Transcription

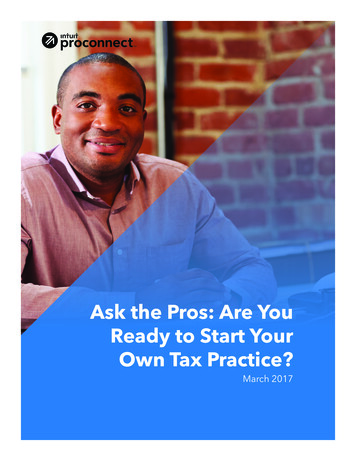

Ask the Pros: Are YouReady to Start YourOwn Tax Practice?March 2017

Ask the Pros: Are You Ready toStart Your Own Tax Practice?Every year, many tax professionals starttheir own tax practice. While they havemany different motivations, and theirfirms take on different structures, manyof these tax professionals agree: startingyour own practice can be a rigorousbut rewarding experience. How do youknow if this is the right path for you andthe right time to take this big step inyour career?We spoke to three tax professionalsand QuickBooks ProAdvisors whostarted their own practices. We wantedto learn about their motivations togo out on their own, the structuresthey chose for their businesses, thechallenges they faced, and the advicethey have for others who want to starttheir own practice. We asked themseveral questions you can also askyourself to answer the most importantquestion: Are you ready to start yourown tax practice?Meet the entrepreneurial expertsMariette Martinez, EAMariette Martinez is a virtual small business accounting consultantand tax professional. Her mission is to empower solo-entrepreneursto seamlessly manage financial performance and meet year-round taxobligations by using accounting, tax and workflow technologies.Jackie Meyer, CPA, MSAJacke Meyer is president and founder of Meyer Tax Consulting, LLC, inSouthlake, Texas. Her team works with a select number of executives,investors, entrepreneurs and small businesses throughout the year ontax preparation, planning and accounting services.Mark Stewart, CPAMark Stewart is a partner at Feldstein & Stewart LLP, a full-servicefirm that serves medium and small businesses, and provides taxpreparation, financial planning and audit/review/compilationattestation services.2

Is the Time Right to Start Your OwnTax Practice?Martinez, Meyer and Stewart all worked in the taxprofession before starting their own practices, butthere came a point for each of them when theydecided that the time was right to break out ontheir own.“I came from an entrepreneur background, andI always wanted my own accounting firm and taxpractice where I could work with small businesses,”said Martinez. “I knew the time was right when Istarted my family. I wanted to be able to raise ourkids and work from anywhere, at any time, so thatI could be a parent while maintaining a successfulbusiness. I also saw an opportunity to create apractice in the cloud. I had a passion for makingthis work and found clients who were excited abouttaking the plunge into the cloud with me. BecauseI am my own boss, I can choose the tools that areright for my practice and take the time to find thebest resources on the cloud.”Meyer’s impetus for starting her own practice wasthat she wanted the independence of workingfor herself. “I wanted to run the show and choosethe business model and location of my practice.I did consulting while my practice grew, whichhelped me network and stay on top of the newesttechnology. Eventually, I had to stop because myfirm was growing so quickly. Being innovative stillkeeps me going every day. There’s nothing holdingme back from making my own choices to ensure westay on the cutting edge of technology for clients.”Stewart knew it was time to start his own practicebecause he had worked with his current partner,Alan Feldstein, for more than eight years, anddeveloped a trusting relationship with him. “Acouple of years before Alan and I became partners,we had a meeting, and he explained to me why hewanted to partner in the business,” said Stewart.“He told me, ‘Mark, I don’t want you to be mypartner for the money or prestige. I want you topartner with me because I care about my clients,and I know you’ll take good care of them.’ I knewright then and there that this is what I wanted todo, and this is the person I wanted to be businesspartners with because we have the same goal: tohave a direct impact and meaningful relationshipwith clients that helps them in their day-to-daylives.” Stewart also believes his personality isalso well suited to run a business, “I am my teamfacilitator. I have a need to control my business, butno need for the spotlight, so I’m happy to let myteam shine.”While each of these tax professionals had adifferent motivation for starting their own practice,they were aligned on one thing: experience is amust. Martinez said, “Make sure you have a strongbackground in accounting and tax. There are somany other hurdles, including administration,learning how to sell and learning how toorganize your practice, so be sure you have thefundamentals. This will give you the tools and theconfidence to strike out on your own.”Your education, background and motivation can helpyou decide whether now is the right time to start yourown tax practice.Along with certifications, including becomingEnrolled Agents, CPAs and QuickBooksProAdvisors, our experts spent years in the industrygaining experience. “I gained the right balance ofexperience by growing up with an entrepreneurialfamily, doing accounting and tax at a CPA office,and learning about the technical support side oftax preparation while working at a tax softwarecompany for a few years,” said Martinez. “Whenthe opportunity came to create my own practicein 2009, I knew I was ready for the opportunity.”Meyer and Stewart also had years of experience3

at CPA firms where they learned the ropes. Meyer“became the marketing guru in the practice,”giving her the skills she needed to market her ownpractice; Stewart grew up watching his family runa small practice, which gave him insight into whatwas necessary to run his own firm.There are many reasons to start your own firm.Whether you are inspired by a family member’sentrepreneurial spirit, have an independent nature,are inspired to create an innovative practice, or areon the brink of a great partnership, be sure youhave the drive and experience to take this leap offaith. Our experts agree, it’s hard work to start yourown firm, but the right experience and motivationcan keep you charging forward when the goinggets tough.Chose thebusinessentitythat offersthe rightbenefits foryour idealpractice.Which Business Entity is Rightfor You?If you have decided you are ready to start your owntax practice, one of the first steps is to decide whattype of business entity is right for you. Each of ourtax professionals chose different entities for theirbusinesses, and there isn’t one right answer forsuccess in a tax practice. Each practitioner chosethe entity that offered the right benefits for theirideal practice.Martinez chose a sole proprietorship for herpractice. This is the most common businessDo your research to help determine which entity optionis right for your ideal tax practice.4

structure, and it can be a simple way to starta practice without creating a formal businessstructure. With the desire to maximize flexibility andcloud technology in her practice, this entity typegives Martinez a lot of wcontrol over her practiceand decision making.Meyer chose a single-member limited liabilitycompany (LLC) with an S corporation for herpractice. For her business model, Meyer said, “Thisis most tax advantageous way to go.”Stewart chose a partnership so that he andhis partner could support each other in thepractice. “The way the environment is rig ht now,with constantly changing tax laws and financialreporting standards, it’s very difficult for one personto go into practice on their own.” Stewart chose apartnership as one of his sources of support, butcautions, “If you choose to enter into a partnership,you need to find a partner who has a similar visionto your own. ‘Opposites attract’ might work in theworld of marriage, but in business, you need to findsomeone with similar goals and values, as I did.”What Challenges Do Pros FaceWhen Starting Their Own Practice?Professional SupportOur three experts agree that while no two practicesare alike, the biggest challenges many new taxprofessionals face is where to get professionalsupport and mentorship as they begin thetransition to their own practice. With ever-changingtax code, technology and industry climate, supportis often necessary to keep up. “You aren’t goingto know all of the answers, but you need to knowwhere to get the answers; it’s important to makesome connections before you start your ownpractice,” said Stewart. “You cannot possibly stayon top of all of the changes yourself, so you’ll needto have a network of fellow professionals in placeto help you along.”The type of entity you choose can have broadimplications on your practice, from the taxes youmay pay and the challenges you may face, to theadvantages you may be able leverage. For moreinformation about business entity types, visit theSmall Business Administration’s (SBA’s) resource onChoosing Your Business Structure.“‘Opposites attract’might work in theworld of marriage, butin business, you needto find someone withsimilar goals and values.”- Mark Stewart, CPANetworking before you start your practice can help youfind the necessary professional support and mentorship.For Stewart and Meyer, professional organizationshave been a strong source of support. Stewartis a long-time member and president of theWestchester/Rockland Chapter of the NationalConference of CPA Practitioners (NCCPAP).“Trade associations are a great way to buildconnections with people who have differentexpertise. I get more information talking to fellow5

practitioners at networking events than I do fromspeakers at conferences. I recommend takingcontinuing education in person so we can continuecollaborating with other CPAs.”Meyer has worked with the American Institute ofCertified Tax Coaches (AICTC) to get on top of taxplanning for her practice’s executive packages,and the Professional Association of Small BusinessAccountants (PASBA) to stay up to date on changeson the small business front. She also works with abusiness coach and attends his webinars to learnhow to improve her practice’s sales and businessprocesses, along with sharing ideas and support.“Chuck Bauer in Dallas has been instrumental inimproving my executive package offerings as wellas my business model this year,” she said.Martinez added that family and social media werehelpful support systems for her — and continueto be helpful today. “Early on, I realized that mybiggest support system is at home. Pick familymembers’ brains, and let them know that they canchip in by understanding that you will be workinga little more as you get your business up andrunning,” she said.With a virtual practice, it’s no surprise that Martinezfound a lot of support online. “The most surprisingsupport for me came from Facebook. I had noidea how I could really use Facebook to grow mybusiness, and I found some great professionalgroups. I started by looking at what they weredoing, joining other groups they were in andeven connecting with their connections.” She alsorecommends searching online, including SBA.gov,for helpful resources.ProConnect Training Center to help you continuelearning, including live and recorded webinars,how-to videos, and peer training via forums. TheTraining Center offers the latest tax law changesand the impact they have on ProConnect software,the latest technology updates, best practicesto help keep your client’s data secure, how togrow your firm, and more. Intuit ProConnect alsooffers the Tax Pro Center, a collection of valuablecontent, including articles, infographics and more,that provides insights on tax laws, building clientrelationships and practice management to helpyou take your practice to the next level.No matter the sources of support you choose,it’s clear from our pros that it’s important to getconnected to some dependable resources beforeyou start your practice. And, Martinez adds, “Don’tbe afraid to ask for help!”Implementing the Latest TechnologyWhile staying up to date on the latest technologyis a challenge of its own, Meyer says thatimplementing the right technology withoutoverwhelming her team and her clients oftenproves to be a greater challenge. “For the first fewyears in my practice, I would be the first person tojump into new apps. As the team grew, it becameharder to quickly change to a new customerrelationship management (CRM) system, documentmanagement system or other new technology. Asyou grow, there will always be some foundationalDo you need more resources for finding adviceand mentors? Check out the QuickBooks site,“How to Get More Advice” for a list of even moreresources for financial help, legal assistance, peeradvice and finding a mentor.It’s important to do your due diligence when youchoose a professional tax software company aswell. Some offer not only product support, buttraining and tools that can help you stay up todate. Intuit offers several resources in the IntuitEnsure you, your clients and your staff are ready toadopt the technology you choose for your tax practice.6

“I wish I would haveprepared myself forstaffing and managinga team.”- Jackie Meyer, CPA, MSAissues with technology, and we’ve made somemistakes along the way. Bottom line, clients andstaff need to be comfortable with new features.”According to our pros, some of the biggestchallenges with technology occur when softwaredoesn’t operate as promised, so consider demosof the latest technology before implementing it inyour firm and transitioning your clients to the newtechnology.Hiring and Managing StaffComing from a CPA firm, tax professionals startingtheir own practices are often challenged with hiringand managing a staff of their own for the first time.“I wish I would have prepared myself for staffingand managing a team,” said Meyer. “Learning howto be a manager was a surprisingly difficult factorof starting my own practice.” She added, “I’verushed into staffing decisions under pressure thatI would never make again with that experienceunder my belt. It’s a huge hit to an infant firm’sbottom line when a new hire investment doesn’tpan out. I needed to replace my gut feeling ofpeople and their touted experience with trueskills and personality testing, so using a site likeoptimizehire.com became imperative. I used to hireonly very experienced people to avoid training,but I’ve learned that someone with less experiencewho has a high level of commitment, drive andadaptability may end up performing better.”Defining expectations and guidelines to staff andclients has been a key part of Meyer’s managementstrategy, especially when her firm was new. “Forexample, we use the E/U/NU urgency email systemto help our team and clients understand prioritylevels and be more proactive versus reactive to‘accounting emergencies.’”MarketingOur pros had several pieces of advice regardingmarketing. Meyer said that when she was startingher practice, LinkedIn was her secret to success. “Iperformed targeted marketing on LinkedIn, and Ifound great business clients in my area. Firms noware really getting integrated into Facebook andleveraging targeted marketing on that platform.”Meyer and Martinez warned that they did not makea large amount of revenue the first year of their firmas they were focused on administration and firmgrowth. Meyer said, “I offered potential clients freeone-hour consultations during the growth phase ofmy firm. I don’t need to do this anymore, but whenI was getting started, it helped me prove myself topotential clients.”Martinez also offered some general marketingadvice: “There’s so much content on the web fromother people who are entrepreneurs. Blogging andbeing interviewed are great opportunities to shareyour story.”Managing Third-Party PartnershipsStewart described his biggest surprise as a new7

partner in his practice as “the flood of phone callsand contacts I received from other businessestrying to partner with my firm as clients.”Companies offering insurance, payroll, bankingservices and more often reach out to Stewart totry to convince him to do business with them. “Ihad to manage a lot of incoming calls, but moreimportantly, pick the right businesses who wouldtreat my clients well. When you run your business,you are now a facilitator between clients and thirdparties, and you need to be prepared for that,”Stewart said.the manager not only of your own livelihood, but ofyour employees. Meyer said, “I don’t think peoplerealize how much weight you tend to take on yourshoulders when you have your own practice. Theresponsibility level is insanely high.”Managing it all”can come with a learning curve, butMartinez’ advice is to never give up. “You’re goingto mess up, fail and disappoint people, but takethe opportunity to learn from your mistakes so thatsomething good can come from something bad.”“You’re going to messup, fail and disappointpeople, but take theopportunity to learnfrom your mistakes sothat something goodcan come fromsomething bad.”- Mariette Martinez, EAManaging It AllConclusionOur panel of experts expressed that “managingit all” is one of the biggest challenges they facedwhen starting their own practices.If you have powerful motivation and a solidbackground, and if you’re ready to face thechallenges that come with starting your own taxpractice, then perhaps you are ready to start yourown tax practice. Despite the challenges, our threepros assert that it’s a rewarding experience and anaccomplishment of which they are proud. We hopetheir learnings helps pave the way for you to have asuccessful start to your new business.Because you are managing and growing yourown practice, your practice’s success is directlycorrelated to how hard you work. “You never reallyshut down,” said Martinez. “You need to createefficiencies because you cannot work all of thetime.” Meyer added, “There are times I’ve had tostep away from parts of my practice to make sure Istay sane in my personal life. “Several of the pros discussed the pressure of beingIf you are ready to take the next step and wouldlike to learn more about ProConnect professionaltax solutions, visit us online, or call 1-877-682-4254.8

DISCLAIMER OF LIABILITY: This document, and all the materials contained within it, is provided for educational andinformational purposes only, without warranty of any kind, express or implied. While effort has been made to ensurethe accuracy of information contained this document, Intuit and the authors and contributors accept no responsibilityfor any errors or omissions, or for any consequences arising therefrom. Neither the provision, nor your receipt, of thisdocument is intended or should be construed or relied upon to be or constitute legal or tax advice or opinions on anyspecific matters, or to create any form of relationship between you and Intuit or the document authors or contributors.Views and opinions expressed by individual authors and contributors to this document are their own and do notnecessarily reflect the views or opinions of all or any other authors or contributors, or of Intuit.YOU ACKNOWLEDGE and understand that Tax laws and regulations change frequently and their application can varywidely based upon the specific facts and circumstances involved. YOU AGREE that you, and not Intuit, are responsiblefor the applicability and accuracy of information as it relates to your practice and your clients and that you are notrelying on Intuit for advice regarding the appropriate tax treatment of items reflected on tax returns. YOU FURTHERAGREE that all judgments concerning the treatment and preparation of items on tax returns are decisions made solelyby you, and nothing in this document relieves you of the responsibility, including that owed by you to any third party,for the content, accuracy, proper preparation, and review of tax returns.NOTICE OF RIGHTS: This document is copyright 2016 Intuit Inc. All rights reserved. No part may be reprinted,reproduced, transmitted, or disseminated in any form or by any means without the prior written permission of IntuitInc.Intuit, the Intuit logo, ProConnect, the ProConnect logo, Lacerte, ProSeries, QuickBooks, and Quicken are trademarksor registered trademarks of Intuit Inc. All other trademarks are the property of their respective owners. Trademarkednames may appear throughout this document and do not represent any endorsement or affiliation by, for, or with thebrands or services mentioned, but are used for editorial purposes only, to the benefit, and with no intent to infringeupon the rights, of the respective trademark owners.9

faith. Our experts agree, it’s hard work to start your own firm, but the right experience and motivation can keep you charging forward when the going gets tough. Which Business Entity is Right for You? If you have decided you are ready to start your own tax practice, one of the first steps is to decide w