Transcription

AIA 2020-21 ANNUAL PERFORMANCE REPORTANNUAL PERFORMANCEREPORTSuperannuation and investment products issued byAIA Australia Limited30 June 2021ABOUT THIS DOCUMENTPERFORMANCE EXPLAINEDThis document outlines investment performance and investment strategies and objectives for your superannuation orinvestment product issued by AIA Australia Limited. The information and advice contained in this booklet is of ageneral nature and does not take into account your individual objectives, financial situation or needs. Because of this,you should consider the appropriateness of the information having regard to your own circumstances and the relevantPDS and/or policy terms and schedule. Before making a decision to act on any of this information, it is recommendedthat you seek financial advice specific to you. You should seek advice from your taxation adviser in relation to taxationmatters.Unit-linked productsThis document should be read in conjunction with your 2021 Annual Statement.To find out which investment options you are currently invested in, please refer to your Annual Statement.If you would like to change your investments, please contact us using the phone number listed on your AnnualStatement.Your specific sub-product or policy determines which investment options are available toyou and you may not be eligible to invest in all investment options listed against yourproduct in this booklet. Please contact us on the phone number listed on your AnnualStatement for further details.How we calculate performanceReturns are net of investment option fees and costs, taxes and charges (where applicable). Fees that are deducteddirectly from members’ accounts such administration fees are excluded when calculating performance returns.Performance is calculated on the change in the withdrawal unit prices for the period ended 30 June 2021,corresponding to the investment timeframe indicated.Individual net returnsYour individual net return may differ from the returns quoted in this report. Your return depends on the timing oftransactions such as contributions, withdrawals, switches or unit adjustments during the period and your mix ofinvestment options.For the price of units on the dates of any deposits, withdrawals or switches (including any investment options you haveswitched into or out of), please call us on the phone number provided on your annual statement between 8.30am and6pm (AEST/AEDT), Monday to Friday, excluding public holidays.Past performance is not indicative of future performanceReturns are not guaranteed and past performance is not indicative of future returns. Investments can go up and downand there is no guarantee that one investment option will outperform another. The performance of the investmentoptions is generally dependent on economic conditions, investment management, taxation and superannuation laws.Whole of Life and Endowment productsAnnual bonuses are additional to the sum insured and are payable under the same conditions as the sum insured.Reversionary bonuses are guaranteed once declared and added to the policy.Terminal bonuses are not guaranteed and they can increase, decrease, or be removed depending on investmentperformance.The face value of bonuses are paid on death or maturity and are calculated per calendar year. Bonuses are worth lessthan their face value if cashed in early.A smoothing methodology is used when calculating bonuses each year. The rationale for this is to produce declaredbonus rates that are less volatile than the underlying investments. To achieve this, when the returns from theunderlying investments are high, some of these returns will be retained and not included in the bonus declaration forthat year, in order to provide a buffer if investment returns deteriorate. In times of low investment returns, these bufferamounts can then be drawn on to declare a higher bonus amount than would have been possible, if based solely onthe returns of the underlying investments.1[AIA - CONFIDENTIAL]

AIA 2020-2021 ANNUAL PERFORMANCE REPORTContentsABOUT THIS DOCUMENT . 1PERFORMANCE EXPLAINED. 1Unit-linked products . 1How we calculate performance . 1Individual net returns . 1Past performance is not indicative of future performance . 1Whole of Life and Endowment products . 1UNIT LINKED PRODUCTS . 3Performance as at 30 June 2021 . 3Allocated Annuity . 3Business Super Bonds . 3Corporate Super Bonds . 3Deferred Annuity . 4Easy Saver . 4Easy Saver Plus . 4Investment Bond . 5Investment Growth Bond . 8InvestorPlan . 9Lifebuilder . 9LifeLink . 10LifeLink Series 2 . 10LifeLink Series 3 . 10LifeWise Series 4 . 10LifeWise Series 5 . 10Managed Investment Plan . 11Managed Investment Super Plan - Corporate . 11Managed Savings Plan. 11Money Plan . 11Personal Superannuation Bond. 12Private Trustee . 12PruPlan Superannuation . 12PruPlan Superannuation "Unit-Linked" . 12Retirement Accumulation Plan . 13Retirement Investment Plan . 13Rollover Bond . 13Rollover Deferred Annuity . 14Rollover Deposit Plan . 14Rollover Fund . 14Rollover Plan . 15Rollover Plan "S" Series . 16Rollover Plan Goldseal . 16Superannuation Bond . 162[AIA - CONFIDENTIAL]Superannuation Bond “S” Series .17Retirement Accumulation Plan . 36SuperBridge.17Retirement Investment Plan . 36SuperBridge - Investment Linked .18Rollover Bond . 36SuperBridge - New Series .18Rollover Deferred Annuity . 38SuperBridge - Series lll.18Rollover Deposit Plan. 38SuperBridge - Series lV .18Rollover Fund . 38SuperCash.19Rollover Plan . 39SuperPlan Superannuation .19Rollover Plan "S" Series. 40SuperSpan - Limited Offer.19Rollover Plan Goldseal. 40SuperSpan (Limited Offer) Multi Option .19Savings Plan . 40SuperSpan ll Multi Option.19Superannuation Bond . 40SuperSpan Plus .20SuperBridge . 42SuperSpan Plus Series lll .20SuperBridge - Investment Linked . 42Tailored Annuity Plan - Allocated Annuity .21SuperBridge - New Series. 42Umbrella Financial Plan .21SuperBridge - Series lll . 42Umbrella Investment Plan .22SuperBridge - Series lV. 43Umbrella Investment Plan Super .22SuperCash . 43Wealth Portfolio .23SuperPlan Superannuation . 43Wholesale Investment Portfolio .24SuperSpan - Limited Offer . 44Investment option strategies and objectives .25SuperSpan (Limited Offer) Multi Option . 44Allocated Annuity .25SuperSpan ll . 44Business Super Bonds .25SuperSpan ll Multi Option . 44Corporate Super Bonds.25SuperSpan Plus . 44Deferred Annuity .26SuperSpan Plus Series lll. 44Easy Saver .26SuperSpan Plus Series lV . 45Easy Saver Plus .27Tailored Annuity Plan - Allocated Annuity . 45Investment Bond .27Umbrella Financial Plan . 46Investment Growth Bond .31Umbrella Investment Plan . 47InvestorPlan.32Wealth Portfolio . 48Life Umbrella .32Wholesale Investment Portfolio . 49Lifebuilder .33WHOLE OF LIFE AND ENDOWMENT PRODUCTS. 50LifeLink .33Reversionary bonuses: Ordinary . 50LifeLink Series 2 .33Reversionary bonuses: Superannuation . 51LifeLink Series 3 .33Terminal bonuses: Ordinary . 53LifeWise Series 4 .34Terminal bonuses: Superannuation. 53LifeWise Series 5 .34Advance Contribution Account . 55Managed Investment Plan.34Whole of Life and Endowment Asset Allocation as at 30 June 2021 . 55Managed Investment Super Plan - Corporate.34Managed Savings Plan .35Money Plan.35Personal Superannuation Bond .35Private Trustee .36PruPlan Superannuation .36PruPlan Superannuation "Unit-Linked" .36

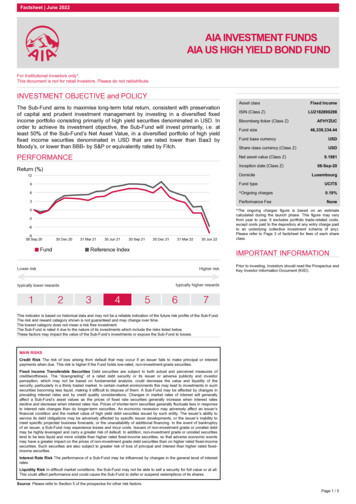

AIA 2020-2021 ANNUAL PERFORMANCE REPORTUNIT LINKED PRODUCTSPerformance as at 30 June 2021Asset allocation (%)As at 30 June 20213 mths6 mths1 yr3 yrs (p.a.)5 yrs (p.a.)10 yrs (p.a.)Sinceinception (p.a.)AustraliansharesGlobal sharesListed propertyAlternativesFixed interestCashCompound annual returns (%)1 mthReturn for specified period (%)Capital 9/20100.000.000.000.0038.4061.60Low3 467.4721/09/201029.0029.400.0019.3017.904.40High6 years1.87%Product andinvestment optionInvestmentoption ameInvestmentoption feesand costs1Allocated AnnuityBusiness Super BondsCapital 9900.000.000.000.0036.0064.00Low3 years1.80%Capital 9900.000.000.000.0036.0064.00Low3 054/01/199420.3020.600.0017.2027.7014.20Medium toHigh5 054/01/199420.3020.600.0017.2027.7014.20Medium toHigh5 7426/03/199029.6030.000.0018.9017.603.90High6 7426/03/199029.6030.000.0018.9017.603.90High6 32/05/199434.3035.300.0021.806.801.80High7 32/05/199434.3035.300.0021.806.801.80High7 19900.000.000.000.0036.0064.00Low3 years1.13%Corporate Super BondsCapital Secure1B3Investment option fees and costs include investment fees, performance and transactional costs.3[AIA - CONFIDENTIAL]

AIA 2020-2021 ANNUAL PERFORMANCE REPORTAsset allocation (%)As at 30 June 2021AustraliansharesGlobal sharesListed 63.722.432.36Guaranteed .85Managed GrowthLM1.104.405.67Managed GrowthPM1.104.39Capital Guaranteed(non participating)AM0.04Capital SecureDM0.44Low3 years1.12%27.7014.20Medium toHigh5 years1.20%17.2027.7014.20Medium toHigh5 years1.19%0.0018.9017.603.90High6 years1.19%30.000.0018.9017.603.90High6 years1.16%34.3035.300.0021.806.801.80High7 ry low3 80Very low3 3023.10Low toMedium3 00100.00Very .900.0019.1017.803.70High6 00.0019.1017.803.70High6 29.900.0019.1017.803.70High6 0012.600.0011.9017.7057.80Very low3 .6011.500.0015.5038.3023.10Low toMedium3 years1.64%5 yrs (p.a.)64.003 yrs (p.a.)36.001 yrInvestmentoption feesand costs16 mthsMinimumSuggestedTimeframeInvestmentoption code3 mthsRiskProfileProduct andinvestment option1 mthCashInceptiondateFixed interestSinceinception (p.a.)Compound annual returns (%)10 yrs (p.a.)Return for specified period (%)Capital hL21.845.89CGSUP10.36Capital Guaranteed(non participating)AMCapital SecureDeferred AnnuityCapital GuaranteedEasy SaverEasy Saver Plus4[AIA - CONFIDENTIAL]

AIA 2020-2021 ANNUAL PERFORMANCE REPORTAsset allocation (%)As at 30 June 2021AustraliansharesGlobal sharesListed 40.040.040.360.42Capital Guaranteed(non participating)CGTSB0.000.000.000.000.90Capital Guaranteed(non participating)CGTSB10.000.000.000.00Capital Guaranteed*6BON0.070.070.07Ordinary FuneralBond6FNR0.070.07Ordinary PassbookRate6HIN0.07Capital GuaranteedCash8BCACapital SecureDAVery LowNoMinimum1.41%17.803.70High6 years1.70%19.1017.803.70High6 years1.74%0.0019.1017.803.70High6 years1.74%12.200.0010.5020.7056.60Very low3 years0.07%0.0012.600.0011.9017.7057.80Very low3 y low3 80Very low3 057.80Very low3 17.7058.30Very low3 1.4017.7058.30Very low3 0011.9017.7057.80Very low3 600.0011.9017.7057.80Very low3 012.600.0011.9017.7057.80Very low3 80.000.000.000.000.00100.00Very 4/12/198711.6011.500.0015.5038.3023.10Low toMedium3 years1.80%5 yrs (p.a.)100.003 yrs (p.a.)0.001 yrInvestmentoption feesand costs16 mthsMinimumSuggestedTimeframeInvestmentoption code3 mthsRiskProfileProduct andinvestment option1 mthCashInceptiondateFixed interestSinceinception (p.a.)Compound annual returns (%)10 yrs (p.a.)Return for specified period (%)Guaranteed 7311.855.375.82Managed GrowthLM1.104.405.6711.785.34Managed GrowthPM1.104.395.6911.81Capital GuaranteedCGORD10.290.871.74Capital GuaranteedCGIB0.040.04Capital Guaranteed(non participating)6BCG0.07Capital Guaranteed(non participating)CGIB4Capital Guaranteed(non participating)Investment Bond5[AIA - CONFIDENTIAL]

AIA 2020-2021 ANNUAL PERFORMANCE REPORTAsset allocation (%)As at 30 June 2021AustraliansharesGlobal sharesListed 00.000.150.21Guaranteed CashSSGB0.000.000.000.000.30Guaranteed CashSSGA0.000.000.000.00Guaranteed CashUW0.000.000.00Australian FixedInterestZB40.270.61Fixed InterestFI93NG0.24Capital StableCAPSNGCapital StableCS2NGLow toMedium3 years1.66%38.8022.90Very Low3 years1.33%0.000.00100.00Very LowNoMinimum1.66%0.000.000.00100.00Very LowNoMinimum1.76%0.000.000.000.00100.00Very LowNoMinimum1.40%0.000.000.000.000.00100.00Very .00Very 0100.00Very 00.00100.00Very 00.000.00100.00Very 00.000.000.00100.00Very 0.000.000.000.00100.00Very 9940.000.000.000.00100.000.00Med3 0.000.000.000.00100.000.00Med3 9411.6011.500.0015.5038.3023.10Low toMedium3 9411.6011.500.0015.5038.3023.10Low toMedium3 years1.86%5 yrs (p.a.)23.103 yrs (p.a.)38.301 yrInvestmentoption feesand costs16 mthsMinimumSuggestedTimeframeInvestmentoption code3 mthsRiskProfileProduct andinvestment option1 mthCashInceptiondateFixed interestSinceinception (p.a.)Compound annual returns (%)10 yrs (p.a.)Return for specified period (%)Capital SecureDA40.441.871.563.702.392.32Capital 0.000.000.00Guaranteed CashVY0.000.00Guaranteed CashVY40.00Guaranteed CashSOGBGuaranteed Cash6[AIA - CONFIDENTIAL]

AIA 2020-2021 ANNUAL PERFORMANCE REPORTAsset allocation (%)As at 30 June 2021AustraliansharesGlobal sharesListed 24.445.77Managed GrowthLB1.104.22Managed GrowthPB41.11Managed GrowthSOMBManaged GrowthLow toMedium3 years1.96%38.3023.10Low toMedium3 years1.56%19.1017.803.70High6 years1.92%0.0019.1017.803.70High6 years1.59%29.900.0019.1017.803.70High6 years1.84%29.5029.900.0019.1017.803.70High6 gh6 70High6 803.70High6 018.203.50High6 18.9017.604.30High6 0.0019.1017.803.70High6 29.900.0019.1017.803.70High6 9.5029.900.0019.1017.803.70High6 98229.5029.900.0019.1017.803.70High6 01/198229.5029.900.0019.1017.803.70High6 years1.28%Managed 98329.3029.800.0019.2018.203.50High6 years1.63%Managed 229.3029.800.0019.2018.203.50High6 years1.65%Managed 8929.3029.800.0019.2018.203.50High6 years1.76%5 yrs (p.a.)23.103 yrs (p.a.)38.301 yrInvestmentoption feesand costs16 mthsMinimumSuggestedTimeframeInvestmentoption code3 mthsRiskProfileProduct andinvestment option1 mthCashInceptiondateFixed interestSinceinception (p.a.)Compound annual returns (%)10 yrs (p.a.)Return for specified period (%)Capital StableCS93NG0.411.791.403.422.112.05Capital dB93NG1.08BalancedBALI-NBalanced7[AIA - CONFIDENTIAL]

AIA 2020-2021 ANNUAL PERFORMANCE REPORTAsset allocation (%)As at 30 June 2021Listed ian Equities8BAE1.166.077.4518.856.257.53Australian SharesYB41.166.067.3018.546.16Australian SharesWS11.427.469.0424.40Equity ProfileEPNG1.274.626.46Equity ProfileEP93NG1.264.60Equity ProfileSEPNG1.28International Equities8BIECashGlobal shares99.40Global PropertySecuritiesFixed interestAustralianshares0.005 yrs (p.a.)0.003 yrs (p.a.)2/11/19981 yr5.176 mths5.81Investmentoption code3 mthsInceptiondateProduct andinvestment option1 mthSinceinception (p.a.)Compound annual returns (%)10 yrs (p.a.)Return for specified period ption feesand costs10.000.60Very High7 years1.74%0.000.00Very High7 years1.53%0.000.000.00Very High7 years1.55%0.000.000.000.00Very High7 years1.67%35.500.0020.307.302.00High7 years1.86%34.9035.500.0020.307.302.00High7 h7 ery High7 years1.51%Investment Growth BondCapital ery low3 years1.31%Capital 30/03/19930.000.000.000.000.00100.00Very LowNoMinimum1.04%NC - 0.000.000.000.000.00100.00Very LowNoMinimum0.85%NC - /03/201311.6011.500.0015.5038.3023.10Low toMedium3 years1.24%Fixed 3/19930.000.000.000.00100.000.00Med3 years1.31%NC - Global 418/03/20130.000.000.000.00100.000.00Med3 years1.12%Consensus 611.0011.100.0015.0037.3025.60Low toMedium3 0530/03/199311.6011.500.0015.5038.3023.10Low toMedium3 years1.37%8[AIA - CONFIDENTIAL]

AIA 2020-2021 ANNUAL PERFORMANCE REPORTAsset allocation (%)As at 30 June 2021AustraliansharesGlobal sharesListed 1.176.077.3318.766.527.87International Equities3INT2.837.5512.3623.3510.34NC - 90.871.741LUO0.320.98Capital GuaranteedCGORD20.29Capital GuaranteedCGSUP50.36High6 years1.53%17.803.70High6 years1.52%16.4026.3017.10Medium toHigh5 years1.31%0.0019.1017.803.70High6 years1.37%35.500.0020.307.302.00High7 years1.43%0.000.0099.400.000.000.60Very High7 years1.64%18/03/20130.000.0098.000.000.002.00Very High7 years1.49%6.6330/03

AIA 2020-21 ANNUAL PERFORMANCE REPORT 1 [AIA - CONFIDENTIAL] ABOUT THIS DOCUMENT This document outlines investment performance and investment strategies and objectives for your superannuation or investment product issued by AIA Australia Limited. The information and advice contained in this booklet is of a