Transcription

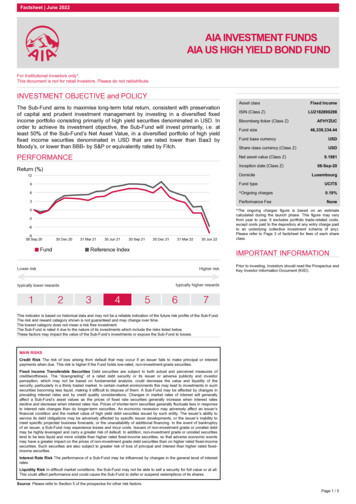

Factsheet June 2022AIA INVESTMENT FUNDSAIA US HIGH YIELD BOND FUNDFor Institutional Investors only*.This document is not for retail investors. Please do not redistribute.INVESTMENT OBJECTIVE and POLICYThe Sub-Fund aims to maximise long-term total return, consistent with preservationof capital and prudent investment management by investing in a diversified fixedincome portfolio consisting primarily of high yield securities denominated in USD. Inorder to achieve its investment objective, the Sub-Fund will invest primarily, i.e. atleast 50% of the Sub-Fund’s Net Asset Value, in a diversified portfolio of high yieldfixed income securities denominated in USD that are rated lower than Baa3 byMoody’s, or lower than BBB- by S&P or equivalently rated by Fitch.PERFORMANCEAsset classISIN (Class Z)Bloomberg ticker (Class Z)Fund sizeAFHYZUC46,339,334.44USDShare class currency (Class Z)USDInception date (Class Z)Domicile12LU2182890298Fund base currencyNet asset value (Class Z)Return (%)Fixed Income9.198108-Sep-20Luxembourg9Fund typeUCITS6 Ongoing charges0.19%3Performance FeeNone0-3-6-908 Sep 2030 Dec 20Fund31 Mar 2130 Jun 2130 Sep 2130 Dec 2131 Mar 2230 Jun 22Reference IndexLower risktypically lower rewards The ongoing charges figure is based on an estimatecalculated during the launch phase. This figure may varyfrom year to year. It excludes portfolio trade-related costs,except costs paid to the depository at any entry charge paidto an underlying collective investment scheme (if any).Please refer to Page 3 of factsheet for fees of each shareclass.IMPORTANT INFORMATIONHigher riskPrior to investing, Investors should read the Prospectus andKey Investor Information Document (KIID).typically higher rewardsThis indicator is based on historical data and may not be a reliable indication of the future risk profile of the Sub-Fund.The risk and reward category shown is not guaranteed and may change over time.The lowest category does not mean a risk free investment.The Sub-Fund is rated 4 due to the nature of its investments which include the risks listed below.These factors may impact the value of the Sub-Fund’s investments or expose the Sub-Fund to losses.MAIN RISKSCredit Risk The risk of loss arising from default that may occur if an issuer fails to make principal or interestpayments when due. This risk is higher if the Fund holds low-rated, non-investment-grade securities.Fixed Income Transferable Securities Debt securities are subject to both actual and perceived measures ofcreditworthiness. The “downgrading” of a rated debt security or its issuer or adverse publicity and investorperception, which may not be based on fundamental analysis, could decrease the value and liquidity of thesecurity, particularly in a thinly traded market. In certain market environments this may lead to investments in suchsecurities becoming less liquid, making it difficult to dispose of them. A Sub-Fund may be affected by changes inprevailing interest rates and by credit quality considerations. Changes in market rates of interest will generallyaffect a Sub-Fund’s asset values as the prices of fixed rate securities generally increase when interest ratesdecline and decrease when interest rates rise. Prices of shorter-term securities generally fluctuate less in responseto interest rate changes than do longer-term securities. An economic recession may adversely affect an issuer’sfinancial condition and the market value of high yield debt securities issued by such entity. The issuer’s ability toservice its debt obligations may be adversely affected by specific issuer developments, or the issuer’s inability tomeet specific projected business forecasts, or the unavailability of additional financing. In the event of bankruptcyof an issuer, a Sub-Fund may experience losses and incur costs. Issuers of non-investment grade or unrated debtmay be highly leveraged and carry a greater risk of default. In addition, non-investment grade or unrated securitiestend to be less liquid and more volatile than higher rated fixed-income securities, so that adverse economic eventsmay have a greater impact on the prices of non-investment grade debt securities than on higher rated fixed-incomesecurities. Such securities are also subject to greater risk of loss of principal and interest than higher rated fixedincome securities.Interest Rate Risk The performance of a Sub-Fund may be influenced by changes in the general level of interestrates.Liquidity Risk In difficult market conditions, the Sub-Fund may not be able to sell a security for full value or at all.This could affect performance and could cause the Sub-Fund to defer or suspend redemptions of its shares.Source: Please refer to Section 5 of the prospectus for other risk factors.Page 1 / 5

AIA US HIGH YIELD BOND FUNDPERFORMANCECumulative Returns (%)Annualised Returns (%)1m3mYTD1y3y(p.a)Class Z-7.0-10.3-14.9-13.4- Benchmark-6.8-10.0-14.1-12.6-Relative Return-0.22-0.27-0.78-0.71-10 - ICE BofAML US High Yield Constrained IndexBenchmark Performance represents the following: Sep 08 2020 to Jan 09 2022 - (ICE BofAML BB-B US High Yield Constrained Index); Jan 10 2022 onwards - (ICE BofAML US High YieldConstrained Index)Past performance is not a guide to future performance.Please refer to Section 5 of the prospectus for other performance & risk factors.TOP 10 HOLDINGS (%)1.CCO Holdings LLC 4.5% 15/08/20301.12.Hilton Domestic Operating Co Inc 3.75% 01/05/20290.73.Ford Motor Credit Co LLC 5.125% 16/06/20250.64.MPT Operating Pship LP MPT Fin 4.625% 01/08/20290.65.Ford Motor Credit Co LLC 4.125% 17/08/20270.66.MSCI Inc 4% 15/11/20290.67.DIRECTV Holdings LLC 5.875% 15/08/20270.68.American Builders Contractors Supp 4% 15/01/20280.69.IIVI Inc 5% 15/12/20290.610.180 Medical Inc 3.875% 15/10/20290.6COUNTRY WEIGHTS (%)USADURATION WEIGHTS (%)91.80 - 1 Year0.4Canada3.71 - 3 Years11.7United Kingdom1.43 - 5 Years42.3France1.15 - 10 Years45.0Netherlands0.510 r Countries0.3SECTOR WEIGHTS (%)0.7RATING WEIGHTS (%)Consumer, Cyclical22.7AAA0.0Consumer, Non-cyclical22.3AA gy11.4A 0.0Financial6.5A0.0Technology5.2A-0.0Basic Materials3.4BBB 0.0Utilities1.5BBB0.0BBBOthersDerivativesNote: Due to rounding limitations, the summation of (%)s might not be an exact 100%.0.0100.00.0Page 2 / 5

AIA US HIGH YIELD BOND FUNDSHARE CLASS mMinimum MinimumsalesFee /Distributionmanagement Offerinitialsubsequent Redemption HoldingchargesConversionfrequencyfee% (max)Pxinvestment investmentAmountAmount% (max)FeeZUSDAFHYZUC LU2182890298 2020-09-08 Up to 5%IDQUSDAFHYIUQLU2182890025 2020-09-11 Up to 5%0%.USD 10Up to 1%USD20mUSD100,000 USD100,000 USD20mN/AUp to 0.75% USD 10Up to 1%USD10mUSD100,000 USD100,000 USD10mQuarterlyEx-dateDividendper shareNANA2022-06-15 0.113941Distributions are not guaranteed and may fluctuate. Past distributions are not necessarily indicative of future trends, which may be lower. Distribution payouts and its frequency aredetermined by the Board of Directors and should not be confused with the Fund's performance, rate of return or yield. Any payment of distributions may result in an immediate decrease inthe net asset value per share. Please refer to Section 7.2 of the prospectus for dividend distribution policy.For more information about charges, please see section charges and expenses of the prospectus of the UCITs, which is available at : www.aia.com/en/funds-informationCumulative Returns (%)Annualised Returns (%)Currency1m3mYTD1y3y(p.a)5y(p.a)10 -4.5 BenchmarkUSD-6.8-10.0-14.1-12.6----3.2Relative 15.1-13.8----4.9 BenchmarkUSD-6.8-10.0-14.1-12.6----3.2Relative ReturnUSD-0.26-0.39-1.00-1.15----1.67Share classZFundIDQFund ICE BofAML US High Yield Constrained IndexBenchmark Performance represents the following: Sep 08 2020 to Jan 09 2022 - (ICE BofAML BB-B US High Yield Constrained Index); Jan 10 2022 onwards - (ICE BofAML US High YieldConstrained Index)Past performance is not a guide to future performance.Please refer to Section 5 of the prospectus for other performance & risk factors.Page 3 / 5

AIA US HIGH YIELD BOND FUNDCOMMENTARYCommentary Sources1. AIA Investment Management Pte Ltd2. AIA Investment Funds2. PIMCO Asia Pte LtdEven within an already challenging year for markets, performance across assetclasses was particularly poor in June. Concerns that the Fed could accelerate thetightening of financial conditions were fueled by a higher than anticipated consumerprice index (CPI) print in the US. Persistent inflation, and increasing recessionconcerns were main contributors to the sell-off in markets. Within equities, theS&P500 lost 8.3%, while the MSCI World lost 9.3% in June. US 10-year yields roseto 3.47% in the run up to the Federal Open Market Committee (FOMC) meeting,before ending the month at 3.01% up by 17 basis points (bps) versus May. 10-yearUK and German yields rose 13bps and 21bps to 2.23% and 1.33%, respectively.Yields at the front end of the curve moved up across developed markets, with US,UK, and German 2-year increasing 40bps, 26bps, and 14bps to 2.95%, 1.83%, and0.63%, respectively. Within spreads, USD investment grade corporate spreadswidened 24bps to 164bps while EUR investment grade corporate spreads widened52bps to 212bps, up 114bps since the beginning of the year. In high yield credit, USDand EUR spreads widened by 165bps and 164bps, respectively. Finally, oil postedits first monthly decline in 2022, finishing the month 3.15% lower at 109 per barrel(Crude Oil, Brent).In the monetary space, the Fed hiked rates by 75bps following the stronger thanexpected CPI print in June. In conjunction with the hike, the Fed started to reduce itsbalance sheet. In total 48.25bn of treasury securities matured in June, with only theshare in excess of the initial 30bn monthly cap being reinvested. In the MBSmarkets, only prepayments were reinvested this month. The European Central Bank(ECB) continued its hawkish stance amidst elevated inflation prints, announcing anend of net asset purchases for July 1st and preparing the market for a hiking cyclestarting in July. The Bank of England (BOE) raised rates by 25bps in June to combatpersistent price pressures in the UK, as inflation rose to 40-year high in May drivenby energy prices and prices of goods.Looking at macro prints, US CPI increased 1.0% in May, rising 8.6% over the past 12months ending May 2022. In the Euro Area, headline inflation remained elevated at8.1% yoy (Harmonised Index of Consumer Prices) in May – mainly due to increasesin housing, energy, and transportation.Global investment grade (IG) credit spreads widened by 29 bps in June to 156 bps,and the sector returned -2.58% for the month, underperforming like-duration globalgovernment bonds by -1.52%. Global IG spreads widened as rising rates, inflationconcerns, and weaker consumer sentiment weighed on risk sentiment. Global highyield bonds returned -6.99% in June and underperformed like-duration Treasuries by-6.27%. Spreads widened from 502 bps to 666 bps after weak economic data addedto concern about a recession amid aggressive Federal Reserve policy.The AIA US High Yield Fund lost 7.03% for the month, underperforming its referenceindex (ICE BofA US High Yield Constrained Index) by 0.22%.Key contributors to fund performance include security selection within the Packagingand Retailers sector. Key detractors include security selection within the Healthcaresector, and overweight to the Building Materials sector.The Fund continues to favour US exposure, where the managers see better growthprospects. Additionally, the US high yield market is a larger and relatively more liquidmarket which is important in volatile environments, and has a broader and morediverse buyer base. The Fund continues to emphasize on sectors that are asset-richand defensive in nature. The Fund continues to favour Healthcare, which have highquality underlying assets and high barriers to entry while underweighting Wirelines,as fundamentals remain challenging for legacy technologies and long-term ROI isquestionable.Page 4 / 5

AIA US HIGH YIELD BOND FUNDDISCLAIMER*This document is exclusively for use by Institutional Investors as defined under Luxembourg laws and regulations and the Securitiesand Futures Act (Chapter 289 of Singapore) and is not to be used with or distributed directly or indirectly to the public and must not bereproduced, extracted or circulated without prior permission.AIA Investment Funds (“AIAIF”) is an open-ended investment company with variable capital registered in the Grand Duchy ofLuxembourg, which qualifies as an Undertaking for Collective in Transferable Securities under relevant EU legislation. Themanagement company of AIAIF is FundRock Management Company S.A. AIAIF may not be registered in every jurisdiction and thisdocument and any related materials may not be distributed or published in any jurisdiction where it would be contrary to local law orregulation.This document is for information only and is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares ofsecurities or any financial instruments nor does it constitute any investment advice to anyone as it does not have regard to any specificinvestment objective, financial situation or particular needs. Subscriptions for shares of AIAIF can only be made on the basis of itscurrent Prospectus and the Key Investor Information Document (“KIID”) of the relevant sub-fund.Investments in AIAIF are not obligations of, deposits in, guaranteed or insured by AIAIF nor any of its affiliates and are subject toinvestment risks, including the possible loss of the principal amount invested. Prospective investors are invited to further considerthe risk warnings section of the Prospectus and the relevant KIID. This document is solely for information and does not have anyregard to the specific investment objectives, financial or tax situation and the particular needs of any specific person who may receivethis document. No investment strategy or risk management strategy techniques can guarantee returns or eliminate risks in any marketenvironment.Please refer to the offering documents (including, but not limited to the current Prospectus and the KIID) of AIAIF for details on feesand charges, dealing & redemption, product features, risk factors and seek professional advice before making any investmentdecision. The value of shares in any sub-fund of AIAIF and the income accruing to the shares, if any, may fall or rise. Where aninvestment is denominated in a currency other than the base currency of a sub-fund of AIAIF, exchange rates may have an adverseeffect on the value price or income of that investment. Investors should not make any investment decision solely based on thisdocument. In the event that an investor may choose not to seek advice from a financial adviser, the latter should consider carefullywhether an investment into a sub-fund of AIAIF in question is suitable for him.Past performance and the predictions, projections, or forecasts on the economy, securities markets or the economic trendsof the markets are not necessarily indicative of the future or likely performance of the AIAIF.Any sub-fund of AIAIF may use derivative instruments for efficient portfolio management and hedging purposes.This paragraph is only applicable to the distribution share classes of AIAIF. AIAIF may, at its discretion, determine how theearnings of distribution share classes shall be distributed and may declare distributions from time to time. When AIAIF decides to paydividends in respect of a distributing share class out of the capital of the sub-fund of AIAIF or where the dividends in respect of adistributing share class are paid out of gross income of the sub-fund of AIAIF, while the sub-fund of AIAIF's fees and expenses arecharged to or paid out of the capital of the sub-fund of AIAIF, resulting in an increase in distributable income for the payment ofdividends by the sub-fund of AIAIF, such payment of dividends may, in the light of the rules applicable in the jurisdictions where thesub-fund of AIAIF is registered for public distribution, be considered as a payment of dividends out of and effectively out of capitalrespectively, both of which would amount to a return or withdrawal of part of an investor's original investment or from any capital gainsattributable to that original investment. The distributions, including amounts and frequency, are not guaranteed and are subject to thediscretion of AIAIF. Past dividends are not a forecast or projection of future distributions.There is no assurance that any securities discussed herein will remain in the portfolio in the future. All material is compiled fromsources believed to be reliable and correct but accuracy cannot be guaranteed. No warranty of accuracy is given and no liability inrespect or any error or omission is accepted nor liability for damages arising out of any person’s reliance upon the information, opinion,forecast or estimate contained in this document.The above is based on information available as of the date of this document, unless otherwise stated. Any information, opinion or viewpresented is subject to change and AIAIF reserves the right to make any amendments to the information at any time, without notice.Page 5 / 5

AIA US HIGH YIELD BOND FUND Commentary Sources 1. AIA Investment Management Pte Ltd 2. AIA Investment Funds 2. PIMCO Asia Pte Ltd COMMENTARY Even within an already challenging year for markets, performance across asset . such payment of dividends may, in the light of the rules applicable in the jurisdictions where the .