Transcription

Taskforce onClimate-relatedFinancial DisclosuresReport 2020TCFD A NA LYS I S

CARLYLE TCFD REP ORT 2020Climate change is one of the mostpressing issues of our time, creatingunprecedented risks and opportunitiesfor businesses across all industries.As a global investment firm we worktogether to create long-term value forour investors, companies, shareholders,people and communities.We believe that better understanding and managing of theemerging risks and opportunities that arise from climatechange is an important component of this work. Climatechange is complex, however, and it is challenging to analyzeor predict the exact interrelated impacts it may have on aninvestment portfolio, although data and insights continue toevolve our understanding.We are focused on improving our insights while developingstrategies that we believe will make our investments moreresilient to a wide array of potential outcomes. Importantly,transparency and disclosure are critical components toarticulating our learnings and challenges to stakeholders.2

CARLYLE TCFD REP ORT 2020In our inaugural TCFD report, wedescribe our evolving approach toclimate change. Highlights from thepast year include:05Hosted a climate scenario workshopto model the potential impacts on08Integrated diligence of physicalclimate risk into select investments toCarlyle’s investment portfolio under differentbetter understand the risk of sea level rise, extremeclimate scenarios. The workshop was run byweather events, and insurability of assets.Business for Social Responsibility (BSR), a non-profitpartner, and the insights were presented to seniorleaders from across the firm, including our ChiefExecutive Officer (CEO), Chief Operating Officer(COO), Chief Risk Officer (CRO), and others.09Partnered with external experts,such as the Environmental DefenseFund, on better understanding and mitigatingissues such as methane leakage for select assets.01Launched our Renewable andSustainable Energy platform, a03Formally excluded investing in orfinancing thermal coal unless the06Achieved our third year of carbonneutrality across our 32 globalWhile it is important for us to get started, we areoffices and the activities of our more than 1,750committed to improving over time through collectingdedicated team addressing the energy transitioninvestment is to repower the asset to lower-employees, after we became the first majorbetter data, uncovering new insights, collaboratingby investing globally in the renewable energycarbon energy generation, or deploy Carbonprivate equity firm to make a carbon neutralitymore effectively, and developing more advancedand sustainable resources sector.Capture and Storage (CCS).commitment in 2017.strategies for effectively navigating climate change.We look forward to continuing to learn from our02Initiated bottom-up carbonfootprinting for our majority-owned04Joined the One Planet PrivateEquity Funds Initiative (OPPEF), a07many stakeholders on this important work.Formally established oversight for ourESG and Impact activities, including ourcompanies in our three primary corporategroup of private equity investors committed toapproach to climate risks and opportunities, at Theprivate equity strategies: US Buyout, Europeintegrating climate change analysis intoCarlyle Group Board of Directors, and appointed aBuyout, and Asia Buyout.our investments.Board lead on ESG and Impact.Carlyle Investment Exclusions and Parameters Policy applied to all direct equity and credit investments. It does not apply torelated entities AlpInvest, Metropolitan Real Estate, or NGP.13

CARLYLE TCFD REP ORT 2020GovernanceIn 2020, following our conversion to a C-Corporation,Carlyle formally established oversight for our ESG activities,including our approach to climate risks and opportunities,through The Carlyle Group Board of Directors. The Boardreceives bi-annual updates on the firm’s ESG strategy andinvestment implications, which have included Carlyle’sapproach to climate risk and opportunity. One of themembers of our Board of Directors has been appointed asthe ESG and Impact lead, directly responsible for oversightof the firm’s work in this area.We believe it is important to have both dedicated inhouse ESG expertise, as well as broad-based responsibilityfor ESG matters across investment teams. Carlyle has adedicated global team of internal ESG professionals ledby Carlyle’s Global Head of Impact, who reports in directlyto the firm’s COO. The ESG team works closely with ourdeal teams and the Global Legal Investment team asthey diligence potential investments, and subsequentlydirectly with our majority-owned portfolio companies todrive understanding and adoption of ESG principles andto create tailored value-creation plans. We also workclosely with investors and broader stakeholders to driveIbid.24

CARLYLE TCFD REP ORT 2020industry learnings and best practice. As such, our work onAccounting Standards Board (SASB) and license theirclimate risks and opportunities are integrated across thedata, and are members of the Renewable Energyresponsibilities of Carlyle professionals.Buyers Association (REBA), and the Green Chemistry andCommerce Council (GC3).In 2020 Carlyle also formalized our Investment Exclusionsand Parameters Policy. This policy excludes investingFurthermore, our CEO, Kewsong Lee, signed the Businessin or financing thermal coal unless the investment is toRoundtable’s Statement on the Purpose of a Corporation inrepower the asset to lower-carbon energy generation,2019, reaffirming our commitment to protect the environment,or deploy Carbon Capture and Storage (CCS). The policyand is a board member of FCLT Global (Focusing Capitalalso applies a higher level of scrutiny to energy-intensiveon the Long-Term), a non-profit organization that developsinvestments, with an explicit focus on “climate change andresearch and tools that encourage long-term investing andthe energy transition, including physical, technological,business decision-making.and regulatory risks.” For investments that warrant ahigher level of scrutiny on material ESG risks, includingclimate change, our ESG Review Committee provides anadditional level of risk oversight and governance. Themembers of the ESG Review Committee include Carlyle’sCRO, COO, Global General Counsel for Investments, andGlobal Head of Impact.We participate in cross-industry gatherings andworkshops to enhance our understanding on climateissues. We are a member of Businesses for SocialResponsibility (BSR), an industry group working to advanceCarlyle has a dedicatedglobal team of internal ESGprofessionals led by Carlyle’sGlobal Head of Impact, who reportsin directly to the firm’s COO.sustainability practices in the business sector (BSRfacilitated our first climate scenario workshop, detailedon page 9). We actively engage with the Sustainability5

CARLYLE TCFD REP ORT 2020StrategyThe TCFD’s climate-related risks andopportunities have been a helpful guidingframework for our work. We focus on the two maincategories of risk identified through that process:TRANSITION RISKS from the shift to a lower-carboneconomy, which include policy and legal risks, technologyrisks, market risks, and reputational risks, andPHYSICAL RISKS from a changing climate, which includeacute risks (such as extreme weather-related events), andchronic risks (such as sea-level rise).We also consider climate-related opportunities,which include:RESOURCE EFFICIENCYMARKETSENERGY SOURCESRESILIENCEPRODUCTS AND SERVICES6

CARLYLE TCFD REP ORT 2020The timeframe, scope, and potential impact of risks andequity upside opportunities. We tend to have less controlopportunities differs significantly across our investmentthan in our equity investments, and hence have less abilitywork, and are important dimensions to how we considerto influence a business model during our hold period. In ourthese issues.corporate and real asset private equity investments, weare focused both on climate risks and opportunities, andTIMEFRAME As a private equity investor, we tend to holdwhere we have controlling stakes or greater influence, ourcompanies for several years on average. Hence, forability to improve the climate resilience of investments overindividual investments, we are predominantly focused onour hold period significantly increases. In our asset-heavyshort- to medium-term risks and opportunities (such asinvestments and investments with complex supply chains,policy and legal risks, reputational risks, and acute physicalwe are particularly focused on the physical risks of climaterisks), which are material over our hold period. However,change.we see that as the impacts of climate change becomebetter understood, longer-term risks and opportunitiesPOTENTIAL IMPACT We calibrate our work on any givencan increasingly impact our exit multiples, and hence areproject based on the potential impact of climate risks anda greater focus. Our credit investments have differentopportunities to a given sector, industry, or company asdurations and levels of influence, and hence our risk iswell. For example, the energy transition will generally haveappropriately calibrated. For issues impacting us at thea greater impact on investments in our Energy and Naturalfirmwide and portfolio level, we are more focused onResources portfolios (both in terms of risks and businessmedium- to long-term issues and opportunities, such asopportunities), than on a tech-enabled software company.technology risks (e.g. established technologies becomingWe focus on the sectors, industries, and companies whereobsolete; disruptions from emerging technologies), marketwe see the potential for greatest impact, but also work onrisks (e.g. stranded assets), reputational risks, and more.improving the climate resilience of investments across ourbroad portfolio as well. Please see a case study in the “RiskSCOPE In our credit investments we are predominantlyManagement” section on the following page, which detailsfocused on downside risk mitigation, and have a greaterhow we specifically address risks and opportunities in onefocus on better underwriting and mitigating climate-of our “high impact” investment areas – our Internationalrelated risks as opposed to creating or capitalizing onEnergy strategy.3Our Carlyle Global Partners fund tends to hold investments over a longer time period.7

CARLYLE TCFD REP ORT 2020RiskManagementINDIVIDUAL INVESTMENTS RISKSindustry-focused investment teams, in partnership with01our dedicated ESG team. As an example, in 2015 CarlyleAs an example, this past year, one of our investmentteams was evaluating a portfolio of assets on coastal realinvested in AxleTech International, a premier providerestate. In partnership with our dedicated ESG team, weof powertrain systems and components for heavy-identified physical risks from climate change (both extremeduty commercial and defense vehicles. Recognizing theweather-related events and sea level rise) as a materialimportance of the electrification of the vehicle fleetWe evaluate and manage risks and opportunitiesrisk for this potential investment, alongside corollary risksglobally, Carlyle and AxleTech partnered to invest anthrough two primary lenses – implications forsuch as insurability. We worked with a third-party climateadditional 20M in designing and developing an in-axlerisk consultant to help us better model, understand, andelectric powertrain. That investment was a significantprice those risks. A combination of factors, which includedgrowth driver for the company.individual investment opportunities, and implicationsfor firmwide and portfolio strategy.the climate-related physical risks, ultimately led us not topursue that deal.02Another deal we evaluated in the past year hadINDIVIDUAL INVESTMENTSsignificant potential market and policy risks due to theFor individual investments, we use the Sustainabilitycarbon-intensity of the core business model. We workedAccounting Standards Board (SASB) framework to guidewith a third-party ESG consultant to conduct on-the-groundour diligence of material issues. Our investment teamsdiligence of the material ESG risks we identified. As part oflead this diligence, in partnership with our dedicated in-that work, we modeled out investment implications underhouse ESG team. We furthermore bring in specialized ESGdifferent carbon-pricing scenarios. We also incorporatedthird-parties on specific diligence items, where needed.improved monitoring of greenhouse gas emissions and aOur diligence of individual investment opportunitiesmore robust approach to reducing those emissions over ourhas increasingly included climate-related risks andhold period as part of our investment thesis, as we believeopportunities, where material. As mentioned above,this would position us for a stronger exit.In 2015, Carlyle and AxleTechpartnered to invest 20M indesigning and developing anin-axle electric powertrain,becoming a growth driver forthe company.potential investments with a higher level of perceived ESGrisk are elevated to our ESG Review Committee, whichINDIVIDUAL INVESTMENTS OPPORTUNITIESprovides a recommendation as to whether the firm can01proceed with an investment or not.opportunities, led by the thematic expertise of ourWe have increasingly discovered climate-related8

CARLYLE TCFD REP ORT 2020FIRMWIDE AND PORTFOLIO LEVELrisk lenses to integrate into our go-forward investmentIn addition to our individual investments, we are also focuseddecision making. We focused on a few specific portfolioon understanding and better managing climate-related riskscompanies, but also considered implications for otherand opportunities at the firmwide and fund levels.sectors and investment strategies. BSR guided us by usingthree different 2030 scenarios, each tied to a differentFIRMWIDE AND PORTFOLIO RISKSone of the Intergovernmental Panel on Climate Change’s01representative concentration pathways. The majorCarlyle recently concluded an important project toassess, refresh, and adapt our Investment Exclusions andimplications and discussion points identified during theParameters Policy to better reflect the changing realities ofworkshop were presented to a group of senior Carlylethe current environment. An important component of thisleaders, including our CEO, COO, CRO, Co-Head of USproject was excluding investing in or financing thermal coal,Buyout, and others. The context and impetus for thisand applying a higher level of scrutiny to energy-intensiveworkshop are profiled further here.investments, with an explicit focus on “climate change andthe energy transition, including physical, technological,FIRMWIDE AND PORTFOLIO OPPORTUNITIESand regulatory risks.” We believe this updated policy is an01important component of our climate risk management.2019, Carlyle launched its Renewable and SustainableAs a result of a strategic review completed from 2018-Energy platform in late 2019. This dedicated team is02In 2020 Carlyle hosted its inaugural climateaddressing the energy transition by investing globally in thescenario planning workshop, facilitated by BSR, a non-renewable energy and sustainable resources sector. Theprofit partner. The three-hour workshop was attendedteam has already completed several investments, including aby approximately 25 Carlyle professionals from acrosspartnership with Cardinal Renewables, profiled here.industries and strategies, and enabled us to think criticallyabout a range of plausible climate scenarios, and from02those scenarios, brainstorm what would better position ourchange was launched this past year, as we began aportfolio today for those worlds. The goal of the exercisesignificant body of work to carbon footprint our majority-was not to identify an “answer” to climate change, butowned portfolio companies across our three primaryrather to start building the agility, critical thinking, andcorporate private equity strategies: US Buyout, EuropeAn important component of our approach to climate9

CARLYLE TCFD REP ORT 2020Buyout, and Asia Buyout. We believe this informationproducts have a much lower carbon footprint thanis vital for both understanding risks for portfoliothose of competitors. As such, the company’s productscompanies (especially from policy and legal shifts) asare positively rated by green building schemes [suchwell as highlighting potential opportunities. Examples ofas Leadership in Energy and Environmental Designopportunities include:(LEED) and BREEAM], providing customers who useits products extra points toward certifications. TheA US tech company is building out their ability tocompany’s sales strategy is based in part on gettingcalculate the carbon emissions reduction of using theirthese certifications in each jurisdiction, which itdigital service versus conventional technologies, whichbelieves give it a competitive edge.they believe will be a sales driver for corporates withcarbon reduction goals.03By helping a US manufacturing company establishpage 12, which examines the relationship between variousa carbon footprint for their manufacturing anddimensions of movement along the energy transition andproduction, we helped obtain data necessary forthe potential impact on company valuations.We have published proprietary research, detailed onan energy auditor (and procurement specialists)to evaluate where the best financial cost-savings04opportunities are, which is of heightened importanceon emerging climate-related risks and opportunitiesduring the disruptions of COVID-19.that are material to their businesses. For example, inWe helped a consumer-facing brand in the UK2020 we hosted a virtual gathering for our energycalculate its facility’s carbon footprint and obtainportfolio companies which featured presentations bycarbon offsets in order to make it carbon neutralEnvironmental Resources Management (ERM) on emergingunder Carbon Trust standards. In addition to being aclimate change-related regulatory implications and TCFDfocus area of its consumers, the company also saw thisreporting best practices, as well as the Environmentalwork as a demonstration of operational excellence atDefense Fund on the developments in methane trackingthat facility, which it considers important for its brandand reduction.Finally, we work to educate our portfolio companiesand employee base.A European manufacturing company collects detailedcarbon information about its processes because its10

CARLYLE TCFD REP ORT 202011

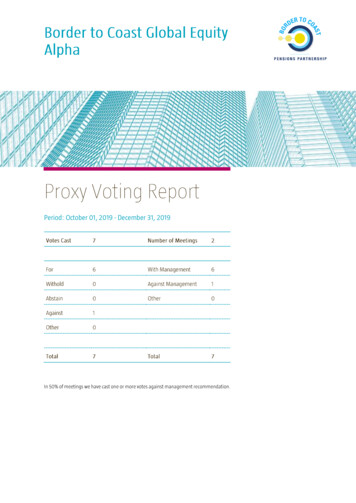

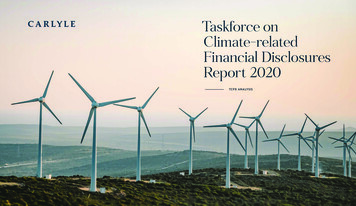

CARLYLE TCFD REP ORT 2020Case StudyCarlyle International Energy PartnersVALUATION MULTIPLES HAVE ADJUSTEDTO ENERGY TRANSITION RISK IN ADVANCEOF CHANGES IN FUNDAMENTALSRenewableInfra FacilitiesM U LT I P L E90.00XOur International Energy platform is keenly aware of80.00Xthe risks and opportunities climate change presentsto its underlying investments, while recognizing that70.00Xhydrocarbons represent a significant portion of theenergy supply in the coming decades under most transition60.00Xscenarios. The International Energy team is focusedon minimizing the environmental impact of its energyinvestments and helping their portfolio companies invest50.00XWind Turbine &Solar Technologyin clean energy technologies as a core part of the energytransition. We believe that evolving the oil & gas business40.00XS&P Global Utilitiesmodel provides attractive financial and environmentalopportunities. As broad awareness of the nearer-30.00Xterm consequences of climate change have intensified,disparities in energy sector multiples have emerged. Today,in our experience, the valuation assigned to a given energycompany largely depends on where its assets sit on theclean energy spectrum, creating compelling financialIntegratedOil and Gas20.00X10.00XEV & BatteryManufacturersincentives to accelerate the energy transition throughdiversified energy companies – not solely through pureplayrenewable energy developments.0.00XE N E RGY TR AN S ITI O N12

CARLYLE TCFD REP ORT 2020Furthermore, our research has indicated that increasingwind, offshore gas & hydrogen – integrated to produceNOURYONrenewables’ (photovoltaic solar and wind) share of totalelectricity via injection of the hydrogen into the existing01revenue from zero to 40% could lead to a doubling of thegas infrastructureemissions per tonne of product) by 29% since 2009Our climate priorities across our International EnergyVARO02Sources 56% of its energy from low-carbon sourcesplatform are: 1) reducing emissions from operations, 2)01encouraging low- and zero-emissions product development,refinery energy efficiency by 6.8% by 202303Increased the use of bio-steam at two plants in theReduced its carbon intensity (carbon dioxidetypical energy company’s trailing EBITDA multiple.Signed a Swiss federal convention to improve3) supporting in TCFD reporting implementation, 4)Netherlands, reducing CO2 emissions by 150ktpaencouraging methane leak monitoring, and 5) select02investment exclusions based on hydrocarbon intensity.135 kilowatts (KW) of grid powerInstalled 820m2 of Solar photovoltaic (PV), savingAt least three of our portfolio companies within this strategy0420% of revenue linked to “eco-premium” products:Partnership with Photanol to use CO2 & sunlight forhave adopted the TCFD recommendations. We have03highlighted below how some of our portfolio companiesfor refinery heating & hydrogen manufacturing: CO2care productshave worked to reduce emissions from operations andemissions reduced by 25ktpaSustainable, water-miscible defoamer for cleaners 10 million invested in a new natural gas pipelineinnovate in low- and zero-emissions products:Sustainable adhesion promoter for use in asphalt04800 million litres of sustainable bio fuels suppliedNEPTUNE ENERGYin 2018, reducing CO2 emissions of their customers by 1.701metric tons (MT)Gjøa floating platform in the North Sea is poweredproduction of biodegradable plastics & personalwith hydroelectric power generated on-shore: CO2emissions reduced by 200 kilotonne per annum (ktpa)05(equivalent to emissions from 100,000 cars)well-to-propeller CO2 reductions vs traditional fuel: itDelivered marine biofuel that provides 80-90%contains no sulphur dioxide, complying with International02Snøhvit field captures CO2 at the LNG processingfacility & reinjects it into the aquifer, storing up to 700ktpaMaritime Organization (IMO) 2020Our research has indicated thatincreasing renewables’ share oftotal revenue from zero to 40%of CO2could double the typical energy03company’s EBITDA multiple.Q13a will be the first offshore green hydrogen pilotglobally: three energy systems in the North Sea – offshore13

CARLYLE TCFD REP ORT 2020200KTPA56%800MPHOTOVOLTAIC (PV) SAVING 135EMISSIONS BY 200 KILOTONNE PER ANNUM (KTPA)OF ITS ENERGY FROM LOW-LITRES OF SUSTAINABLE BIOKILOWATTS OF GRID POWER(EQUIVALENT TO EMISSIONS FROM 100,000 CARS)CARBON RESOURCESFUELS IN 2018820M2VARO INSTALLED 820M 2 OF SOLARGJOA FLOATING PLATFORM HAS REDUCED CO2NOURYON SOURCES 56%VARO SUPLIED 800 MILLION14

CARLYLE TCFD REP ORT 2020MetricsWe believe data is an integral part of our ability tobetter understand and manage climate risks andopportunities. We are focused on collecting betterdata on both our own corporate operations, as wellas on our portfolio company investments.OUR OWN OPERATIONS 2019 was Carlyle’s third yearof carbon neutrality across our 32 global offices and theactivities of our more than 1,750 employees, after we becamethe first major private equity firm to make a carbon neutralitycommitment in 2017. Using the World Resources Institute’sGreenhouse Gas Protocol (GHGP), we focused on the materialsources of emissions for our firm across Scopes 1-3: officeutilities, offsite data centers, commercial and private air travel,and employee commuting. In 2019 we emitted 19,576 metrictonnes of carbon dioxide equivalent across those categories,detailed in the table on the next page. As in prior years, weoffset our emissions by purchasing carbon offsets in truck stopelectrification projects in the US through The Carbon Fund,which were verified by the American Carbon Registry. Ourcarbon footprint was assured by Apex Companies.15

CARLYLE TCFD REP ORT 2020CARBON NEUTRALITY FOOTPRINT ACROSS32 GLOBAL OFFICES AND 1,750 CARLYLEEMPLOYEES SINCE 2017OFFICE UTILITIESScope 220 175 , 28 120 1 85 , 1 17better understand the environmental implications of ourcollection to track KPIs that are relevant across diverserenewable and sustainable energy investments. Thesegeographies and assets for our Corporate Private Equitycalculations will be tracked and aggregated annually atand Natural Resources investments. These KPIs includethe portfolio company and strategy levels.several climate-related questions, such as if a companyE M I S S I O N S ( MT/C O 2 E )C AT E G O RYOUR INVESTMENTS In 2020 we expanded our ESG data20 1 95 ,0 42purchases renewable energy and/or has a target forPORTFOLIO CARBON FOOTPRINTING Importantly, thispurchasing renewable energy, if a company monitorspast year we embarked on a significant body of work toenergy usage and/or greenhouse gas emissions andcarbon footprint Scopes 1 and 2 carbon dioxide equivalentreports on that, and if a company has set energy efficiency(CO2e) emissions for majority-owned portfolio companiesor greenhouse gas emissions reduction targets.across our three primary corporate private equitystrategies: US Buyout, Europe Buyout, and Asia Buyout.DATA CENTERSScope 253 839 63 63For some of our largest strategies, we also work withThe work was accomplished through a partnership withportfolio companies on collecting material, bespoke,the Environmental Defense Fund Climate Corps.climate-related data (please see a case study of Neptune’sBUSINESS TRAVELScope 3EMPLOYEE COMMUTINGScope 3TOTAL9, 7 751 , 24 51 6 , 8399, 6 5 51,30116,4681 2 , 78 0work reducing the carbon intensity of their activities, and aOur portfolio carbon footprinting methodology iscase study of Accolade Wine’s efforts to carbon footprintconsistent with the GHGP and Scope 2 Guidance developedand offset the emissions of their facility).by the World Resources Institute. It included the direct1 , 39 01 9, 576emissions from owned or controlled sources as well asAdditionally, for the investments done by our Renewableindirect emissions associated with purchased energy forand Sustainable Energy team, we perform a qualitativethe year 2019. We did not gather data on Scope 3 emissionsand quantitative analysis of the climate impact as part ofat this stage, though many portfolio companies activelyour investment due diligence process, which is included intrack, measure, and work to reduce these indirect emissionsour Investment Committee memos. As an example, for athat occur both upstream and downstream within arecent investment we calculated the total carbon emissionscompany’s supply chain.abatement capacity potential of a pipeline of solarprojects in various stages of development. This quantitativeWe normalized emissions to portfolio company revenueapproach helps us refine our investment decisions andto arrive at a carbon intensity of metric tons (MT) CO2e*Note, these values may not add up due to rounding16

CARLYLE TCFD REP ORT 2020per million dollars of revenue. By using an intensity-basedThrough this exercise, we observed that there aremetric rather than an absolute-based metric, we are ableincreasingly market pressures for consumer-facingto better account for the difference in size and operationscompanies to disclose and potentially reduce carbonacross portfolio companies.emissions in particular. Investors, employees, andcustomers are interested in the carbon positioning ofWe carbon footprinted the majority of companies acrossthe companies they invest in, work for, and buy from. Bythe three funds, although for several companies wepublishing carbon data, companies may be able to improvewere unable to due to exits from the portfolio or similartransparency, bolster their credibility and reputationcircumstances. For the small portion of companies whereamong stakeholders, and improve profitability throughwe lacked data, we made certain assumptions – forcost savings and operational efficiency measures. Strategicexample, we could perform estimates using headcount orcarbon management can potentially be leveraged as asquare footage and location data. For most companies,strength and value proposition that brings a competitivewe assisted in completing a carbon-footprint, although foradvantage to both mitigate risk and create opportunities.others that had already footprinted their business we wereable to review and confirm the data provided to us.We hope to continue to share the learnings and challengeswe experienced with our peers and stakeholders, to helpWe believe this carbon data provides companies with aadvance this work on a go-forward basis, and consider themore holistic picture of the climate-related exposure andpotential of setting carbon reduction targets.resilience of their businesses, although it is a starting point,not an “answer” to this question. Understanding theircarbon intensity can help companies better prepare forpotential climate-related policy changes, comply with GHGemissions reductions targets and reporting requirements,and better position themselves for growth in a businessand consumer context that is increasingly focused onclimate change.17

CARLYLE TCFD REP ORT 2020Climate change has critical implications for us as a globalinvestment firm, creating both risks as well as significantinvestment opportunities.Companies that can navigate theseemerging challenges – from physicalrisks to policy shifts and technologicaldisruptions – and seize the mountingopportunities of the energy transition, weexpect will have the climate resilience tothrive in a changing world.As such, we are committed to continuing to enhance ourgovernance, strategy, risk mitigation, and metrics andtargets on climate change. Our first TCFD report is animportant part of good governance and transparency, andwe loo

Carlyle Group Board of Directors, and appointed a Board lead on ESG and Impact. Joined the One Planet Private . Equity Funds Initiative (OPPEF), a . group of private equity investors committed to integrating climate change analysis into our investments. 02. 04. 07. Launched our Renewable and . Sustainable Energy platform, a