we consider attractive assets for a company looking to increase its exposureto diagnostics. Most exposed names: CPHD (Buy) and GPRO (Neutral).(3) Avoid mature, decelerating growth and single-product riskWe see a wide range of growth opportunities in Diagnostics given innovations in newtechnologies and ongoing discovery of new content. As a result, we think investors shouldavoid names with decelerating top-line growth even in the face of compelling valuation ona relative or historical basis. We would also avoid single-product stories given the dynamicenvironment around high-growth market segments such as infectious disease and cancer,where innovation is rampant and high-priced tests can quickly see competition that stallstop-line growth or leads to market share losses. Most exposed names: QGEN (Sell) andMYGN (Sell).(4) Dx correlation has transitioned from smid-cap MedTech to Life Science ToolsWith similar exposure to aggregate patient volumes, regulatory trends, and benefits fromnew product cycles, the Diagnostics group has had high correlation to small/mid-capMedTech companies. Below we chart 10yr group performance for our Diagnosticscoverage group vs. smid-cap MedTech and Life Science Tools. From 2002-2007, ourDiagnostics coverage group was almost perfectly correlated with the performance of oursmid-cap MedTech index (r-sq 96%).However, the Diagnostics group has begun to trade more closely with Tools over the lastfew years (r-sq 44%), which we attribute to heavy M&A activity and increasing crossoveruse of Life Science Tools platforms in clinical diagnostic settings (i.e. DNA sequencing, PCR,mass spec). Additionally, the Diagnostics group has generally been immune to thereimbursement and utilization pressures being placed on conventional therapeutic devicecategories.As a result, while we think investors should remain vigilant of patient volume and hospitalspending-related trends that drive small/midcap med tech stocks, given the decliningcorrelation in stock performance, we believe stock selection in Diagnostics should bedriven by factors that drive the Life Science Tools sector. Among these factors are newGoldman Sachs Global Investment Research4

February 23, 2011Americas: Medical Technology: Life Science Tools & Diagnosticsproduct cycles, technology innovation around genomics and novel instrumentationplatforms.Exhibit 1: Dx was correlated with Smidcap MedTech Exhibit 2: but has become more correlated with Tools2525100Dx20Smidcap MedTech1510Market Cap ( bn)Dx9080701560501040Market Cap ( bn)Market Cap ( bn)20LST305520100Jan‐00 Jan‐01 Jan‐02 Jan‐03 Jan‐04 Jan‐05 Jan‐06 Jan‐07 Jan‐08 Jan‐09 Jan‐10 Jan‐11Source: Goldman Sachs Research, FactSetGoldman Sachs Global Investment Research00Jan‐00 Jan‐01 Jan‐02 Jan‐03 Jan‐04 Jan‐05 Jan‐06 Jan‐07 Jan‐08 Jan‐09 Jan‐10 Jan‐11Source: Goldman Sachs Research, FactSet5

February 23, 2011Americas: Medical Technology: Life Science Tools & DiagnosticsKey issues and how we are differentThe Diagnostics market has historically been viewed as a sector within healthcare that hadma

Source: Goldman Sachs Research estimates RELATED RESEARCH Americas: Medical Technology: Life Science Tools & Diagnostics: Pay for product cycles as domestic growth slows; Neutral view PerkinElmer, Inc. (PKI): Awaiting margin and cash use visibility; initiate with Neutral rating Isaac Ro (212) 902-6393 isaac.ro@gs.com Goldman Sachs & Co. The Goldman Sachs Group, Inc. does and