Transcription

The Timing of Parimutuel Bets Marco Ottaviani†Peter Norman Sørensen‡May 2006AbstractWe propose a dynamic model of parimutuel betting that addresses the followingthree empirical regularities: a sizeable fraction of bets is placed early, late bets aremore informative than early bets, and proportionally too many bets are placed onlongshots. Exploiting a similarity with Cournot oligopoly, we show that bettorshave an incentive to bet early when they are large and act on common information.Bettors who are instead privately informed and small have an incentive to bet atthe end without access to the information of the others. Longshots (or favorites) arethen less (or more) likely to win than indicated by the market odds.Keywords: Parimutuel betting, timing, oligopoly, information, favorite-longshotbias.JEL Classification: D82 (Asymmetric and Private Information), D84 (Expectations; Speculations), G13 (Contingent Pricing; Futures Pricing), L13 (Oligopoly andOther Imperfect Markets). Earlier versions of this paper were titled “Late Informed Betting and the Favorite-Longshot Bias” and“The Timing of Bets and the Favorite-Longshot Bias”. We thank Marcus Asplund, David Goldreich, Denis Gromb, Johnnie Johnson, Maureen O’Hara, Stefano Sacchetto, Stephen Salant, Lones Smith, XavierVives, Tim van Zandt, Bill Zame, Bill Ziemba, Jeff Zwiebel, and seminar participants at the 2003 NorthAmerican Summer Meetings of the Econometric Society, 2004 European Meetings of the EconometricSociety, Economic Theory Workshop (Odense), Aarhus, Bristol, Copenhagen, Essex, European University Institute, Helsinki, London Business School, London School of Economics, Michigan, Southampton,Tilburg, University College London, and Venice for helpful comments.†Economics Subject Area, London Business School, Sussex Place, Regent’s Park, London NW14SA, England.Phone: 44-20-7262-5050 ext.3778.Fax: 44-20-7402-0718.E-mail:mottaviani@london.edu. Web: http://faculty.london.edu/mottaviani.‡Department of Economics, University of Copenhagen, Studiestræde 6, DK—1455 Copenhagen K, Denmark. Phone: 45—3532—3056. Fax: 45—3532—3000. E-mail: peter.sorensen@econ.ku.dk. Web:http://www.econ.ku.dk/sorensen.

1IntroductionAccording to the efficient market hypothesis, the price of a financial asset is an unbiasedestimate of its fundamental value, reflecting all the information available to the market(Fama (1991)). It has proven difficult to perform direct tests of this hypothesis in regularfinancial markets, due to the lack of exogenous measures of fundamental values of theassets traded.1 Researchers have turned to betting markets, where fundamental values areboth observable and typically exogenous, and have found a number of somewhat puzzlingempirical facts. In this paper, we propose a theoretical explanation for these regularities.Our analysis is based on the institutional features of parimutuel betting markets.2 Theseare mutual markets, in which the total money bet on all outcomes (net of the track take)3is shared proportionally among those who bet on the winning outcome. Typically, bets areplaced in real time, resulting in provisional odds that are publicly displayed and updatedat regular intervals until post time, when betting is closed. Since the payments are madeexclusively on the basis of the final distribution of bets, individual bettors can only takepositions without knowing with certainty the odds they face.4In the context of a horse race, market efficiency predicates that the final distribution ofparimutuel bets is directly proportional to the market’s assessment of the horses’ chances ofwinning. This is because the gross expected payoff of a bet on a horse is equal to the ratioof its probability of winning to the proportion of bets placed on that horse. Equivalently,the expected payoffs on the different horses are equalized when the fraction of money beton each of them is equal to the probability that the horse wins.Starting with Griffith (1949), data on parimutuel bets have been used to test this1Typically, the fundamental values of the assets traded in financial markets are not directly observable.In addition, the performance variables used as proxies of value are not exogenous, being themselves affectedby market prices.2Since its introduction in the nineteenth century, parimutuel betting has become the most commonwagering system at horse-racking tracks throughout the world. Parimutuel schemes are also adopted forbetting on outcomes of many sport events (e.g., soccer and basketball) as well as by lotteries.3The track take includes taxes and other expenses for running the race and the betting scheme.4It is worth contrasting parimutuel betting with the alternative scheme of “fixed odds” betting (cf.Dowie (1976)). In fixed odds betting, bookmakers accept bets at specific, but changing, odds throughoutthe betting period. With fixed odds, the return to any individual bet is therefore not affected by the betsplaced subsequently.1

proposition. The proportion of money bet on a horse has been shown to track closelyits empirical chance of winning, in support of the market efficiency hypothesis. However,three empirical regularities have emerged: A large amount of money is placed just before post time, but sizeable amounts areplaced much earlier (see e.g. Camerer (1998) and National Thoroughbred RacingAssociation (2004)).5 If more information becomes available later, why are so manybets placed well before post time? This is the puzzle of early betting. Late bets tend to contain more information about the horses’ finishing order thanearlier bets (see e.g. Asch, Malkiel and Quandt (1982) and Gandar, Zuber and Johnson (2001)). This is the phenomenon of late informed betting. Horses with short odds (i.e., favorites) tend to win even more frequently than indicated by the final market odds, while horses with long odds (i.e., longshots) win lessfrequently (see e.g. Thaler and Ziemba (1988) and Snowberg and Wolfers (2005)).This is known as the favorite-longshot bias.In this paper we formulate a theoretical model that sheds light on these facts. Themodel posits an exogenous initial distribution of bets placed by outsiders, so that therational insiders can earn non-negative returns despite the presence of a positive tracktake. Each insider has some private information, modeled as an informative signal aboutthe outcome of the race. These informational assumptions are similar to those made inthe market microstructure literature, and applied to fixed-odds betting by Shin (1991and 1992). We focus instead on parimutuel betting markets, in the context of which theempirical evidence reported above has been collected.6In the context of this model, we study the strategic incentives that drive the timing ofbets placed by the insiders. Our starting point is a prevailing intuition that has been firstformulated by Asch, Malkiel and Quandt (1982): “bettors who have inside information5In Camerer’s data set roughly half of the money is placed in the last three minutes before post time,and half (often well) before then.6We refer to Ottaviani and Sørensen (2005) for a comparison of the equilibrium outcomes resulting inparimutuel and fixed-odds betting markets. See also the discussion in Section 6.2

would prefer to bet late in the period so as to minimize the time that the signal is availableto the general public.” We show that this result holds provided that insiders are small, inthe sense that their individual effect on the odds is negligible. In this case, each insiderhas an incentive to wait in order to hide one’s private information and possibly see thatof others. When instead the insiders are large and can affect the odds, they have acountervailing strategic incentive to bet early in order to prevent others from exploitingthe market power stemming from the common information shared among them. In thisobservation lies the main contribution of this paper.To understand our explanation of the early betting puzzle, consider a small numberof bettors who share the same information about the horses’ winning chances, and so arenot concerned about revealing this information. Due to the parimutuel structure, thepayoff per dollar bet on a profitable horse is a decreasing function of the total bets placedon that horse. Bettors are effectively competing in a market with a downward slopingdemand curve, with the final price determined by the final distribution of bets. We showthat bettors have then an incentive to act early, in order to prevent competitors fromunfavorably changing the odds against them (Proposition 1). This strategic incentive toplace early bets is based on the simple fact that parimutuel betting is a Cournot game,and appears not to have been noticed before in the literature.Our explanation of the second regularity – late informed betting – is based on thepresence of private information. We show that when the insiders are “small,” in the sensethat they are price takers and so have no market power, bets are simultaneously placedat post time (Proposition 3). Our analysis reveals that the incentive to bet late is due tothe fact that parimutuel prices are determined by the overall number of orders made inthe market, regardless of when the orders are placed. The information revealed by earlyorders can then be used by other bettors who affect the price to the detriment of the earlybettors. Our result on late informed betting formalizes the conditions needed to verifyAsch, Malkiel and Quandt’s (1982) intuition reported above. This incentive to bet lateis similar to the one that operates in auctions with a fixed deadline (see e.g. Roth and3

Ockenfels (2002)) and in pre-opening markets (Medrano and Vives (2001)).7Our explanation of the third regularity – the favorite-longshot bias – is based on theinformational content of the equilibrium distribution of simultaneous bets, characterized inProposition 2. We argue that the presence of private information introduces a systematicwedge between the final distribution of bets and the market’s beliefs. To understandthis, suppose for the moment that some privately informed insiders bet simultaneouslyat post time. When many (or few) insiders end up betting on the same outcome, whichnow becomes more of a favorite (or longshot), it means that many (or few) had privateinformation in favor of this outcome. If individual bettors knew that many bets wouldhave been placed on that outcome, they would have been even more likely to bet onthat outcome. But the final distribution of bets is not known when betting, so that thisinference can only be made after betting is closed. Intuitively, a disproportionately low (orhigh) fraction of bets are placed on favorites (or longshots), because these bets were placedwithout knowing the final odds (Proposition 4). Despite its simplicity, this explanation ofthe favorite-longshot bias has not been proposed before.8Our results have implications for the design of market mechanism for trading contingentclaims. As discussed by Economides and Lange (2005), the parimutuel structure has beenrecently adopted in new markets for contingent claims on economic statistics, such asUS nonfarm payroll employment figures and European harmonized indices of consumerprices.9 These markets allow traders to hedge risks related to these variables. A majoradvantage of parimutuel markets is that the intermediary managing the system is notexposed to any risk. On the flip side, market participants are subject to risk on the terms7The incentive to delay trade is in contrast to theoretical predictions obtained in the context of regularfinancial markets with continuous trading, in which every order to buy asset A immediately increasesthe price of A, thereby eroding the profitability of later buy orders for A. As shown by Holden andSubrahmanyam (1992) and Back, Cao and Willard (2000), competition among a large enough numberof insiders in regular financial markets tends to result in almost immediate trade. Note that fixed-oddsmarkets considered by Schnytzer and Shilony (2002) are equivalent to regular financial markets. We returnto this comparison with regular financial markets at the end of the paper.8Ottaviani and Sørensen (2004) further analyze this informational explanation. See Section 5.3 for adiscussion of the other explanations proposed in the literature on the favorite-longshot bias.9Since October 2002, Deutsche Bank and Goldman Sachs have been hosting Parimutuel Derivative CallAuctions of options on economic statistics. Baron and Lange (2003) report on the performance of thesemarkets.4

of trade and might have incentives to delay their orders. If traders are small and haveprivate information, they might trade late and place orders mostly on the basis of theirlimited information, without access to information revealed by other market participants.10Parimutuel markets are not conducive to strong market efficiency, due to the incentive topostpone one’s trade and free ride on the private information of others.11In the literature, Koessler and Ziegelmeyer (2002) formulated the first analysis ofparimutuel betting under asymmetric information. They assumed that bettors have binary signals and bet sequentially with exogenous order. We instead allow bettors to havecontinuous signals, as is commonly done in auction theory. In the context of our tractablemodel, we are able to provide a simple characterization of equilibrium betting, offer insightsabout the forces driving the endogenous timing of bets, and derive the favorite-longshotbias.12 We defer a more comprehensive discussion of the literature to Section 5.3.The paper proceeds as follows. We formulate the model in Section 2. In general, betsnot only affect odds but also reveal information to other bettors. We analyze these twoeffects in isolation by considering two versions of the model in turn. In Section 3 weconsider the case in which individual bettors are large enough to have a non-negligibleeffect on the odds, but are not concerned about revealing information. We show that earlybetting results in this case. In Section 4 we turn to the second version of the model in whichthere is a continuum of privately informed bettors, and show that in equilibrium they allpostpone their bets to the end. For this purpose, we characterize the equilibrium of thelast-period simultaneous betting game and then we endogenize the timing by allowing thebettors to decide when to act. In Section 5 we show that the favorite-longshot bias resultswhen the large bettors act early on the basis of public information as well as when theprivately informed bettors delay betting to the last period. We conclude in Section 6 bydiscussing the predictions of our theory. The proofs are collected in Appendix A. AppendixB contains additional details not intended for publication.10See Wolfers and Zitzewitz (2004) for a broad introduction to the informational content of marketgenerated forecasts.11Trade will instead be early if it is based on common information and individual traders have marketpower. But note that these conditions are rather undesirable for the other market participants.12See also Feeney and King (2001) for the characterization of the equilibria in a sequential parimutuelgame with complete information and exogenous order.5

2ModelWe present a stylized model of parimutuel betting on the outcome of a race between twohorses, A and B.13 The winning horse is identified with the state, x {A, B}.Time is discrete and betting is open in a commonly known finite window of time, withperiods denoted by t 0, 1, . . . , T . As explained in detail below, in period t 0 bettorsreceive information about the state. Betting opens at t 1 and closes at t T (posttime). A publicly observable tote board displays in any period the cumulative amountsbet on each horse until post time.14At the racetrack, some bets are placed for recreational purposes based on idiosyncraticpreferences for particular horses, while others are motivated by profit maximization. Eventhough in reality individual bettors could be motivated by a combination of recreation (private value) and profits (common value), for convenience our model separates recreationalfrom profit-maximizing bettors. In this way, we depart from the literature on preferencesfor risk taking, but follow an approach commonly adopted in market microstructure models, in which noise traders are usually separated from informed arbitrageurs.15The amount of exogenously given bets placed on outcome x at time t 1 by unmodeledoutsiders is denoted by n (x).16 For simplicity, we assume that the amount of outsiders’bets is not random and publicly known. Liquidity or noise traders play a similar role inmore traditional models of financial markets.There are I rational bettors, or insiders. The insiders are risk neutral and maximizetheir expected return.17 Thanks to the presence of the outsiders, the insiders are able toderive a non-negative expected return from betting. The insiders are assumed to sharea common prior belief q Pr (A) that horse A is the winner, possibly formed after the13We formulate the model for the simplest case with two horses, but clearly our insights apply to morerealistic settings with a larger number of horses.14For example, the UK’s Tote updates the display every 30 seconds. The assumption of discrete time isrealistic and technically convenient, but is not essential for our results.15Similar results holds when bettors are ex-ante identical and are motivated by the sum of a recreationalutility and the expected monetary payoff of the gamble (see Ottaviani and Sørensen (2004)).16While in betting markets these outsiders often have recreational motives, in hedging markets theirrole could be played by market participants with private values from hedging certain risks.17Payoffs are not discounted, since betting takes place within a short time frame.6

observation of a common signal. We consider two cases: In Section 3 we assume that there is finite number of large insiders who share thesame information. In this case each insider is allowed to bet a variable amount oneither horse. In Section 4 we consider the case with a continuum [0, I] of atomistic insiders, eachendowed with some private information (see Section 4.1). In this case we assumethat each insider faces an identical wealth constraint, being able to bet an amountnormalized to 1. Each insider decides if, when, and whether to bet on x A orx B.The total amount bet by the insiders on outcome x is denoted by m (x).We make the realistic assumption that bets cannot be cancelled once they are made.18The total amount bet by insiders and outsiders is placed in a pool, from which a proportional track take τ is taken. The remaining money is then evenly distributed to thewinning bets. If x is the winner, each unit bet on outcome x yieldsPBy A [n (y) m (y)](1 τ ).n (x) m (x)(1)The insiders know the exact amounts n (A) and n (B) and the other parameters of themodel.3Early Betting with Market PowerIn this section, we show that parimutuel payoffs generate an incentive to bet early. In orderto isolate this incentive, we allow the bettors to be “large”, i.e., to place bets of arbitrary(non-negative) size. A bettor who can make a sizable bet faces an adverse movement inthe odds, and should consider this effect when deciding how much to bet. This market18Typically, patrons are not allowed to cancel their bet after leaving the seller’s window, unless theycan prove to have made a mistake. The limitations on the right to cancel bets are set in order to preventmanipulation and preserve integrity of the wagering process. See e.g., Canada Department of Justice(1991), paragraph 57, and Delaware Harness Racing Commission (1992), rule 9.4.1.3.7

power channel introduces an incentive to bet early, before other bettors place their bet toone’s detriment.Following Hurley and McDonough (1995), we assume that there is a finite number I ofrational bettors who share the same information about the state. Clearly, in this settingthe amounts bet by others cannot then reveal any information.Assume that the common prior belief, the track take and pre-existing bets are such thatq (1 τ ) n (A) / [n (A) n (B)], i.e. the pre-existing market probability is sufficientlylower than the prior belief that it is profitable to bet on A. If bettors i 1, . . . , I placethe amounts m1 , . . . , mI on outcome A, bettor i’s payoff isPn (A) n (B) Ii 1 mimi mi .Ui (mi ) q (1 τ )Pn (A) Ii 1 miThis game is a special version of Cournot’s oligopoly model of quantity competition.To see this, interpret the amount mi as the quantity produced at constant marginal unitcost by firm i. Let the market’s inverse demand curve be equal top (m) q (1 τ )n (A) n (B) m,n (A) m(2)where m is the aggregate quantity.The I bettors play a dynamic Cournot game. As is well known, in the two-playerStackelberg game, the leader would bet a larger amount and earn greater profits than thefollower. By increasing the bet size beyond the static Cournot outcome, the leader pushesthe follower to reply with a smaller amount. When the timing is endogenous, one wouldintuitively expect the insiders to place their bets as soon as possible, in order to profitfrom the early mover advantage.Following Hamilton and Slutsky (1990), we consider an “extended game with actioncommitment”, according to which each bettor first commits to the one period in whichto bet, and in that period decides how much to bet as a function of the betting historyuntil then. At period t, it can be observed how much was bet by each bettor in allprevious periods 1, . . . , t 1, excluding the current period t. In our setting, this timingassumption incorporates the fact that the tote board can be observed, in addition to threeless appealing properties: (i) each bettor can bet only once, (ii) each bettor cannot change8

strategy in reaction to others’ bets as the game proceeds, and (iii) each bettor can observeprecisely the set of bettors who have already bet and are therefore no longer active. Webelieve that this technical timing assumption can be dropped without consequence for theresult, but the assumption conveniently allows us to apply a known result. Matsumura’sProposition 3 allows us to conclude::Proposition 1 With I informed bettors, there are two possible subgame perfect equilibriumoutcomes. In the first equilibrium, all bettors bet at t 1, when they play the static Cournotoutcome. In the second equilibrium, all but one bettor place bets at t 1. Proof. See Appendix A.In every equilibrium, all (but at most one) bettors place simultaneous bets in the firstperiod, immediately after receiving their public information. Intuitively, market powergives an incentive to move early, in order to capture a good share of the money on thetable. This can explain why a sizeable fraction of bets are placed well before betting isclosed – our first puzzle.194Late Betting with Private InformationIn this section, we turn to late informed betting. We assume that there is a continuum [0, I]of small, privately informed insiders, each of whom can make a unit bet. We show thatthe presence of private information introduces an incentive that operates in the oppositedirection to the one identified in the last section. Since bettors are small, their individualpayoffs (1) are not affected by any individual’s bet. This price-taking assumption is theessential feature of our continuum population assumption.20In Section 4.1 we extend the model to allow the insiders to have private information. InSection 4.2, we analyze the simultaneous betting game that takes place in the last period,t T . We show that there exists a unique equilibrium in period T , and characterize the19An alternative explanation for early betting is based on the exogenous preference of bettors for placingbets early. Our explanation for early betting is instead based on the strategic response of insiders to thepresence of outsiders.20With a continuum of bettors, each of them takes the price as given. See our companion paper Ottavianiand Sørensen (2004) for an analysis of simultaneous betting with a finite number of insiders.9

equilibrium strategies. In Section 4.3, we solve the dynamic game by using a backwardsinduction argument. We prove that the insiders postpone their bets until the last period,and characterize the amounts bet on the two horses. In Section 5, we then show that theequilibrium exhibits the favorite-longshot bias.4.1Private InformationPrivate information is believed to be pervasive in horse betting (see e.g. Crafts (1985)).It is modeled as follows. At t 0, before betting begins, each insider i privately observesa signal si . Conditionally on state x, these signals are assumed to be identically andindependently distributed with probability density function f (s x), where the index i hasbeen dropped.21Upon observation of signal s, the prior belief q is updated according to Bayes’ ruleinto the posterior belief p Pr (A s) qf (s A) / [qf (s A) (1 q) f (s B)].22 Thistransformation of s into p determines the conditional distributions of p given x fromthe corresponding distributions of s given x. The posterior belief p is then distributedaccording to the cumulative probability distribution function G on [0, 1]. By the law ofR1iterated expectations, G must satisfy q E[p] 0 p dG (p).23We assume that G is continuous 24 with density g and has full support equal to thebeliefs set [0, 1]. The full support assumption requires that that there are arbitrarilyinformative signal realizations and guarantees the existence of an interior equilibrium.The conditional distributions of the posterior belief p given x play a central role in ouranalysis. By Bayes’ rule, we have p qg (p A) /g (p) and 1 p (1 q) g (p B) /g (p). Thedensities of the posterior beliefs are then g (p A) pg (p) /q and g (p B) (1 p) g(p)/(1 21See Watanabe (1997) for an alternative model of parimutuel betting with a continuum of bettors. Inhis model, the bettors’ heterogeneous beliefs are assumed to be common knowledge. In our model instead,beliefs reflect heterogeneous information about the state.22Note that the case of common information analyzed in Section 2 is a degenerate outcome of this modelresulting when the signals are completely uninformative, so that p q Pr (x A) always.23While the conditional distributions of the signal is our primitive, there is no loss of generality inmaking assumptions directly on G. Any posterior belief distribution with q E [p] can be derived fromthe assumption that the distribution of the signal s is the same as the distribution of the posterior p.24In the presence of discontinuities in the posterior belief distribution, equilibria might involve mixedstrategies. Our results can be extended to allow for these discontinuities.10

q). The monotonicity in p of the likelihood ratio g (p A) /g (p B) [p/ (1 p)] [(1 q) /q]reflects the property that higher beliefs in outcome A are relatively more likely when outcome A is true. This monotonicity implies that G (p A) first-order stochastically dominatesG (p B), so that G (p A) G (p B) for all p (0, 1).4.2Equilibrium Betting in the Last PeriodCumulative bets committed by insiders at end of period T 1 are considered part of theoutside bets n (A) , n (B). The population size I refers to the continuum of insiders whodid not bet before the last period, and G is the cumulative distribution of their posteriorbeliefs. We maintain the assumption that G has full support.25In a Bayes-Nash equilibrium, every rational bettor best replies to a correctly predictedfraction of the insiders who bet on each outcome in each state. Denote by m (y x) theamount bet by the insiders on outcome y {A, B} when state x {A, B} is true. If statex is true, the gross payoff to a bet on outcome x isW (x x) (1 τ )n (A) n (B) m (A x) m (B x) 0.n (x) m (x x)(3)Consider the decision problem of a bettor with belief p. The expected return from aunit bet on outcome A is pW (A A) 1, where p is the probability that horse A wins,W (A A) is the gross payoff from a unit bet on A and 1 is the cost of this unit bet.Similarly, the expected payoff for a bet on B is (1 p) W (B B) 1, and for not bettingis 0. It follows immediately that there exist thresholds beliefs 0 p̂B p̂A 1 such thatthe bettor optimally bets on B when p p̂B , abstains when p̂B p p̂A , and bets on Awhen p p̂A .If the winning probability of horse A implied by the pre-existing bet is not too extremecompared to the track take, in the unique equilibrium insiders bet on both outcomes.Proposition 2 Assume that0 τ min½n (B)n (A),n (A) n (B) n (A) n (B)25¾.(4)We argue below that the case in which G is no longer unbounded (0 G (p) 1 for all p (0, 1))results in a rather trivial last-period game.11

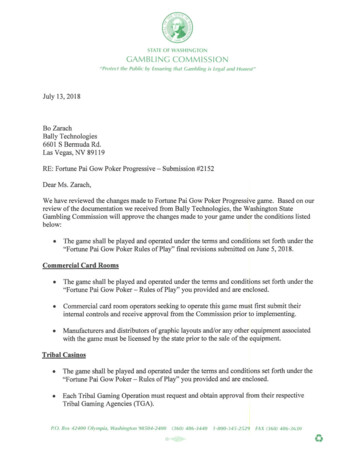

pA1.00.80.60.40.20.00.00.20.40.60.81.0pBFigure 1: This illustrates the determination of equilibrium in the linear signal examplewith q 1/2, n (A) n (B) I, and τ .15. The solid line represents the set of(p̂B , p̂A ) solving (5), while the dashed line represents the solutions to (6). Both curves aredownward sloping, and the solid line crosses from below the dashed line at the equilibriumvalues of (p̂B , p̂A ).There exists a unique Bayes-Nash equilibrium of the last-period game. Every insider betson B when p p̂B , abstains when p̂B p p̂A , and bets on A when p p̂A , wherethe thresholds 0 p̂B p̂A 1 constitute the unique solution to the two indifferenceconditionsp̂A andn (A) I [1 G (p̂A A)]11 τ n (A) n (B) I [1 G (p̂A A)] IG (p̂B A)p̂B 1 n (B) IG (p̂B B)1.1 τ n (A) n (B) I [1 G (p̂A B)] IG (p̂B B)(5)(6) Proof. See Appendix A.Note that when the pre-existing bets heavily favor outcome A or the track take isvery large, the gross expected payoff of a bet on A is W (A A) 1 regardless of howmany i

the market microstructure literature, and applied to fixed-odds betting by Shin (1991 and 1992). We focus instead on parimutuel betting markets, in the context of which the empirical evidence reported above has been collected. 6 In the context of this model, we study the strategic incentives that drive the timing of bets placed by the insiders.