Transcription

11/5/2013GOVERNING PROVISIONSCOMPLIANCECERTIFICATESection 383A(1) of Companies Act 1956Companies (Compliance Certificate) Rules2001Guidelines issued by ICSIProviso to Section 383A(1) of Companies Act1956Companies (Compliance Certificate )Rules 2001¾ Introduced by Companies (Amendment ) Act 2000 whichcame into force w.e.f December 13, 2000¾ Company not required to employ a whole‐time secretaryand having a paidup share capital of Ten Lacs rupees orpaid‐upmore shall file with the Registrar a certificate from a secretary inwhole‐time practice attach a copy of such certificate with Board’s report The Companies (Compliance Certificate ) Rules 2001came into force w.e.f 1St Feb 2001 The Compliance Certificate to be filed to ROC within 30days from date on which AGM is held. Where AGM is notheld then within 30 days from day on which AGM shouldhave been held Compliance Certificate to be laid in its Annual GeneralMeeting1

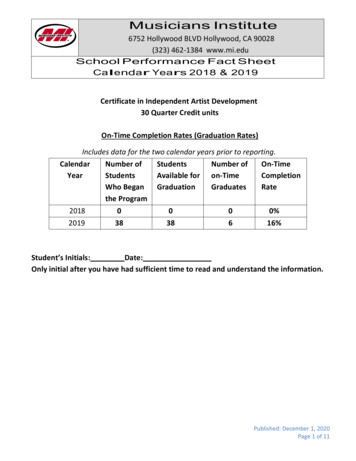

11/5/2013GUIDELINES FOR ISSUINGCOMPLIANCE CERTIFICATEATTESTATION SERVICES MEAN Effective from 1st January 2008 Ceiling on issuing Compliance Certificate and annualreturn - 80 Companies in aggregate in a calendar year.yearIn case of partnership firm ceiling apply to each partner. Every Practicing Company Secretary (PCS)/Firm of PCSshall maintain a register regarding attestation servicesprovided by him/her/it, which shall be open for inspectionby such person as may be authorisedFORM AND CONTENTSy CC should be in form appended to rulesy It should be addressed to the members of theCompanyy 33 pointsprescribediib dy Qualification should be stated with reasonableprominencey Flexibility have been given to PCS to make necessarymodificationsy CC shall relate period pertaining to the financial yearof the CompanySigning ofAnnualReturnIssue ofComplianceCertificateIssue ofcertificate ofSecuritiesTransfers inCompliancewith theListingAgreementCertificate ofreconciliationof capital,updation ofregister ofmembers etcPENALTY FOR FALSE STATEMENTS(SECTION 628 AND SECTION 448)If in any return, report, certificate, balance sheet, prospectus,statement or other document required by or for the purposes ofany of the provisions of this Act, any person makes a statement‐(a) which is false in any material particular, knowing it to be false;or(b) which omits any material fact knowing it to be material;he shall be punish‐ able with imprisonment for a termwhich may extend to two years, and shall also be liable tofineSection 448 of Companies Act, 2013 –Imprisonment – Minimum three years which may extend toseven years ANDupto Rs. 10 lacsFine ‐2

11/5/2013AN INTRODUCTIONSECRETARIALAUDITVoluntary Secretarial Audity Earlier MCA has released Corporate GovernanceVoluntary Guidelines 2009 on December 21, 2009,according to which voluntary secretarial audit wasintroduced to ensure the effective compliance systemis in place.yy Secretarial Audit is a health check up process of anorganizationy Multiplicity of laws, rules, regulations, etc. has necessitatedintroduction of a compliance management system toensure compliances of laws applicable to a companyy It is a compliance audit. it is a part of total compliancemanagement in an organization. The Secretarial Audit is aneffective tool for corporate compliance management.y It helps ensure timely corrective measures when non‐compliance is detected.Section 204 of Companies Act 2013Applicability Every Listed Company Company belonging to other class of companies asmay be prescribed shall annex with its Board’s report a secretarial auditreport given by a Company Secretary in Practice Board to respond to qualifications, madeby the Secretary, in the Board’s report.3

11/5/2013y As per Rule 13.7. of draft Rules : Every public companyhaving a paid‐up share capital of one hundred crorerupees or more shall require the Secretarial AuditReporty A practicing company secretary being SecretarialAuditor has all the same powers to verify the booksand statutory records as any Financial Auditors dohave.havey Format of the Secretarial Audit Report shall be inForm No. .13.3y Section 143 (14) of the Companies Act 2013 hasspecifically empowered Secretarial Auditors todemand and scrutinize the documents and company isobliged to assist the Secretarial Auditors.CONTENTS OF SA REPORTy Secretarial Auditor’s comments and observations oncompliance or non‐compliance during the defined auditperiody Significant litigation(s) within the Scope of Audity Board Processes followed by the Companyy A statement on the existence of adequate internal controlsystems, procedures and safeguards for ensuringcompliance withlaws applicable to the company,commensurate with the size of the company and the natureof its business.y Such other matters that may be required to beaudited/ reviewed from a compliance and governanceperspectivey Any material event(s) happening after the financialyear but before the date of the report havingsubstantial impact on any of the above reported itemsy Report shall be signed by the PCS, who acts as theSecretarial Auditor in his individual capacity (and notas a partner or sole proprietor of a firm) by mentioninghis CP Number4

11/5/2013CERTIFICATION OF E‐FORMSPRE‐CERTIFICATIONy Before the launch of MCA 21 all the forms werephysically submitted at the ROC offices.y It means certification of correctness of any documentby a professional before the same is filed with theRegistrar.The Central Government has amended the Companies(Central GovernmentGovernment’ss ) General Rules and Forms,Forms 1956vide Notification No. GSR 56(E) dated February 10, 2006And notified the e‐forms to enable the electronic filing ofdocumentsy The e‐forms requires the pre‐certification by professional(CS /CA/ CWA).y Objective :y Reduction of errorsy AccuracyDUTIES OF PRACTISINGCOMPANY SECRETARYLIABILITIES OF PRACTISINGCOMPANY SECRETARYy To check thoroughly the correctness of the contents ofthe forms before certifying it as correct.y The members in practice are, accordingly, expected tog the dutyyperformingexercise due care and skill while pof certification.y Certification of e‐form is, therefore, not a routine ormechanical exercise but is a serious and involved workcalling for sound application of mind in verifying theaverments made in the e‐form after due considerationof the provisions of the Companies Act read with therelevant rules.y With a view to ensure that the secretary in whole‐timepractice carries out his work with due diligence, theRegistrar may carry out scrutiny of Forms on randombasis.basisy If any Secretary in whole‐time practice is found guiltyof dereliction of duties, he will be liable fordisciplinary action by the Institute/High Court underthe Company Secretaries Act, 1980 as well as penaltyunder the Companies Act, 1956.y Penal Provisions applicable as per Section 628 of theCompanies Act, 1956 / Section 448 of Companies Act20135

11/5/2013LIABILITY FOR PROFESSIONAL MISCONDUCTUNDER THE COMPANY SECRETARIES ACT, 1980y In case there is any false statement in any materialparticular or omission of any material fact in the formcertified as correct by a Practising Company Secretary,he would be liable for disciplinary action forprofessional or other misconduct under the provisionof the Company Secretaries Act, 1980DILIGENCE REPORTFOR BANKSScope of Diligence ReportObjectivey In order to avoid the frauds mainly due to lack ofeffective sharing of information about the credithistory and the conduct of account of the borroweramong the various banks – the new concept ofdiligence report for banks was introduced in 2008.y The PCS is required to certify compliance in respect ofmatters specified in the RBI circular no. DBOD No.BP.BC. 46/08.12.001/2008‐09 dated September 19,2008.2008y Diligence Report shall be in the format given inAnnexure III as per the RBI circular.y The RBI advised all the scheduled commercial Banksto obtain regular certification means Diligence Reportby professional, preferably a PCS.6

11/5/2013Guidance on Diligence Reportingy Period of Reporting‐ Diligence Report shall bemade on a half year basis.y Right to Access Records of the company andother related documents such as borrowing ,investment details of the company with regardto Diligencey Professional Responsibility & Penalty for Falsediligence Reporty Communication the appointment to issue thediligence Report to old PCS in writing byregistered postcontinueCompliance Input & checklist forissue the Diligence Reporty List of present Directors ‐ with details regarding changes took placeduring the period and Retired by rotation Directors yeary The Shareholding Pattern of the Company as on with changes tookplace during the periody Details of alteration of MOA/AOA during the periody Details of transactions entered with the business entities in whichDirectors are interestedy Details of advanced loans, given guarantee, provided securities toits Directors and /or persons or firms in which directors areinterestedy Details of loan and investment, given guarantees or providedsecurities to other business entitiesy Details of all Borrowings from Directors/members/FI's/Bankscontinuey Details of creation, modification and satisfaction of chargesy Details/clarification of pending statutory dues, if anyy Details of default in repayment of public deposits, usecured loan,y Declaration from the Company/Management that name of theyyyyyydebentures, facilities granted by banks/FisPrincipal value of forex exposure and overseas borrowingsDetails of issue and allotment of securities during theDetails of insurance policyCompliance of terms and conditions set forth by the lendinginstitutions at the if availing any facilities and also during thecurrency of the facilitiesDetails of Declaration and Payment of DividendsDeclaration from the Company/Management that any of itsdirectors does not appear in the defaulters list of RBIcompany/any of its directors does not appear in the SpecificApproval of ECGCy Declaration from the management that the borrowed funds havebeen used for the purposes for which they were borrowed.y Compliance of the provisions of Section 372A of the CompaniesAct‐ Details requiredy Declaration from the management that applicable accountingstandards have been followed during the period.7

11/5/2013continuey Details of amount credited to the Investor Education andProtection Funds‐ Amounts how arrivedy Details of prosecution initiated, show cause noticesreceived by the company under various statutoryprovisions and also fines/penalties imposed on theCompany and any other action against the Companyand/or its Directorsy Compliance of Listing Agreementy Confirmation with regard to timely deposit of bothEmployee's and Employers Contribution of ProvidentFunds with the prescribed AuthoritiesDepositoryy The two Depository service providers in India1. National Securities Depository Ltd. (NSDL) and2. Central Depository Services (India) Limited (CDSL)y National Securities Depository Ltd. (NSDL) and CentralDepository Services (India) Limited (CDSL) have allowedCompany Secretaries in Whole‐time Practice to undertakeinternal / concurrent audit of the operations of DepositoryParticipants (DPs)Role of Company SecretaryNSDL has vide its circular No. NSDL/SG/II/010/99 dated26th March 1999 notified amendment of its Bye Law 10.3.1of Chapter 10 as follows:10.3.1 “Every Participant shall ensure that an internal auditin respect of the operations of the Depository is conductedat intervals of not more than three* months by a qualifiedCompany Secretary or a Chartered Accountant** holding aCertificate of Practice and a copy of the internal auditreport shall be furnished to the Depository.”CDSL has also made the similar provisions vide its circulardated September 28, 1999 notified amendment of its ByeLaws 16.3.18

11/5/2013BUSINESSRESPONSIBILITYREPORTINGBusiness Responsibility Reportingy BRR is part of “National Voluntary Guidelines issued on Social,Environment and Economic Responsibilities of Business” issued byMCA in July, 2011y SEBI vide its circular number CIR/CFD/DIL/8/2012 dated August13, 2012, amended55 byd d ListingLi ti AgreementAt tot insertit ClauseClb whichhi h itis mandatory for all listed companies to submit, as part of theirAnnual Reports, Business Responsibility Reports (BRR), describingthe initiative taken from an environment, social and governanceperspective, in the prescribed format.y In the first phase, top 100 listed companies, based on marketcapitalisation at BSE and NSE as on March 31, 2012, to disclose theBR Reports from financial year ending on or after December 31,2012. Other listed companies can voluntarily disclose BR Reports aspart of their Annual Reports.yWhy report?y Enhanced business valuey Improved operationsReportingy The NVG (National Voluntary Guidelines) form havebeen at articulated in the form of Nine Principlesy Strengthened relationshipsy Enhanced trust and credibilityy And a few more y Meet growing expectations of broad range of stakeholdersy Improved reputation with socially responsible investorsy Employee recruitment and retentiony Brand protection and customer loyaltyy There are Five Sections as per draft reporty Section A – General Information about the Companyy Section B – Financial Details of the Company¾ Paid up Capital¾ Total Turnover¾ Profit after tax¾ Total spending on CSR as % of profit after tax9

11/5/2013Section E – Principle – wiseperformancey Section C – Other Details like Whether the company is having any Subsidiary Company (ies) Their participation in BR initiative of the parent companyy Principle 1 – Business should conduct and governthemselves with Ethics, Transparency andAccountability Other entity (ies) like suppliers, distributors etc. also participatein BR initiative, if yes then indicate the % of such entity.y Section D – BR Informationy Principle 2 – Business should provide goods andservices that are safe & contribute to sustainabilitythroughout their life cycle Details of Directors responsible for BR BR Policy reporting of the co

COMPLIANCE CERTIFICATE Effective from 1st January 2008 Ceiling on issuing Compliance Certificate and annual return - 80 Companies in aggregate in a calendar year. In case of partnership firm ceiling apply to each partner. Every Practicing Company Secretary (PCS)/Firm of PCS shall maintain a register regarding attestation services