Transcription

Capitalisation of borrowing costsFrom theory to practiceApril 2009

Capitalisation of borrowing costs1IntroductionThe International Accounting Standards Board (IASB) issued a revised version of IAS 23 BorrowingCosts (IAS 23) in March 2007. In the revised standard, the previous benchmark treatment ofrecognising borrowing costs as an expense has been eliminated. Instead, borrowing costs that aredirectly attributable to the acquisition, construction or production of a qualifying asset will form partof the cost of that asset. The revised IAS 23 is effective for annual periods beginning on or after1 January 2009 with earlier application permitted.The new standard will represent a change in accounting policy for entities that applied thebenchmark treatment under the previous standard. These entities will now need to developprocedures to calculate the amount of borrowing costs to be capitalised. Although the concept ofcapitalising borrowing costs is simple and familiar to many, putting that concept into practicefrequently leads to questions. Issues that often take up management time, and may therefore need tobe considered early, include: which of the entity's loans are specific borrowings? how does an entity reflect the fluctuation of borrowings and interest rates during the period whencalculating the borrowing costs to capitalise? how does an entity take into account the effects of exchange differences in determining theamount of borrowing costs to capitalise?These and many other common questions are considered in this guide: Capitalisation of borrowing costs from theory to practice (the guide).The member firms of Grant Thornton International Ltd (Grant Thornton International) - one ofthe world's leading organisations of independently owned and managed accounting and consultingfirms - have gained extensive insights into the more problematic aspects of IAS 23. Grant ThorntonInternational, through its IFRS team, develops general guidance that supports its member firms’commitment to high quality, consistent application of IFRS and is therefore pleased to share theseinsights by publishing this guide. The guide reflects the collective experience of Grant ThorntonInternational's IFRS team and member firm IFRS experts.Using this guideThe guide is arranged in a 'question and answer' format to address the questions that we encountermost frequently. The guide also includes several examples illustrating the capitalisation of borrowingcosts.Before moving on to the specific application guidance, section A presents an executive summary ofIAS 23 and a summary flowchart to illustrate the main concepts. 2009 Grant Thornton International Ltd. All rights reserved.

Capitalisation of borrowing costs2The guide looks then at the scope and definitions in IAS 23 (section B), while Section C deals withdetermining the amount of borrowing costs to be capitalised. Section D deals with frequently askedquestions about the period of capitalisation, in other words when capitalisation begins and when itends. Group situations, which can give rise to complex application issues, are discussed in sectionE.Section F deals with the transitional provisions - both for existing preparers with a previous policyof expensing borrowing costs and also for first-time adopters.The guide is intended to assist companies and auditors in applying IAS 23. We have not attemptedto cover every aspect of IAS 23. However, we believe this guide will help in addressing the problemsmost often encountered in practice.Grant Thornton International LtdApril 2009 2009 Grant Thornton International Ltd. All rights reserved.

Capitalisation of borrowing costs3ContentsPageA: IAS 23 in briefIAS 23 decision tree - summaryExecutive summaryB: Scope and definitionsScopeDefinition of borrowing costsCost of equity instrumentsDefinition of a qualifying assetAssets measured at fair valueExemption for certain types of inventoriesC: Borrowing costs to be capitalisedSpecific borrowings for a qualifying assetGeneral borrowingsQualifying assets financed by a combination of general and specific borrowingsExchange differencesDerivative gains or lossesOther practical issuesD: Period of capitalisationCommencement of capitalisationSuspension of capitalisationCessation of capitalisationE: Group situationsSeparate and individual financial statementsConsolidated financial statementsF: Effective date and transitionExisting preparers with a previous policy of expensing borrowing costsFirst-time adopters 2009 Grant Thornton International Ltd. All rights 83839

Capitalisation of borrowing costs4A: IAS 23 in briefA revised version of IAS 23IAS 23 Borrowing Costs (IAS 23) addresses accounting for borrowing costs. It considers whetherborrowing costs should be capitalised as part of the cost of the asset, or expensed in profit or loss.The previous version of IAS 23 permitted a choice in accounting for borrowing costs. Thebenchmark treatment was to expense all borrowing costs. The alternative treatment allowedcapitalisation of borrowing costs directly attributable to the acquisition, construction or productionof a qualifying asset.As part of the IASB's efforts to seek convergence with US GAAP a revised version of IAS 23 wasissued in March 2007. The revised version requires (rather than permits) the capitalisation ofborrowing costs that are directly attributable to the acquisition, construction or production of aqualifying asset. The Board concluded that recognising borrowing costs as an expense immediatelydoes not give a faithful representation of the cost of an asset (IAS 23.BC9). This new approachachieves convergence in principle with US GAAP (SFAS 34), although some detailed differences ofapplication will remain.The new benchmark treatment in the revised version of IAS 23 becomes mandatory for accountingperiods beginning on or after 1 January 2009. 1 For entities with a previous policy of expensingborrowing costs the standard sets out transitional provisions which should reduce the cost andcomplexity of changing accounting policies (where required).On the following pages a decision tree of the requirements of IAS 23 is presented together with anexecutive summary.1IAS 23 Borrowing Costs (Revised 2007) was endorsed for use in the European Union in December 2008. 2009 Grant Thornton International Ltd. All rights reserved.Capitalisation ofborrowing costs hasbeen discussed for anumber of years. Somecommentators argue thatexpensing borrowingcosts reducescomparability betweenpurchased assets andconstructed assets,because the price of apurchased asset wouldinclude the seller'sborrowing costs incurredduring construction.Others argue that thecapitalisation ofborrowing costs is notuseful, for examplebecause two entitiesconstructing identicalassets may capitalisedifferent amountsdepending on theircapital structure.

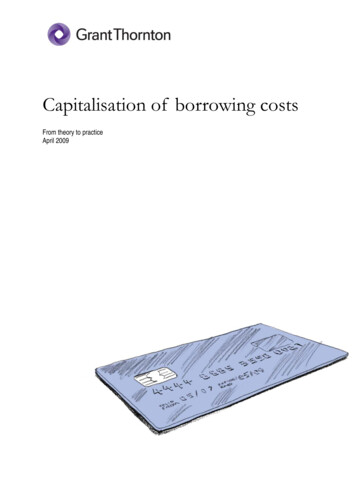

Capitalisation of borrowing costs5IAS 23 decision tree - summaryHow do you determine the amount of borrowing costs to be capitalised? The purpose of thefollowing diagram is to summarise the main requirements of the standard and to illustrate the routewhich preparers need to follow to determine the treatment of borrowing costs.Does the entity haveboth a qualifying assetand borrowing costs?NoYesIs thequalifying assetscoped out?No capitalisationNoYesNoDoes the entityelect to capitaliseborrowing costs?YesDetermine the commencementdate for capitalisationGeneralSpecific or generalborrowing?SpecificCapitalise actual borrowing costsless any investment income on thetemporary investment of thoseborrowings (IAS 23.12)Work out the capitalisation rateand apply this to the expenditureson that asset (IAS 23.14)Check that the amount capitaliseddoes not exceed the amount ofborrowing costs incurred.Determine when the entity ceasesto capitalise borrowing costs 2009 Grant Thornton International Ltd. All rights reserved.

Capitalisation of borrowing costs6Executive summaryA.IAS 23 addresses accounting for borrowing costs.B.Borrowing costs are defined as interest and other costs that an entity incurs in connectionwith the borrowing of funds. Borrowing costs may include interest expense calculated usingthe effective interest method, finance charges in respect of finance leases and certainexchange differences from borrowings denominated in a foreign currency.C.If, and only if, an asset meets the definition of a qualifying asset then borrowing costsincurred are capitalised as part of its cost (unless a scope exception applies). A qualifyingasset is an asset that necessarily takes a substantial period of time to get ready for itsintended use or sale. The standard excludes certain qualifying assets from its scope.D.The core principle of the standard is that only those borrowing costs that are directlyattributable to the acquisition, construction or production of a qualifying asset should becapitalised. All other borrowing costs are expensed as incurred.E.Borrowing costs that satisfy the 'directly attributable' criterion are generally thoseborrowing costs that would have been avoided if the expenditure on the qualifying assethad not been made. Borrowing costs are not always readily attributable to a qualifying asset.This may be the case where an entity borrows funds generally. The standard includesguidance on how to allocate borrowing costs in such circumstances.F.An entity begins to capitalise borrowing costs on the commencement date which is whenthree conditions are met: a) it incurs expenditures for the asset; b) it incurs borrowing costsfor the asset; and c) it undertakes activities that are necessary to prepare the asset for itsintended use or sale. An entity suspends capitalisation of borrowing costs during extendedperiods in which it suspends active development of a qualifying asset.G.An entity ceases to capitalise borrowing costs when substantially all the activities necessaryto prepare the qualifying asset for its intended use or sale are complete.H.An entity is required to apply the standard for annual periods beginning on or after1 January 2009. An entity starts capitalising borrowing costs only for those qualifying assetsfor which the commencement date is on or after 1 January 2009.I.Entities are not required to apply the standard retrospectively. However, an entity may wishto apply the standard to qualifying assets for which the commencement date is before 1January 2009. An entity is permitted to designate any date before 1 January 2009 and applythe standard to borrowing costs relating to all qualifying assets for which thecommencement date is on or after that designated date. 2009 Grant Thornton International Ltd. All rights reserved.

Capitalisation of borrowing costs7B: Scope and definitionsScopeWhat is the scope of IAS 23?The guidance in IAS 23 should be applied in accounting for borrowing costs (IAS 23.2). As apractical matter, entities are affected by IAS 23 only if they both incur borrowing costs and have oneor more 'qualifying assets'. The actual or imputed cost of equity is not a borrowing cost and is nottherefore addressed by IAS 23 (including the cost of preferred capital that is classified as equity).IAS 23 includes two optional scope exemptions. It need not be applied to: assets measured at fair value; or certain inventories.The scope exemptions are discussed below.Definition of borrowing costsThe scope paragraph states that the standard should be applied in accounting forborrowing costs but what is the definition of borrowing costs?IAS 23.6:"Borrowing costs mayinclude:(a) interest expensecalculated using theeffective interest methodas described in IAS 39;(d) finance charges inrespect of finance leasesrecognised inaccordance with IAS 17;(e) exchangedifferences arising fromforeign currencyborrowings to the extentthat they are regarded asan adjustment to interestcosts." [emphasis added]Borrowing costs are defined as interest and other costs that an entity incurs in connection with theborrowing of funds (IAS 23.5). Borrowing costs may include items such as interest expensecalculated using the effective interest method, finance charges in respect of finance leases and someexchange differences arising from foreign currency borrowings (IAS 23.6).The definition is relatively broad and, therefore, other types of finance costs may also be consideredborrowing costs.Is the list in IAS 23.6 exhaustive in its catalogue of borrowing costs?No. Generally, IAS 23.6 gives examples of costs that may be included in borrowing costs. As statedin the definition of borrowing costs, both interest and other costs can meet the definition.Accordingly, it is often necessary to use judgement to establish which finance costs are within thedefinition.What types of costs are eligible for capitalisation?The definition of borrowing costs is broad. Therefore, questions often arise as to what types ofcosts are eligible for capitalisation. These application issues are discussed further in section C. 2009 Grant Thornton International Ltd. All rights reserved.

Capitalisation of borrowing costs8Are there any differences in the list of borrowing costs in IAS 23.6 compared to theprevious version of IAS 23?Yes. Paragraph 6 was amended by Annual Improvements to IFRSs released in May 2008 and theamendment is effective on the same date as the standard (1 January 2009), meaning that entitiesadopting IAS 23 (revised) should apply the amended paragraph. After the amendments, the conceptof interest expense in paragraph 6 is now aligned to the effective interest method in IAS 39 FinancialInstruments: Recognition and Measurement (IAS 39). As a result the references to 'ancillary costs' and'amortisation of discounts or premiums' have been removed from the list, as they will often beincluded in the calculation of interest expense in accordance with the effective interest method.What types of costs are included in the effective interest method under IAS 39?The effective interest method takes account of all fees and points paid or received that are anintegral part of the effective interest rate, transaction costs and all other premiums or discounts(IAS 39.9). The effective interest method is used where a financial liability is accounted for atamortised cost under IAS 39 (most loans in practice). The result of applying this method is toallocate interest expense over the relevant periods by producing a periodic interest expense equal toa constant percentage of the carrying amount of the liability. This means that transaction costs andfees are in effect amortised over the life of the loan and are included in the interest expense. IAS 39includes further guidance on the application of the method in IAS 39.AG5-8.Cost of equity instrumentsIs the 'cost of equity' such as, for example, dividends within the scope of thestandard?No. The standard does not deal with the actual or imputed cost of equity, including preferred capitalnot classified as a liability (IAS 23.3). Accordingly, where a financial instrument has been classifiedas equity in accordance with IAS 32 Financial Instruments: Presentation (IAS 32) the costs of servicingthe equity instrument cannot be capitalised. Rather, these costs are charged to equity in accordancewith IAS 32.36.On the other hand, if the instrument is classified as a liability, the costs in connection with servicingthe liability are generally within the scope of the standard (and may be capitalised). Classification ofan instrument as either equity or liability can be a complex issue and is not discussed in thispublication.Are interest expenses on a compound financial instrument within the scope of thestandard?Yes. A compound financial instrument is divided into an equity component and a liabilitycomponent. Therefore, the interest expense on the liability component, calculated in accordancewith the effective interest method, should be considered part of borrowing costs.Some compound instruments may feature payment of dividends in relation to the equity componentat the discretion of the issuer (in addition to interest on the liability). Such dividends are charged toequity as a distribution and are not within the scope of IAS 23.The entity has issued preference shares that are redeemable at the option of theholder. Are dividends paid on the shares within the scope of the standard?Yes. A preference share that provides for redemption at the option of the holder is generally afinancial liability in accordance with IAS 32. Dividend payments on shares classified as a liability arerecognised in profit or loss in the same way as interest on a bond (IAS 32.36). The dividendpayments are therefore within the scope of IAS 23 (IAS 23.3) and may need to be capitalised. 2009 Grant Thornton International Ltd. All rights reserved.Because 'cost ofequity' is notcapitalised,comparability betweenassets is onlyachieved for thoseassets that arefinanced withborrowings (not thosefinanced with equity orby a combination ofboth).An entity's capitalstructure maytherefore affect thereported cost of aqualifying asset.

Capitalisation of borrowing costs9Definition of a qualifying assetWhat is a qualifying asset?A qualifying asset is an asset that necessarily takes a substantial period of time to get ready for itsintended use or sale (IAS 23.5).The definition of a qualifying asset is key for the capitalisation principleIn this section we look at what types of assets are a qualifying asset. This is important, as an assetmust meet the definition of a qualifying asset in order for borrowing costs to be capitalised aspart of the carrying amount of that asset. Borrowing costs are immediately expensed if they arenot incurred to acquire, construct or produce a qualifying asset.Determining if an asset is a qualifying asset will depend on the circumstances and requires the use ofjudgement in each case. However the following assets cannot be a qualifying asset: (i) financialassets, (ii) assets that are ready for their intended use or sale when acquired, and (iii) inventories thatare manufactured, or otherwise produced, over a short period of time (IAS 23.7).IAS 23.7:"Depending on thecircumstances, any ofthe following may bequalifying assets:Is IAS 23.7 an exhaustive list of qualifying assets?(a) inventories(b) manufacturing plants(c) power generationfacilities(d) intangible assets(e) investmentproperties.Yes. IAS 23 does not exclude internally developed intangible assets from the definition of aqualifying asset. An example of a qualifying intangible asset could be internally developed softwareproduced over a substantial period of time.Financial assets, andinventories that aremanufactured, orotherwise produced, overa short period of time,are not qualifying assets.Assets that are ready fortheir intended use or salewhen acquired are notqualifying assets."[emphasis added]This list is not exhaustive. The items listed are examples of what may be a qualifying asset.Can internally developed intangible assets be a qualifying asset?A qualifying asset takes a substantial period of time to get ready for its intended useor sale. Does the standard include a quantitative definition of a 'substantial period oftime'?No. Management considers the facts and circumstances and uses its judgement to determinewhether an asset takes a substantial period of time to get ready for its intended use or sale.Should management's intention be taken into account when it determines whether theasset is a qualifying asset?Yes. The standard clearly states that an asset is assessed based on its intended use or sale (seedefinition of a qualifying asset in IAS 23.5). Accordingly, alternative uses are not taken into accountwhen management evaluates an asset. To illustrate the application of this principle, consider thefollowing example:Property acquired for developmentA property developer acquires a property, which management intends to develop into luxury apartments.Alternatively, the property could be sold or leased immediately after its acquisition.Should management's intention be taken into account?Yes. Assessing whether an asset is a qualifying asset takes into consideration its intended use. The propertyis determined to be a qualifying asset because management intends to develop the asset over a substantialperiod of time. This is not changed by the fact that the property could alternatively be sold immediately. 2009 Grant Thornton International Ltd. All rights reserved.

Capitalisation of borrowing costs10An asset might be acquired in a finished state, but its intended use is as a part of alarger group of integrated assets. Can the acquired asset be a qualifying asset?The acquired asset might be a qualifying asset while activities on the larger project are under way.For example, an entity constructing a new factory might take delivery of air-conditioning unitsduring the construction period. The air-conditioning units might be qualifying assets even if they aresubstantially complete when considered in isolation. This is because they might not be ready fortheir intended use until the factory project as a whole is substantially complete.Assets measured at fair valueWhen a qualifying asset is measured at fair value, should borrowing costs still becapitalised?This is an option. IAS 23.4(a) states that an entity is not required to apply the standard to borrowingcosts directly attributable to the acquisition, construction or production of a qualifying assetmeasured at fair value.Effectively this means that an entity can make an accounting policy choice of capitalising borrowingcosts for assets measured at fair value. Capitalisation will not affect the carrying value of the asset inquestion (as this is fair value) but will affect the presentation of borrowing costs and fair valuemovements - see examples on page 11. The chosen policy should be applied consistently anddisclosed in the notes if significant.Can the exemption for assets measured at fair value be applied for assets where gainsor losses are recognised in other comprehensive income?Yes. IAS 23 states that all assets measured at fair value are included in the exemption. Therefore,borrowing costs are not required to be capitalised (it is an accounting policy choice) for assetsmeasured at fair value with gains or losses recognised in other comprehensive income, such asproperty, plant and equipment accounted for in accordance with the revaluation model in IAS 16Property, Plant and Equipment.After a recent amendment, investment property under construction can now bemeasured at fair value. Should borrowing costs for investment property underconstruction be capitalised?Whether borrowing costs are capitalised will depend on the entity's accounting policy for investmentproperty under construction. IAS 40 Investment Property (IAS 40) was amended by Annual Improvements2008 to permit investment property under construction to be measured at fair value (for accountingperiods beginning on or after 1 January 2009).Where investment property under construction is measured at fair value entities are not required tocapitalise borrowing costs but, as noted above, they may choose to do so (IAS 23.4(a)). Where thecost option is chosen, entities are required to capitalise borrowing costs for investment propertyunder construction (assuming IAS 23's other conditions are met). 2009 Grant Thornton International Ltd. All rights reserved.The exemption in IAS23.4 does not meanthat assets measuredat fair value cannot bequalifying assets.Rather, it states thatan entity does nothave to capitaliseborrowing costs forsuch assets. Thisrecognises the factthat the measurementof such assets will notbe affected by theamount of borrowingcosts capitalised.

Capitalisation of borrowing costs11What is the effect of capitalising (or not capitalising) borrowing costs for assetsmeasured at fair value?This affects the presentation of borrowing costs and fair value movements within profit or loss andother comprehensive income. The value of the asset remains the same. The effect is best illustratedby considering the following two examples:Investment property under construction measured at fair valueAn entity develops property that will be investment property. In accordance with the amended version of IAS 40Investment Property the entity can choose to measure the property under construction at fair value with gainsand losses recognised in profit or loss. At the end of the reporting period the fair value of the property is CU1,000. Costs incurred at the end of the reporting period amount to CU 900, including borrowing costs of CU 50.Scenario 1: Entity does not capitalise borrowing costsThe entity recognises borrowing costs directly attributable to the property in profit or loss. The cost of theproperty excluding borrowing costs is CU 850. The entity recognises a fair value gain in the income statementof CU 150. The total effect on profit or loss is CU 100 (fair value gain of CU 150 less borrowing costs ofCU 50).Scenario 2: Entity capitalises borrowing costsThe entity capitalises borrowing costs directly attributable to the property as part of the cost of the asset. Thecost of the property at the end of the period is CU 900. The entity recognises a fair value gain in profit or loss ofCU 100. The total effect on profit or loss is CU 100.The asset is measured at CU 1,000 in both scenarios. The effect on profit or loss is CU 100 in both scenarios.If the entity elects to capitalise borrowing costs, the only effect is a reallocation between interest expense andthe fair value gain.Owner-occupied property under construction measured at fair value in accordance withthe revaluation model of IAS 16An entity constructs a property that is intended for own-use as its head office building. It chooses to measurethe property at revalued amount being its fair value, in accordance with IAS 16 Property, Plant and Equipment.At the end of the reporting period the fair value of the property is CU 1,000. Costs incurred at the end of thereporting period amount to CU 900, including borrowing costs of CU 50.Scenario 1: Entity does not capitalise borrowing costsThe entity recognises borrowing costs directly attributable to the property in profit or loss. The cost of theproperty excluding borrowing costs is CU 850. The entity recognises a fair value gain in other comprehensiveincome of CU 150. The total effect is an interest expense in profit or loss of CU 50 and a fair value gain in othercomprehensive income of CU 150.Scenario 2: Entity capitalises borrowing costsThe entity capitalises borrowing costs directly attributable to the property as part of the cost of the asset. Thecost of the property at the end of the period is CU 900. The entity recognises a fair value gain in othercomprehensive income of CU 100. The borrowing cost of CU 50 is excluded from the interest expense in profitor loss.The asset is measured at CU 1,000 in both scenarios. The accounting policy choice affects profit or loss andother comprehensive income. Total comprehensive income is unaffected. 2009 Grant Thornton International Ltd. All rights reserved.

Capitalisation of borrowing costs12Exemption for certain types of inventoriesAre borrowing costs required to be capitalised if they relate to inventories within thescope of the exemption?No. This is an option. The scope exemption in IAS 23.4(b) means that preparers are allowed anaccounting policy choice in respect of borrowing costs directly attributable to those inventories. Therequirements are summarised in the box below:Capitalisation of borrowing costs for inventoriesMain rule for all inventoriesIf the inventory is a qualifying asset, the entity is generally required to capitalise borrowing costs(IAS 23.7(a) and IAS 23.8).Exception for certain inventories that are manufactured, or otherwise produced, in largequantities on a repetitive basis:This is an accounting policy choice (IAS 23.4(b)). Entities can elect not to capitalise borrowingcosts - but only for those inventories within the scope of the exemption.For inventories within the scope of the exemption, the chosen policy should be consistently appliedand disclosed if significant. The exemption is likely to benefit many entities that produce 'standard'inventories in large quantities (see also IAS 23.BC6).What types of inventories qualify under the exemption in IAS 23.4(b)?IAS 23 does not give examples of assets that are covered by this exemption. Hence judgement willbe required to determine whether the exemption applies in specific circumstances. Factors toconsider include the production volume and the extent to which items are produced to a standarddesign. 'Standard items' may be exempted even if they are high value and require substantial time toproduce (such as aircraft).The exemption is relevant only to inventories that meet the definition of qualifying assets in the firstplace. Inventories that are produced in a short period of time are not qualifying assets and aretherefore outside the scope of IAS 23.What are 'large quantities' for this purpose?IAS 23 does not set out a quantitative threshold and judgment is required. As noted above, webelieve that aircraft that are produced as a standard item in large quantities (several hundred) mayqualify under the exemption.Where an asset is built to order it becomes difficult to argue that the inventories are produced inlarge quantities. An example would be a non-standardised ship that is manufactured to the highlyspecialised requirements of the customer. In our opinion, such an asset would normally not qualifyunder the exemption, because it is not produced in large quantities or on a repetitive basis.Are residential houses within the scope of the exemption?Some house-builders undertake high volume developments based on one or more standard designs.Others may design each house or housing development as a 'one-off'. We believe that it may beappropriate to apply the exemption in some cases but judgement is required based on specific

Capitalisation of borrowing costs 4 A: IAS 23 in brief A revised version of IAS 23 IAS 23 Borrowing Costs (IAS 23) addresses accounting for borrowing costs. It considers whether borrowing costs should be capitalised as part of the cost of the asset, or expensed in profit or loss.