Transcription

Vol. 78Monday,No. 222November 18, 2013Part IICommodity Futures Trading Commissionsroberts on DSK5SPTVN1PROD with RULES17 CFR Parts 15, 17, 18, et al.Ownership and Control Reports, Forms 102/102S, 40/40S, and 71; FinalRuleVerDate Mar 15 201020:54 Nov 15, 2013Jkt 232001PO 00000Frm 00001Fmt 4717Sfmt 4717E:\FR\FM\18NOR2.SGM18NOR2

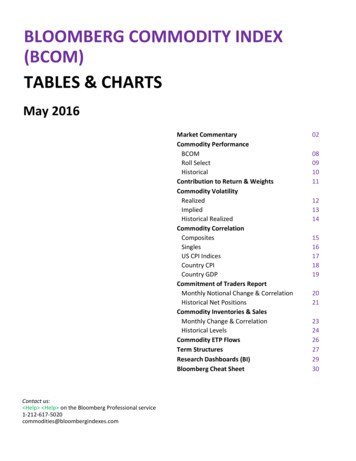

69178Federal Register / Vol. 78, No. 222 / Monday, November 18, 2013 / Rules and RegulationsCOMMODITY FUTURES TRADINGCOMMISSION17 CFR Parts 15, 17, 18, and 20RIN 3038–AD31Ownership and Control Reports,Forms 102/102S, 40/40S, and 71Commodity Futures TradingCommission.ACTION: Final rule.AGENCY:The Commodity FuturesTrading Commission (‘‘Commission’’ or‘‘CFTC’’) is adopting new rules andrelated forms to enhance itsidentification of futures and swapmarket participants. These final ruleswill leverage the Commission’s currentposition and transaction reportingprograms by requiring the electronicsubmission of trader identification andmarket participant data on amendedForms 102 and 40, and on new Form 71.The new and amended forms require thereporting of certain trading accountsactive on reporting markets that aredesignated contract markets or swapexecution facilities. Among otherinformation, the forms collectownership and control information withrespect to both position-based specialaccounts and trading accounts that meetspecified volume-based reporting levels.DATES: Effective date: February 18, 2014.Compliance date: The compliancedate will be delayed by an additional180 days, with the result that thecompliance date of these final rules willbe August 15, 2014.FOR FURTHER INFORMATION CONTACT:Sebastian Pujol Schott, AssociateDirector, Division of Market Oversight(‘‘DMO’’), at 202–418–5641 or sps@cftc.gov; Mark Schlegel, SpecialCounsel, DMO, at 202–418–5055 ormschlegel@cftc.gov; Brian Robinson,Attorney Advisor, DMO, at 202–418–5385 or brobinson@cftc.gov; or JamesOuten, Industry Economist, DMO, at202–418–5710 or jouten@cftc.gov;Commodity Futures TradingCommission, Three Lafayette Centre,1155 21st Street NW., Washington, DC20581.SUPPLEMENTARY INFORMATION:SUMMARY:sroberts on DSK5SPTVN1PROD with RULESTable of ContentsI. BackgroundA. Overview of Final RulesB. Benefits Derived From Final RuleII. Statutory Framework for PositionReporting and Trader and AccountIdentificationIII. Current Trader and AccountIdentification ProgramsA. Futures Large Trader Reporting—Current Forms 102 and 40VerDate Mar 15 201020:54 Nov 15, 2013Jkt 232001i. Identification of Special Accounts—Current Form 102ii. Statement of Reporting Trader—CurrentForm 40B. Large Trader Reporting for PhysicalCommodity Swaps—102S and 40SFilingsIV. Summary of 2010 and 2012 NPRMsV. Summary of New and Amended FormsAdopted in These Final RulesA. Position-Triggered Form 102A (SpecialAccounts)i. Special Accounts and ReportablePositionsii. 102A Form Requirementsiii. Timing of 102A Reportingiv. Timing of 102A Change Updates andRefresh UpdatesB. Volume-Triggered Form 102B (VolumeThreshold Accounts)i. Volume Threshold Accounts andReportable Trading Volume Levelii. 102B Form Requirementsiii. Timing of 102B Reportingiv. Timing of 102B Change Updates andRefresh UpdatesC. Position-Triggered Form 102S(Consolidated Accounts)i. 102S Form Requirementsii. Timing of 102S Reporting, ChangeUpdates and Refresh UpdatesD. Form 71 (Omnibus Accounts and SubAccounts)E. New Form 40 (Reporting Traders)VI. Data Submission Standards andProceduresA. OverviewB. Schedule of Effective Date andCompliance DateVII. Review of NPRM and Summary of FinalRulesA. Part 15i. § 15.00(q)—Reporting Marketii. § 15.00(t)—Controliii. § 15.00(u)—Reportable Trading Volumeiv. § 15.00(v)—Direct Market Accessv. § 15.00(v)—Omnibus Accountvi. § 15.00(w)—Omnibus AccountOriginatorvii. § 15.00(x)—Volume Threshold Accountviii. § 15.00(y)—Omnibus VolumeThreshold Accountix. § 15.00(z)—Omnibus Reportable SubAccountx. § 15.00(aa)—Reportable Sub-Accountxi. § 15.00(bb)—Trading AccountController; § 15.00(cc)—VolumeThreshold Account Controller;§ 15.00(dd)—Reportable Sub-AccountControllerxii. § 15.01(c)—Persons Required To Reportxiii. § 15.02—Reporting Formsxiv. § 15.04—Reportable Trading VolumeLevelB. Part 17i. § 17.01(a)—Identification of SpecialAccounts (via 102A)ii. § 17.01(b)—Identification of VolumeThreshold Accounts (via 102B)iii. § 17.01(c)—Identification of OmnibusAccounts and Sub-Accounts (via 71)iv. § 17.01(d)—Exclusively Self-ClearedContractsv. § 17.01(e)—Identification of OmnibusAccounts and Sub-Accountsvi. § 17.02(b)—Section 17.01(a) Reports(via 102A)PO 00000Frm 00002Fmt 4701Sfmt 4700vii. § 17.02(c)—Section 17.01(b) Reports(via 102B)viii. § 17.03(a)–(g)—Delegation ofAuthority to the Director of the Office ofData and Technology or the Director ofthe Division of Market OversightC. Part 18i. § 18.04—Statement of Reporting Traderii. § 18.05—Maintenance of Books andRecordsD. Part 20i. § 20.5—Series S FilingsVIII. Related MattersA. Paperwork Reduction Acti. Overviewii. Information To Be Providediii. Total Reporting and RecordkeepingCosts; Methodology Used To EstimateCostsiv. Reporting Burdens—New and RevisedFormsv. Recordkeeping Burdens—Revised§ 18.05B. Consideration of Costs and Benefitsi. Backgroundii. The Statutory Requirement for theCommission To Consider the Costs andBenefits of Its Actionsiii. Commission Request for CommentsRegarding Cost and Benefit Estimatesiv. Methodology Used To Estimate Costsv. Costs and Benefits of IndividualReporting Forms and Reporting andRecordkeeping Requirementsvi. Comments Regarding Costs and Benefitsvii. Consideration of Alternativesviii. Reporting on Form 102Six. Consolidation Form Proposed by FIAx. Section 15(a) FactorsC. Regulatory Flexibility ActI. BackgroundA. Overview of Final RulesThe CFTC’s large trader reportingrules (also referred to herein as the‘‘reporting rules’’) are contained in parts15 through 21 of the Commission’sregulations.1 The reporting rules arecurrently structured to collectinformation with respect to positions in‘‘open contracts,’’ 2 including: (1)Information necessary to identifypersons who hold or control ‘‘reportablepositions’’ 3 in open contracts (viacurrent Form 40); and (2) informationnecessary to identify ‘‘specialaccounts’’ 4 (via current Form 102).These final rules modify the current1 17 CFR parts 15 through 21. These final rulesgenerally relate to parts 15, 17, 18 and 20 of theCommission’s regulations.2 ‘‘Open contract’’ means any commodity orcommodity option position held by any person onor subject to the rules of a board of trade whichhave not expired, been exercised, or offset. See§§ 1.3(t) and 15.00(n).3 A ‘‘reportable position’’ is defined in § 15.00(p)as any open contract position that at the close ofthe market on any business day equals or exceedsthe Commission’s reporting levels specified in§ 15.03.4 A ‘‘special account’’ is defined in § 15.00(r) asany commodity futures or option account in whichthere is a reportable position.E:\FR\FM\18NOR2.SGM18NOR2

Federal Register / Vol. 78, No. 222 / Monday, November 18, 2013 / Rules and Regulationssroberts on DSK5SPTVN1PROD with RULESreporting rules and forms as theypertain to positions in open contracts.Specifically, the Commission isexpanding the reporting rules and formsso that they may also be used to identify‘‘volume threshold accounts,’’ definedas individual trading accounts thattrigger volume-based reportingthresholds on a reporting market 5 thatis a registered entity under sections1a(40)(A) or 1a(40)(D) of the CommodityExchange Act (‘‘CEA’’ or ‘‘Act’’) (i.e., adesignated contract market (‘‘DCM’’) ora swap execution facility (‘‘SEF’’)),regardless of whether such activityresults in reportable positions.6 Volumethreshold accounts associated withDCMs and SEFs will be required to bereported by clearing members, asdiscussed in sections V(B) and VIIbelow. The Commission notes thatvolume threshold accounts couldreflect, without limitation, trading infutures, options on futures, swaps, andany other products traded on or subjectto the rules of a DCM or SEF.The amendments to the reportingrules and forms will achieve threeprimary purposes. First, they willexpand and subdivide current Form 102into a new Form 102 (‘‘New Form 102’’),partitioned into three sections: Section102A for the identification of positionbased special accounts (‘‘102A,’’ ‘‘Form102A,’’ or ‘‘New Form 102A’’); section102B for the collection of ownershipand control information from clearingmembers on volume threshold accountsassociated with DCMs or SEFs (‘‘102B,’’‘‘Form 102B,’’ or ‘‘New Form 102B’’);and section 102S for the submission of102S filings for swap counterparty andcustomer consolidated accounts withreportable positions (‘‘102S,’’ ‘‘Form102S,’’ or ‘‘102S filings’’). Second, theamendments will enhance theCommission’s surveillance and largetrader reporting programs for futures,options on futures, and swaps througha variety of enhancements, including:Requiring the reporting on Form 102Aof the trading accounts that compriseeach special account; requiring thereporting of certain omnibus accountinformation on Form 71 (‘‘Form 71’’ or‘‘New Form 71’’) upon special call by5 ‘‘Reporting market’’ is defined in current§ 15.00(q) as a designated contract market,registered entity under section 1a(29) of the Act,and unless determined otherwise by theCommission, a derivatives transaction executionfacility. By way of these final rules, the Commissionis revising § 15.00(q) to define reporting market asa designated contract market or a registered entityunder section 1a(40) of the Act. This revision istechnical in nature, and serves to conform§ 15.00(q) with recent amendments to the Act. Seeinfra sections VII and IX.6 See infra section VII and IX for a discussion ofthe definition of volume threshold account.VerDate Mar 15 201020:54 Nov 15, 2013Jkt 232001the Commission; 7 updating Form 40(‘‘New Form 40’’); and integrating thesubmission of 102S and 40S filings intothe general Form 102 and Form 40reporting program. Finally, these ruleswill provide for the electronicsubmission of Forms 102, 40, and 71through either a web portal or secureFTP transmission.B. Benefits Derived From Final RulesThe benefits of reporting through adedicated ownership and control report(‘‘OCR’’) were discussed in proposedrulemakings that preceded these finalrules—specifically, the AdvancedNotice of Proposed Rulemakingpublished in July 2009 8 (the ‘‘2009Advanced NPRM’’), the Notice ofProposed Rulemaking published in July2010 9 (the ‘‘2010 OCR NPRM’’) and thesubsequent Notice of ProposedRulemaking published in July 2012 10(the ‘‘NPRM’’). Section IV belowdiscusses the history of certain previousOCR rulemakings in more detail. Asdiscussed in the NPRM, the final ruleswill enhance the Commission’s currenttrade practice and market surveillanceprograms for futures and options onfutures, and facilitate surveillanceprograms for swaps, by expanding theinformation presently collected oncurrent Forms 102 and 40, andintroducing a new informationcollection for omnibus volumethreshold accounts in New Form 71.11The rules will also help implement the102S and 40S filing requirementsadopted in connection with theCommission’s part 20 rules addressinglarge trader reporting for physicalcommodity swaps (discussed below).12Ultimately, the final rules willsignificantly enhance the Commission’sability to identify participants in the7 As explained below, information regarding theowners and controllers of volume thresholdaccounts reported on Form 102B and that areidentified as omnibus accounts (‘‘omnibus volumethreshold accounts’’) will be collected by theCommission directly from originating firms, viaForm 71.8 See Commission, Advanced Notice of ProposedRulemaking: Ownership and Control Report, 74 FR31642 (July 2, 2009).9 See Commission, Notice of ProposedRulemaking: Ownership and Control Report, 75 FR41775 (July 19, 2010).10 See Commission, Notice of ProposedRulemaking: Ownership and Control Reports,Forms 102/102S, 40/40S, and 71, 77 FR 43968 (July26, 2012).11 See id. at 43970. See infra section V for adiscussion of New Form 71 and omnibus volumethreshold accounts.12 See infra section V for a discussion of the 102Sand 40S filing requirements. See also 17 CFR20.5(a) and (b). Final part 20 was published in theFederal Register on July 22, 2011. See Commission,Large Trader Reporting for Physical CommoditySwaps, 76 FR 43851 (July 22, 2011) (‘‘Large TraderReporting for Physical Commodity Swaps’’).PO 00000Frm 00003Fmt 4701Sfmt 470069179derivatives markets and to understandrelationships between trading accounts,special accounts, reportable positions,and market activity. This will enable theCommission to better deter and preventmarket manipulation; deter and detectabusive or disruptive practices (such asmarking the close, ‘‘wash trading,’’ ormoney passing); and better perform riskbased monitoring and surveillancebetween related accounts.As discussed in the NPRM, the finalrules respond, in part, to the increaseddispersion and complexity of trading inU.S. futures markets following theirtransition from localized, open-outcryvenues to global electronic platforms.13Although electronic trading hasconferred important informationalbenefits upon regulators, the resultingincreases in trading volumes, productsoffered, and trader dispersion havecreated equally important regulatorychallenges. Effective surveillance nowrequires automated analysis and patternand anomaly detection involvingmillions of daily trade records 14 andhundreds of thousands of positionrecords 15 present in the surveillancedata sets received daily by theCommission.16 Although the final rulesare partly driven by these developmentsin the U.S. futures markets, as discussedabove, the rules will also facilitate thecreation of a robust surveillanceprogram for swaps that adequatelycaptures information with respect toswap market participants.In order to perform effectivesurveillance, the Commission mustreceive data sets that contain a sufficientnumber of reference points for

trader reporting programs for futures, options on futures, and swaps through a variety of enhancements, including: Requiring the reporting on Form 102A of the trading accounts that comprise each special account; requiring the reporting of certain omnibus account information on Form 71 (‘‘Form 71’’ or