Transcription

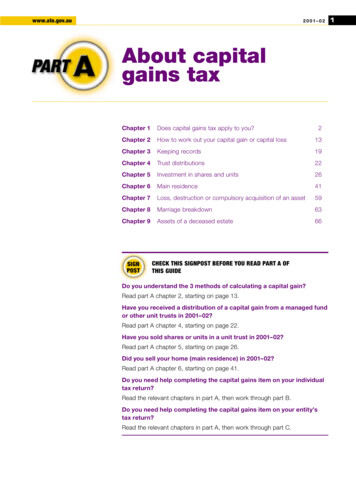

www.ato.gov.au2001–02About capitalgains taxChapter 1Does capital gains tax apply to you?Chapter 2How to work out your capital gain or capital loss13Chapter 3Keeping records19Chapter 4Trust distributions22Chapter 5Investment in shares and units26Chapter 6Main residence41Chapter 7Loss, destruction or compulsory acquisition of an asset59Chapter 8Marriage breakdown63Chapter 9Assets of a deceased estate66SIGNPOST2CHECK THIS SIGNPOST BEFORE YOU READ PART A OFTHIS GUIDEDo you understand the 3 methods of calculating a capital gain?Read part A chapter 2, starting on page 13.Have you received a distribution of a capital gain from a managed fundor other unit trusts in 2001–02?Read part A chapter 4, starting on page 22.Have you sold shares or units in a unit trust in 2001–02?Read part A chapter 5, starting on page 26.Did you sell your home (main residence) in 2001–02?Read part A chapter 6, starting on page 41.Do you need help completing the capital gains item on your individualtax return?Read the relevant chapters in part A, then work through part B.Do you need help completing the capital gains item on your entity’stax return?Read the relevant chapters in part A, then work through part C.1

2G U I D E T O C A P I TA L G A I N S TA XCHAPTER 1Does capital gains tax apply to you?This chapter provides general backgroundinformation about capital gains tax (CGT) and how itapplies to you or your entity.What is capital gains tax?Capital gains tax is the tax you pay on any capitalgain you make and include on your annual incometax return. There is no separate tax on capital gains,it is merely a component of your income tax. Youare taxed on your net capital gain at your marginaltax rate.Your net capital gain is:your total capital gains for the yearminusyour total capital losses (including any net capitallosses from previous years)minusany CGT discount and CGT small businessconcessions to which you are entitled.You may make a capital gain from most CGTevents, if your capital proceeds are greater thanyour cost base—for example, if you received morefor an asset than you paid for it. You make a capitalloss if your reduced cost base is greater than yourcapital proceeds. You can also make a capital gainif a managed fund or other trust distributes a capitalgain to you.NOTENew termsWe may have used some terms that are not familiarto you. These words are explained in Explanation ofterms at the back of this guide.While we have sometimes used the word ‘bought’rather than ‘acquired’, you may have acquired anasset without paying for it (for example, as a gift orthrough an inheritance). Similarly, we refer to ‘selling’an asset when you may have ‘disposed’ of it insome other way (for example, by giving it away ortransferring it to someone else). For the purposes ofthis guide, all of these ‘acquisitions’ and ‘disposals’are CGT events.Generally, you can disregard any capital gain orcapital loss you make on an asset you acquiredbefore 20 September 1985 (pre-CGT). For details ofsome other exemptions, see Exemptions and rollovers on page 9.There are special rules that apply when working outgains and losses from depreciating assets. To theextent that a depreciating asset is used for a taxablepurpose (for example, in a business) any gain istreated as ordinary income and losses as deductions.A capital gain or capital loss may arise only to theextent that a depreciating asset has been used fora non-taxable purpose (for example, used privately).For details on the CGT treatment of depreciatingassets, see CGT and depreciating assets onpage 10.If you are completing your entity’s tax return, capitalgains are shown at the following items: item 7 Company tax return 2002 item 18 Trust tax return 2002 or item 9 Fund income tax and regulatory return 2002.If you are an individual, you show your total currentyear capital gains at H item 17 on your tax return.You show your net capital gain at A item 17 on yourtax return.To work out whether you have to pay tax on yourcapital gains, you need to know: whether a CGT event has happened (this is thequestion asked at G item 17 on your tax return) the time of the CGT event how to calculate the capital gain or capital loss whether there is any exemption or roll-over thatallows you to reduce or disregard the capital gainor capital loss how to apply any capital losses whether the CGT discount applies whether you are entitled to any of the CGTconcessions for small business.What is a CGT event?CGT events are the different types of transactions orevents that may result in a capital gain or capital loss.Many CGT events involve a CGT asset while otherCGT events relate directly to capital receipts (capitalproceeds).To work out your capital gain or capital loss, you needto know which CGT event applies. The type of CGTevent affects when you can include the capital gainin your assessable income and how you calculate thecapital gain or capital loss.

www.ato.gov.auThere is a wide range of CGT events. Some happenoften and affect many different people while othersare rare and affect only a few people. There is asummary of CGT events A1 to K7 at appendix 1.2001–02contract for disposal. If there is no contract, the CGTevent generally happens when you stop being theasset’s owner.The most common CGT event happens if youdispose of an asset to someone else—for example,if you sell or give away an asset. Some other CGTevents from which you may make a capital gain orcapital loss include when:EXAMPLE an asset you own is lost or destroyed (thedestruction may be voluntary or involuntary)Sue makes the capital gain in the 2001–02 incomeyear when she enters into the contract and not the2002–03 income year when settlement takes place. shares you own are cancelled, surrendered orredeemed you enter into an agreement not to work in aparticular industry for a set period of time a trustee makes a non-assessable payment to youfrom a managed fund or other unit trustsContractIn June 2002, Sue enters into a contract to sell land.The contract is settled in October 2002.If a CGT asset you own is lost or destroyed, the CGTevent happens when you first receive compensationfor the loss or destruction. If you do not receive anycompensation, the CGT event happens when the lossis discovered or the destruction occurred. a company makes a payment (not a dividend) toyou as a shareholder a liquidator declares that shares you own areworthless you receive an amount from a local council fordisruption to your business assets by roadworks you stop being an Australian resident you enter into a conservation covenant or you dispose of a depreciating asset that you usedfor private purposes.Australian residents make a capital gain or capitalloss if a CGT event happens to any of their assetsanywhere in the world. As a general rule, nonresidents make a capital gain or capital loss only ifa CGT event happens to a CGT asset that has anecessary connection with Australia.Non-Australian residents may also make a capitalgain or capital loss where CGT events create: contractual or other rights (CGT event D1) or a trust over future property (CGT event E9).Order in which CGT events applyIf more than one CGT event could apply to yourtransaction or circumstances, the most relevant CGTevent applies.Time of the CGT eventThe timing of a CGT event is important because ittells you in which income year a capital gain or capitalloss from the event affects your income tax.If you dispose of a CGT asset to someone else,the CGT event happens when you enter into theEXAMPLEInsurance policyLaurie owned a rental property that was destroyedby fire in June 2001. He received a payment underan insurance policy in October 2001. The CGT eventhappened in October 2001.The CGT events relating to shares and units, and thetimes of the events, are dealt with in chapter 5.What is a CGT asset?Many CGT assets are easily recognisable—forexample, land, shares in a company and unitsin a unit trust. Other CGT assets are not sowell understood—for example, contractual rights,options, foreign currency and goodwill. All assets aresubject to the CGT rules unless they are specificallyexcluded.CGT assets fall into 3 categories: collectables personal use assets other assets.CollectablesCollectables include the following items that are usedor kept mainly for the personal use or enjoyment ofyou or your associate(s): paintings, sculptures, drawings, engravings orphotographs; reproductions of these items orproperty of a similar description or use3

4G U I D E T O C A P I TA L G A I N S TA X jewellery antiques coins or medallions rare folios, manuscripts or books postage stamps or first day covers.A collectable is also: an interest in any of those items a debt that arises from any of those items or an option or right to acquire any of those items.Any capital gain or capital loss you make from acollectable acquired for 500 or less is disregarded.A capital gain or capital loss you make from aninterest in a collectable is disregarded if the marketvalue of the collectable when you acquired theinterest was 500 or less. However, if you acquiredthe interest for 500 or less before 16 December1995, a capital gain or capital loss is disregarded.If you dispose of collectables individually that youwould usually dispose of as a set, you are exemptfrom paying CGT only if you acquired the set for 500 or less. This does not apply to collectables youacquired before 16 December 1995.Personal use assetsA personal use asset is: a CGT asset, other than a collectable, that is usedor kept mainly for the personal use or enjoyment ofyou or your associate(s) an option or a right to acquire a personal use asset a debt resulting from a CGT event involving aCGT asset kept mainly for your personal use andenjoyment or a debt resulting from your doing something otherthan gaining or producing your assessable incomeor carrying on a business.Personal use assets include such items as boats,furniture, electrical goods and household items. Landand buildings are not personal use assets. Anycapital loss you make from a personal use asset isdisregarded.If a CGT event happened to a personal use assetduring or after the 1998–99 income year, any capitalgain you make from the asset or part of the assetis disregarded if you acquired the asset for 10 000or less.If you dispose of personal use assets individuallythat would usually be sold as a set, you obtain theexemption only if you acquired the set for 10 000or less.Other assetsAssets that are not collectables or personal useassets include: land shares in a company rights and options leases units in a unit trust instalment receipts goodwill licences convertible notes your home (see Exemptions on page 9) contractual rights foreign currency any major capital improvement (above theimprovement threshold) made to certain land orpre-CGT assets. Improvement thresholds are listedin the table on the next page.PartnershipsIt is the individual partners who make a capitalgain or capital loss from a CGT event, not thepartnership itself. For CGT purposes, each partnerowns a proportionate share of each CGT asset.Joint tenantsFor CGT purposes, individuals who own an asset asjoint tenants are each treated as if they own an equalinterest in the asset as a tenant in common (seepage 68 for more information).Separate assetsFor CGT purposes, there are exceptions to the rulethat what is attached to the land is part of the land.In some circumstances, a building or structure isconsidered to be a separate CGT asset from the land.Other improvements to an asset (including land)acquired before 20 September 1985 may also betreated as a separate CGT asset.Buildings, structures and other improvements toland you acquired on or after 20 September 1985A building, structure or other capital improvement onland that you acquired on or after 20 September1985 will be a separate CGT asset from the landif a balancing adjustment provision applies to it.For example, a timber mill building is subject to abalancing adjustment if it is sold or destroyed, so it istreated as a separate asset from the land.

www.ato.gov.au2001–02Buildings and structures on land acquired before20 September 1985A building or structure on land that you acquiredbefore 20 September 1985 will be a separate asset if: you entered into a contract for the construction ofthe building or structure, or construction began on or after that date.Other capital improvements to pre-CGT assetsIf you make a capital improvement to a CGTasset you acquired before 20 September 1985, thisimprovement will be treated as a separate assetand be subject to CGT if certain conditions aremet. These conditions relate to the improvementthresholds in the table below.If these conditions are met, when a CGT eventhappens to the original asset, the cost base of thecapital improvement must be: more than the improvement threshold for the yearin which the event happens more than 5 per cent of the amount of money andproperty you receive from the event.If there is more than one capital improvement andthey are related to each other, they are treated as oneseparate CGT asset if the total of their cost bases ismore than the threshold.The improvement threshold is changed to takeaccount of inflation. The thresholds for 1985–86 to2001–02 are shown in the following table.Improvement thresholds for 1985–86 to 2001–02EXAMPLEAdjacent landOn 1 April 1984, Dani bought a block of land. On1 June 2001, she bought another block adjacentto the first one. Dani amalgamated the titles to the2 blocks into one title.The 2nd block is treated as a separate CGT assetacquired on or after 20 September 1985 and istherefore subject to CGT.What are capital proceeds?Capital proceeds is the term used to describe whatyou receive from a CGT event. This is usually anamount of money or the value of any property youreceive (or are entitled to receive) as a result of aCGT event.In some cases, if you receive nothing in exchangefor a CGT asset (for example, if you give the CGTasset as a gift) you are taken to have received themarket value of the asset at the time of the CGTevent. You may also be taken to have received themarket value if: your capital proceeds are more or less than themarket value of the CGT asset you and the purchaser were not dealing with eachother at arm’s length in connection with the event.You are said to be dealing at arm’s length withsomeone if each party acts independently and neitherparty exercises influence or control over the other inconnection with the transaction. The law looks at notonly the relationship between the parties but also thequality of the bargaining between them.IncomeyearThreshold( )IncomeyearThreshold( )1985–8650 0001994–9582 2901986–8753 9501995–9684 3471987–8858 8591996–9788 227 the non-receipt is not due to anything you havedone or failed to do1988–8963 4501997–9889 992 you took all reasonable steps to obtain payment.1989–9068 0181998–9989 9921990–9173 4591999–200091 072Provided you are not entitled to a tax deductionfor the amount you repaid, capital proceeds arereduced by:1991–9278 1602000–0192 802 any part of the proceeds that you repay or1992–9380 0362001–0297 7211993–9480 756 any compensation you pay that can reasonably beregarded as a repayment of the proceeds.Capital proceeds from a CGT event are reduced if: you are not likely to receive some or all of thoseproceedsIf you are registered for GST and you receive paymentwhen you dispose of a CGT asset, any GST payableis not part of the capital proceeds.5

6G U I D E T O C A P I TA L G A I N S TA XThere are special rules for calculating the proceedsfrom a depreciating asset. A depreciating asset isa tangible asset (other than land or trading stock)that has a limited effective life and can reasonablybe expected to decline in value over the time it isused. Certain intangible assets are also depreciatingassets.For more information, refer to the Guide todepreciating assets.What is the cost base?For most CGT events, the cost base of a CGT assetis important in working out if you have made a capitalgain. For working out the amount of a capital loss forthese events, the reduced cost base of a CGT assetis relevant.For some CGT events, the cost base is not relevant.In these cases, the CGT event explains the amountsto use to work out your capital gain. For example,if you enter into an agreement not to work in aparticular industry for a set period of time, CGT eventD1 specifies that you make a capital gain or capitalloss by comparing the capital proceeds with theincidental costs. Also the cost base of an asset thatis a depreciating asset is not relevant in working out acapital gain from that asset.For details of the CGT treatment of depreciatingassets, see CGT and depreciating assets onpage 10.Elements of the cost baseThe cost base of a CGT asset is made up of5 elements. You need to add together all theseelements to work out your cost base for eachCGT asset.Where relevant, the elements of the cost base arereduced by any GST included in the price.First element: money paid for the assetThis element includes money paid (or required to bepaid) for the asset and the market value of propertygiven (or required to be given) to acquire the asset.2nd element: incidental costs of the CGT event orof acquiring the CGT assetExamples of these incidental costs include agentscommission, the cost of advertising to find a selleror buyer, stamp duty and fees paid for professionalservices (for example, to an accountant, professionaltax adviser, valuer or lawyer).You can include expenditure for advice concerningthe operation of the tax law as an incidental costonly if it was provided by a recognised professionaltax adviser and you incurred the expenditure after30 June 1989.Do not include expenditure for which you have or mayhave a deduction for income tax purposes in any year.3rd element: non-capital costs associated withowning the assetExamples of these non-capital costs include interest,rates, land taxes, repairs and insurance premiums.They also include non-deductible interest onborrowings to re-finance a loan used to acquire aCGT asset and on loans used to finance capitalexpenditure you incur to increase an asset’s value.You can include non-capital costs of ownership onlyin the cost base of assets acquired on or after21 August 1991. You cannot include these noncapital costs in the cost base of any collectables orpersonal use assets.These costs cannot be indexed or used to work outa capital loss. Do not include expenditure for whichyou have or may have a deduction for income taxpurposes in any year.4th element: capital costs associated withincreasing the value of your assetThis element is relevant only if the expenditure isreflected in the state or nature of the asset at the timeof the CGT event—for example, if you paid for a carport to be built on your rental investment property.5th element: capital costs to preserve or defendyour title or rights to your assetThis element includes capital expenditure you incur topreserve or defend your title or rights to the asset—for example, if you paid a call on shares.In some cases, a deduction you have claimed on aCGT asset can be partly or wholly ‘reversed’; thatis, the value of part or all of the deduction maybe declared as income in the year the CGT eventhappens. In this case, the capital gains cost base ofthe CGT asset is increased by the amount you haveto include in your assessable income.Any expenditure you recoup does not form part ofthe cost base of a CGT asset except if the recoupedamount is included in your assessable income.

www.ato.gov.auEXAMPLERecouped expenditureJohn bought a building in 2000 for 200 000 andincurred 10 000 in legal costs associated withthe purchase. As part of a settlement, the vendoragreed to pay 4000 of the legal costs. John did notclaim as a tax deduction any part of the 6000 hepaid in legal costs.He later sells the building. As he receivedreimbursement of 4000 of the legal costs, inworking out his capital gain he includes only 6000in the cost base.Assets acquired after 13 May 1997If you acquired a CGT asset after 13 May 1997, thecost base of the asset does not include: any expenditure on the asset that has been (orcan be) allowed as an income tax deduction; thisapplies to all elements of the cost base, or heritage conservation expenditure and landcareand water facilities expenditure incurred after12 November 1998 that give rise to a tax offset.NOTESpecial rules for landSpecial rules apply if you acquired land on or before13 May 1997 but you incurred expenditure betweenthis date and 1 July 1999 on constructing a buildingthat is treated as a separate asset from the land forCGT purposes. If you think this may be relevant toyou, contact the Australian Taxation office (ATO) formore information.2001–021999 may be indexed to account for inflation upto the September 1999 quarter. Only expenditureincurred before 21 September 1999 may be indexedbecause changes to the law mean indexation wasfrozen at that date. Refer to chapter 2 page 14 formore information.Reduced cost baseThe reduced cost base is the amount you take intoaccount when you are working out whether you havemade a capital loss when a CGT event happens to aCGT asset. Remember that a capital loss can only beused to reduce a capital gain—it cannot be used toreduce other income.The reduced cost base of a CGT asset has the same5 elements as the cost base (see previous page),except for the 3rd element. The 3rd element of thereduced cost base of an asset is any amount that isassessable because of a balancing adjustment for theasset or that would be assessable if certain balancingadjustment relief was not available. These elementsare not indexed and do not include any relevant GSTinput tax credits. You need to add together all theseelements for a CGT asset to find out your reducedcost base for the relevant CGT event.The reduced cost base does not include any ofthose costs that have been (or can be) allowedas deductions—for example, write-off deductions forcapital expenditure. It also does not include anyexpenditure that you have recouped—for example,a claim on an insurance policy (except for anyrecouped amount included in your assessableincome).EXAMPLESpecial building write-off deductionEXAMPLEZoran acquired a rental property on 1 July 1997for 200 000. Before disposing of the property on30 June 2002, he had claimed 10 000 in specialbuilding write-off deductions.Write-off deductionAt the time of disposal, the cost base of the propertywas 210 250. Zoran must reduce the cost base ofthe property by 10 000 to 200 250.Indexation of the cost baseIf a CGT event happened in the 2001–02 incomeyear in relation to a CGT asset you acquired before21 September 1999, you may be able to use eitherthe indexation method or the discount method tocalculate your capital gain.If you use the indexation method, some of the costbase expenditure you incurred up to 21 SeptemberDanuta acquired a new income-producing asset on28 September 1994 for 100 000. She sold it for 90 000 in November 2001. During the period sheowned it she was allowed write-off deductions of 7500. Her capital loss is worked out as follows:Cost baseless write-off deduction 100 000 7 500Reduced cost base 92 500less capital proceeds 90 000Capital loss 2 5007

8G U I D E T O C A P I TA L G A I N S TA XModifications to the cost base and reducedcost baseIn some cases, the general rules for calculatingthe cost base and reduced cost base have to bemodified. For example, the market value may besubstituted for the first element of the cost base orreduced cost base if: you did not incur expenditure to acquire the asset some or all of the expenditure you incurred cannotbe valued, or you did not deal at arm’s length with the vendor inacquiring the asset.If you acquire a CGT asset or incur expenditure andonly part of the expenditure you incur relates to theCGT asset, only that part of the expenditure that isreasonably attributable to the asset can be includedin its cost base or reduced cost base.Similarly, if a CGT event happens only to part of aCGT asset, the cost base or reduced cost base of theasset is generally apportioned to work out the capitalgain or capital loss from the CGT event.Special rules for the cost base and reducedcost baseThere are other rules that may affect the cost base orreduced cost base of an asset. For example, they arecalculated differently: when you first use your main residence to produceincome (see chapter 6) for an asset that you receive as a beneficiary oras the legal personal representative of a deceasedestate (see chapter 9) for bonus shares or units, rights and options andconvertible notes (see chapter 5).Debt forgivenessA debt is forgiven if you are freed from the obligationto pay it. Commercial debt forgiveness rules applyto debts forgiven after 27 June 1996. A debt is acommercial debt if part or all of the interest payableon the debt is, or would be, an allowable deduction.EXAMPLEDebt forgivenessOn 1 July 2001, Josef had available net capitallosses of 9000. On 1 January 2002, he sold someshares for 20 000. They had a cost base (noindexation) of 7500. On 1 April 2002, a commercialdebt of 15 000 that Josef owed to AZC PtyLtd was forgiven. Josef had no prior year revenuelosses and no deductible capital expenditure.Josef would work out what net capital gain toinclude in his assessable income as follows:Available net capital losses 9 000less debt forgiveness adjustment 9 000Adjusted net capital lossNilCost base of shares (no indexation) 7 500less debt forgiveness adjustment 6 000Adjusted cost base 1 500Calculation of net capital gainSale of sharesAdjusted cost base (no indexation) 20 000 1 500less carried forward lossCapital gain (eligible for discount)Nil 18 500less discount percentage (50%) 9 250Net capital gain 9 250Under the commercial debt forgiveness rules, aforgiven amount may reduce (in the followingorder) your: prior year revenue losses prior year net capital losses deductible expenditure cost base and reduced cost base of assets.These rules do not apply if the debt is forgiven asa result of: an action under bankruptcy law a deceased person’s will or reasons of natural love and affection.Acquiring CGT assetsGenerally, you acquire a CGT asset when youbecome its owner. You may acquire a CGT asset asa result of: a CGT event happening (for example, the transferof land under a contract of sale)

www.ato.gov.au other events or transactions happening (forexample, a company issuing shares, where theirissue is not a CGT event), or applying specific rules (for example, if a CGTasset passes to you as a beneficiary whensomeone dies).Time of acquisitionThe time a CGT asset is acquired is important for4 reasons: CGT generally does not apply to pre-CGT assets;that is, assets acquired before 20 September 1985 different cost base rules apply to assets acquiredat different times—for example, non-capital costsare not included in the cost base of an assetacquired before 21 August 1991 the time of acquisition determines whether the costbase of a CGT asset is indexed to take accountof inflation and the extent of that indexation (seechapter 2 page 14) the time of acquisition also determines whetheryou are eligible for the CGT discount—for example,one requirement is that you need to have owneda CGT asset for at least 12 months (see chapter2 page 15).If you acquire a CGT asset as a result of a CGT event,certain rules determine when you are taken to haveacquired the asset. These rules depend on whichCGT event is involved. For example, if you enterinto a contract to purchase a CGT asset, the timeof acquisition is when you enter into the contract.If someone disposes of an asset to you withoutentering into a contract, you acquire the asset whenyou start being the asset’s owner. If a CGT assetpasses to you as a beneficiary of someone who hasdied, you acquire the asset on the date of their death.If you acquire a CGT asset without a CGT eventhappening, different rules apply to determine whenyou acquire the asset. If—for example, a companyissues or allots shares to you, you acquire the shareswhen you enter into a contract to acquire them, orif there is no contract, at the time of their issueor allotment.Becoming a residentSpecial CGT rules apply to assets you own whenyou become a resident of Australia. You are taken tohave acquired these assets at the time you becamea resident.This rule only applies to assets that you acquiredon or after 20 September 1985 that did not havea necessary connection with Australia—for example,land in a foreign country. The general cost base rules2001–02apply to an asset that had a necessary connectionwith Australia (for example, land in Australia) whenyou became a resident.ChoicesIn some cases you are given a choice as to how theCGT rules apply to you. As a general rule, if you wishto make a choice you must make it by the day youlodge your tax return. Generally, the way you prepareyour tax return is sufficient evidence of your choice.However, there are some exceptions: some replacement asset roll-overs for companiesmust be made earlier choices relating to the small business retirementexemption must be made in writing a longer period is allowed to choose the smallbusiness roll-over.Exemptions and roll-oversThere may be exemptions or roll-overs that allowyou to reduce, defer or disregard your capital gainor capital loss. The most common exemption isif you dispose of an asset you acquired before20 September 1985.ExemptionsThe exemptions listed below allow you to reduce ordisregard a capital gain or capital loss you make fromcertain CGT events.General exemptionsA capital gain or capital loss you make from any ofthe following is disregarded: a car (that is, a motor vehicle designed to carrya load of less than one tonne and fewer than9 passengers) or motor cycle or similar vehicle a decoration awarded for valour or

www.ato.gov.au 2001-02 1 SIGN POST About capital gains tax Chapter 1 Does capital gains tax apply to you? 2 Chapter 2 How to work out your capital gain or capital loss 13 Chapter 3 Keeping records 19 Chapter 4 Trust distributions 22 Chapter 5 Investment in shares and units 26 Chapter 6 Main residence 41 Chapter 7 Loss, destruction or compulsory acquisition of an asset 59