Transcription

Healthcare Valuation & Advisory ServicesColliers International MENA RegionLONG-TERM CARE(LTC), REHABILITATION & HOMECARE (HC) IN SAUDI ARABIAGrowth Opportunities in a Specialised SectorThe Pulse Series: 14th Edition

Healthcare & Wellness Overview - 2020/21Long-term Care , Rehabilitation & Home Care Sector in the KSA2COLLIERS INTERNATIONAL HEALTHCAREVALUATION & ADVISORY SERVICESSegment Focused اﻟﺗرﻛﯾز ﻋﻠﻰ اﻟﻔﺋﺎت Sector Focused اﻟﺗرﻛﯾز ﻋﻠﻰ اﻟﻘطﺎﻋﺎت Hospitals and ClinicsMother and Paediatric Care رﻋﺎﻳﺔ ا م واﻟﻄﻔﻞ اﻟﻤﺴﺘﺸﻔﻴﺎت واﻟﻌﻴﺎدات Pharmaceutical Sector & Medical ConsumablesRehabilitation / Long-term Care & Home Care ﻗﻄﺎع ا دوﻳﺔ واﻟﻤﺴﺘﻠﺰﻣﺎت اﻟﻄﺒﻴﺔ اﻟﺮﻋﺎﻳﺔ ﻃﻮﻳﻠﺔ ا ﻣﺪ واﻟﺮﻋﺎﻳﺔ اﻟﻤﻨﺰﻟﻴﺔ / إﻋﺎدة اﻟﺘﺄﻫﻴﻞ Medical Wellness and Alternative MedicineCardiology / Pulmonary / Neurology / Nephrology وأﻣﺮاض اﻟﻜﻠﻰ / ا ﻋﺼﺎب / اﻟﺮﺋﺔ / أﻣﺮاض اﻟﻘﻠﺐ اﻟﺼﺤﺔ واﻟﻌﺎﻓﻴﺔ واﻟﻄﺐ اﻟﺒﺪﻳﻞ Liver / Pancreas / Kidney Treatment & TransplantClinical Laboratories, Diagnostic & R&D Centres ﻋ ج وزراﻋﺔ اﻟﻜﻠﻰ / اﻟﺒﻨﻜﺮﻳﺎس / اﻟﻜﺒﺪ اﻟﻤﻌﺎﻣﻞ اﻟ ﻳﺮﻳﺔ وﻣﺮاﻛﺰ اﻟﺘﺸﺨﻴﺺ واﻟﺒﺤﺚ واﻟﺘﻄﻮﻳﺮ In Vitro Fertilisation (IVF)Medical Colleges & Universities أﻃﻔﺎل ا ﻧﺎﺑﻴﺐ اﻟﻜﻠﻴﺎت واﻟﺠﺎﻣﻌﺎت اﻟﻄﺒﻴﺔ Nursing Colleges & Certification InstitutionsMental Health ﻛﻠﻴﺎت اﻟﺘﻤﺮﻳﺾ وﻣﺮاﻛﺰ اﻟﺘﺼﺪﻳﻖ اﻟﺼﺤﺔ اﻟﻨﻔﺴﻴﺔ Beauty & Cosmetic and Aesthetic TreatmentsAllied Health Professional (AHP) Institutions اﻟﺘﺠﻤﻴﻞ وﻋ ﺟﺎت اﻟﺘﺠﻤﻴﻞ ﻣﺆﺳﺴﺎت اﻟﻘﻄﺎع اﻟﺮﻋﺎﻳﺔ اﻟﺼﺤﻴﺔ Services Offered by Colliers Healthcare Team اﻟﺧدﻣﺎت اﻟﻣﻘدﻣﺔ ﻣن ﻗﺑل ﻓرﯾﻖ اﻟرﻋﺎﯾﺔ اﻟﺻﺣﯾﺔ ﻟدى ﻛوﻟﯾرز إﻧﺗرﻧﺎﺷﯾوﻧﺎل Strategic & Business Planning Economic Impact Studies Academic Planning Market & Competitive StudiesCommitmentCommitment اﻟﺗزام اﻟﺗزام Catchment Area AnalysisPassion Market & Financial Feasibility Studies ﺷﻐف PassionColliers USP Financial and Business ModellingGlobal Reach /Local KnowledgeGlobal/ اﻟﻣﺣﻠﯾﺔ Reach اﻟﺧﺑرة Local Knowledge واﻟﻌﺎﻟﻣﯾﺔ اﻟﺧﺑرة اﻟﻣﺣﻠﯾﺔ واﻟﻌﺎﻟﻣﯾﺔ ﻧﻘﺎط ﺗﻣﯾز ﻛوﻟﯾرز إﻧﺗرﻧﺎﺷﯾوﻧﺎل Market & Commercial Due Diligence Land and Property Valuation Brand and Business Valuation Mergers & Acquisitions Assistance Buy Side / Sell Side Advisory Sale & Lease Back Advisory Public Private Partnership (PPP) PrivatisationRegionalExperience اﻟﺧﺑرة Regional اﻹﻗﻠﯾﻣﯾﺔ ExperienceIndustryIntelligence ﻓﮭم اﻟﺻﻧﺎﻋﺔ Colliers International Healthcare Advisory & ValuationServices team is solely focused on healthcare relatedbusiness (OpCo) and real estate (PropCo), from complexbusiness-related operational advisory to real estate relatedadvisory.Our group has the expertise and knowledge essential toproviding forward thinking solutions to any challenginghealthcare related decisions where success is measured inhigh quality care delivered in a cost-effective way. Operator Search & Selection andContract Negotiation Site Selection & Land / PropertyAcquisition Asset Management Performance Management Industry Benchmarking Surveys اﻟﺗﺧطﯾط اﻻﺳﺗراﺗﯾﺟﻲ واﻟﺗﺟﺎري دراﺳﺎت اﻷﺛر اﻻﻗﺗﺻﺎدي اﻟﺗﺧطﯾط اﻷﻛﺎدﯾﻣﻲ دراﺳﺎت اﻟﺳوق واﻟﺗﻧﺎﻓﺳﯾﺔ ﺗﺣﻠﯾل ﻣﻧﺎطﻖ اﻷﻋﻣﺎل دراﺳﺎت اﻟﺟدوى اﻟﺳوﻗﯾﺔ واﻟﻣﺎﻟﯾﺔ إﻋداد اﻟﻧﻣﺎذج اﻟﻣﺎﻟﯾﺔ واﻟﺗﺟﺎرﯾﺔ إﺟراء دراﺳﺎت اﻟﺳوق واﻷﻋﻣﺎل اﻟواﺟﺑﺔ ﺗﺛﻣﯾن اﻷراﺿﻲ واﻟﻌﻘﺎرات ﺗﻘﯾﯾم اﻟﻌﻼﻣﺔ اﻟﺗﺟﺎرﯾﺔ واﻷﻋﻣﺎل اﻟﻣﺳﺎﻋدة ﻓﻲ ﻋﻣﻠﯾﺎت اﻹﻧدﻣﺎج واﻹﺳﺗﺣواذ اﻟﻣﺷﺗرﯾن / ﺗﻘدﯾم اﻻﺳﺗﺷﺎرات ﻟﻠﺑﺎﺋﻌﯾن اﺳﺗﺷﺎرات اﻟﺑﯾﻊ واﻻﺳﺗﺋﺟﺎر اﻟﺷراﻛﺔ ﺑﯾن اﻟﻘطﺎﻋﯾن اﻟﻌﺎم واﻟﺧﺎص اﻟﺧﺻﺧﺻﺔ اﻟﺑﺣث ﻋن اﻟﻣﺷﻐﻠﯾن واﺧﺗﯾﺎرھم واﻟﺗﻔﺎوض ﺑﺷﺄن اﻟﻌﻘود واﻟﻣﺳﺎﻋدة ﻓﻲ ﻋﻣﻠﯾﺔ / اﺧﺗﯾﺎر اﻟﻣوﻗﻊ أو اﻷرض اﻹﺳﺗﺣواذ إدارة اﻷﺻول ادارة اﻷداء إﺟراء اﺳﺗﻘﺻﺎءات ﻣﻌﺎﯾﯾر اﻟﺳوق ﯾرﻛز ﻓرﯾﻖ ﻛوﻟﯾرز إﻧﺗرﻧﺎﺷﯾوﻧﺎل وﺧدﻣﺎت اﻟرﻋﺎﯾﺔ اﻟﺻﺣﯾﺔ ﻓﻘط ﻋﻠﻰ اﻷﻋﻣﺎل ﺑدءاً ﻣن اﻻﺳﺗﺷﺎرات ،(ProCo) ( واﻟﻌﻘﺎرات OpCo) اﻟﻣﺗﻌﻠﻘﺔ ﺑﺎﻟرﻋﺎﯾﺔ اﻟﺻﺣﯾﺔ . اﻟﺗﺷﻐﯾﻠﯾﺔ اﻟﻣﻌﻘدة اﻟﻣﺗﻌﻠﻘﺔ ﺑﺎﻷﻋﻣﺎل اﻟﺗﺟﺎرﯾﺔ واﻹﺳﺗﺷﺎرات اﻟﻣﺗﻌﻠﻘﺔ ﺑﺎﻟﻌﻘﺎرات ﺗﻣﺗﻠك ﻣﺟﻣوﻋﺗﻧﺎ اﻟﺧﺑرة واﻟﻣﻌرﻓﺔ اﻟﺿرورﯾﺔ ﻟﺗوﻓﯾر اﻟﺣﻠول اﻟﻣﺑﺗﻛرة اﻟﻼزﻣﺔ ﻻﺗﺧﺎذ ﺣﯾث ﯾﺗم ﻗﯾﺎس ﻣﻌﺎﯾﯾر اﻟﻧﺟﺎح ﺑدرﺟﺔ ، اﻟﻘرارات اﻟﺻﻌﺑﺔ ﻓﻲ ﻣﺟﺎل اﻟرﻋﺎﯾﺔ اﻟﺻﺣﯾﺔ . ﻋﺎﻟﯾﺔ ﻣن اﻟدﻗﺔ وﺗﻘدﯾﻣﮭﺎ ﺑﺄﻗل ﺗﻛﻠﻔﺔ ﻣﻣﻛﻧﺔ

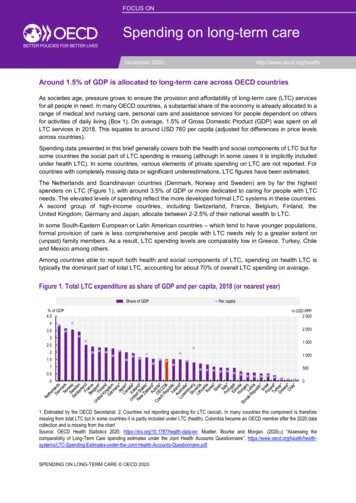

3The Kingdom of Saudi Arabia with a current estimatedpopulation of approximately 35 million, as ofNovember 2020, is the largest country in the GCC.Under Vision 2030 the country is going throughfundamental structural changes in all the sectorsincluding healthcare.The Healthcare sector in KSA is undergoing anevolution on the back of rapid advancements intechnology and research and development (R&D) inline with global and regional trends. However, COVID19 has also exposed the vastly diverse structure ofhealthcare systems and increased the importance ofR&D and the provision of specialised healthcare withingeneralised healthcare.Long-term care (LTC), rehabilitation and home care(HC) are amongst the main focal points fordiversification and enhancement of the healthcaresystem in KSA. A key driver is the changingdemographic profile through a decreased fertility rateand increased life expectancy. As a result, thepopulation above 60 years is expected to increasefrom 5.5% in 2020 to 11.0% by 2030.This shift will have a significant impact on diseasepatterns and the type of healthcare services required.As almost 80% of a person’s healthcare requirementstypically occur after the age of 60 years this willincrease the demand for LTC, rehab and HC. This isespecially true in the case of KSA with its highprevalence of lifestyle related diseases includingdiabetes, coronary and obesity-related illnesses.These are in addition to existing demand fromdisabilities which also require LTC, rehab and HC.Public Private Partnership (PPP), is one of thecornerstone policies of Vision 2030. A part of theSaudi government’s strategy for transforming andgrowing the economy by developing the overallhealthcare system including the LTC, rehab and HCthrough PPP.The Ministry of Health (MoH), Private SectorParticipation (PSP) initiatives aim to increase theshare of the private sector in healthcare delivery viaPublic Private Partnership (PPP). This is focused onenhancing extended care by improving overallprovision and quality of the services.Improvement in the provision of quality long-term careis expected to not only optimise and better utilise thecapacity of tertiary care hospital beds but alsoexpected to enhance the quality of post-acute careand home care treatments.Another emerging trend relating to provision of LTCand Rehab facilities is development of facilities withinhospitality developments. Rehabilitation treatmentrelating to trauma, accident and mental health can beoffered within a hospitality environment. This can beachieved through affiliation with the local hospitalswhere emergency treatment can be provided torehabilitation patients, if needed.Introduction of LTC and Rehab facilities within existinghospitality developments will not only reduce therequired capital investment to build new LTC andrehab facilities, but also expected to providesustainability to the hospitality sector in post COVIDworld as resorts offering such services increase thedomestic and international tourists (patients) stay fromfew weeks to months in hotels instead of few days.This paper on Long-term Care, Rehabilitation & HomeCare in KSA is focused on highlighting how thedevelopment of this sector can act as a changecatalyst to the healthcare sector from elderly to acutecare. Though a gradual shifting of bed-bound patientsfrom hospitals to specialised LTC and Rehab facilitiesand ultimately treating them at home, thus reducingthe pressure on both acute care and LTC andrehabilitation hospitals.Based on Colliers estimates, KSA would requireadditional 20,000 – 22,000 Long Term Care andRehabilitative beds by 2030 and to achieve OECDaverage standards, the country would require28,000 to 30,000 additional beds by 2030.Healthcare & Wellness Overview – 2020/21Long-term Care, Rehabilitation & Home care Sector in KSAINTRODUCTION

LONG TERM AND POST-ACUTE CARE (LTPAC)6 DIMENSIONSWELLNESSCONTINUUMOF OFCAREMORESERVICE INTENSITYHealthcare & Wellness Overview - 2020/21Long-term Care, Rehabilitation & Home Care Sector in KSA4IndependentLiving /ContinuingCareRetirementCommunitiesAssistedLiving Acute CareHospitalHospiceCare792468Home CareSkilled NursingHomeOutpatientPhysiotherapy& RehabilitationLong TermAcute CareILLNESS SEVERITYLESSMOREIn order to understand the demand for long-term, one needs to understand the complete patient caremanagement process beginning at discharge from acute care to rehabilitation through to Long Term &Post-Acute Care facilities, as presented belowNormalIndividualExperiences eitheraccident/ disease thatrequires hospitalisationLong-term Post-AcuteCare InstitutionalizedAcute CarePatient either referredto the long-term postacute care facilitiesand/or communitybased settings orreturned homeHospitalLong Term CareCommunity BasedHomeLong Term Care HospitalHome CareAssisted LivingInpatient /Outpatient Physio& Rehab FacilitySkilled NursingFacilitiesSource: Source: Colliers International Healthcare Analysis 2020Continuing CareRetirement Community

5Stroke1Spinal Cord InjuryWhat is LTPAC?3Major layAmputationSepticemia1315Pneumonia6This wide array of services ranges fromcomplex care in a long-term, acute-carehospital to personalised home careassistance. Compared to the generalpopulation, patients who receive LTPACservices typically have a broader rangeof conditions and more complex, chroniccare needs that result in frequenttransitions between their homes, acute,post-acute and longer-term caresettings.11Fractures4A Long Term and Post-Acute Care(LTPAC) includes a variety ofrehabilitation or palliative services thathelp meet the medical and non-medicalneeds of people with chronic illnesses ordisabilities. It includes the care patientsreceive after, or in some cases, insteadof a stay in an acute care hospital over arelatively long period of time.5Pain Syndromes28Arthritis10Brain Dysfunction121416Heart FailureVentilator weaningOsteomyelitisComplex woundmanagementBenefits of Transitioning a Patient to Post-Acute CareLower cost oftreatmentContinuity of careLower rates ofreadmissionLess burden onacute care set upSource: Colliers International 2020Increased positive outcomesin patient health recoverySpecialized treatment planfor individual patientsImproving survival rateamong patientsHealthcare & Wellness Overview - 2020/21Long-term Care, Rehabilitation & Home Care Sector in KSAKey Indications / Diseases requiring Long-term Care & Rehabilitation

6Healthcare & Wellness Overview - 2020/21Long-term Care, Rehabilitation & Home Care Sector in KSA6PUBLIC PRIVATE PARTNERSHIP (PPP)6 DIMENSIONS OF WELLNESSHealthcare remains a top priority for thegovernment of Saudi Arabia as it explores privatesector participation in healthcare infrastructuregrowth. Public-private partnership (PPP) andprivatisation is one of the cornerstone policies ofVision 2030, the Saudi government’s strategy fortransforming and growing the economy. In line withthe government’s Vision 2030 and the NationalTransformation Program (NTP), the Ministry ofHealth (MoH) is expected to spend close to US 71billion over five-years ending in 2020. Byincorporating Public Private Participation (PPP)models for healthcare, the government is aiming tounlock value in the health system and fast-trackingthe change of healthcare with plans to lift the overallprivate sector contribution in total healthcarespending to 35% by 2020. In the interim, innovationremains a center factor in overhauling the KSAhealthcare market in the coming years withinformation technology playing a pivotal role inoffering solutions related to cost, quality, accessand resources.NTP targets for the Ministry of Health for 2020 include: Increasing private healthcare expenditure from 25%to 35% of total healthcare expenditure Increasing the number of licensed medical facilitiesfrom 40 to 100 Increasing the number of internationally accreditedhospitals Doubling the number of primary healthcare visitsper capita from two to four Decreasing the percentage of smoking and obesityincidence by 2% and 1% from baseline respectively Doubling the percentage of patients who receivehealthcare after critical care and long-termhospitalisation within four weeks from 25% to 50% Focusing on improving the quality of preventive andtherapeutic healthcare services. Increasing focus on digital healthcare innovationsOptions Available – Public Private PartnershipAccesstoPrivateFundingAccess toExpertise &ImprovedTechnologyImproved/ BetterServiceQualityBenefits ofPPPOPTIONSBuild Operate Transfer (BOT)Build Own Operate Transfer (BOOT)Rehabilitate Own Operate Transfer (ROOT)RiskSharing/ AllocationOperation and Maintenance Contract (O&M)Lease Develop Operate (LDO)Concession Agreement / JV AgreementContinuousR&D & Accessto GlobalNetworkCostEfficientManagement AgreementAs many emerging markets face uncertain prospects andeconomic pressures as a result of the global pandemic, SaudiArabia offers a large market, economic and financial strength anda growing track record of successful PPPs and privatisations'momentum has continued into 2020, despite the constraintsimposed around the world by the Covid-19 pandemic.Source: Colliers International 2020

KEY CREDENTIALS 2020200-bed Long-termcare & RehabilitationHospital located inKing Saud HospitalComplex in Riyadh200-bed Long-termcare & RehabilitationHospital focusing onPulmonary Care inRiyadh400-bed General &Maternity & PaediatricCare Hospital in NorthRiyadhMarket & FinancialFeasibility /DevelopmentRecommendations andOperator Search &SelectionMarket & FinancialFeasibility /DevelopmentRecommendations andOperator Search &SelectionMarket & FinancialFeasibility / DevelopmentRecommendations andOperator Search &Selection200-bed GeneralHospital located inKing Saud HospitalComplex in RiyadhHome Care (HC)facility in publicsector as part ofPotential PublicPrivate Partnership(PPP)Merger of Two LeadingHospital Group in theKSAMarket & FinancialFeasibility /DevelopmentRecommendations andBusiness PlanCost Analysis andMarket BenchmarkingStudy to assessefficiency level againstPrivate SectorValuation and MarketCompetitionAssessment (as arequirement for theGeneral Authority forCompetition)Long-term Care &RehabilitationHospital and WellnessResort in TaifWomen only Beauty &Cosmetic & WellnessCentre & Medical Spain RiyadhMedical / Nursing /Allied HealthProfessional (APH)College in JeddahMarket & FinancialFeasibility Study /DevelopmentRecommendationsMarket and FinancialFeasibility Study/DevelopmentRecommendations /Business PlanMarket and FinancialFeasibility Study/DevelopmentRecommendationsHealthcare & Wellness Overview - 2020/21Long-term Care, Rehabilitation & Home Care Sectors in KSAColliers International dedicated Healthcare team currently working with number of owners /operators / developers to establish new healthcare facilities and assist in expansion of existinghealthcare facilities. Some of key credentials are presented below7

Healthcare & Wellness Overview - 2020/21Long-term Care, Rehabilitation & Home Care Sector in KSA8MINISTRYOF HEALTH(MOH)6 DIMENSIONSOF WELLNESSPRIVATE SECTOR PARTICIPATION (PSP) 1/2The Ministry of Health (MoH), Private Sector Participation (PSP) initiative aims toincrease the share of the private sector in healthcare delivery via Public PrivatePartnership (PPP) and is focused on enhancing extended care by improving the overallprovision and quality of the services. The key challenges are identified belowLong-term Care1. The Long-term care (LTC) bed capacity is below requirements.2. A large number of acute care treatment beds in hospitals areoccupied by LTC patients, creating a burden on availability of beds.3. Some patients who occupy LTC beds can be provided home care,resulting in a significant cost reduction and greater overall utilisation.4. There is shortage of advanced medical capabilities such asmechanical ventilation in many LTC facilitiesRehabilitation1. The inpatient rehabilitation capacity listed below shows therequirement in KSA.2. There is a shortage of rehabilitation physicians and specializedallied healthcare personnel.Home Care1. The provision of capabilities, resources, and efficiency in home care(HC) vary across different cities in KSA.2. There is limited availability of medical devices and consumables.3. Due to lack of efficient operational procedures and informationsystems utilisation of home care personnel remains low.Rehabilitation Bedscapacity to increase from235 (2017) to 3,190 (2022)Home Care Coverage (PopulationReached Annually) to increase from40,090 (2017) to 90,300 (2022)93 Extended CareFacilities to beestablished by 2022Source: Ministry of Health (MoH), KSA, Colliers International Healthcare Analysis 2020PPP /PSPLong-term Care Bedscapacity to increase from705 (2017) to 3,155 (2022)14 Rehabilitation Centres tobe transferred to PrivateSector & 285 new homecareunits to be deployed via PSP** Complete transfer of operations may take longer as this wave depends on medical cities and hospital commissioning.

999Target for PSP Model (2022) - DFBOT (Design,Finance, Build, Operate and Transfer)Objectives of PSP Model:1.Increase extended care capacity2.Free up the acute hospital beds which arebeing occupied by the long-term carepatients3.Increase utilisation of human resources(e.g., daily rate of home care visits perteam from 3.2 to 7.5)4.Recruit qualified workforce5.Increase the qualification of existingextended personnel care via training1.Rehabilitation: to build 1,000 beds by 2022, Increasing thenumber of rehabilitation beds from 0.77 per 100,000 populationto global benchmark level of 10 per 100,000.2.Long-term care (LTC): to build 1,000 beds by 2022, freeing upthe acute hospital beds which are being occupied by the longterm care patients.3.Home Care (HC): to recruit 20,000 patients by 2022, freeing upthe acute hospital beds which are being occupied by the homecare patientsPSP Operating Model:Payment Model: PPPproject that is based onguaranteed offtake agreementwhich will be structuredaccording to the pricesprovided by the transactionadvisors and bidders Availability of finance for theconstruction, renovationand furnishing activities Service payments for theprovided services based ona DRG-based fee forservice approach Per diem service paymentsfor long-term care services Per visit service paymentsfor home care services Per-day/per-visit fees willchange across carepackages.PSP ModelSalientFeaturesResponsibilities of the Private Sector PartnerConstruction/Renovation and Equipping of theFacilities Construction, furnishing and equipping of new facilities Equipping and renovation of existing facilitiesInformation Systems1.Post-acute rehabilitationservices will be provided inrehabilitation hospitals andrehabilitation centers.2.100-150 bed rehabilitationhospitals will providecomprehensive services tomultiple regions.3.20-100 bed rehabilitationcenters will provide essentialrehabilitation services and willbe distributed across theKingdom.4.Long-term care (LTC) facilitieswill provide three levels ofservices based on the medicalcomplexity.5.Home care (HC) services will beprovided by general HC unitsand specialized HC units.6.The core of the HC organisationwill be the general home careunits. Specialised HC units willbe composed of general unitsand specialised personnel forprovision of specialty services athome.(received from other regional PSP-type companies)Others All personnel will be employed by the private partner. Buildings and infrastructure constructed by the private partnerwill be leased to the MoH and transferred to the MoH at theend of contract period. Establishment of information systems The facilities that are transferred to the private partner foroperation will remain the property of the MoH . Compliance of the information systems with commoncommunication protocols New equipment will be purchased and owned by the privatepartner.Support Services Existing equipment will be owned by MoH and will be given tothe private partner for operations. The provision of laboratory, radiology and pharmacy servicesSource: Ministry of Health (MoH), KSA, Colliers International Healthcare Analysis 2020Healthcare & Wellness Overview - 2020/21Long-term Care ,Rehabilitation & Home Care Sector in KSAMINISTRYOF HEALTH(MOH)6 DIMENSIONSOF WELLNESSPRIVATE SECTOR PARTICIPATION (PSP) 2/2

Healthcare & Wellness Overview - 2020/21Long-term Care, Rehabilitation & Home Care Sector in KSA106 DIMENSIONSOF WELLNESSFURTHEROPPORTUNITIESMedical TourismLow availability and quality of specialisedhealthcare facilities remains one of the majorreasons for outbound medical treatment in theGCC. Both national and expatriate patients prefergoing oversees for medical treatments mainly inGermany, UK, US, Canada and Asian countries.This includes treatments relating to long-term careand rehabilitation.It is estimated that 3,000 - 5,000 Saudi patients aretreated abroad for various treatment atgovernment’s expense. In the past, these numberswere as high as 20,000 patients being sent abroadevery year.However, with the government introducing PublicPrivate Participation (PPP) models for healthcareand by encouraging both local and internationalinvestments numbers have fallen in recent years.Number ofPatientsTreatmentAbroadHistorically upto20,000 patientswere treatedabroad.Presently,between 3,0005,000 patientsare treatedabroad.Cost perPatientCost per patientfor intentionaltreatment SAR 1millionCost perCompanionExpensesincurred on thecompanions isestimated to bearound 0.2 millionper patientSource: Saudi Gazette; Colliers International Healthcare Analysis 2020The plan now is that unless treatment is notavailable in Saudi Arabia the state will no longerpay for overseas treatment.In the GCC, especially in the UAE, there has alsobeen an improvement in quality of healthcareservice provision. The emergence of a number ofreputed indigenous brands and the opening ofinternationally recognized hospitals (such as KingsCollege Hospital, Mediclinic, Cleveland Clinic) isexpected to lead to a further decline in outboundmedical tourism.Establishing quality LTC and Rehab facilities withhome based international operators can act ascatalyst to reduce expenditure on outboundtreatments whilst simultaneously growing a newservice sector.Age ofPatients32% of thetotal patientssent abroadwere above 50years of age.The Way ForwardReplacing internationaltreatments by establishingmedical facilities withinternational operators

11Medical Wellness & PreventativeHealthcareIn the MENA region the prevalence of diabetesand obesity is one of the highest in the world, withalmost 55 million people aged 20 to 79 yearssuffering from diabetes. This number is expectedto double by 2045.Projects are being developed in lifestyle retreatsettings where recovery is in a relaxed andcomfortable environment rather than a typicalhospital setting. Colliers has also been engaged invarious projects including waterfront hospitalitywhere health and medical wellness componentsare incorporated within the resorts. These projectsare expected to have a positive impact in the longterm by reducing the demand for both acute carehospitals and post-acute care long-term andrehabilitation facilities.Eight Middle Eastern countries; Kuwait, Qatar,Egypt, KSA, Bahrain, UAE, Jordan and Lebanonhave the highest ratio of obesity among adultsglobally with 27% to 40% of the total populationaffected. The prevalence of overweight andobesity in these countries ranges from 74% to86% in women and 69% to 77% in men.Within KSA the Red Sea Project, QiddiyaEntertainment City and Amaala Red Sea Rivieraprojects could be ideal locations to developmedical wellness and preventive healthcarefacilities.The GCC countries have one of the highest levelof lifestyle diseases in the world and in line withglobal trends there is need to focus on morepreventive rehabilitation care by the establishmentof medical wellness treatment centers.Existing & Projected Mental Health Patients inthe KSACAGR (1990-2018): 3.68%4.4 million205020502.0 million1.4 million430,000203020201990Mental HealthcareAccording to World Health Organisation (WHO)report on mental health in 2019, one-in-four peoplein the world will be affected by mental orneurological disorders at some point in their lives.Around 450 million people currently suffer fromsuch conditions, placing mental disorders amongthe leading causes of ill-health and disabilityworldwide. A significant percentage of mentalhealth issues are age related and can beaccommodatedthroughlong-termcare/rehabilitation facilities or even as part of home care.Source: Colliers International Healthcare Analysis 2020Mental Health & COVID-19: COVID-19 pandemichas also exacerbated mental health issues throughadditional life stress and isolation. This hasOpportunities: Offering mental health in LTC /Rehab facilities or as part of Home Care, cansignificantly reduce the capital and operatingexpenditure and free up beds and resources inacute care hospitals and family clinics.Healthcare & Wellness Overview - 2020/21Long-term Care , Rehabilitation & Home Care Sector in KSA6FURTHERDIMENSIONSOF WELLNESSOPPORTUNITIES

12Total Population(2020 estimated)11.0%LTC ’s Vision2030 and NTP focuseson healthcaredevelopment, thoughMinistry of Health(MoH), Private SectorParticipation (PSP),using PPP ModelSource: Colliers International Healthcare Analysis 2020THE GAP ANALYSIS & CONCLUSIONSDue to the shortage of long-term care, rehabilitation andhome care services in KSA, patients in need of long-termcare utilise acute care facilities, creating a burden on acutecare facilities.Based on various reports and discussions with hospitaloperators, patients who could be better served in LTC andRehab facilities occupy an estimated 20% to 30% of publichospital beds in the KSA. Research shows that AverageLength of StayThe cost of patients who need LTC and Rehab but areinstead treated in general hospitals is significantly highercompared to a long-term care facility. This is a crucialissue; all government budgets are under pressure whiledemand for healthcare continues to rise. Capital andoperating costs of setting up LTC and Rehab facilities is upto 30% or more lower when compared to an acute carehospital.The need for infrastructure to support the provision of LTCand Rehab facilities is one of the main policy drivers forvarious governments in the GCC. For example, Dubai hasprioritized investments in setting up LTC and Rehabpatient services under its latest Investment Guide. As partof the privatisation process in KSA, the Ministry of Health isseeking to engage operators for LTC and Rehab facilitiesand Home Care.So, what is the Gap?As per Colliers estimates, KSA, by 2030 would requireadditional 20,000 – 22,000 Long-term Care (LTC) andRehabilitative beds. However, to achieve OECD averagestandards, the country would require 28,000 to 30,000additional beds by 2030.An important aspect will be improving Home Care (HC)services. Presently the capabilities, resources, andefficiency in home care vary across regions with limitedservice provided. Due to a lack of efficient operationalprocedures and proper information systems, the utilisationof home care personnel remains low. An improved homecare provision will reduce the pressure on both acute careand LTC and rehabilitation hospitals. The target under thePSP initiative is to increase home care coverageannually from 40,090 (2017) to 90,300 (2022).In November 2020, the Ministry of Human Resources andSocial Development (MHRSD) announced theimplementation of a uniform model for elderly care in KSAin collaboration with the private and non-profit sectors. InColliers’ opinion this initiative is expected to improve theefficiency and quality of services provided to elderly in theKingdom with better utilisation of tertiary care, LTC andrehab facilities.The greatest challenge lies in the shortage of manpoweras the number of physicians and specialized nurses andallied healthcare personnel for rehabilitation is insufficient.With new hospital developments underway the competitionto hire experienced and skilled physicians, nurses andallied workforce is further set to intensify.Currently, the market is in its nascent stage and manyexisting LTC, Rehab and HC facilities lack advancedmedical capabilities. As the market matures, more centersproviding specialised comprehensive rehabilitation such musculoskeletal rehabilitation will enter the market.Colliers International healthcare team is actively workingwith several local, regional and international investors andoperators to facilitate entry and/or expansion in KSA’slucrative LTC, Rehab and HC sector.Healthcare & Wellness Overview - 2020/21Long-term Care, Rehabilitation & Home Care Sector in KSA35 MPercentage ofpopulationabove 60 yearsby 2030

FOR MORE INFORMATIONMANSOOR AHMEDDirector Development SolutionsHealthcare Education & PPPMiddle East & North Africa 971 55 899 6091mansoor.ahmed@colliers.comIMAD DAMRAHManaging DirectorKingdom of Saudi Arabia 966 50 417 2178imad.damrah@colliers.comAbout Colliers InternationalColliers International is a global leader in commercial real estate services, with over 18,000 professionals operating in 68 countries. Colliers International delivers a full rangeof services to real estate users, owners and investors worldwide, including global corporate solutions, brokerage, property and asset management, hotel investment sales andconsulting, valuation, consulting and appraisal services and insightful research. The latest annual survey by the Lipsey Company ranked Colliers International as the secondmost recognised commercial real estate firm in the world. In MENA, Colliers International has provided leading advisory services through its regional offices since 1996.DisclaimerThe information contained in this report has been obtained from sources deemed reliable. Any information on projects, financial or otherwise, are intended o

1. The inpatient rehabilitation capacity listed below shows the requirement in KSA. 2. There is a shortage of rehabilitation physicians and specialized allied healthcare personnel. Rehabilitation Beds capacity to increase from 235 (2017) to 3,190 (2022) 14 Rehabilitation . Centres. to be transferred to Private Sector & 285 new homecare units