Transcription

Muhurat Picks

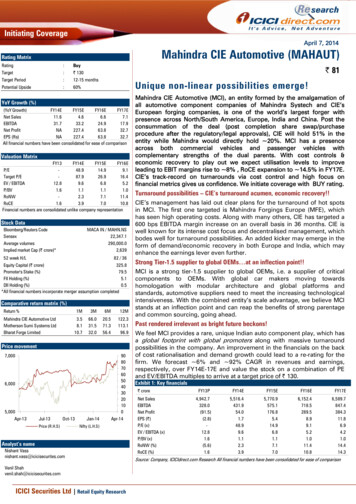

Muhurat Picks - 2014October 9, 2014Muhurat Picks for 2014 State Bank of India UltraTech Cement Rallis India Exide Industries SKF India Maharashtra Seamless Kansai NerolacMuhurat 2014Improving economy to benefit operating leverage plays Equity markets have rallied over 25% since last Diwali, largely fuelledby improving corporate earnings, expectations of tough reforms fromthe new government and reviving macroeconomic variables. Thegovernment has already initiated several confidence buildingmeasures and taken key decisions like allowing FDI in several sectors,railway fare hike, online environment and forest clearance, etc The government’s pro-activeness is complemented by robustness ineconomic data points. GDP growth has revived to a nine-quarter highof 5.7% in Q1FY15, strengthening hopes of an economic turnaroundand a shift to a high growth trajectory. Secondly, softening crudeprices at a 27-month low of 91/barrel would cushion the current andfiscal account imbalances. At current levels, under-recoveries areexpected to decline to 80,500 crore in FY15 from 140,000 crorein FY14. Thirdly, declining crude prices would also help softeninflation, which had remained at elevated levels for much of therecent past. Consequently, we expect CPI to reach below 7% by FY15from the current 7.8% levels, which could pave the way for rate cuts The current rally marks a peculiar trend wherein investors haveshown a preference for cyclicals and sectors linked to the capex cyclerevival but not opted for a blanket sector rotation. Consumerdurables, capital goods, banking and automobile have rallied in therange of 40-55% since last Diwali while FMCG has underperformedwith 10% appreciation. However, at the same time, other defensiveslike healthcare and IT have appreciated 47% and 29%, respectively Though volatility is expected to prevail on the global front as centralbanks across the globe recalibrate liquidity levels, India, with itshigher growth rate and least political instability among majoremerging markets, will remain in a sweet spot and continue to attractglobal investors. India has already received 9.8 billion in the currentfiscal and seems to be on track to record its highest ever inflows Sensex earnings grew 17.1% in FY14, partly aided by suppressedcumulative growth of 6.9% in last two years. Earnings are expected togrow 16.2% in FY15E before reviving to 18.5% in FY16E. We expectSensex to trade at 16.5x FY16E EPS of 1880 at 31000 by next DiwaliExhibit 1: Sensex and Nifty TargetSensex EPSGrowth (%)Target MultipleSensex Target - Diwali 2015Corresponding Nifty 5x310009250Source: Company, ICICIdirect.com Research ICICI Securities Ltd. Retail Equity ResearchWe are positive on auto, cement on the back of the robust demandoutlook and capital goods on account of balance sheet improvementand margin expansion. In addition, declining crude prices also makesthe oil & gas sector attractive. We would avoid the infrastructure andreal estate sector for now as the outlook for both is still hazy.Moreover, these sectors would perform with a lag as the benefit frominitial phase of economic recovery may not accrue to them

State Bank of IndiaSBINII croreGrowth%PAT crorePAT 1.7RoA%0.6Source:: ICICIdirect.com Research0.70.7 SBI has consistently managed 16-17% market share in bothdeposits, advances. Retail deposit funds 82% of total depositthat is stable in nature while its bulk deposit proportion is sub10%. Hence, liquidity risk & interest rate risks are limited for SBI.Going ahead, we expect SBI to maintain its market share andgrow in line with industry at 15.5% CAGR for deposit to 1860692crore and credit CAGR of 15.2% to 1604457 crore in FY16E Supported by the strong liability franchise (14000 branches and44% CASA ratio), its cost of fund (sub 6%) is among the lowest inthe industry, which enables the bank to earn such strong NIM of3.2% (domestic NIM - 3.5%) on such a large base. We expect themargins to be maintained GNPA stood at 60434 crore (4.9% of credit) while its standardrestructured assets are manageable at 3.5% ( 42226 crore) as onJune 2014. Considering the large size of SBI, its exposure tostressed sectors is relatively low compared to its peers. Weexpect GNPA and NNPA ratio to be 4.7% and 2.5%, respectively,by FY16E We expect the bank to post healthy 18% CAGR in profit to 15908 crore, over FY14-16E with return ratios of RoA at 0.70.8% and RoE of 11-12% . We continue to recommend SBI ledby comfort on scale and relatively lower headwinds on the assetquality. We assign a target price of 3234, valuing the core bookat 2x FY16E ABV (i.e. 1.4x P/BV) and adding 450 for associatebanks and subsidiaries (life and general insurance, AMC, etc.)UltraTech CementUltratech .017.3EBITDA margins %18.018.719.62,144.52,531.53,206.5Net sales croreGrowthPAT crorePAT RoE%12.512.914.4RoA%9.0Source:: ICICIdirect.com Research9.711.4ICICI Securities Ltd. Retail Equity ResearchTarget - 3234Target - 3180 UltraTech Cement is one of the most geographically diversifiedand undoubted leader in the Indian cement space with a capacityof 62.0 MT and market share of 17% in the domestic cementindustry. Also being one of the most efficient players in theindustry, it has commanded better margins compared to its peers.In FY10-14, the company’s sales and PAT have grown at a CAGRof 29.9% and 18.3%, to 20,078 crore and 2144.5 crore,respectively The company has consistently remained ahead of its peers interms of capacity expansion with a CAGR of 23% vs. peer’s CAGRof 13% over the past five years. The acquisition of the 4.8 MTPAGujarat cement unit of Jaypee Cement Corporation at a cost of 3800 crore has strengthened the company’s presence in thegrowing western market. Further, UltraTech is aiming to reach itstotal capacity of 70 MT by FY16E, which we believe would help itto maintain its leadership We believe the industry’s capacity utilisation bottomed out at 69% in FY14. We think low capacity addition & demandrecovery should lift utilisation levels from hereon given thecyclical upturn in the economy coupled with an expected policypush to drive investments in infrastructure sector. We forecastpan-India utilisation at 78% by FY16E that may offer pricingpower. Given the scenario, we expect UltraTech, as an industryleader with strong balance sheet, to trade at premium valuationsPage 2

Rallis IndiaRallis IndiaFY14FY15EFY16E1,727.22,026.62,360.8Net sales croreGrowth%19.917.316.5EBITDA margins %15.115.616.5PAT crore151.9183.7217.4PAT oE%21.222.022.2RoA%18.119.321.0 Rallis India, a Tata enterprise, is a major crop protection (agrochemicals) player domestically with presence across theagricultural value chain including hybrid seeds (through itssubsidiary Metahelix), plant growth nutrients and organic manure& soil conditioners. In FY10-14, sales and PAT recorded a CAGR of18.4% and 10.6%, to 1727 crore and 152 crore, respectively Rallis also has a notable presence in the contract manufacturingsegment wherein it manufactures chemicals and formulations forother reputed industry players. It is developing its new Dahej SEZunit for the purpose of contract manufacturing and clocked atopline of 250 crore from this segment in FY14. The companyalso possesses good brand recall and enhanced farmer reach. Itsdistribution network comprises 2,000 dealers and 30,000 retailers.Rallis is also de-risking its business profile through increasingshare of non-pesticide portfolio in the total product mix Rallis has a lean balance sheet with minimal leverage and strongreturn ratios with FY14 RoCE & RoE at 21% & 28%, respectively.The company also possesses relatively better working capitalcycle with net working capital days at 23 days in FY14 vis-à-visindustry average of 44 days. We expect sales and PAT to growat a CAGR of 16.8% and 21.6%, respectively, in FY14-17E. Wehave valued the company at 24x P/E on an average FY16E andFY17E EPS of 12.6 and arrived at a target price of 302 with along term (18-24 months) investment horizonSource: Company, ICICIdirect.com ResearchExide IndustriesExide IndustriesFY14FY15EFY16E5,964.37,442.38,511.9Net sales croreGrowth%-1.824.814.4EBITDA margins %13.715.216.6PAT crore713.6910.51,070.2PAT oE%13.116.918.6RoA%12.616.4Source: Company, ICICIdirect.com Research18.1ICICI Securities Ltd. Retail Equity ResearchTarget - 302Target - 220 Exide Industries is the largest battery manufacturer in India andlargest supplier of batteries for motorcycles, passenger vehicles,trucks and tractors. With the estimated registered vehicles in Indianearly doubling to 12.3 crore during FY03-10 (up 83%), 9 crorebatteries are likely to be sold from FY15-17E (considering threecycle replacement). Exide’s enviable network of 20,000 retailtouch points is the major factor in maintaining the leadershipposition in the burgeoning replacement segment Exide’s performance has been improving in the past couple ofquarters after about three years of underperformance in financialswith low utilisation levels ( 70%), loss of pricing power leading toa systemic downgrade of EBITDA margins from 20% levels toas low as 8%. Going ahead, with expectation of a strong pick-upin demand from the automotive segment and higher levels ofindustrial activity leading to higher volumes and thereforeutilisation levels, Exide’s operating margins are likely to improve With strong replacement demand likely to continue and OEMdemand also likely to pick up, Exide’s financial performance islikely to remain on an uptrend, with topline, bottomline growth of 17%, 30% CAGR in FY14-17E. Consequently, RoCE and RoEare also likely to improve to 26%, 19%, respectively, by FY17EPage 3

SKF IndiaSKF IndiaCY13CY14ECY15E2,246.42,466.52,804.9Net sales croreGrowth%1.99.813.7EBITDA margins %11.512.413.2PAT crore166.7217.5263.6PAT RoE%13.115.115.9RoA%13.015.0Source: Company, ICICIdirect.com Research15.9 SKF India is the largest bearing manufacturer in India with anoverall market share of 28%. Known for deep groove ballbearings (forming 35% of revenues and 45% market share),SKF has an equal presence across the industrial (46% of sales)and automotive segment (54% of sales), spread across OEMs(55% of sales) and aftermarket We believe that SKF, with leadership in the bearing space,commands scalability bandwidth coupled with a lean balancesheet and is poised to capture the opportunity arising from therevival of demand in the automotive segment. Consequently, weexpect SKF’s manufactured product (auto) sales to exhibit 14.6% CAGR over CY13-16E. We also expect import substitutionof industrial bearings, through ramp up in SKF Technologies, tobe a key revenue driver for SKF’s revenues and margin expansionas SKF would improve its turnaround time. Consequently, weexpect industrial sales to grow at 11.3% CAGR over CY13-16E Going ahead, with an anticipated recovery in end user industry,we expect revenues to bounce back at 13.4% CAGR over CY1316E and margins to recover to 13.6% in CY16E vs. 11.5% in CY13,driving earnings growth at a CAGR of 24% in CY13-16E. A healthybalance sheet, robust cash flow generation, strong parentage &product profile/ strong distribution reach are other key positives.Maharashtra SeamlessMaharastra SeamlessFY14FY15EFY16ENet sales crore1208.31633.52177.3Growth%-30.135.233.3EBITDA margins %7.410.614.1PAT crore101.5187.9301.4PAT oE%3.56.39.5RoA%3.36.09.4Source: Company, ICICIdirect.com ResearchICICI Securities Ltd. Retail Equity ResearchTarget - 1448Target - 430 Maharashtra Seamless (MSL) is a leading manufacturer ofseamless and ERW pipes in India. In addition to the large diameterseamless pipe plant, MSL also manufactures higher value-addedproducts, such as drill pipes used in the oil & gas sector The company is likely to be a key beneficiary of the imposition ofsafeguard duty on import of seamless pipe and tubes. The centralgovernment has imposed a safeguard duty on imported seamlesspipes and tubes which is as follows: a) 20% duty ad valoremwhen imported during August 13, 2014 to August 12, 2015, b)10% duty ad valorem when imported during August 13, 2015 toAugust 12, 2016 and c) 5% duty ad valorem when importedduring August 13, 2016 to February 12, 2017. This move is likelyto aid Maharashtra Seamless in augmenting its sales realisationsin the domestic market. Furthermore, the sales volume is alsolikely to witness healthy traction, going forward Going forward, we expect an improvement in capacity utilisationlevels and realisations. We have assumed blended EBITDA/tonneto increase from 3551/tonne in FY14 to 6350/tonne in FY15Eand further to 9163/tonne in FY16E. We have valued thecompany at 6x FY16E EV/EBITDA and arrived at a target price of 430 with a long term (18-24 months) investment horizon.Maharashtra Seamless has a strong balance sheet, healthy cashflow and net cash status, which augur well for the companyPage 4

Kansai Nerolac Kansai NerolacFY14EFY15EFY16ENet sales crore3136.13705.04446.3Growth%10.418.120.0EBITDA margins %11.513.813.9PAT crore206.6303.0374.3PAT RoE%14.518.619.6RoA%13.217.0Source: Company, ICICIdirect.com Research18.2 .ICICI Securities Ltd. Retail Equity ResearchTarget- 2396KNL is the biggest industrial paint company in India with 35%market share in industrial paints and third largest player with anoverall market share 14%. With sustainable growth in decorativepaints and subdued industrial demand, KNL has increased itsrevenue contribution of decorative paints from 50% in FY09 to55% currently. KNL has strong brands in interior, exterior andmetal paints like Impressions, Excel, Surkasha, etc. and continuesto invest in brands with 4-5% of sales going into A&P. We believedecorative paints would continue to grow strongly with thepresence of limited players and strong repainting demand. Weexpect a revival in industrial paints demand (75% automotivepaints), led by a recovery in automotive segments. We expectblended volume growth of 14.1% and 15.5% YoY in FY16E andFY17E, respectivelyDespite the company consciously increasing its decorative paintscontribution to 55% of sales from 50%, we believe the stock isstill trading at a discount to Asian Paints. With improving marginsand better return ratios, we believe the discount to Asian Paintswould shrink and the stock would command a premium to itshistoric average of 22x. Further, we expect industrial anddecorative volume growth of 16% and 15% YoY, respectively, inFY17E resulting in revenue CAGR of 19.3% in FY14-17E.Moreover, stable raw material prices are expected to lead to anexpansion in operating margins by 250 bps by FY17E over FY14.At the CMP, the stock is trading at 27.4x its FY16E earnings and22.2x its FY17E earnings. We value the stock on 28x multiple toarrive at a target price of 2396/sharePage 5

Performance of 2013 Muhurat PicksExhibit 2: Performance of Muhurat Picks 2013Scrip NameSBIBajaj ElectricalsEntertainment NetworkWiproBajaj AutoReco price17051552904782075Exit price/CMP18722803605702376Return (%)9.880.624.119.214.5Source: Company, ICICIdirect.com ResearchICICI Securities Ltd. Retail Equity ResearchPage 6

Pankaj PandeyHead – ct.com Research Desk,ICICI Securities Limited,1st Floor, Akruti Trade Centre,Road No 7, MIDCAndheri (East)Mumbai – 400 093research@icicidirect.comDisclaimerThe report and information contained herein is strictly confidential and meant solely for the selected recipient and may not be altered in any way,transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior writtenconsent of ICICI Securities Ltd (I-Sec). The author may be holding a small number of shares/position in the above-referred companies as on date ofrelease of this report. I-Sec may be holding a small number of shares/position in the above-referred companies as on date of release of this report.This report is based on information obtained from public sources and sources believed to be reliable, but no independent verification has beenmade nor is its accuracy or completeness guaranteed. This report and information herein is solely for informational purpose and may not be usedor considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments. Nothing in thisreport constitutes investment, legal, accounting and tax advice or a representation that any investment or strategy is suitable or appropriate to yourspecific circumstances. The securities discussed and opinions expressed in this report may not be suitable for all investors, who must make theirown investment decisions, based on their own investment objectives, financial positions and needs of specific recipient. This report may not betaken in substitution for the exercise of independent judgment by any recipient. The recipient should independently evaluate the investment risks. ISec and affiliates accept no liabilities for any loss or damage of any kind arising out of the use of this report. Past performance is not necessarily aguide to future performance. Actual results may differ materially from those set forth in projections. I-Sec may have issued other reports that areinconsistent with and reach different conclusion from the information presented in this report. This report is not directed or intended for distributionto, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where suchdistribution, publication, availability or use would be contrary to law, regulation or which would subject I-Sec and affiliates to any registration orlicensing requirement within such jurisdiction. The securities described herein may or may not be eligible for sale in all jurisdictions or to certaincategory of investors. Persons in whose possession this document may come are required to inform themselves of and to observe such restriction.ICICI Securities Ltd. Retail Equity ResearchPage 7

banks and subsidiaries (life and general insurance, AMC, etc.) UltraTech Cement Target - 3180 UltraTech Cement is one of the most geographically diversified and undoubted leader in the Indian cement space with a capacity of 62.0 MT and market share of 17% in the domestic cement industry.