Transcription

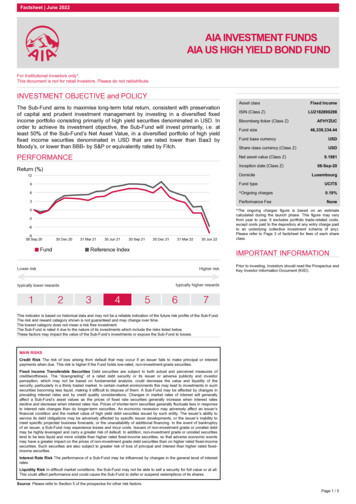

Factsheet November 2020AIA INVESTMENT FUNDSAIA DIVERSIFIED FIXED INCOME FUNDFor Institutional Investors only*.This document is not for retail investors. Please do not redistribute.INVESTMENT OBJECTIVE and POLICYThe Sub-Fund aims to maximise long-term return by investing in a diversified fixedincome portfolio consisting primarily investment grade bonds and other debtsecurities denominated in USD. In order to achieve its investment objective, the SubFund will invest primarily, i.e. at least 50% of the Sub-Fund’s Net Asset Value, inUSD-denominated fixed or floating rate fixed income securities issued bygovernment, agencies and companies globally. The Sub-Fund may invest in a fullspectrum of fixed income securities including corporate bonds, emerging marketsdebt instruments, collateralized loan obligations (CLOs), asset backed securities(ABS), commercial mortgage backed securities (CMBS), taxable municipals, USgovernment or agency obligations, as well as cash and commercial paper.Investments in collateralized loan obligations (CLOs), commercial mortgage backedsecurities (CMBS), asset backed securities (ABS) and emerging market securitiesshall not exceed 20% of the net assets of the Sub-Fund.PERFORMANCEReturn (%)Asset classISIN (Class I)Bloomberg ticker (Class I)Fund sizeFixed IncomeLU1982194364AFDFIUC143,046,730.32Fund base currencyUSDShare class currency (Class I)USDNet asset value (Class I)Inception date (Class I)Domicile11.379805-Jul-19LuxembourgFund typeUCITS Ongoing charges0.68%Performance FeeNone The ongoing charges figure is based on an estimatecalculated during the launch phase. This figure may varyfrom year to year. It excludes portfolio trade-related costs,except costs paid to the depository at any entry charge paidto an underlying collective investment scheme (if any).Please refer to Page 3 of factsheet for fees of each shareclass.18151296IMPORTANT INFORMATION30Prior to investing, Investors should read the Prospectus andKey Investor Information Document (KIID).-3-605 Jul 19Fund31 Oct 1931 Jan 2030 Apr 2030 Jul 2030 Nov 20Reference IndexLower risktypically lower rewardsHigher risktypically higher rewardsThis indicator is based on historical data and may not be a reliable indication of the future risk profile of the Sub-Fund.The risk and reward category shown is not guaranteed and may change over time.The lowest category does not mean a risk free investment.The Sub-Fund is rated 4 due to the nature of its investments which include the risks listed below.These factors may impact the value of the Sub-Fund’s investments or expose the Sub-Fund to losses.MAIN RISKSCounterparty Risk The insolvency of any institutions providing services such as safekeeping of assets or actingas counterparty to derivatives or other instruments, may expose the Sub-Fund to financial loss.Credit Risk The risk of loss arising from default that may occur if an issuer fails to make principal or interestpayments when due. This risk is higher if the Fund holds low-rated, non-investment-grade securities.Source: Please refer to Section 5 of the prospectus for other risk factors.Page 1 / 5

AIA DIVERSIFIED FIXED INCOME FUNDPERFORMANCECumulative Returns (%)Annualised Returns (%)1m3mYTD1y3y(p.a)Class I2.62.59.29.7- Benchmark3.02.510.210.7-Relative Return-0.35-0.02-1.04-1.04-10 y(p.a)SinceInception(p.a)-9.6--10.8---1.235y(p.a)- AIA Diversified Fixed Income Blended BBG/Barclays/JPM BenchmarkPast performance is not a guide to future performance.Please refer to [Section 5] of the prospectus for other performance & risk factors.TOP 10 HOLDINGS (%)1.CBT US 10YR NOTE (CBT)Mar217.12.JPMorgan Chase Co 2.083% VRN 22/04/20261.03.BMW US Capital LLC 3.9% 09/04/20250.94.CVS Health Corp 4.30% 25/03/20280.85.Corp Nacional del Cobre de Chile 3.75% 15/01/20310.86.TMobile USA Inc 3.875% 15/04/20300.77.Citigroup Inc 3.106% VRN 08/04/20260.78.Wells Fargo Co 3.196% VRN 17/06/20270.79.HCA Inc 4.5% 15/02/20270.710.JPMorgan Chase Co 3.96% VRN 29/01/20270.7COUNTRY WEIGHTS (%)USADURATION WEIGHTS (%)80.40 - 1 YearUnited Kingdom4.41 - 3 YearsNaNJapan2.33 - 5 Years19.3Mexico2.05 - 10 Years57.1Belgium1.810 vesOther Countries0.00.9-2.16.5SECTOR WEIGHTS (%)RATING WEIGHTS (%)Financial32.2AAA0.0Consumer, Non-cyclical14.9AA 8.7A 0.8Utilities8.0A3.0Consumer, Cyclical7.5A-14.2Technology5.5BBB 23.75.0BBB33.1-2.1BBB-19.8Basic MaterialsDerivativesOther Sectors1.1OthersDerivativesNote: Due to rounding limitations, the summation of (%)s might not be an exact 100%.5.5-2.1Page 2 / 5

AIA DIVERSIFIED FIXED INCOME FUNDSHARE CLASS iondateInitialRedemptionMinimumMinimumMinimum MinimumAnnualInitialsalesFee /initialsubsequent Redemption Holdingmanagement OfferchargesConversioninvestment investmentAmountAmountfee% (max)Px% (max)FeeIUSDAFDFIUCLU1982194364 2019-07-05 Up to 3%ZDSUSDAFDFZUSLU1982190701 2019-07-05 Up to 3%0%ZUSDAFDFZUC LU1982194794 2020-05-06 Up to 3%0%IDQUSDAFDFIUQLU2209052336 2020-09-11 Up to 3%Up to 0.50% USD 10DistributionfrequencyEx-dateDividendper shareNANANAUp to 1%USD10mUSD100,000 USD100,000 USD10mUSD 10Up to 1%USD20mUSD100,000 USD100,000 USD20m Semi-annual 2020-06-30 0.159907USD 10Up to 1%USD20mUSD100,000 USD100,000 USD20mNANANAUp to 0.50% USD 10Up to 1%USD10mUSD100,000 USD100,000 USD10mQuarterlyNANADistributions are not guaranteed and may fluctuate. Past distributions are not necessarily indicative of future trends, which may be lower. Distribution payouts and its frequency aredetermined by the Board of Directors and should not be confused with the Fund's performance, rate of return or yield. Any payment of distributions may result in an immediate decrease inthe net asset value per share. Please refer to Section 7.2 of the prospectus for dividend distribution policy.For more information about charges, please see section charges and expenses of the prospectus of the UCITs, which is available at : www.aia.com/en/funds-informationCumulative Returns (%)Share classAnnualised Returns (%)Currency1m3mYTD1y3y(p.a)5y(p.a)10 d BenchmarkUSD3.02.510.210.7---10.8Relative 0.3---10.2ZDSFund BenchmarkUSD3.02.510.210.7---10.8Relative Fund BenchmarkUSD3.02.5-----11.1Relative ReturnUSD-0.30.1------0.7USD2.6------2.0IDQFund BenchmarkUSD3.0------2.2Relative ReturnUSD-0.35-------0.23 AIA Diversified Fixed Income Blended BBG/Barclays/JPM BenchmarkPast performance is not a guide to future performance.Please refer to [Section 5] of the prospectus for other performance & risk factors.Page 3 / 5

AIA DIVERSIFIED FIXED INCOME FUNDCOMMENTARYCommentary Sources1. AIA Investment Management Pte Ltd2. AIA Investment Funds3. BlackRock Financial Mgmt, IncThe resolution of uncertainty around the US election and positive news on thedevelopment of a Covid-19 vaccine drove historic market performance in November.By the end of the month, both the S&P 500 and NASDAQ posted record highs.Credit spreads traded in tandem with equities as the US Investment Grade CreditIndex outperformed duration-adjusted Treasuries by 211 basis points (bps) with theOption Adjusted Spread (OAS) of the Index tightening 19 bps to end the month at100 bps. Post-election, markets priced out a ‘blue wave’ into ‘biden dividedgovernment’ political environment. The implications were largely viewed as lowerexpected fiscal stimulus, more burden on the Fed to support the economy and thepartisan divide keeping a favorable tax and regulatory environment intact. Investorstook the latter to be a huge positive for corporations, especially industries prone toregulation. Later in the month both Pfizer and Moderna announced that theirvaccines were 94% effective and that both companies would apply for emergencyFDA approval. Although risk assets sored on the news, the reality remains that theUS daily case rate has topped 100,000, and many areas of the country could beforced to implement shutdowns in the coming months. In monetary policy, theSecretary of the Treasury, Steven Mnuchin, announced his intention to let severalemergency lending programs expire at the end of December including the Primaryand Secondary Market Corporate Credit facilities. Although this announcement wasunexpected, credit spreads showed little reaction with most investors focusing on thepositive vaccine news. In the primary markets a healthy 122 billion printed duringthe month with the year-to-date issuance standing at staggering 2.07 trillionaccording to Barclay’s data. Toward the end of November, it was announced thatS&P Global agreed to buy IHS Markit in a deal worth 44B that will be 2020’s largestmerger. Regarding earnings, with third quarter reporting nearly completed, S&P 500earnings is poised to drop 6.6% which will be the fourth largest decline since Q32009. Despite the decline, 84% of companies beat EPS estimates suggesting thatwall street analysts were much too pessimistic in their forecast. Over the month thebest-performing sectors were Oil Field Services, Refining, Independent Energy,Midstream and Financial Companies. The worst-performing sectors wereSupranationals, Foreign Agencies, Construction Machinery, Apartment REITs andOffice REITs.November was a strong month for risk assets as President-elect Biden's victoryalongside the potential for a split congress mitigated the tail risk of an elongateddecision process and the potential for what could be viewed as an extreme policyagenda. Market positioning heading into the election was centered around a potential"Blue Wave" scenario, angling for a sharp increase in rates due to heavy issuanceand increased inflationary expectations as a result of significantly more fiscalstimulus. Upon realizing the results, rates settled back down into their recent multimonth range and risk assets rallied on the expectation that policy and regulatoryadjustments may be more limited. Exceptionally positive vaccine results from Pfizerand, a week later, Moderna provided additional boosts to spread asset performance.Spreads were -15-25 tighter on the month, taking index levels back near the preCovid tights. Beta compression remains the focus, with high yield credit, emergingmarket debt, and Covid-exposed sectors all outperforming. As some of the macrouncertainty abated this month the fund participated in both primary and secondarycorporate adds, particularly in the BBBs and down the cap stack. Yield-focusedassets will remain the benefit of a world bereft of income, so the fund continues tolike compression plays, including preferred, emerging market, and curve flatteners.The fund also think that rates will see a bear steepening pattern in 2021, so it ispositioned for short duration, with an underweight to the back end of the curve via USTreasury (UST) futures.Page 4 / 5

AIA DIVERSIFIED FIXED INCOME FUNDDISCLAIMER*This document is exclusively for use by Institutional Investors as defined under Luxembourg laws and regulations and the Securitiesand Futures Act (Chapter 289 of Singapore) and is not to be used with or distributed directly or indirectly to the public and must not bereproduced, extracted or circulated without prior permission.AIA Investment Funds (“AIAIF”) is an open-ended investment company with variable capital registered in the Grand Duchy ofLuxembourg, which qualifies as an Undertaking for Collective in Transferable Securities under relevant EU legislation. Themanagement company of AIAIF is FundRock Management Company S.A. AIAIF may not be registered in every jurisdiction and thisdocument and any related materials may not be distributed or published in any jurisdiction where it would be contrary to local law orregulation.This document is for information only and is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares ofsecurities or any financial instruments nor does it constitute any investment advice to anyone as it does not have regard to any specificinvestment objective, financial situation or particular needs. Subscriptions for shares of AIAIF can only be made on the basis of itscurrent Prospectus and the Key Investor Information Document (“KIID”) of the relevant sub-fund.Investments in AIAIF are not obligations of, deposits in, guaranteed or insured by AIAIF nor any of its affiliates and are subject toinvestment risks, including the possible loss of the principal amount invested. Prospective investors are invited to further considerthe risk warnings section of the Prospectus and the relevant KIID. This document is solely for information and does not have anyregard to the specific investment objectives, financial or tax situation and the particular needs of any specific person who may receivethis document. No investment strategy or risk management strategy techniques can guarantee returns or eliminate risks in any marketenvironment.Please refer to the offering documents (including, but not limited to the current Prospectus and the KIID) of AIAIF for details on feesand charges, dealing & redemption, product features, risk factors and seek professional advice before making any investment decision.The value of shares in any sub-fund of AIAIF and the income accruing to the shares, if any, may fall or rise. Where an investment isdenominated in a currency other than the base currency of a sub-fund of AIAIF, exchange rates may have an adverse effect on thevalue price or income of that investment. Investors should not make any investment decision solely based on this document. In theevent that an investor may choose not to seek advice from a financial adviser, the latter should consider carefully whether aninvestment into a sub-fund of AIAIF in question is suitable for him.Past performance and the predictions, projections, or forecasts on the economy, securities markets or the economic trendsof the markets are not necessarily indicative of the future or likely performance of the AIAIF.Any sub-fund of AIAIF may use derivative instruments for efficient portfolio management and hedging purposes.This paragraph is only applicable to the distribution share classes of AIAIF. AIAIF may, at its discretion, determine how theearnings of distribution share classes shall be distributed and may declare distributions from time to time. When AIAIF decides to paydividends in respect of a distributing share class out of the capital of the sub-fund of AIAIF or where the dividends in respect of adistributing share class are paid out of gross income of the sub-fund of AIAIF, while the sub-fund of AIAIF's fees and expenses arecharged to or paid out of the capital of the sub-fund of AIAIF, resulting in an increase in distributable income for the payment ofdividends by the sub-fund of AIAIF, such payment of dividends may, in the light of the rules applicable in the jurisdictions where thesub-fund of AIAIF is registered for public distribution, be considered as a payment of dividends out of and effectively out of capitalrespectively, both of which would amount to a return or withdrawal of part of an investor's original investment or from any capital gainsattributable to that original investment. The distributions, including amounts and frequency, are not guaranteed and are subject to thediscretion of AIAIF. Past dividends are not a forecast or projection of future distributions.There is no assurance that any securities discussed herein will remain in the portfolio in the future. All material is compiled fromsources believed to be reliable and correct but accuracy cannot be guaranteed. No warranty of accuracy is given and no liability inrespect or any error or omission is accepted nor liability for damages arising out of any person’s reliance upon the information, opinion,forecast or estimate contained in this document.The above is based on information available as of the date of this document, unless otherwise stated. Any information, opinion or viewpresented is subject to change and AIAIF reserves the right to make any amendments to the information at any time, without notice.Page 5 / 5

AIA DIVERSIFIED FIXED INCOME FUND Commentary Sources 1. AIA Investment Management Pte Ltd 2. AIA Investment Funds 3. BlackRock Financial Mgmt, Inc COMMENTARY The resolution of uncertainty around the US election and positive news on the development of a Covid-19 vaccine drove historic market performance in November.