Transcription

Warm-Up?Understanding Checking andDebit AccountsLessonQuestionLesson GoalsLearn about checking and debit accounts.Defineaccount.W2KCompareBalance a.fees and benefits.Words to KnowFill in this table as you work through the lesson. You may also use the glossaryto help you.debitdepositor taking money out of an accountto an accountaddingelectronic funds system of moving money from onetransferwithout any paper money exchanging handsto anotheroutstandingoverdrawnmoney than was available taken out of anhavingaccount Edgenuity, Inc.1

InstructionUnderstanding Checking andDebit AccountsSlide2Describing a Checking AccountA checking account is a service provided bythat allows customersto deposit money at the bank. The money isprotected. Customers can take money out of their accounts by writing checks. The amount of money in an account is called the5/241300Bob Jim SmithTwenty and 00100Skateboard Edgenuity, Inc.Billy Jim Smith2

InstructionUnderstanding Checking andDebit AccountsSlide2Identifying DepositsA deposit puts money into a bank account. Checks or cash using aslip Checks or cash using an automated teller machine (ATM) Online transfer offrom one account to another Electronic Funds Transfer (EFT) Money is moved electronically from one(direct deposit).to another501005/23/2013Billy Jim Smith150 Edgenuity, Inc.300

InstructionUnderstanding Checking andDebit AccountsSlide4Identifying DebitsA debit, or withdrawal, is Write amoney from an account.to another person Present aslip Use an ATM/debit card Perform antransfer Make online bill payments ()1/1ABC Co.Twenty five and 00100Phone call Edgenuity, Inc.John Smith411

InstructionUnderstanding Checking andDebit AccountsSlide7Balancing a Checking Account Aregister or computer software is generally used to make surechecking accounts remain balanced. Reasons to balance a checking account: Know how much money is in the account at any time Track monthly earnings/spending for a Prevent the account from being overdrawn An account is overdrawn when more money isthan is in the account. Check for bank Edgenuity, Inc.5

Understanding Checking andDebit AccountsInstructionSlide7Using a Check RegisterCheckDescription ofDateNumberTransaction(–)Debit ( ) DepositsBalanceBeginningBalance00193/15bicycle tire3/16present125.36 36.51Balancing a Checking AccountBalancing a checking account meansyourwiththe bank’s records to make sure they match.Account Statement2/16/13-3/16/13Account Number 12345678Deposits3/16DepositTotal DepositsWithdrawals#0013/15Total ChecksTotal Other WithdrawalsTotal WithdrawalsBalance as of 3/16 Edgenuity, Inc.6 50.00 50.00 36.51 36.51 0 36.51 138.85

InstructionUnderstanding Checking andDebit AccountsSlide9Using the Worksheet to BalanceAccount Balance Calculation Worksheet1. Enter the ending balance shown on your statement. 2. Enter the total of all outstanding deposits. 3. Calculate the subtotal. (Add parts 1 and 2). 4. Enter the total of all outstanding withdrawals. 5. Calculate the ending balance. (Subtract part 4.) Outstanding transactions are those that did not reach thedate of the bank Edgenuity, Inc.736.0020.00before the

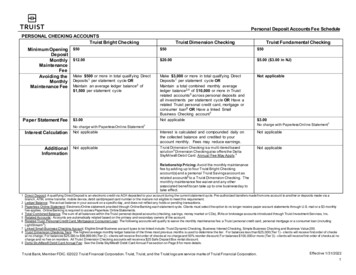

InstructionUnderstanding Checking andDebit AccountsSlide12Analyzing a Checking AccountMinimumInterestWhich bankis best?MonthlyServiceChargeOverdrawATMUsageand Fees Edgenuity, Inc.Annual8

InstructionUnderstanding Checking andDebit AccountsSlide12Comparing Checking AccountsMinimum BalanceAccount AAccount BAccount C 500 250 1000.2%0%0% 35 per overdraw 25 per overdraw 0 for ABC bankATMs 3 for non-ABCbank ATMs 3 per transaction 0 0 10 12 0 if linked withOverdraw Feesaccount or 40 peroverdrawATM Usage/Fees 0 for all ATMs 10 or 0 withMonthly Feedeposit 0 Edgenuity, Inc.9

Summary?Understanding Checking andDebit AccountsLessonQuestionWhat is a checking account?Answer2Review: Key Concepts Deposits are moneyan account.toare money taken from an account. Transfers can be eitherHow do you balance a checkbook?How do you know which amounts toadd and which amounts to subtract?You write down your startingamount. Any money that you putinto your account, you add. Anymoney that you take out, yousubtract.or debits. Keep your account balanced to besure it does not become. Compare banks by learning aboutinterest, minimum balance, ATM fees,overdraft protection, overdrawn fees,monthly Edgenuity, Inc.fees, and annual fees.10

SummaryUnderstanding Checking andDebit AccountsUse this space to write any questions or thoughts about this lesson. Edgenuity, Inc.11

Balancing a Checking Account Balancing a checking account means your with the bank's records to make sure they match. Account Statement 2/16/13-3/16/13 Account Number 12345678 Deposits 3/16 Deposit 50.00 Total Deposits 50.00 Withdrawals #001 3/15 36.51 Total Checks 36.51 Total Other Withdrawals 0 Total Withdrawals 36.51 Balance as of 3/ .